Key Points:

- Voluntary carbon credits are expected to experience enormous growth over the coming years.

- Carbon credits are not created equal - with enormous variance in quality. They have been controversial due to exaggerated/misleading impact, illiquidity, and lack of transparency.

- Blockchain technology can help address these fundamental problems - especially around traceability and transparency.

- DeFi can improve the value proposition of carbon credits by enabling holders to use them as collateral in DeFi protocols.

- Infrastructure projects such as Toucan are potentially exciting as they could play a vital role in onboarding carbon assets to DeFi.

- KlimaDAO has been controversial but has a committed team and community, and intends to onboard higher quality assets into its treasury.

- Regen Network is interesting as it monitors live data from its projects and records on-chain, and provides a marketplace for these credits.

More carbon-backed tokens will spring up focusing on different areas of the market, with nascent projects such as EDEN DAO intending to focus exclusively on tier-1 carbon removal credits.

Carbon Economy Overview

Introduction

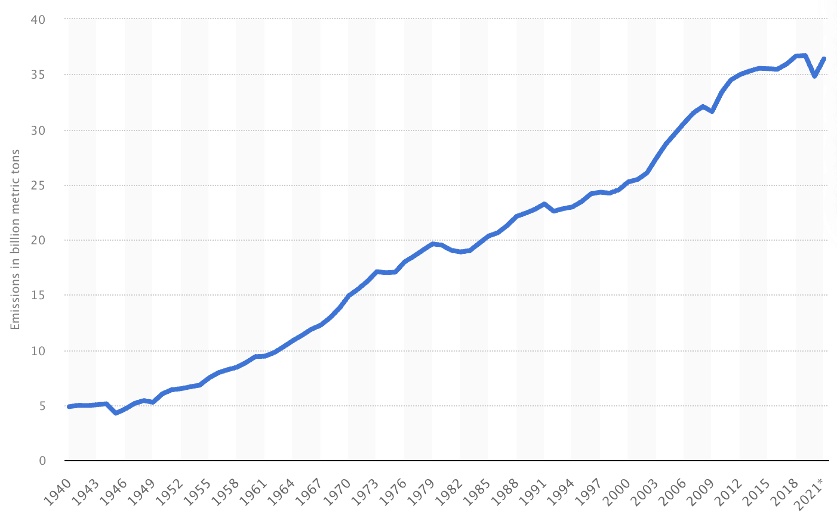

Global warming is arguably the world's biggest market failure. A clear misalignment of incentives has resulted in enormous ecological and environmental damage, with greenhouse gas (GHG) emissions increasing dramatically over the last century.

Annual CO2 emissions worldwide from 1940 to 2020

Enter Carbon Credits

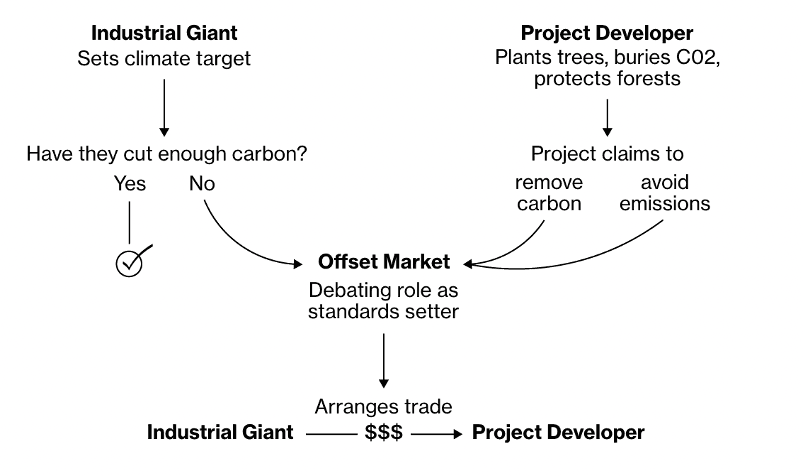

A potential solution to realign incentives is the voluntary carbon credit industry. A carbon credit represents an avoidance, reduction, or removal of GHG emissions. Carbon credits are tradable and can be exchanged numerous times between multiple participants.

Ultimately, many companies will continue to emit greenhouse gas in their operations - this is unavoidable in many cases. However, these companies can buy carbon offsets that are intended to compensate for their emissions. An efficient carbon credit market should create a flow of money from emitters to offsetters. When an end-buyer uses the credits to offset their GHG emissions, the credit is retired. In order to track the carbon credit more broadly and maintain a source of truth, a registry maintains a record of all active and retired credits. Although carbon credits pose a solution to climate change, all carbon credits are not created equal. Currently, there is no single ‘winning’ standard that is widely adopted and a wide range of carbon standards exist today. In fact, it has been controversial for corporations to purchase them due to extreme differences in quality and actual impact. There are many types of carbon credits on the market today and many of them address short, medium, and long-term solutions based on the durability of the credit.

Despite some fundamental flaws that need to be urgently resolved, carbon offsets will play an important role in how we address and remove carbon emissions from the atmosphere. They are “the worst possible idea — except for everything else” in the words of Timothy Searchinger, Princeton researcher on climate change.

The financialization of carbon is underway - and its natural and necessary progression will see it be traded like a commodity and the rise of a massive industry. Efficient carbon financial markets will be a crucial component to address the climate crisis by connecting and incentivizing planet-positive projects with the capital required to make a positive impact.

Market Growth

A McKinsey study found that the market size for voluntary carbon credits in 2030 could be between $5-30b conservatively, and could even rise to more than $50b optimistically. This is an enormous increase from the present $1b in 2021. Trove Research estimates that demand for offsets will increase between 10-20x between 2020-2030. Traditional financial markets are recognizing the enormous opportunity. In 2021, chancellor Rishi Sunak announced his intention to make London a global trading hub for voluntary offsets. Meanwhile, Singapore announced plans to develop an international carbon trading marketplace and a services ecosystem.

Avoidance, Reduction, and Removal Offsets

Carbon credits are issued to companies that conduct activities that avoid, reduce or remove carbon emissions.

Avoidance

These carbon credits are issued to projects that take active steps to ensure GHG emissions are avoided. An example of this is avoiding deforestation. If legitimate, carbon avoidance credits are important as they accelerate carbon emission reductions.

Reduction

These carbon credits are issued to projects that take steps to reduce carbon emissions. This could include new work processes and emission reduction technologies.

High-quality avoidance and reduction projects are important and necessary as they help accelerate our progression to a decarbonized economy.

Removal

Removal projects actually remove pre-existing CO2 from the atmosphere. These are by far the most important offsets and it is essential in the medium-term that the majority of the industry shifts towards focusing on high-quality carbon removal offsets. However, there are also fundamental differences between removal projects. These can be classified as short, medium, and long-term projects.

| Type | Time Frame | Project Examples |

|---|---|---|

| Short-term | (0 - 100 years) | Forestry and soil. |

| Medium-term | (100 - 1000 years) | Carbon dioxide utilization like biochar. |

| Long-term | ( 1,000 - ∞ years) | Bioenergy, Direct Air Capture. |

Although carbon credits are expected to grow quickly, there are many issues along the carbon stack - from sourcing the credits to the actual marketplaces in which they are sold. A seriously concerning statistic is that only 4% of offsets actually extract CO2 from the atmosphere, which leaves the other 96% as merely avoidances and reduction. An example is a carbon offset based on preventing trees from being cut down, rather than directly extracting the carbon from the air. Other examples are shifting from fossil fuels to cleaner energy. Although both are positive preventative measures, they don't actually extract the CO2 emissions from the atmosphere and are inadequate in addressing the climate crisis.

Fundamental Problems

Some of the issues surrounding carbon credits come down to the following:

- Unsatisfactory/Misleading Impact

- Illiquidity

- Opacity

- Inefficiency

Unsatisfactory/Misleading Impact In many cases, carbon offset projects have over-promised, under-delivered and indirectly led to even worse emissions in the past.

In some cases, carbon credits have created a moral hazard when it is cheaper to buy credits than reduce emissions, disincentivizing companies from taking meaningful decarbonization measures

Some carbon credits have been criticized as having an exaggerated/weak impact. An example of this is CarbonPlan’s research into California’s forest offset program:

“Rather than improve forest management to store additional carbon, ecological and statistical flaws in California’s offsets program create incentives to generate credits that do not reflect real climate benefits… this has manifested in practice at a large and systemic scale.”

- This continuing on a large scale could create a situation where there would be even more emissions than there otherwise would be. For example, there have been reported cases of forestry-based carbon credits being sold only for the forests ending up cut down anyway.

Illiquidity

There is great variance of carbon credits resulting in fragmented liquidity.

Carbon credits will never receive sufficient financing until they can be commoditized and traded on a large scale. The industry is too fragmented in its current state for this to occur.

Illiquidity makes carbon offset investment riskier and perpetuates underinvestment in the industry.

According to the World Bank, commoditized carbon markets are likely the most cost-effective way to trigger a shift in global commerce toward sustainable business practices and financing.

Opacity

Deals are often done behind closed doors with unsatisfactory reporting requirements resulting in poor price transparency for the market. This often allows buyers to underbuy the market. Crystal Davis, director of Global Forest Watch at the World Resources Institute, stated that carbon credits will never realize their full potential as a conservation financing mechanism without more public-facing transparency and accountability in the system.

With current accounting methods, credits are often double-counted, sometimes repeatedly.

The lack of information regarding the impact and quality of the credits creates an additional due diligence cost, pricing out potential participants.

Inefficiency

A lack of confidence in the quality of the underlying credits stifles demand.

Carbon projects often require multiple layers of intermediaries to sell their credits.

These intermediaries capture a significant portion of the value.

These issues are being addressed today, as more people become aware of the enormous carbon opportunity and the demand for high-quality offsets increases. The widespread criticisms show a clear desire for more impactful offsets - and a number of projects in the space are working to make this a reality, in Web3 and beyond.

Crypto-Carbon Economy

An efficient carbon economy needs to internalize the real cost of carbon in commerce, create new carbon-based financial products, and incentivize decarbonization across the economy. Blockchain technology has the potential to bring greater transparency, accountability and efficiency to an industry that is held back by opacity, poor performance and inefficiency. Alexandre Gellert Paris, Associate Programme Officer at UNFCCC, stated:

“Blockchain could contribute to greater stakeholder involvement, transparency, and engagement and help bring trust and other innovative solutions… leading to enhanced climate actions.”

Web3 incentive structures and coordination mechanisms could be key to aligning interests across the economy. Crucially, DeFi can accelerate the financialization of carbon by adding a new money lego - programmable carbon - giving carbon credits greater utility and value.

In order to understand the potential, it is necessary to examine some of the existing players in this space.

| Toucan | Toucan provides on-ramp infrastructure for carbon offsets to DeFi. | Token to-be-launched. BCT tokens representing carbon offsets (ERC-20). |

|---|---|---|

| Moss | Moss is a Brazilian-based company focused on carbon offsets from forestry projects. These carbon offsets are onboarded on-chain as MCO2. | Token to-be-launched. MCO2 token representing carbon offsets (ERC-20). |

| KlimaDAO | KlimaDAO launched the first carbon-backed cryptocurrency KLIMA which is intrinsically backed by carbon offsets. KlimaDAO is an OHM fork. | KLIMA token on Polygon. |

| Regen Network | Regen seeks to connect carbon-positive projects to buyers around the world. Their goal is to connect every participant in the stack - from sourcing the credits to the financial products built atop these liquid carbon credits. | REGEN token on Cosmos. |

| Chia | Chia is a smart contract blockchain with an innovative consensus mechanism. They have (non-binding) agreements with the World Bank and Costa Rica to use Chia’s blockchain technology for carbon market infrastructure. | XCH (Non-carbon specific). |

| Others | EDEN DAO, IXO network, Solidworld | To be launched |

Toucan Protocol

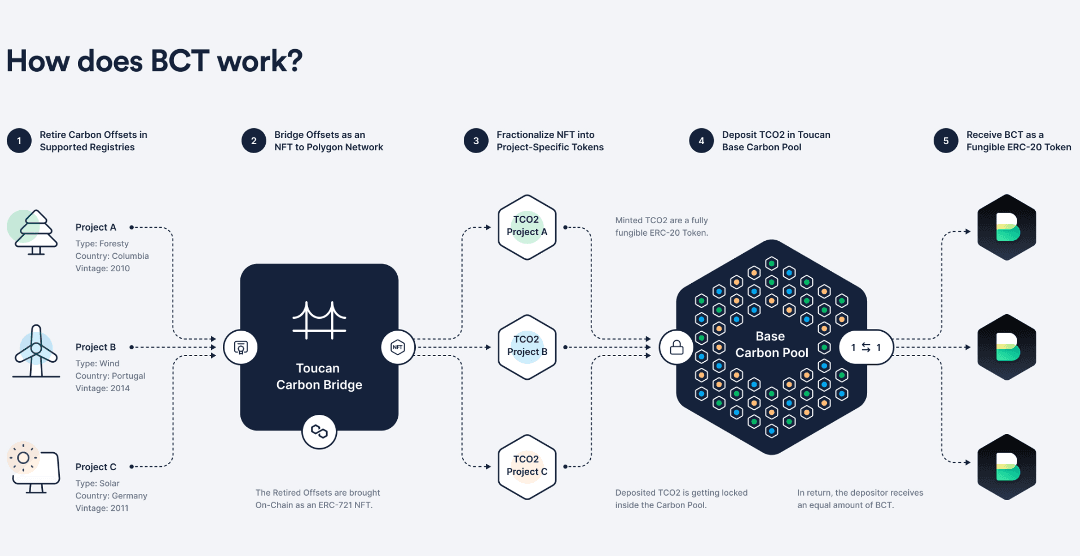

Overview Toucan Protocol is creating programmable carbon, by bringing carbon credits on-chain. Toucan’s aim is to optimize the carbon credit market for fungibility and liquidity, providing real-time pricing information and a public record of trades. Importantly, the Toucan Carbon Bridge allows for the tokenization of carbon credits and integration of these credits into DeFi. Toucan converts tokenized carbon credits into more liquid and fungible carbon reference tokens.

Toucan addresses the issue of fragmented liquidity in the industry by aggregating into pools carbon tokens with similar attributes across projects and vintages. Their goal is to enable price discovery for different classes of carbon assets and a new money lego for DeFi. For every ton of CO2 (TCO2) deposited in a pool, a carbon reference token is created. These carbon reference tokens are ERC-20 and designed to be liquid and highly tradable. Toucan currently has one carbon reference token - Base Carbon Token (BCT) but will be launching more, most recently announcing Nature Carbon Token (NCT) which will comprise nature-based projects. Toucan is essentially trying to commoditize carbon markets in order to reduce investment risk and enable massive financing flows into carbon assets.

How it works

Toucan Carbon Bridge:

- The Carbon Bridge connects legacy carbon registries with the Toucan Registry - an on-chain registry on Polygon.

- The Carbon Bridge is a one-way bridge: Once carbon credits are brought on-chain, they cannot be taken off-chain.

- The reason for this is that the transparency and immutability of blockchain prevent double counting and improve traceability and transparency. Credits need to be retired on the public registry before being brought on-chain.

- This already has some key benefits - burning a carbon credit on-chain is completely transparent and an alternative to retiring a credit off-chain - which requires a centralized registry.

The following diagram demonstrates how Toucan works:

Analysis Toucan is potentially a promising project in the crypto-carbon economy. They are providing the key infrastructure to onboard carbon credits on-chain, and segment them into pools with similar attributes. This enables a liquid market for carbon credits in DeFi, with possibilities for using carbon reference tokens as collateral in DeFi protocols, from stablecoins to lending and borrowing. Toucan’s focus on creating highly tradable and standardized carbon tokens is in line with the Taskforce on Scaling Voluntary Carbon Markets agenda of standardizing contracts to enable the large-scale trading of carbon offsets that is ultimately required to scale this industry. For Toucan, BCT is just the beginning, and more higher quality carbon reference tokens are expected to be onboarded in the near future - starting with NCT.

It is also worth noting that bridged credits are sourced through trusted third parties such as Verra. Although vetted and widely regarded as upholding high standards, these credits are still subject to counterparty risk. That said, promising solutions are being actively worked on to bring more transparency and confidence to the underlying credits. Blockchain technology would be well suited to address this, and it is highly likely that in the future it will be widely used for these purposes. It would be interesting to see some of the decisions and governance processes for carbon credits recorded on-chain in the future to improve accountability and transparency. Although promising, only time will tell if Toucan can deliver on these promises.

Toucan is expected to launch a token in the near future.

How Impactful are BCTs? For BCT, Toucan only uses carbon credits issued by Verra. Verra is a generally well-regarded non-profit organization that certifies GHG reduction projects. Toucan requires BCTs to have a vintage of greater than 2008, as older carbon credits are deemed not as good. However, it is arguable that 2008 credits are also lacking in quality and provide no resources for current projects seeking to address the climate crisis. Additionally, most BCTs derive from credits that were issued for avoidance rather than reduction. While carbon avoidance is positive, carbon removal is more impactful and important in addressing the climate crisis. It is widely considered that BCTs generally represent low-quality carbon offsets.

Moss - MCO2

Overview

Moss is a Brazilian-based company that is seeking to prevent deforestation of the Amazon rainforest. Moss represents verified carbon credits on-chain as the MCO2 token in which 1 MCO2 token = 1 ton of carbon. MCO2 is used by a number of projects such as Celo, One River Asset Management, and Gol - Brazil’s largest airline to offset emissions. MCO2 offsets are derived from

- Preservation of Native Forests / Deforestation Prevention (REDD+)

- Reforestation and Natural Regeneration

- Credits Generated by Carbon Sequestration

MCO2 offsets are widely considered to be of superior quality to BCT, due to their greater impact. The MCO2 token is listed on Coinbase and Gemini, among others and is a treasury asset in KlimaDAO.

Analysis Moss carbon credits are primarily composed of forest preservation and carbon reduction. The benefits of this are clear - maintaining forests is of great importance in the fight against climate change. However, in terms of the true impact of removing dangerous levels of GHG from the atmosphere, these projects fall short. This is not to criticize the Moss credits but to highlight a more fundamental problem. They are still important in achieving carbon targets.

MCO2 will likely launch a governance token in the future.

Use Cases of Carbon Tokens In Web3

| Borrowing and Lending | Tokenized carbon credits can be used as collateral in DeFi and would help diversify and grow the DeFi ecosystem which is heavily reliant on highly speculative tokens. Additionally, carbon assets can be used to generate yield in the DeFi ecosystem - further enhancing their value proposition. | |

|---|---|---|

| Treasury | DAO treasuries can diversify by holding real-world carbon assets. For example, Qi DAO is using profits to purchase BCT as a diversified and planet-positive treasury asset. | |

| Stablecoins | Overcollateralized on-chain carbon credits could be used to back a green stablecoin. | |

| Tokens | KlimaDAO’s KLIMA token is the first carbon-backed governance token - whose value is derived from (a) the value of the carbon credits in its treasury (b) governance value and speculation. However, expect to see more carbons launch in the near future. | |

| Offsetting Emissions / Carbon Negative | As people become increasingly environmentally conscious as the effects of climate change grow more severe, it is likely that DAOs and other protocols may seek to become carbon neutral/negative. For example, Celo has a carbon offsetting fund.Green NFTs | Carbonized.xyz is creating carbon-capturing art that removes BCT from circulation.Another example is the 100,000,000 Mangroves NFT collection. This is a collaboration between Regenerative Resources (RRC), Regen Network, Chainlink, and Elevenyellow, to raise sufficient funds to grow 100 million mangroves. This series will emit ~120 tons of carbon but is expected to sequester 20,000,000 tons of carbon over 25 years.Project Ark is collaborating with the World Wildlife Foundation by selling NFTs whose proceeds go towards funding animal and environmental conservation efforts around the world. |

| Metaverse | There are many foreseeable and unforeseeable uses of carbon tokens in the metaverse. Already, Atlantis World is building carbon-sequestering forests with BCT in the metaverse (Atlantis World is a metaverse gaming project backed by Yearn Finance). There is exciting potential for the gamification of carbon credits in the metaverse in the future. |

KlimaDAO

Overview KlimaDAO is perhaps the most famous example of carbon credits in DeFi. The KLIMA token is backed by Toucan’s BCTs and now Moss’ MCO2. As an Ohm fork, KLIMA’s intrinsic value is based on the value of the BCTs in the treasury. There is a premium on the token price as the KLIMA token enables its holders to participate in the governance of the platform. The purpose of KlimaDAO is to increase the price of carbon offsets by purchasing offsets for its treasury and permanently removing them from circulation. This results in (a) buy pressure and (b) shrinking the circulating supply. The goal is to increase the price of offsets and making carbon-positive projects more profitable.

Analysis It has been noted that the BCTs KlimaDAO has been purchasing typically represent carbon reduction credits. These are lower priced than carbon removal and of lower impact. In addition to this, the minimum vintage year of 2008 is generally considered lower quality - and is not helpful in terms of enabling new carbon projects.

Notwithstanding this, KlimaDAO’s mass purchasing of such offsets has been reported to contribute to a price increase for these carbon offsets which could be viewed as a net positive for the industry. However, it could be argued that many companies would have likely avoided these credits due to greenwashing concerns. Another concern facing KlimaDAO is that its lower-quality offsets could lose their value as the industry moves towards more impactful carbon removal projects. However, it should be noted that KlimaDAO has shown clear intent to add higher quality carbon offsets to its treasury as they become more readily available. KlimaDAO also recently onboarded MCO2 tokens which are widely considered superior to BCT. In addition, Klima will onboard NCT - a nature-based Toucan carbon reference token that is expected to be of similar quality to MCO2. Importantly, KlimaDAO has a committed team and community, and a treasury to sustain it for a number of years.

The criticism KlimaDAO has received for onboarding low-quality credits is clearly being addressed by their stated intent to onboard higher-quality credits. KlimaDAO views itself as a catalyst for the carbon credit industry, removing many credits from the market and driving up the price to make it more profitable for existing and future carbon credits. As demand shifts towards high-quality carbon removals, KlimaDAO will need to ensure the majority of its treasury comprises verifiably high-impact carbon credits or risk treasury depreciation in the future.

Regen Network

Overview

Regen Network is a blockchain project focused on ecological data, that seeks to connect carbon positive projects to buyers around the world. Regen is focusing on carbon sequestration through regenerative agriculture projects, agroforestry and more. Their goal is highly ambitious - to connect every participant in the stack - from sourcing and monitoring the projects, to providing a platform to sell their credits.

Regen Ledger is a PoS blockchain developed with the Cosmos SDK built for verification of claims, agreements and data related to the ecological state. Regen claims that their blockchain’s smart contract functionality and inherent transparency will complement existing registries. Regen is interoperable with over 200 existing and developing blockchains within the Cosmos ecosystem which now boasts $75bn TVL and EVM compatibility with Evmos.

Regen’s system uses a digital Monitoring, Reporting, and Verification approach (dMRV). This technique combines open-source data with in-field sampling to create rigorous MRV systems for monitoring soil organic carbon. Regen has created a system that enables digital signatures at all stages of the dMRV process to create verifiable and easily audited claims.

Additionally, Regen is exploring an NFT module for eco-art, and an asset-wrapping module for vaulting BTC and offsetting crypto-transactions to create carbon-negative DeFi. Notably, Microsoft purchased Regen carbon credits - which is outlined below.

Analysis

The not-for-profit CarbonPlan rated Regen’s methodologies with the lowest score possible. They stated that some of Regen’s projects have included significant inconsistencies with their stated methodology. Kevin Silverman argued that the general lack of consensus surrounding methodology and the scientific approach is a key issue in the industry that requires resolving before a project like Regen can achieve proper adoption. One could argue that the industry may be premature for blockchain technology. It is clear that greater consensus on regenerative technology and methodology would benefit Regen.

Regen is addressing fundamental problems with the industry - providing clear and transparent access to quality information regarding the ecological state of carbon projects, enabling stakeholders to see that the projects have genuine impact rather than simply greenwashing. This transparency increases accountability between parties, and the blockchain-based solution is designed to streamline many of the processes and costs that hinder the industry today. If Regen can attain widespread legitimacy around their methodology and can deliver their services to projects in a cost-effective way, it could be an enormously important project in this space. However, the challenges are significant.

Corporates and Carbon Offsets

It is clear that corporations will be the largest purchasers of carbon offsets. While many have been accused of greenwashing and paying lip service to be more environmentally friendly, some companies such as Stripe, Shopify, and Microsoft are leading the way in purchasing high-quality carbon removals to remove their carbon footprint. It is arguably very likely that consumer and government demands for greener companies, combined with employee expectations will drive companies to take a similar approach.

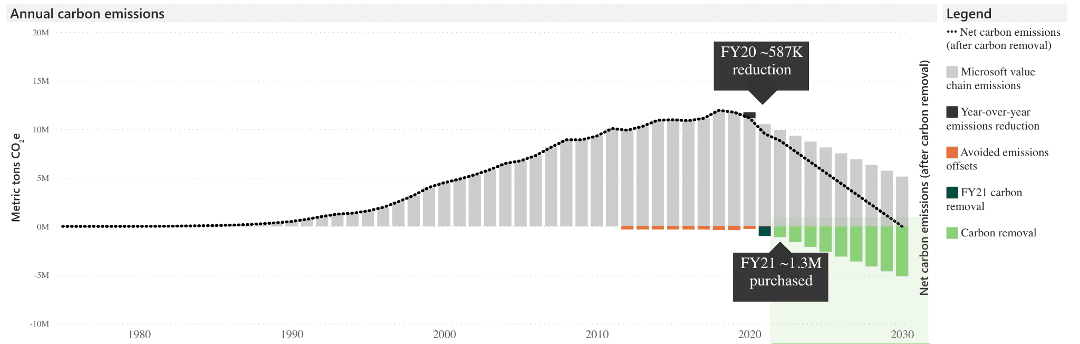

Case Study - Microsoft & Regen

Microsoft has pledged to become carbon negative by 2030 and to remove from the environment all the carbon the company has emitted since its inception by 2050. Microsoft is widely regarded as upholding high standards in their selection of carbon offset projects.

The company has stated that they have found it difficult to validate the carbon reduction/removal claims of projects, citing various difficulties with forestry, biomass and soil projects. This is the primary issue facing the carbon offset industry. They are using Deloitte to audit their sustainability practices and are even aligning executive pay in relation to sustainability. Within their first year, the company purchased 1.3m tons of carbon removal, including 100,000 tons from Regen Network.

As part of Microsoft's carbon negative pledge, Regen Network’s CarbonPlus Grassland credits were purchased. These credits measure carbon sequestration and other co-benefits, such as ecosystem health, animal welfare, and soil health. Regen Network monitored and measured soil organic carbon via remote sensing which resulted in significant reductions in monitoring costs while maintaining a high level of measurement accuracy. Regen issued credits to Wilmot Cattle Co., which have increased soil organic carbon to 4.5% and removed over 30,000 tons of CO2 in two years. Elizabeth Willmott, carbon program manager at Microsoft stated:

“Microsoft is pleased to select Regen Network’s carbon credit product to help meet our climate goals. Regen Network’s carbon credits rooted in soil organic carbon sequestration backed by technologically-enabled measurement are an exciting advancement in carbon credit markets.”

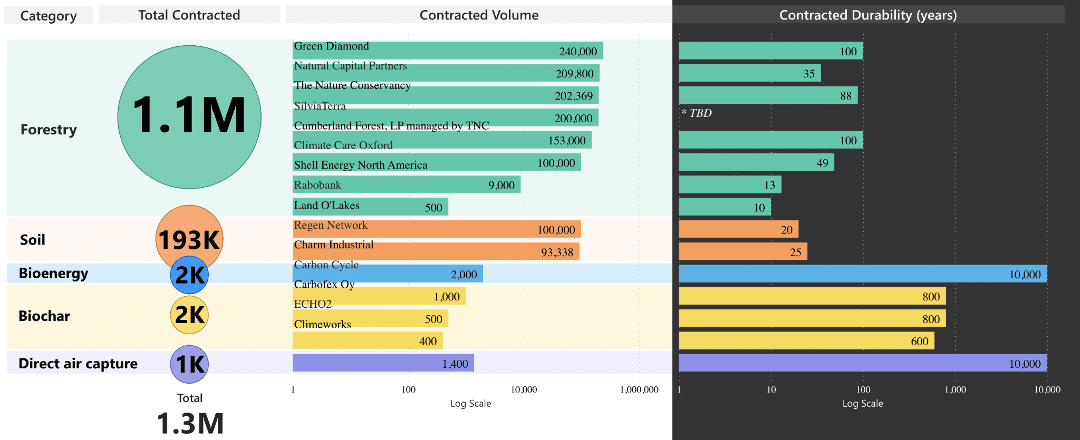

The diagram below is a breakdown of what category of carbon removals were purchased, who they were purchased from, and the estimated duration of the carbon removal.

As illustrated, Microsoft purchased 100,000 soil credits from Regen with a durability of 20 years. While this is a positive development and validation of Regen Network, it also highlights the consideration of carbon removal longevity. The graph above shows many carbon removal projects are temporary, with one lasting as little as ten years. This is of course inadequate to meet the colossal task of absorbing carbon emissions.

Chia

Overview

Chia is a proof of space and time (PoST) smart contract blockchain. Chia claims to be the most decentralized blockchain, with 350,000 nodes.

World Bank Partnership

Chia notably announced a partnership with the World Bank. In a non-exclusive and non-cost agreement, Chia will collaborate with the World Bank’s Climate Change Group in developing ‘Climate Warehouse’ - which is a program seeking to develop the next generation of carbon markets. Chia’s role is intended to facilitate transparent sharing and reporting of climate project information and carbon credit issuances. Through their partnership, Chia will aim to provide blockchain infrastructure that shares data from independent registry systems and governments to enable transparency and traceability.

Government of Costa Rica MOU In addition, Chia has also entered a Memorandum of Understanding (MOU) with the government of Costa Rica - a country widely regarded as a leader in environmental conservation. This agreement is for Chia to contribute to the nation’s National Climate Change Metrics System. This will be an open-source platform for registries of carbon inventory, climate registry etc. Chia will support by providing blockchain infrastructure for transparency.

“...Costa Rica selected Chia as an open-source partner due to… the platform’s secure… blockchain technology and immutable data storage… This is a critical step toward robust, transparent cooperation on climate action focused on environmental integrity.” Andrea Meza Murillo, Minister of Environment and Energy of Costa Rica.

Analysis While non-exclusive agreements and MOUs are not binding, they show recognition and validation of the unique benefits blockchain technology can offer carbon markets. This legitimizes the use case and potentially signifies a future in which blockchain technology is integrated into carbon markets. It will be interesting to see how these relationships develop.

Others: EDEN DAO It is essential that long-term solutions that remove and store carbon ‘permanently’ are scaled and receive the necessary funding. Investing in long-term carbon removal projects is arguably the most important thing to prevent climate change from spiraling out of control.

One such project is EDEN DAO, which seeks to invest forward in carbon projects that are using technology for long-term carbon removal. EDEN DAO ultimately seeks to become like a Keiretsu - in which it is the financial center of a network of carbon positive projects.

For example, EDEN DAO is launching a syndicate ‘DRM DAO’ with the sole purpose of investing in tier-1 long-term carbon removal offsets - partnering with Patch.io and having the offsets assessed by (carbon)plan - an independent organization that seeks to provide transparency on the scientific integrity of offsets. In the future, the carbon offsets are intended to be tokenized on Toucan as CDRM (Carbon Dioxide Removal Mass) tokens on Polygon. EDEN DAO seeks to have carbon priced in terms of years of permanence - creating demand and a marketplace for long-term carbon removal solutions. EDEN DAO aims to have a network of such syndicates in the future.

Analysis While EDEN DAO is not yet fully developed, the concept of creating a DAO with the sole purpose of financing long-term carbon removal projects is a very compelling one. With the price of carbon and the urgency of the climate crisis set to accelerate - a structure like this becoming extremely successful is definitely in the realm of possibility.

Collaboration Projects in the crypto-carbon economy largely have a symbiotic relationship with one another. For example, Regen-verified carbon offsets could be onboarded to carbon reference pool(s) on Toucan, which in turn could be purchased by KlimaDAO to have higher-quality carbon credits with greater legitimacy. Many of the actors in this ecosystem will need to work together to maximize individual and collective growth and industry legitimacy.

Solutions Being Built The carbon offset industry’s flaws have been repeatedly outlined in this report. However, there is widespread recognition of these flaws which are being actively addressed. There are several off-chain solutions being built to easily connect businesses and consumers with high-quality carbon offsets.

Pachama Pachama is harnessing AI, satellite data and carbon markets to drive funding for effective reforestation and conservation.

Patch.io Patch.io enables businesses to estimate emissions using their carbon accounting tools, and build a diversified portfolio of carbon offsets. Patch takes care of contractual arrangements and ensures the integrity of carbon credits on behalf of the customer.

Cloverly Cloverly connects carbon offsets to businesses and consumers by using real-time calculations powered by the Cloverly API.

Sylvera Sylvera seeks to become the leading carbon credit rating agency, i.e. the Moody’s of the carbon credit industry.

These businesses are addressing key problems in the industry and some are backed by a roster of tier-1 investors. In the words of Larry Fink: “The next 1,000 unicorns… will be sustainable, scalable innovators — startups that help the world decarbonize and make the energy transition affordable for all consumers.” These solutions are promising, and their ability to scale could help shape an exciting future for the industry. Poor quality carbon credits are no longer acceptable.

Businesses (like those listed above) can eventually incorporate blockchain and web3 elements as they reach scale to add an additional layer of transparency to their projects. Any of these businesses can also compose on existing on-chain solutions like Regen Network that provide this, and the carbon credits could be integrated into DeFi through the likes of Toucan. Right now, it is clear that blockchain-based solutions are not superior, but can at least serve as a complement to other solutions being built. As the industry matures, the additional accountability through transparency that blockchain introduces could make it a widespread feature of the industry. The immutability of blockchain technology is arguably essential for the industry going forward for auditability and addressing the unclear life-cycle of issued carbon credits.

Final Thoughts

The carbon credit market is flawed and ripe for disruption. Promising solutions are being built to address its problems, with some of the most exciting applications on-chain. DeFi can provide enormous value to carbon credits by enabling holders to leverage them as collateral for borrowing, lending and more. The financialization of carbon credits will improve their value proposition and DeFi more broadly. However, quality controls on these carbon credits are essential. Low-quality credits need to be avoided, and the emphasis needs to be on long-term carbon removal projects.

Toucan is an exciting project with a clearly defined vision of providing the infrastructure that brings carbon credits on-chain. If Toucan can attain a competitive advantage in doing so, it could be the primary entry point for all carbon credits on-chain. Carbon credits as a money-lego in DeFi makes sense, and there is an exciting future here.

KlimaDAO will likely need to focus on purchasing high-quality carbon offsets in order to become a true force in the industry. Other projects with plans for carbon-backed currencies are exciting developments to pay close attention to, with EDEN DAO notably focusing on tier-1 long-term carbon removals. EDEN DAO wants to create a network of sub-DAOs with a single mandate to invest forward in long-term carbon removal projects - providing the financing these projects need to scale and helping price carbon offsets in terms of permanence. This is an extremely exciting concept and if it works will demonstrate the unique coordination mechanisms of Web3. Humanity has so far failed to take any meaningful action toward developing these projects, and crypto-economic incentives and coordination could provide a solution.

Transparency and traceability of offsets is crucial in order to ensure the carbon credit industry is having a credible impact on reducing and removing carbon emissions. This is a prerequisite to creating large carbon marketplaces which are unworkable if the underlying carbon credits are tainted. Blockchain solutions can help provide the transparency and traceability required to legitimize carbon credits. Regen Network is addressing this issue but has potentially overextended itself, as it must maintain a blockchain, develop and refine legitimate methodology and provide scientific monitoring on-chain, as well as a marketplace. If successful, Regen will become an enormously valuable company. The World Bank and Costa Rica have given recognition to the objective benefits of blockchain technology by entering public (non-binding) agreements with Chia to help develop efficient carbon markets.

It is obvious that blockchain technology and Web3 can significantly improve the carbon economy. It is likely that a significant amount of carbon market activity will occur on-chain over the next decade. This has the potential to greatly enhance the public perception of crypto, create awareness of the unique coordination and incentive mechanisms enabled by crypto, and bring more people into the industry.

Nansen’s Take

- ReFi Investment landscape:

- Infrastructure plays like Toucan are likely to perform very well.

- KlimaDAO is going nowhere and plans to greatly improve the quality of carbon credits in its treasury. Worth keeping an eye on.

- Regen has been around for years and has enormous ambitions. Its scope as both an infrastructure provider and marketplace means it is at risk of being stretched too thin and failing to achieve a competitive advantage in either. However, the team is highly regarded and if successful, it will be hugely valuable.

- Nascent projects like EDEN DAO are the most ‘risk on’ as they are not yet properly developed. However, the vision is very compelling and if executed correctly it will have an extremely positive impact.

- In general, very bullish on carbon credits - they are widely expected to rise in price over the coming years. Demand for offsets is expected to increase 10x over the next decade, making price rises highly likely.

Worth thinking about:

Carbon offsets are not created equally, and there is large variance in terms of quality - ranging from negligible impact to permanent carbon removal.

As higher quality offsets flood the market, older, lower quality carbon offsets that lack transparency will be rendered practically worthless.

Buying BCT carries more risk as they typically represent lower-quality carbon offsets – as stated above, many companies will not want to buy these due to the risk of being accused (fairly or unfairly) of greenwashing.

Higher quality offsets such as MCO2 and NCT (coming soon) are likely a better investment. Preventing deforestation and reforestation projects will always be important as forests are crucial to sustaining life on earth as we know it.

Long-term carbon removal offsets will be the most prized carbon asset and receive the greatest attention and investment as the climate crisis worsens. These will be very expensive in the short term. While they may be a good investment, caution should be taken in monitoring the situation as technology develops and long-term carbon removal projects scale and potentially become cheaper.