Introduction

This report delves into the world of crypto narrative traders, shedding light on the strategies and techniques employed by 15 successful individuals in the field. The process of identifying these traders is explained through a well-defined methodology. Key aggregated metrics, such as most held tokens, most used chains, and most interacted with contracts, are discussed to provide an overview of the selected wallets' behavior.

A comprehensive analysis of each wallet is presented, unveiling their unique trading activities and strategies. The ultimate goal of this report is to derive actionable alpha, allowing readers to leverage the insights and potentially profit from understanding these traders' tactics. We will also provide some practical applications, such as smart alerts, a dashboard to track the most popular entities, and the aggregated real-time view of their portfolio.

Methodology

The methodology used in this analysis consists of a multifaceted approach. First, a long list of wallets was generated by querying various narratives and timeframes, followed by a manual examination to identify the top-performing wallets.

In the query stage of the process, seven distinct narratives were defined as a starting point. For each narrative, one or more representative tokens were identified, along with a specific timeframe when narrative traders would likely experience an inflow of these tokens. This approach enabled a targeted exploration of wallet activities that aligned with the chosen narratives:

Subsequently, successful wallets (i.e. wallets with significant token inflow) across these narratives were cross-referenced to compile a list of proficient narrative traders. This list was then refined through manual examination to ensure the selection of the most relevant and skilled traders for further analysis.

Aggregated Metrics

To get a feeling of what these traders are generally up to, the report first takes a look at aggregated metrics like portfolio and chain allocation and the most interacted with entities, before doing the more granular deep dive into individual wallets.

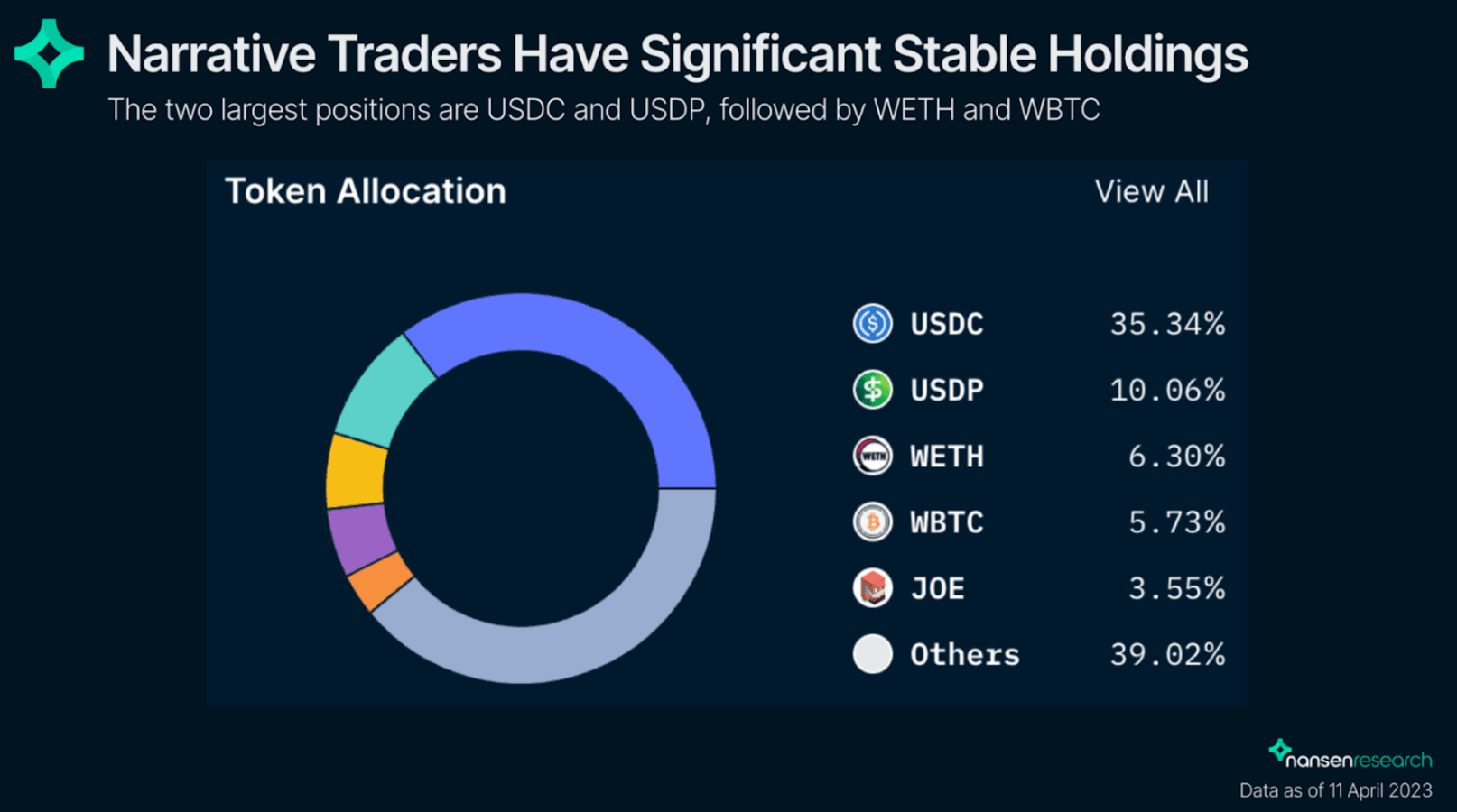

Portfolio Allocation

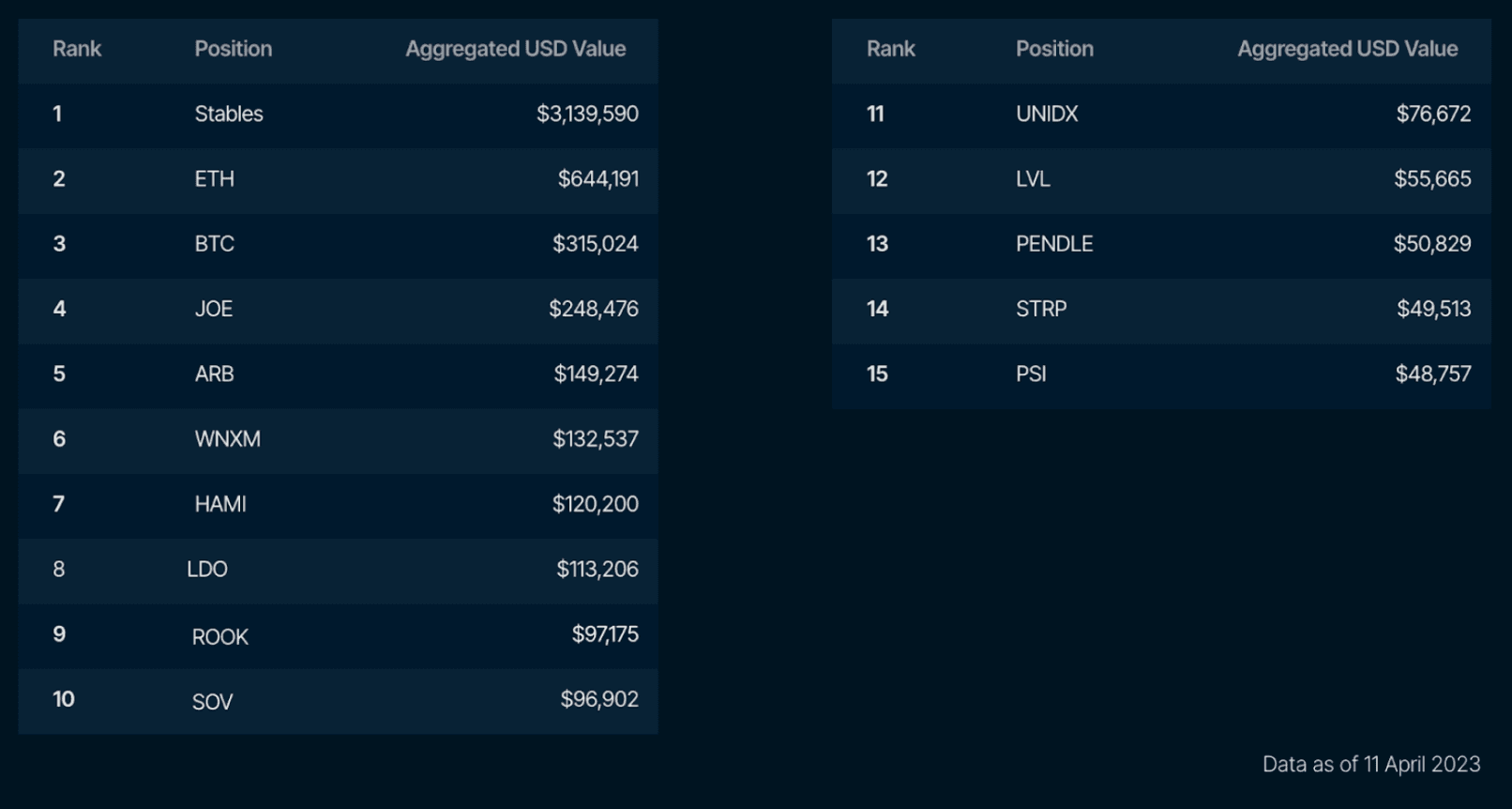

At first glance, it is apparent that the narrative traders are not “all in”, and still hold a significant portion in stables, supposedly as dry powder for the next narrative. After stables, ETH and BTC are their largest holdings, surprisingly followed by JOE. It has to be noted, that only on-chain holdings are tracked and some assets might be held on exchanges.

When taking a more detailed look at the positions and aggregating similar asset types (e.g. all stables or WETH and ETH), the top 15 largest positions by USD value confirm the initial observation. The narrative traders’ spot holdings consist of >50% stables, followed by ETH and BTC, whereas they hold around twice as much ETH as BTC. Their other holdings might reveal (future) hot narratives or be remnants of their past trades:

- JOE, UNIDX: UNI-V3 fork narrative

- ARB, HAMI, PSI: Arbitrum Narrative

- LDO, ROOK, PENDLE: Shanghai, LSD, MEV Narrative

- UNIDX, LVL, WNXM: Real Yield Narrative

- UNIDX, STRP: zk Narrative

- SOV: Dog Coin Narrative

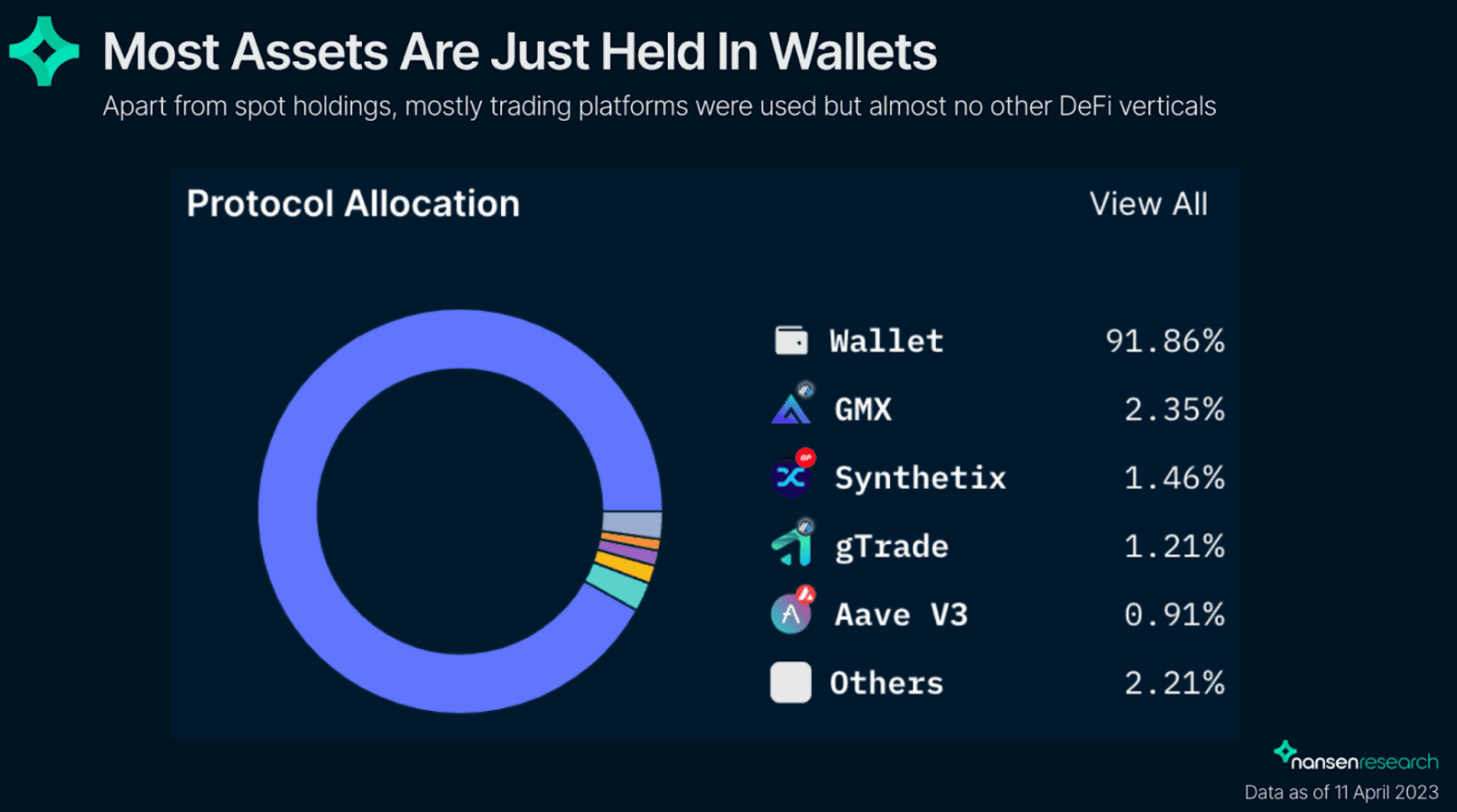

Protocol Allocation

The vast majority of assets from narrative traders are held idle in their wallets. A few on-chain trading protocols are used, but apart from that, there are barely any assets locked inside other DeFi applications. This could hint at traders discounting smart contract risk in their risk preferences, following the never-ending chain of hacks (with Euler being one of the more recent and prominent ones) and the perceived lackluster risk-reward-ratio.

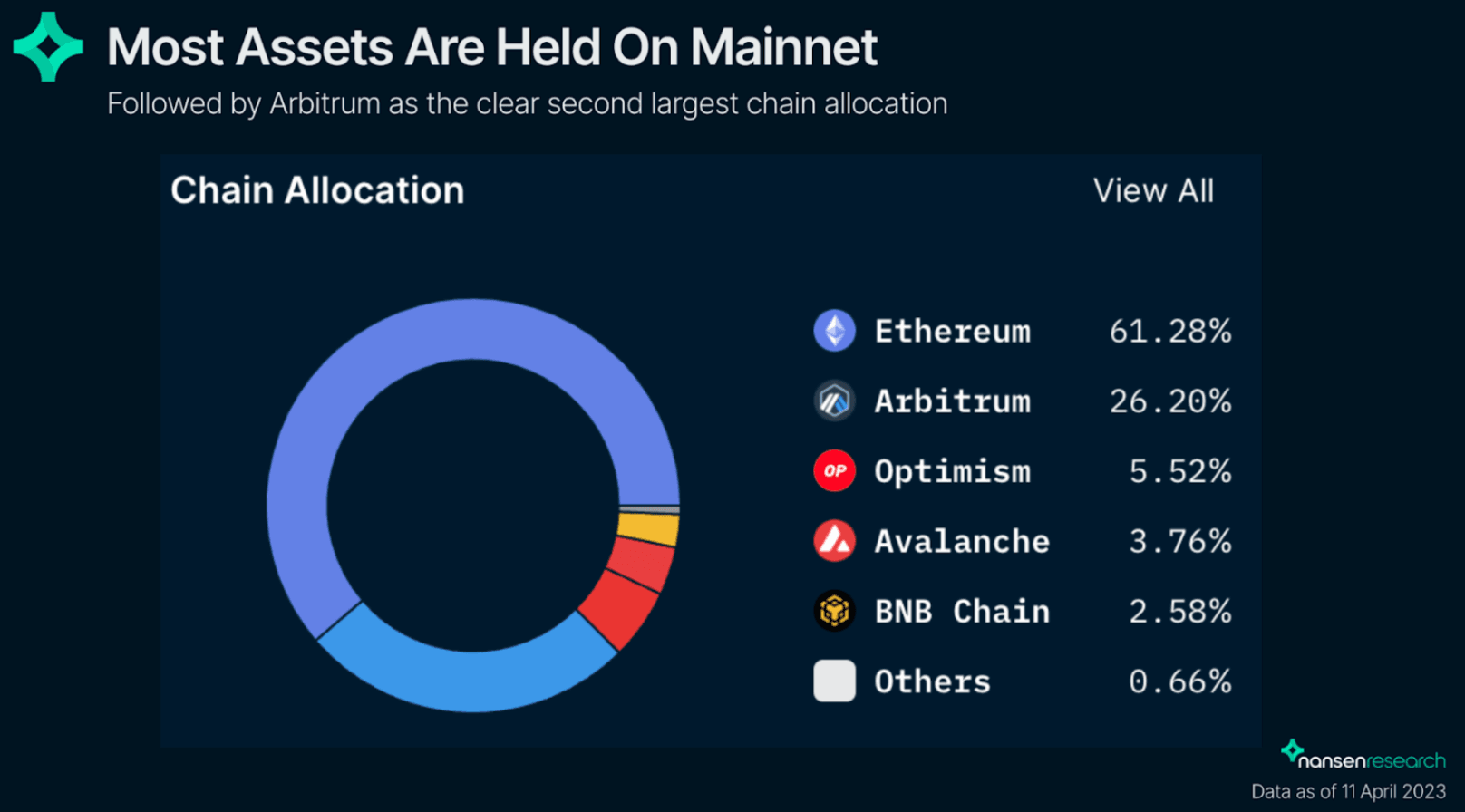

Chain allocation

Ethereum Mainnet remains the most popular chain among narrative traders, as it holds 61% of their assets, followed by Arbitrum with 26%. Optimism, Avalanche, and BNB Chain fall significantly behind Arbitrum, with only 6%, 4%, and 3% of assets held there, respectively. However, the Arbitrum narrative was explicitly included in the methodology for digging up the wallets so it may naturally skew in favor of Arbitrum.

Most Interacted Entities

This section examines the most interacted entities of the narrative traders in the last 30 days. To identify the entities, we tracked the outgoing transactions from the smart narrative traders to the corresponding entity. Although many of the top entries on the list are expected, such as the largest DEXs and aggregators (Uniswap, 1inch, ParaSwap, …), most common tokens (USDC, Tether, Maker, WETH, …) and NFT marketplaces (Opensea, Blur) there are also some entities that might contain some alpha:

- Synapse seems to be the most used bridge

- zkSync season seems in full swing

- Unsheth seems almost as popular as Lido

Deep Dives

Wallet 1

Label: 0xMecha on Opensea

No. of Narratives Traded: 3

No. of Tokens Traded: 4

Top Tokens Traded: MUTE, MAGIC, SYN

Wallet on Nansen Portfolio.

Takeaways:

- Current Largest Holding(s):

- JOE ($96k)

- PENDLE ($47k)

- Etc.

- 0xMecha has been swapping FOLD for PENDLE.

- This address is also quite active in the Arbitrum ecosystem, with 71% of its assets on this chain.

Wallet 2

Label: Heavy DEX Trader

No. of Narratives: 3

No. Tokens Traded: 3

Top Tokens Traded: APE, GRAIL, SYN

Wallet on Nansen Portfolio.

Takeaways:

- Staking ETH on Ether.fi

- Holding FXS

- This wallet seems to be capitalizing on the LSD narrative.

Wallet 3

Label:pauljin.eth*

No. of Narratives: 3

No. Tokens Traded: 3

Top Tokens Traded: LOOKS, SYN, GRAIL

Wallet on Nansen Portfolio.

Takeaways:

- Current Largest Holding(s):

- USDT on Arbitrum ($20k)

- MUTE ($13k)

- Staking ARB on Buffer Finance

- This wallet recently swapped USDT for MUTE and is still holding numerous assets on Arbitrum.

Wallet 4

Label: Heavy DEX Trader

No. of Narratives: 3

No. of Tokens Traded: 4

Top Tokens Traded: LDO, SYN, MAGIC

Wallet on Nansen Portfolio.

Takeaways:

- Current Largest Holding(s):

- $979k USDC

- This wallet is mostly risk-off and in stables but would be interesting to set up alerts for when they start de-risking and diversifying.

Wallet 5

Label: Elite DEX Trader

No. of Narratives: 3

No. of Tokens Traded: 4

Top Tokens Traded: LOOKS, GRAIL, SYN

Wallet on Nansen Portfolio.

Takeaways:

- Wallet is primarily holding WETH ($300k)

- The wallet has also moved on to trade the Uniswap v3 fork narrative today. As more Uni v3 forks launch, active liquidity management protocols will start becoming more prominent.

Wallet 6

Label: Elite DEX Trader

No. of Narratives: 2

No. of Tokens Traded: 4

Top Tokens Traded: GRAIL, SYN

Wallet on Nansen Portfolio.

Takeaways:

- Current Largest Holdings:

- ARB ($152k)

- JOE ($137k)

- This wallet is an active trader for ARB and has the label “Bear Market Accumulator for MAGIC”.

Wallet 7

Label: Found on Avalanche

No. of Narratives: 2

No. Tokens Traded: 2

Top Tokens Traded: OCEAN, APE

Wallet on Nansen Portfolio.

Takeaways:

- This address has $203k SOLID locked in the Solidly pool.

- This address also has $109k staked in LQTY.

- Interestingly, this wallet is holding 3% of its assets on Fantom.

Wallet 8

Label: 🤓 blockyieldcap.eth

No. of Narratives: 2

No. Tokens Traded: 2

Top Tokens Traded: SYN, LDO

Wallet on Nansen Portfolio.

Takeaways:

- Farming 201 ETH in unshETH, receiving rewards in USH.

- Farming in Level Finance pool.

- Staked 30 ETH in Ether.fi.

- Farming in the PILOT + ETH pool in Unipilot.

- This address is widely active in the current LSD narrative and continues to invest in new farms and protocols within this trend.

Wallet 9

Label: sungjae.eth

No. of Narratives: 2

No. Tokens Traded: 2

Top Tokens Traded: SYN, MAGIC

Wallet on Nansen Portfolio.

Takeaways:

- Sungjae.eth has 49% of their assets on Arbitrum and 44% on Ethereum.

- Current Largest Holdings:

- USDC on Arbitrum ($40k)

- Recently swapped USDC for SYN ($37k)

Wallet 10

Label: DEX Trader

No. of Narratives: 2

No. Tokens Traded: 2

Top Tokens Traded: APE, OCEAN

Wallet on Nansen Portfolio.

Takeaways:

- This trader is primarily holding stables and has traded the APE and OCEAN tokens successfully.

- The address has most assets staked on OlympusDAO, locked on Solidly, and staked on Liquity.

Wallet 11

Label: High Balance

No. of Narratives: 2

No. Tokens Traded: 3

Top Tokens Traded: SYN, GRAIL

Wallet on Nansen Portfolio.

Takeaways:

- This trader is capitalizing on the LSD narrative, with its largest holdings in USH, PENDLE, etc.

- This address also recently participated in the PoolParty (PARTY) token donation sale, however, has sold its holdings since.

Wallet 12

Label: hambeast.eth

No. of Narratives: 2

No. Tokens Traded: 2

Top Tokens Traded: LDO, SYN

Wallet on Nansen Portfolio.

Takeaways:

- This trader is capitalizing on the LSD narrative. Their assets are mostly diversified across various farming protocols like unshETH, farming in the USH pool.

- The trader is also diversified across the Uniswap v3 fork narrative, staking nICE on Popsicle Finance.

- Separately, this address also staked LVL on Level Finance on BNB Chain.

Wallet 13

Label: BouncyOnion44

No. of Narratives: 2

No. Tokens Traded: 2

Top Tokens Traded: GRAIL, SYN

Wallet on Nansen Portfolio.

Takeaways:

- This address is mostly holding stables or blue-chips like WBTC and ETH. The majority of their portfolio is in USDP, USDC on Arbitrum, USDC on Mainnet, and USDC on Optimism.

- This trader is exhibiting risk-off behavior given that most of the tokens that they’ve traded in the past narratives are no longer in their portfolio.

Wallet 14

Label: "dafbed" on OpenSea

No. of Narratives: 2

No. Tokens Traded: 3

Top Tokens Traded: LDO, GMX

Wallet on Nansen Portfolio.

Takeaways:

- This address has diversified to protocols on zkSync Era, specifically providing liquidity on SpaceFi (a DEX). Separately, this address is still holding $108k worth of HAMI on Arbitrum and $64k LDO in their portfolio.

Wallet 15

Label: ximu.eth

No. of Narratives: 2

No. Tokens Traded: 2

Top Tokens Traded: ZZ, MAGIC

Wallet on Nansen Nansen Portfolio.

Takeaways:

- This address is trying to capitalize on both the Layer Zero “airdrop” and zkSync narrative. Their wallet recently traded ZGEM on zkSync and bridged funds using Stargate.

Actionable Alpha

Common Traits of Top Narrative Traders

- Arbitrum remains the second most utilized chain after Ethereum amongst the Top 15 narrative traders

Despite the exhaustion of Arbitrum's narrative after the airdrop, a considerable number of traders are still retaining significant portions of their portfolio on Arbitrum compared to other chains. These traders are not just holding native tokens on Arbitrum but are also engaging in yield farming on different protocols such as Lodestar and Hamachi Finance.

- Average holding time per token is short

These traders who prioritize trading narratives usually have a short asset holding period since they predominantly rotate between different narratives.

- Traders perform best when rotating across 1-2 narratives

Most of the aforementioned traders have effectively rotated between one or two distinct narratives. While we might anticipate more traders to switch between narratives, we have determined that less is more, and excessive diversification may not be optimal.

Upcoming Narratives

- LSD tokens

Interestingly, Unsheth (USH) was high on the list when looking at the contracts that the top 15 traders have interacted with in the last 30 days towards the Shanghai upgrade. Unsheth has taken the LSD space by storm, capturing over $24.29m in TVL (Defillama).

- zkSync Era

The majority of these narrative traders have shifted their attention to the next big thing, with zkSync Era emerging as one of the trending narratives. Most of these traders used the official zkSync bridge to move their funds over from Ethereum to zkSync Era. Notably, some of the protocols that these traders have been involved in include Velocore (native DEX on zkSync Era), zkGEM (native DEX on zkSync Era), MUTE, ZigZag, and a few others.

Keeping Track of Future Narratives

As these wallets have successfully traded past narratives, there is a high chance that they will also catch upcoming trends. There are several ways you can keep track of these wallets and gain an edge for your future trading activities:

- Keep track of their aggregated token holdings using this Nansen Portfolio bundle. This allows you to observe aggregated holdings of these wallets and general trends in their portfolio. Furthermore, you can use the wallet bundle as starting point to deep dive into individual wallets.

- Use our interactive Nansen Query dashboard to discover the top entities most frequently interacted with by these traders. This can help you identify which narratives are currently trending.

- If you prefer a more real-time update of what they are up to, you can also set up a smart alert for these wallets. Keep in mind, that you need to set up separate smart alerts for each chain. You can use this smart alert template for Ethereum or this smart alert template for Arbitrum to help set them up. Tinkering with the USD value thresholds for token transfers to include in the alerts (set at >$10k in the templates) can help improve the signal-to-noise ratio and tailor the alerts to your needs.