Disclaimer

Nansen has produced the following report as part of its existing contract for services provided to Avalanche (the "Customer") at the time of publication. While Avalanche has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

Avalanche is a smart contract platform designed for scalability, with a multichain framework consisting of Subnets that scale the network. The primary network includes P, X, and C chains. The P-chain manages validator and Subnet-level functions, the X-chain manages Avalanche Native Tokens (which are a digital representation of real-world assets), and the popular C-chain is an implementation of the Ethereum Virtual Machine (EVM).

Subnets on Avalanche refer to a subset of nodes or validators that work together to achieve consensus on transactions related to one or multiple blockchains. A Subnet can be a network operating within another network or a network built on top of a larger network. Avalanche's Subnet architecture offers fast finality, custom Virtual Machine support, and a wide range of configuration parameters to builders.

In Q4 2023, Avalanche witnessed significant growth through various partnerships and initiatives in sectors like DeFi, NFTs, gaming, and enterprise solutions, showcasing a mix of traditional and decentralized finance, gaming advancements, and blockchain applications for businesses.

Key Developments: Q4 2023

Source: Avalanche

- Avalanche partnered with OpenZeppelin Defender to enhance blockchain security. This collaboration integrates Defender's tools into the Avalanche Mainnet, allowing developers to manage blockchain applications. This strategic move enables users to deploy, monitor, and operate blockchain applications securely on Avalanche.

- Avalanche enhanced its platform by integrating Chainlink Automation 2.0 and Chainlink Functions 1.0 into the Avalanche C-Chain. This move provides developers with advanced off-chain computation services, enabling the creation of more dynamic and efficient Web3 applications. The integration significantly improves the ecosystem, offering tools for offloading computations and connecting smart contracts with external data sources.

- Codebase by Avalanche, a new 12-week accelerator program by the Avalanche Foundation, was launched to support early-stage Web3 startups. It offers a $50k stipend, mentorship from Web2 and Web3 experts, and access to tech giants like Amazon Web Services. The program culminates in a Demo Day with a significant investment opportunity and the first cohort begins in Spring 2024.

- NodeKit secured $1.2 million in pre-seed funding to create SEQ, a shared sequencer L1 using Avalanche's HyperSDK. SEQ, focusing on decentralized rollup transaction sequencing, aims to improve rollup efficiency and interoperability across various networks. This development signifies Avalanche's expanding influence in Ethereum's L2 ecosystem.

Ecosystem

Avalanche hosts a large ecosystem of dApps and protocols on its C-chain and Subnets, which users can explore on the Avalanche Ecosystem page. In Q4 2023, there were many exciting updates within the Avalanche ecosystem, most notably:

- DeFi

- Avalanche has partnered with Canza Finance to launch Baki, a stablecoin platform, to enhance the Forex market in Africa. Baki is a unique protocol providing slippage-free swaps between African currencies and utilizing synthetic assets pegged to these currencies. This collaboration helps bring forex trading to emerging markets, leveraging Avalanche's low transaction costs and high-speed finality.

- Hubble Exchange has introduced a decentralized exchange (DEX) on a custom Avalanche subnet. It features a unique decentralized order book, providing a user experience akin to centralized exchanges but with blockchain transparency. The DEX supports AVAX, ETH, and SOL trading using USDC as a gas token and plans to expand its collateral options.

- NFTs & Gaming

- Hyperspace, a multi-chain NFT marketplace has been running a rewards program on Avalanche. Users receive AVAX rewards for trading on the platform. Its Season 1 saw the distribution of over 50,000 AVAX to users. Check out its Season 4 here.

- Salvor NFT is a Peer-to-Peer NFT lending protocol for AVAX NFTs that launched in December 2023.

- Steady NFT Mint at the start of January 2024 is an Avalanche-based collection that has gained notable traction.

- Blockticity, a startup addressing fraudulent paperwork in the $4.5 trillion supply chain industry, has minted certifications for $275 million worth of products on Avalanche. Blockticity's Certificate of Analysis (COA) NFT verification system aims to prevent fraud in supply chains, by using QR codes linking to NFTs that provide verifiable proof of product testing and authenticity.

- Mirai Labs, known for developing Pegaxy, has migrated to an Avalanche subnet to combine SocialFi with Web3 gaming. This enhances player experience and leverages Avalanche's blockchain for better scalability and security.

- Tiltyard, developed by the creators of Crypto Raiders, is revolutionizing Web3 gaming on Avalanche with tournament and fantasy sports features. It allows the hosting of large-scale tournaments in games like Midnight Heist, emphasizing fairness and transparency using blockchain technology. The platform plans to expand and includes various games and customizable tournaments.

- Really, previously known as Moviebill, has launched 'Fandime' NFTs on Avalanche to offer exclusive movie-related AR content as rewards. Users can earn Fandime tokens through activities like movie attendance and merchandise purchases, where they can be redeemed for digital rewards and movie-related AR content.

- Enterprise

- LAMINA1, co-founded by Neal Stephenson, partnered with Avalanche to launch a new Layer-1 blockchain focused on the open metaverse. This platform, integrating with Avalanche's consensus protocol, aims to provide creators with tools and protocols for metaverse content creation and development.

- Onyx by J.P. Morgan and Apollo Global, in collaboration with the Monetary Authority of Singapore’s (MAS) Project Guardian, used Avalanche's blockchain for a proof-of-concept in portfolio management. This project demonstrated how blockchain technology can automate and enhance the inclusion of alternative assets like private equity and real estate in portfolios.

- Alternatively, Citi collaborated with MAS’ Project Guardian to trial a blockchain-based foreign exchange solution on Avalanche. This proof-of-concept automated pricing and trade execution for simulated FX trades, using Avalanche's blockchain for real-time pricing and trade data recording.

- Republic chose Avalanche for Republic Note, a digital asset that offers profit-sharing from its investment portfolio. The asset traded on INX.One, leveraging Avalanche's high speed and scalability, raising $30 million in pre-sales, highlighting the growing interest in blockchain-based financial solutions.

Nansen On-chain Data

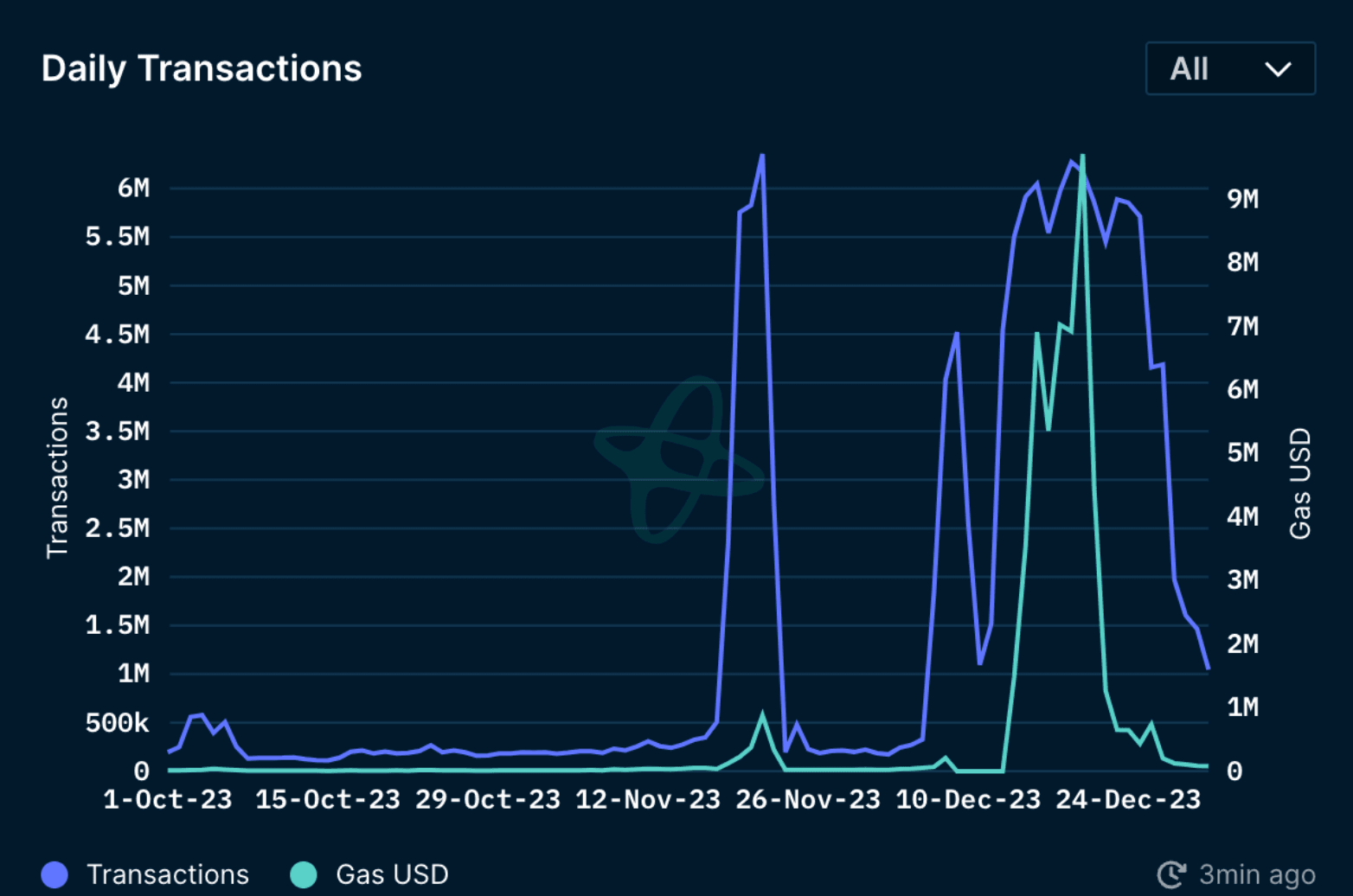

Daily Transactions on C-Chain

Source: Nansen

In Q4 2023, the Avalanche C-Chain fluctuated significantly in its daily transaction count, ranging between 109k and 6.4m transactions. Concurrently, the gas usage within the network ranged between 5.6k and 9.7m.

The sudden spike in late November's activity was due to ASC-20 inscriptions. These inscriptions, akin to those in Bitcoin, allowed users to attach any data to AVAX tokens by utilizing the extra data space in each transaction, called Call Data. While this increase in activity was notable, it proved short-lived, as both transactions and fees normalized to their average levels in less than a week. Additionally, December saw a sustained high level of transactions and gas usage, likely driven by two main factors: the overall improvement and returning activity in the industry.

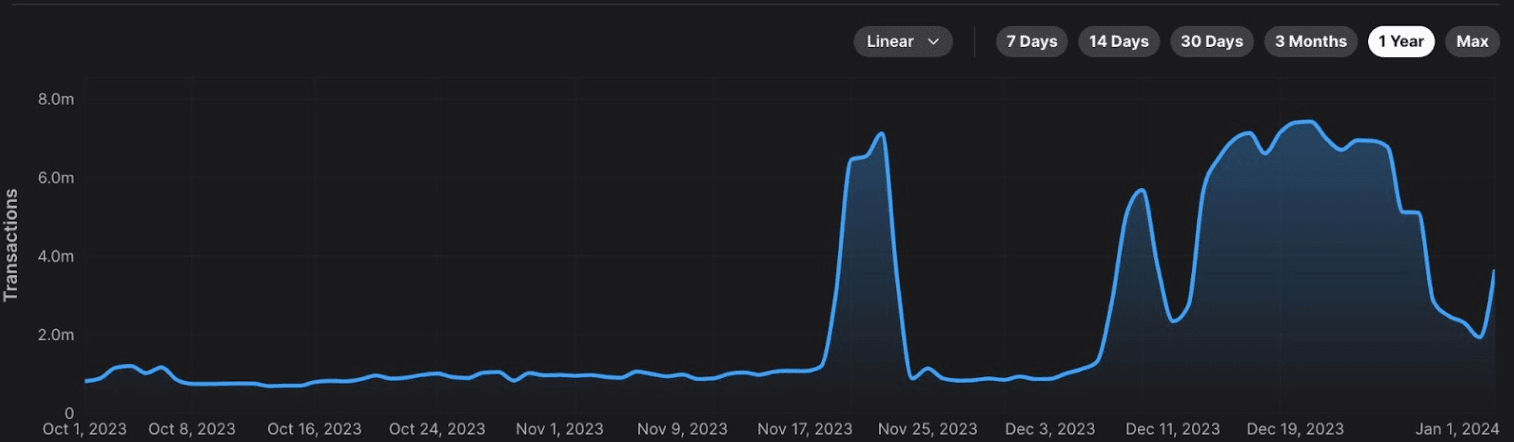

Daily Transactions Across Subnets

The daily transactions across all the subnets follow a similar pattern to that of the C-Chain. Daily transactions were typically around 1m per day, with periods of heightened activity reaching upwards of 7m transactions per day.

Source: Avalanche

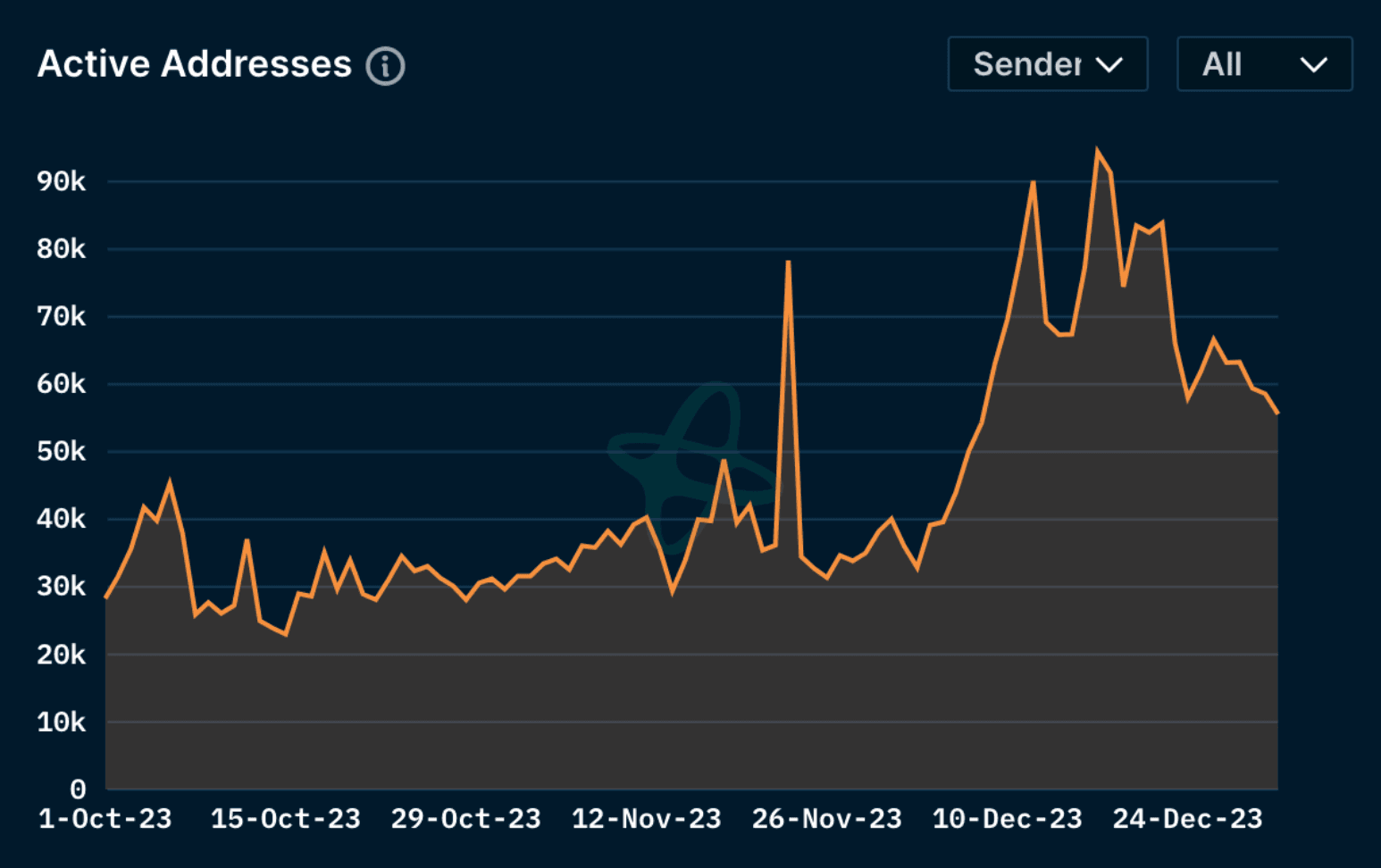

Daily Active Addresses on C-Chain

Source: Nansen

During Q4 2023, Avalanche's C-Chain experienced a significant increase in user activity, with daily active addresses peaking at 95k and fluctuating between 23k and 95k. This upward trend marked an improvement from Q3, where daily active addresses ranged from 27k to 86k. The notable spike in active addresses can likely be attributed to the introduction of ASC-20 inscriptions and overall industry recovery, as previously discussed.

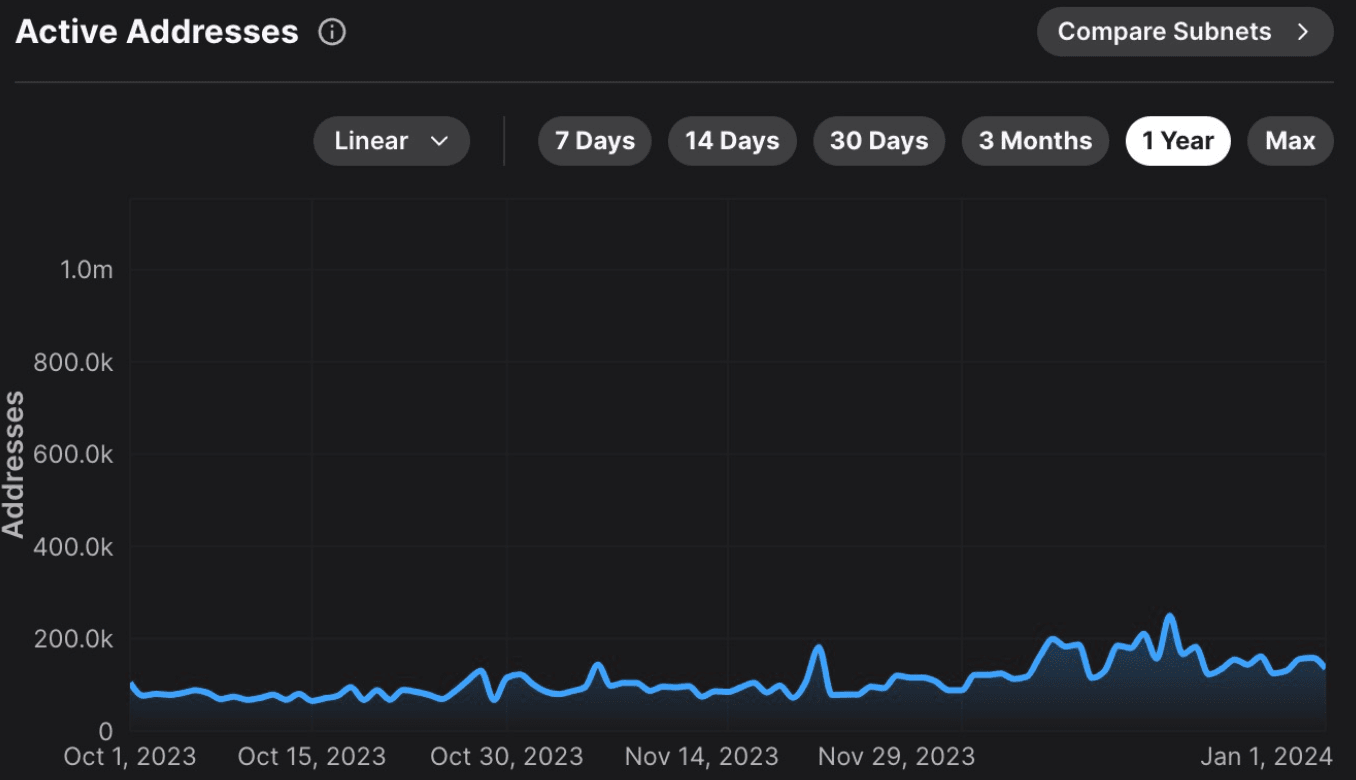

Active Addresses Across Subnets

Total active addresses ranged from 70k - 286k across the subnets. The Avalanche C-Chain remains the dominant subnet. Other notable subnets include DeFi Kingdoms, UPTN (a Web3.0 Platform where real-world business and lifestyle services can integrate into) and Beam (Merit Circle) subnet.

Source: Avalanche

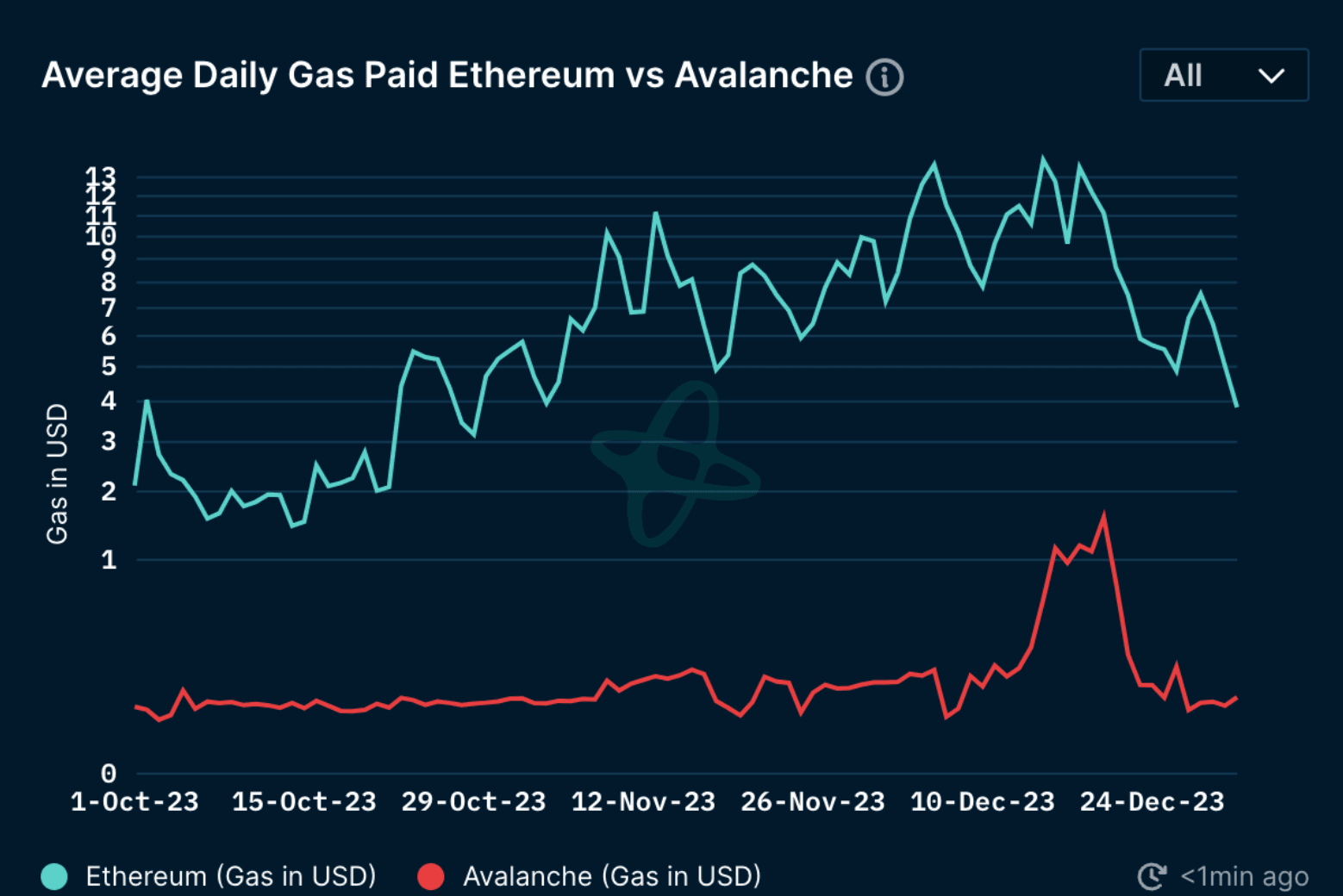

Average Daily Gas Paid (vs Ethereum)

Source: Nansen

In Q4 2023, the average daily gas fee on Avalanche varied between $0.03 and $1.57, in stark contrast to Ethereum, where the gas fees were considerably higher, ranging from $1.45 to a peak of $14. Unlike Ethereum, which showed an overall upward trend in gas fees throughout the quarter, Avalanche's daily gas fees showed a relatively sideways trend, surging only in December, reaching nearly 10 times its usual average.

Top Entities by Users and Transactions on C-Chain

Source: Nansen *(data excludes unlabelled transactions)*

Nansen's list of labels provides a comprehensive way to analyze the top entity interactions on Avalanche based on the number of users and transactions. Trader Joe reclaimed the top position in the number of transactions at 2.46m, followed by Stars Arena at 2.28m, with LayerZero dropping to third at 1.51m.

USDC, recorded the most users at 306k, suggesting that they may have more users engaging in fewer transactions, in contrast to Trader Joe’s 245k users, which drives a higher number of transactions per user. By analyzing these entity interactions, we can better understand the behavior and trends of different entities on the Avalanche network.

Closing Thoughts

Reflecting on Avalanche's progress in Q4 2023, the platform has significantly advanced in scalability, innovation, and sectoral outreach. Key initiatives include enhanced blockchain security through collaboration with OpenZeppelin Defender, and the integration of Chainlink's tools. The Avalanche blockchain, noted for its lower carbon footprint, has also managed to attract financial entities and promote the tokenization of off-chain assets.

Overall, Q4 2023 has been a quarter of strategic growth, sustainability focus, and technological advancements for Avalanche.

Disclosure

Nansen has produced the following report as part of its existing contract for services provided to the Customer at the time of publication. While the Customer has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

The authors of this content and members of Nansen may be participating or invested in some of the protocols or tokens mentioned herein. The foregoing statement acts as a disclosure of potential conflicts of interest and is not a recommendation to purchase or invest in any token or participate in any protocol. Nansen does not recommend any particular course of action in relation to any token or protocol. The content herein is meant purely for educational and informational purposes only and should not be relied upon as financial, investment, legal, tax or any other professional or other advice. None of the content and information herein is presented to induce or to attempt to induce any reader or other person to buy, sell or hold any token or participate in any protocol or enter into, or offer to enter into, any agreement for or with a view to buying or selling any token or participating in any protocol. Statements made herein (including statements of opinion, if any) are wholly generic and not tailored to take into account the personal needs and unique circumstances of any reader or any other person. Readers are strongly urged to exercise caution and have regard to their own personal needs and circumstances before making any decision to buy or sell any token or participate in any protocol. Observations and views expressed herein may be changed by Nansen at any time without notice. Nansen accepts no liability whatsoever for any losses or liabilities arising from the use of or reliance on any of this content.