Introduction

Arbitrum's gaming and NFT ecosystem is dominated by TreasureDAO, primarily due to its first-mover advantage and Arbitrum-native marketplace, Treasure Trove. The surge in the L2 narrative has seen new protocols such as TridentDAO emerge as they compete for market-share from dominant players like TreasureDAO.

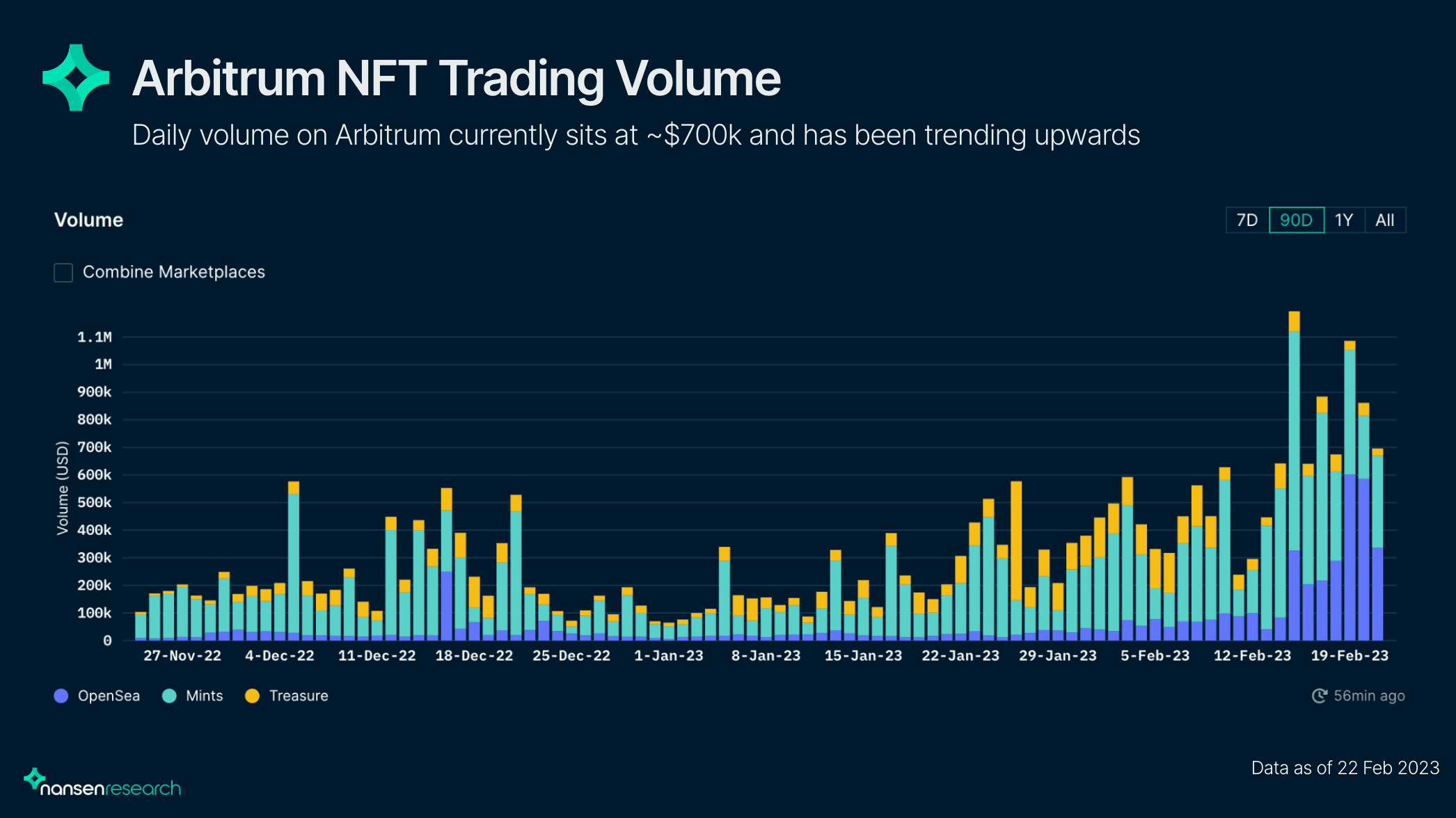

The Arbitrum NFT sector activity has been trending upwards since the beginning of the year, along with the entire Arbitrum ecosystem, currently sitting at ~$700k in daily trading volume at the time of writing. However, despite the growth, Treasure Trove has been losing its market share to OpenSea.

TreasureDAO

Treasure is, by far, the most dominant NFT and gaming ecosystem on Arbitrum, with over 100k unique players engaging with the ecosystem. Furthermore, Treasure is also responsible for over 95% of all gaming and NFT transactions on Arbitrum and has amassed over $267m in lifetime marketplace volume. Their focus is to become the decentralized Nintendo, hosting various games and aiming to transform game publishing through shared resources.

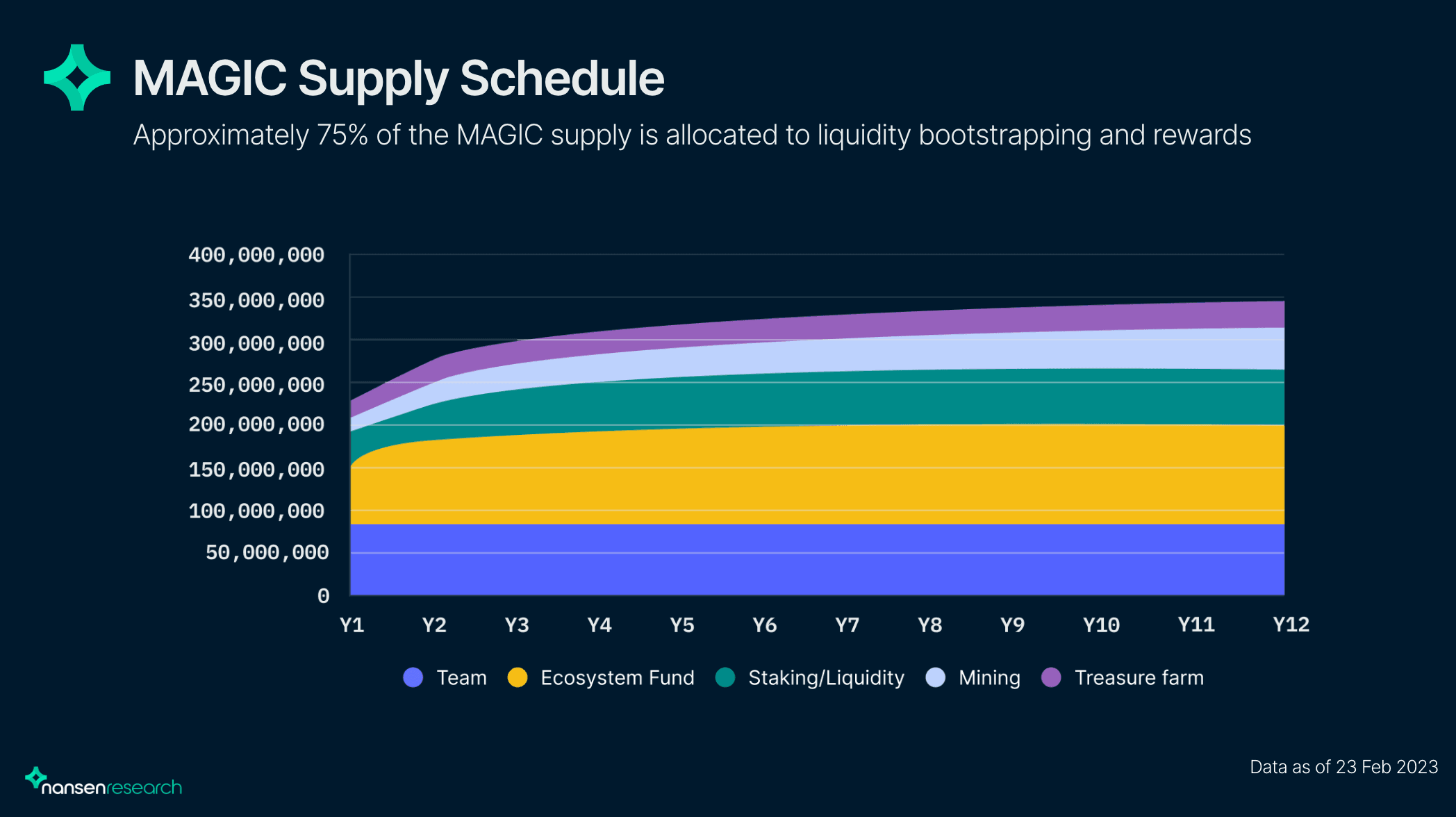

MAGIC and Bridgeworld

MAGIC sits at the center of the ecosystem. It is the medium of exchange connecting all games in the Treasure ecosystem, serving as the cross-metaverse currency. Every game listed on Treasure Trove, Treasure's native marketplace, utilizes MAGIC, with each inventing its own lore and storytelling around the token.

Bridgeworld, Treasure’s flagship and central metaverse of the ecosystem, is where MAGIC is emitted and harvested. It has 3 main resources to its economy:

- MAGIC (power)

- Treasures (Resources)

- Legions (NFTs/players)

These assets make up the foundation of the Treasury economy. The flywheel that makes up the base layer of the Treasure ecosystem is as follows:

- The NFTs and resources represent characters and items used to extract MAGIC from the metaverse.

- Legions quest for treasures. Treasures and MAGIC are used to craft consumables.

- Consumables, treasures, and legions can be staked to boost mining efficiency for MAGIC.

In short, MAGIC is an increasingly scarce resource (emissions are halved yearly) used to turn treasures into productive assets, which are in turn converted into consumables and used to mine more MAGIC. This relationship between the native token and resources makes up the base layer of the Treasure ecosystem. In other words, in this proof-of-work system where the rarest assets are earned through labor. Players are incentivized to stake their MAGIC indefinitely to obtain these assets rather than a farm-and-dump approach, meaning that there will be less available supply over time.

MAGIC's primary use case includes:

- Reserve currency for the web of metaverses under the Treasure umbrella

- MAGIC emissions are used to bootstrap new projects and support existing projects

- Staking in return for gMAGIC, used for governance voting

Smolverse

Smolverse is the first proof-of-concept NFT and metaverse project, fully community-driven, built in the Treasure ecosystem and the MAGIC token. Smolverse comprises three core NFT collections:

- Smol Brains (Smols)

- Smol Bodies (Swols)

- Smol Pets

On top of that, other items in Smolverse, such as Smol Cars, Smol Treasures, and Swolercycles, are represented as utility NFTs for its metaverse. Smol Brains is the main PFP NFT collection of the Smolverse ecosystem, which started as a free mint in October 2021 and has solidified its status as a blue-chip collection on Arbitrum.

Smol Brains are progressively evolving NFTs (along with other NFTs in the ecosystem) based on staking as a mechanism for active participation and social co-ordination. Users can stake their Smol Brains to earn IQ (in which the NFT's metadata updates as its brain size increases) over time and can be spent to upgrade their Land NFTs within the metaverse. Similarly, Smol Bodies (Swols) can be staked to earn Plates, which can be spent to build certain parts of the land where only Swols can build. In short, the NFTs within the ecosystem incorporate synergies between them. Holders are incentivized to stake their assets to evolve their NFTs aesthetically and earn tokens and redeemable prizes. Smolverse's design rewards long-term holders and members with high conviction.

In August 2022, the team partnered with Strider (ex-AAA gaming developers) to create a flagship Life and Strategy simulation game, Smolville.

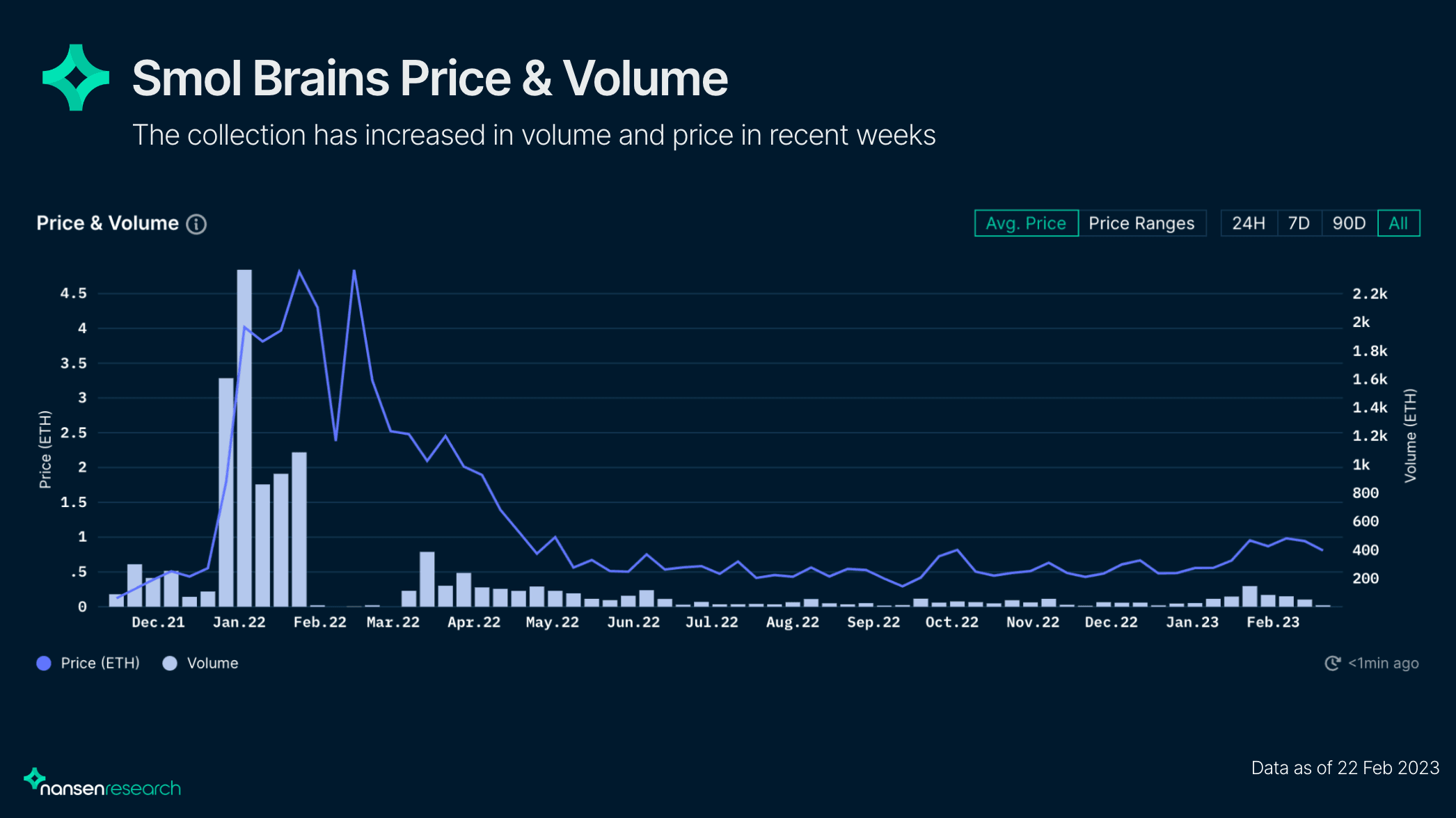

The project has accrued over 39.2m MAGIC in trading volume, with 79.3% and 60.3% of Swols and Smols currently staked, respectively. Although the Smol Brains collection volume and price have seen a dramatic drawdown following the market collapse in 2022, it has seen some incoming volume in recent weeks due to the Arbitrum narrative gaining traction.

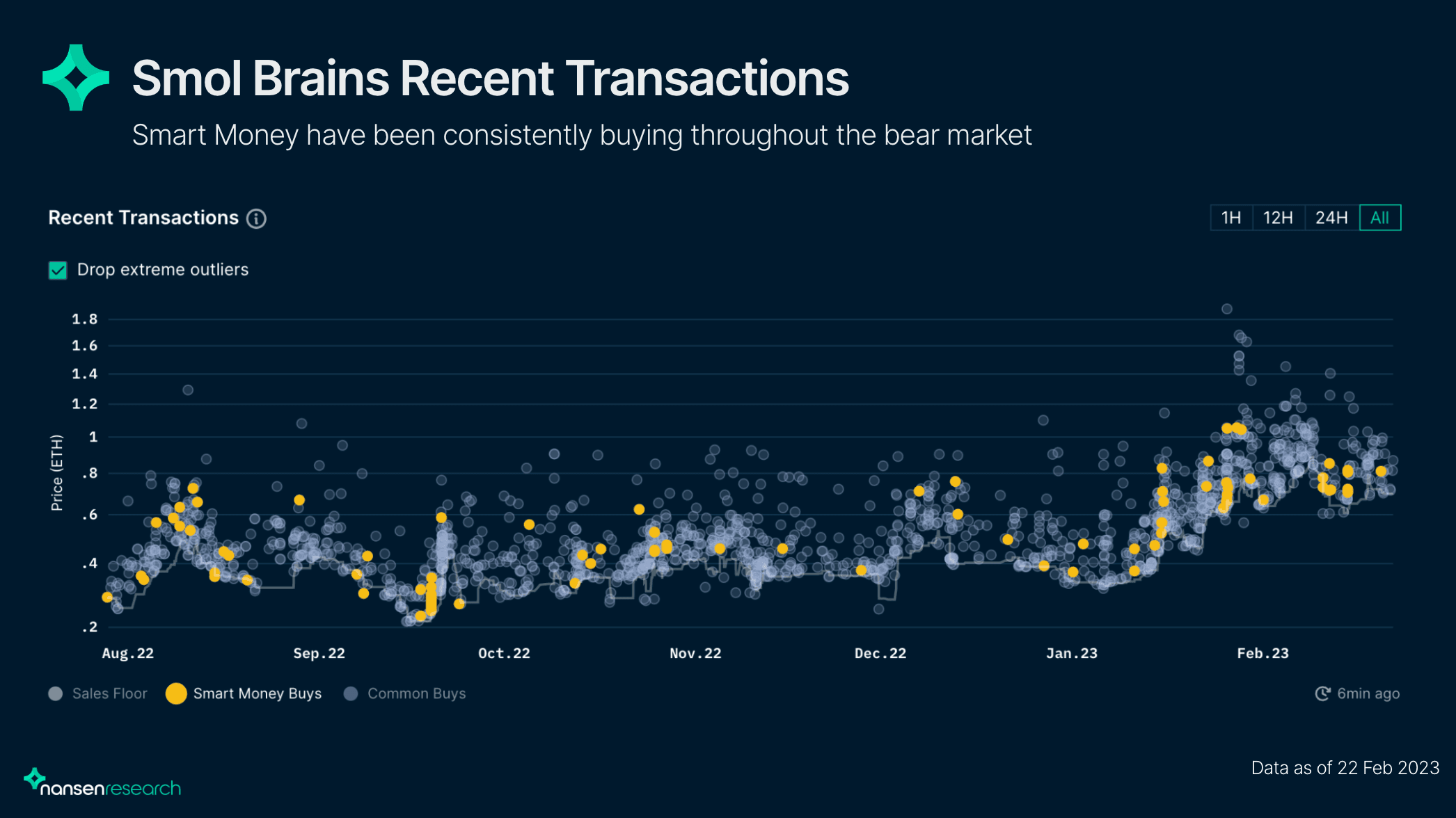

Despite the bear market and periods of low activity, Smart Money have been consistently buying Smol Brains, signifying interest and conviction in the project. Specifically, 2,334 of the 12,727 Smol Brains NFTs are diamond-handed, and this number is trending upwards. 309 of those diamond-handed NFTs are owned by 63 different Smart Money wallets.

TridentDAO

TridentDAO is a 2D MMO free-to-play game incorporating an infinite universe and various mini-games outside the main MMO game. The games are under development by Geyser Forge Studios and are native to Arbitrum (although they have previously launched on Harmony). The project has not taken any VC investments to keep the team's vision aligned with the users.

The Play-to-Earn Model Is Broken

TridentDAO aims to propose a better, more sustainable approach to the GameFi sector. Some of the main issues with the current play-to-earn model of existing crypto-gaming projects are:

- GameFi projects attract investors and promise high-quality games, but most are either slow-rugs or just clones of pre-existing games.

- Players are rewarded through the inflation of the native token without risk or value tied to its growth, creating constant selling pressure.

- Most existing P2E games are favorable to early adopters and those with characters suited to the meta of the game, which introduces a pay-to-win element.

- P2E only works when market participants are speculating on the in-game assets but fails when supply exceeds demand.

- P2E also only works if there are new players continuously entering the ecosystem and fails when growth halts, reflective of a Ponzi scheme.

In short, P2E does not work at an economic level; economic issues arise when buying pressure falls below a necessary threshold. In this case, players resort to playing in hopes of earning.

Risk-to-Earn

TridentDAO structures its games around the risk-to-earn model. Essentially, players are rewarded based on their merits, skills, and dedication to the game rather than how many tokens they own, the characters they can purchase, or the number of items they grind to sell for profit. Risk-to-earn comprises a zero-sum mechanism based on risk and reward. Winners benefit from the losers' stakes, while TridentDAO merely serves as a hosting platform that takes a fee from successful wagers, which is then added to its treasury.

Ecosystem

Trident currently consists of its main MMO game and a Pet Battles game. In the main MMO, players can explore the various worlds within the game, harvest resources, fight for territory, go on bounty missions, poach creatures within the respective worlds, and more. The Pet Battles mini-game is a pokemon-inspired battle game in which users can use pets they have poached or bought on the secondary market. Both are currently in pre-alpha testing stages, while its native DEX, OasisSwap, will be launching later in the quarter.

The pets (Pseudo Krakens), items, and cosmetics within the ecosystem are represented as NFTs, whereas the PSI token is the native token of the game, used to wager against other players, exchange NFTs, and interact with the game. However, there is a lack of clarity around the specifics of the utility for the PSI token, as the project has just been relaunched recently.