Introduction

Curve is among a number of well-established DeFi protocols commonly referred to as bluechips: these include Aave, Maker, Compound, and Uniswap. Of these, Maker demonstrated the potential for a native stablecoin to drive revenue for a protocol. As a result, Aave announced earlier this year that it will also launch a USD stablecoin called GHO. See Nansen’s report here covering GHO. This was shortly followed by rumours that Curve was going to enter the stablecoin game. While Aave’s stablecoin is similar in many respects to other overcollateralized stablecoins, Curve has taken a new approach which is described in this report.

Overview

- Unlike other borrow/lending protocols such as Aave and Maker, liquidations on Curve will not occur all at once. Instead, multiple liquidations occur as the collateral price moves through a specified liquidation range.

- Initially, the collateral used for crvUSD will be ETH. Due to the unique liquidation design that acts as collateral protection, the collateralization requirements for Curve are expected to be lower than traditional borrow/lending protocols. In fact, it may be possible to deposit ETH for a crvUSD loan at close to 100% collateralization ratio.

- Here is where things get interesting:

- When the ETH price falls within its specified liquidation range, it is swapped to crvUSD.

- When the ETH price rises back into the specified liquidation range, the crvUSD is swapped back to ETH collateral.

- This feature means that bad debt theoretically should not happen and collateral value is protected from large downward swings in ETH price, but leaves the borrower open to market-making costs.

Simply:

- When ETH is above the borrower’s specified liquidation range - collateral is in ETH.

- When ETH is below the borrower’s specified liquidation range - collateral is in crvUSD.

- When it is within the liquidation range, it is gradually swapped for crvUSD (if ETH price is falling) or crvUSD is swapped for ETH (if ETH price is rising).

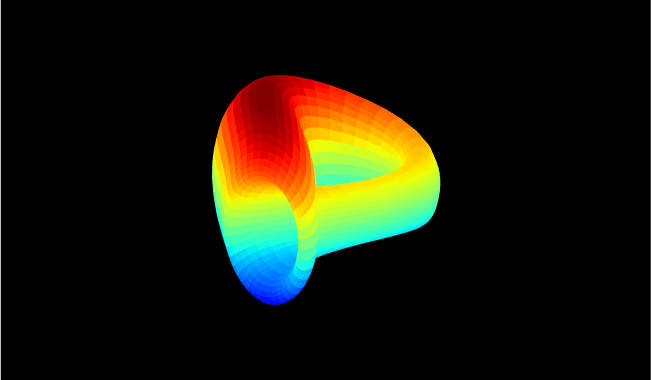

Let’s look at the graph below:

Source: crvUSD Whitepaper

Source: crvUSD Whitepaper

At a high level: The liquidation range is the black area on the graph. It is here where liquidations and deliquidations occur. The borrower chooses their liquidation range.

ETH Price Falls

- As the price moves down into the liquidation range, it starts to be swapped into crvUSD. It increasingly gets swapped to crvUSD as it moves down the liquidation range until it is entirely in crvUSD (when the ETH price is below the liquidation range).

Assume ETH is $1000, and the liquidation range is $800-900. John has deposited 1 ETH as collateral. Within the liquidation range are multiple price bands where liquidations occur. In this hypothetical example, there are 10 bands where liquidations occur.

- ETH falls into the liquidation range

- 1st Band: $890-$900: 0.1 ETH liquidated at $895

2nd Band: $880-890: 0.1 ETH liquidated at $885 ... ...

10th Band: $800-810: 0.1 ETH liquidated at $805

Therefore, ETH is liquidated as it moves down the specified liquidation range.

This model helps protect depositors from the downward price action of the collateral asset. Curve have stated that models (using data from Sept 2017 onwards) show that if a user deposits collateral for three days, during which the price subsequently falls by 10%, the user would incur a 1% loss rather than the 10%. This is because the collateral would be converted to crvUSD as it fell, meaning that the depositor avoids the scenario of making significant losses with volatile collateral (ETH).

ETH Price Rises (up through the liquidation range)

- Collateral gets ‘deliquidated’ - i.e. crvUSD gets swapped back to ETH. This is gradually swapped for ETH as it moves up the liquidation range until the price of ETH is outside the liquidation range and the collateral is now entirely ETH.

The crvUSD model leaves the borrower open to market-making costs during liquidation, as their collateral is continually swapped as it moves through the price bands.

LLAMMA: Lending-Liquidating AMM Algorithm

Liquidation/Deliquidation Liquidations and deliquidations are carried out by market participants. The LLAMMA operates in an opposite way to that of a typical AMM - it generates liquidity when the collateral price is moving downwards. This means that market participants should be able to receive better swap rates on Curve and then arbitrage on different platforms.

In this system, the price of ETH will be determined by the Curve tricrypto2 pool (comprised of USDT, ETH and WBTC).

Collateral Protection Curve’s design can provide collateral protection to the borrower and ensures that positions cannot get liquidated at a significant discount (as in typical borrow/lend protocols).

Where Losses Can Be Suffered With a system like this, collateral will increase in lockstep with spot if the price never falls into the specified liquidation range. Collateral loss will be incurred if the price fluctuates within the liquidation range, resulting in multiple liquidations and deliquidations. Collateral loss occurs during liquidations only.

Lower Risk of Bad Debt Typical borrow/lend protocols such as Maker have a minimum collateralization ratio. When the price of collateral falls below this level, it can be fully liquidated. However, there is a risk here that it may be liquidated at levels where it is undercollateralized.

Curve seeks to reduce this risk by having continuous liquidation within a specified liquidation range.

Market-Making Costs v Impermanent Loss

Impermanent Loss IL is somewhat of a misnomer as the losses incurred are typically permanent. As prices between two volatile assets change relative to each other, the (relatively) appreciating asset is sold for the depreciating asset, resulting in a loss when a position is closed compared to holding the assets in spot.

Market Making Cost With the Curve stablecoin, the opposite occurs. If the collateral is depreciating, it is sold for crvUSD (the relative appreciating asset), and if the collateral (ETH) is rising in price, crvUSD is sold to buy the appreciating ETH.

The risk and magnitude of the market-making costs incurred on Curve should generally be much less than that of the typical ‘impermanent loss’ seen with AMMs. One thing to watch out for: if the collateral regularly moves up and down within the liquidation range, this will result in collateral attrition due to the market-making costs (of getting liquidated at a slight discount to the rest of the market, and deliquidated at a slight premium to the rest of the market).

PegKeeper: An Automated Price Stabiliser

PegKeeper is a mint/burn mechanism to help maintain the USD peg of crvUSD. If the price of crvUSD rises above $1, additional crvUSD will be added to a single-sided liquidity pool to push down price. Conversely, if the price falls below $1, crvUSD will be burned. While ‘mint/burn mechanism’ may have connotations of UST, this is fundamentally different as it is a tool to help maintain the peg of an overcollateralized stablecoin.

Curve DAO will receive fees for stabilizing the peg.

Key Considerations

When participating with the Curve stablecoin - users need to be aware of:

- Market-making costs (arising from the automated liquidation/deliquidation)

- Slippage

- Gas

- Tax: The automated liquidation of ETH collateral could cause a taxable event, depending on your jurisdiction. However, this should be unlikely. It is similar to Uniswap v3 where the market swaps against an LPs position.

- As liquidation occurs over a number of price bands and not all at once, in the event of a full liquidation the user will lose more collateral than they would with a typical liquidation.

Flash Crash Collateral Protection: When ETH Dips and Rips

crvUSD is an especially good feature to guard against ETH dropping (causing a liquidation) and then subsequently mooning after you have been liquidated. With crvUSD, your ETH collateral would be swapped to crvUSD during the drop, and then swapped back to ETH again as the price moves up. This way you do not miss out on benefiting from the upward price action in this scenario. Of course, market making costs will be incurred from the liquidations and deliquidations.

Why Launch A Stablecoin?

The rationale for launching yet another stablecoin is likely:

- To attract liquidity to Curve

- An additional and potentially large revenue source for veCRV

- Increase trading volume

It is arguably necessary for Curve to launch a stablecoin to ensure there is sustainable revenue flow to the protocol, especially with the prospect of a prolonged bear market looming.

Is it objectively better than existing models? It is difficult to tell at this stage. While it offers some potential improvements such as reducing the likelihood of bad debt, it is not yet blatantly a superior stablecoin design. Its deployment and adoption will give a clearer answer to this. Nevertheless, it is an important development for the Curve ecosystem, and could become a key driver of revenue.

Audits

crvUSD is currently undergoing 3 audits from Chainsecurity, MixBytes, Peckshield.

crvUSD is an innovative design, and therefore may have some design issues / smart contract bugs that need to be addressed. Thorough audits are important, and when the system goes live it is important to exercise great caution if participating.

Conclusion

- crvUSD is potentially the most legitimate stablecoin innovation since Dai.

- It enables efficient liquidations and greatly reduces the risk of bad debt due to its liquidation design. It should offer great value to users that want to avoid the situation where a sharp dip in collateral price liquidates their position, causing them to miss out on a large upward movement in price shortly after.

- Borrowers should note the market making costs associated with liquidations, and that a total liquidation on Curve may be more expensive than a liquidation on another borrow/lending protocol due to the multiple liquidations along the liquidation range on Curve.

- The stablecoin should generate further revenue for Curve; interest payments will go to veCRV, and all price stabilizations lead to additional fees. If the stablecoin kicks off, it could drive strong fundamental value to the Curve protocol.

- It will be interesting to see how it plays out in practice. Like all new protocols, it will carry significant risk. Will the design work as intended? Will any unanticipated negative outcomes arise? Only time in the market will reveal if its mechanism is durable.