Introduction

Berachain is an upcoming L1 blockchain built on the Cosmos SDK, utilizing the Tendermint core consensus. Berachain's core tenets include a 'Proof of Liquidity' consensus mechanism, whereby users can stake whitelisted assets to receive block rewards and contribute to chain security. The governance token of Berachain can only be earned from staking BERA. This aims to reward long-term users and drive "sticky liquidity", incentivizing protocols/DAOs who have a stake to stay on the chain. It aims to tackle the issue of mercenary capital in the current L1 landscape that results in the cycle of farming and dumping tokens before moving onto the next new chain.

The team behind Berachain was largely inspired by OlympusDAO - a protocol aimed at building the decentralized reserve currency of DeFi. A key feature of OlympusDAO was its bonding mechanism which was very successful at bootstrapping protocol liquidity. The protocol has a rebase system, which rewards token holders for holding onto OHM. This inspired the creation of Bong Bears - the first rebasing NFT collection by the Berachain team. The rebasing mechanism allows current holders to receive the rebased collection and new users to obtain access to the NFTs at a lower price. Even though OlympusDAO was eventually unsuccessful, its initial growth was driven by memes and community, which Berachain aims to replicate.

Overview

Berachain’s standout feature is its tri-token model. The model proposes that each token will serve a specific purpose which will support the Berachain flywheel.

- HONEY: the defacto stablecoin of Berachain native AMM/DEXs

- Assets deposited for staking in the native AMM are all paired with HONEY, which can be used as collateral to mint HONEY.

- HONEY will be overcollaterized by at least 150%.

- BGT: the governance token of Berachain

- BGT is a non-transferrable NFT token and can only be accrued from staking BERA.

- The majority of fees gathered from native projects (from swaps, loans etc.) on Berachain are paid out to BGT holders in HONEY.

- Note: According to a podcast by the team, users will lose their BGT holdings when they unstake BERA. This further emphasizes the goal of the chain to incentivize long-term users by giving them more rewards.

- BERA: the gas token of Berachain

- BERA will be used as the medium of exchange on Berachain and staking it will allow users to receive block rewards and BGT.

- Users who stake whitelisted assets on Berachain will get block rewards paid out in BERA.

Through this model, Berachain has a good chance of incentivizing and maintaining liquidity on the chain. Aligning the chain's growth with long-term holders' interests is possible through Berachain's staking mechanism.

The team will decide which assets can be deposited and their respective rewards at the start. The weight of block rewards for staked assets will be determined upon launch, based on the token’s utilization and security. However, they have indicated that the governance will shift to BGT holders as the chain matures and becomes more stable. The team also mentioned the possibility of native Berachain tokens being whitelisted as stakeable assets in the future. BGT holders also have the power to direct BERA emissions to certain pools or protocols, creating a significant demand for BGT since it can only be acquired through staking BERA and is non-transferable. Staked assets will also be made productive as users will receive a liquid LP token which can be used to swap, borrow or lend in the native AMM DEX without unstaking their assets. Users can also mint HONEY against their collateral to be used for swaps and perp trading in the ecosystem.

The native AMM DEX and perpetual platform on Berachain will be integrated into the chain itself, built by Crocswap. Crocswap is a concentrated liquidity AMM DEX that utilizes a single smart contract. This means that all collaterals are mixed together in a single smart contract which allows for cheaper trades across multiple pairs. It also supports both concentrated and ambient (Uni v2) liquidity with single-sided liquidity pools as staked assets are automatically paired with HONEY.

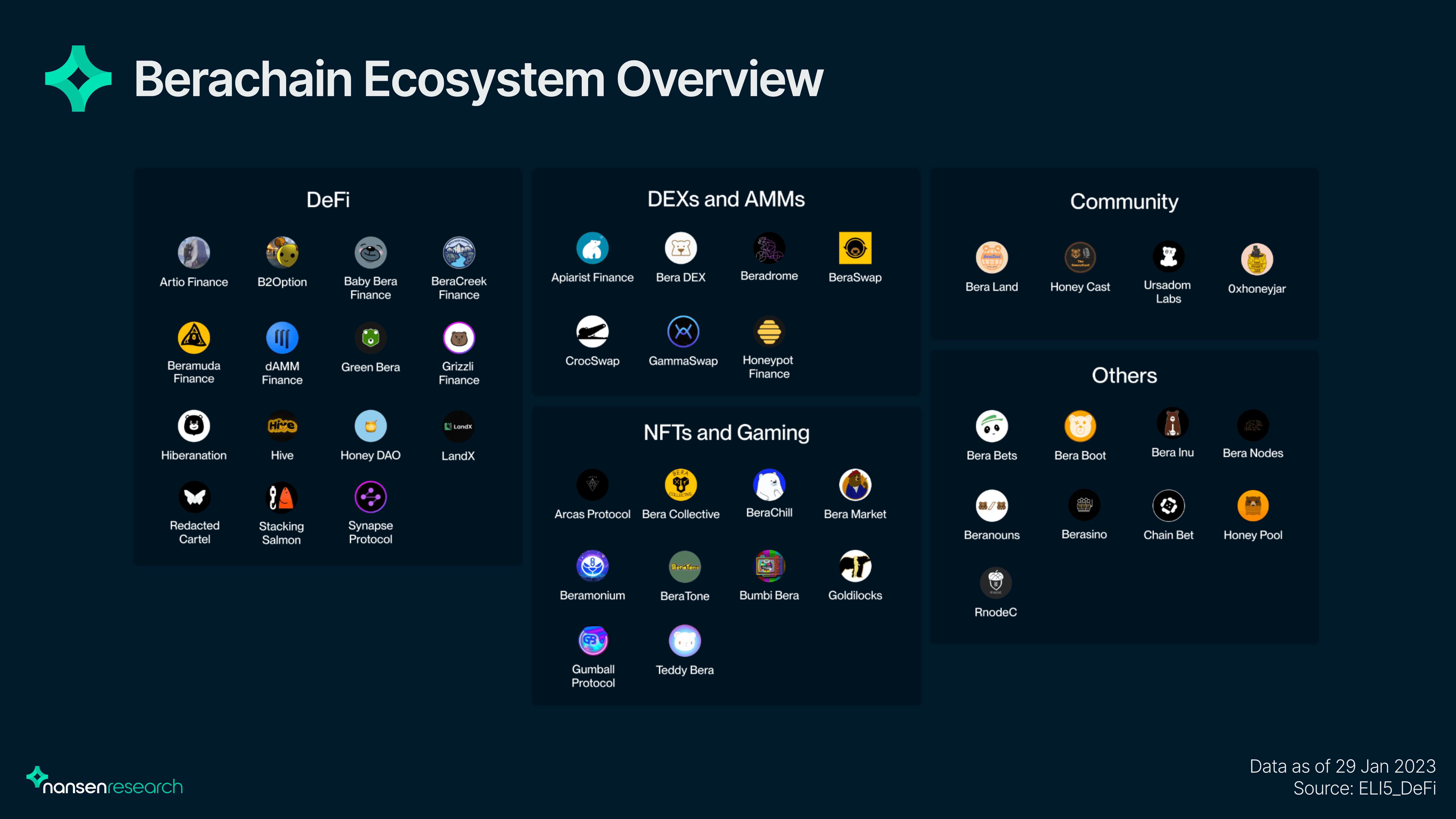

Ecosystem

The Berachain ecosystem is highly anticipated, with prominent protocols such as Synapse, Redacted Cartel, dAMM Finance (which is actually backed by Berachain) set to launch on the chain. It also boasts a wide variety of native projects of which some have already been active in releasing its own products before the chain launch.

Native projects have also been rather active in the past few weeks, potentially signaling. Prominent protocols include Hiberanation, Stacking Salmon, Honey Pool, Crocswap, B2Option, Baby Bera Finance, Gumball Protocol, Goldilocks, Beradrome, and Bera Inu. A recent tweet showing these protocols at a ‘roundtable’ could probably hint at the possibility of them going live once Berachain launches. A brief overview of these protocols:

- Hiberanation: auto-compounder for yield-maximizing strategies, similar to Beefy Finance

- Stacking Salmon: lending protocol with leveraged yield farming for borrowers

- Honey Pool: a prize savings protocol that allows users to earn yield on top of potential lottery prizes

- Crocswap: the native AMM DEX and perpetual platform integrated with the chain

- B2Option: native options protocol on Berachain

- Baby Bera Finance: a memecoin project with NFTs and yield farms

- Gumball Protocol: an NFT marketplace focused on liquidity for NFTs

- Goldilocks: the protocol is an AMM that offers several yield strategies and an NFT lending platform

- Beradrome: an AMM focused on capital efficiency, a fork of Velodrome

- Bera Inu: a memecoin project

Protocols such as Chain Bet have also migrated from Polygon and are set to launch on Berachain, signaling a strong anticipation for the chain even before it has even launched.

Gaining exposure to Berachain

Bera NFTs

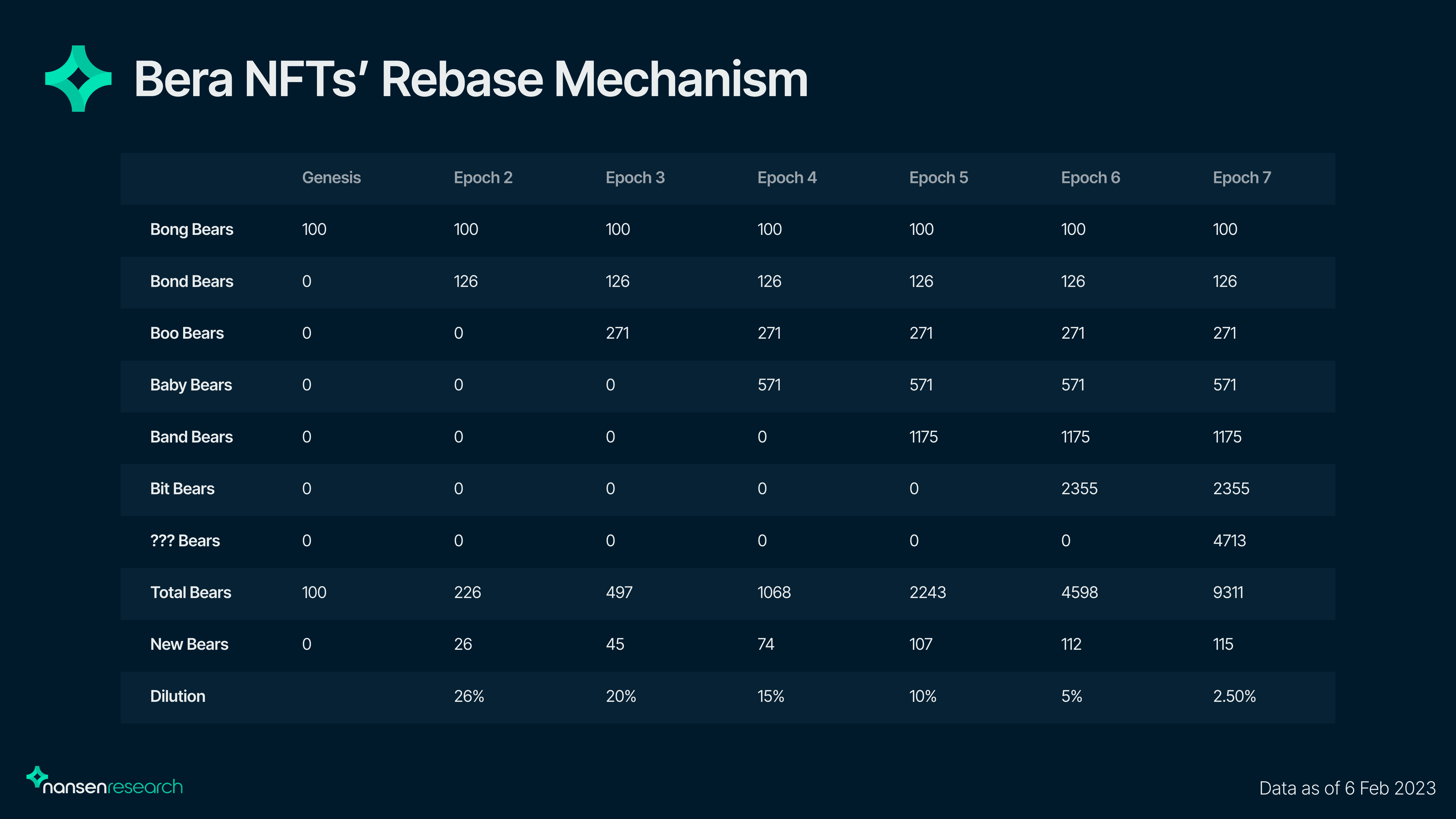

NFTs are one key way to ‘access’ Berachain for now, until its launch. The very first NFT collection Bong Bears is a collection of 101 NFTs launched by the core team back in April 2022. The collection is known as the ‘Genesis’ collection, as the NFT undergoes rebasing to form new collections. Since the launch last year, 5 rebases to the collection have been completed - forming Bond Bears, Boo Bears, Baby Bears, Band Bears, and Bit Bears. The final rebase is rumored to happen when the chain goes live. The table below shows the dilution of the NFTs across all the collections, with the final collection slated to bring the total supply of the entire collection to 9311.

(Note: Holders of previous collections will always receive the rebased collection)

There have been talks of rewarding early supporters which have led many to speculate that it will boil down to holding the NFT. Initial decks show that 5% of BERA’s supply will be distributed to NFT holders and will be liquid from the start. Assuming a $1b FDV and equal allocation of tokens among all collections, the Bong and Bit Bears collection are trading at a premium. However, considering the fact that current holders will receive a final rebase, there is likely still upside from Bit Bears as the premium will be reduced. Even though token allocation is still speculation at this point, the NFT collections have been making moves in recent weeks.

Across all of the NFT collections, a prominent holder for the NFTs would be DigitsDAO. The DAO is the top collector of the Boo Bears, Baby Bears, Band Bears, and Bit Bears collections - totaling over 303 NFTs across these 4 collections with an estimated value of 929 ETH (~$1.5m) as of 28 February 2023

The breakdown for DigitsDAO and other prominent wallets (as of 28 February 2023):

- digitsdao.eth (0xf13) - 17 Boo Bears, 24 Baby Bears, 50 Band Bears, 66 Bit Bears

- “DigitsDAO” on OpenSea (0x0c1) - 7 Boo Bears, 19 Baby Bears, 49 Band Bears, 71 Bit Bears

- @ohmzeus (0x562) - 11 Boo Bears, 21 Baby Bears, 41 Band Bears and 82 Bit Bears

- beraman69.eth (0x7f2) - 2 Boo Bears, 13 Baby Bears, 33 Band Bears and 25 Bit Bears

- deepname.eth (0x706) - 4 Boo Bears, 11 Baby Bears, 18 Band Bears, 54 Bit Bears

- Tornado Cash Depositor (0x2b3) - 4 Boo Bears, 12 Baby Bears, 23 Band Bears and 45 Bit Bears

Due to the nature of the rebase, many of the NFTs are concentrated in the hands of a few OG holders - which explains the large holdings of many of these wallets. It is also important to note that the cost basis for these wallets is extremely low as most have minted or accumulated from the free claims received during the rebase. Even though most of these holders have been diamond-handing the collections, having a lower number of unique holders would subject the collection to huge price volatility should one of the larger wallets choose to dump. The collections in general also have low liquidity, which means that a few buys/sells could significantly affect the price. Thus, it would be helpful to set Smart Alerts on these wallets for the particular collection that you are interested in or have a position in.

0xhoneyjar

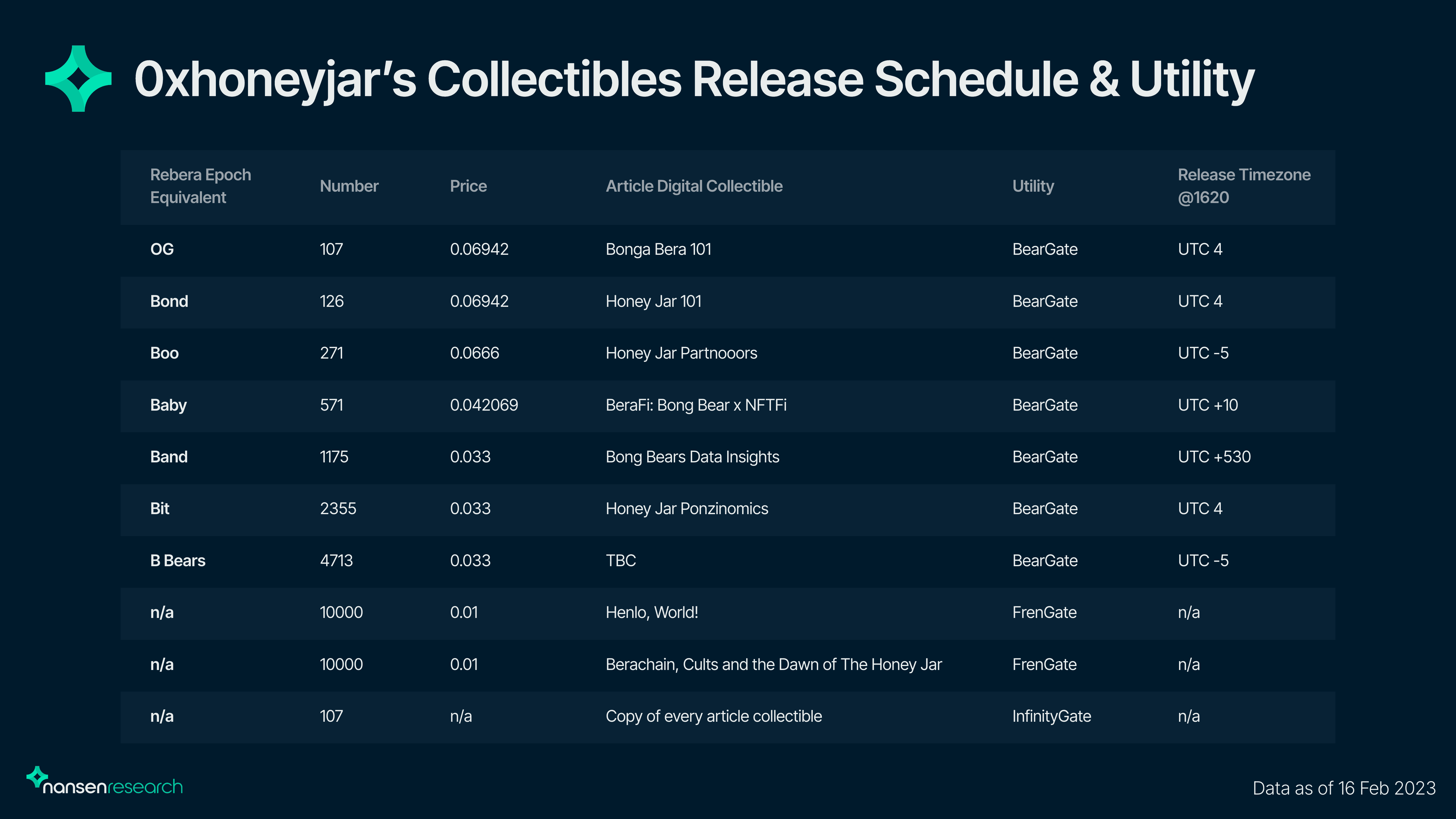

0xhoneyjar is a community project on Berachain that aims to provide its holders with special access to projects on the chain through whitelists, airdrops, or collaboration with projects in the ecosystem. The project will launch its own NFT soon, with priority access to the mint through various ways. Besides owning a Berachain NFT, another way will be to own HoneyJar articles listed below - with different articles enabling a different type of access to the mint. The first few articles - “Bonga Bera 101”, “Honey Jar 101” and “Honeyjar’s partners” was minted out and have done well in secondary sales. Special access is also given to partners of the project - namely OlympusDAO, Tokemak, Anatas, Dopex, and Tubby Cats whereby holding the token/NFT of this project will potentially give you a whitelist under the "Frengate" utility.

Based on the latest article on Honeyjar’s partners, holding the Honeycomb NFT will receive airdrops of many Berachain protocols as well as benefits of boosted yield, and whitelists from other Honeyjar partners. The project has also held several podcasts with different community groups, with the prominent ones being Moni and AlfaDAO. Having some sort of collaboration with these groups could help the project gain significant traction given that some of their members are notable individuals in the space. Hence, it would be worth paying attention to the project by getting some of the collectibles for the eventual Honeycomb mint.

Other NFTs related to Berachain projects include Tour de Berance - a collection by Beradrome. The utility mainly consists of increased voting power over emissions on the Beradrome DEX through increased hiBERO allocation to NFT holders as well as a rebase on Berachain once the chain is live. The tokenomics also show that only the community will receive liquid tokens from the start, which many speculate to be dependent on holding the NFT. Another project that has been active recently is Beramonium - a RPG game on Berachain. The team has been giving out WL for NFTs to active members in the Discord, which will grant access to special characters in the game when it launches.

Catalysts and Risks

Berachain is primed to receive attention upon its launch, as the narrative of rotating towards alt L1s remains prominent. Berachain has a strong community on Twitter and is backed by prominent individuals such as dcfgod (as mentioned in this podcast). The memetic community also helps to garner greater traction and attention over Twitter, as seen in the success of OlympusDAO. The team has consistently reinforced the notion of rewarding early supporters, which could help in creating a stronger community.

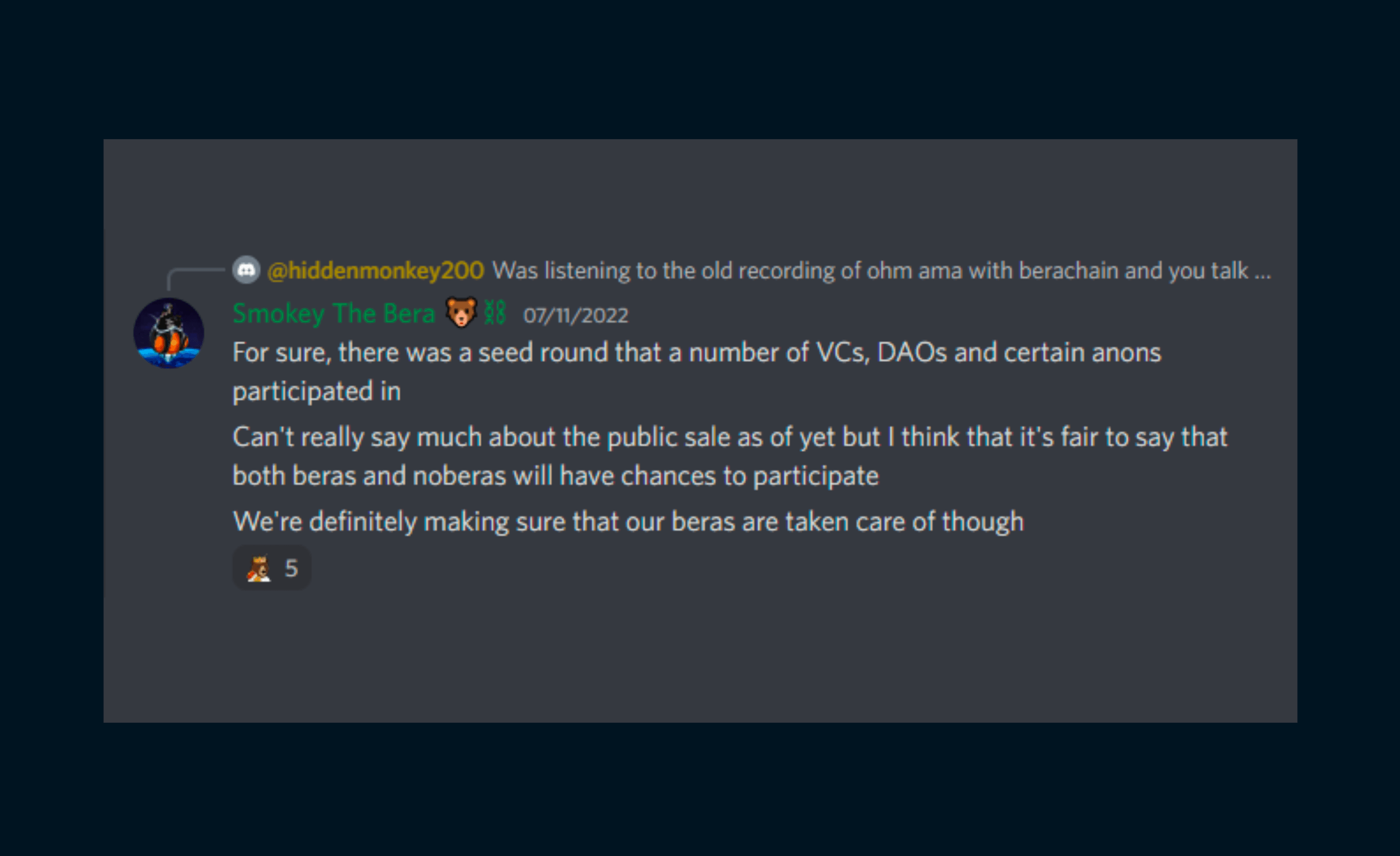

According to a podcast with DigitsDAO, the chain has raised $42m and $420m in seed and strategic rounds respectively. The seed deck also indicated that 5% of airdrops would go to all Bera NFT holders, whose tokens would be liquid from the start while other seed/strategic investors' tokens would have a 6-month cliff. Hence, they would probably receive a significant amount of liquid BERA tokens from the start based on their holdings of Bera NFTs, reflecting their conviction in the project. Additionally, they have expressed interest in validating the network and incubating projects on the chain, potentially driving significant growth.

The failure of Evmos to capture market share and sticky liquidity since its launch has been mentioned by the team, and they are working to ensure that the same will not happen to Berachain. Besides the tri-token model, the team has also mentioned that they are working with funds and DAOs to ensure that sufficient liquidity will be committed to the chain from the start, ensuring that the trading experience will be good from the get-go.

However, there are still many caveats - given that there is not a lot of open-source information regarding the chain yet. The team has mentioned that they are revamping their documentation which would likely introduce changes to some of the mechanisms that were previously mentioned. Besides that, centralization would likely be an issue when the chain launches, given that liquid BERA tokens will be in the hands of few. While Synapse will likely serve as the initial bridge for users to onboard the chain, the risk of bridged assets is still significant since any exploit on such assets could compromise a significant portion of the chain's security. Additionally, assets bridged over are settled through a closed governance process by the team, indicating a high degree of centralization in the chain. Hence, security is likely to be a significant issue for the competitiveness of the chain since L2 solutions do not introduce such bridge risks to their security.

Another caveat would be the ability of the chain to incentivize enough users to deposit into the chain given that there are many risks such as smart contract, chain security, and code risk. LPs only earn yield in BERA (unlike BGT holders) which will likely be inflationary from the start. Thus, the farm and dump situation could happen on Berachain as well. Therefore, the flywheel of the tri-token mechanism is highly dependent on whether the chain is able to receive significant adoption. If the chain is unable to attract liquidity and maintain it, it will be hard for BGT holders to want to hold on as well due to lower yields.

Furthermore, the macro environment that the chain launches in will likely be important as well, given that we are not entirely out of the ‘bear’ market yet. Nonetheless, based on tweets from various Berachain projects - an incentivized testnet may be coming soon and it would be beneficial to join the Discord to find out how to secure a spot if interested.

Resources

Berachain is a small but tight-knit community. Follow these people to get the latest updates on the chain.

Twitter:

- SmokeyTheBera

- co-founder of Berachain

- itsdevbear

- co-founder of Berachain

- FWCrypto_

- host of The Honey Cast, BD of 0xhoneyjar

- deepname99

- founder of 0xhoneyjar

- 0xdoug

- founder of Crocswap

- serbobross

- building multiple Berachain protocols

- 0xSerJaMad

- building Bera Bets

- Bera_Land

- community hub for Berachain

Conclusion

Glossary

| Term | Description |

|---|---|

| Cosmos SDK | A modular framework that makes it easy for developers to build customizable blockchains. Focuses on the application level by having an ecosystem of modules for developers to choose from. Developers can build their own modules or use existing modules to easily support applications. |

| Tendermint | A consensus engine and pBFT consensus algorithm. Any state machine (app-chain) can be built on top of it in any language. It combines the networking and consensus layers of a blockchain into a generic engine. |