Introduction

Base continues to lead in terms of innovation and a burgeoning onchain ecosystem spanning core DeFi pillars to basic consumer applications such as restaurant loyalty programs or even streamlined high-end watch marketplaces. What we find interesting about Base is two pronged - on the one hand, we have a healthy onchain presence as seen with traditional metrics (i.e TVL, stablecoin velocity, DAUs, etc.) but there is also the less measurable component which we deem “crypto powered experiences”. For the first, we usually think of traditional lending protocols, DEXs and other such core primitives that are indicative of a healthy source of liquidity and capital efficiency across many DeFi activities which have to do primarily with trading and sources of yield downstream of speculation. The second uses crypto rails (i.e stablecoins, NFTs, etc.) to power apps in order to deliver a better UX or value accrual across multiple stakeholders - as such, this does not need traditional decentralization guarantees but simply a open, permissionless and liquid network to be built off.

As an L2 built off of the OP stack, Base is contributing to arguably the fastest growing ecosystem to date as measured across developer activity, funding, roadmaps, and general onchain activity. On top of the narrative surrounding Base, we wanted to write this report because we feel that Base has many tailwinds going for it including:

- Robust onchain activity and growing metrics and user base.

- Future catalysts lined up for Q2 along with new features for developing new app-chains and creating further network effects.

- SEC dropping its case on Coinbase and a very clear framework being put in place for tokens and securities at large with a very pro-crypto administration

- Base is Coinbase’s direct bet on an onchain future and given the large network effects and scale of Coinbase, we see Base positioned strongly.

Let’s dive in.

State of the Chain

Base continues to lead across many onchain metrics.

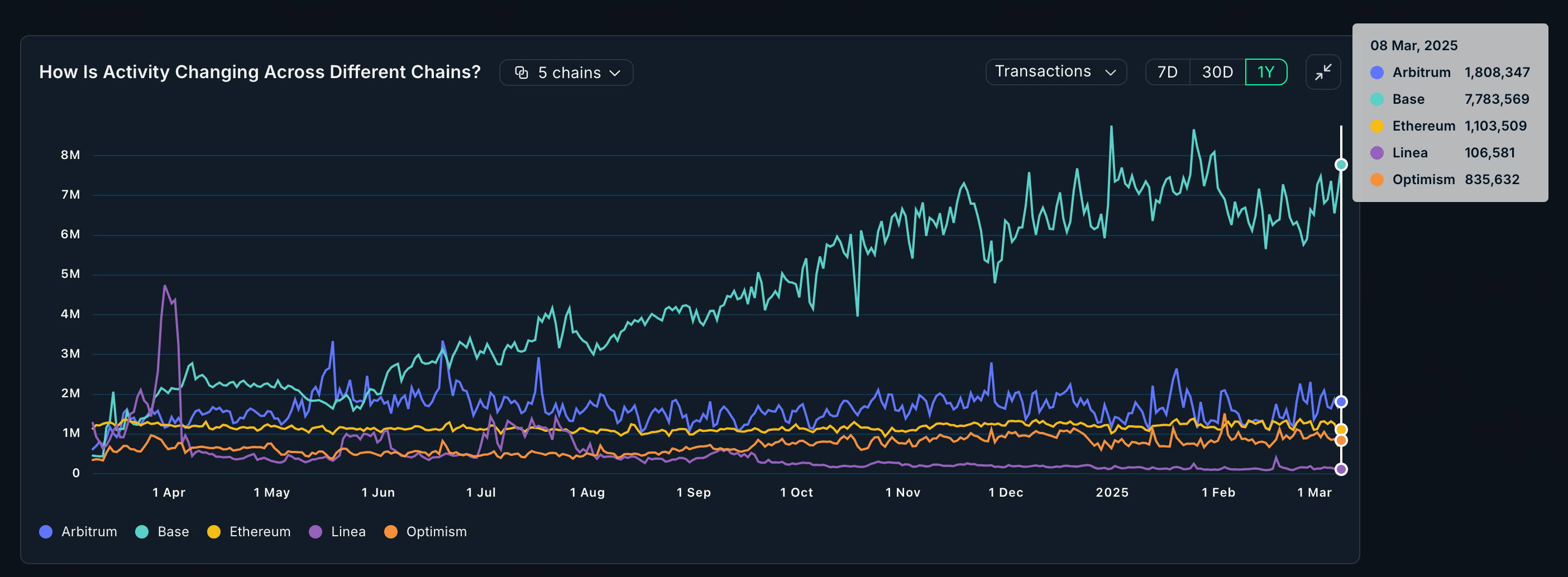

Transaction Activity

Activity on Base remains strong, despite the recent downturn in markets, outpacing many other L2s.

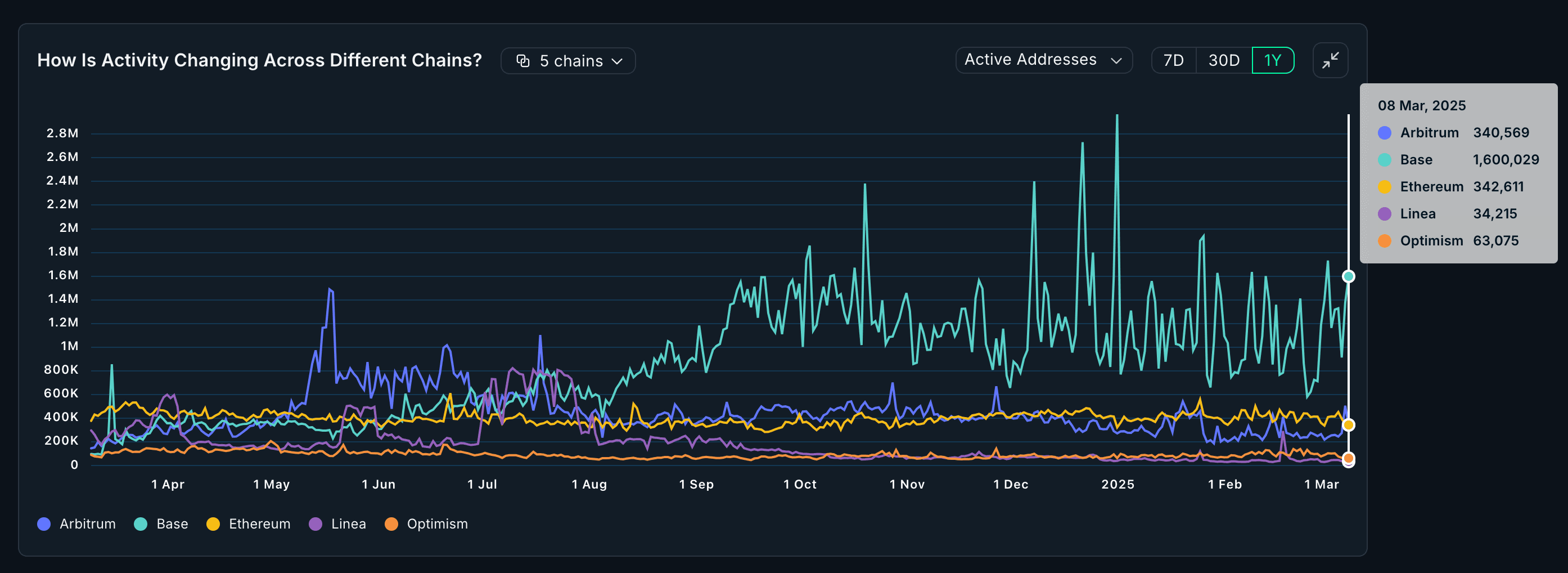

Active Addresses

In terms of daily active users, Base is clearly the go-to platform to relative to other L2s.

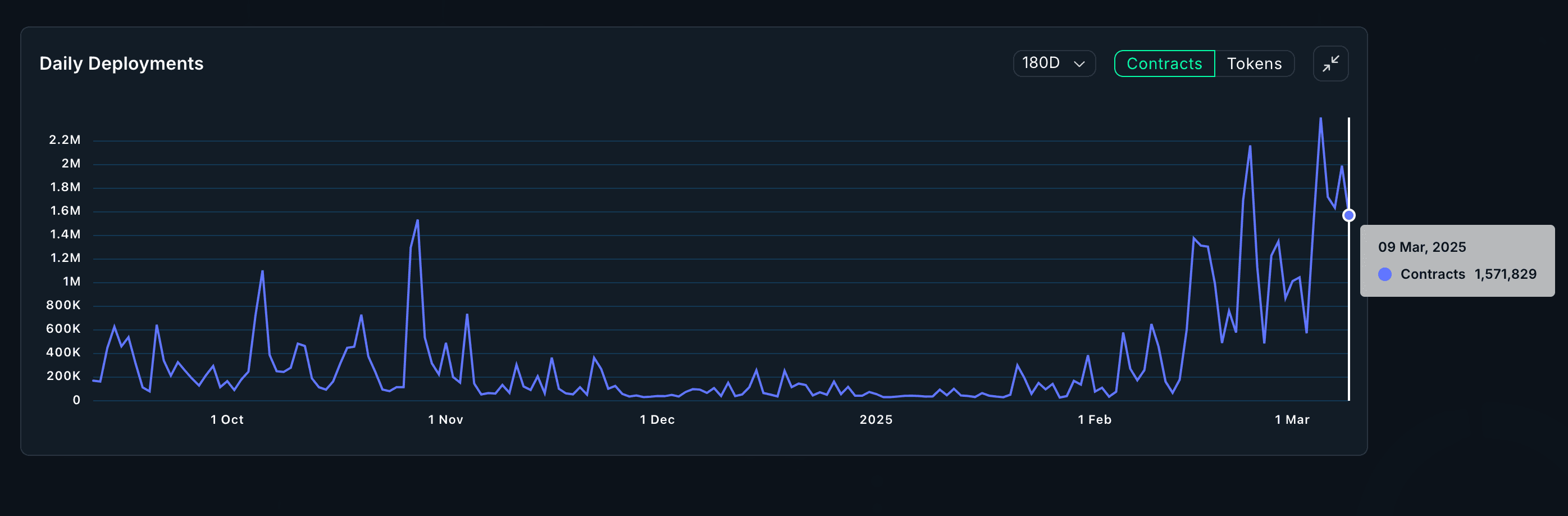

Contract Deployments

As for deploying contracts as a measure of developer activity, this metric is also showing very promising growth.

Real Time TPS Metrics

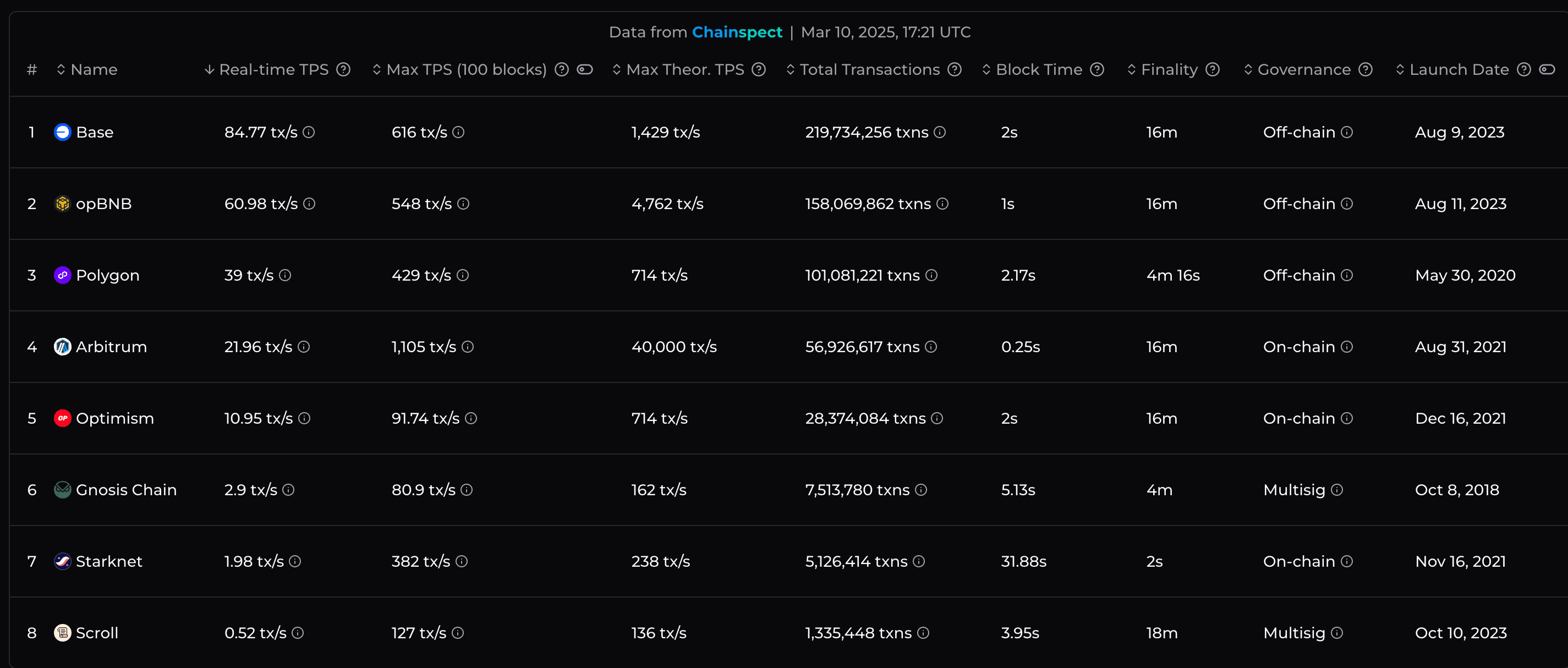

Shifting gears to the underlying performance of the L2 (not the L3 based app-chains), we can see Base is also outpacing all other rollups with an effective real-time TPS of ~85 TPS with 2 second block times.

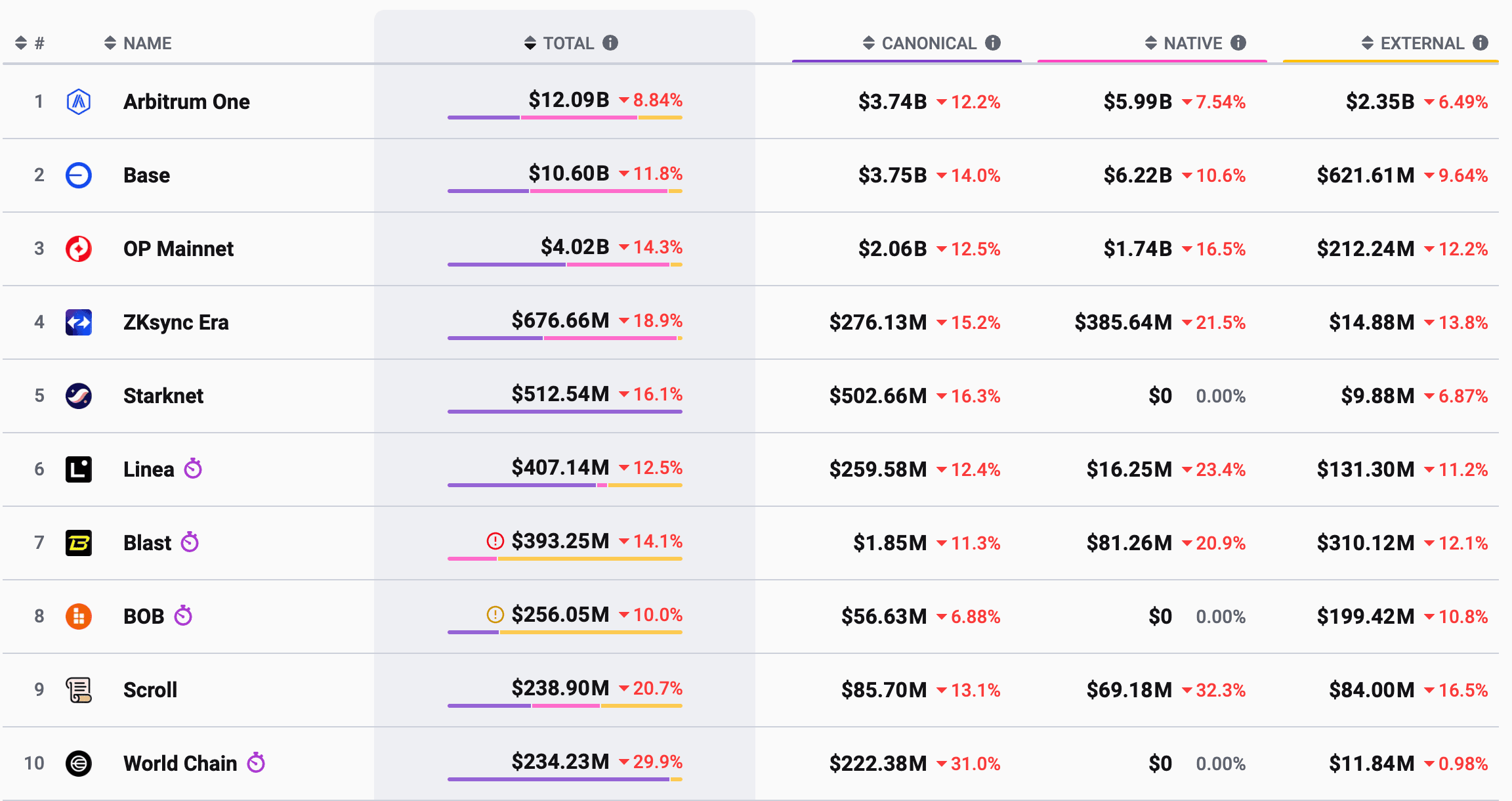

Given the upgrades we mention below with respect to block times via Flashblocks, we expect even more outperformance of Base (more on this later). As for TVL metrics, Base is the second most popular TVL as measured by canonical, bridged and native assets on the platform. Only Arbitrum outpaces Base but without Hyperliquid, this would put Base first in TVL.

Given the current success of Base across many core metrics across users, developer activity, TVL and performance, what's next?

Current and Future Catalysts

With the founder of reddit looking to buyout TikTok to bring it onchain and Coinbase teasing a tokenization of COIN stock, it is becoming very clear that many core applications will be coming onchain. The question is where and what are some of the network effects we’d expect to see from this - both from the end users and other market participants (i.e advertisers etc.)? We believe Base is uniquely positioned for many of these consumer applications, such as social media as seen with Farcaster, and much more over the long run given its large network effects. To get the end state of an onchain TikTok, TPS and much of the infrastructure is not there yet but many catalysts will take us one step further in the next few months.

Flashblocks (Q2)

Live on testnet, Flashbocks makes Base 10x faster, from 2 seconds to 200 milliseconds pre-confirmation blocks, making it the fastest EVM chain to date. There is even a demo to checkout here to see how fast it truly feels as the end user. For end users, they get early confirmation times for a better UX (no more waiting for a transaction to go through). This is expected to go live on mainnet in Q2.

Base Appchains (Live)

High throughput applications can now take advantage of launching as their own chains, L3s, on top of the Base ecosystem. They get access to dedicated blockspace for demand, gas-free transactions, shared sequencers/nodes and all the ready made tooling made available by Base already (i.e block explorer, smart accounts, etc.). These are live today and we are already seeing widespread adoption across many games and consumer apps such as Blackbird. Some of the current L3s include:

- Blackbird

- Restaurant loyalty transaction network

- Farcade AI

- AI powered gaming

- Slice

- Commerce protocol

Smart Wallet Sub Accounts (Q2)

Building upon wallet UX, Base continues to accelerate smart accounts as the go to for users to interact onchain. Out of the box, users get direct fiat/crypto onramping, universal accounts, passkey sign in, access to Coinbase liquidity/funds and much more. Their planned upgrade includes many interesting features including programmatic spending limits and a single universal account. These features will allow users to have multiple accounts and easily keep track of assets spread across different accounts without having to worry about funding them separately. Additionally, the spending limits feature can create very interesting onchain use cases, mainly, the mechanism allows a “spender” to pull funds from a user smart wallet according to some defined rule. The rules can be arbitrary logic which can lead to very interesting things like subscription or payment services such as a contractor being paid out in real time (every block) after they complete a given task and much more. The possibilities are very broad and can create very new onchain dynamics and how users interact with one another.

How to get Directional Exposure to Base?

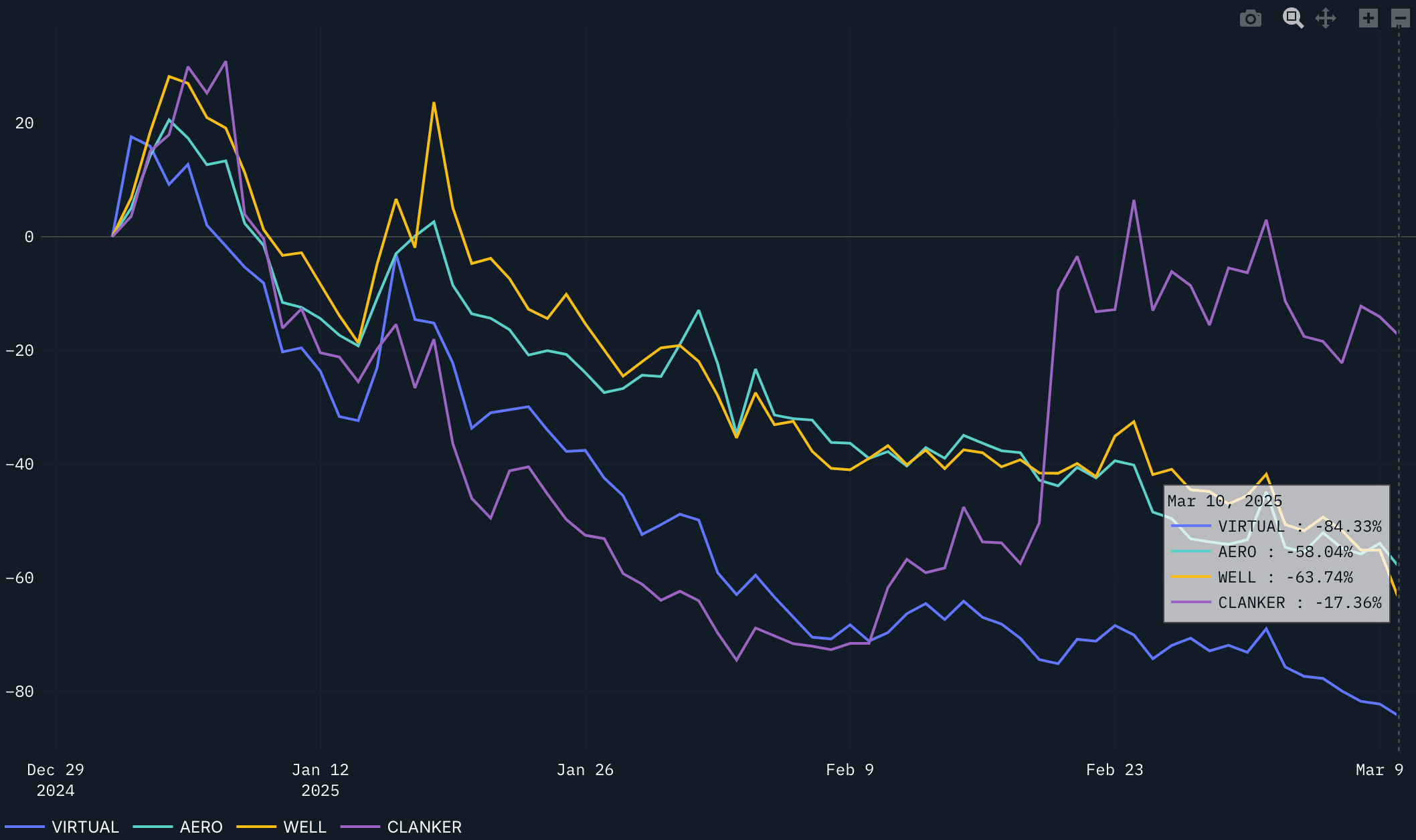

Base still does not have a native token and many of the ways to take exposure to the ecosystem have traditionally been through the “casinos” themselves of the current meta. We have seen both memes and AI tokens take off quite a bit on Base and respectively, VIRTUAL and AERO have done very well. Not only were these likely used as index bets on the specific narratives without taking too much directional exposure via a specific agent/token but traders also look to get exposure to Base activity in general given there is no direct way to do it. Thus, we are left with liquid bets within the ecosystem with strong product market fit and teams building out clear roadmaps. Given the recent price action, many of these potential altcoins are at very large discounts and may serve as potential liquid exposure for Base given its continued adoption.

YTD Price Performance

Surprisingly, CLANKER has held up a lot better than its peers, down just 18% whereas VIRTUAL is down over 84% YTD. In short, we chose the above tokens because they cover a few verticals with recent/upcoming catalysts:

- VIRTUAL

- Narratives: AI and gaming meta

- Catalysts:

- Expansion to Solana

- Agent commerce protocol for agents to coordinate with one another natively onchain

- Potential Coinbase listing on the roadmap.

- AERO

- Narratives: Memecoin and DeFi meta

- Catalysts:

- Fees and buyback program of the AERO token, nearly $15m collected in monthly fees already.

- Weekly DEX volumes are very healthy, $3.606b spot volumes, outpacing Uniswap by more than 2.5x at the time of writing.

- Number one in TVL, making it the go-to trading platform memecoins on Base.

- Listed on Kraken recently and also listed on Coinbase. Coinbase ventures also has a very large position in AERO, they're the top smart money holder at the time of writing.

- CLANKER

- Narratives: Memecoin and SocialFi meta

- Catalysts:

- Content creators get paid for popular posts

- Coinbase listing coming soon

- WELL

- Narratives: DeFi and payments meta

- Catalysts:

- Created virtual accounts for easier payment/savings accounts

- Listed on Coinbase

The above tokens are just a select few that tackle different sectors within the Base ecosystem and 3/4 of them are already listed/planned to be listed on Coinbase. As for VIRTUAL, it is quite liquid on Base and now Solana for those interested. In short, there are many potential trade setups for “betting on Base” and we just surfaced a few that are very Base-focused as opposed to say UNI or AAVE which are inherently multichain as per their usage.

Given the current range we are trading in for BTC, we are not eager to try to time alt trades at the moment; in other words, we would rather wait for confirmation of a reversal or a bottom to be made on BTC before positioning into any alt for that matter. However, this makes it all the more important to surface potential winners when the tides do change and have the correct positioning. If we see BTC breakout to the upside of the range and the Q2 timeline works out, we are excited about the potential of native Base tokens given the entries we are seeing at today’s prices.

Base continues to gain traction, with strong fundamentals and upcoming catalysts that position it as a key player in the onchain space. While there’s no native Base token, the best way to gain exposure is through high-liquidity market leaders within the ecosystem.

Right now, we see two major tailwinds:

- Deep discounts across Base-related tokens, presenting attractive entry points.

- Strong catalysts in Q2, including Flashblocks, appchains, and smart wallet upgrades, driving further adoption.

With BTC still trading in a range, we’re not in a rush to time altcoin trades, but positioning for a potential breakout remains key. If the momentum shifts, Base-native assets could outperform significantly.