Overview

Avalanche is a Layer-1 blockchain platform designed to support decentralized applications, digital assets, and smart contracts with a focus on scalability, low latency, and cost efficiency. Developed by Ava Labs, the network leverages a Proof-of-Stake model and the Avalanche consensus protocol to deliver sub-second finality and high throughput, enabling applications that require fast settlement and predictable performance. Its three-chain architecture, comprising the X-Chain, C-Chain, and P-Chain, supports a broad range of use cases across DeFi, enterprise applications, and real-world asset tokenization.

In Q4 2025, Avalanche continued to build on this foundation through progress across ecosystem growth, infrastructure development, and real-world adoption. The quarter reflected increasing momentum in enterprise-facing applications, onchain financial infrastructure, and region-specific expansion, alongside ongoing support for developers and network builders. The sections that follow detail the key developments, ecosystem activity, and real-world deployments that shaped Avalanche’s trajectory during the final quarter of the year.

Key Developments: Q4 2025

- Q4 was one of Avalanche’s strongest quarters to date, with transaction volume nearly doubling from Q3 and user activity increased 41x. Total Network Transactions (C-Chain + all L1s) was 3.5 billion in Q4, which is nearly double from 1.7B in Q3 (+103%). C-Chain recorded its highest quarterly transaction amount on record (197 million), up 63% vs Q3. 21 Avalanche L1s also reached all-time-high quarterly transaction volumes.

- Avalanche had a major tech upgrade, Granite, which activated on November 19th. This upgrade delivered faster confirmation times, lower transaction and messaging costs, more efficient cross-chain validation, and foundation for upcoming performance upgrades.

- The Avalanche Foundation announced the third cohort of Retro9000 grantees, with 3 projects (Blaze Stream, Hashfire, Tesseract, and Transparency Protocol) awarded over $140,000 in retroactive funding for launching Avalanche L1s and infrastructure tooling on mainnet. The program also recognizes returning grantees like Tesseract for continued development, which has expanded integrations with BLAZE L1 and PLYR L1, added support for multiple DEXs including Blackhole, Pangolin V3, Pharaoh V3, APEX DeFi, and ArenaDEX, and deployed a new scalable pathfinding algorithm. The next snapshot is scheduled for January 2026, with the program continuing to support builders who deliver measurable onchain impact.

Ecosystem

DeFi

- Sierra Protocol launched the SIERRA token, a Liquid Yield Token (LYT) backed by a diversified portfolio of real-world assets (U.S. Treasury money-market funds, commercial paper) and blue-chip DeFi protocols (Aave, Morpho, Pendle). Powered by OpenTrade's institutional-grade yield-as-a-service infrastructure, Sierra dynamically adjusts reserves between traditional and onchain sources. This expands Avalanche's RWA ecosystem, which now hosts over $1.24 billion in RWA value with transfer volume exceeding $18B in a single month. The protocol demonstrates how yield-oriented assets can function transparently on Avalanche: accessible, adaptive, and built on a foundation of real assets.

- The launch of the beta version of Arena V2 DEX went live with improvements including concentrated liquidity, multichain swaps, creator fees, referral incentives, and upgraded token launch controls

- Major DeFi protocols like Pharaoh, an exchange, generated $283,000 in revenue on Nov 24th, boasting new records for activity and others like Dexalot passed 400 million total transactions.

- AVAX One acquired 9.4 million AVAX in November.

Payments

- The payments sector has also picked up a lot of momentum. LuLu Financial has processed $19B+ in remittances and is partnering with Avalanche to build blockchain-native payments infrastructure, including a purpose-built Avalanche Layer 1 launching in 2026 via AvaCloud, alongside regulated partners like Axiym.

- Further, Kasikornbank (KBank), Thailand’s second-largest bank, launched cross-border tourist payments on Avalanche in partnership with StraitsX through Project BLOOM, bringing regulated, real-world payment flows on-chain for international travelers.

- The payments sector showed much adoption across the world. It includes NH NongHyup Bank, who is piloting stablecoin tax refunds on Avalanche. Littio, a Colombian neobank, is bridging DeFi with traditional finance to bring dollar-denominated instruments to its clients. The South American entity has launched a new product with OpenTrade, a firm that offers stablecoin yield products backed by real-world assets, and Glim and OpenTrade Launch Automatic USD Payroll Yield on Avalanche, Expanding Financial Security for Colombian Workers.

NFTs & Gaming

- MyPrize brings its social casino to Avalanche, enabling millions of players and billions in volume to operate with prize redemptions, game resolution, and tracking natively onchain. This integration enables transparent, verifiable gaming experiences where every win is recorded onchain, demonstrating blockchain's utility in the gaming industry.

- Other big NFT one right up there with MyPrize - FIFA - users were able to convert their RTB tickets which are NFTs to pay and receive their FIFA World Cup 26 tickets. Because of this, transactions on its L1 hit a new ATH of 272k transactions (+16% Q/Q), average daily wallets went up 120% from Q3 to Q4.

- Gunzilla's GUNZ L1 hit all-time highs in daily transactions and active addresses with Off the Grid, MapleStory Universe launched $50M ecosystem fund, achieved 100M+ transactions in 6 months, Playfull opened Amazon storefront for Avalanche gaming assets and digital items, Blaze launched streaming testnet, Maple Story's Henesys L1 surpassed 100M total transactions. Maplestory also hit an ATH in transactions in a single quarter on its L1.

Enterprise & RWAs

- FIS and Intain Markets launched the Digital Liquidity Gateway, a marketplace built on Avalanche's Layer 1 that allows regional and community banks to buy, sell, and securitize loan portfolios with greater transparency and efficiency. By connecting to FIS' core banking systems and using AI to automate workflows, the platform streamlines asset-backed finance, with hundreds of millions of dollars in transactions expected to flow through by year-end. This brings sophisticated financial tools to roughly 2,000 regional and community banks across the United States, expanding capital access and strengthening local economies.

- Securitize gained EU approval to operate as a tokenized trading and settlement system on Avalanche, becoming the first regulated digital securities operator in both the US and EU.

- Dinari, an Avalanche L1, partnered with S&P Dow Jones Indices to launch the S&P Digital Markets 50 which is the first index to combine tokenized U.S. equities and crypto assets, and make the benchmark directly investible onchain.

- Record Financial and 11am bring real-time royalty infrastructure to the music industry on Avalanche, representing artists like Armani White, RealestK, Lil Tjay, A$AP Ferg, Alex Warren, and Maddox Batson. By using stablecoins like USDC, Record delivers transparent, real-time payments directly to artists and creators, transforming a system where royalty payments traditionally took months to process. The platform aggregates and normalizes royalty data, then uses Avalanche's high-performance blockchain to distribute payments instantly, providing a single, verifiable source of truth for artists, distributors, and managers.

- Avalanche partnered with Blockticity to bring global supply chain standards onchain, enabling transparent and verifiable supply chain tracking. This enterprise application demonstrates blockchain's utility in logistics and supply chain management, providing real-world infrastructure for supply chain verification.

- At Union Square's Holiday Market in New York City, small businesses and shoppers are experiencing faster, simpler payments powered quietly by Avalanche technology. This real-world implementation demonstrates blockchain's practical utility in everyday commerce, bringing onchain payments to traditional retail environments.

- The Avalanche Foundation established a DLT foundation in Abu Dhabi Global Market (ADGM) to support MENA regional growth. This institutional move positions Avalanche for long-term expansion in the Middle East and North Africa region, with Abu Dhabi serving as a strategic hub for Avalanche's vision in MENA, bridging decentralized innovation with real-world adoption at scale. The foundation's participation in Abu Dhabi Finance Week further highlights this commitment to regional growth and institutional partnerships.

- Avalanche Treasury Co. announced $675 Million+ Business Combination with Mountain Lake Acquisition Corp. with Goal to Build $1 Billion+ Ecosystem Treasury.

- $500m was added to BlackRock BUIDL on Avalanche which made Avalanche the second largest chain of Black Rock funds after Ethereum.

- Bitwise and VanEck filed for AVAX ETFs; with both intending to offer staking yields.

Onchain Data

Daily Transactions

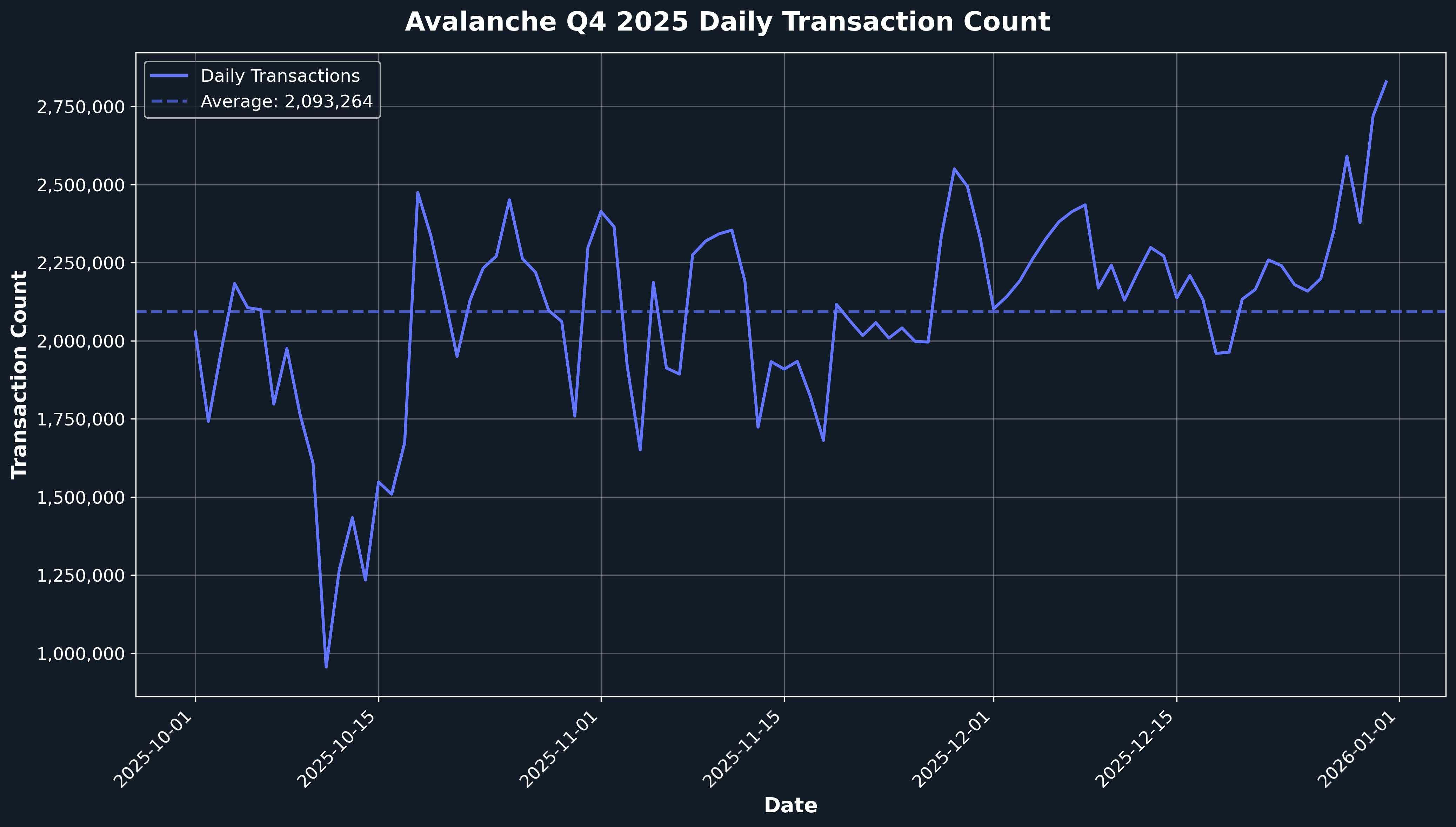

Despite transaction fees going down significantly, the median transaction fees declined 79% Q3 to Q4 (98% vs 2024). Avalanche has demonstrated robust transactional activity throughout Q4 2025, with an average of 2.09 million daily transactions and peaks reaching 2.83 million. The quarter showed consistent throughput, reflecting strong protocol usage and ecosystem engagement. Notable activity spikes occurred in mid-October and late November, coinciding with major announcements including the launch of Sierra Protocol, the Digital Liquidity Gateway partnership with FIS and Intain, and the Retro9000 third cohort announcement. The network maintained resilience with daily transaction volumes consistently above 1.5 million, demonstrating Avalanche's capacity to handle high-volume financial operations from enterprise partnerships like Record Financial's music royalty platform and the growing RWA ecosystem. This sustained activity aligns with the network's expanding role in real-world asset tokenization, where over $1.24 billion in RWA value now resides on Avalanche.

Daily Active Addresses

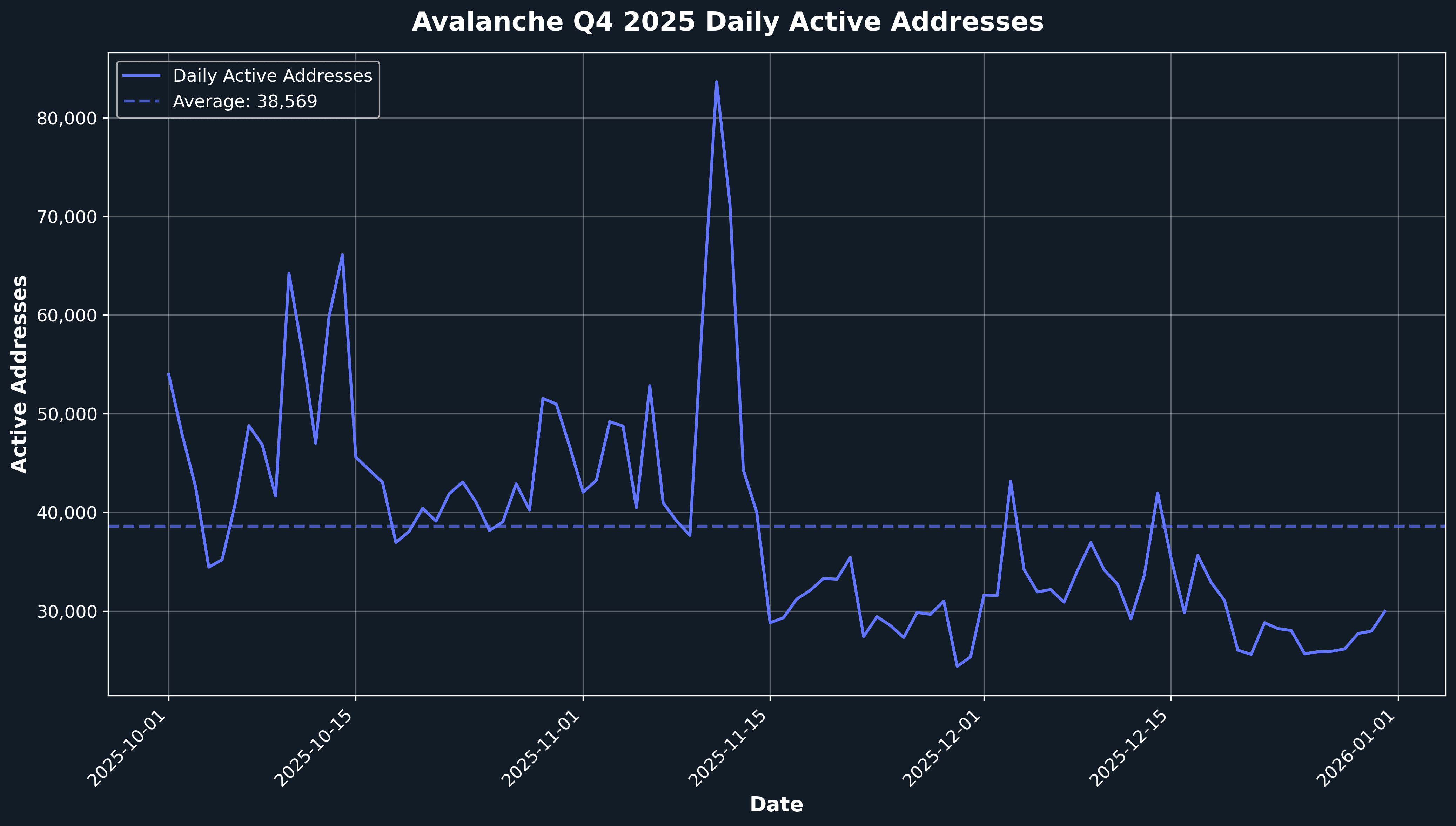

Avalanche C-chain maintained a healthy base of active addresses throughout Q4 2025, averaging 38,569 daily active addresses with peaks reaching 83,636. The quarter showed periodic surges in user activity, particularly in early October and mid-November, which aligned with ecosystem developments including MyPrize's social casino launch, the Union Square Holiday Market payment integration, and MENA regional expansion initiatives. These activity spikes demonstrate growing user engagement across diverse use cases, from gaming and entertainment to enterprise payments and financial services. The consistent user base reflects Avalanche C-Chain’s expanding appeal across multiple sectors, from DeFi protocols like Sierra and LFJ to enterprise applications like the Digital Liquidity Gateway and music royalty infrastructure. As the network continues to onboard new partnerships and protocols, user activity patterns suggest sustained ecosystem growth and diversification.

Top Entities by Users and Transactions

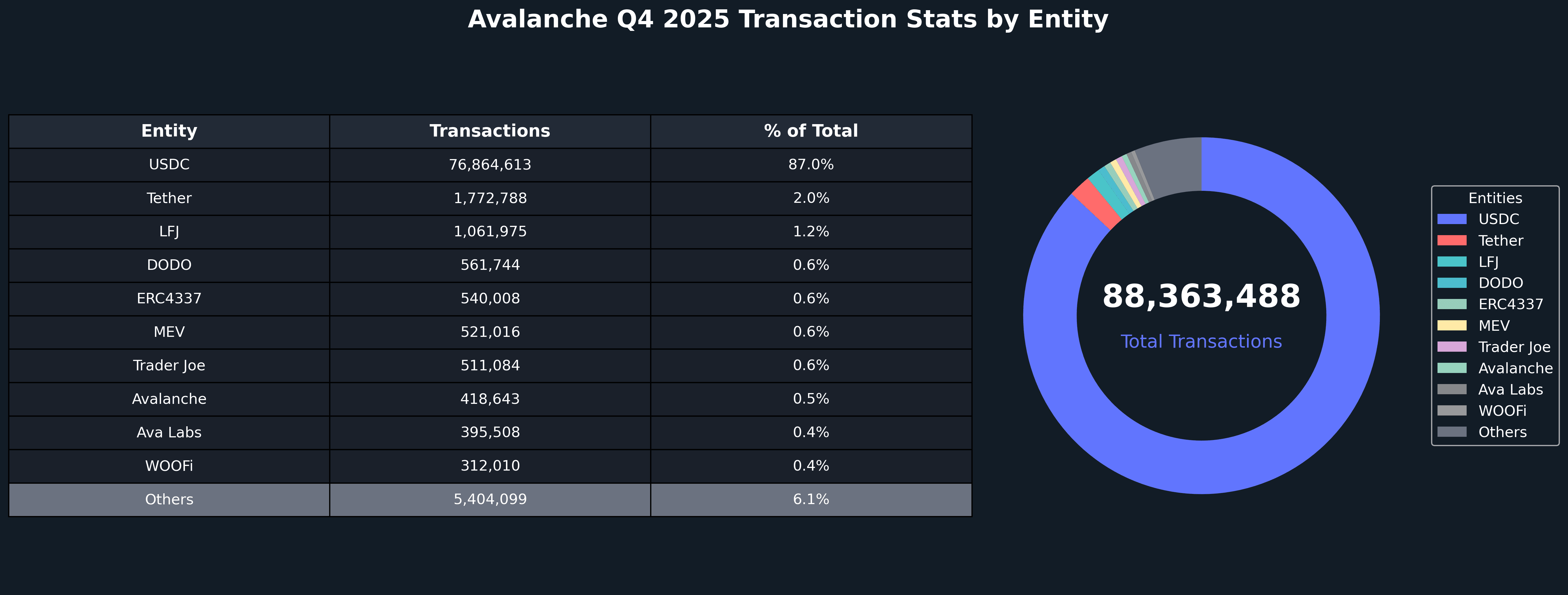

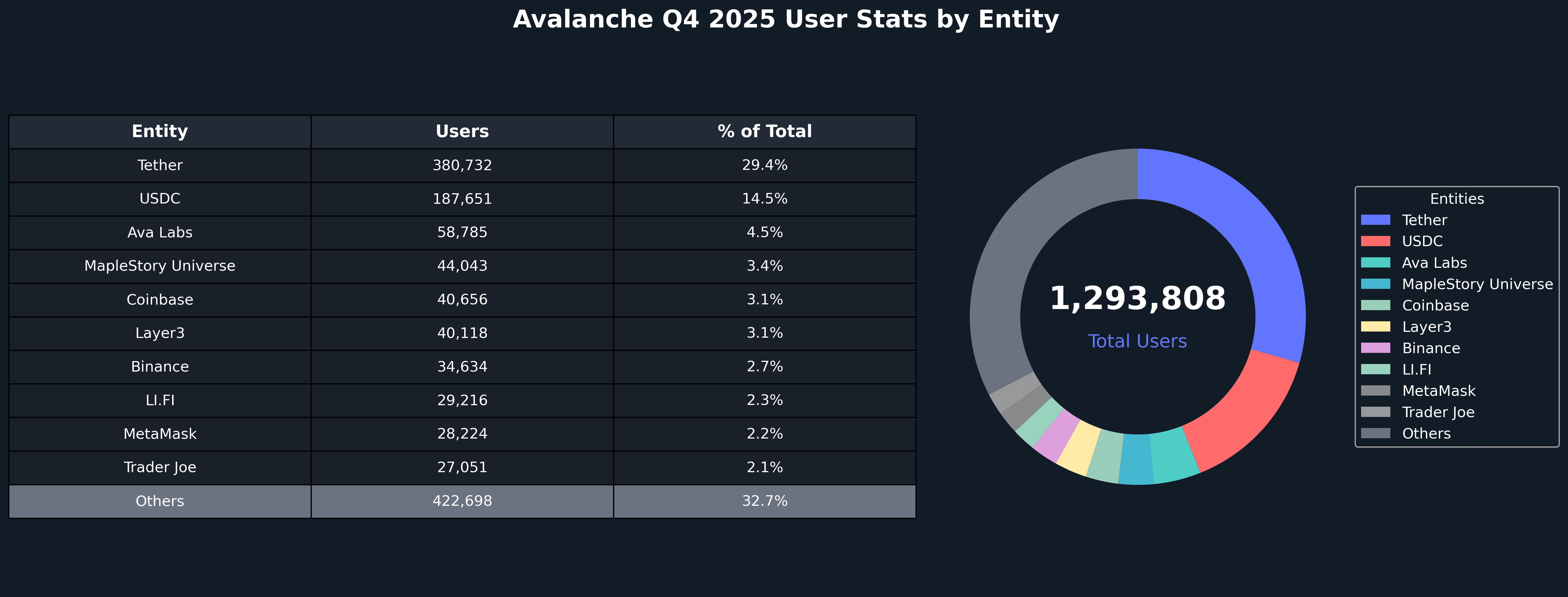

Avalanche C-chain's top entities by users and transactions highlight a mature ecosystem anchored by stablecoin infrastructure, DeFi protocols, and cross-chain infrastructure. USDC dominated transaction volume with 76.9 million transactions (87% of total), representing a 64.58% quarter-over-quarter increase that reflects the growing importance of stablecoin rails for enterprise applications like Record Financial's music royalty platform and Sierra Protocol's yield token. Tether led in user activity with 380,732 unique users (29.4% of total), showing a 12.36% QoQ increase, while LFJ demonstrated strong growth with 63.59% transaction growth despite a user decline, indicating increased engagement from existing users. Infrastructure protocols showed remarkable expansion: ERC4337 (account abstraction) saw 1,820% transaction growth, while Chainlink grew 35.14% as oracle infrastructure becomes critical for RWA and enterprise applications. The ecosystem's distribution reinforces Avalanche's dual role as both a high-performance DeFi platform and an enterprise-grade blockchain for real-world asset tokenization, with stablecoins serving as the foundational layer for institutional adoption and cross-border payments.

Closing Thoughts

Q4 2025 has reaffirmed Avalanche's position as a leading blockchain platform for enterprise adoption and real-world asset tokenization. The network's robust onchain metrics, averaging 2.09 million daily transactions and 38,569 daily active addresses, demonstrate sustained ecosystem engagement and growing institutional interest. The quarter's strategic developments reflect a clear evolution toward practical, real-world applications: from community banking infrastructure via the Digital Liquidity Gateway to music royalty payments through Record Financial, and from supply chain verification with Blockticity to retail payments at Union Square's Holiday Market.

The network's expanding RWA ecosystem, now hosting over $1.24 billion in value, positions Avalanche as a critical infrastructure layer for tokenized finance. Sierra Protocol's launch of a Liquid Yield Token backed by both traditional and onchain assets exemplifies this trend, while partnerships with FIS, Intain Markets, and Record Financial demonstrate institutional confidence in Avalanche's enterprise-grade capabilities. The foundation's establishment of a DLT foundation in Abu Dhabi Global Market signals long-term commitment to MENA regional growth, expanding Avalanche's global footprint.

Onchain data reveals a mature ecosystem where stablecoins, particularly USDC, serve as the foundational layer for enterprise applications, with 64.58% QoQ transaction growth reflecting increased institutional adoption. Infrastructure protocols like ERC4337 and Chainlink also showed explosive growth. As the network continues to bridge traditional finance with blockchain technology through partnerships with banks, music labels, and supply chain providers, Avalanche enters 2026 well-positioned to advance its mission of enabling a decentralized, borderless financial system with real-world utility at scale.