Disclaimer: Nansen has produced the following report in collaboration with Slice Analytics as part of its existing contract for services provided to Sei (the "Customer") at the time of publication. While Sei has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

In Q4 2024, Sei, the fastest parallelized EVM Layer 1, accelerated its evolution across DeFi, gaming, and enterprise infrastructure. The ecosystem showcased strong momentum, driven by new protocol deployments, infrastructure integrations, and foundational improvements designed to meet the demands of modern onchain applications. Within DeFi, Filament, a hybrid derivatives exchange, introduced a novel compartment based liquidity pool and order book architecture to facilitate low slippage trading in volatile markets. Meanwhile, Yei Finance secured $2 million in seed funding to expand its omnichain money market and modular lending pools. Onboarding became easier with the arrival of Dynamic, while wallet infrastructure saw improvements via Turnkey, Privy, and OneBalance, all contributing to seamless cross chain asset management. Stablecoin activity grew significantly through Frax Finance, Elixir, and Synnax, who introduced yield bearing and SEI backed stablecoins purpose built for DeFi applications. SeiGas launched, integrating Blocknative's Gas Platform to deliver precise, real-time gas price predictions optimizing transaction fees without compromising on execution speed by leveraging mempool data and predictive modeling. In NFTs and gaming, Sei allocated over $61,000 to 198 projects during Round 4 of the $10 million Sei Creator Fund, reinforcing its commitment to grassroots development. Titles like Cat vs Monsters, Archer Hunter, and FishWar gained strong user traction, while Sei’s official NFT launch on Magic Eden was marked by a 250,000 SEI prize pool. Enterprise and infrastructure development continued with the Sei Research Initiative, a collaborative program reimagining the EVM’s architecture to support enterprise grade throughput and scalability. This was complemented by the integration of Orderly Network, which brought institutional grade perps trading infrastructure to Sei. Underlying it all, Sei’s advancements in consensus, parallelized execution, and its SeiDB storage engine solidified the network’s capability to support high throughput, data intensive use cases. These efforts reflect Sei’s long term vision of bridging Web2 performance with Web3 decentralization, positioning itself as the most performant EVM compatible blockchain in the market.

Key Developments: Q4 2024

- Sei has established itself as a high performance Layer 1 blockchain purpose built to scale the Ethereum Virtual Machine (EVM) for modern onchain applications. With nearly all crypto native developers building on the EVM, its widespread adoption has created a strong foundation, but one that was not originally designed for today’s demand. Sei is addressing this gap by introducing parallelized execution, delivering sub second finality and dramatically higher throughput without compromising EVM compatibility. Since the launch of Sei v2 in July 2024, the network has surpassed $250M in total value locked, onboarded 150 projects, and reached 400,000 daily active users. Now targeting 5 gigagas per second, a next generation benchmark focused on computational capacity rather than just transactions per second, Sei is setting the pace for scalable infrastructure. With continued innovation across consensus, storage, and execution, Sei is building the most performant EVM blockchain yet, empowering developers to unlock Web2 level performance for the next era of decentralized applications.

- As part of its broader $10 million ecosystem initiative, the Sei Creator Fund dedicated Round 4 exclusively to Web3 gaming, underscoring Sei’s commitment to fostering a high performance gaming and NFT ecosystem. The round funded 198 projects and attracted over $61,400 in crowdfunding from 15,612 donations made by 3,838 unique contributors, reflecting strong grassroots momentum for Sei native game development. To preserve fairness and transparency, Sei employed advanced Sybil detection tools powered by DBSCAN clustering and cross chain data analysis, validating legitimate participation and eliminating manipulation. Notable recipients included Bando - Creator Series, NFTDad.Sei, Kosa on SEI, Shockermandan Games, and Synergy (BkArchived), each contributing to a diverse pipeline of real time, on chain games and NFT projects built on Sei’s parallelized execution layer and EVM compatibility.

- Filament, a hybrid decentralized exchange for derivatives, is emerging as a key DeFi protocol within the Sei ecosystem. Backed by a team with experience from Goldman Sachs, BlackRock, Persistence, Nethermind, and Open Status, Filament secured $1.1 million in seed funding led by Lingfeng Innovation Fund, with support from notable Web3 investors. Designed for low liquidity environments, Filament introduces a novel architecture that integrates a compartment based liquidity pool (COMB Pool) with a high performance order book, enabling capital efficient trading across market conditions. This approach addresses a core challenge in DeFi by facilitating reliable, low slippage derivatives trading even in volatile or thinly traded markets. Its first product, MemeX, offers leveraged memecoin trading tailored for retail users.

Ecosystem

DeFi

Yei Finance has announced the successful close of a $2 million seed funding round as it builds toward the launch of Yei Finance V2: Modular Lending Markets. Backed by Manifold Trading( and supported by leading firms such as DWF Ventures, Kronos Research, OVioHQ, Sidedoor VC, WOO Ecosystem, and industry leaders including Matt Dobel and 0xZhuang, the project is positioned as a next-generation lending protocol within the Sei ecosystem. With $130 million already in total value locked, Yei Finance is building a hub-and-spoke architecture to unify fragmented liquidity across blockchains, enabling seamless borrowing and lending through an omnichain money market. The capital will be used to launch modular lending pools that support customizable strategies, enhance platform usability, and further its vision of delivering secure, efficient, and composable cross-chain lending infrastructure.

Frax Finance, the issuer of FRAX and sFRAX, delivers decentralized stability through a hybrid model that blends the reliability of fiat-pegged stablecoins with algorithmic stabilization, enabling seamless value transfer and yield generation within the Sei ecosystem. Elixir, the team behind deUSD and the Sei-native stablecoin fastUSD, is focused on powering Sei’s rapidly expanding DeFi landscape with a stable, yield-bearing asset designed for high-performance applications. Meanwhile, Synnax Labs introduced the first SEI-backed stablecoin and is preparing to launch v2 with innovative yield solutions that expand the utility of SEI and other native assets across the network.

The fastest parallel EVM Layer 1, Sei, has officially integrated with Galxe, further expanding its ecosystem reach through on-chain identity infrastructure and future campaign rewards. This reinforces Sei’s open-source development mission and its commitment to engaging a broader on-chain community.

LI.FI integrated with Compass Wallet, bringing its advanced DEX aggregation infrastructure to the Sei blockchain. This marks LI.FI’s first deployment within the Leap ecosystem, enabling Compass users to access optimal pricing for same-chain swaps through a network of 32 DEXs, aggregators, and solver networks. Known for powering major cross-chain integrations across 30+ chains, LI.FI’s middleware stack enhances swap efficiency on Sei and positions itself as a critical backend layer for future DeFi and developer tooling in the ecosystem.

Torii has officially rebranded to Symphony, reflecting a more global and professional identity that aligns with its mission as Sei Network’s first native DEX aggregator. With superior routing efficiency and minimal price slippage, especially on large swaps, Symphony aims to deliver optimal trade execution and capture institutional liquidity. The rebrand launch includes an OG role claim period in its newly opened Discord and sets the stage for upcoming community incentive campaigns, branding initiatives, and a public API rollout to integrate with key ecosystem partners.

NFTs & Gaming

Web3 gaming on Sei continues to gain momentum as on-chain titles like Cat vs Monsters, Archer Hunter, and FishWar report strong community traction and adoption. Cat vs Monsters surpassed 250,000 players just one month after launch, boasting 26,800 daily active users, over 4,000 daily Arena battles, and an average session time of 45 minutes—demonstrating early user retention and engagement. Archer Hunter, developed by Nika Labs, introduces a native Web3 gaming IP fully powered by Sei’s parallelized architecture, while FishWar takes advantage of Sei’s high-throughput EVM to deliver fast-paced, on-chain gameplay.

On Dec 3rd, Sei has officially launched NFTs on Magic Eden, marking a major milestone for the network’s growing digital asset ecosystem and reflecting the relentless momentum of its community. To celebrate the launch, a 250,000 SEI prize pool has been announced for the top 100 NFT traders on Sei over the next two weeks, with rankings based on trading volume and strict disqualification rules for wash trading.

Final Glory, a Free-to-Play, performance-driven AAA title developed by MetaArena, officially launched on the Sei blockchain, delivering a high-speed, immersive gaming experience. Built to reward skill and competition, the game has already attracted over 100,000 users within its first two months, showcasing the scalability and gaming readiness of the Sei network. With fast finality and low fees, Sei continues to position itself as a premier home for next-gen Web3 gaming.

Enterprise & RWAs

The Sei Research Initiative, spearheaded by Sei Labs and the Sei Foundation, represents a bold leap forward in scaling Ethereum Virtual Machine (EVM) performance for enterprise-grade applications. Embracing an open-source, collaborative approach, the initiative brings together top researchers, developers, and thought leaders to reimagine the EVM from first principles across execution, consensus, and storage. With nearly 90% of blockchain development anchored in the EVM, Sei is unlocking new levels of scalability and efficiency through parallel execution, optimistic block processing, and SeiDB—all while preserving full EVM compatibility. Rooted in values like credible neutrality, permissionless participation, and trust minimization, Sei is building a resilient and future-ready Layer 1 designed to empower developers, institutions, and real-world asset platforms with unmatched performance and flexibility.

Orderly Network, a unified liquidity layer for Web3 trading, expanded to the Sei ecosystem in Q4 2024, bringing institutional grade infrastructure to on-chain perps trading. By integrating with Sei’s high speed, parallelized EVM architecture, Orderly enables developers to launch exchange quality DeFi applications that benefit from low latency, deep liquidity, and seamless cross-chain access. Orderly’s modular suite includes shared order books, risk engines, and liquidity aggregation tools, providing a powerful backend for builders on Sei to create scalable, capital efficient platforms with CEX level user experiences.

- Sei, as the first parallelized EVM Layer 1, is addressing long-standing inefficiencies in Ethereum’s storage architecture by rethinking how smart contract state is managed at the base layer. Traditional EVM clients like Geth, Besu, and Erigon rely on the Merkle Patricia Trie (MPT), which, while secure, introduces costly storage operations and contributes to state bloat as on-chain data grows. These inefficiencies increase gas fees, reduce node accessibility, and limit developer flexibility. Sei bypasses these limitations with SeiDB, an optimized state management engine designed to improve read/write performance, reduce storage complexity, and enhance scalability across DeFi, gaming, and enterprise applications. By shifting away from deep trie traversal and recomputation bottlenecks, Sei delivers a more efficient and developer-friendly storage layer, unlocking the next generation of high-throughput, data-intensive blockchain use cases.

On-chain Data

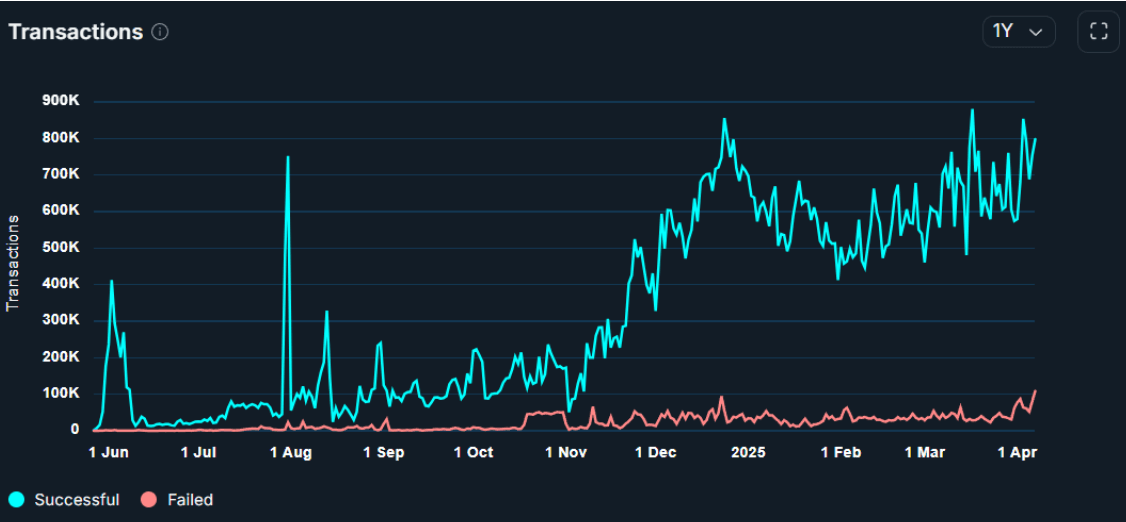

Daily Transactions

Since the beginning of Q4 2024, the Sei chain has demonstrated strong and sustained growth in daily transaction activity. Starting from around 100,000 transactions per day in early October, the network saw a steady climb, peaking at nearly 900,000 daily transactions by late December. This sharp increase can be partly attributed to the rise of several popular gaming projects recently launched on Sei, including Archer Hunter, Spincity, and Drift Zone, among others.

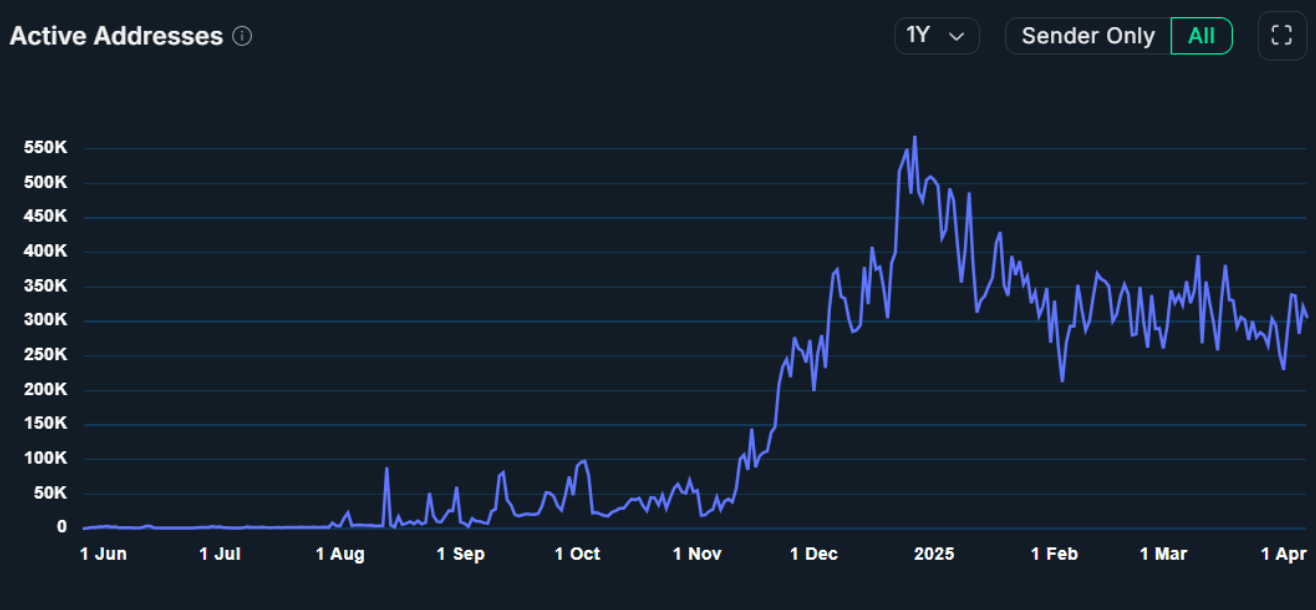

Daily Active Addresses

In Q4 2024, the Sei network experienced substantial growth in active addresses, signaling increased user adoption and ecosystem engagement. Daily active addresses surged from under 100,000 at the start of the half to a peak of over 400,000 in December. This rapid rise coincided with major network milestones, including the launch of Sei v2 and the onboarding of new applications. While activity fluctuated throughout the quarter, Sei maintained a strong baseline of 250,000 to 350,000 active addresses per day in December, showing solid user retention and growth in Q4. This sustained usage highlights Sei’s ability to support a high volume of activity across DeFi, gaming, and enterprise applications.

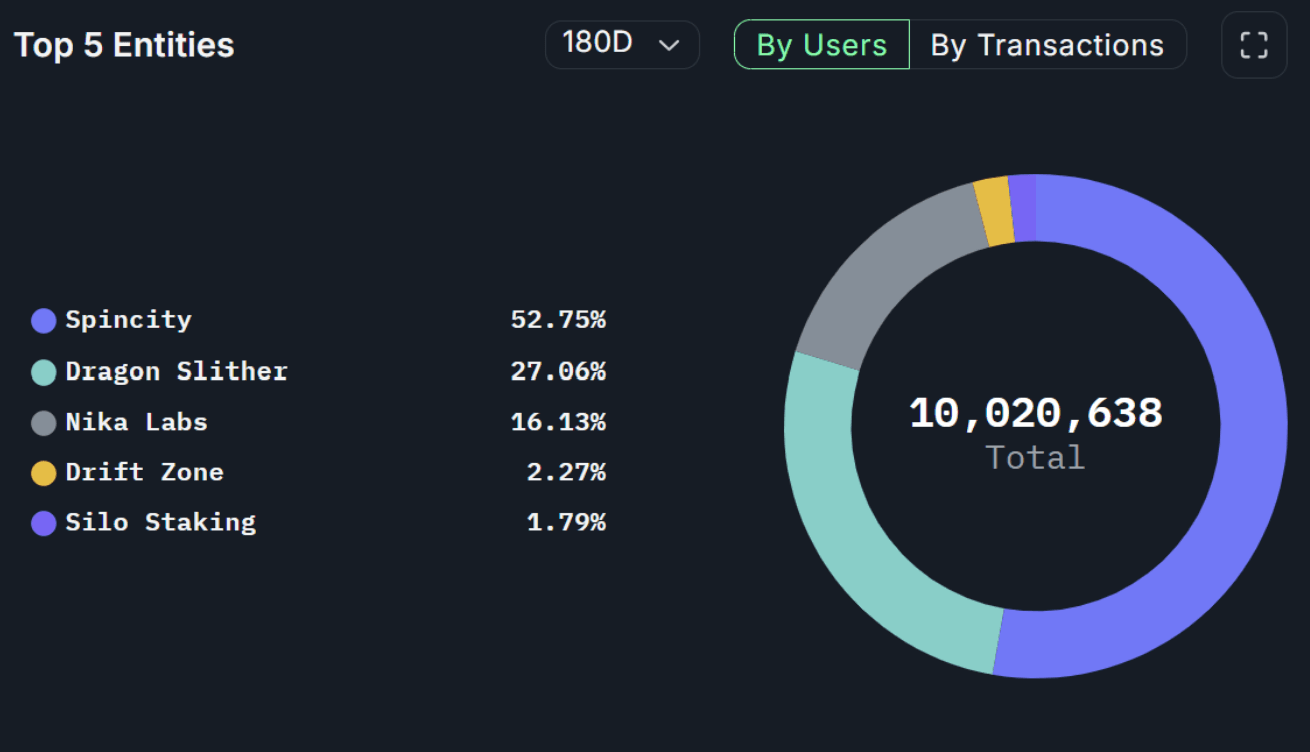

The Top Entities chart provides us with a comprehensive way to analyze projects based on the amount of users and transactions. In Q4 2024, the most utilised on-chain entity was Spincity - a Telegram driven Blockchain casino. Its smart contracts were responsible for over 52% of the entire Sei unique user base, with over 5 million users over the period. Dragon Slither and Nika Labs take up an additional 43% of unique users and continue to propel gaming on Sei forward. While Drift Zone, and Silo Staking make up roughly 4% of unique users.

Closing Thoughts

The Sei ecosystem closed out Q4 2024 with strong momentum across all verticals—DeFi, gaming, and enterprise infrastructure—demonstrating both technical maturity and ecosystem depth. On the DeFi front, projects like Filament and Yei Finance highlight the network’s growing appeal for complex, capital efficient financial applications, while infrastructure partnerships with Dynamic, Turnkey, and wallet providers further streamline user onboarding. The stablecoin landscape is becoming more robust, with Frax Finance, Elixir, and Synnax introducing a new generation of yield bearing and SEI backed assets that enable greater composability across protocols. In the gaming and NFT space, Sei is rapidly positioning itself as a top tier chain for real time gameplay and asset ownership. From the launch of NFTs on Magic Eden to strong metrics from live games like Cat vs Monsters and Final Glory launched eclipsing 100k users, proving the Sei ecosystem is cultivating a vibrant and engaged user base. On the enterprise side, the Sei Research Initiative and the integration of Orderly Network reflect the network’s institutional grade ambitions. With SeiDB solving core EVM storage bottlenecks and the network now targeting 5 gigagas per second, Sei is pushing toward infrastructure performance levels historically exclusive to centralized systems. Taken together, Sei’s consistent delivery across protocol innovation, ecosystem funding, and enterprise readiness positions it as one of the most technically advanced and adoption ready Layer 1s in the market. Its ability to attract capital, developers, and users while advancing Ethereum compatibility at a structural level makes Sei a leading contender to power the next generation of decentralized applications.