Disclaimer: Nansen has produced the following report in collaboration with Slice Analytics as part of its existing contract for services provided to Avalanche (the "Customer") at the time of publication. While Avalanche has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

Avalanche is a smart contract platform designed for scalability, with a multichain framework consisting of Avalanche L1s that scale the network. The primary network includes P, X, and C chains. The P-chain manages validator and Avalanche L1-level functions, the X-chain manages Avalanche Native Tokens (which are a digital representation of real-world assets), and the popular C-chain is an implementation of the EVM.

L1s on Avalanche refer to a subset of nodes or validators that work together to achieve consensus on transactions related to one or multiple blockchains. An Avalanche L1 can be a network operating within another network or a network built on top of a larger network. Avalanche's L1 architecture offers fast finality, custom Virtual Machine support, and a wide range of configuration parameters to builders.

In Q2 2024, Avalanche continued its growth trajectory through various key initiatives and partnerships across DeFi, NFTs, gaming, enterprise solutions, and even “memecoins”, reflecting its diverse and robust ecosystem. Notably, the Avalanche Foundation partnered with Gitcoin to launch the Community Grants Program, providing quadratic funding to early-stage projects in DeFi, NFTs, and infrastructure. Avalanche’s ecosystem expanded through integrations, such as Stripe, which enabled streamlined crypto onramping for GoGoPool and Halliday. Further advancements included Core’s introduction of a community Airdrop Tool and the launch of Snowfort, a bounty platform designed to enhance ecosystem collaboration.

In DeFi, Avalanche expanded its offerings with Clearpool launching Credit Vaults for institutional lending and Entangle boosting cross-chain liquidity with its Photon Messaging Protocol. Avalanche focused on liquid staking via the Icebreaker Program, deploying over 400K AVAX to enhance network liquidity and security.

In NFTs & Gaming, Avalanche played a key role in advancing Web3 gaming. Funtico launched its incentivized gaming platform, while Salvor secured a $1 million grant to develop NFT lending on Avalanche. Gaming partnerships continued with Gamestarter launching GameChain, and Elixir Games acquiring RoboKiden to drive blockchain-based gaming.

On the enterprise side, Avalanche partnered with Diamond Standard and Oasis Pro to tokenize diamonds, making them an accessible asset class for institutional investors. The network's scalability was demonstrated by Coachella’s Quests, which gamified the festival experience using NFTs and rewards.

Key Developments: Q2 2024

- The Avalanche Foundation partnered with Gitcoin to launch a Community Grants Program in Q2. This initiative provided funding to innovative projects through community-driven donations and quadratic funding, allowing developers to secure resources for building on Avalanche. The program focused on supporting early-stage projects in areas like DeFi, NFTs, and infrastructure, with the Avalanche community playing a key role in selecting grant recipients.

- Avalanche's Codebase incubator named its first cohort of 15 Web3 startups, selected from nearly 250 global applicants. The program, in collaboration with Colony Lab, provided funding ranging from $500k to $1M per project, as well as access to a $400k investment prize pool. The cohort represented a diverse range of projects, from decentralized finance to blockchain services, receiving mentorship and resources to scale their innovations within the Avalanche ecosystem.

- Avalanche integrated with Stripe to enable a seamless crypto onramping experience directly within Avalanche dApps. This integration allows users to purchase AVAX through Stripe’s fiat-to-crypto widget without needing to go through an exchange. Stripe handles KYC, payments, and compliance, simplifying onboarding for Web3 users and bridging fiat with digital currencies. Several Avalanche ecosystem projects, such as GoGoPool and Halliday, have already integrated with Stripe’s onramp service.

- Core introduced a new Airdrop Tool that allows users to easily distribute tokens and reward their communities on Avalanche. This free tool enables projects to engage their audiences by airdropping tokens directly to users' wallets, streamlining the process of distributing incentives or rewards. With features like wallet filtering and flexible distribution options, the tool simplifies community engagement for both new and established Avalanche projects.

- The Avalanche Ambassador DAO launched Snowfort, a community bounty platform where ecosystem partners can post paid bounties for tasks such as content creation, social media, and event hosting. Ambassadors can earn native tokens, AVAX, or USDC for completing these tasks. Built on the Pakt blockchain stack, Snowfort enables collaboration among Avalanche protocol partners and aims to grow the Avalanche ecosystem by empowering Ambassadors to contribute actively.

- The Avalanche Foundation launched a community airdrop, distributing AVAX and COQ tokens to wallets actively engaged in the Avalanche ecosystem, including participants in the Memecoin Rush program and holders of Diamond Hands. The airdrop aimed to reward loyalty and on-chain activity while excluding non-qualifying wallets such as those involved in wash trading.

Ecosystem

DeFi

- Clearpool expanded its on-chain credit marketplace to Avalanche with the exclusive launch of Credit Vaults. These vaults enable uncollateralized borrowing for institutional clients, with the first Real World Asset (RWA) pool launched on Avalanche. The Credit Vaults tokenize private credit loans, enhancing efficiency and transparency in lending.

- Entangle integrated with Avalanche to enhance cross-chain communication and capital efficiency through its Photon Messaging Protocol and Liquid Vaults. This collaboration enabled developers to utilize Avalanche's fast transaction speeds for DeFi, RWA, and on-chain gaming dApps while boosting interoperability with other blockchains like Ethereum and Near. Additionally, Liquid Vaults optimized liquidity by allowing users to convert LP positions into synthetic tokens, providing further yield opportunities.

- The Icebreaker Program's first phase focused on supporting liquid staking tokens (LSTs) like sAVAX, ggAVAX, and ankrAVAX, deploying over 400K AVAX to enhance Avalanche's ecosystem. These tokens were used for lending and staking while maintaining network security. The program aims to improve on-chain utility and efficiency by backing a variety of DeFi protocols. Future phases will expand to cover additional protocols, continuing the program's role in fostering growth and innovation within the Avalanche ecosystem.

NFTs & Gaming

- Funtico partnered with Avalanche to launch a next-generation incentivized gaming platform, integrating up to 10 games, including titles like Formula Funtico and Heroes of the Citadel. The platform utilizes Avalanche’s customizable subnets to ensure scalability and seamless gameplay. Players can earn rewards using Funtico's $TICO token, driving engagement in both Web2 and Web3 gaming communities.

- [Salvor](https://salvor.io/, a peer-to-peer NFT and memecoin lending platform on Avalanche, secured a $1M incentive grant through the Avalanche Rush Program. The platform allows users to borrow against their NFTs or memecoins, enhancing liquidity while offering lenders the opportunity to earn passive income. If loans are not repaid, they are auctioned via a Dutch auction mechanism. This expansion supports over 800 NFT collections, aiming to increase liquidity in the Avalanche NFT ecosystem.

- LiveDuel launched a Web3 sports betting platform on Avalanche, utilizing a custom Avalanche Subnet to offer a decentralized, transparent, and user-friendly betting experience. By integrating Automated Market Makers (AMMs) and liquidity pools, LiveDuel enhances liquidity and simplifies the betting process, while enabling real-time settlement with near-instant transaction finality.

- Gamestarter introduced GameChain, a Layer 1 blockchain powered by Avalanche, to streamline blockchain integration for Web3 game developers. With features like an intuitive SDK and cross-chain asset transfers, GameChain simplifies game development while offering node holders rewards from transaction fees and token launches. Over 50 games are in the pipeline, with Gamestarter's in-house development team working on several titles.

- Elixir Games announced the acquisition of RoboKiden, developed by Breach Studios, and formed a strategic partnership with Ava Labs to boost Web3 gaming on Avalanche. RoboKiden will serve as a flagship game on Elixir’s platform, utilizing Avalanche's blockchain to offer scalable gameplay and in-game asset ownership.

- Konami Digital Entertainment, in collaboration with Ava Labs, unveiled Resella, an innovative NFT solution built on Avalanche. Resella allows users to design, issue, and trade NFTs without needing a Web3 wallet or engaging in cryptocurrency transactions. Tailored to the Japanese market, Resella facilitates transactions in Japanese Yen, lowering barriers for companies to adopt blockchain technology.

- OtherWorld launched the digital collectibles platform "Solo Leveling: Unlimited" on Avalanche, bringing the popular webtoon IP into the Web3 space. The platform offers users the ability to engage with the Solo Leveling universe by earning monster cards and leveling them up through gameplay. Leveraging Avalanche’s blockchain, OtherWorld enables gasless NFT transactions and a smooth user experience, targeting non-crypto natives while also planning future expansions to include more IPs from webtoons and K-pop artists.

Enterprise

- Diamond Standard partnered with Oasis Pro and Avalanche to launch a tokenized fund, making diamonds an investable asset class for institutional investors like pension funds and endowments. The fund, tokenized on the Avalanche C-Chain, provided increased accessibility, liquidity, and transparency in diamond investments, which had historically been difficult to standardize.

- Coachella launched Coachella Quests, a gamified loyalty program that blended virtual and in-person festival experiences using Avalanche. Going live on April 4th, 2024, Festival-goers completed various quests to earn digital Stamps (NFTs) and XP, unlocking exclusive rewards such as VIP access, merchandise, and unreleased music. Integration with the OpenSea Wallet allowed fans to easily collect their rewards.

- Feature.io used Avalanche’s blockchain infrastructure to power its Smart Content API, which allows any streaming platform or media file to integrate Web3 features. This API turns passive media consumption into interactive experiences by rewarding users for engaging with content, such as watching shows or listening to music. These rewards can include digital art, exclusive offers, and early access, enhancing fan engagement and loyalty. The initiative highlights the use of blockchain in transforming media into more dynamic, reward-based experiences.

- stc Bahrain partnered with Avalanche to launch a Web3-focused subnet as part of its Web3 Launchpad Program. This partnership aimed to accelerate blockchain adoption across the Middle East by fostering innovation and building a regional ecosystem of decentralized applications (dApps). Avalanche’s Subnet architecture was selected for its speed, flexibility, and scalability, supporting stc Bahrain’s goal of advancing Web3 infrastructure in the region. The collaboration included co-marketing efforts, hackathons, and community engagement to boost Web3 progress.

- Seedhe Maut the dynamic hip-hop duo from New Delhi partnered with Avalanche and Metasky to revolutionize fan engagement by integrating Web3 rewards into their concerts. Fans attending their concerts in Bangalore and Delhi could earn digital collectibles, exclusive tickets, and merchandise through blockchain-based interactions. Metasky's decentralized network provided a transparent and secure experience, helping combat counterfeit tickets and scalping while enhancing fan engagement through rewards tied to concert participation.

- Really launched an Avalanche Subnet to scale its blockchain-based movie engagement platform, allowing users to claim Proof-of-Attendance (POA) tokens by attending movies. The subnet ensures high performance and stability during peak usage, enabling users to unlock fan experiences like digital collectibles and discounts. This marks a significant step in leveraging blockchain technology to enhance the entertainment experience, providing rewards and deeper engagement for moviegoers.

Nansen On-chain Data

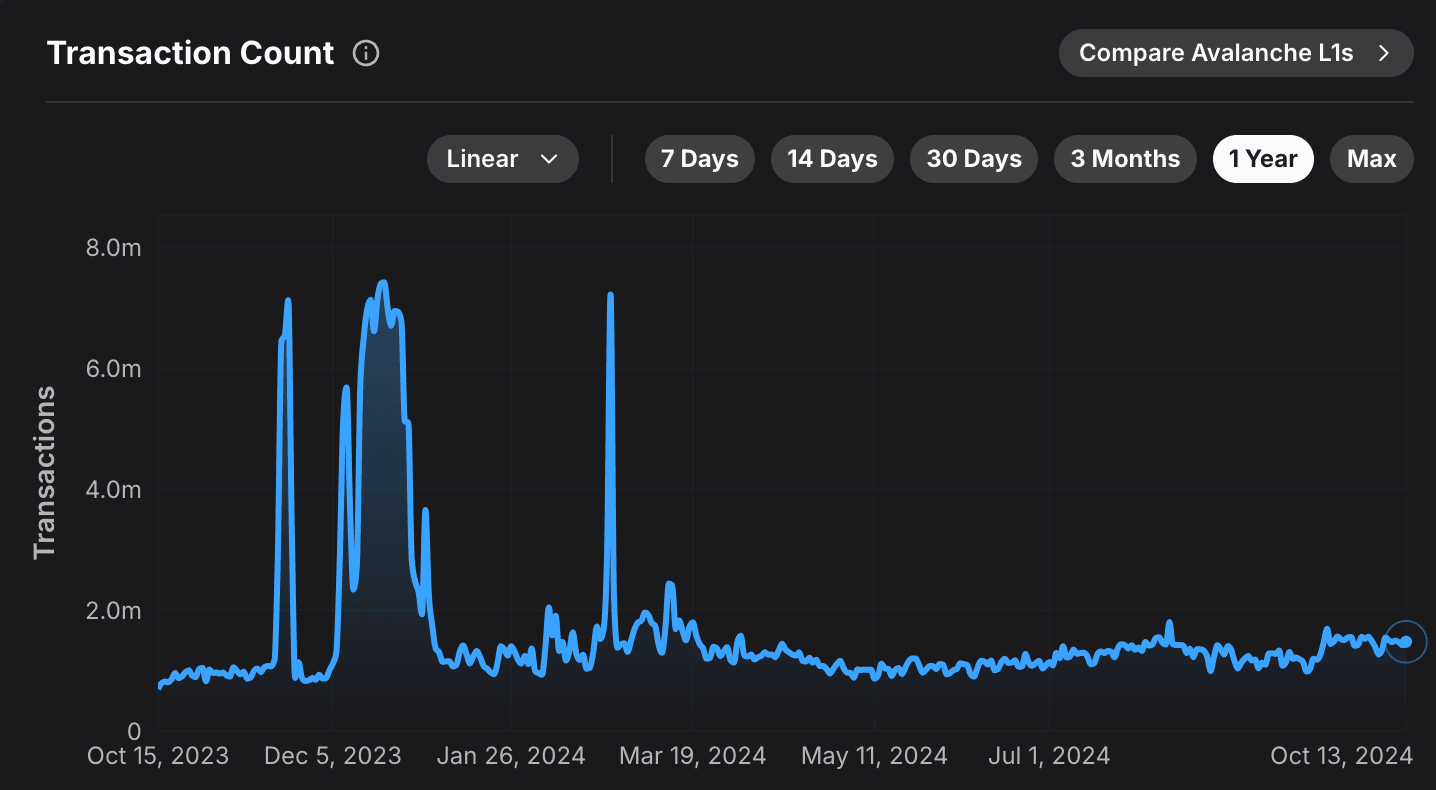

Daily Transactions Across Avalanche Chains

With the winding down of the ASC-20 inscriptions craze in Q1 2024, daily transactions across all Avalanche chains stabilized between 1.44 million and 0.9 million in Q2 2024. (DeFi Kingdoms)[https://docs.defikingdoms.com/] chain continues to drive significant activity on the network, averaging 500,000 transactions per day. (Dexalot)[https://dexalot.com/] surpassed the Avalanche C-Chain to claim the second spot, with C-Chain following in third. As the network expands and more subnets emerge, this trend is likely to continue.

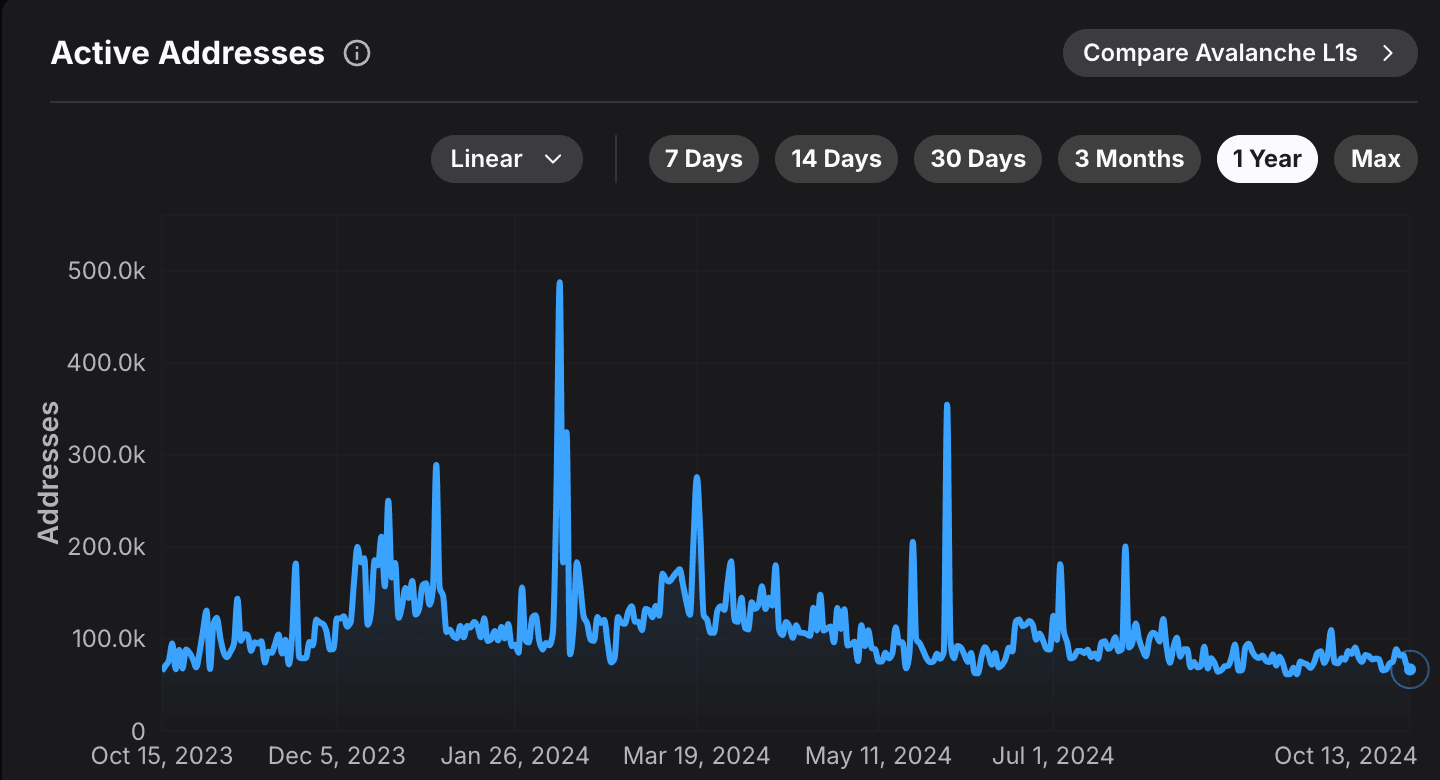

Daily Active Addresses Across Avalanche Chains

During Q2 2024, the Avalanche network saw fluctuations in user activity, with daily active addresses peaking at 354,000. Despite a broader market downtrend impacting chains like BNB, Ethereum, and Optimism, the Avalanche network maintained a consistent average of around 100,000 daily active addresses. The C-Chain led this sector, reaching 324,000 active addresses in a single day, followed by (DeFi Kingdoms)[https://docs.defikingdoms.com/] and (SK Planet's UPTN)[https://www.avax.network/blog/sk-planet-announces-uptn-south-koreas-long-awaited-web3-ecosystem-built-on-avalanche] chain.

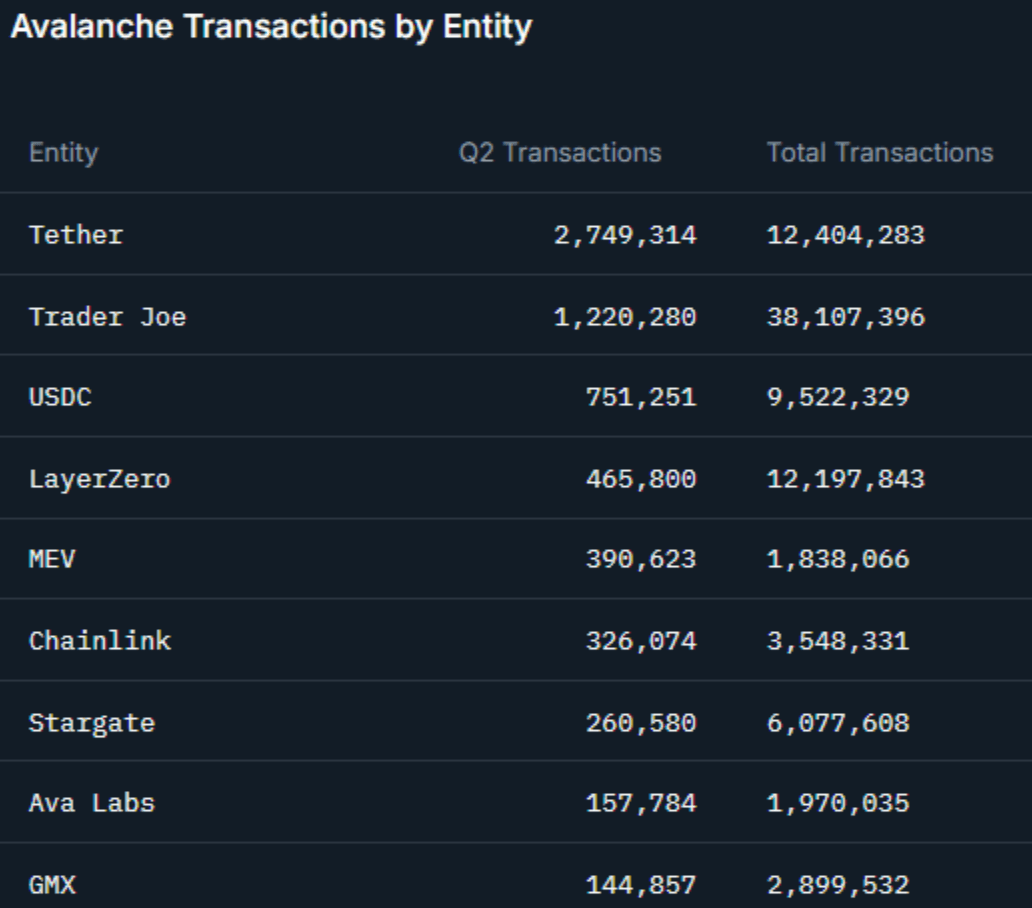

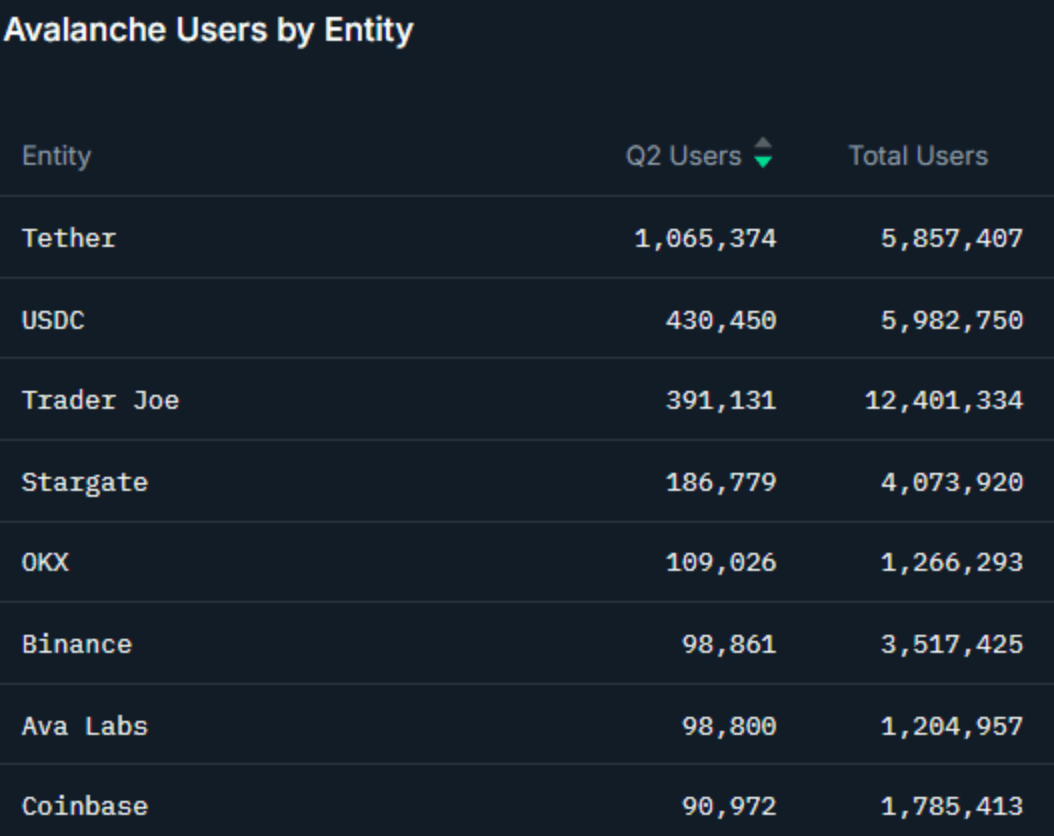

Top Entities by Users and Transactions on C-Chain

Nansen's label data provides a comprehensive view of top entity interactions on the Avalanche C-Chain, based on user activity and transaction volume. In Q2, Tether overtook Trader Joe as the leading entity with 2.7 million transactions and 1.1 million users. USDC ranked second with 430,000 users, while Trader Joe dropped to third with 391,000 users. The C-Chain remains a dominant network for financial dApps. By analyzing these interactions, we gain deeper insights into the behavior and trends of key entities on the Avalanche network.