Liquidity continues to be a critical factor in enabling broader institutional participation in the crypto market, influencing both execution quality and perceived market stability. In 2025, Bitget reported increased trading volumes and improvements in order book depth and execution efficiency, which are now on par with several established exchanges. These developments, alongside reported engagement from funds, competitive fee structures, and institution-oriented services, suggest Bitget may play a growing role in the evolving digital asset trading ecosystem.

Liquidity and Why It Matters

Liquidity is often mentioned in crypto, but it is not always well understood. It is not just about trading volume or temporary hype, it is about how reliably an asset can be bought and sold at a predictable cost. Liquidity defines the quality of the market for both retail and institutional participants. In illiquid markets, bid ask spreads widen and execution becomes more expensive. When order books are shallow, even small trades move prices, and larger trades can push them sharply. Weak liquidity also makes markets vulnerable to manipulation and overreaction. Protocols and DeFi projects depend on consistent liquidity as well, since it is essential for attracting users and preventing system stress.

Retail traders are concerned mainly with ease of access and limiting slippage. Institutions face more complex challenges, since their orders are large enough to shift markets, and their strategies, such as arbitrage or market making, require consistent liquidity. If liquidity falls short, institutions withdraw, and their absence impacts the entire ecosystem. This is why liquidity should be treated as a structural foundation rather than a secondary concern.

Institutional Liquidity on Bitget

Liquidity is one of several factors institutions may consider when allocating capital, especially for trading or market-making strategies. Since early 2025, Bitget has reported increased institutional activity since early 2025, which has coincided with reported changes in order book depth and execution patterns.

Growth in Institutional Clients.

Data provided by Bitget, shows a clear trend toward higher institutional participation on Bitget:

- Spot markets: Institutional trading volume rose from 39.4% on January 1 to 72.6% by July 30.

- Futures markets: Institutional market makers went from accounting for 3% of activity at the beginning of the year to around 56.6% by late July.

These developments appear to have coincided with higher observed liquidity across certain trading pairs, though broader market factors may also contribute.

Market Quality

Bitget reports and our findings show that its liquidity metrics on selected trading pairs (BTC/USDT, ETH/USDT, SOL/USDT, XRP/USDT, and DOGE/USDT) are in line with those observed on several other major platforms. Bid–ask spreads remain tight, and order book depth within ±1% of mid-price is sufficient to support both retail and institutional order flow. Importantly, spreads have stayed stable even during periods of higher volatility.

Institutional Services

To support professional users, Bitget offers:

- Maker and taker fee structures designed to be cost-efficient (as low as 1.6bps taker fees and rebates up to 1.2bps).

- High API rate limits (up to 200 requests per second) and low-latency infrastructure for systematic and high-frequency trading.

- Sub-accounts and custody options, including integrations with OSL, Copper, Cobo, Cactus, and Fireblocks.

- Loan services tailored for institutional clients, including conditional interest-free lending.

Market Microstructure Analysis Report

Exchange Performance Comparison

For this research, we analyze liquidity across cryptocurrency exchanges using two established microstructure methods over a 29-day period (August 14th - September 11th, 2024). Our dataset consists of 1-minute OHLCV data for five major trading pairs: BTC/USDT, ETH/USDT, SOL/USDT, XRP/USDT, and DOGE/USDT.

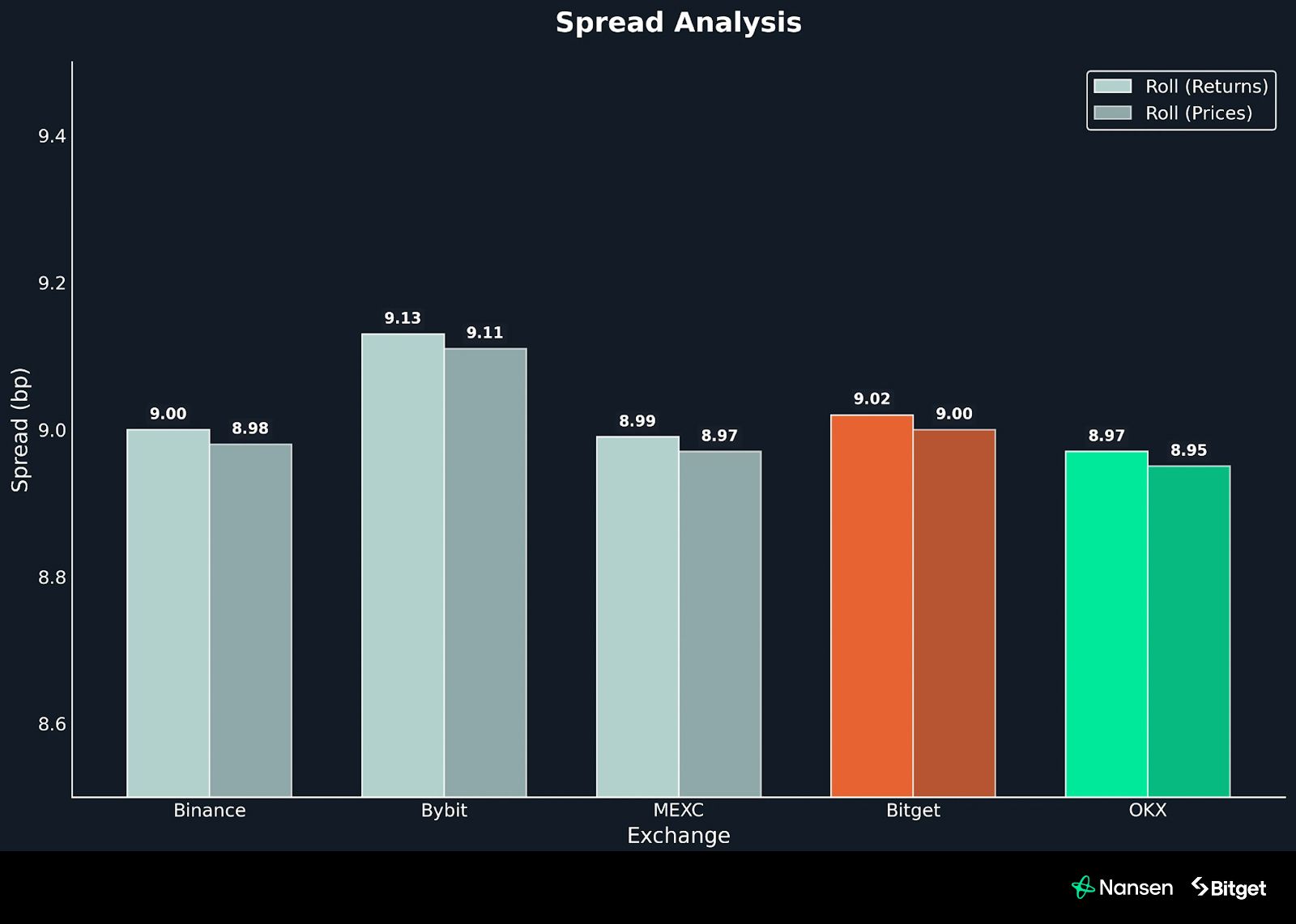

We employ the Amihud Illiquidity Ratio to measure price impact by dividing absolute returns by trading volume - lower values indicate more liquid markets where prices move less per unit of volume traded. Additionally, we use the Roll Spread Estimator to estimate bid-ask spreads through serial covariance analysis of price changes, which assumes negative correlation due to bid-ask bounce, with tighter spreads showing less serial correlation.

These complementary measures provide a comprehensive view of market liquidity, capturing both transaction costs (Roll) and price impact (Amihud), comparing Bitget to four other exchanges.

Liquidity

Source: Bybit, Binance, MEXC, Bitget, and OKX via CCXT

Binance posts the lowest Amihud ratio (0.0004), reflecting the deepest liquidity. Bitget’s 0.0014 score places it right alongside peers like Bybit and MEXC. The narrow dispersion across venues shows that institutional grade liquidity is no longer limited to Binance alone.

Spreads

Source: Bybit, Binance, MEXC, Bitget, and OKX via CCXT

Roll spread estimates cluster tightly between 8.95–9.13 basis points. OKX posts the lowest spread (8.95 bp), while Bitget stands at 9.02 bp, very close to the median. This narrow band highlights consistent cost efficiency across all exchanges.

NOTE: The spreads are an average across the five token pairs (1-minute OHLCV, BTC/USDT, ETH/USDT, SOL/USDT, XRP/USDT, DOGE/USDT).

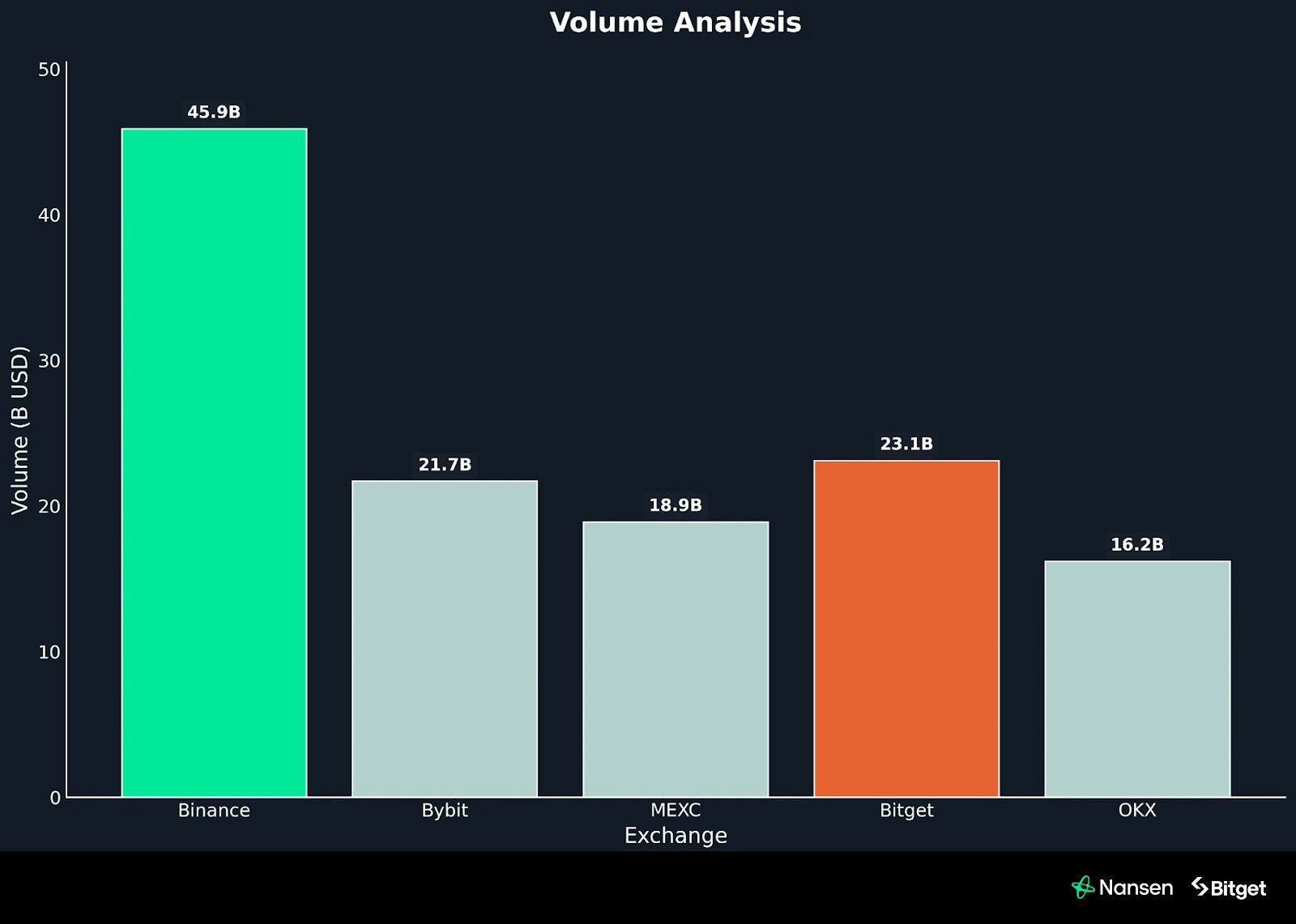

Volumes

Source: Bybit, Binance, MEXC, Bitget, and OKX via CCXT

Binance leads with $45.9B traded, while Bitget secures the second position with $23.1B, ahead of Bybit ($21.7B), MEXC ($18.9B), and OKX ($16.2B). High trading volumes are often interpreted as indicators of market activity, though they do not necessarily reflect execution quality or user sentiment. Again, the volume reported here is for the five aforementioned tokens pairs

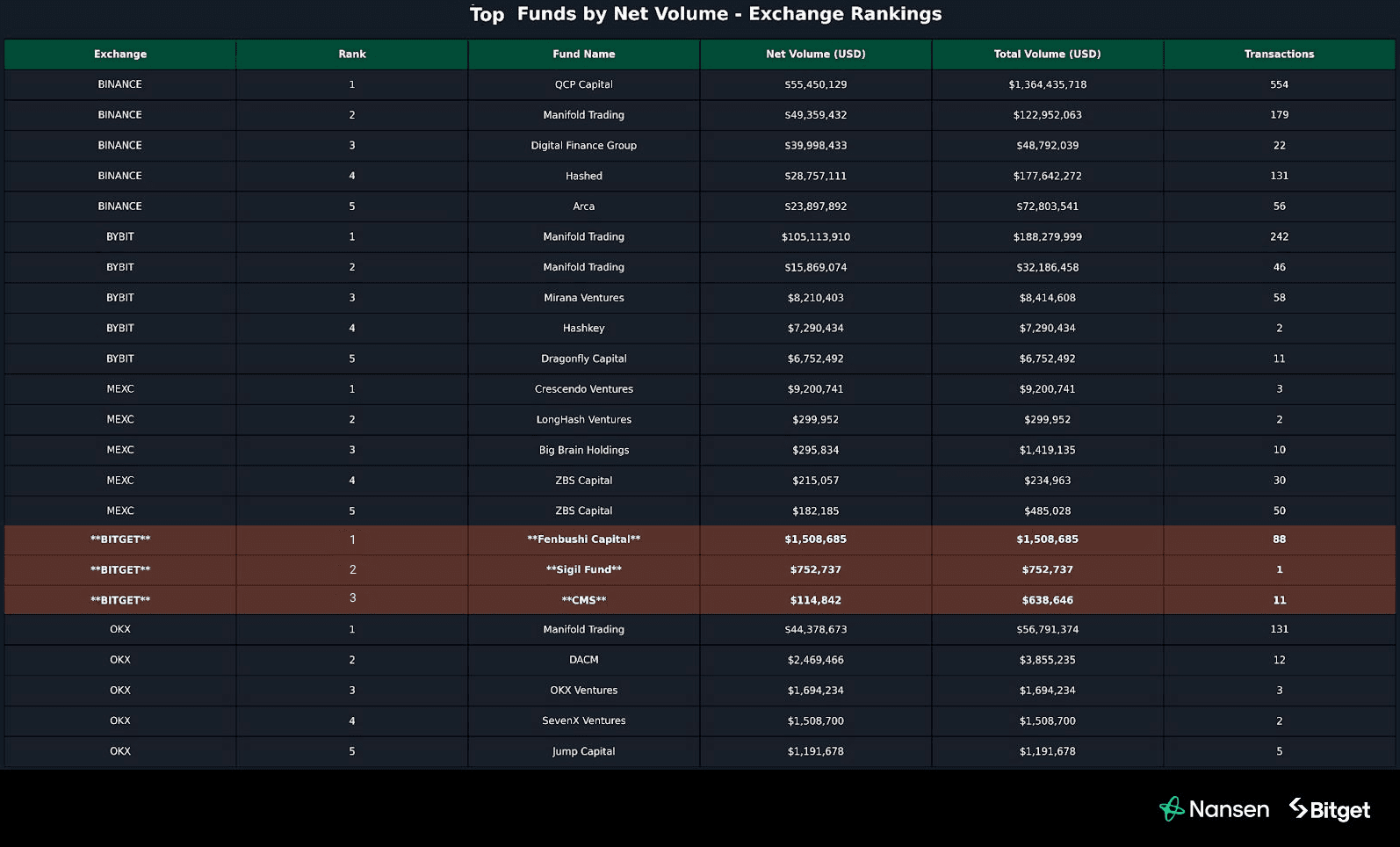

Onchain Fund Activity and Bitget

Onchain fund flow analysis from January to September 2025 shows that activity on Bitget is led by a concentrated group of institutions. Across 31 tracked funds, the top five generated over 95% of observed positive net onchain flows.

Source: Nansen

Fenbushi Capital led with $1.5M in net volume and a perfect net efficiency ratio of 100%, meaning they deposited but did not withdraw from Bitget. Asteroid Capital was also highly active, executing 181 transactions with nearly all net positive flows to Bitget. Other names such as Kosmos Capital and Hashed posted strong efficiency scores above 70 to 100%.

The concentration of activity highlights Bitget’s ability to attract leading funds while pointing to clear opportunities for expansion. Building on the success of Fenbushi Capital and extending engagement to new high-efficiency partners would broaden participation and strengthen Bitget’s institutional ecosystem.

Source: Nansen

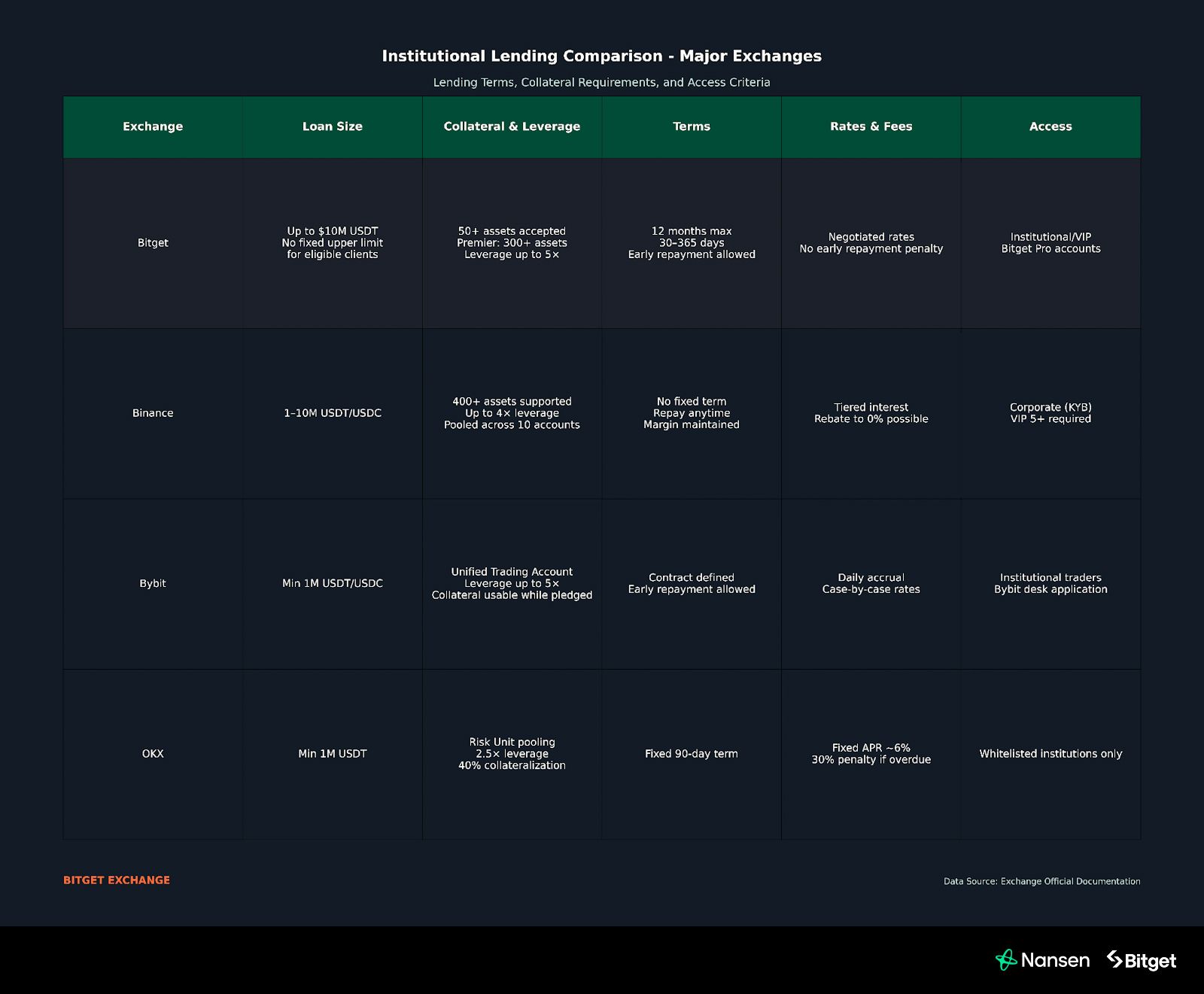

Bitget’s Institutional Loan Program

Bitget offers a flexible institutional lending program with loans reportedly reaching up to 10 million USDT, supported by a range of over 300 cryptocurrencies as collateral. There is no stated upper limit for certain qualified users. Institutions can borrow with leverage of up to 5×, choose terms of up to 12 months, and repay early without penalties. A key feature is the absence of forced liquidation for late payments under the Premier program, giving borrowers added protection and flexibility. The loan program is designed with features that may appeal to institutions seeking customized lending terms.

Source: Bybit, Binance, MEXC, Bitget, and OKX

Institutional share of trading and assets today

Institutions now account for most trading volume on CEXs. On centralized exchanges including Bitget, institutional clients generated close to 80% of total trading volume in 2025. Assets under management in exchange traded funds show a similar trend. By September 2025, US spot Bitcoin ETFs held 153 billion dollars, equal to 6.26% of Bitcoin’s circulating supply. BlackRock’s iShares Bitcoin Trust is the largest single product, with more than $88B dollars in assets and over 761,000 BTC. Fidelity and Ark 21Shares add further depth, with the total US ETF market reaching between $137B and $153B dollars. Corporates are also building positions. MicroStrategy holds nearly 639,000 BTC, while the top 100 public Bitcoin treasury companies together hold more than 370,000 BTC, including MicroStrategy. The major shift compared with 2024 has been the rise of ETF vehicles, which grew from negligible levels in early 2024 to 137 billion dollars within 18 months. Surveys underline the trend, with 76% of institutions already reporting exposure and 83% planning to increase allocations in 2025.

BlackRock, MicroStrategy, and Bitget

BlackRock has become the primary entry point for many institutions through its iShares Bitcoin Trust. It is one of the fastest growing ETFs in the United States. MicroStrategy remains the largest corporate holder of Bitcoin, with a treasury strategy that has scaled to 639,000 BTC. Bitget represents the exchange side of institutional adoption. The platform averaged 750 billion dollars in monthly trading volume in the first half of 2025, with derivatives accounting for about 90%. From November 2023 to June 2025, cumulative derivatives volume reached 11.5 trillion dollars. Institutions drive roughly 80% of spot trading on Bitget and about half of its derivatives flows. The lower institutional share in derivatives reflects strong retail participation in futures, which remains a core driver of Bitget’s growth, while institutional participation is steadily climbing.

Spot markets have also expanded quickly, with 102.8 billion dollars traded in May 2025, a 32% increase from the prior month. Custodial assets rose by 250% in four months during the ETF launch cycle, while institutional accounts nearly doubled. Bitget has expanded its offerings in areas relevant to institutional trading, such as custody and unified margin systems. Looking forward, Bitget’s Universal Exchange (UEX) initiative suggests its role may extend further, bridging crypto with traditional markets by combining liquidity improvements with expanded asset coverage.

Five year outlook and macro drivers

As of September 2025, US spot Bitcoin ETFs hold around 1.31M BTC valued at 153 billion dollars. Analysts at UTXO Management project 420 billion dollars of total institutional inflows by 2026, equal to around 4.2M BTC across ETFs, corporates, and funds. The same report suggests institutions could hold about 20% of supply, around 4.27M BTC, by then.

Looking further ahead, extending this trajectory to 2030 gives three illustrative paths. A bearish case would see ETF holdings reach 1.5 to 1.7M BTC, equal to about 170 to 220 billion dollars at current prices. A base case projects 2.0 to 2.3M BTC, or 250 to 330 billion dollars. A bullish case points to 3.0 to 3.5M BTC, or more than 400 to 500 billion dollars. These ranges are based on a simple extrapolation of recent inflows, which is unlikely to follow a straight line, but they provide a useful reference point for the scale of possible institutional adoption. These long term scenarios refer specifically to ETF holdings, while broader institutional ownership across corporates and funds is expected to be larger.

The US repeal of SAB 121 has opened custody to banks, the MiCA framework in the EU began rolling out at the end of 2024 and will continue through 2026, and Singapore’s Payment Services Act enforces custody and segregation rules. These frameworks, together with rising demand for tokenized treasuries, will shape which path plays out and to what degree.

Conclusion

Institutional adoption is now a structural feature of the crypto market. Liquidity has become the central measure of market quality, shaping costs, execution, and resilience. Bitget has advanced quickly on this front, with deepened order books, competitive spreads, and growing participation from professional funds. Its infrastructure and tailored services show it is equipped to support sustained institutional flows.

Across the wider market, ETFs, corporate treasuries, and professional investors already account for the majority of volume and assets, with projections pointing to significantly higher ownership of Bitcoin supply in the years ahead. Regulatory frameworks in the US, Europe, and Asia provide additional support for this trend.

The result is a market that is deeper, more stable, and increasingly aligned with institutional standards. Bitget’s recent steps toward evolving from a centralized exchange into a Universal Exchange reflect how its role may continue to shift alongside these broader market dynamics.