Ordinals

This story starts with Ordinals. They are Bitcoin’s version of NFTs and have attracted a new userbase to Bitcoin - those interested in NFTs and ‘digital artifacts’. But what are they and how are they different to anything we are familiar with?

Each BTC is divided into 100m sats. Ordinals can give each individual sat a unique number, distinguishing them and essentially making individual sats ‘Bitcoin NFTs’. These sats can be inscribed with arbitrary data up to 4MB, which are typically pictures. Data can take the following forms:

- Pictures

- HTML Code

- Videos

- GIFs

Here is an example of an Ordinal inscription from the Taproot Wizard collection (#70). There is a supply of 2105 Wizards.

Naturally, the larger the data (up to 4MB) the more expensive it is to inscribe an Ordinal. This is a fully on-chain digital artifact. At present, Ordinal inscriptions are commonly taking the form of meme NFT collections and derivatives of NFTs from other chains. As with most new things in crypto, the majority of Ordinal inscriptions will be valueless, and beware of scams. That said, they have a compelling narrative as NFTs of the OG blockchain, and some have become (and could remain) very valuable. The Ordinal and BRC-20 market is currently in a speculative frenzy so there are numerous opportunities (and very significant risk) for those participating.

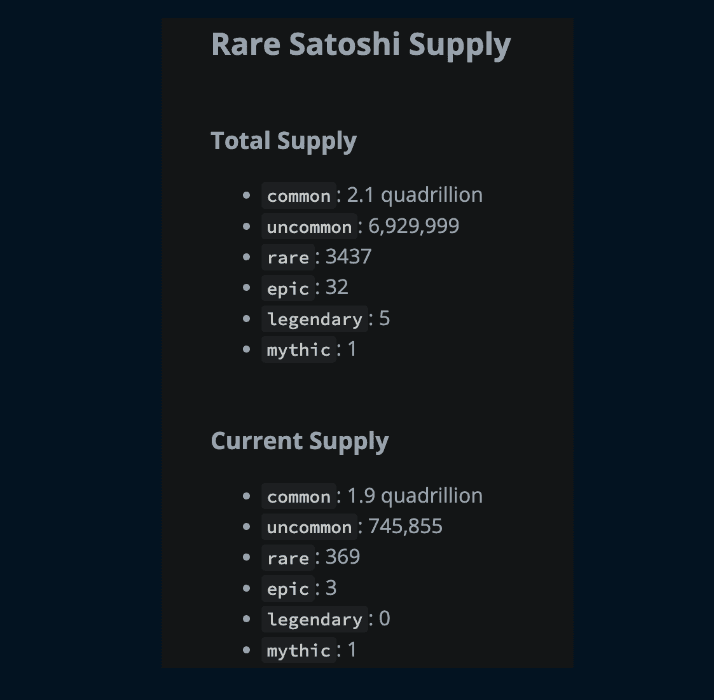

Ordinals are controversial as some argue that they are at odds with the classical Bitcoin narrative focused on hard money. If sats are differentiated and ascribed different values, then the fungibility of Bitcoin itself is slightly reduced. Not surprisingly, maximalists are strongly against them. However, it is difficult to foresee this becoming bearish for BTC, the asset, given the sheer number of sats (~2.1 quadrillion or 2.1 * 10^15). Nevertheless, they have exploded in popularity and BRC-20s (built atop Ordinals) surpassed $1b in market cap 2 months after their inception.

Ordinals have now reached centralized exchanges, and Binance will list them on its NFT marketplace in “late May”.

Ordinal Characteristics

Ordinals can be described as Bitcoin NFTs, but there are several distinctions to the NFTs we are familiar with on Ethereum. They can also be described as digital artifacts on Bitcoin, as they are fully on-chain.

Ordered

Ordinals are sats inscribed in order on the blockchain. This means there is a 1st, 69th and 420,420th Ordinal. Therefore, their specific ordering can give them value. The earlier Ordinals are typically ascribed more value, as are those with memetic numeric value.

Ordering is essential to showing that the Ordinal is valuable. According to Ordinal Theory, there are the following tiers of rarity for sats:

- Common: Any sat that is not the first sat of its block

- Uncommon: The first sat of each block

- Rare: The first sat of each difficulty adjustment period

- Epic: The first sat of each halving epoch

- Legendary: The first sat of each cycle

- Mythic: The first sat of the genesis block

Not Smart Contracts

On Ethereum or other smart contract chains, NFTs collections can be minted together through contracts (they themselves being smart contracts). This is impossible with Ordinals, which must be inscribed separately.

On-Chain

An issue with NFTs on Ethereum is that their metadata is often on a centralized server, with the potential of being removed. Meanwhile, Ordinals themselves are stored fully on-chain.

Ordinal Wallets

To prevent an Ordinal holder from mistakingly spending their Ordinal, special wallets are required to ‘freeze’ the sat(s) that are Ordinal(s). This is why some have argued that Ordinals somewhat reduce BTC's fungibility. Certain sats are prevented from being transferred and can be valued differently. However, this is arguably inconsequential and is more an issue with Ordinals rather than BTC the asset. Ordinals Wallet is an example of a wallet service used to purchase Ordinals.

Interesting projects to follow:

Check out the top projects by volume/floor here on Ordinals Wallet.

BRC-20

BRC-20s are fungible tokens built atop Ordinals that rose to a market cap of over $1b since debuting on March 8th 2023. While BRC-20s are named after the ERC-20 token standard on Ethereum, there are several key distinctions.

- Most importantly, BRC-20s are not smart contracts.

- They are simply script files stored on Bitcoin that are used to attribute tokens to satoshis which can be transferred between users (with transfers indexed off-chain).

- All BRC-20 tokens are free mints with no pre-mine.

Some popular tokens are those that complete words given that they can only have 4 characters. A prime example of this is ORDI and NALS coins. In addition, there are others with memetic value such as PIZA (referring to the famous Bitcoin pizza transaction).

Note that under the hood they are quite inefficient:

- Once a BRC-20 collection completes minting, users can transfer their tokens. This is done by essentially minting another - you inscribe a transfer of how many tokens you want. This inscription NFT then appears in your wallet, and when it is sent to the new address the corresponding BRC-20 tokens will be received.

Most notably, as mentioned above, BRC-20 transactions need to be indexed off-chain to reflect current balances.

Indexing Off-Chain

This is a primary criticism of BRC-20s - the need for centralized businesses to index transactions. As an example, it is possible for anyone to mint a 'PEPE' BRC-20, resulting in hundreds of PEPE BRC-20s on-chain. However, the first mint of this is the one that holds value - following the ‘first is first’ golden rule. An off-chain indexing system is required to show which wallets holds the original - and thus the one that holds value.

One potential criticism of the ‘first is first’ requirement is that this data is not referred to explicitly on-chain and requires indexers. However, the blockchain data is transparent for all, and numerous indexers can provide this data. It is important that indexers are held to the highest of standards (i.e. open sourcing the indexer) and that there are a number of reputable geographically and legally distributed indexers.

Analysis Despite their inefficiencies, they have gained great popularity as speculative vehicles on the chain. BRC-20s, in its current state, appear to not have few potential killer use cases beyond speculation. However, it will be interesting if builders can create solutions to give them more utility. At this stage, it is difficult to see how it can evolve into such. A comparison to Ethereum would be having to create a new NFT every time you want to sell your ERC-20. Nevertheless, the primary use case for crypto is speculation, and BRC-20s have typically been ‘memecoins’ and speculative vehicles for degens.

Trading tools

Some trading tools that have arisen for BRC-20s include Ordspy. Note that these tools are also in their infancy and there is little sophisticated infrastructure at present around this technology.

The primary trading venue for BRC-20s is UniSat. It is fully open source. On UniSat you can:

- Store and transfer Ordinals.

- Inscribe Ordinals yourself, including .sats addresses.

- Store, mint and transfer BRC-20s.

The next section provides a guide on using UniSat.

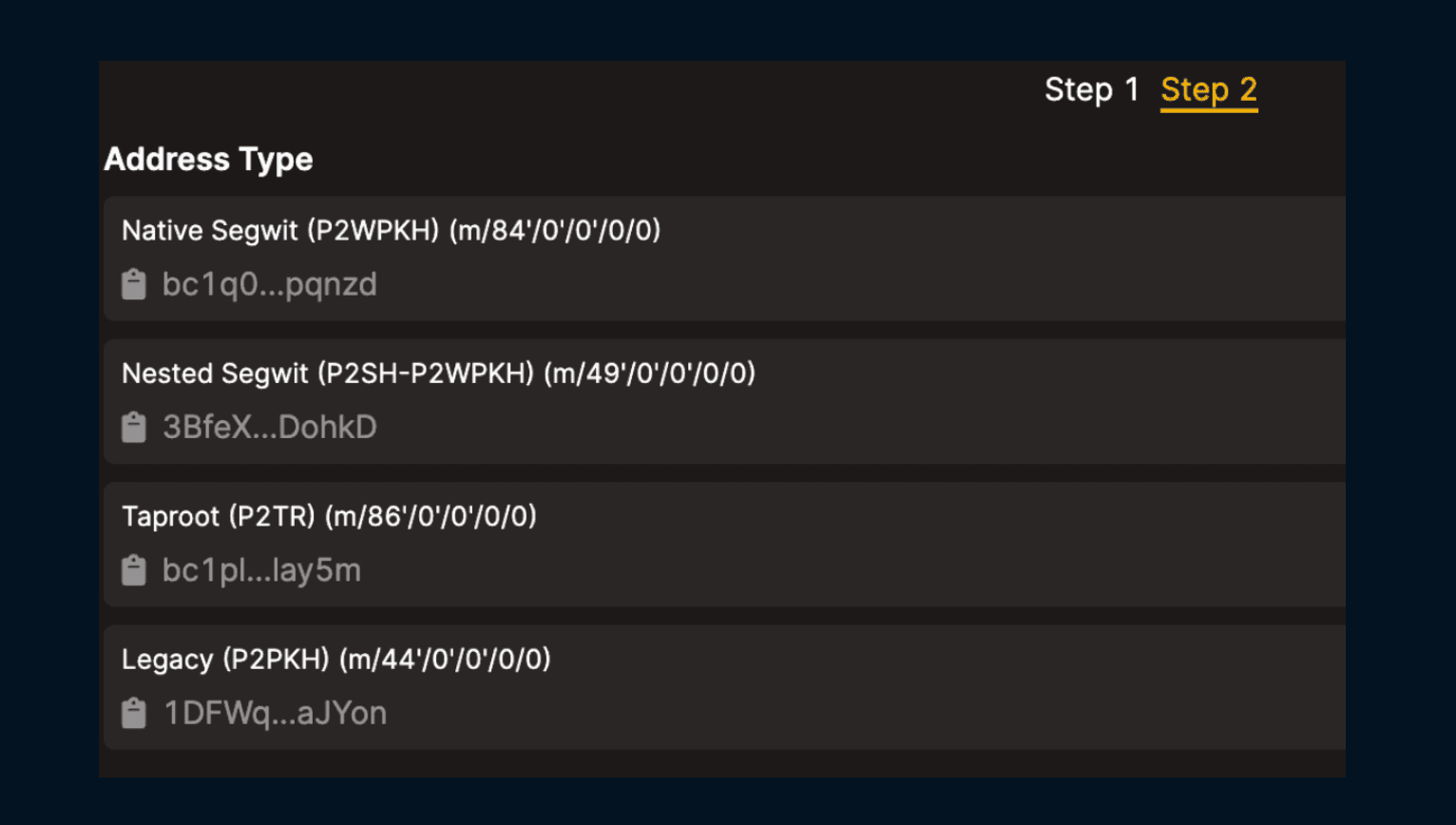

Getting Started on UniSat

UniSat has established itself as the de facto BRC-20 wallet and marketplace. It regularly accounts for ~85-90% of the trading volume of BRC-20s. Here is a quick tutorial on getting started.

- Download the chrome extension.

- Set up wallet (same as Metamask with password and seed phrase)

- A number of wallets will show on the screen, select the Taproot option.

- Taproot-script paths are used to store Ordinal inscription’s data on-chain. Because of how Ordinals are structured, it makes it difficult to transfer given you are sending specific sats. You should send them to another Ordinal wallet, not a traditional wallet.

- A number of wallets will show on the screen, select the Taproot option.

- If you use a non-KYC exchange, you need to ensure it sends to an Ordinal wallet.

- If you send your Ordinals to your legacy wallet, you can then send it to your Taproot wallet.

- Then go to the marketplace.

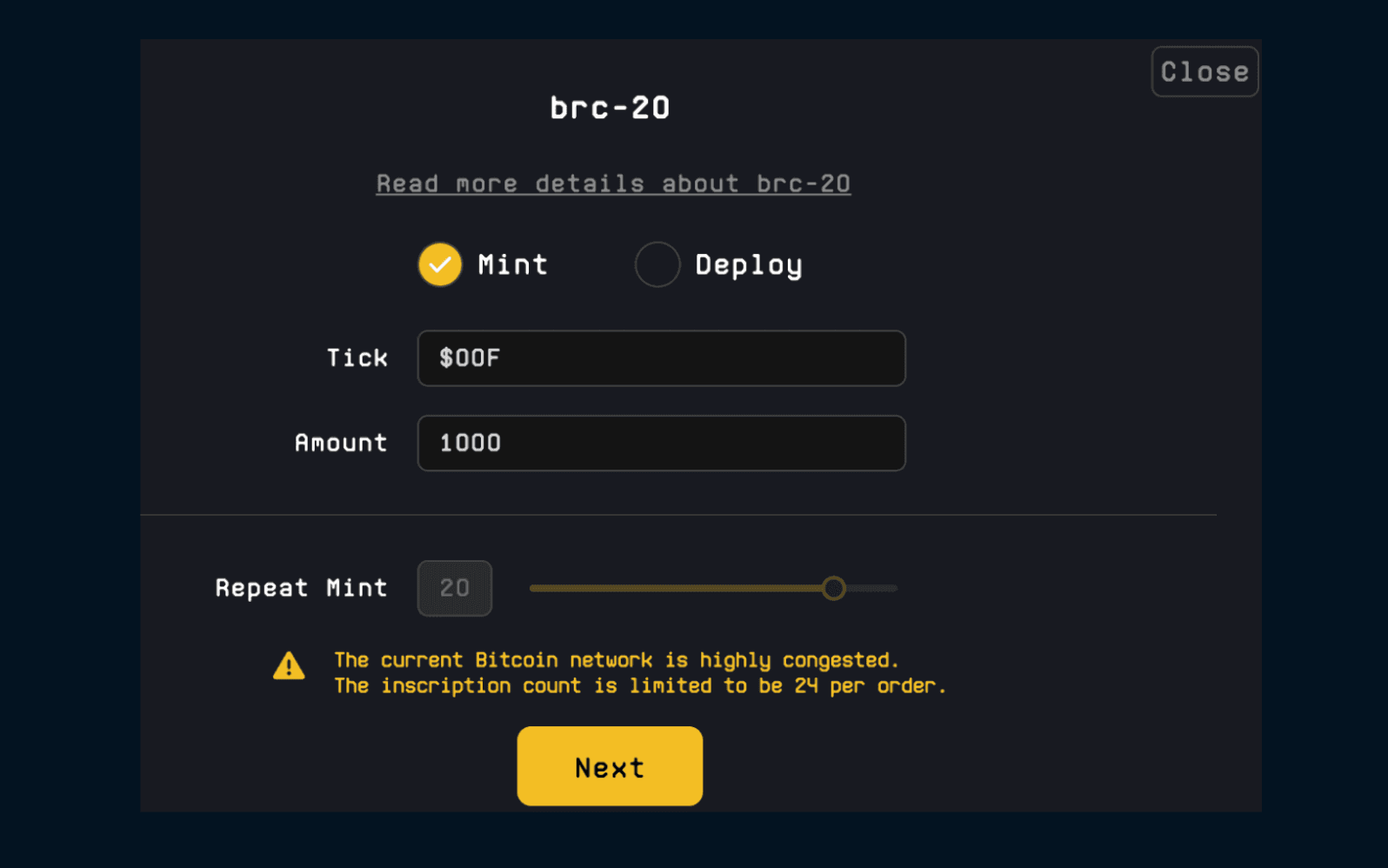

Select ‘brc-20’ tab to mint new BRC-20s.

- Select 'in progress'

- Select a BRC-20 you would like to mint

It is possible to do ‘Repeat Mints’. The screenshot below shows this is limited to 24 (note this is constantly changing).

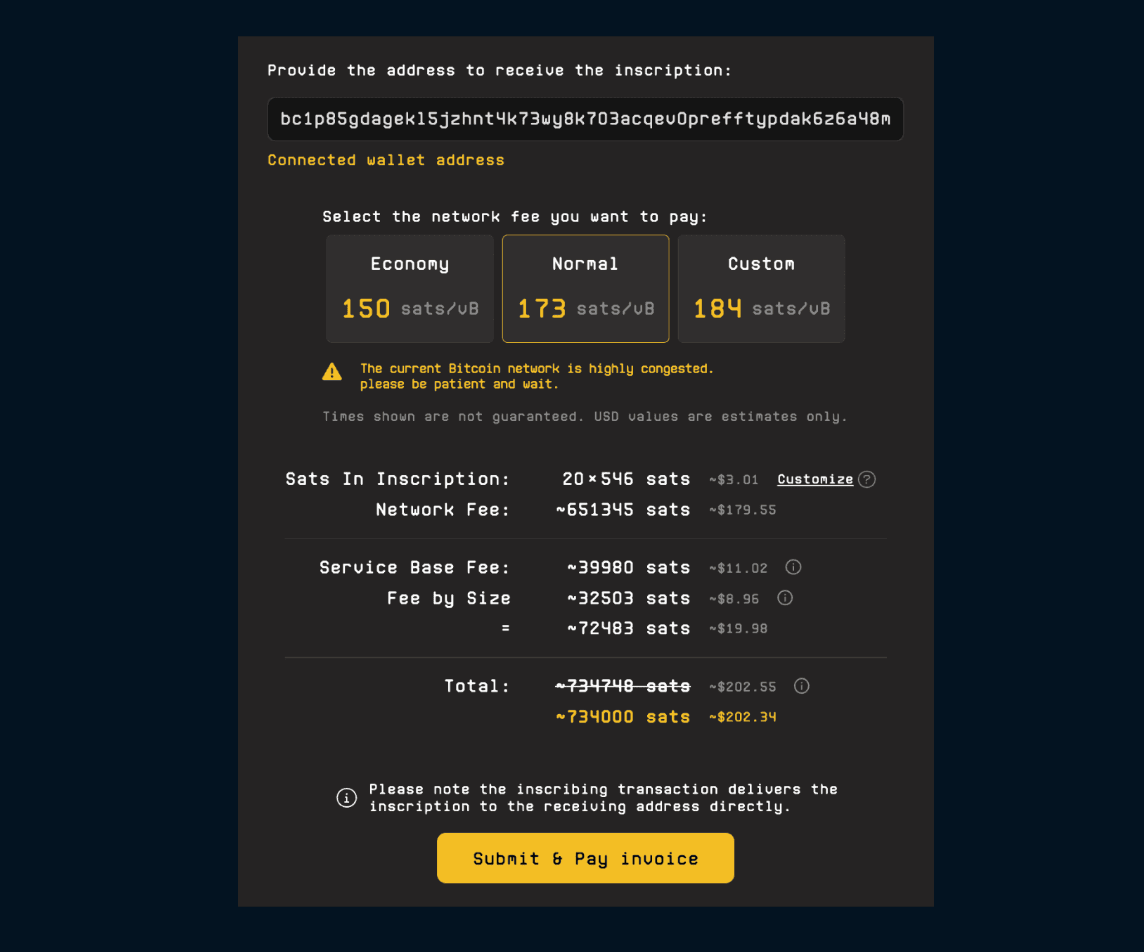

- After clicking ‘Next’ the following screen shows up. This shows what is stored in the BRC-20:

Source: UniSat

Source: UniSat - You can then provide the wallet address to which you want to receive the BRC-20 and the network fees you would like to pay. Select ‘Submit & Pay invoice’, and you will be asked to confirm in your wallet.

- There are options to pay in 3 different way

- Unisat wallet

- Lightning network

- Sending it from any Bitcoin address

- Set up an address you can send Bitcoin to, which can be a good strategy if UniSat is overloaded and/or you are trying to mint a large amount.

Further Notes

- Another benefit of UniSat is that you can send numerous BRC-20s to the same wallet. This is much easier than having dozens of wallets that you send individual BRC-20s into. Some users have done this when the infrastructure was less mature because if you spend your BTC then you may up spending your BRC-20s by mistake.

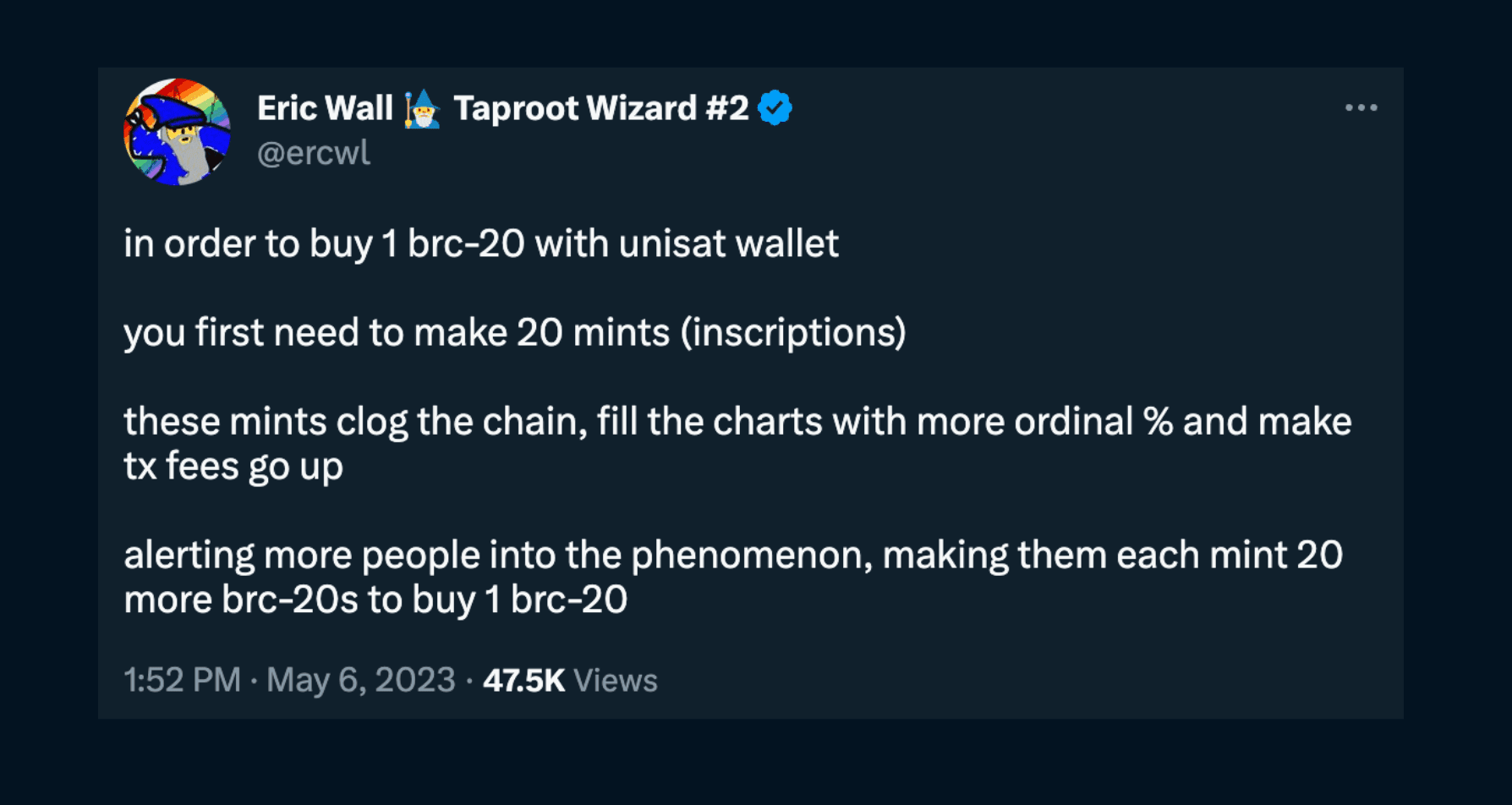

- The requirement for 20 UniSat transactions was controversial. However, this requirement was removed on the 11th of May. Some still question the motivations behind this requirement.

Source: Twitter

Infrastructure

The Current State of Affairs

The infrastructure has evolved rapidly since BRC-20 first came onto the scene, and UniSat has established an early dominant position for determining the legitimacy of inscriptions. Some have raised centralization concerns with this, however, the ecosystem is very much in its infancy but has evolved extremely quickly. Note it is easy to criticize the initial centralization of these new phenomena, but it is highly likely it will continue to rapidly mature. Ideally, this will be in the direction of a more robust and distributed ecosystem.

Some Interesting Projects

Note that this is not financial advice, and Ordinals/BRC-20s are currently purely speculative vehicles that are in peak mania at present.

ORDI

This is the first and largest BRC-20, with a total supply of 21m. It will always have bluechip status for BRC-20s because it is the first collection and the weight given by Ordinal theory to ‘firsts’.

MEME

Given that BRC-20s are currently all speculative vehicles and memecoins, this one holds true by literally being named ‘MEME’. More importantly, it is the 2nd BRC-20.

PEPE

Pepe is the second largest BRC-20 by market cap. It obviously has meme potential, as well as deriving strong speculative value due to its Ethereum counterpart. Interestingly, it existed before its Ethereum counterpart did.

VMPX

Jack Levin is involved with this project which has gathered significant attention. It has the largest number of individual holders.

TRAC

Trac is another low-cap BRC-20 (currently at ~$2m). It is building an indexer for Ordinals. According to its Twitter, “The Trac project aims at providing a decentralized body for tracking and accessing Ordinals related metaprotocols such as brc20, sats domains and more.”

Trading BRC-20s

Speculators are seeking to purchase ones that they anticipate will be listed on a CEX like Crypto.com or Binance. Others are buying something that has been listed already on Gate.io (for example) and anticipate it will be listed on a much larger exchange like Binance after.

Furthermore, people have to send a transaction to make a transfer. For those with the requisite skill, you can see big moves before they happen especially wallets unlocking for market makers on CEXs.

Exchanges listing BRC-20s at present include:

- Gate.io

- Bitget

- BitMart

- BKEX

- Crypto.com

- Binance (late May)

- And others that will likely follow

Impact on Bitcoin

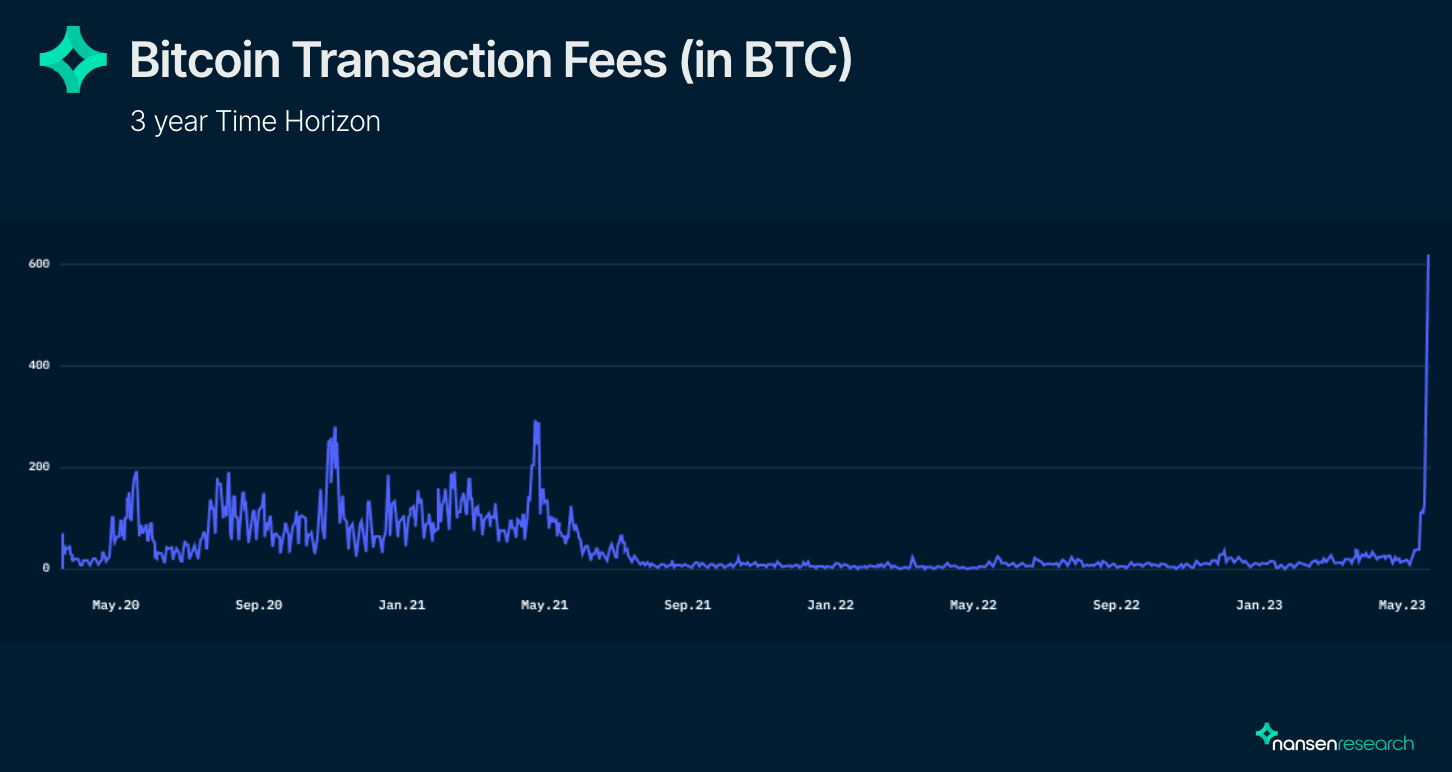

Fees

Bitcoin’s sustainability has rightly been called into question due to its declining miner rewards and very low transaction fees. Given that BTC rewards are halved every 4 years, fees will be required to continually compensate the miners. However, because BTC is seen as a store of value, it inherently does not have a lot of transaction activity. Ordinals have changed that, for now.

Some have argued that the increase in fees caused by Ordinals is actually bad for the chain and makes it less usable, which rhymes with arguments from 2017 of Bitcoin vs Bitcoin Cash. However, BTC is mostly seen as a store of value rather than a monetary and transactional asset. Therefore, higher fees on Bitcoin = more revenue for miners (required to sustain the chain) and are on balance a good thing for the blockchain and the asset.

Do These Innovations Cause Harmful State Bloat?

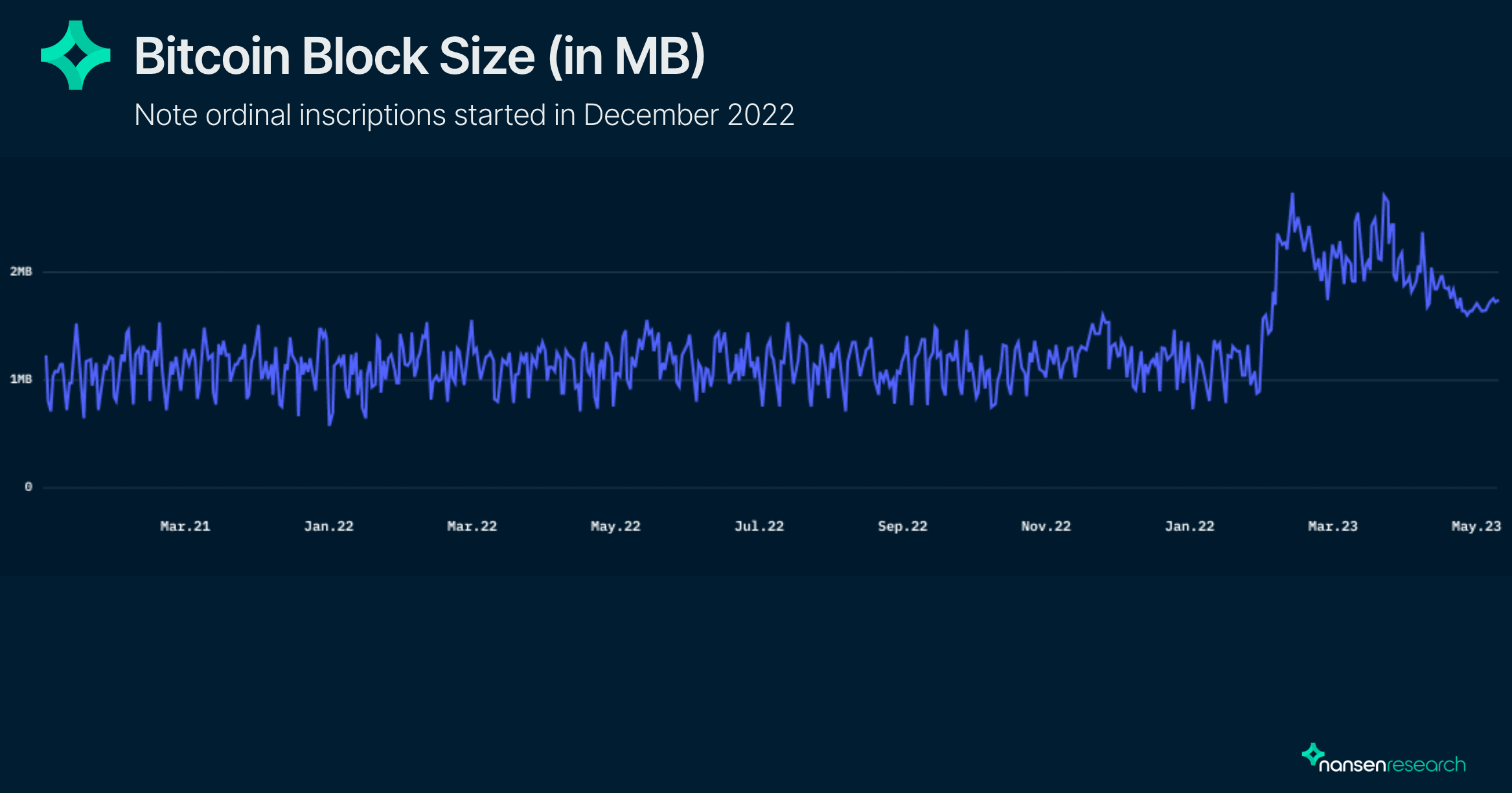

One issue with blockchains that has often been overlooked is the problem of state bloat, whereby nodes have to store more data as the chain grows, thus becoming more centralized. Ordinals and BRC-20 have brought a new wave of users and transactions and are thus increasingly contributing to this. Viable solutions to this may be developed down the road. Users that prune their nodes can avoid this issue. Also, as discussed in the previous section, more transactions = more fees for miners which should be viewed as a positive for the longevity and security of the network

As the graph below shows, Bitcoin block size has essentially doubled since Ordinal inscriptions started in December 2022.

Quick ORC-20 Overview

ORC-20s were introduced as an improvement on BRC-20s, offering a more functional standard for the Bitcoin ecosystem (beyond memecoins).

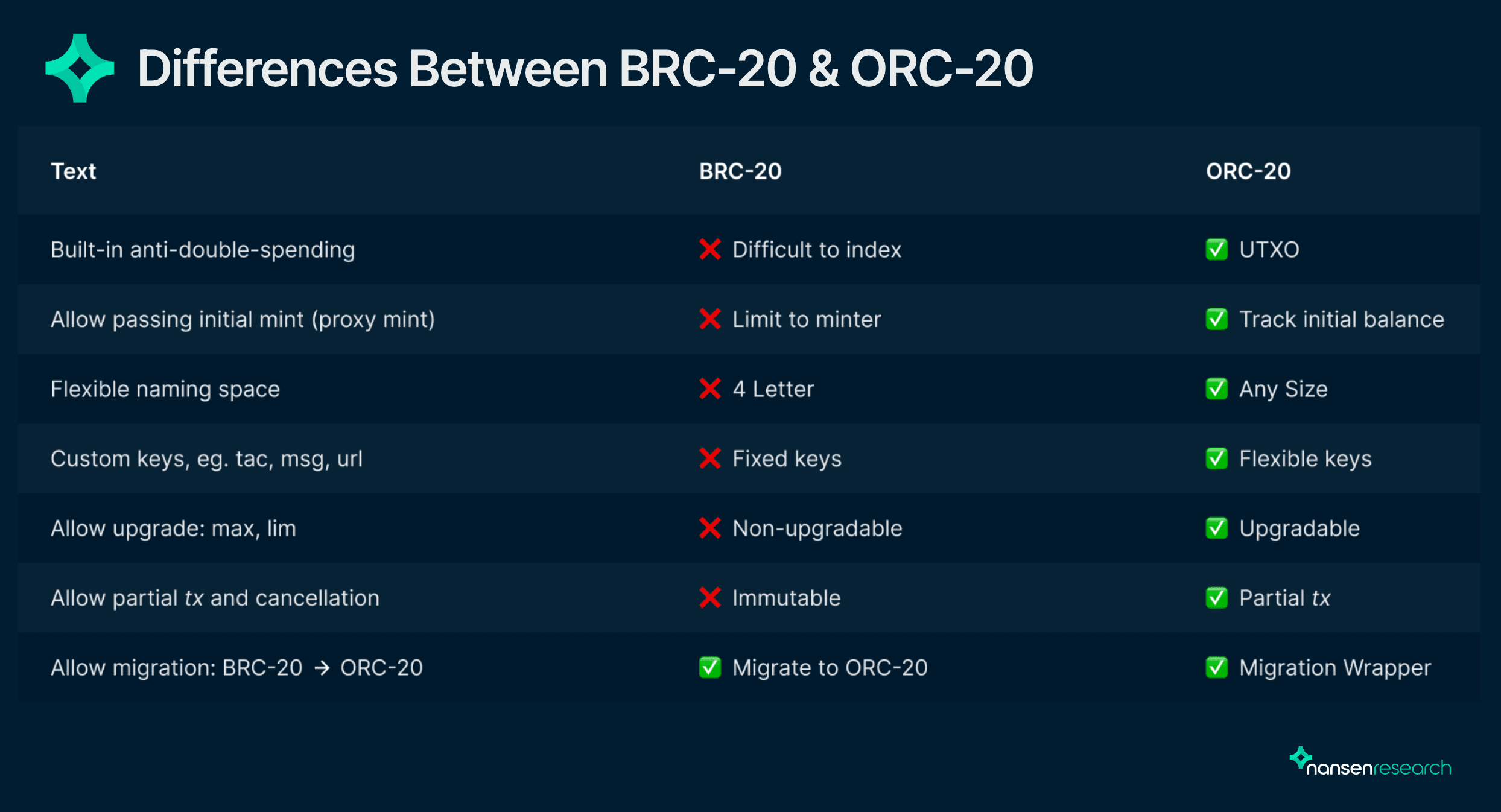

Here are the listed differences/improvements laid out by orc20.org:

Importantly, it does away with the requirement for centralized indexers for “bookkeeping” of the ‘first is first’ rule and transfers. In addition, by default, the sender (after specifying how much he will send) of ORC-20s will retain all unsent ORC-20s.

Some issues that have been pointed out regarding ORC-20s is that they allow the deployer to upgrade the token limit e.g. supply is 21m, the deployer may decide to make it 420m in the future. This is antithetical to many in the Bitcoin community. Another thing to bear in mind is that migrating to ORC-20 from BRC-20 means that both are valid on the blockchain, and a project needs to properly communicate the v2 contract (likely causing some confusion).

Ordinals have unleashed a new wave of innovation and activity on Bitcoin not seen in years. It has onboarded a new userbase of speculators and experimenters and made Bitcoin fun again for others.

It will be worth closely observing how the space develops. Ordinals and certain BRC-20s have the potential to become extremely valuable given their status as NFTs on the OG and largest blockchain. Beyond memecoins and NFTs, the excitement and attention this has attracted can help spur on the development of further innovations and DeFi on Bitcoin.