Introduction

Silicon Valley Bank (SVB) collapsed on Friday, March 10, sending ripples through the financial world. As one of the main banks for tech firms and startups, SVB's collapse caused serious concern among its clients and depositors. Circle, the issuer of the USDC stablecoin, had $3.3b out of the ~$40b reserves, that are used to back USDC, with SVB as of 11 March. This raised questions about how much of the USDC stablecoin was consequently backed by dollars. In response, people began to panic and sold USDC, resulting in lows of $0.88 on most markets. This panic is somewhat understandable, due to the UST collapse and numerous bankruptcies such as FTX in the last 12 months. Usually, arbitrageurs buy back USDC, redeem 1:1 for USD and stabilize the peg in this way, but redemptions were restricted during the weekend since Circle's partner banks were not open.

Meanwhile, faith in Circle seems somewhat restored following the announcement that SVB depositors will be made whole, and USDC is now trading at $1 again on most exchanges as of 16 March.

This research report will delve deeper into the recent de-pegging of USDC and explore the underlying factors that contributed to this event and how serious the situation could have become. The report will focus on on-chain data and examine the dynamics of USDC redemptions, the top redeemers and look at what happened on-chain during the sell-off.

Dynamics of USDC Reserves

After news about the SVB collapse on 10 March, there was large uncertainty about exactly how much of USDC’s backing would be affected and whether a percentage of the funds would be recoverable. Since Circle at this point only disclosed how much of the reserves is held in banks (25% at the time), but not how much exactly was at SVB, many market participants feared for the worst case.

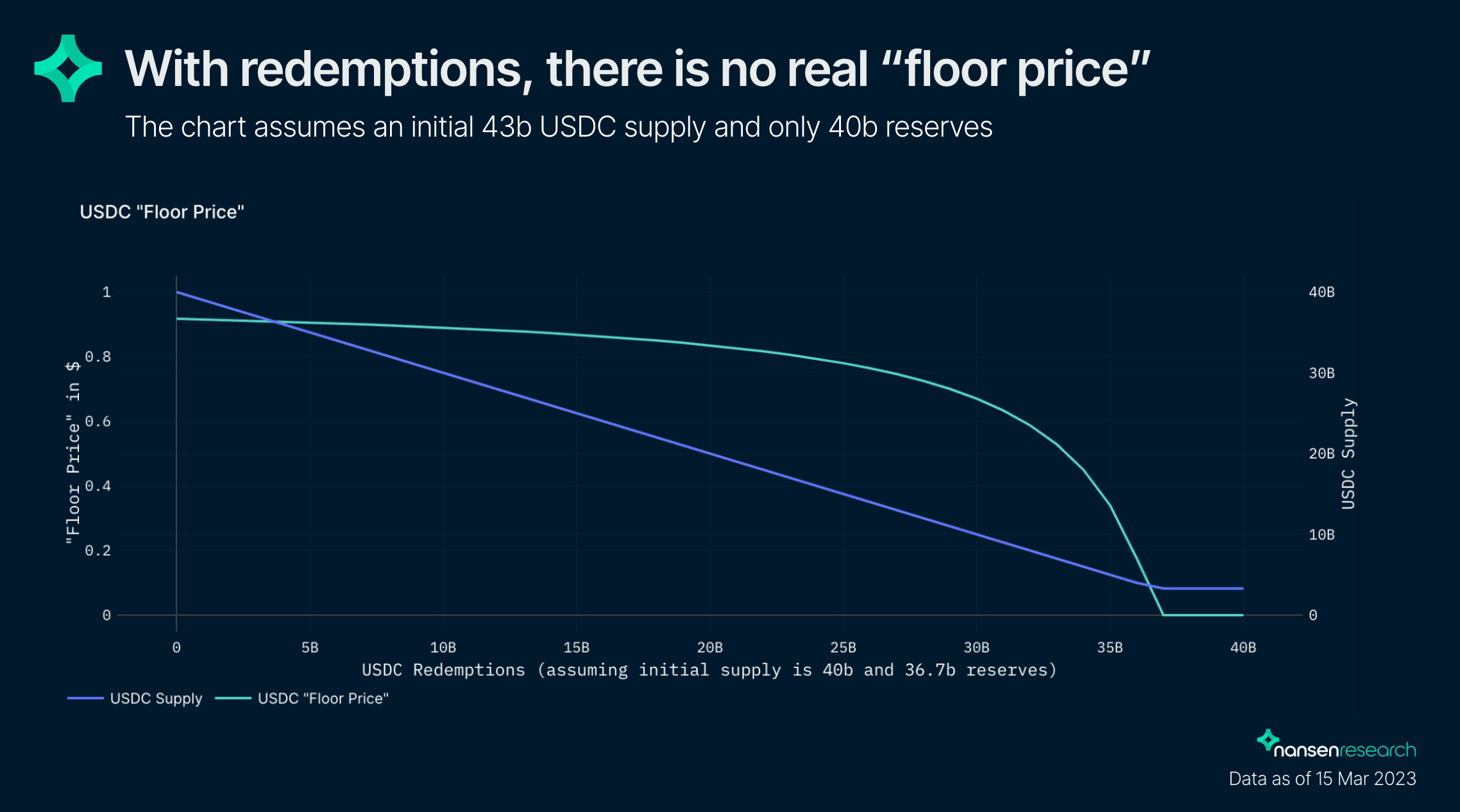

Many argued that there would be a “floor price” for USDC which can easily be calculated using the ratio of backing / USDC supply. However, this is in fact only applicable if the supply of USDC stays constant, i.e. there was no minting or redeeming. If there is a hole in the collateral, with mass redemptions at 1:1, the fundamental backing would decrease and eventually reach $0, as demonstrated in the chart below.

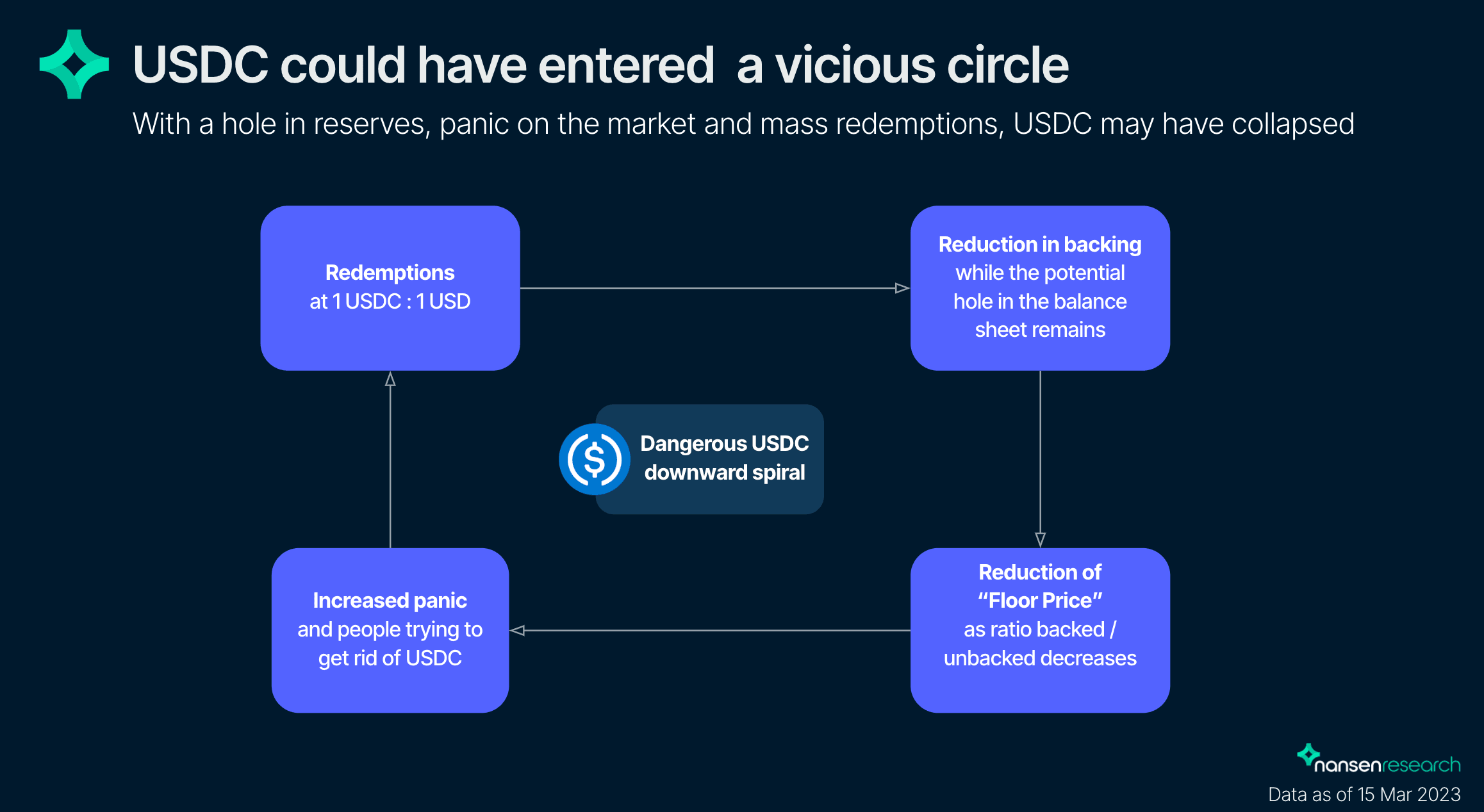

While there is a case to be made that redemptions would have stabilized the peg due to arbitrage, on the other hand, restricted redemptions might have prevented a bank run and an even worse scenario. However, this would also likely create large-scale panic in the markets and may have caused USDC to significantly de-peg. Nonetheless, with redemptions ongoing, in the most extreme case, USDC may have descended into a death spiral as illustrated below.

Redemptions

After examining the dynamics, the question remains how severe the situation could have become. Let’s take a deeper look into the redemptions that occurred and redemptions that potentially could have happened.

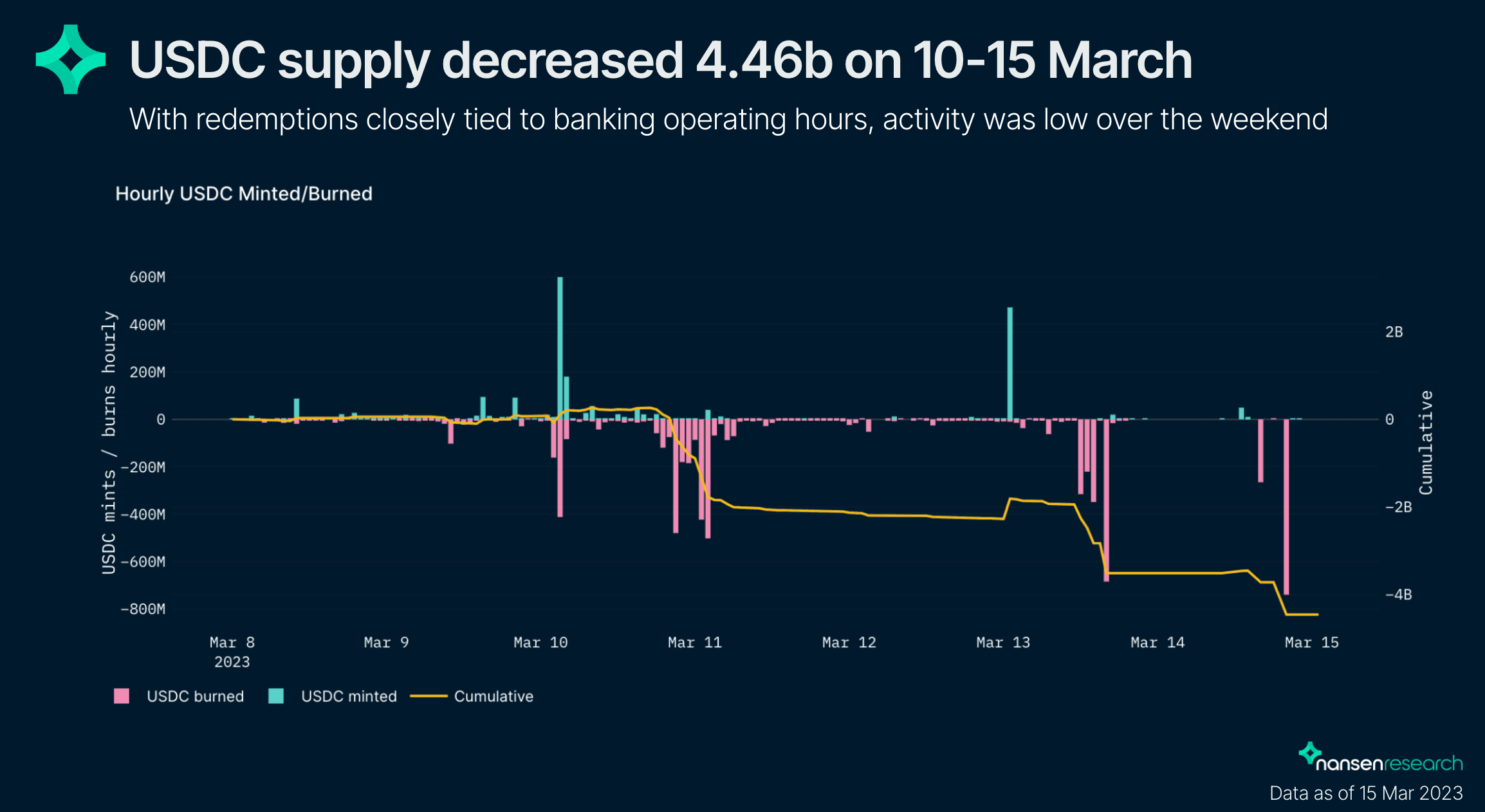

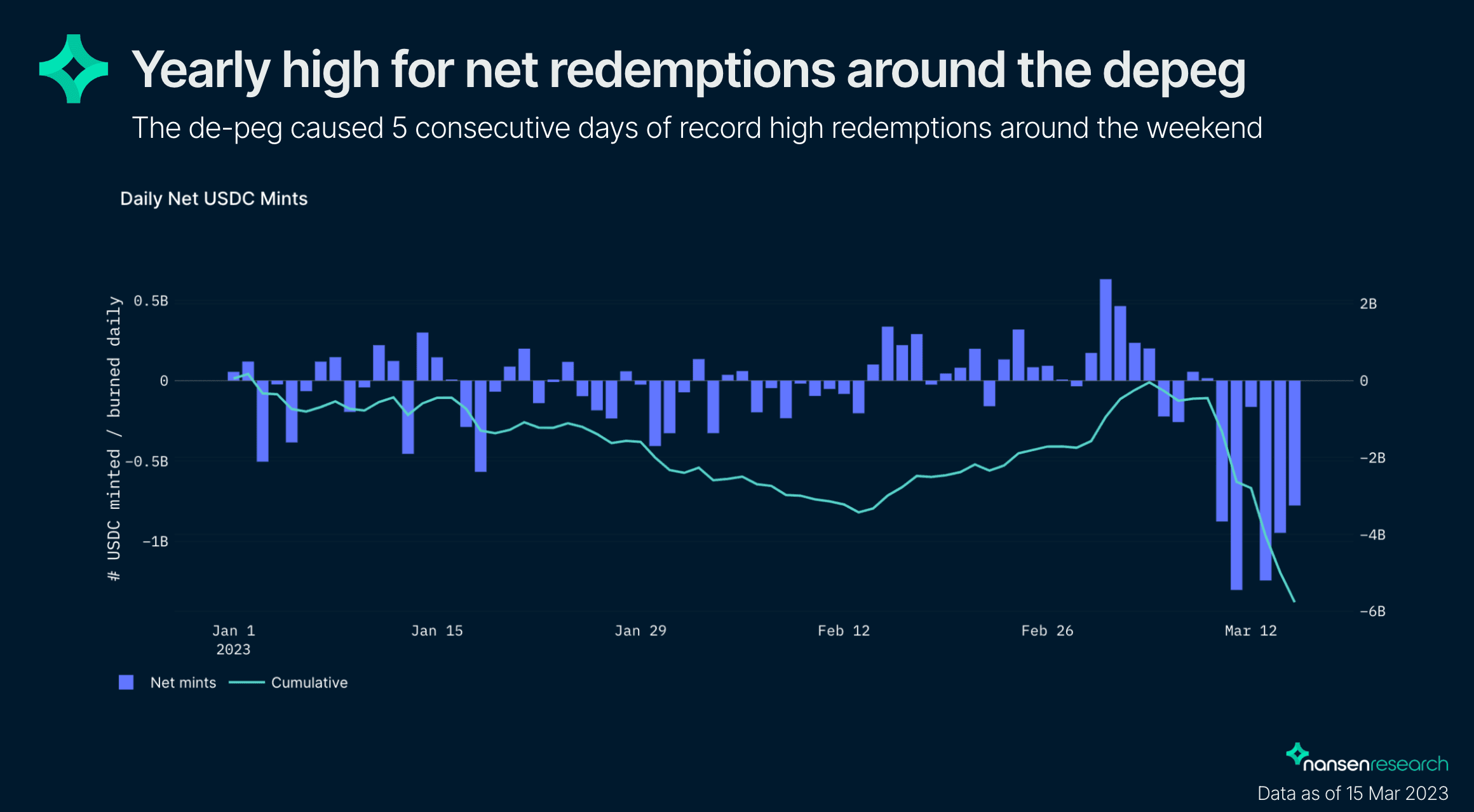

As briefly touched above, redemptions were halted over the weekend, there was a large number of redemptions before and after. During the de-peg, net over $4.4b USDC was redeemed.

Looking at net redemptions since the beginning of this year, this easily marks a record-high. This was quite concerning given the potential downward spiral explained above. For a per-transaction view, check out Nansen’s wallet pair profiler for the wallets USDC: Circle and the 0x00 Burn address.

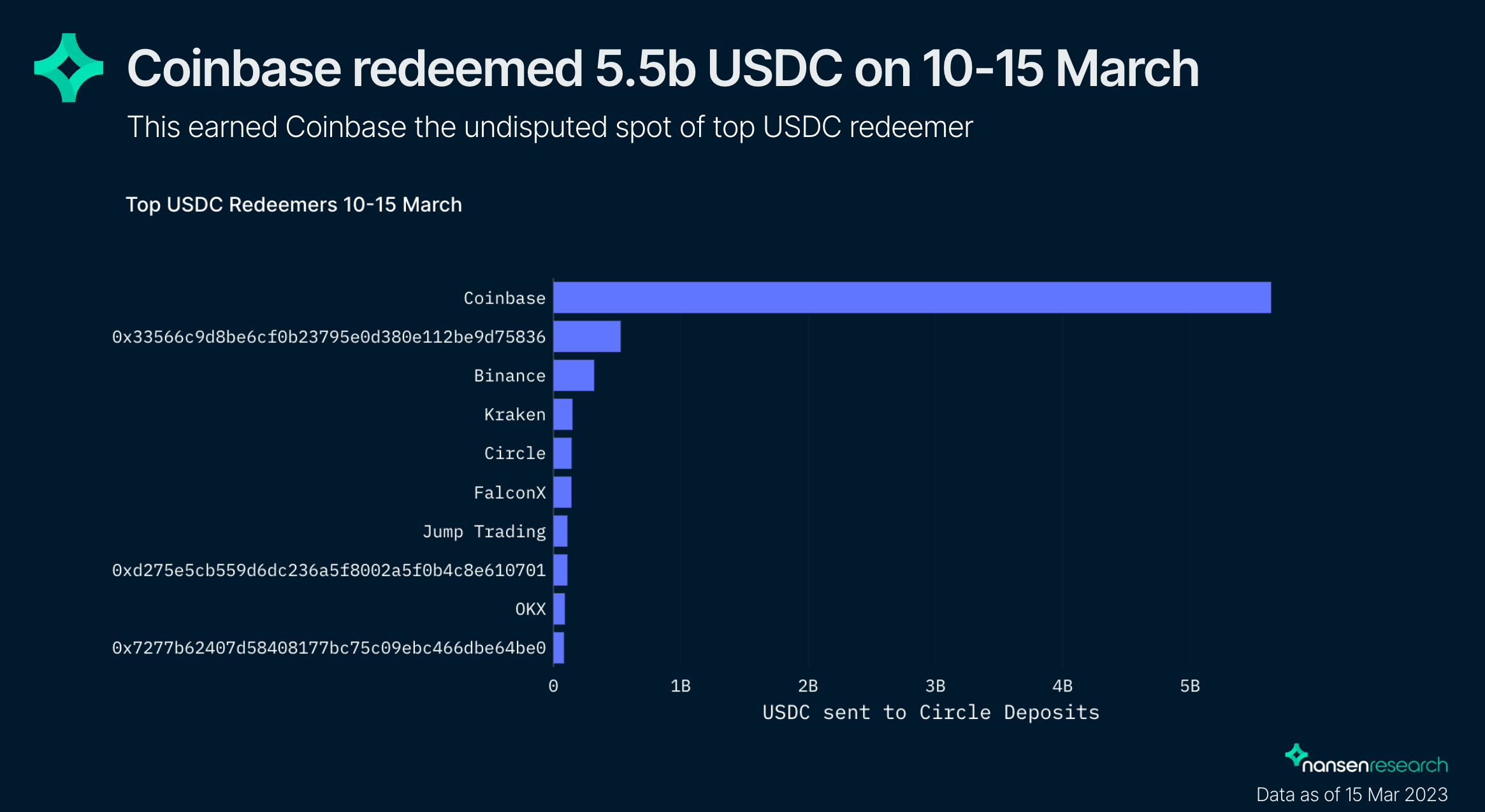

The majority of redemptions came from Coinbase users (~5.5b between 10-15 March), rather than large private institutions accessing USDC through Circle.

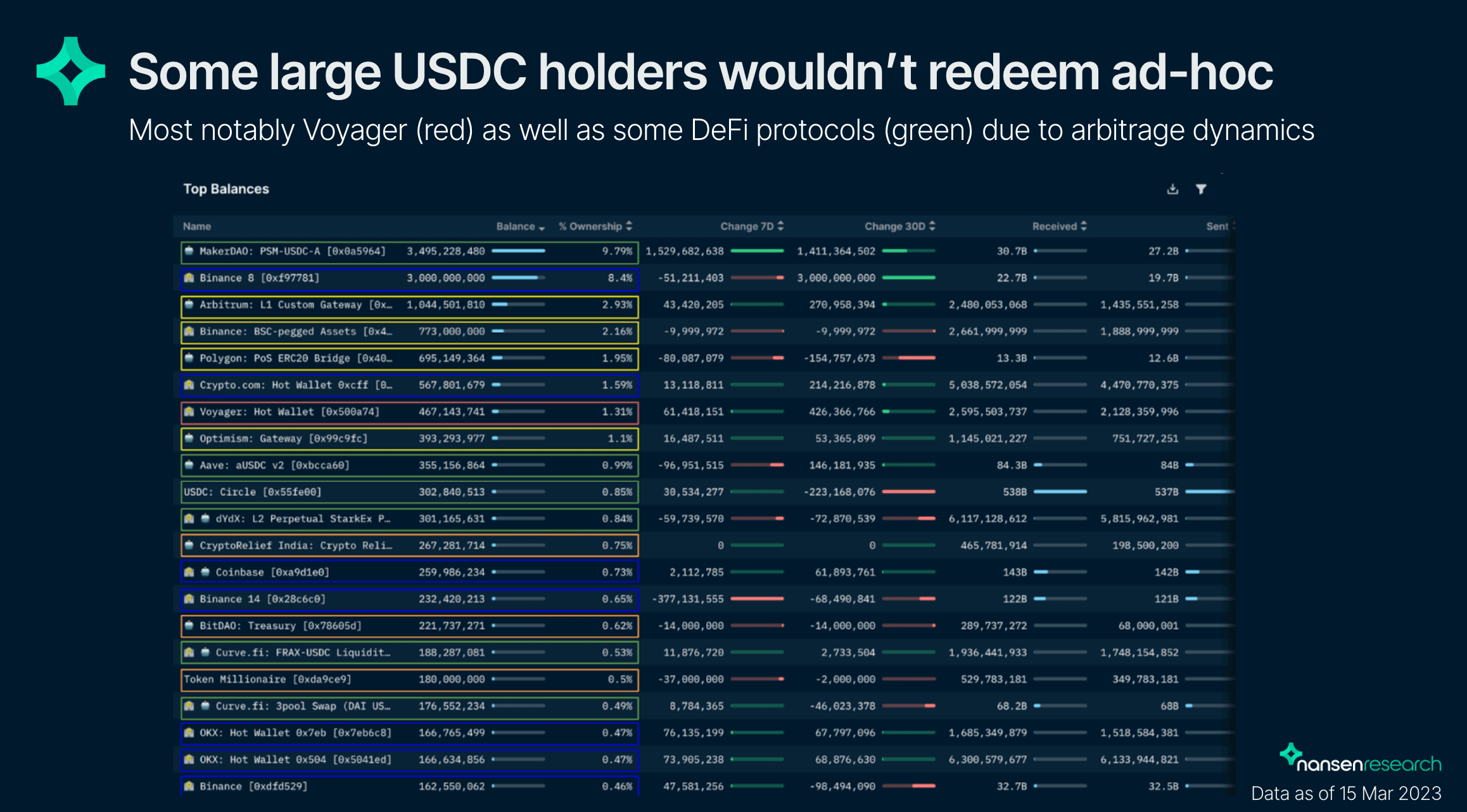

It is important to note however, that not all of the USDC would be able to be redeemed immediately.

Out of the largest holders, Voyager (red box below) would likely be the last one to redeem as it is currently undergoing bankruptcy filings and the funds cannot be touched. Protocols and liquidity pools (green) might also not be drained and redeemed immediately, as arbitrage dynamics might fill them back up. Centralized exchanges (blue) might redeem relatively early, as might USDC which is currently bridged to other chains (yellow). Finally, USDC held privately or by organizations, like bitDAO or the India CryptoRelief Fund (orange), might act very quickly, depending on the organizational structure.

In theory, the amount of USDC that can be redeemed within a few days is large enough to significantly deplete the collateral. Therefore, "protection" through illiquid USDC is likely a myth. However, luckily, after more news regarding the assets at SVB surfaced, guaranteeing a full recovery of funds, redemptions subsided. On 15 March, Circle announced that they cleared the whole backlog of redemptions.

Market Reaction and USDC Selling

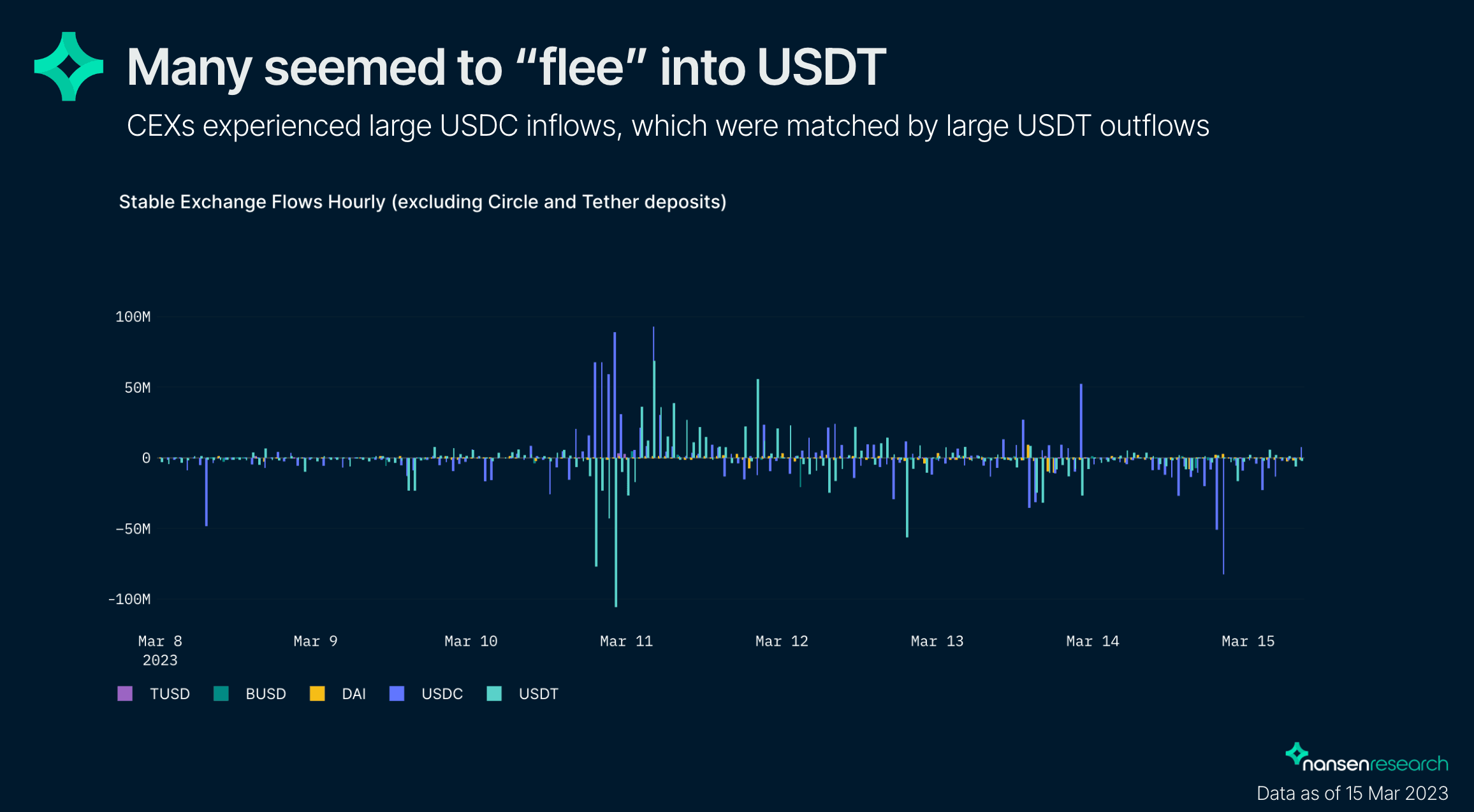

Following the events surrounding SVB, the market began massive sell-offs of USDC. The chart below shows exchange flows for the top 5 stablecoins by market cap starting on 8 March. There are distinctly visible inflows of USDC into exchanges parallel to large outflows of USDT, especially on 11 March. This strongly suggests that people were selling USDC in large quantities and were “fleeing” into USDT.

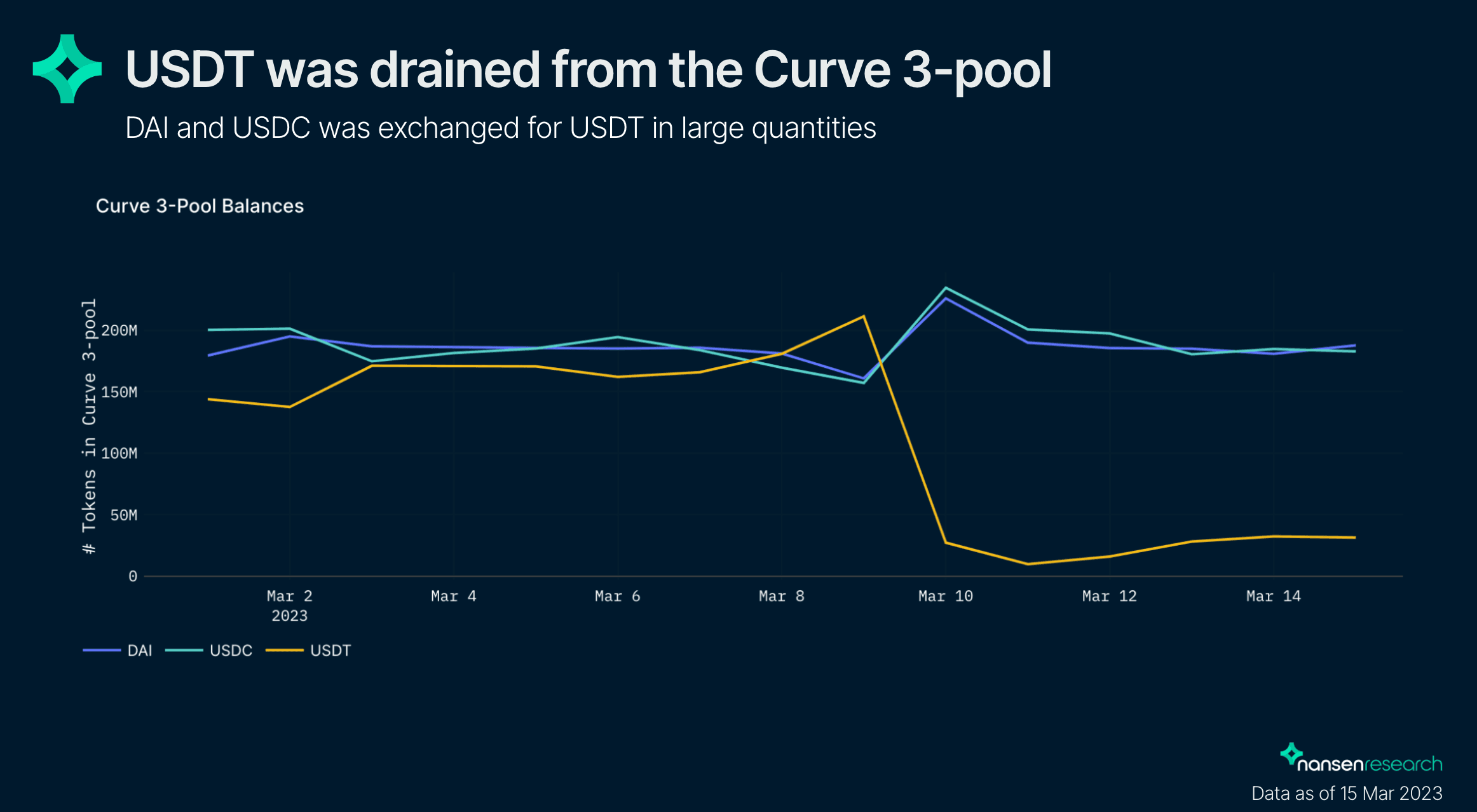

Data from the Curve 3 pool, which is one of the largest sources of stablecoin liquidity for USDC on-chain, also supports this scenario. The balance of USDC and DAI increased, while the pool was drained of USDT.

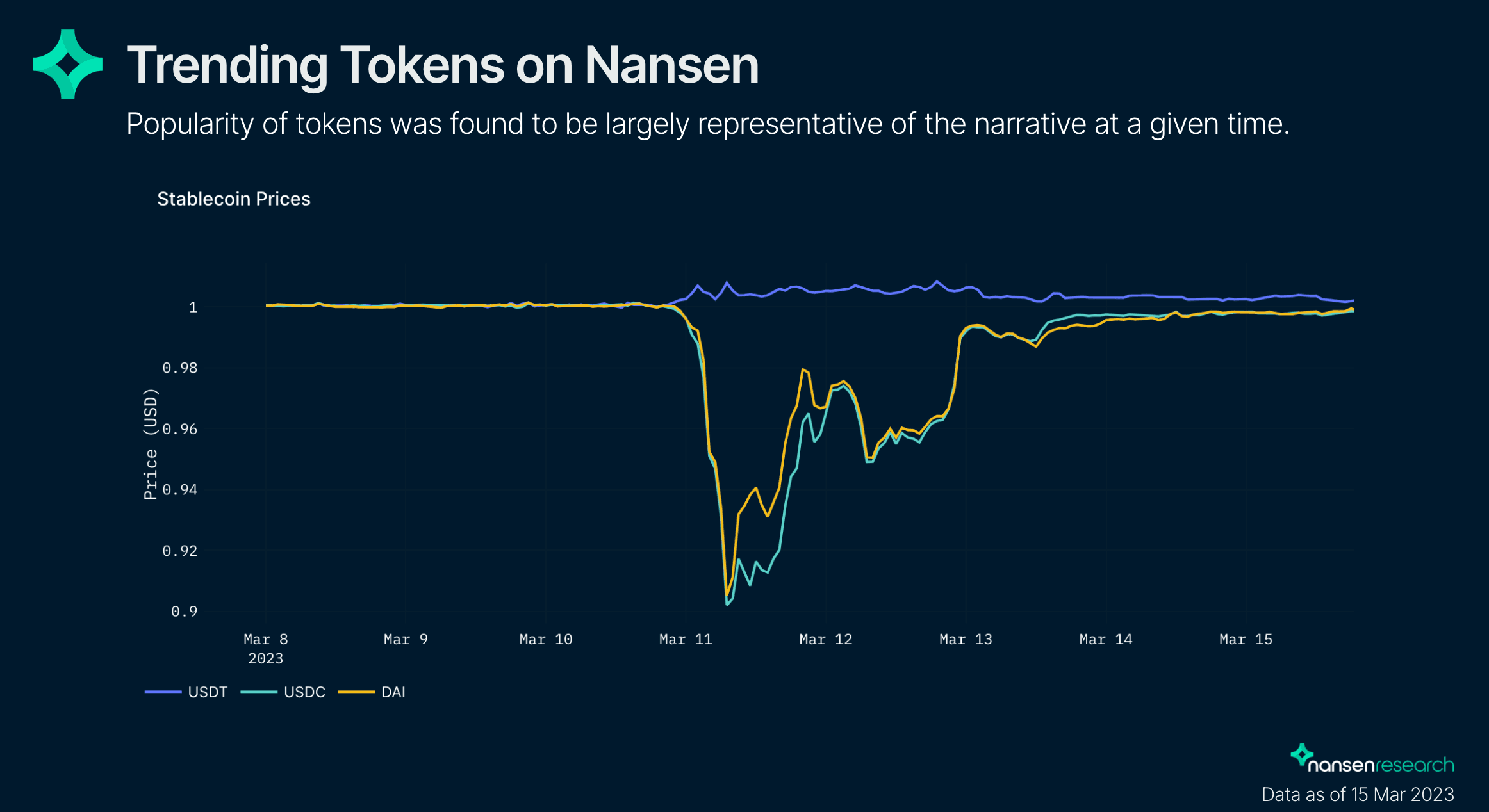

As suggested by the Curve 3-pool balances during the USDC de-peg, DAI followed the price action of USDC very closely, while USDT even temporarily traded above $1.

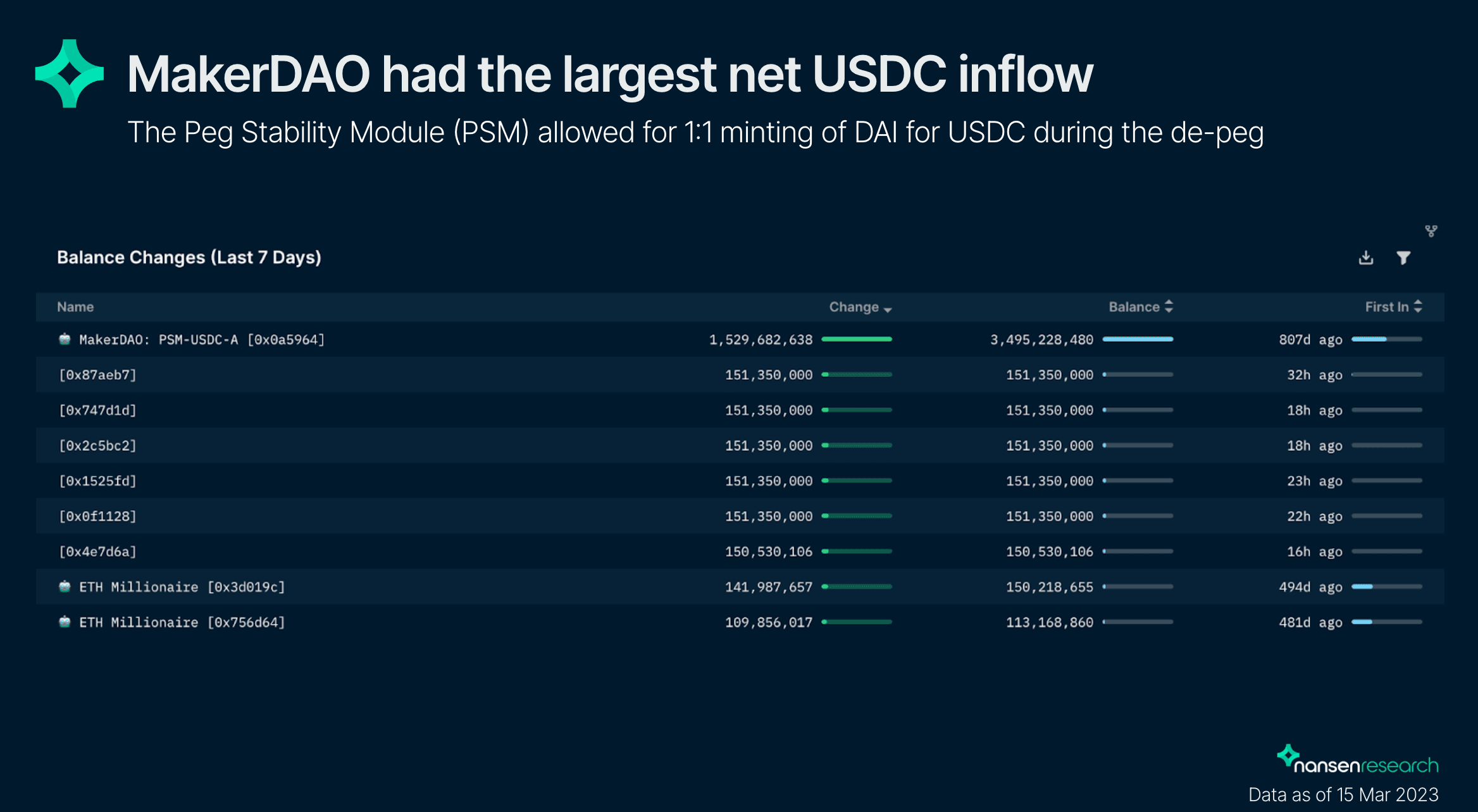

The tight coupling of DAI and USDC was mainly caused by DAI’s Peg Stabilization Module (PSM), allowing a 1:1 mint of DAI for USDC. This still worked even when USDC was off-peg, allowing for arbitrage (buy USDC, use it to mint DAI, sell DAI) as long as DAI traded above USDC. Consequently, there was a large inflow of USDC into the PSM during the de-peg, resulting in the PSM-USDC contract having the largest net inflow of USDC during that period.

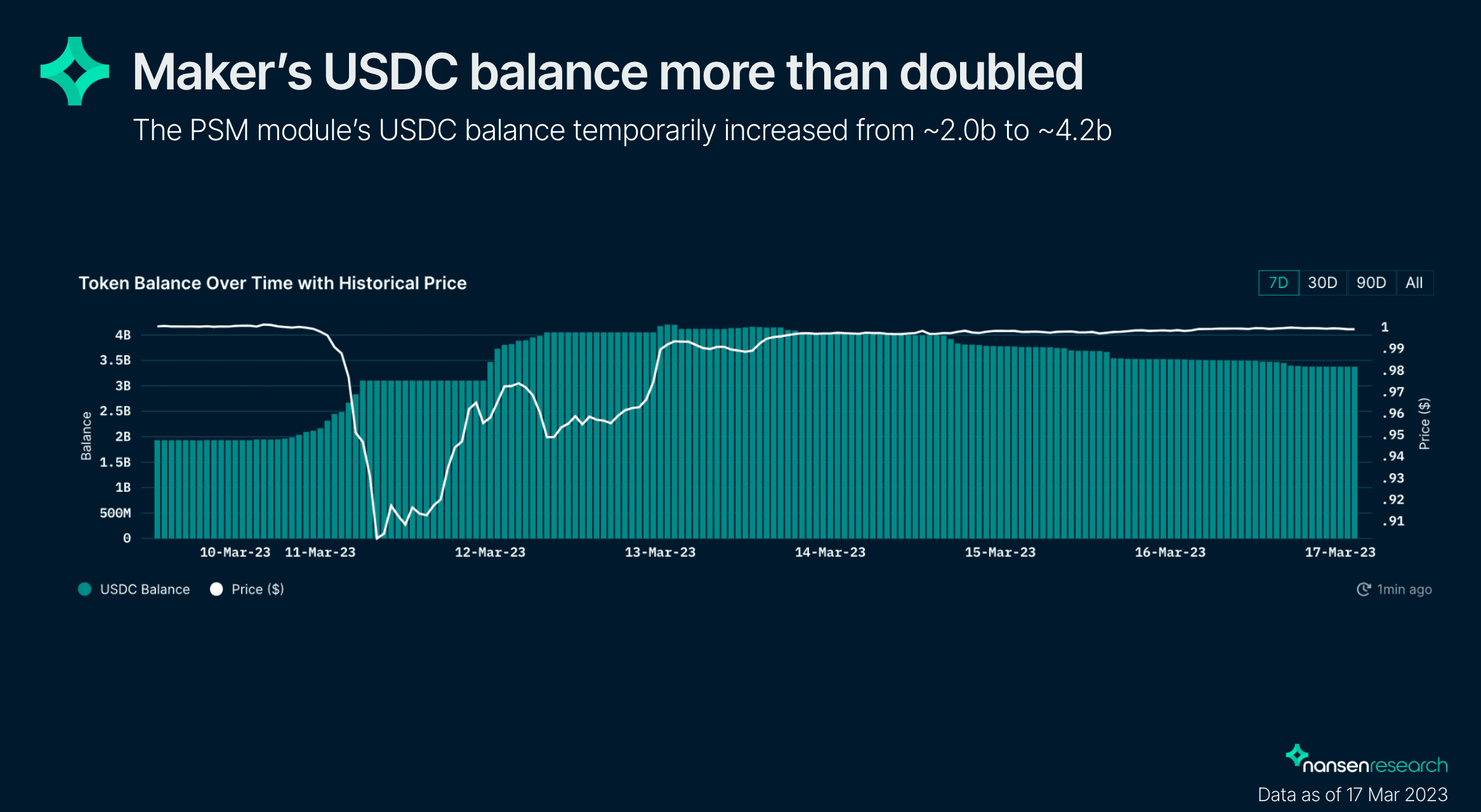

Looking deeper into the PSM, it can be seen that the balance temporarily increased ~$2.2b, more than doubling the USDC balance of the PSM. After USDC regained its peg, around $500m flowed out again.

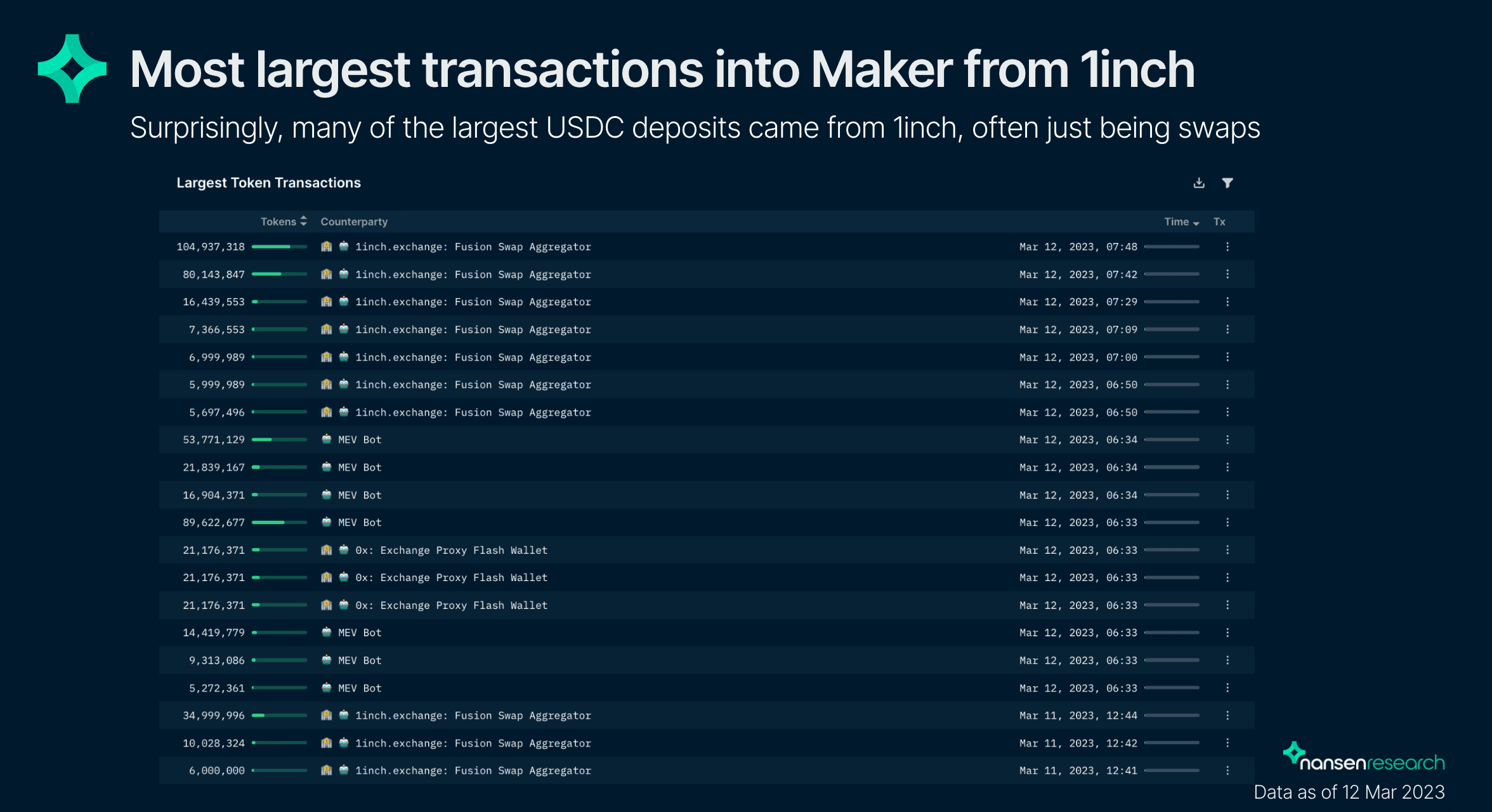

During that time, not only did professional arbitrageurs and bots profit, but the majority of volume and almost all of the largest transactions came from DEX routers, particularly 1inch, which appears to have integrated the PSM into their normal swaps (like this transaction for example).

This works both ways however, and with USDC regaining peg, DAI also followed suit and is now trading at $1 again on most exchanges.

Without taking the politics surrounding the full recovery of funds stuck in SVB into account, the USDC de-peg was a seriously concerning event. How the situation would have evolved if the funds at SVB had been lost can only be speculated. However, it could easily have been much closer to a complete disaster for USDC than many make it out to be.

It was a strong reminder that decentralization is still a long way ahead and that the need to build a truly decentralized ecosystem is stronger than ever. Not only did the failure of a centralized bank negatively affect Circle and USDC itself, but also “decentralized” protocols and products that are heavily reliant on it.