TLDR

- In a peer-to-peer lending model, lenders have the ability to set terms according to how much they value a specific NFT rather than the floor price. Fixed rates and terms are generally more appealing to borrowers.

- Liquidity-pool models reduce the friction and fragmentation of matching lenders with borrowers by allowing borrowers to gain access to capital from readily available pools. Meanwhile, lenders get instant quotes on yield upon depositing their assets.

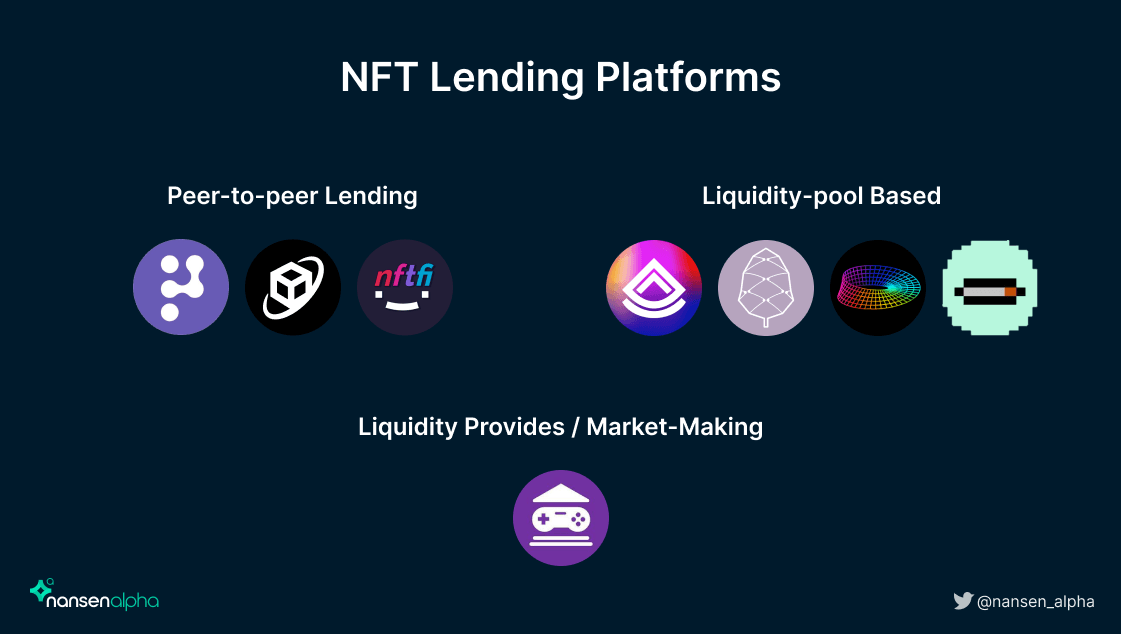

- NFTfi and Arcade are protocols that utilize the peer-to-peer lending model. On the other hand, Pine, BendDAO, JPEG’D, and DropsDAO are notable projects implementing the liquidity-based pool model.

- Emerging NFT lending projects, including FluidNFT, OpenSky, Unlockd, DeFrag, and Astaria, are attempting to expand on these existing models. However, most of these projects have chosen the liquidity-pool route.

- MetaStreet enhances the liquidity of peer-to-peer models by serving as a secondary market for NFT credits, allowing note originators to trade their NFT-backed notes via vaults. Therefore, adding another layer of liquidity to peer-to-peer NFT lending markets.

Key Terms

| Term | Description |

|---|---|

| Peer-to-peer lending model | Peer-to-peer lending model matches individual lenders to borrowers. Lenders receive yield based on loan execution that is manually agreed upon by both lenders and borrowers. |

| Liquidity pool lending model | Liquidity-pool lending models rely on floor price or recent sales oracles to determine loan execution and liquidation conditions. Note that liquidity-pool based models are sometimes referred to as peer-to-pool models and can be used interchangeably. |

| Loan-to-value (LTV) | LTV ratio is how much the lender is willing to offer as a percentage of the collateral’s value. LTV calculation: (loan value / NFT value) x 100 |

Introduction

In the past year, we’ve seen a meteoric development in the NFT ecosystem. Billions of dollars in value are being traded each month in the NFT market, with a significant increase in mainstream adoption.

The NFT market has generated 7.22m ETH in volume year-to-date, across 1.96m wallets

Note that a single NFT collector can have multiple wallets.

In addition, we’ve seen various verticals within the NFT ecosystem emerge, from pure PFP NFTs, to fashion, to community/membership passes, to art and collectives, as well as games and entertainment. The emergence of the verticals has opened up plenty of opportunities for new use cases to unlock, in particular the NFT financialization layer.

The most common bottleneck for NFTs is issues with illiquidity. For every NFT traded, there needs to be an individual buyer and seller as a two-fold system. Because NFTs are still relatively nascent and commonly subjected to pump-and-dump schemes, their floor prices are extremely volatile. NFTs are often unpredictable, and one-off catalysts can cause prices and volumes to skyrocket. However, once the hype dies down, volume and liquidity in the collection are often sparse. The main pain-points of NFTs is the lack of options available for users to access liquid funds without having to sell their NFTs.

NFT lending is an inevitable innovation in the NFT space, but there are few options readily available in the market. Currently, there are two main types of NFT lending: peer-to-peer and liquidity-pool lending models. In a peer-to-peer model, this brings us to a classic model of a lending marketplace that matches lenders to borrowers. Generally, in P2P models, lenders receive yield based on loan execution that is manually agreed upon by lenders and borrowers. Liquidity-pool lending models, however, typically rely on the floor prices or an average of the recent sales of an NFT collection (tracked by oracles). Liquidity-pool-based models depend on the liquidity pools in the protocols and are often more flexible than P2P models. liquidity-pool-based models also allow borrowers faster access to liquidity through standardization of loan terms and rates for a particular collection.

Comparing peer-to-peer & liquidity-pool based models

Peer-to-Peer visualization

Liquidity-pool based visualization

Borrowers and Lenders

Borrowers can choose to collateralize their NFTs if they require near-instant liquidity without having to sell their NFTs. Most platforms enable borrowers to secure loans equivalent to 20-30% of their collateral.

NFT-backed loans will be extremely valuable for NFT collectors, as well as guilds and funds, for foreseeable reasons, but what is there for lenders? Some of the risks associated with lenders can arise due to floor price volatility that could leave lenders at a loss if the borrower defaults and liquidates the collateral.

Despite the risks involved, in a peer-to-peer model, lenders can also charge higher interest rates on loan execution to “hedge” for potential setbacks. For more established NFT collections, rates usually start at 15% to 25% but can rise between 40-60% for less established collections. On the other hand, lenders in a liquidity-pool based model do not have as much flexibility in hedging their positions. Lenders in this model are given a fixed standardized rate. Besides hiking up interest rates, loans are typically worth a percentage of the value of the NFT to hedge against a potential drop in price. Alas, lenders should be mindful of choosing an appropriate LTV ratio to account for floor price fluctuations and the “blue-chip” status of the given collection.

Landscape and Competitor Analysis

General Protocol Design

| Protocol | Chain | Protocol Design | Loan Assets Available | No. of NFT collections/ pools supported | Token |

|---|---|---|---|---|---|

| Arcade | Ethereum | P2P | wETH, BTC, YFI, DAI, UST, USDC, UNI | 98 | No |

| NFTfi | Ethereum | P2P | wETH and DAI | 115 | No |

| Pine | Ethereum | Liquidity-pool model | wETH | 33 active pools | “Not yet” |

| BendDAO | Ethereum | Liquidity-pool model | ETH | 7 | BEND |

| JPEG’d | Ethereum | Liquidity-pool based | PUSd | 4 | Native stablecoin PUSd (can be minted upon depositing collateral) & governance token JPEG |

| DropsDAO | Ethereum but mentions “multi-chain” infrastructure | Liquidity-pool based | USDC (Available only to Yuga Labs pool), ETH | 4 NFT pools and 1 ERC-20 pool | DOP |

Loan Execution + Fees

Notable emerging protocols

FluidNFT

FluidNFT is an NFT lending protocol with a vision of enabling instant loans for any NFT collection through community-owned liquidity, referred to as DeFi 3.0. This reduces the barrier for non-blue-chip NFT projects to access liquidity. Specifically, holders of these collections would not have to liquidate their assets for liquidity. Additionally, the interest generated from loans goes back to support the project. Any project can aid their community access to liquidity by onboarding via providing seed liquidity. The protocol is currently in testnet. Join the Beta testing here.

OpenSky

OpenSky is a decentralized liquidity-pool based NFT lending platform that enables NFT stakers to value their NFTs and access liquidity by borrowing against them on demand. When users stake their NFT, the NFT is locked, and a lending pool is created where lenders can value the NFT to earn trading fees and interest. Through integration with Aave, the deposited crypto is routed to Aave to earn more yield for lenders. Once staked, the borrower can borrow up to 50% of the collateral's floor for a fixed rate and maturity. The borrower is subject to liquidation once the total borrow balance is 10% more than the market cap of their collateral market. OpenSky is currently in testnet on Polygon, which can be accessed here.

Unlockd

Unlockd is a liquidity-pool based cross-chain protocol for NFTs through NFT-backed, cross-chain, instant loans. Unlockd’s model allows the collateral and borrowed tokens to be on different chains, leveraging the potential of the multi-chain world. Borrowers can either receive a loan instantly with a standard LTV or wait for their collateral to be crowd-valued to unlock up to 85% LTV. The protocol's focus on integrations with multiple digital asset pricing and algorithmic appraisers means that they can give higher LTVs than many of their competitors. In addition, Unlockd has also partnered with various gaming and metaverse projects to bring more liquidity to guilds and gaming assets. The beta version of the protocol is scheduled for later this month.

DeFrag

DeFrag is a liquidty pool NFT lending protocol where users can deposit NFT collateral for loans. However, unlike other protocols, the protocol evaluates the collateral asset's value and the required put options to be purchased from underwriters to insure the loan. The protocol has bootstrapped liquidity for their NFT underwriting pool by releasing 6,400 NFTs called Metamaticians. The Metamaticians serve as the User ID and stake within the DeFrag ecosystem, allowing the holder to earn premium fees from the sale of put options, protocol rewards, governance votes, and other benefits. As more collections become eligible for collateral, lenders will be able to choose which collection they want to underwrite by depositing ETH into that particular underwriting pool. Currently, Genesis Legions from TreasureDAO will be the first eligible collection for collateral.

Astaria

Astaria is a liquidity-pool based NFT lending protocol led by Joseph Delong (ex-Sushi CTO) and Justin Bram. The protocol is structured around a 3 actor model, which includes an appraiser, liquidity provider, and borrower. Appraisers can create a vault (choose and value NFTs) and define the terms (such as rate, duration, amount, and position) to earn fees, liquidity providers provide liquidity to the vault, and borrowers can deposit their NFTs into the vaults as collateral against their loans. The protocol is still in development and scheduled to launch in September. They are currently looking to whitelist appraisers.

Potential catalysts for the NFT Lending Market Landscape

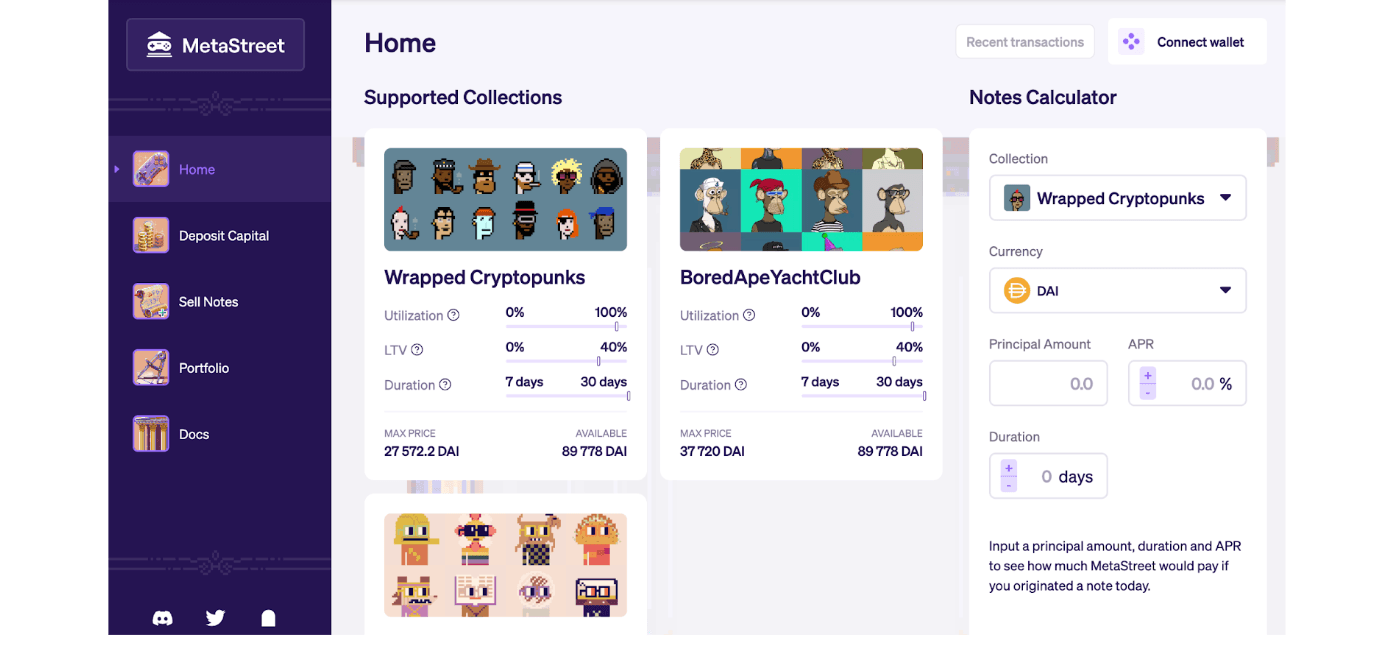

Metastreet

MetaStreet is a peer-to-peer NFT lending platform that brings liquidity to secondary markets for NFT-backed notes through capital vaults. A capital borrower and a note originator sign a promissory note, which is represented as an NFT in itself, for their terms and conditions. Note originators serve as the intermediary between MetaStreet and existing P2P marketplaces such as Arcade and NFTfi. The promissory notes are tradable via the capital vault, meaning that a noteholder does not necessarily have to be a note originator. A noteholder can choose to sell their contract to the capital vault during any period before maturity. Thus, adding another layer of liquidity to P2P lending models. Wrapped CryptoPunks, Bored Ape Yacht Club, and Nouns are the only presently supported collections.

A capital depositor can enter low-risk (senior) or high-risk (junior) positions within the capital vault in return for yield. Junior positions obtain additional rewards on top of the fixed rate earned by senior positions. However, the junior positions take on more risk as it absorbs the loss of up to 100% before the senior position is impaired. This mechanism allows any market participant to earn interest based on risk tolerance. Moreover, it gives investors with insufficient capital to issue promissory notes access to participation and exposure to opportunities they would not otherwise have in a traditional P2P lending market, further adding liquidity to the protocol. MetaStreet plans to integrate stablecoins and wETH as accepted forms of collateral at launch.

Furthermore, a market participant can also become a vault governor whose purpose is to allocate capital efficiently on behalf of the vault and capital depositors to earn a partial share of the interest earned by the vault. While MetaStreet DAO currently privately manages the vault's capital, the protocol will transition into a decentralized system in the future.

These four types of market participants are pillars within the MetaStreet ecosystem which drives the yield and activity on the platform. MetaStreet is innovating the P2P NFT lending model by providing an additional layer of liquidity, and increasing efficiency, through its capital vault and promissory note market, which complements current NFT P2P lending protocols. Their capital vault and introduction of capital depositors reduce the fragmentation of capital and attract more market participants into the ecosystem.

Verdict: P2P or liquidity-pool lending models?

The short answer is: it depends.

P2P models are fundamentally better suited for NFTs. Zooming out, NFTs represent a completely different ball game compared to fungible tokens. Each NFT in a single collection is unique, and how the NFT is valued depends entirely on the opinion of the public. P2P models rely on the lender’s ability to fairly evaluate the value of an NFT.

LP models tend to disregard the “unique” component of any NFT collection, as the price oracle can only detect the minimum value of the NFT collection - meaning the floor price. This is a limitation for holders with rarer NFTs as it affects their loan amount. We can take an example of a floor BAYC, which is equivalent to around 90 ETH at the time of writing. BAYC with rarer traits that are normally valued at 150+ ETH, for instance, will be regarded as their minimum floor price value. Despite the limitations posed above, LP models are well regarded in a way where borrowers can access liquidity immediately after collateralizing their NFTs. This is a common pain point for P2P models, where borrowers have to deal with more processing time and find appropriate LTV ratios and APRs.

Another key difference between P2P and liquidity-pool lending models is the liquidation condition. Liquidity-pool models face immediate liquidations if the floor price of an NFT (tracked by oracle) falls below loan LTV. This poses fear for borrowers as they risk losing their NFTs to lenders in the case of liquidation. There is no guarantee that borrowers will be able to repurchase the same NFT once the lenders get ahold of it. In the P2P-based lending model, however, the loan execution is set by both the lenders and borrowers. This not only allows for more flexibility but the NFT value is determined by both lenders and borrowers. Liquidations can only be triggered if borrowers fail to repay before the loan expires.

Regardless of preference, there are developments utilizing both models. NFT lending platforms, whether peer-to-peer or liquidity-pool , bring liquidity to this relatively illiquid asset class. As the NFT market continues trending upwards over time, the demand to access liquidity becomes increasingly significant as investors look to hedge against their NFT positions or remain liquid without selling their non-fungible assets. Particularly, financializing NFTs by bringing in liquidity via lending platforms will benefit guilds, venture capitals, and funds. These market participants are often large holders with many illiquid assets in their portfolios as part of their treasury. NFT lending platforms allow them to remain liquid to enter new positions without liquidating their NFTs.

At the same time, the build-up of leverage in a system can cause catastrophes due to liquidation cascades. As we have seen with DeFi and especially the recent events of the LUNA collapse and stETH peg deviation, too much leverage in the system will eventually cause it to be flushed out. This tail-risk is a point of concern for the overall NFT market.

Conclusion

The current NFT financialization landscape is still relatively new in terms of adoption. After all, these lending platforms are whitelisting liquidity pools exclusively for well-known blue-chip collections, and many mid-cap to smaller cap collections still face problems with liquidity and volume. While NFT lending is a potential solution for collectors to collateralize their NFTs without necessarily having to sell, proper product-market fit is yet to materialize.