Introduction

The GPU market, particularly within the AI sector, is experiencing explosive growth, with models like NVIDIA's H100, the upcoming B100, and the RTX 4090 facing overwhelming demand. NVIDIA’s compute and networking segment alone reported over $26b quarterly revenue for Q2 2024 - a 154% year-on-year growth. This surge in demand has resulted in significant scarcity, making these GPUs not only difficult to acquire but also highly expensive to rent. Despite these challenges, people are willing to pay a premium for access, signaling strong yield potential for those who can effectively provide these resources.

This is at the intersection of AI, GPU, and on-chain technology that Decentralized Physical Infrastructure Networks (DePIN) can make a profound impact, in our view. By offering efficient and decentralized financing solutions, DePIN can tap into the unmet demand for high-performance GPUs, transforming a supply bottleneck into a lucrative investment opportunity. Additionally, crypto-native mechanisms—such as lending, yield speculation, and even self-repaying loans—can further enhance the yield potential of GPU financing, driving new revenue streams for investors and ecosystem participants alike.

In this rapidly evolving market, DePIN provides a powerful framework to unlock value by efficiently sourcing capital, positioning it as a key player in the future of AI Compute infrastructure.

On-chain GPU rental lifecycle

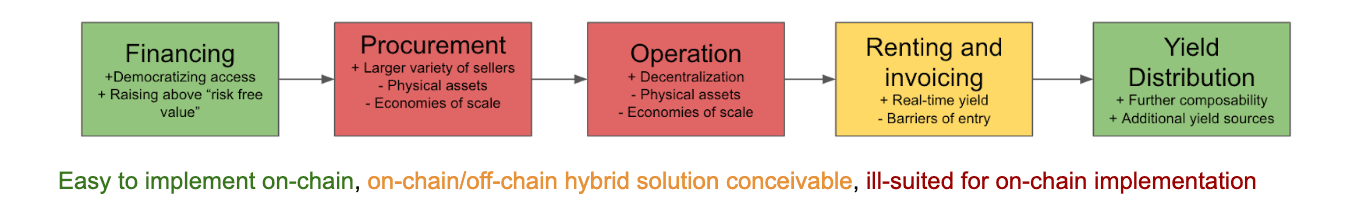

The lifecycle of AI-focused GPU financing consists of several distinct stages, each with unique challenges and characteristics, and not all are suitable for full decentralization or on-chain implementation. The chart below outlines the five major steps in this value chain and visualizes the suitability of each for on-chain implementation.

The first step, financing, is a flagship use case for the crypto space. Whether through venture capital, token sales, node sales, yield-bearing tokens, or loans, there are several proven ways to raise acquisition capital for GPUs. Putting the financing on-chain has two primary advantages. First, it democratizes access, allowing a wider range of investors to participate. Purchasing and running a cluster of GPUs requires substantial capital—hundreds of thousands of dollars—and secondary exposure through stocks offers more indirect exposure to less productive assets. Second, crypto financing allows for speculation, often resulting in raises at higher valuations than the actual underlying assets or "risk-free value," especially in the case of one-time raises and token sales.

Alternatively, making the financing part of the product itself through loans or direct "purchases" of GPUs by users on an ongoing basis is a more flexible and scalable option in the short term. However, this approach may offer less control, long-term security, and runway for the project team.

Once funds are raised, the next steps—procurement and operation of the GPUs—are generally better suited for off-chain implementation. These stages are often combined and sourced from the same entity (e.g., entities providing their computing resources to a network and operating the GPUs themselves) and share similar characteristics. While decentralization and a broader variety of providers can offer benefits, the advantages of economies of scale in off-chain implementation outweigh these. Off-chain solutions reduce procurement and operating costs and make it possible to offer GPU clusters with low latency, which is essential for certain applications and difficult to achieve through more distributed, loosely connected networks. Additionally, since these are physical assets, at least some off-chain components will always be required for their operation.

Renting GPU resources to clients and managing invoicing could theoretically be implemented on-chain, reducing third-party dependencies and enabling real-time yield distribution. However, the benefits of this approach are limited compared to the simplicity of off-chain solutions. More critically, many clients may not have crypto payment systems in place, which could create unnecessary barriers. A hybrid solution—using crypto under the hood while providing a user experience similar to other Infrastructure-as-a-Service (IaaS) platforms—could offer some advantages.

Finally, redistributing the generated yield back to investors is highly suitable for crypto-native implementation, with many well-tested solutions available. From deflationary tokenomics and buy-back mechanisms to interest-bearing LP tokens and self-repaying loans, yield distribution on-chain provides significant advantages over off-chain alternatives. This not only introduces unique, crypto-exclusive opportunities but also the potential to "subsidize" the yield with additional sources from DeFi, speculative strategies, or token emissions. These extra yields can be directed to both the supply side to attract more investors and the demand side to outcompete off-chain alternatives.

Business Case

In the following section, we examine the potential returns for such a product, using NVIDIAs commercially highly successful flagship AI chip, the H100, as a case study. The total yield can be divided into three components:

Total Yield = Productive Yield + Token Yield + DeFi Yield

The yield types are defined as follows:

- Productive yield is yield earned directly from renting out the GPUs:

Conversely, expenses include operating costs, external fees and taxes, hardware depreciation, and protocol fees. This yield component is largely decoupled from the crypto market itself and the least speculative.

Token yield is yield earned via token emissions from the project:

TVL refers to the total value locked in the pools that earn these emissions. These pools could include tokenized licenses, loan pools, or staking pools for the project's native token. This yield type is highly dependent on the project’s performance, token design, and emission schedule and is usually tied to the overall crypto market conditions and thus more speculative.

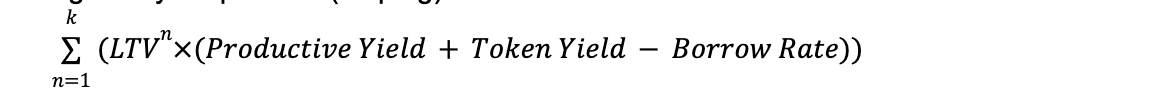

DeFi yield is additional yield generated through leverage by repeatedly borrowing against your position (looping):

LTV refers to the loan-to-value ratio for your lending position, and k represents the number of loops. A recent example of looping yield is borrowing against Ethena's USDE on Morpho, using the borrowed amount to purchase more USDE, and repeating the process. This yield component acts like a multiplier to existing yield and is highly speculative and risky. It is also “optional”, and not all investors will choose to take on the additional risks, especially liquidation risk, but also additional protocol risk or spikes in the borrowing rate.

Scenarios and Assumptions

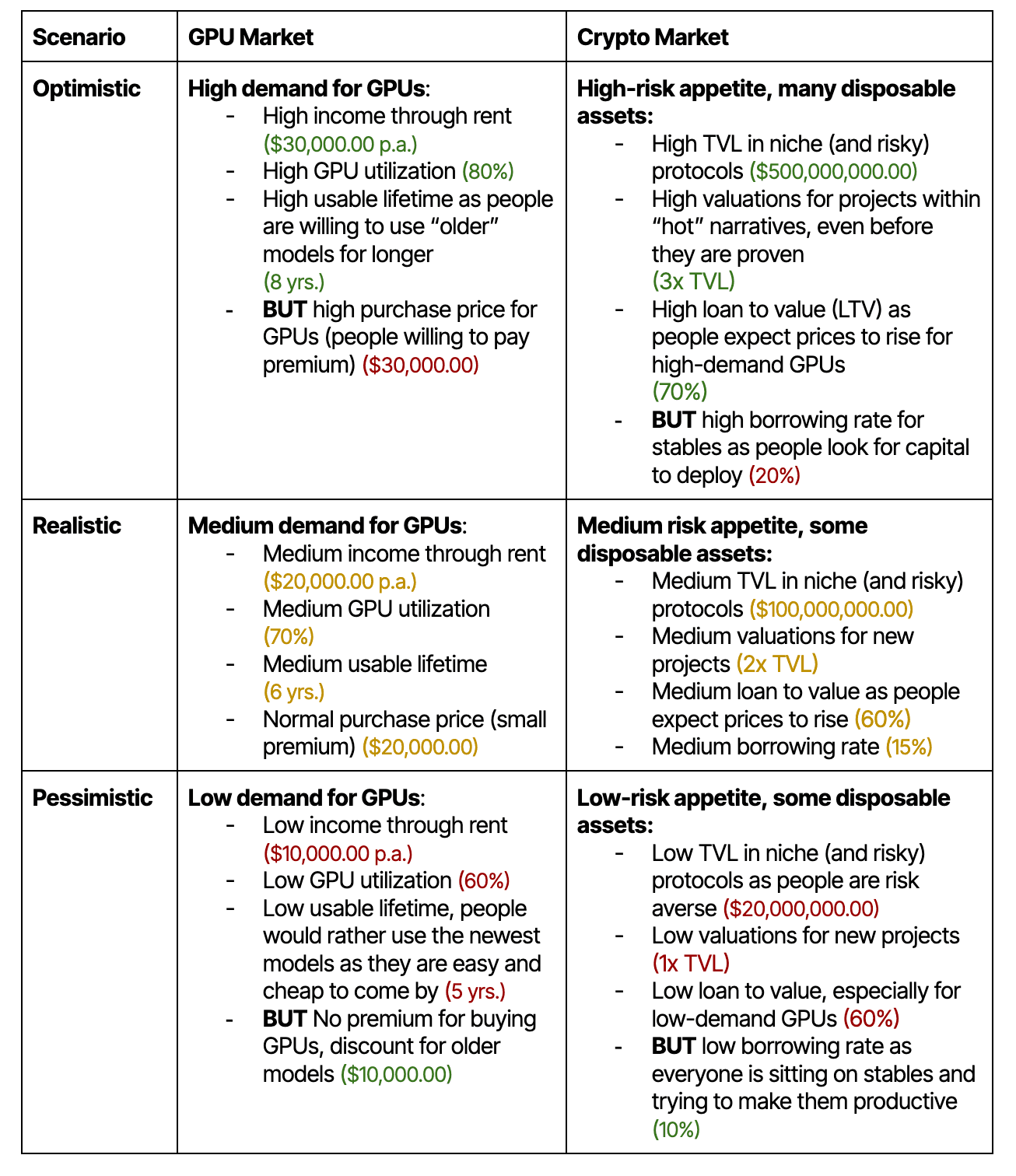

Given the current uncertainty within the tech and crypto markets, this report will present three different scenarios—optimistic, moderate, and pessimistic—rather than focusing on a single case. These scenarios differ in the following ways:

- GPU market conditions (purchase price, renting prices, utilization, usable GPU lifetime) affect the productive yield.

- Crypto market conditions (TVL, TVL to FDV multiplier, LTV, borrowing rate) affect the token and DeFi yields.

The following table depicts the assumptions for each scenario, based on a H100 GPU. The model protocol studied for this simulation is Metastreet, which is spearheading GPU financial, renting, and yield distribution.

The other assumptions necessary for the business case, which are considered constant throughout all scenarios, are:

- Operating costs: ~$5’300 p.a. Per unit (electricity, cooling, maintenance and support, operational infrastructure)

- Fees:

- 10% protocol fees

- 10% additional fees (third parties)

- Token emissions:

- 10% of supply during 1 year across all pools, equally distributed per unit TVL

- Defi leverage:

- 5 loops, providing a good balance between marginal increase in yield (~10% range for the 5th loop for common LTV’s) and ease of unwinding the position.

- Looping: Borrow stables against your assets (in this case your “share of the GPU pool”) at LTV at the borrowing rate, deposit it all back in the pool, and repeat.

Results

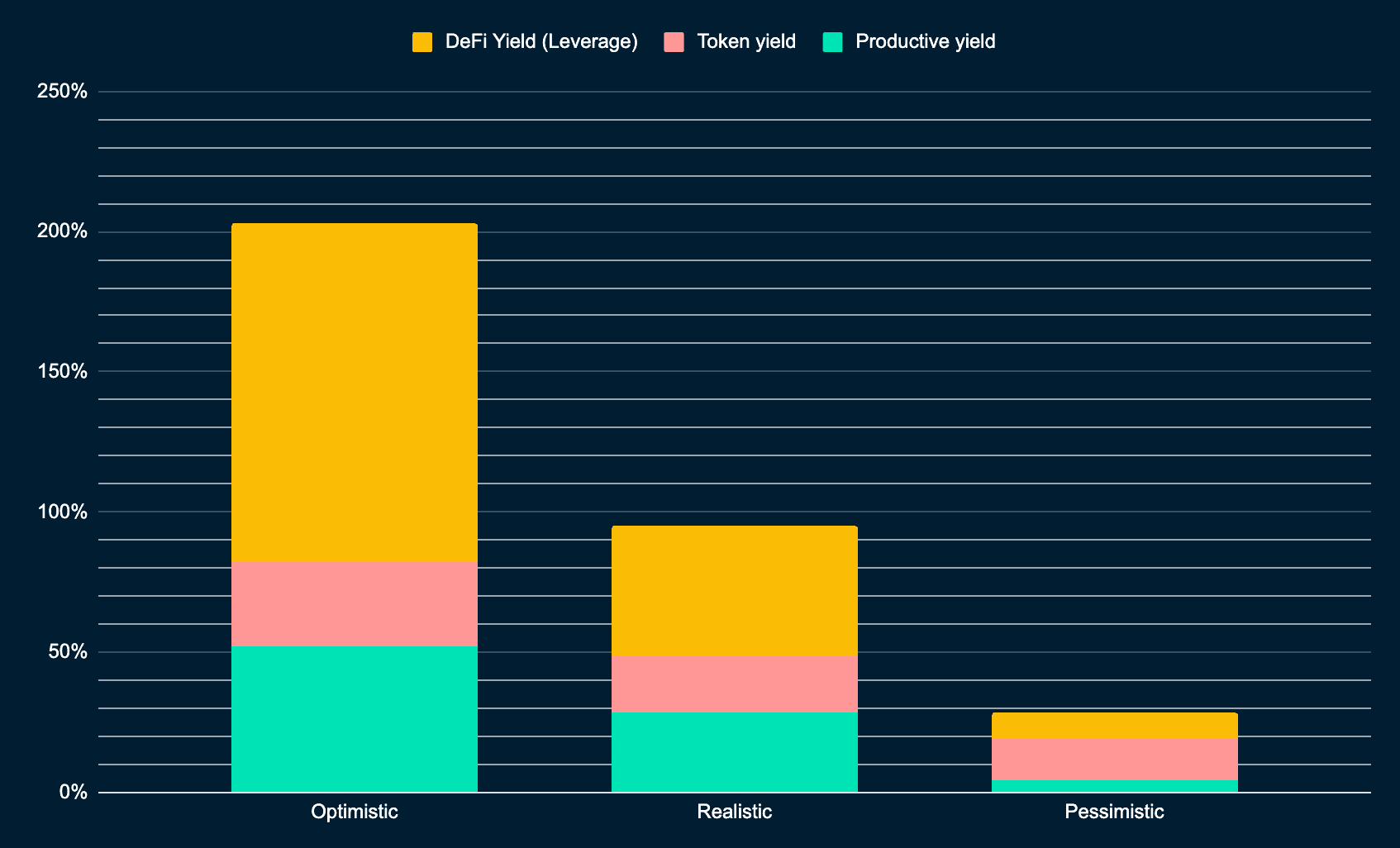

Finally, the chart below shows the resulting yields for each scenario, split into the three yield components.

In the most favorable scenario, both for the crypto and GPU/ AI markets, an APR of around 200% is conceivable, especially when using leverage through DeFi. However, taking on leverage always carries risk, particularly in heated market conditions. Even without leverage, yields of around 80%, primarily consisting of productive yield, represent a highly attractive investment opportunity.

In the realistic scenario, leveraging could result in approximately 95% APR, or just under 50% when considering only productive and token yield. With around 30% coming from productive yield, this case still offers strong returns.

Even in the pessimistic scenario, an APR of about 28% with leverage remains competitive, and even without further DeFi integrations, a return close to 20% seems realistic. However, in this case, the majority of yield comes from token emissions, leaving only a little over 4% in productive yield. In prolonged bear markets, this may not be enough to sustain the token's value over the long term and the yield might collapse altogether.

Overall, even in unfavorable conditions, the likelihood of turning a profit seems plausible if operating within a single scenario. However, most projects will likely experience a mix of different scenarios over their lifespan, potentially leading to more extreme results.

For example, financing GPU clusters or an entire project during a bull market—when GPU prices and premiums are high—followed by an immediate bear market, could result in a combination of high depreciation and low revenue. Although the current public sentiment suggests we are in a realistic scenario, such a shift could be detrimental to investors, particularly in the short term and when using leverage.

Conversely, purchasing GPUs at a discount during a pessimistic scenario and then entering a bull market could push effective APRs well beyond the optimistic 200%, especially if the earned tokens are not sold and keep appreciating. Thus, the timing of GPU financing could play a crucial role in profitability, given the inherent volatility of the underlying asset.

Conclusion

For non-USD yield opportunities, NodeFi can provide up to three-digit attractive yields. For USD yields, while the current yield from GPU rentals is already impressive, the potential to boost profitability by combining these rentals with token emissions and DeFi strategies is substantial and potentially crucial in gaining an edge against off-chain competition. This could hold even in a pessimistic market scenario, where the usual rush toward quick-money on-chain assets, such as meme tokens, may decline. The ability to generate strong, sustainable yields under such conditions highlights the resilience of DePIN-backed GPU financing models.

However, realizing this potential requires overcoming several significant hurdles. The complexity of setup, accurate valuation and accounting, and navigating legal frameworks make this type of investment far more intricate than more straightforward instruments, such as treasury bills.

Additionally, efficient execution is critical to success in this evolving space, and whether a project can successfully manage these challenges in the long term remains to be seen.

That said, a few standout candidates appear well-positioned to lead in this space. Projects like Render, Nosana, Aethir, Io focus more on intermediation in Revenue/ renting and nodes. Meanwhile, Metastreet has extended its positioning to other high-potential sections of the value chain, Tokenization and Financing, thereby capitalizing on the DeFi and Token yields, on top of the productive yield. These projects offer promise that this large revenue potential can indeed (partially) be brought on-chain, creating a profitable and scalable ecosystem for decentralized AI Compute.

Disclaimer: Nansen has produced the following report as part of its existing contract for services provided to Metastreet (the "Customer") at the time of publication. While Metastreet has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.