“Games are a way of communicating. Games are a way of connecting people. It’s like a string tying people together.” - Hideo Kojima - Metal Gear Solid Creator

Introduction

The blockchain gaming market is experiencing rapid growth, with projections indicating a compound annual growth rate (CAGR) of ~68% from 2024 to 2030, potentially reaching $301.5 billion by 2030. This surge is fueled by the decentralized nature of the blockchain, where players have true ownership of in-game assets such as NFTs and tokens. This ownership distinguishes GameFi from traditional gaming ecosystems, offering gamers a unique blend of entertainment and financial incentives that traditional gaming platforms cannot match.

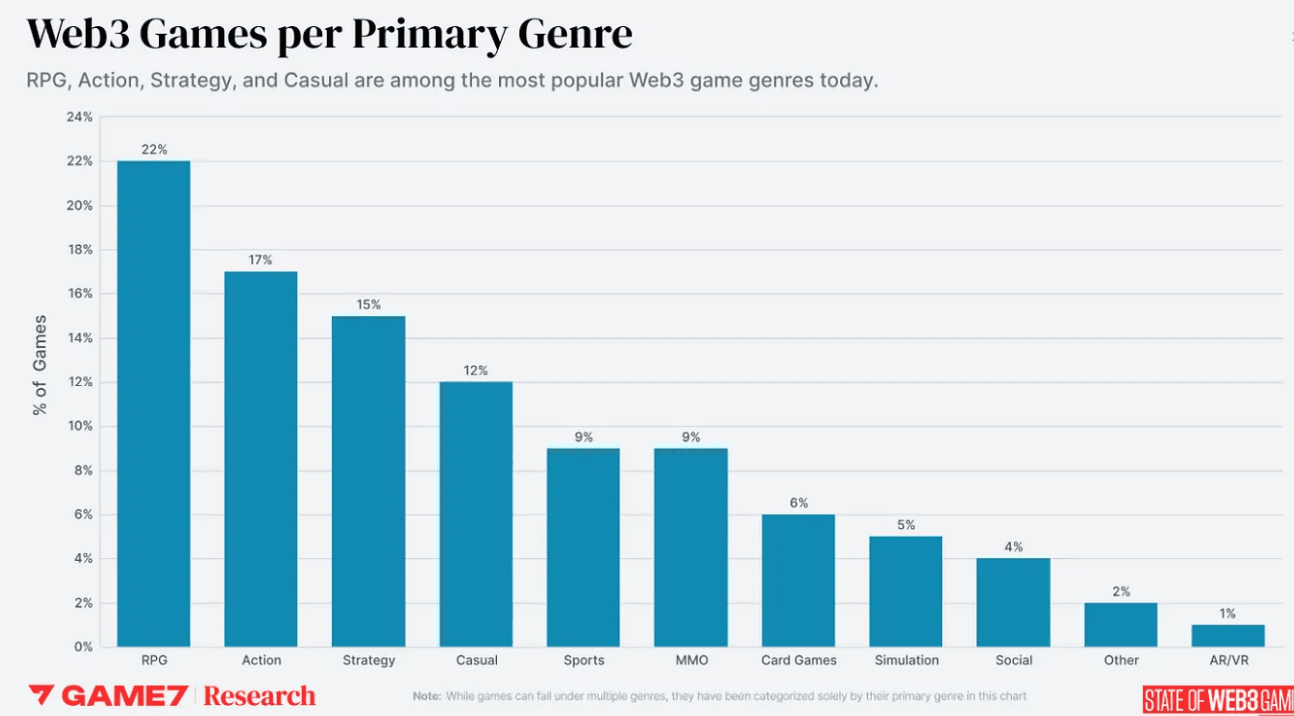

While all genres in GameFi are expected to flourish over the next decade, role-playing games or “RPGs” are particularly well-suited to benefit from the decentralized model of GameFi due to their emphasis on character progression, immersive worlds, and in-game economies. Indeed, in traditional RPGs, players spend significant time building characters, earning rare items, and navigating complex narratives, but the value of their in-game accomplishments remains locked within the game’s ecosystem. Alternatively, GameFi enables players to truly own and trade assets, such as rare items and characters, as NFTs. This adds tangible, real-world value to in-game achievements and enhances player engagement by providing additional incentives for progression. The synergetic partnership between RPGs and GameFi is backed up even further by a 2023 report by Game7, wherein RPGs were identified as the most popular Web3 gaming genre. RPGs account for 22% of all Web3 games, followed closely by action games at 17%.

Another indicator of growth in the Web3 GameFi sector is the rise of AAA and AA games. AAA games are defined as having a minimum funding of $25m, endorsed by a publisher, and backed by a large and experienced team. These games offer quality and immersion previously unseen in blockchain gaming. Although AAA titles in GameFi currently make up just 1% of Web3 games, with AAA and AA games making up 6%, this value exceeds the 4% mark for traditional web2 AAA and AA titles distributed on Steam. Several things could fuel this increase of significant investments in GameFi over traditional markets, whether it be the complexity required to build in Web3 (required added knowledge of blockchain technology and smart contracts) or simply because, per Steam, 71% of their daily users interact with AA or AAA titles. This further cements the idea that users gravitate towards high-production value games, implying that AAA titles in GameFi are filling an expected market need.

Beyond examining GameFi genres like RPGs and Action and the increased magnitude of GameFi financially and socially, this report also explores comparative metrics across the top games and chains.

Differentiating Factors in Web3 Games

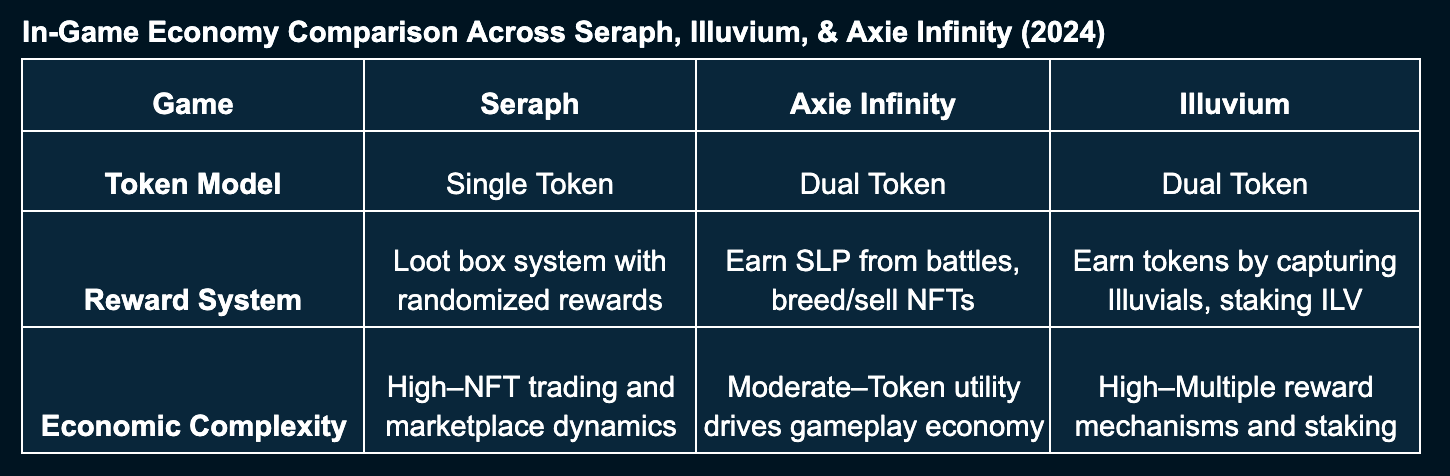

Illuvium, Axie Infinity, and Seraph all exemplify how high-quality gameplay can be combined with decentralized economic systems in Web3 games. Illuvium focuses on creating a visually stunning 3D world with a mix of PvE (player-vs-environment) and PvP (player-vs-player) mechanics. On the other hand, Axie Infinity popularized the Play-to-Earn model, allowing users to generate real-world income through gameplay, although it faces challenges in user retention. Seraph stands out through its variable rarity item and loot box system, which introduces randomness and allows players to earn high-value rewards regardless of investment size. This "degen" reward structure, standard in crypto, creates excitement and encourages consistent engagement. As a PC & mobile loot-based game, Seraph integrates NFTs to verify rare virtual assets earned through gameplay or purchased by players. This NFT integration enables free trading and monetization of assets, fostering strong engagement loops that keep players invested. Below is an example of the dynamic reward system that Seraph offers, with luck representing the large variability in the rarity of rewards.

In-Game Economy Comparison

In successful Web3 games, the structure and mechanics of in-game economies are key drivers of player interaction and engagement. One of the most well-known dual-token economies, Axie Infinity, consists of Smooth Love Potion (SLP) and Axie Infinity Shards (AXS). SLP is the utility token earned through gameplay and used to breed new Axies, creating a cyclical economy where players are rewarded for participating. SLP can also be traded on secondary markets for real-world value, enabling players to monetize their in-game efforts. On the other hand, AXS is the governance token, enabling holders to vote on important decisions regarding the game’s future and participate in staking for additional rewards.

On the other hand, Illuvium operates on a robust NFT marketplace, where players trade rare assets like Illuvials. By integrating a collector's component alongside the Play-to-Earn model, Illuvium adds value and depth to its economy.

Seraph utilizes a single-token model, keeping the utility token off-chain. This strategy promotes stable economic cycles, allows players to transfer funds in and out seamlessly, and concentrates users' capital and engagement on a singular form of currency.

The Social Aspect

In Web3 gaming, community engagement across social platforms is vital in building a strong player base and maintaining user interest. X, Discord, and Telegram are key tools for developers to share updates, engage with players, and foster a sense of belonging within the game's ecosystem. High follower counts on these platforms often reflect a game's ability to create a dedicated and active community, which is critical for long-term success in a decentralized environment.

Axie Infinity, with 869K Twitter followers and 591K Discord members, boasts one of the most active communities in the space, helping drive its early adoption and previous relevance. Seraph also maintains a strong community presence, with 374K Twitter followers, 321K Discord members, and 92K Telegram members, contributing to its rapid growth. Illuvium, while slightly smaller, still holds an impressive audience with 399.5K Twitter followers, 116K Discord members, and 17K Telegram members, demonstrating the importance of maintaining active communication channels. While overall follower counts for all major competitors are impressive, Seraph dominates in recent growth, gaining 52K followers on Twitter over the past month compared to 1.9K and 2.1K for Axie and Illuvium, respectively.

A large, engaged audience across multiple platforms enables games to keep their players informed, involved, and excited about upcoming features and developments. At the same time, recent follower count growth displays ownership of short-term mindshare.

Quantitative Metrics Comparison

Despite the overall crypto market's challenges, daily trading volumes for blockchain games rose by 8.94% in August 2024. If we examine each game’s performance so far in 2024, we can see that Seraph leads in daily active wallets (DAW) with 537K, significantly outperforming Illuvium's 200+ and Axie Infinity's 154K wallets. However, Axie Infinity dominates in the current NFT market cap with $34M, followed by Seraph at $15M and Illuvium at $2.8M. Regarding NFT trading volume, Seraph surged ahead with $65.5M, far exceeding Axie Infinity's $22M and Illuvium's $3.1M. A key driver behind Seraph’s high DAW is likely its 7-day solid retention rate of 66% during its preseason, indicating that many new users remain engaged.

Source: DappRadar, Footprint, CryptoSlam, Immutable.com, ActPass

Comparison of Top GameFi Chains

Evaluating the performance of leading GameFi chains like opBNB, Ronin, Polygon, and Immutable X requires a focus on crucial factors such as gas fees, transactions per second (TPS), and scalability. These metrics are particularly significant for NFT-based gaming ecosystems, where the need for fast and cost-efficient transactions is paramount to supporting high transaction volumes.

Here is a breakdown of the key metrics benchmarked:

- Gas Fees: Gas fees are pivotal in GameFi, where frequent microtransactions and NFT trading are central to the ecosystem. OpBNB offers the lowest median gas fee at $0.0001 among the top chains, making it highly cost-effective for gaming applications. Ronin follows with a median fee of $0.00179, Polygon PoS reports $0.00293, while Immutable X excels with zero gas fees for NFT minting and transfers.

- Theoretical Transactions Per Second (TPS): High TPS is essential to handle large transaction volumes associated with real-time multiplayer games and frequent asset trading. As of October 2024, Ronin leads with 100,000 TPS, surpassing Immutable X 9,000 TPS and Polygon PoS 7,200 TPS. opBNB, with 10,000 TPS, also ranks among the top chains, ensuring scalability for large-scale NFT transactions.

- Average TPS: While the theoretical maximum TPS provides insight into a network's capacity, actual usage often differs. Currently, opBNB processes an average of 97 TPS, well below its theoretical limit of 10,000. Ronin averages 20 TPS, Polygon PoS handles 33 TPS, and Immutable X reports the lowest at 0.02 TPS. Given the much lower average TPS numbers than theoretical maximums, scalability is no immediate concern. As the gaming sector expands and the adoption of Account Abstraction (AA) increases, particularly in complex gaming ecosystems, having a high TPS will be essential for managing the added load and ensuring a seamless user experience.

Fast transaction speeds, low gas fees, and scalability remain essential for GameFi chains looking to support the growing demand for NFT-based gaming economies. opBNB has the highest average TPS (2024) at 97, further proving its ability to handle a large volume of transactions. As GameFi continues to expand, these chains will play a pivotal role in shaping the future of blockchain gaming.

Key Factors for GameFi Blockchains

To gauge the success of blockchain networks within the gaming industry, it is important to assess key performance indicators such as Daily Active Wallets (DAW), Total Value Locked (TVL), and the number of games hosted on each chain. This comparison of opBNB, Ronin, Polygon, and Immutable X will show how these metrics reflect ecosystem vitality, user engagement, and platform liquidity. Additionally, security remains a critical factor, with major chain hacks damaging customer trust in GameFi.

Source: DappRadar, Footprint, Defillama, Crypto Briefing, CNN

Here is what we find:

- Daily Active Gaming Wallets: By October 2024, opBNB experienced a 72% month-over-month growth in DAWs, reaching 1.36M daily active gamers, highlighting its scalability and performance in the gaming sector. In contrast, despite being a widely used platform, Polygon reported a lower DAW of 68,000, indicating a decline in its gaming user base. Ronin and Immutable X showed stable DAWs at 923,000 and 173,000, respectively, maintaining steady engagement within their ecosystems.

- Total Value Locked (TVL): Polygon leads with $972M, solidifying its position as a significant player in the gaming space. Ronin and Immutable X followed with $135M and $132M, respectively. Meanwhile, as a newer Layer 2 solution, opBNB is rapidly gaining traction with $25M in TVL.

- Number of Games: Polygon leads with over 480 games, affirming its status as a hub for developers. opBNB follows with 20+ games, demonstrating its rapid expansion within the GameFi space. Ronin and Immutable X have focused ecosystems with 20+ and 30+ games, catering to specific gaming sectors like Axie Infinity on Ronin and NFT-driven titles on Immutable X.

- Major Recorded Hacks ($ Lost): opBNB and Immutable X have not experienced any recorded hacks, maintaining strong security records. Polygon faced a potential exploit, but a whitehat hacker discovered the bug and relayed the technical flaw to the team in a precautionary manner. Meanwhile, Ronin has faced the most significant challenges from security exploits, with a $600M hack allowed attackers to compromise private keys to validate network transactions. After the hack, Ronin implemented security upgrades, such as increasing the number of validators and adding hardware security modules (HSMs), to prevent future breaches.

Conclusion

In conclusion, the GameFi ecosystem is entering a pivotal phase of expansion, with projections forecasting market value to reach $301.5 billion by the decade's end. This rapid growth is driven by decentralized ownership of in-game assets, such as NFTs and tokens, providing real-world value and unique financial incentives that traditional gaming ecosystems cannot match. Despite broader market challenges, daily active wallets rose by 8.94% in August 2024, further highlighting the resilience of the current GameFi sector.

As blockchain infrastructure improves—offering greater transaction capacity, lower gas fees, and better scalability—GameFi projects, particularly those with NFT-driven economies and impressive social impact, are positioned to thrive. Leading chains like opBNB, Ronin, and Immutable X stand out due to their balance of speed, low costs, and scalability, attracting developers and players alike.

Disclaimer: Nansen and Slice Analytics have produced the following report as part of the existing contract for services provided to Seraph (the "Customer") at the time of publication. While Seraph has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.