Disclaimer: Nansen has produced the following report in collaboration with Slice Analytics as part of its existing contract for services provided to Aptos (the "Customer") at the time of publication. While Aptos Foundation has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes on Aptos in H2 2024 only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

Aptos is a high-performance Layer 1 blockchain designed for scalability, security, and reliability, utilizing the Move programming language for smart contracts. Developed by former Meta (Facebook) engineers, Aptos leverages a novel consensus mechanism called AptosBFT (a variant of Byzantine Fault Tolerance) to achieve high transaction throughput and low latency. Its unique parallel execution engine, Block-STM, allows for efficient processing of multiple transactions simultaneously, improving scalability compared to traditional blockchains. Aptos aims to provide a user-friendly and developer-friendly environment, supporting decentralized applications (dApps) and financial use cases while maintaining robust security and decentralization.

This report covers H2 2024, in which Aptos hosted the Aptos Experience, which showcased major advancements in scalability, security, and accessibility for Web3. Key announcements included Move 2, an upgrade to the Move programming language with enhanced syntax and security tools, and Raptr, a next-gen BFT consensus protocol enabling sub-second latency under heavy loads. Block-STM v2 introduced 256-core scaling for efficient parallel execution, while Aptos Build simplified dApp development. New features were introduced for the Petra Wallet, the Aptos Card hardware wallet, and Aptos Keyless—a revolutionary authentication method replacing private keys with Web2 logins—enhanced usability and security. Additionally, SK Telecom’s T-wallet integrated USDT on Aptos, bridging Web2 and Web3. Aptos surpassed $1B TVL, reflecting 700% growth, with DeFi projects like Amnis Finance, Aries Markets, and Thala Labs driving adoption. Institutional interest from Franklin Templeton, BlackRock, and Bitwise further validated Aptos' scalability, security, and cost efficiency. The network hit milestones including 8M active accounts, 2B transactions, and record-breaking daily volumes.

On-chain Data

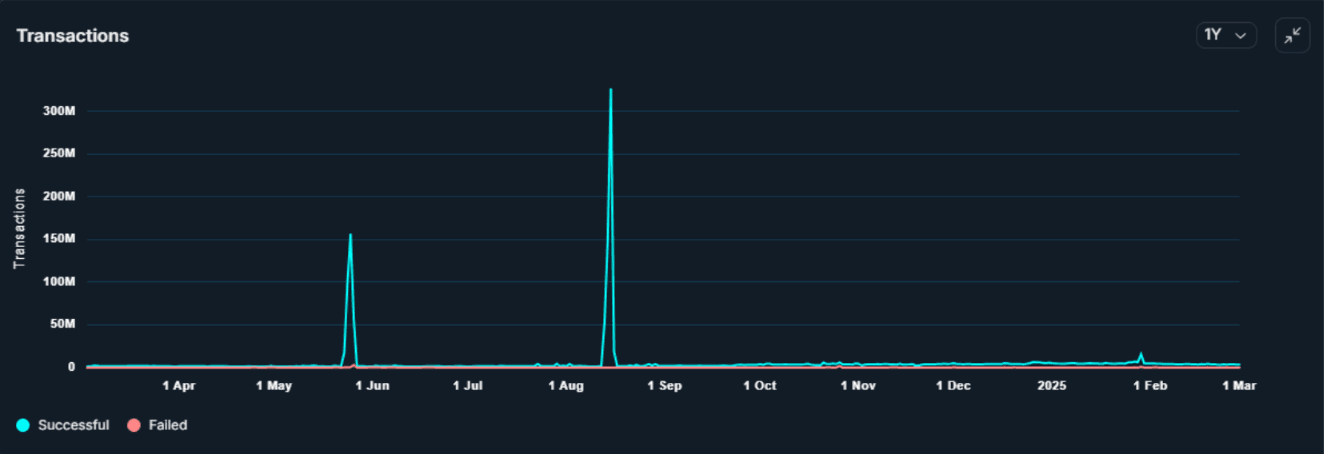

Daily Transactions

In H2 2024, Aptos’s daily transaction number started off with an absolutely explosive peak on the between 13th and 16th of August - when Tapos released their #2 game, ‘Jump, Jump and Jump’. This brought daily transactions from the usual 1-3M range to over 150M daily, with a peak at 326M processed transactions in one day - an unprecedented number for most chains out in the wild. After the launch dust has settled, the chart reflected a significant uptrend moving towards 3-5M transactions processed on a daily basis - a very positive prognostic for 2025.

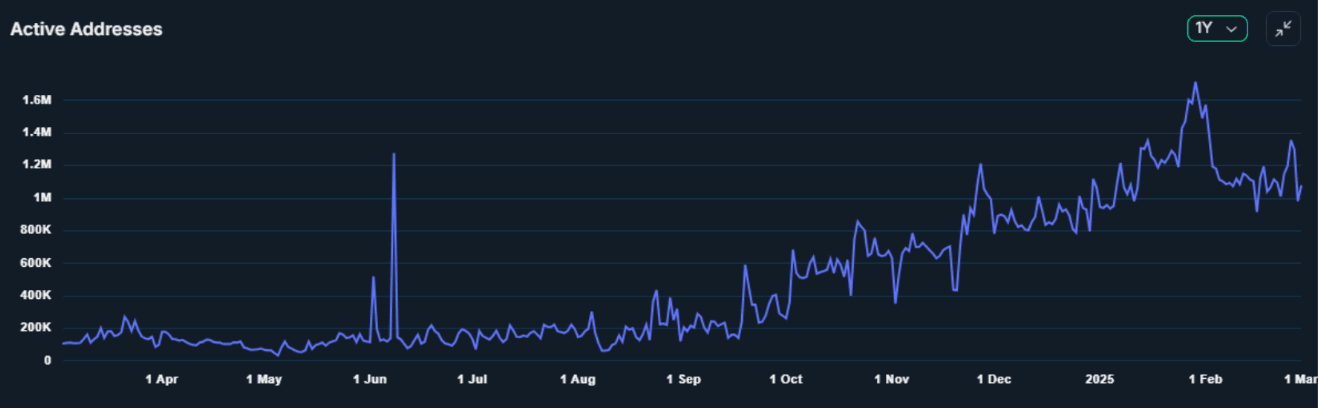

Daily Active Addresses

Just like with transactions - Active Addresses metric displays a significant uptrend in unique addresses interacting with the chain over the course of H2. Hovering around the 200K range during the summer, momentum started picking up significantly in September and continued until the very end of the year, peaking around 1.2M in December, with an end-year average between 800K and 1M daily users.

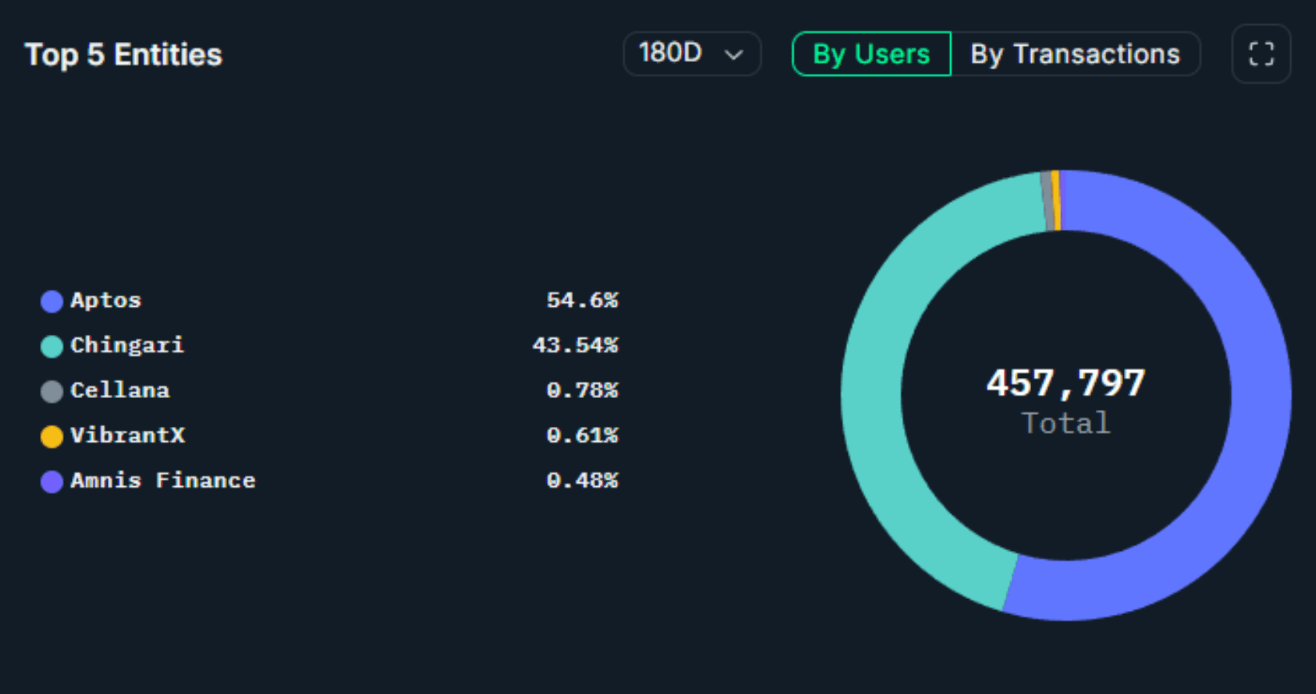

Top Entities

The Top Entities chart provides us with a comprehensive way to analyze projects based on the amount of users and transactions. In H2 2024, the most utilised on-chain entity was APT - taking over 54% of the unique address market share with more than 150M transactions. Second place was claimed by Chingari a social media platform on the rise in countries such as India, Indonesia, and Turkey with an astounding 43% in user market share and more than 50M transactions in H2. The rest of the Top 5 is filled with Aptos staples - Cellana, VibrantX and Amnis Finance - all very well-known protocols and pillars of Aptos’ DeFi ecosystem.

Key Developments: H2 2024

- The Aptos Experience in September 2024 brought together top builders to unveil groundbreaking technical innovations aimed at making Web3 more accessible, scalable, and efficient. Key announcements included Move 2, an enhanced version of the Move programming language, featuring improved syntax, dynamic dispatch, and security tools to simplify DeFi development. Raptr, a next-generation BFT consensus protocol, was introduced as the "endgame for blockchain consensus," designed to maintain sub-second latency and high throughput under heavy network loads. The launch of Block-STM v2 reinforced Aptos' leadership in parallel execution, allowing for 256-core scaling and maintaining low gas fees despite high transaction volume. To streamline Web3 access, Aptos introduced Aptos Build, a toolkit for developers to launch dApps quickly, alongside major upgrades to the Petra Wallet, including Petra Earn, Petra Pay, and Petra Drop. Additionally, Aptos Card, a cold-storage hardware wallet, was announced to enhance crypto security and global transfers.

- Aptos launched Aptos Keyless, which revolutionizes blockchain usability by eliminating traditional private keys and replacing them with Web2 social logins like Google and Apple, making onboarding seamless across all Aptos apps. Using the OpenID Connect (OIDC) standard and zero-knowledge proofs, Keyless ensures secure authentication without exposing sensitive user data to the blockchain. Validators can verify transactions without seeing login details, enhancing both security and privacy.

- Aptos surpassed $1B in Total Value Locked (TVL), marking a 700% growth since the start of the year, driven by a thriving DeFi ecosystem and increasing institutional adoption. Leading projects like Amnis Finance, Aries Markets, Thala Labs, Echo, and TruFin played a key role in expanding liquid staking, lending, and yield-generating solutions on the network. Major financial institutions also recognized Aptos’ security, scalability, and cost efficiency, with Franklin Templeton, BlackRock, and Bitwise integrating tokenized funds and staking products. Throughout the year, Aptos achieved key milestones, including 8M active accounts, nearly 2B transactions, and record-breaking daily transaction volumes.

Ecosystem

DeFi

- USDY, the first tokenized US Treasuries yieldcoin, is now live on Aptos, expanding DeFi opportunities across major protocols like Aries Markets, Thala, and LiquidSwap. Made by Ondo Finance, this integration brings a 5.3% APY yield-bearing asset to Aptos, enabling global (non-US) investors to access stablecoin-like utility with institutional-grade protections. With over $300M in TVL across multiple blockchains, USDY enhances liquidity pools, lending markets, and collateralized debt positions on Aptos' high-performance blockchain. Users can acquire USDY through platforms like Thala, LiquidSwap, and SushiSwap, and store it in Petra and Pontem wallets. Aptos’ integration with Pyth oracles ensures accurate price feeds, further solidifying its role in on-chain finance.

- Tether launched USDT on the Aptos network, making it the first stablecoin available on a Move-powered blockchain. This integration expands USDT’s reach in emerging markets, driving global financial inclusion while leveraging Aptos' low gas fees, high transaction speeds, and unmatched scalability.

- BlackRock’s BUIDL fund is now live on Aptos, reinforcing the blockchain’s position as a leading platform for tokenized assets and institutional finance. As tokenized funds are projected to become a $600B market by 2030, Aptos has become a key player by integrating major real-world assets, including BlackRock’s BUIDL fund, Franklin Templeton’s OnChain U.S. Government Money Fund (FOBXX), and Ondo Finance’s USD Yield (USDY).

- Bitwise launched its Aptos Staking ETP on SIX Swiss Exchange, marking a major milestone in making Aptos more accessible to European institutions and investors. This development reinforces Aptos’ growing institutional momentum, providing a secure and transparent gateway for broader participation in the ecosystem.

- Circle’s USDC, the second-largest stablecoin by market cap, was announced for integration on Aptos, bringing high regulation and transparency to the network. This integration will also introduce the Cross-Chain Transfer Protocol (CCTP), enabling seamless USDC transfers between Aptos and eight major blockchains, including Ethereum, Solana, and Arbitrum. With 72+ cross-chain transaction pathways, Aptos will unlock new use cases for onboarding, swapping, and treasury rebalancing with 1:1 capital efficiency. Additionally, Stripe’s payment services will launch alongside native USDC, providing a secure fiat on-ramp for merchants and streamlining pay-ins and payouts via Aptos-compatible wallets.

- Emojicoin.fun, a token launchpad that allows users to create and trade tokens as emojis, saw remarkable adoption within its first month on mainnet, launching 1,933 tokens, engaging 27,559 unique addresses, and reaching $1 million in TVL. During the same period, emojicoin.fun recorded approximately $33.6 million in total trading volume.

Closing Thoughts

Aptos has emerged as a leading high-performance Layer 1 blockchain, demonstrating significant advancements in scalability, security, and institutional adoption throughout H2 of 2024. The network's technical progress, highlighted by innovations such as Move 2, Raptr consensus, and Block-STM v2, has reinforced its ability to process high transaction volumes efficiently while maintaining low costs. Aptos' DeFi ecosystem has experienced rapid growth, surpassing $1B in Total Value Locked (TVL), driven by liquid staking, lending protocols, and the integration of tokenized real-world assets (RWAs), including BlackRock’s BUIDL fund and Ondo Finance’s USDY yield-bearing token. The blockchain has also strengthened its enterprise and institutional partnerships, with SK Telecom, Franklin Templeton, and the Hong Kong Monetary Authority (HKMA) leveraging Aptos for digital asset infrastructure. Additionally, Aptos has made strides in Web3 accessibility, introducing Aptos Keyless for seamless authentication and integrating USDT and USDC for cross-chain liquidity. The network's growth is reflected in record-breaking transaction volumes, an increase in active addresses, and expanding developer adoption. As Aptos continues to scale, its focus on efficiency, decentralization, and mainstream adoption positions it as a key player in the evolving blockchain landscape.