Introduction

As equity and crypto markets correct (future S&P 500 down -9%, Nasdaq -13.5%, Russell 2000 -17.6%, BTC -29.6% from their respective peaks, as we write), and attempt to stabilize, some single names, among tokens and stocks, are reaching attractive values, in our view.

We added a small long position in Coinbase stock (COIN) last week, based on the simple rationale that the stock price had fully retraced the post-US-election (post-5-Nov-2024) ascent which is at odds with the more favorable business and regulatory environment that emerged post-election, notably the Securities and Exchange Commission (SEC) abandoning its investigation into the exchange.

In this note, we dig deeper, as we sketch the fundamental case for Coinbase, attempt to estimate Q1 2025 financials, and highlight the main risks to our upbeat view on COIN.

Fundamental Rationale

Regulatory environment

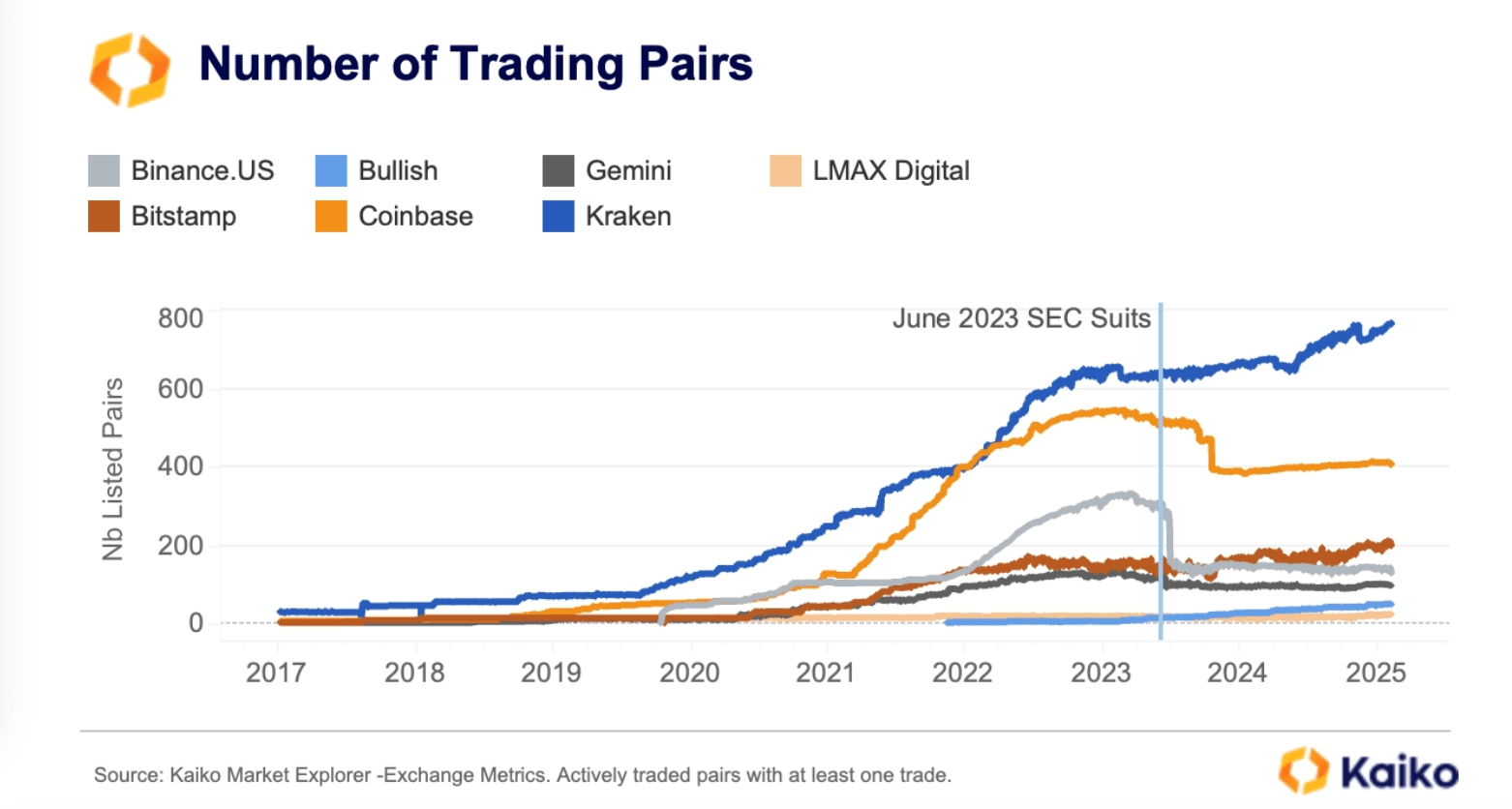

The SEC dismissing its legal action against Coinbase is probably the first step towards a more constructive regulatory environment, notably for centralized exchange (CEX) token listing. The SEC has indicated that it will collaborate with the Commodity Futures Trading Commission (CFTC) and the Crypto Czar to clarify classification criteria for crypto tokens, likely adopting a more expansive definition of the “commodity” category (see the section Crypto America: “Grift Age or New Golden Age?”).

In 2023, after the SEC launched its investigation, Coinbase had to significantly slow token issuance, which likely put a lid on its trading revenues. Indeed, in its Q4 quarterly earnings press conference, Coinbase CFO disclosed that new retail trading clients (non-crypto “newbies”) came to the platform to trade new coins and discover new products.

Aside from new token listing, a clearer regulatory backdrop is a tailwind for institutional and retail product development. Coinbase’s management appears especially well positioned to help shape the crypto regulatory agenda, given its proximity to the US administration.

Products & services, a “network” effect

Coinbase’s strategy is to build a full-fledged suite of the most used crypto services and products by retail and institutional clients.

We highlight the segments that we see as having started to demonstrate their growth potential:

- Stablecoins for Payment: stablecoin revenues were up over 30% YoY in 2024. The strategy of associating with reputable issuers like Circle for USDC, and mainstream payment players like Stripe, to push fast-settlement payment is differentiating and to a certain extent insulated from crypto price developments.

- Stable yield products: Coinbase is also redistributing USDC rewards to self-custodied wallets, offering passive income that incentivizes asset stickiness.

- Bitcoin-backed loans, enabled by the Base open-source lending platform Morpho: BTC has experienced lower drawdowns than other coins and is benefitting from the “strategic reserve” narrative (with the US Treasury hinting at potential asset swapping into BTC) and is therefore a candidate asset for an investor to “hodl”, while benefiting from an associated yield.

- More generally, we are constructive on the model that tests onchain innovative DeFi products efficiently on Base and then integrates those to the Coinbase platform if relevant for more “mass-market” adoption (see the team’s latest article on Base).

- A larger suite of derivative products for trading: as crypto trading gets more sophisticated, it makes sense for Coinbase to integrate futures trading. Although this is a lower-margin business, it enables Coinbase to capture trading volume in higher-volatility markets where traders seek to hedge. Coinbase is reportedly in negotiations to acquire Deribit, and add options to its product suite.

To summarize the fundamental case for COIN: Coinbase is building a one-stop platform for institutions and retail to trade and hedge, potentially custody, earn passive yield income, organize payments, and manage assets. This while helping shape the regulatory landscape that will govern products and services.

However, currently, we have to highlight the still elevated dependency of Coinbase’s top line on crypto spot trading revenues (about 60% of total revenues of the exchange on average over the past few quarters). This means that COIN stock price remains highly correlated to BTC and other crypto prices, a vulnerability that is likely to manifest itself again in Q1 2025 results (see below).

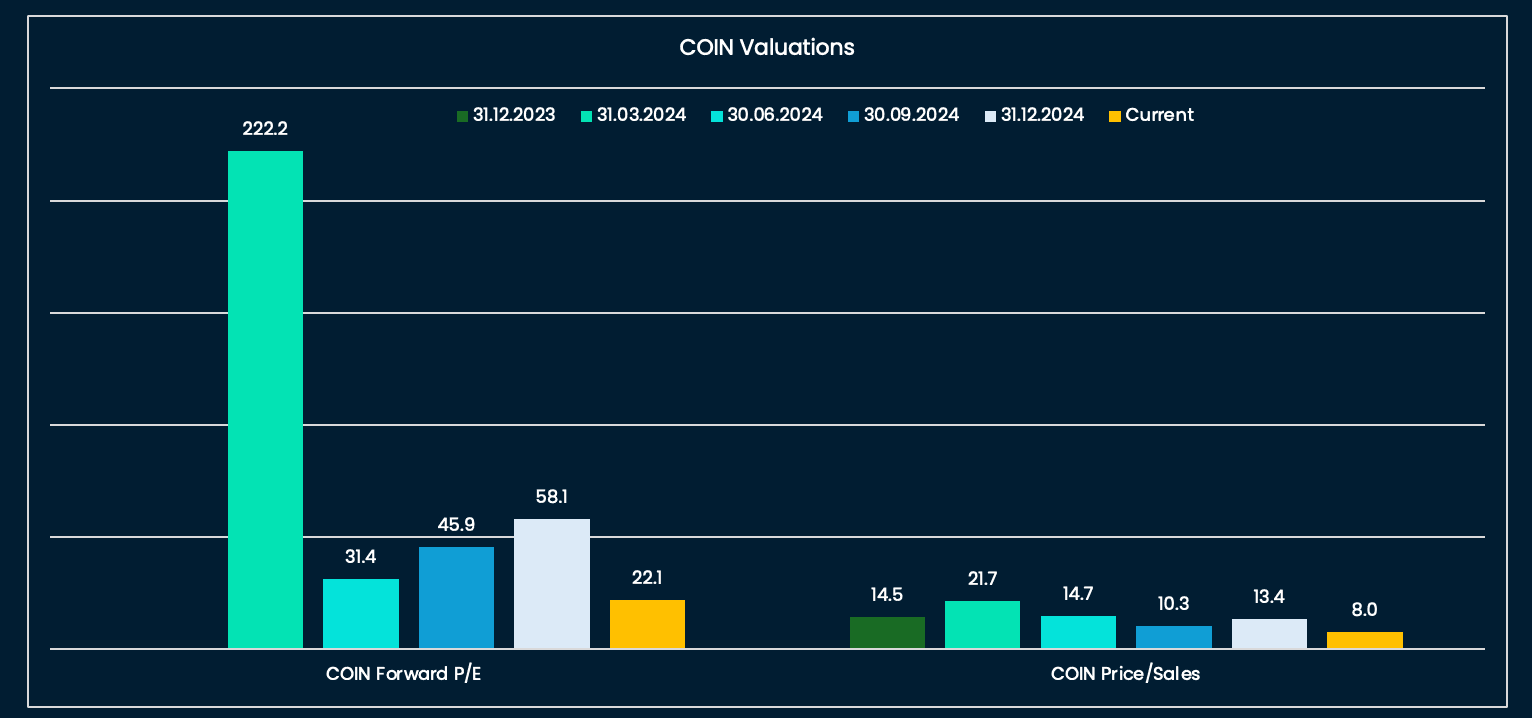

COIN valuations

Most of COIN’s valuation metrics have fallen below Q4 2023 and Q1 2024 levels. Meanwhile, Coinbase has relatively high profit margins (40% as of latest reporting), close to the “Magnificent 7” software stocks’ own margins.

Downside Risks

Likely contraction in Q1 revenues

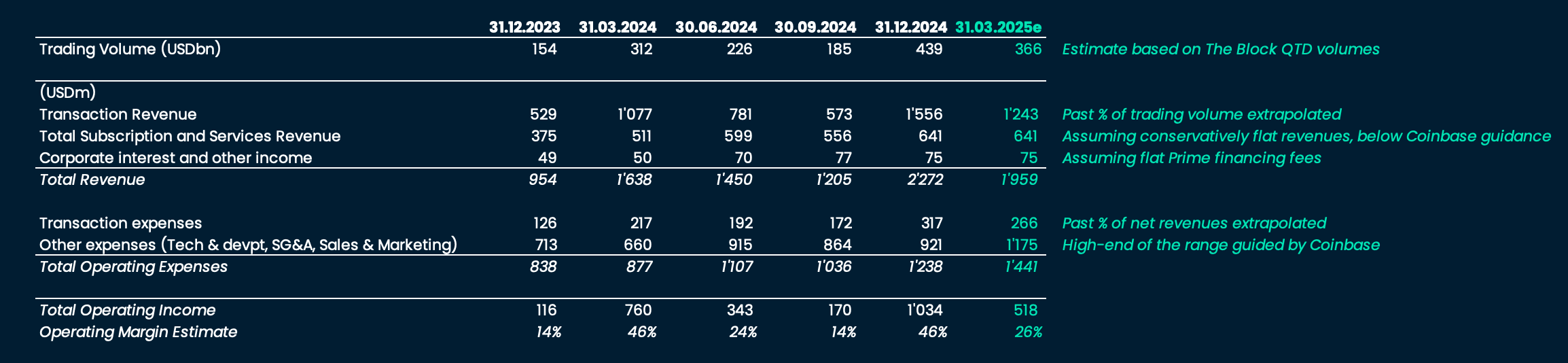

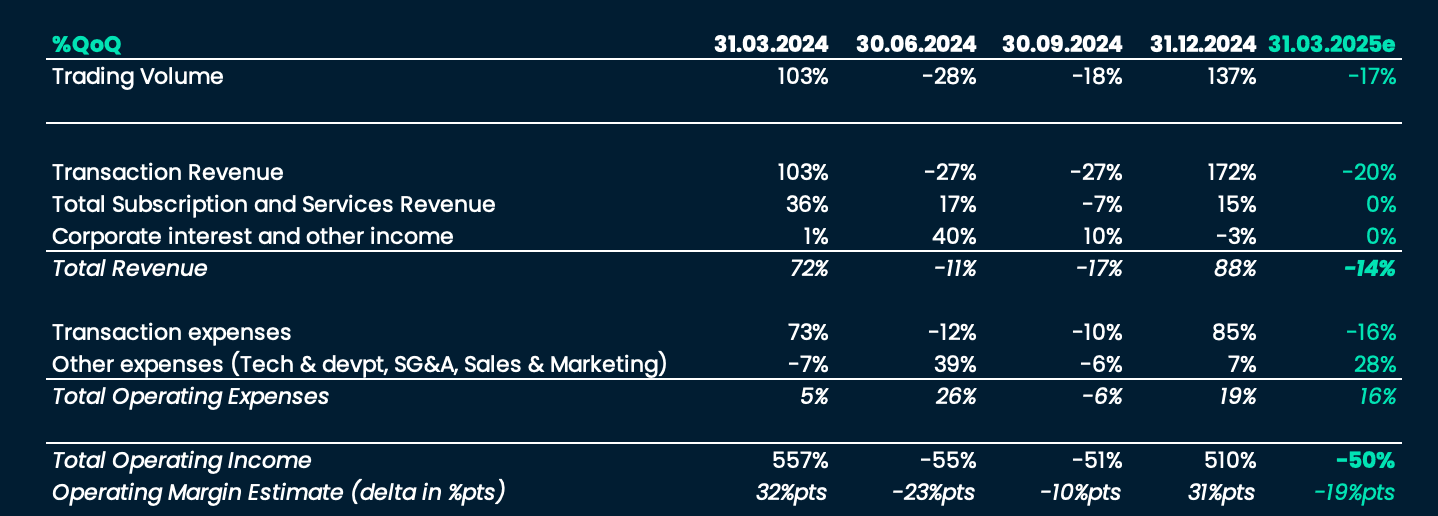

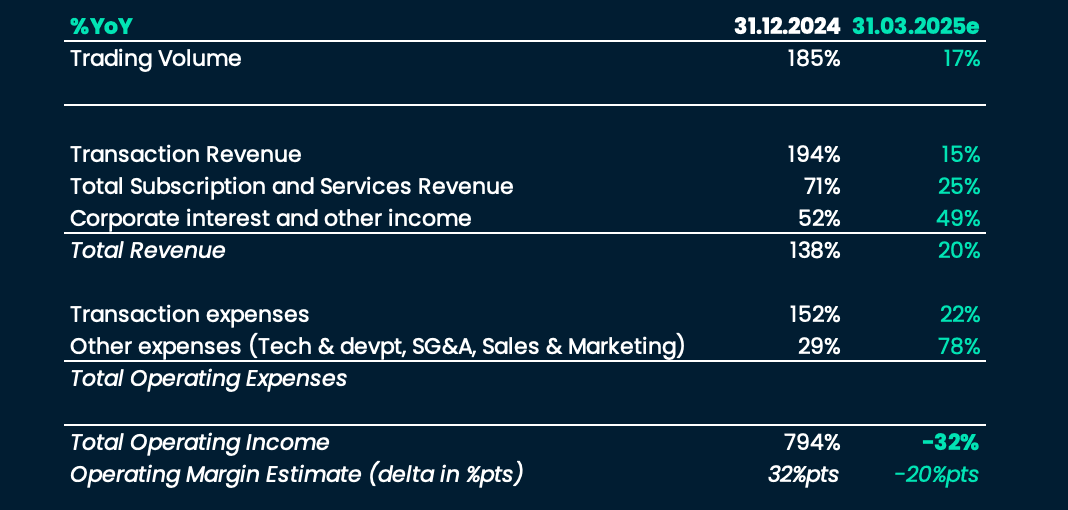

Using Coinbase’s guidance on revenues and costs and proxying Q1 2025’s trading volumes, we apply conservative assumptions and estimate that Coinbase’s Q1 2025 revenues could contract by -14% and operating income by -50% QoQ, primarily due to market conditions.

This magnitude of revenue and income decreases is not unusual, and occurred as recently as in Q2 2024 and in Q3 2024 (see quarterly growth table above).

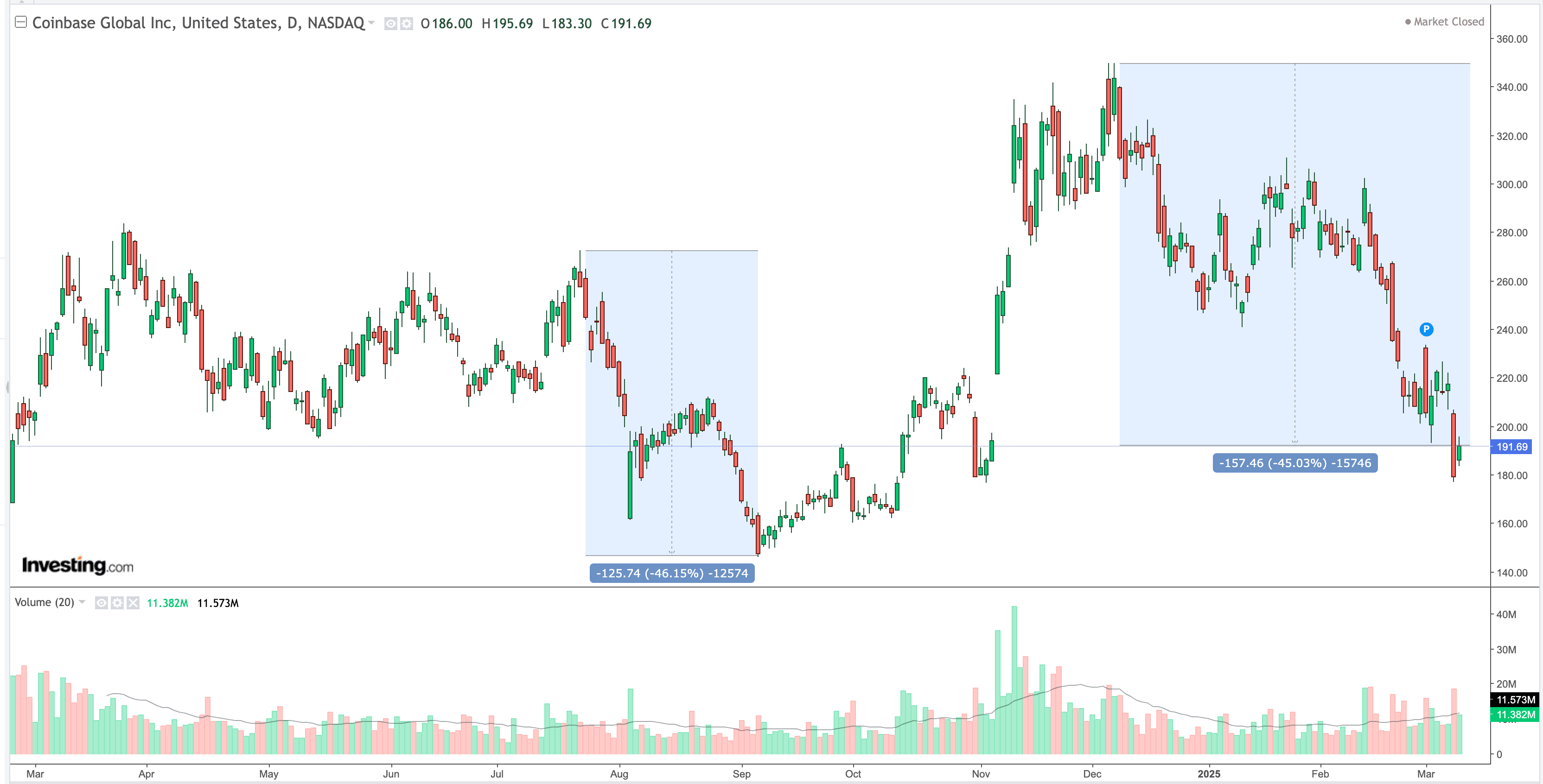

To gauge the price reaction to these Q2-Q3 past results, we measure August 2024 to September 2024 peak-to-trough drawdown which is roughly of -46%. If we mechanically replicate this drawdown from COIN price’s December 2024 high, this brings us to a spot price of 188 USD, just 1% below COIN spot price as we write (192 USD). It is tempting to assume that markets have therefore anticipated Q1 2025 drop in revenues, to some extent.

Is this still a bull market?

The main downside risk to our COIN thesis is a misread of the risk and crypto cycle. We still believe that the backdrop is one of a bull market for crypto and no recession for the US economy.

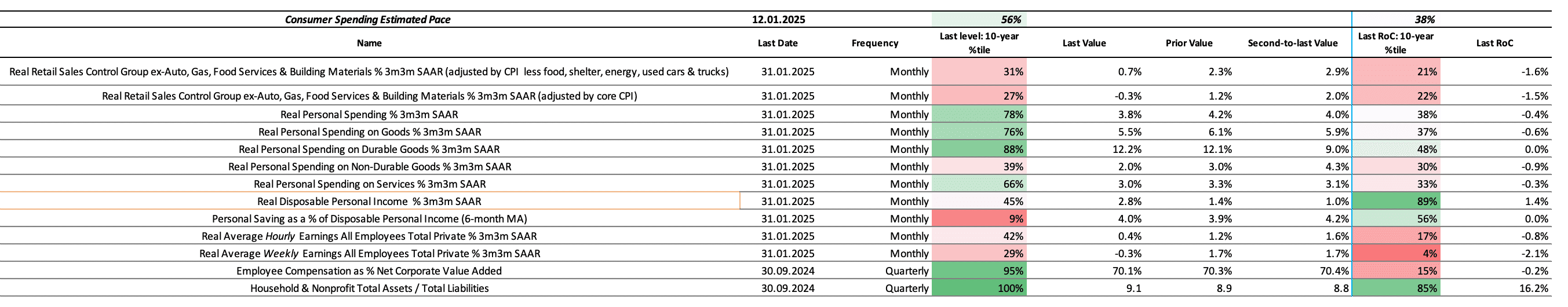

Recently, recession fears have been creeping up among financial media commentators. These are based on the uncertainty generated by and the projections of the impact of the US administration’s policies, most notably tariffs, on private consumption and investment. True, US nowcasters and some business surveys have been alarming. That said, layoffs as measured by initial jobless claims have not picked up yet, outside of the DOGE effect, which means that labor income should remain solid. Household balance sheets are healthy on average, even with the S&P 500 correcting 10%:

So far, estimates of tariff impacts on US growth range from -50bps to -70bps bringing us to a 2025 US growth of 1.7% YoY, which is still OK.

Of course, recessions are hard to spot and we could be wrong. The lower-probability scenario of a recession is the one that presents the largest downside risk to the COIN thesis. For instance, if COIN were to revisit its January 2023 low, it would represent a -86% drawdown, comparable to a BTC drawdown.

To manage this tail risk, we start with a modest position and may increase it following Coinbase’s Q2 earnings reporting, provided macroeconomic data improves and tariff uncertainty diminishes.