Disclaimer: Nansen has produced the following report as part of its existing contract for services provided to BNB (the "Customer") at the time of publication. While BNB has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

BNB Chain is comprised of BNB Beacon Chain (previously Binance Chain, for governance) and BNB Smart Chain (previously Binance Smart Chain or ‘BSC’). It was launched in September 2020 to provide an alternative smart contract platform to the increasingly expensive Ethereum mainnet. It is an independent blockchain that works on a Proof of Staked Authority (PoSA) consensus mechanism (where participants stake BNB to become validators). The chain is also compatible with the Ethereum Virtual Machine (EVM), meaning it could leverage pre-existing Ethereum tooling which contributed to its enormous growth.

BNB Chain was created as a scalable infrastructure to handle a large number of low-cost DeFi transactions without compromising speed. It also aims to deliver programmability and smart contracts to developers who want to launch their tokens on the BNB Chain network.

To date, there are 1400+ projects on the BNB Chain, notably Wombat Exchange, Radio Caca, SecondLive, MOBOX, X World Games and Animal Farm. Meanwhile, PancakeSwap remained the most used dApp on the network in Q3 2022.

This quarter proved challenging, as the crypto market suffered from macroeconomic pressure and governmental interventions. BNB Chain remained the most used chain in terms of transactions due in part to its low transaction costs.

Check out Nansen’s previous reports on BNB Chain and other chains here.

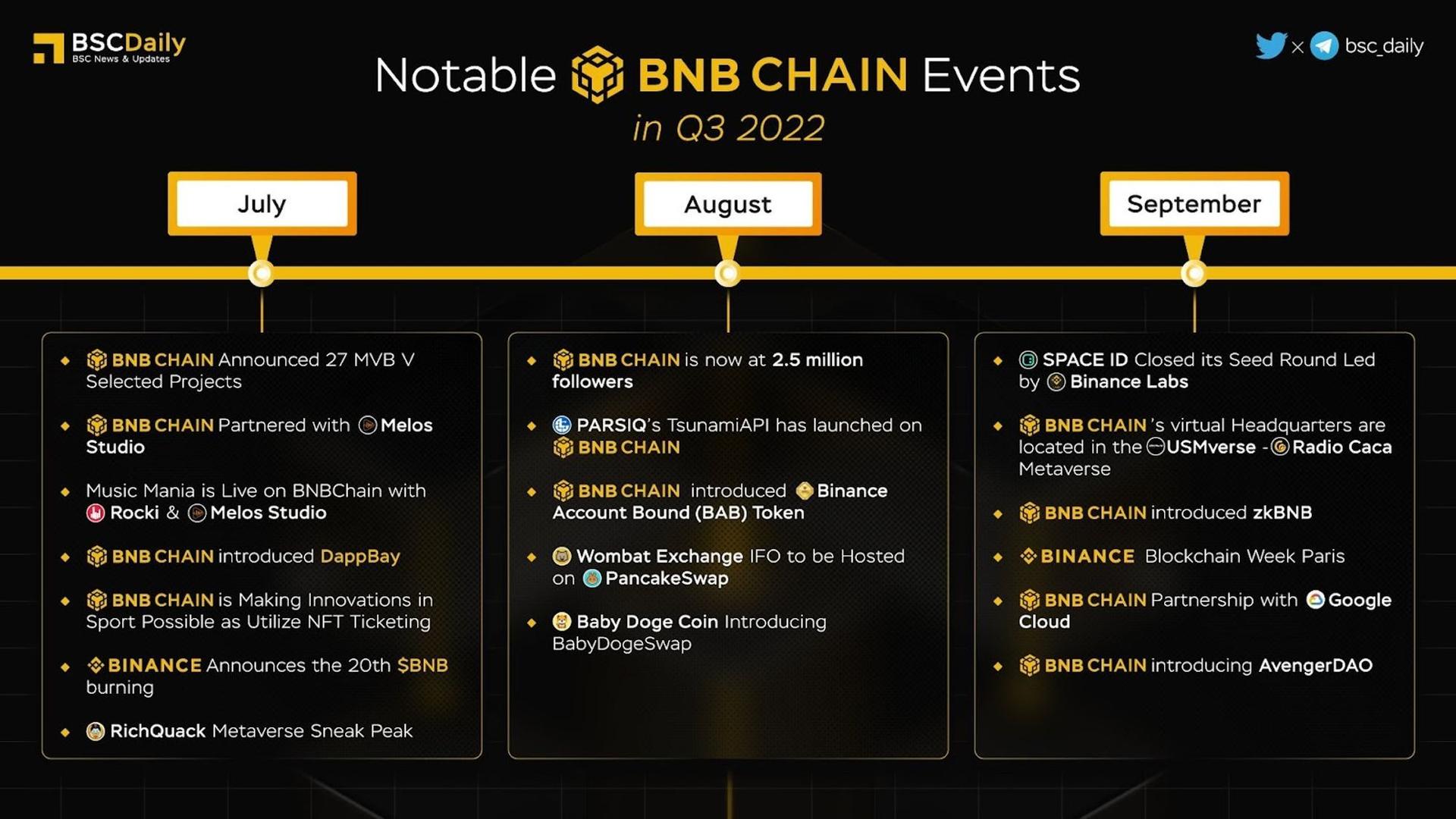

Key Developments

- 27 projects were selected for BNB Chain’s Most Valuable Builder V (MVB V) program from sectors in DeFi, NFT, SocialFi, GameFi and infrastructure.

- Music Mania was launched on BNB Chain to promote music NFTs.

- DappBay was launched for users to discover new Web3 projects and highlight potentially risky decentralized applications.

- Wombat Exchange, a popular Initial Farm Offering (IFO) platform, had its IFO hosted on PancakeSwap.

- Binance Account Bound (BAB) Token was launched on Sep 8, 2022.

- AvengerDAO was introduced on BNB Chain for user protection on Sep 20, 2022.

- On Sep 19, 2022, BNB announced its partnership with Google Cloud.

- On Sep 2, 2022, zkBNB announced the launch of the BNB Chain testnet, ahead of the official release scheduled for November 2022.

- The 20th BNB Burning occurred on Jul 13, 2022 where 1,959,595.29 BNB, or the equivalent of $444,632,106 USD, was removed from circulation.

Ecosystem

In Q3 2022, BNB Chain launched many new projects to grow the ecosystem. The notable projects launched in the quarter were Wombat Exchange, Stader and Helio Protocol.

Additionally, BNB Chain announced the release of zkBNB Testnet, which will significantly impact developers' ability to build large-scale BNB Chain-based applications with guaranteed security and transaction speed, faster finality, and significantly reduced transaction fees. It will launch officially in November 2022.

Google Cloud’s Director of Web3, James Tromans, confirmed that Google Cloud is collaborating with BNB Chain to provide foundational infrastructure for Web3 builders and blockchain projects.

Most Valuable Builder V

Most Valuable Builder (MVB) Incubation Program is an accelerator program co-led by Binance Labs to offer mentorship and funding to emerging projects built on top of the BNB Chain. MVB Incubation Program has completed four seasons and overseen more than 2,000 applicants. Notable MVB projects have included PancakeSwap, Tranchess, WOO Network, Project Galaxy, and many more.

In this quarter, MVB V selected 27 finalists that cover a broad range of sectors, including DeFi, SocialFi, NFT, GameFi, infrastructure, and tooling. The program aimed to promote innovative stability and help projects develop to their full potential on the BNB Chain, while encouraging projects to build on the BNB Chain and grow the ecosystem.

Music Mania on BNB Chain

In order to grow the Music NFT scene, RockiLab and Hitlab launched a music competition on BNB Chain with a $50,000 BUSD prize pool and 4,000 music NFTs where users were able to learn, create and own their very own music NFTs.

DappBay

The BNB Chain launched DappBay, a new platform to discover new Web3 projects. The platform aims to assist the community in understanding market trends with the most up-to-date project rankings and anticipating project dangers in real-time, as well as collecting and summarizing a list of promising future projects in advance, allowing users to be the first to know about them.

A key feature of DappBay called Red Alarm assesses project risk levels in real-time and alerts users of potentially risky decentralized applications. The feature also continually updates the list of risky projects on BNB Chain.

AvengerDAO

A unique community-run security infrastructure project, AvengerDAO, was launched on Sep 20, 2022, to protect users on BNB Chain from possible exploits, scams and malicious actors.

It consists of a passive API system called Meter, a subscription-based alert system called Watch and a programmable fund management system called Vault. It is a collaboration between these three components that helps users have additional security when interacting with counterparties on the BNB Chain.

Nansen On-chain Data

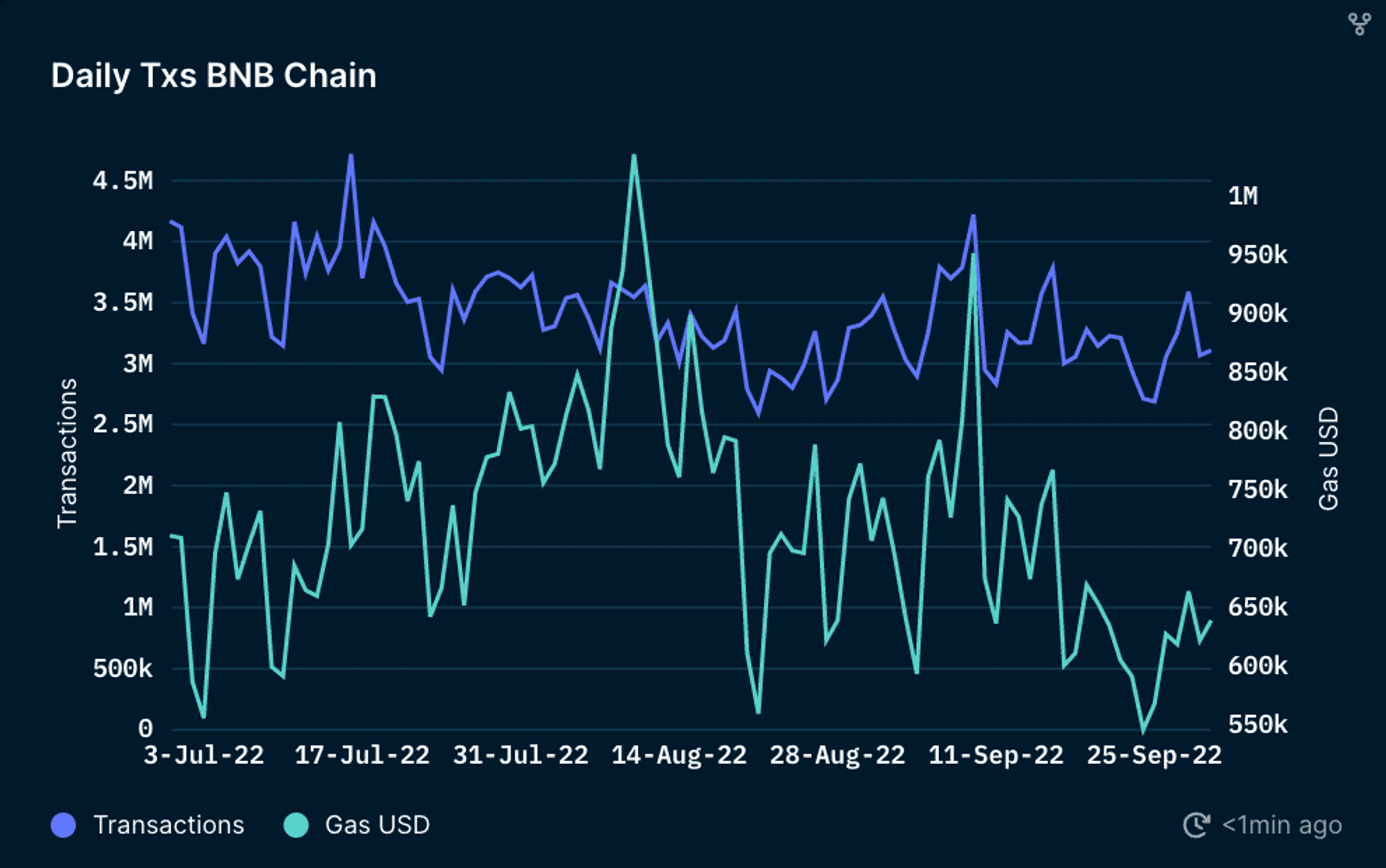

Daily Transactions

The market has been volatile throughout Q3 2022 due to macro factors and regulatory headwinds. Daily number of transactions traded on BNB Chain fluctuated in the range of 2.5m to 5m and the value of daily gas paid fluctuated between $500k to $1.05m.

On Aug 10, 2022, Daily Gas Volume peaked at ~$1m due to the listing of 6 new cryptocurrencies (IBAT, TAMA, BAPE, SLEEP, DVRS and AVO) on PancakeSwap, while the launch of Binance Account Bound (BAB) Token influenced the daily gas volume spike of ~$950k on Sep 9, 2022.

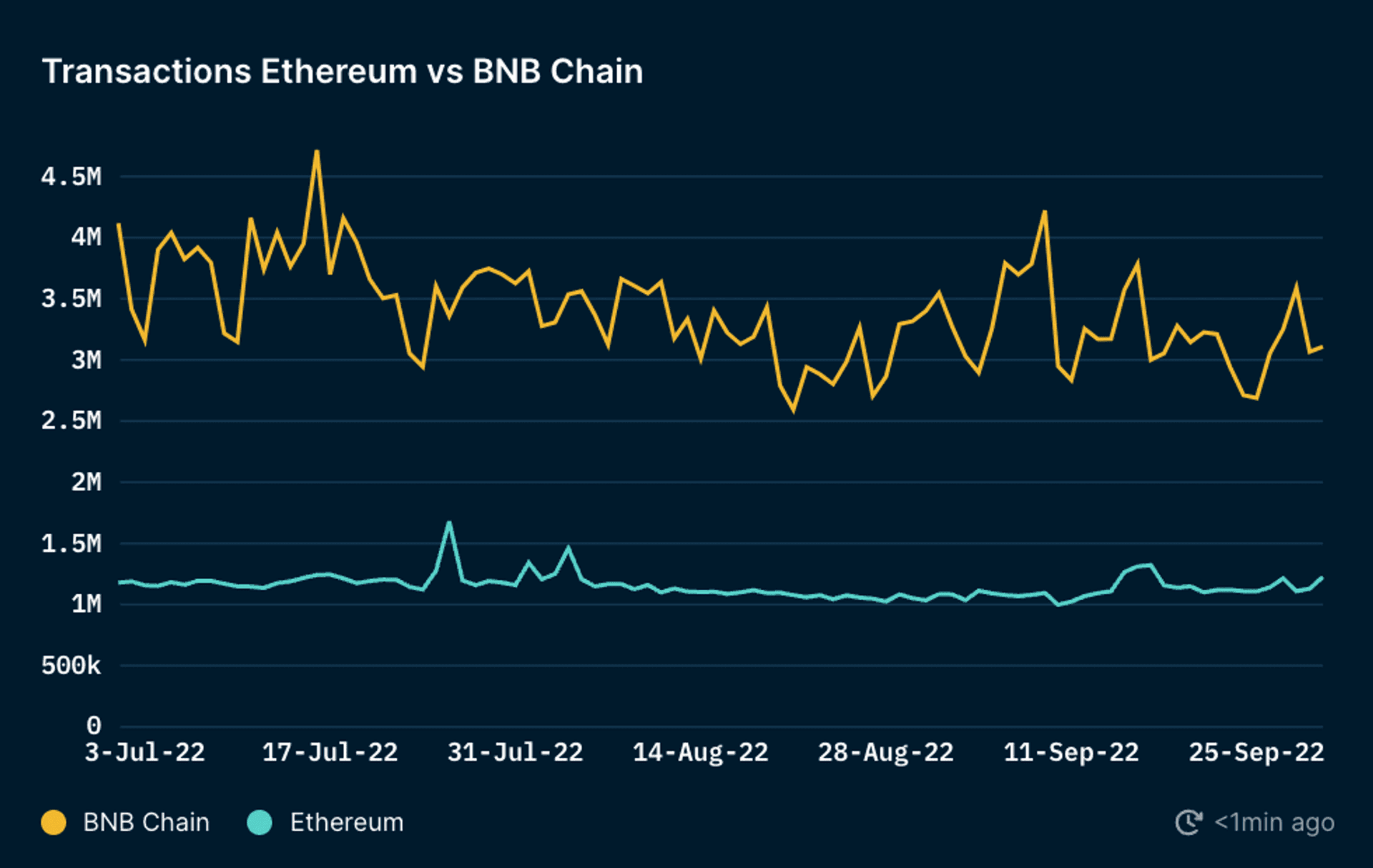

Daily Transactions (vs Ethereum)

BNB Chain was the most popular blockchain by number of transactions in Q3 2022. Compared to Ethereum, BNB Chain managed to maintain an average of ~2x of Ethereum’s transactions count throughout the quarter.

Overall, Ethereum remained fairly consistent in Q3 2022 with ~1m-1.8m transactions while BNB Chain fluctuated between ~2.5m-5m transactions. On a side note, Ethereum transactions count increased slightly towards the end of the quarter, likely due to hype around The Merge that occurred on Sep 15, 2022.

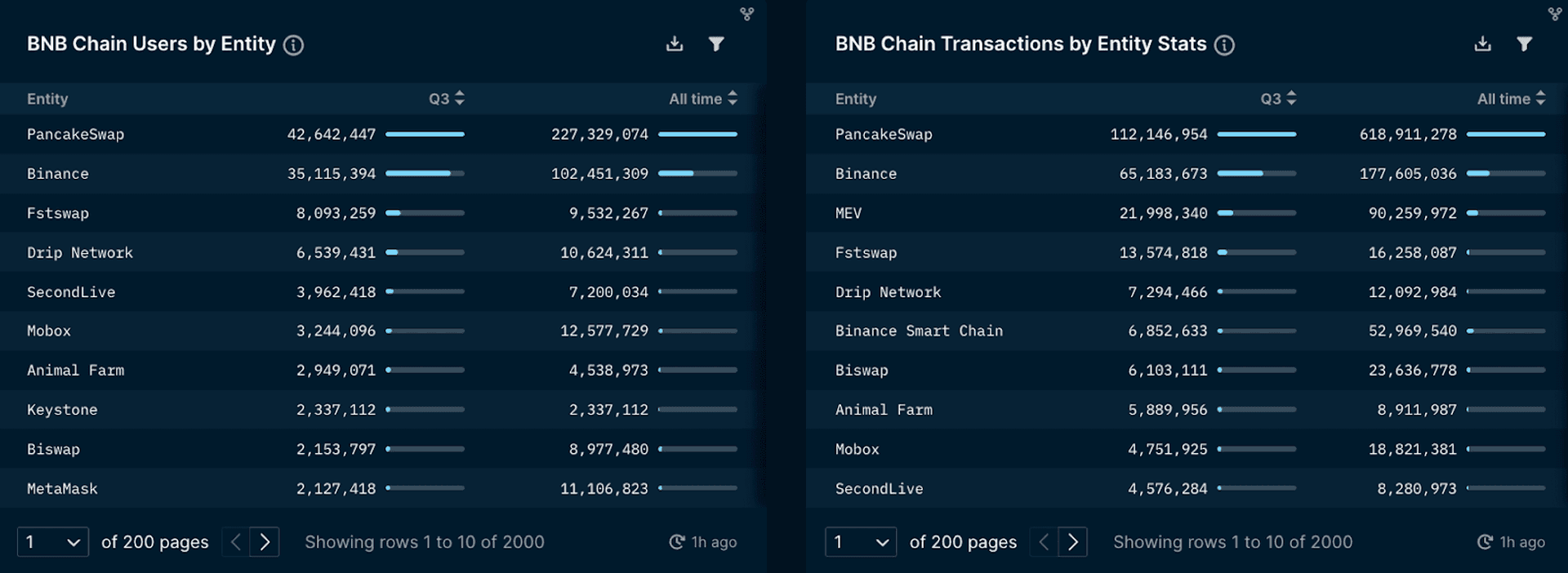

Top Entities by Users and Transactions

From a Nansen-labeled user activity perspective, activity on the BNB Chain was heavily driven by PancakeSwap and Binance. It was then followed by DEX projects such as Fstswap, Drip Network, as well as GameFi projects SecondLive, MOBOX and Animal Farm. This demonstrates the continued success of BNB Chain’s initiatives to grow and diversify the ecosystem this quarter.

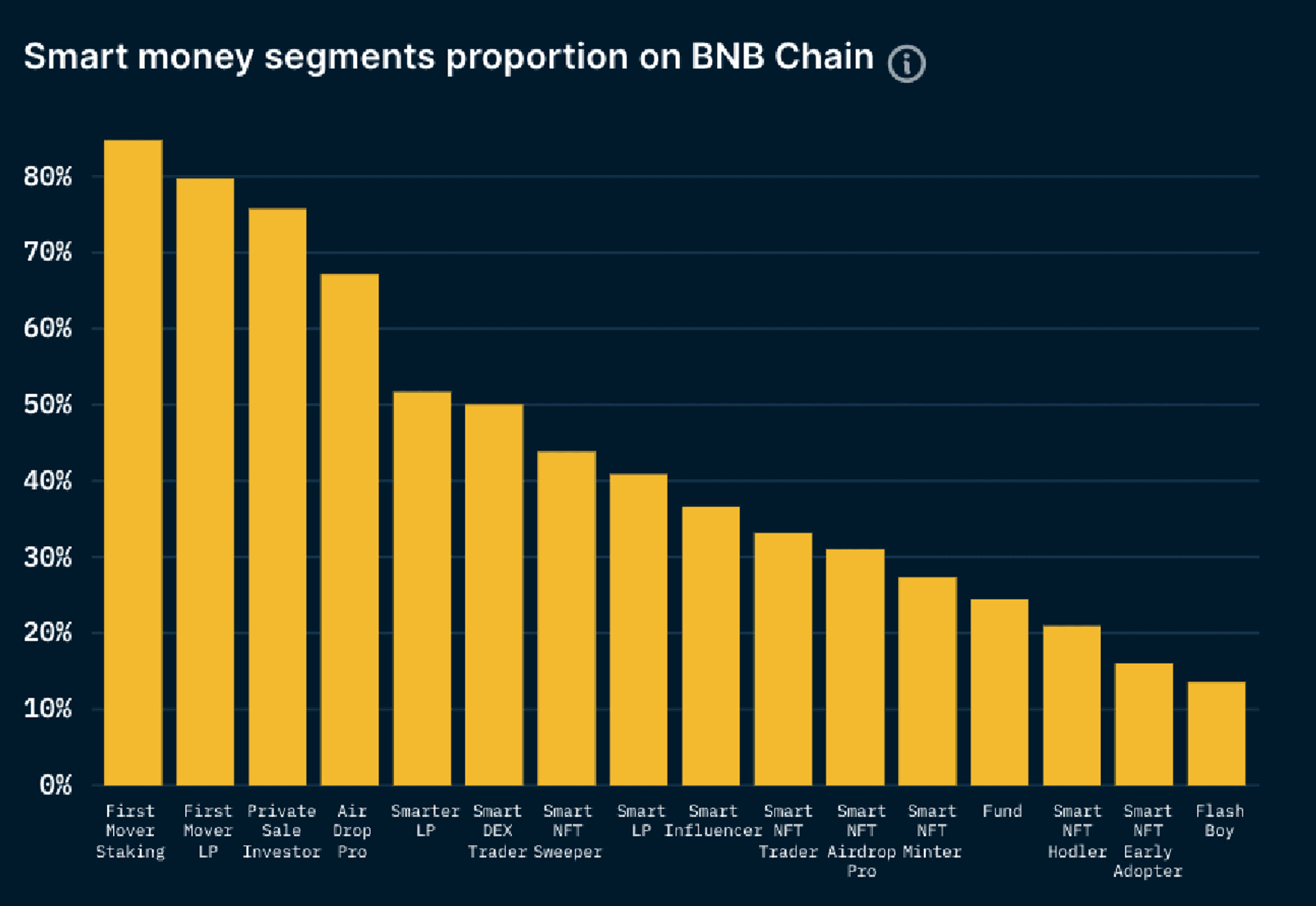

Ethereum Smart Money Segments on BNB Chain

The chart above shows a breakdown of the Smart Money addresses that are active on the BNB Chain as a proportion of the segments in Ethereum addresses. They have been categorized based on the type of Smart Money. If you are not yet familiar with the different labels, follow this link here for the specific definitions.

The majority of the Smart Money segments fell under stakers or liquidity providers (First Mover Staking at 84.8%, First Mover LP at 79.7%, Smarter LP at 52.1%, Smart LP at 40,9%), possibly signaling better opportunities on the chain for such activities . It was then followed by the NFT segments while Funds were a smaller segment with 24.5% overlap.

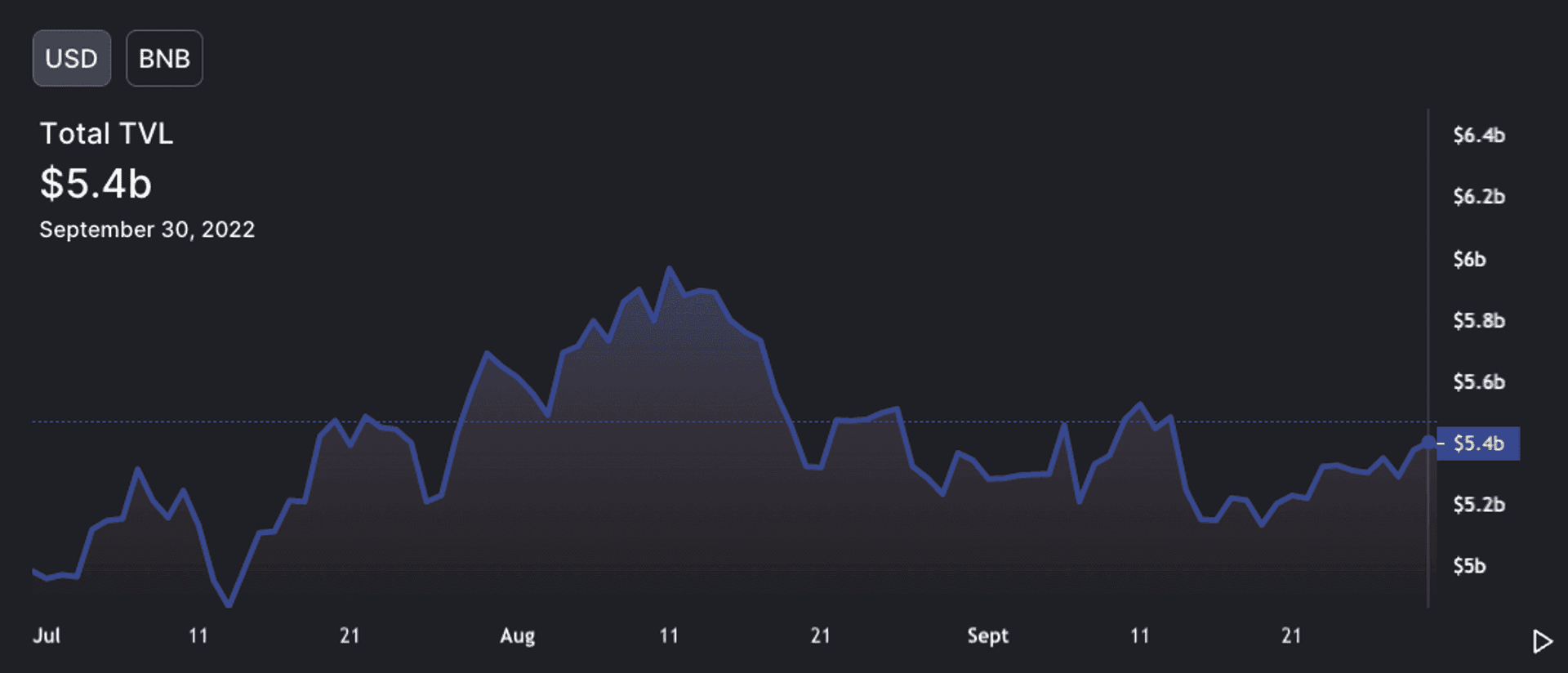

Total Value Locked

| Project | Q3 TVL (USD) | Q2 TVL (USD) | TVL Change (USD) | TVL % Change |

|---|---|---|---|---|

| BNB | 5.40B | 4.99B | 0.41B | 8.22% |

| ETH | 31.51B | 31.37B | 0.14B | 0.45% |

Source: DefiLlama

TVL increased slightly this quarter as the crypto market showed a slightly upwards trend. However, it is worth noting that the increase in TVL in Q3 2022 was higher for BNB Chain at 8.22% compared to Ethereum’s slight increase of 0.45%. The increase in TVL for BNB Chain is positive, considering the challenging market conditions. In contrast, The Merge event that occurred on Sep 15, 2022 had caused a slight drop in ETH TVL towards the end of the quarter.

BNB Hack

The cross-chain bridge which powers the Binance Coin (BNB) ecosystem was hacked on Oct 7, 2022. According to the CEO of Binance, Changpeng Zhao (CZ), BNB Chain paused Binance Smart Chain (BSC) after determining a vulnerability had been exploited. All 44 validators were asked to temporarily suspend BSC in order to contain the damage.

The hacker created and withdrew 2m BNB, worth approximately $566m, on Oct 6, 2022 from the address of BSC: Token Hub through two transactions of 1m BNB each. With quick actions taken by various parties, only ~$137m managed to be moved out to the other chains, while the rest were frozen in BSC.

As of Oct 14, 2022, BNB Chain completed its 21st quarterly burn of BNB tokens (~$574m) in order to help compensate for the losses incurred from the bridge hack. Additionally, BNB Chain introduced a Whitehat program of $1m to uncover any significant bugs in the code and a bounty reward (10% of the funds recovered from the hack) to catch the hacker. BEP-171 was proposed to further enhance the security for the cross-chain bridge between BNB Beacon Chain and BNB Smart Chain.

Check out Nansen’s full report on the BNB hack here.

Closing Thoughts

The BNB Chain continued to lead the market in terms of transaction volume. However, macro pressures and market volatility reduced user activity in the market, including BNB Chain.

As BNB Chain supported and grew its ecosystem this quarter, they have also increased their focus on security for its users through projects like AvengerDAO. Unfortunately, the exploit on the BNB Cross-Chain Bridge added the chain to the list of hacked victims. Despite that, BNB Chain reacted quickly to mitigate the damage, one such action was by burning BNB tokens.

With the growing interest in industries like NFT, GameFi and Metaverse, BNB Chain has been actively supporting and nurturing projects through its accelerator program (MVB V) and ecosystem growth fund. The partnership with Google Cloud this quarter further increased the support for Web3 builders and blockchain projects.