Overview

On May 1, Blur announced the launch of Blend, a peer-to-peer perpetual NFT lending and borrowing protocol built in partnership with Paradigm. With Blend, Blur aims to unlock greater liquidity for NFTs, offer a competitive yield to traditional DeFi protocols, and disrupt the NFT financialization landscape. Check out our previous NFT lending landscape report, where we covered some of the top NFT lending protocols.

Blend has now become one of the leading NFT lending platforms, facilitating over 15.8k loans totaling 123.5k ETH ($224.4m) in volume from 1.2k unique borrowers and 1.6k lenders. Since its inception, it has taken the largest share in terms of volume:

| Protocol | Blend | NFTfi | Paraspace | Arcade | BendDAO |

|---|---|---|---|---|---|

| Loan Volume Since May 1 (ETH) | 123.5k | 11.6k | 5.9k | 4.2k | 3.6k |

Blend's rapid growth is no surprise since Blur is arguably the go-to NFT platform for crypto-natives and NFT degens. Their bidding and listing points system for BLUR airdrops to incentivize liquidity has also contributed significantly to the marketplace's rapid success. Hence, they can easily match borrowers with lenders and the abundance of liquidity on their platform via the point system. We've also previously covered the Blur protocol in this report.

This report provides a walkthrough of how the Blend protocol works, highlights the differences that separate Blend from its peer-to-peer competitors, and how lending points tie in with their airdrop criteria.

Protocol Mechanism and Structure

There are three main models of NFT lending protocols that currently exist; perp-like NFT protocols (such as Floor Perps and Papr), peer-to-pool (such as BendDAO and JPEG'd), and peer-to-peer (such as NFTfi and MetaStreet). Blend has taken the peer-to-peer approach to its design due to inefficiencies of on-chain governance and centralization issues that liquidity pool-based protocols inherit from attempting to manage lender deposits.

However, there are some distinctions in the implementation that Blur has taken that differentiate their lending product from other peer-to-peer NFT lending protocols, including zero protocol fees for both borrowers and lenders, no oracle dependencies, no loan expiries, and refinancing auctions. Blend incorporates two different products, namely lending and borrowing, and Buy Now, Pay Later (BNPL).

Peer-to-Peer Lending and Borrowing

Blend first launched with loan options for CryptoPunks, Azukis, and Mildays. They announced DeGods, MAYC, BAYC, and Pudgy Penguins shortly after, with more collections coming soon. NFT holders of these collections can borrow ETH against their NFTs at a fixed rate and no expiries, meaning borrowers can repay at any time and are only subject to liquidation by market-determined interest rates.

Fixed Term Borrowing

Fixed-term lending goes hand-in-hand with the protocol's oracle-free approach to reduce complexity, as using oracles to determine the assets' values (either the collection's average or floor price), interest rates, or liquidation parameters, would incur additional risks such as faulty oracle readings. Additionally, the value of an NFT is objective. Thus, the protocol leaves the lender to decide the amount of risk they are willing to take on via the loan-to-value (LTV) ratio and interest rates. This allows the market to determine the loan terms (floating rates) and, subsequently, the underlying value of a collection.

No Expiries

On top of having fixed lending terms for borrowers, what sets Blend apart from other peer-to-peer lending protocols is that loan offers on Blend do not have expiry dates, which is much more appealing for both parties.

Borrowers' Side

In other peer-to-peer protocols, borrowers need to close or roll their positions before the expiry date, which would result in the lender confiscating their NFT collateral. However, because Blend's design comprises continuous/perpetual loans by default, the loan is live until the lender triggers a refinancing auction and the loan defaults or the borrower satisfies the amount owed. This is a much more borrower-friendly approach as it gives more flexibility and encourages borrowing. Moreover, it is also more gas-efficient, as the borrower does not need to make any gas-incurring transactions until one of the parties decides to close their position.

Lenders' Side

As for the lender, in other peer-to-peer protocols, having an expiry date means the lender cannot exit their position beforehand. Because the borrower's position is essentially a put option for the NFT by nature, this forces the lender to carefully and tightly manage their loan offer by setting short expiration dates, high-interest rates, low LTV, or a combination of these parameters. Hence, this introduces unattractive offers and discourages borrowing overall. With Blend, lenders can exit their position at any time by triggering a refinancing auction for the borrower to find a new lender at a new rate, which lowers the risk for lenders and creates a much more efficient market (lenders can offer better rates). The NFT will only be liquidated if the auction fails.

Thus, the benefits of having no loan expiries are that borrowers are not time-constrained on their loans and do not need to risk losing their collateral upon failure to pay back at the end of the term, and lenders can manage their risk more prudently and respond to changes in market conditions in real-time.

Risks to consider

- Borrowers' side:

- Need to keep track of interests accrued on their ongoing positions

- Need to monitor the floor price of the collateral's collection

- If the lender decides to trigger a refinancing auction, the borrower may be faced with higher interest rates and unable to pay back

- Lenders' side:

- Need to monitor the floor price of the collateral's collection

- Need to have well-defined risks parameters and price expectations for loan offers in case of a market downturn

Dutch Auction

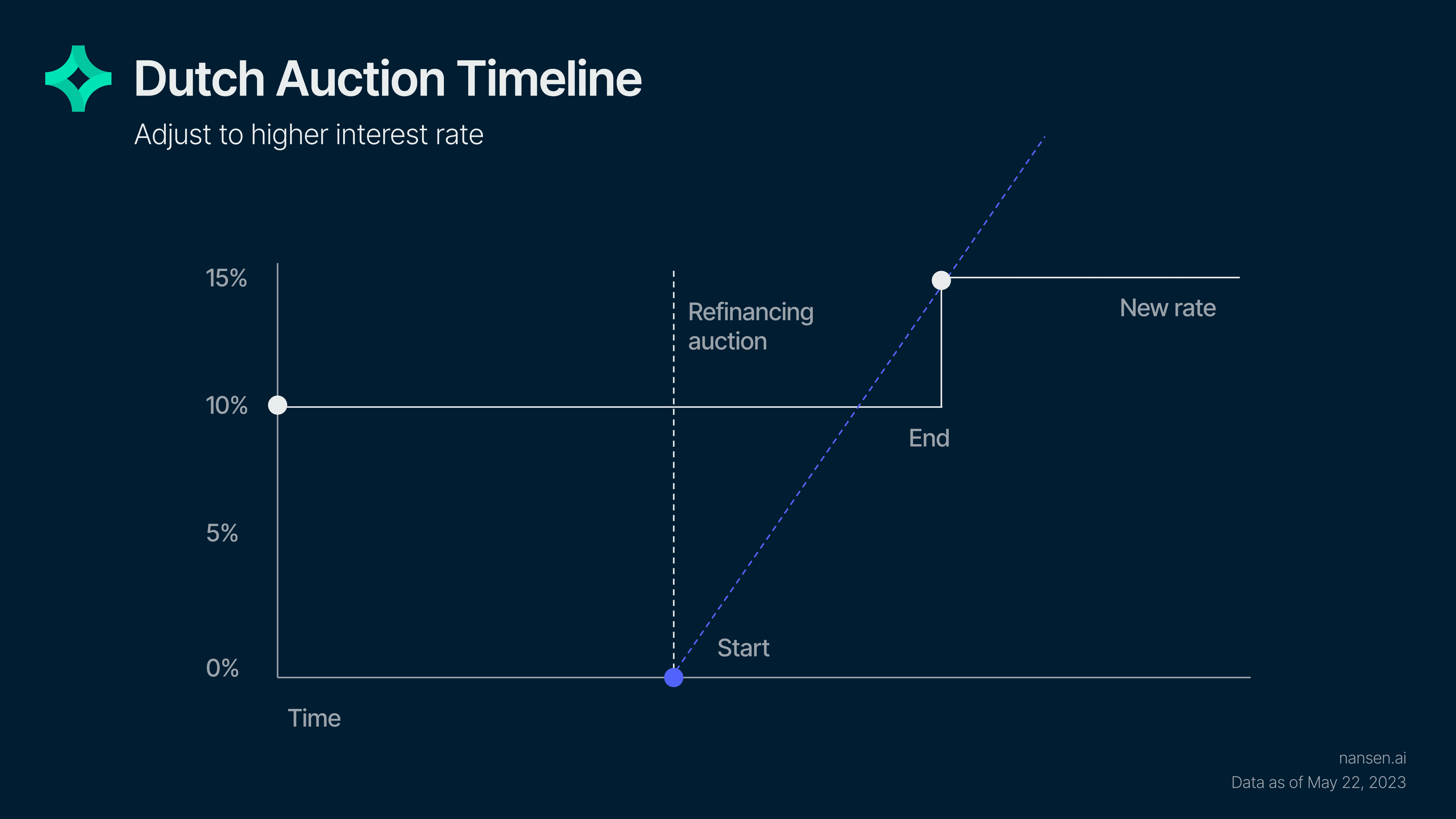

The refinancing auction is a Dutch auction process to extend the loan to a new lender who is willing to repay the full amount to the original lender to take over the loan for a higher interest rate.

As seen in the chart above, the Dutch auction starts at a 0% interest rate and increases until a new lender steps in to take over the loan. Alternatively, the lender can also skip the auction by submitting another lender's offer to the vault to exit their position if a compatible one is available.

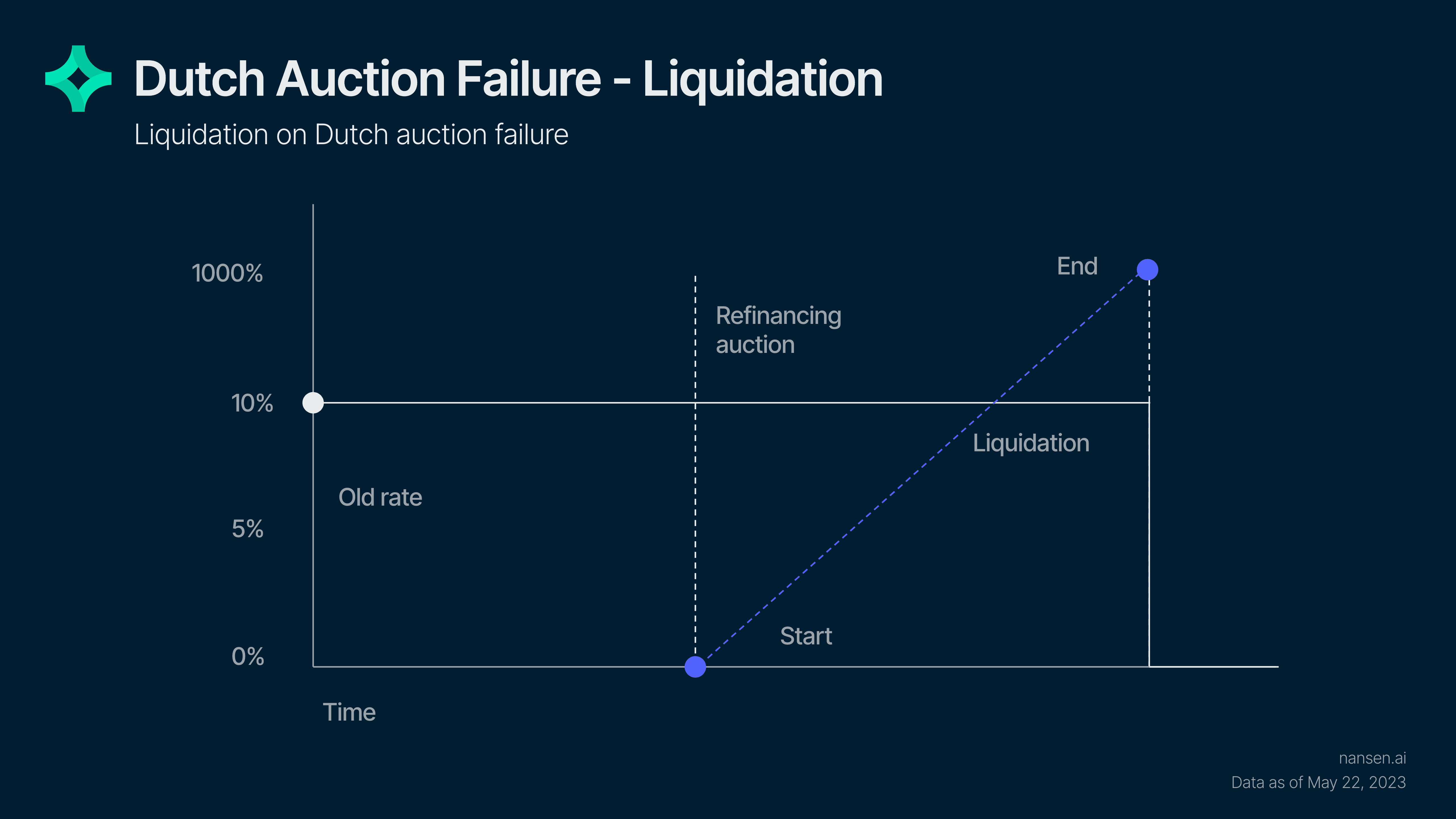

In the case of when the value of the collateral value drops near the amount of debt owed (high LTV) and the borrower gets margin-called, the borrower is also subject to a 30-hour refinancing auction (6 hours to find a new lender, followed by 24 hours to refinance or repay) to find a new lender at a new interest rate.

Previously, the borrower must repay the full borrowed amount when the lender calls within the period. However, Blur has announced that borrowers can now repay the borrowed funds in increments to extend the loan duration.

Liquidation

If no new lender is willing to extend the loan after the 30-hour window, the borrower is liquidated, and the lender gets possession of the NFT or ETH (but only when the NFT's floor price is below the loan amount).

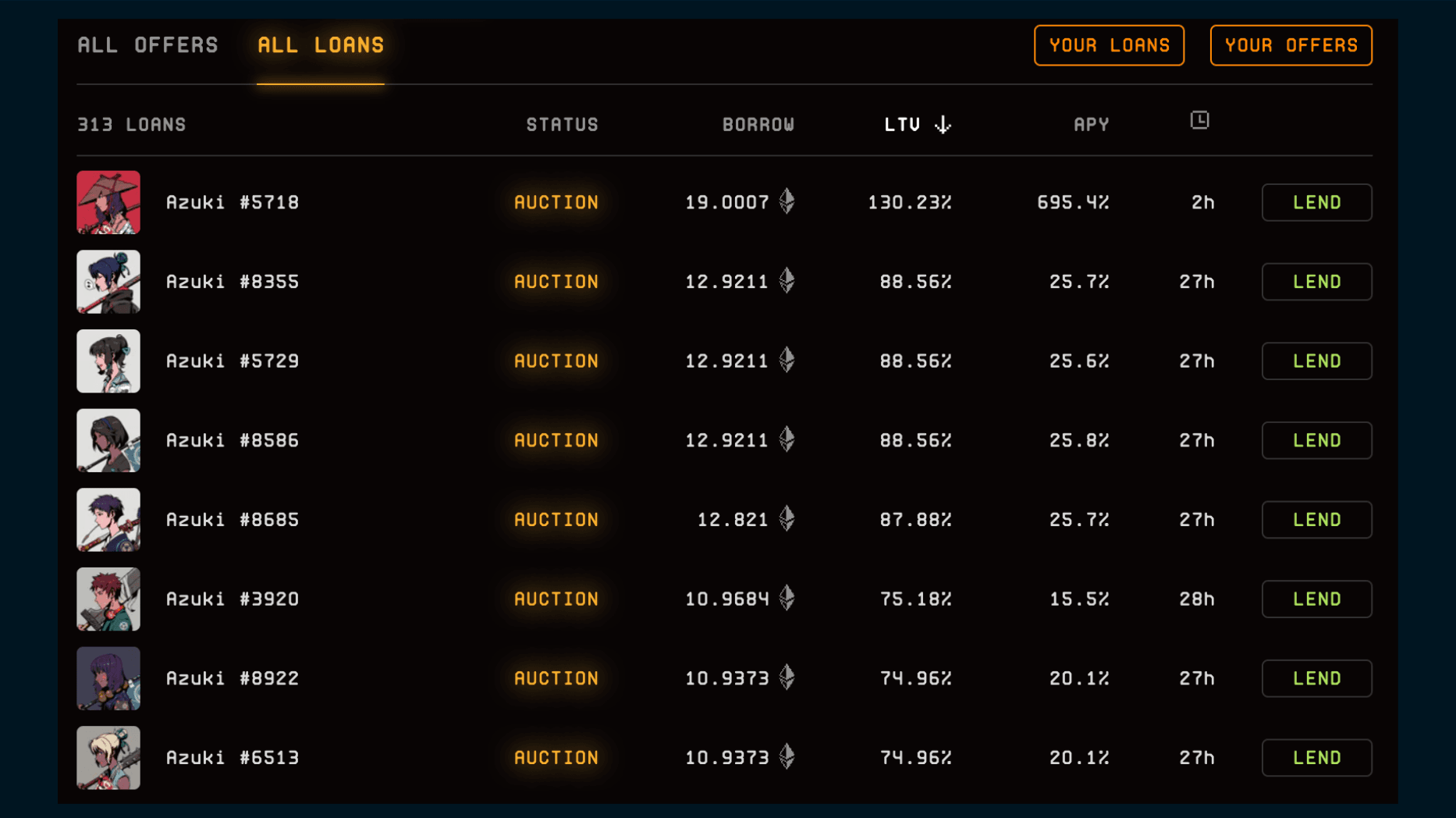

As an example, this table shows some Azuki loans currently in an auction. Most of the NFTs in auction still have between 24 to 27 hours before the borrower defaults, which suggests that, in most cases, a new lender is willing to step in at a reasonable LTV ratio and interest rate. However, Azuki #5718 only has 2 hours remaining until the end of the refinancing period. In this case, the borrower will likely get liquidated since no new lenders were willing to step in as the LTV ratio and APY increased.

While incorporating a refinancing auction instead of having fixed loan terms has many benefits, there is also a significant risk of the borrower being liquidated or subject to higher interest rates (which they will not be able to pay back in most cases) when the lender decides to exit their position, as they can choose to do so at any time, which is unfavorable for the borrower.

Buy Now, Pay Later (BNPL)

Blend's second product is the Buy Now, Pay Later (BNPL) program, in which interested buyers of the supported collections can purchase the NFT with a small portion of the capital upfront while the rest is borrowed, accruing daily interest rates, typically between 0-30% APY. Blend is able to offer this service while others cannot because it already functions as a marketplace in the first place. The borrower has two options:

- Pay back the borrowed funds to obtain full ownership of the NFT,

- Or flip the NFT for a profit and keep the difference

This mechanism essentially introduces leverage into the ecosystem as potential buyers and traders can enter short-term positions on more expensive collections while limiting exposure to the downside. Furthermore, this is also beneficial to smaller retail traders with less capital on hand, as they can profit from the price appreciation of blue-chip projects.

As an example, check out Tyler's short-term trade using BNPL, where he bought an Azuki for 2.2 ETH when the collection's floor price was 15.9 ETH and sold the NFT overnight for 16.9 ETH. He received 3.1789 ETH in return, thus profiting 0.9789 ETH before the gas deduction.

Considerations

Although, introducing leverage into a volatile asset class could lead to heavy losses taken on by uninformed retail borrowers (losing their prized NFT or ETH collateral) if the lender decides to exit their position and no new lender is willing to step in. Specifically, while BNPL allows smaller traders to enter a more expensive collection with less capital upfront, many who choose this option probably do not have enough ETH to repay the loan if the lender calls. With this risk that the borrower has to bear in mind, BNPL should primarily be used for short-term flips.

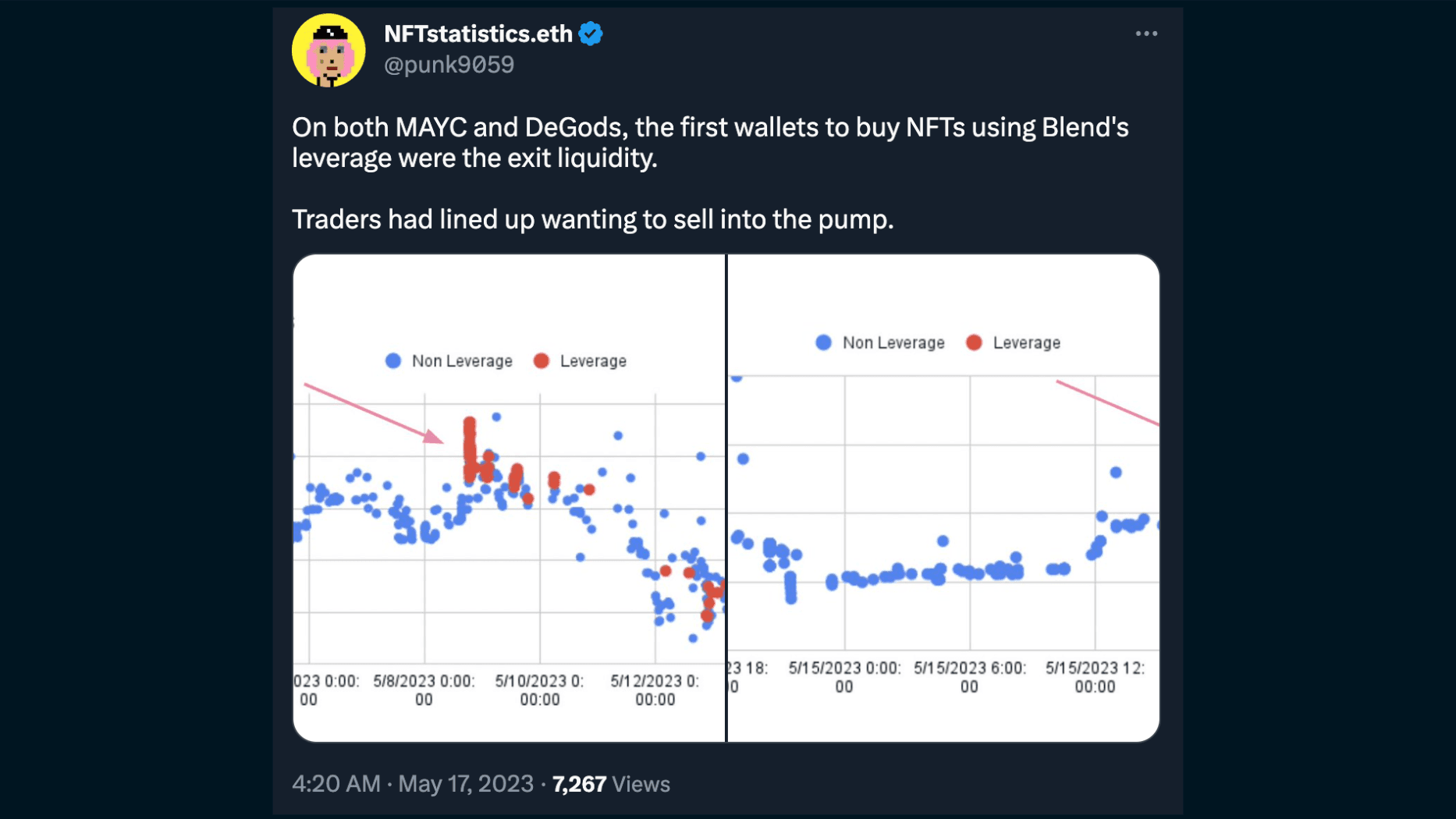

As Punk9059 highlights, the announcement of MAYC, BAYC, and DeGods support for Blend resulted in the floor price appreciation for the subsequent collections. However, leveraged buyers trying to sell into the pump became exit liquidity.

It remains to be seen what impacts introducing such leverage to these collections will have on their respective floor prices in the long term, but it could lead to more volatile price movements as traders lever up during price appreciation. When the market retraces and borrowers are unable to repay, it could escalate the selling pressure and lead to a liquidation cascade as lenders look for liquidity.

Lending Points

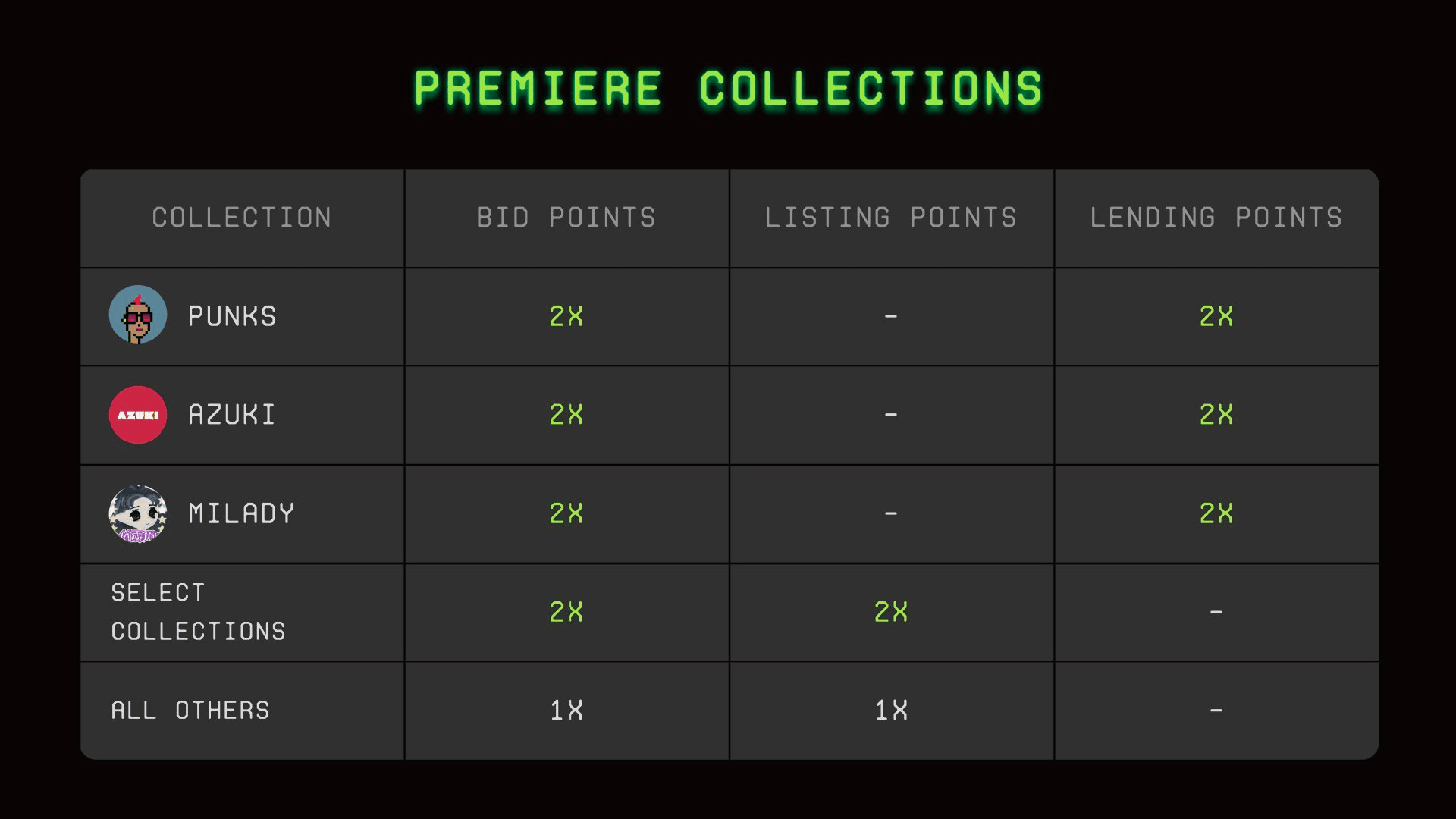

Blur has replaced listing points with lending points for the collections supported by Blend to incentivize liquidity for potential borrowers. This would also help bootstrap the launch of Blend, as more liquidity leads to better offers.

Lenders can get lending points by making loan offers with the ETH in their Blur Pool. Moreover, lending points can be earned simultaneously with the bidding points using the same ETH in the pool. The criteria for earning lending points are as follows:

- Max borrow: Max amount of ETH someone can borrow with an NFT - the higher the max borrow the better

- APY: The interest rate earned once the loan offer has been accepted - the lower the APY the better

A lender could provide multiple loan offers with different parameters on the same collection and earn lending points for each. For example, if the floor is 10 ETH, the lender can make an offer with 9 ETH max borrow + 90% APY, and another offer with 5 ETH max borrow + 20% APY, earning points for both offers. The same ETH can also be deployed across collections to maximize lending points.

Blend's design considerations improve the lending experience for both borrowers and lenders, as well as leveraging its existing marketplace and integration of lending points, which have resulted in the rapid growth and adoption of the protocol. The Buy Now, Pay Later program, in particular, has attracted many smaller NFT traders as it opens up the opportunity to trade higher-end collections with limited downside.

However, it remains to be seen how the introduction of leverage will impact the floor prices of supported collections in the medium to long term, especially during periods of high volatility and sudden downwards in price action, where many traders may get liquidated if not properly managing their risk.