Introduction

Eclipse is a new L2 on Ethereum that launched their mainnet back in November 2024. Eclipse benefits from the best of both worlds: the speed/performance of Solana and the liquidity and security of the Ethereum and broader EVM ecosystem. We wrote a quick report covering the general fundamentals of Eclipse as well as early bridging metrics here, but much has happened since. In just a few months, they have seen an exponential rise in new users, liquidity, applications deployed, scalability, and easier onboarding solutions.

Setting the Scene

Eclipse has many tailwinds going for it, sitting at the center of many exciting narratives today. It simply is “Solana but on Ethereum”. It is the first time that SVM apps and the performance of the Solana Virtual Machine (SVM) can be deployed for a purpose built L2 that benefits from the entire L2 stack. We are already seeing this play out with popular Solana DEXs such as Orca having migrated over.

Eclipse is positioned to bridge the scaling tradeoffs between Ethereum and Solana, blending the strengths of both ecosystems. By leveraging Ethereum’s security and liquidity with Solana’s high-speed execution, Eclipse minimizes compromises that typically exist when choosing one ecosystem over the other. The incentives at play are creating strong momentum, making Eclipse one of the most promising L2s today. In the sections below, we’ll break down the key factors driving our excitement – including compelling narratives, onchain performance, and the broader incentive structures, such as potential airdrops.

Narratives

- Eclipse touches most of the hot narratives today. It is a highly performant chain (i.e Solana/Hyperliquid), an L2 that benefits from the advancements in L2 scaling/interoperability, benefits from modularity ecosystems (i.e Celestia) and it is the cross section of long term scaling between the Solana and Ethereum roadmaps (i.e performance/scalability of SVM and the security/decentralization of L2s.).

- This is the first time SVM apps can port over to an L2 and benefit from the liquidity of Ethereum. We have already seen apps like Orca deploy on Eclipse with over $11m in liquidity already (compared to $328m on Solana) as of January 8th.

- In short, the scalability of SVM meets modularity and liquidity.

Onchain Metrics

Outside of the more qualitative reasons to start looking at Eclipse, we have seen an impressive growth in onchain metrics. So far we have seen:

- Over 1.7b total transactions since inception

- Over 435k unique wallets on Eclipse

- Median Fee: $0.00018

- TVL crossed $162m

- More than 35 live apps and 65 infrastructure tools

- 7,460 TPS in production and 114M transactions in a 24 hour period on mainnet.

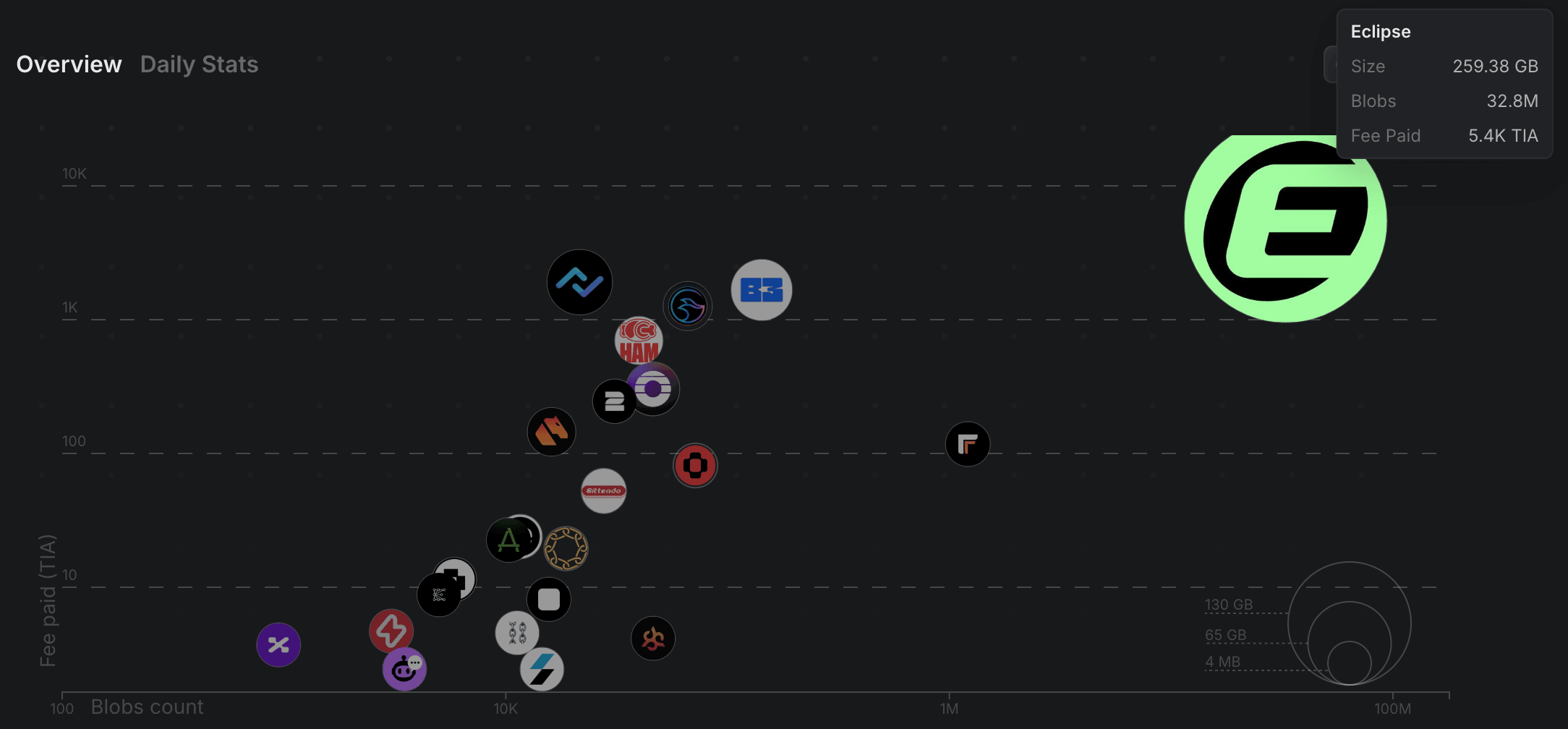

- Largest rollup user of Celestia data

As for TVL data, Eclipse surpassed $162m in the ecosystem according to their official dashboard. As for where the TVL is parked, we do not have a complete breakdown but have a general birds eye view. In it, we see the top DEXs and lending platforms account for $~28m of TVL (just 17% of capital). Note this only covers the top few apps in these verticals so we may be missing a few of the long tail apps by TVL. However, this suggests that much of the capital is simply sitting idle.

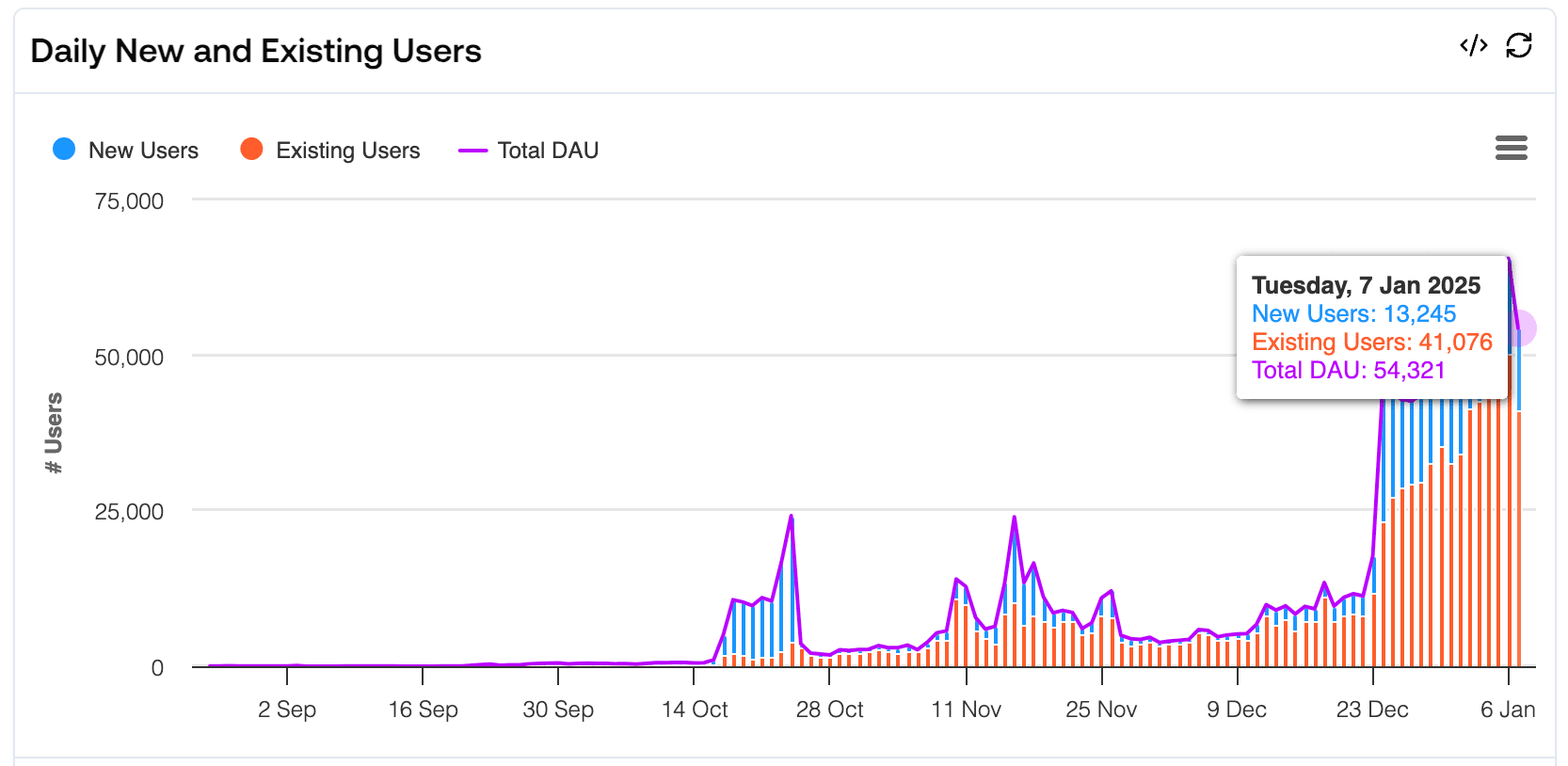

Finally, we can see a glimpse of who is transacting onchain and what they are doing.

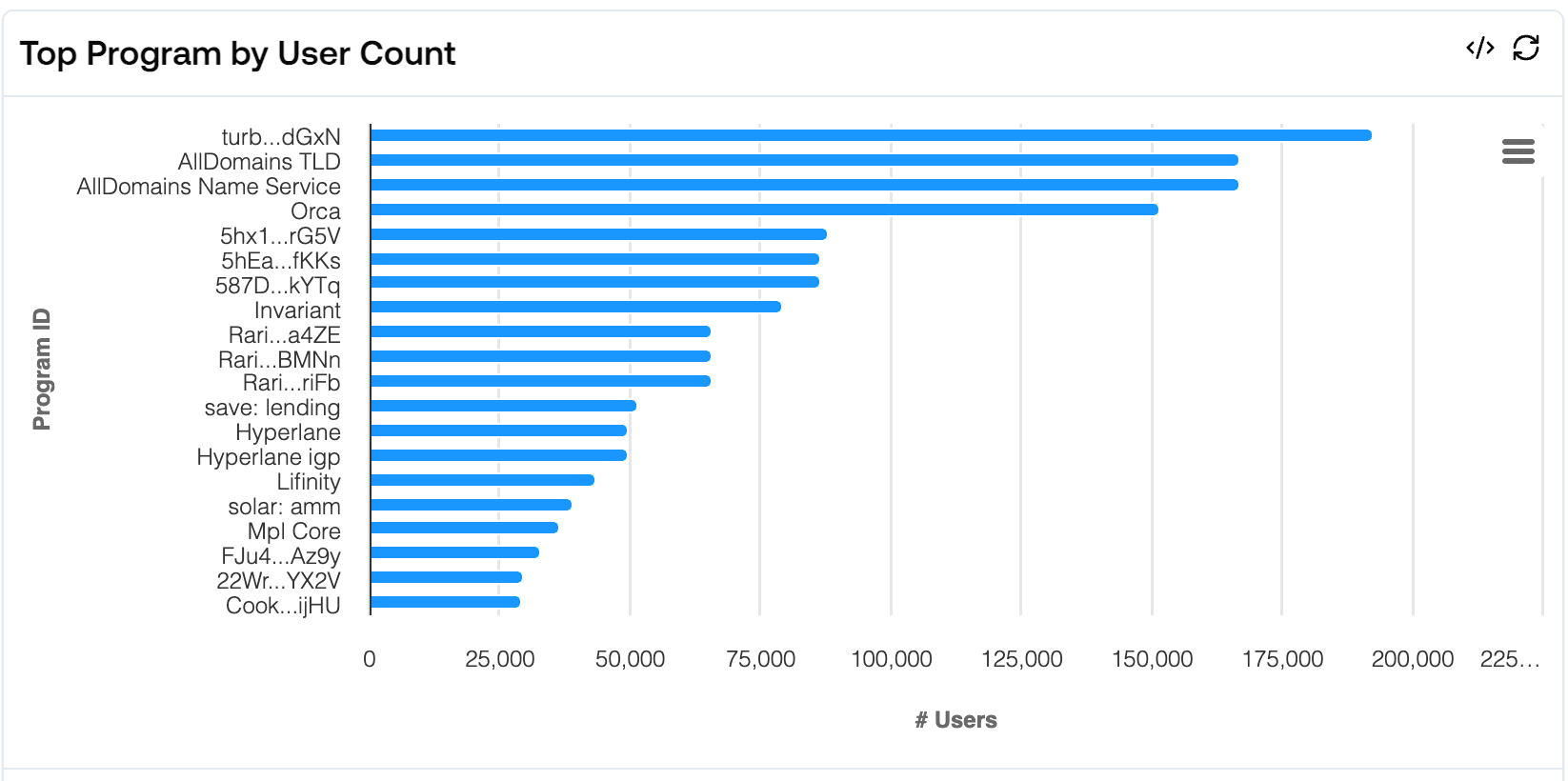

From the total numbers, we can see that being an active user elevates you from the masses, with 54k total daily active users. As for what these users are doing, we can look below to see the top programs by user count:

The top programs include Turbo Tap, All Domains and Orca. We will cover these a bit more later on and what else you can do to diversify activity across a number of programs/counterparties.

Soft Factors

Given the current trending bull market, airdrops tend to be more favorable to launch given the speculation on relative valuations. Given the success of airdrops like FUEL and more notably, HYPE from Hyperliquid, we are seeing that community-focused airdrops that reward early users is a rising meta. Additionally, we are also seeing validation of this community focused alignment on the venture front as well with the likes of Megaeth opening a round to Echo participants at the same valuation and equity of seed investors.

Given Eclipse raised $65m from VCs earlier in the year and the fact they are an L2, it is likely they will eventually have a token for a variety of reasons and that early participants stand to gain.

Underfarmed

- Relative to other major L2s without tokens, Eclipse seems to be under-farmed based on number of users and how early it is. Also given it is not EVM based, many of the bot/sybil farms are not easily “plug and play” with Eclipse as it would be with a new EVM-based L2 out the door. Of course, there will still be many farmers and sybils.

- Most users will need a new wallet, Backpack, to get started, as Phantom is not supported at the time of writing.

Points Program

- Points are usually the precursor to a token, especially given the context that it will eventually need a token to decentralize and we have a wealth of examples of L2s who have already did this (i.e ARB, ZK, OP, etc.)

- Assuming the premise of a points program launching soon and that they will retroactively reward early users (especially given recent HYPE airdrop success), we can assume it is a good time to get started.

- There have already been some hints of this points program given their terms of service. In it, we see the following: “Eclipse may enable you to participate in a limited program that rewards users for interacting with the Service (“Turbo Tap”) by allocating such users with rewards that bear no cash or monetary value and are made available by Eclipse…”. Additionally, we read on to see “ GRASS HAS NO CASH VALUE. GRASS IS NON-TRANSFERABLE.”

- In short, both the official documentation, incentives and recent examples of L2s launching tokens/points programs leads us to believe that a points program is near.

Similar Tooling

- Easy to view block explorer that is the same as Solana (it is also built by Solscan) but gas fees are paid in ETH (not SOL).

- Solana users can onboard using Backpack (also Solana compatible).

Accessible

- Fees are paid in ETH so if you have idle ETH, it is easy to move around via Hyperlane and get started playing around on Eclipse immediately given it is the gas token.

- Median fees are well below $0.01 so it is much cheaper than most L2s people use today.

Given the narratives, onchain momentum and soft factors involved with Eclipse, lets dive into how you can get involved today.

What to Farm?

For a comprehensive overview of the ecosystem, you can check out their official page here as well as this tweet thread outlining potential user workflows. Below, we will create a more bite sized version so you can hit the ground running with the most impact.

tETH

- tETH is a unified restaking token that allows users to deposit LRTs to earn restaked yield on Eclipse. tETH is an index of LRT tokens such as eETH, ezETH, rswETH, steakETH, and pufETH.

- You can use tETH productively throughout DEXs and lending protocols on Eclipse. At the same time, you are still earning the native restaking yield on top of what you are doing within Eclipse.

- In short, tETH provides ETH exposure, yield within Eclipse (i.e LPing on Orca), LRT yield and diversification, and potentially a couple airdrops via native Eclipse apps running points programs already. And to top it off, it also creates organic activity on Eclipse for if they run an airdrop.

Bridging

Since the previous report, it is now more accessible to bridge to Eclipse. Of course, there remains the bridge from mainnet but now users can transfer over assets via Hyperlane, Relay, Gas.zip and Owlto. The diversity of bridges makes it much easier as you can bridge assets over from other chains for a fraction of the cost of the mainnet bridge.

DeFi Apps

Of the 35+ app already deployed, many of them are DeFi apps. We will highlight some of the top used protocols under their respective categories or those currently live and offering points programs.

DEXs/Derivatives

- Orca

- Swap and LP in some of the pools. The top pools are tETH/ETH, ETH/USDC, SOL/ETH and SOL/USDC. There are other smaller pools as well with much less TVL and volumes.

- For LPs, you can either deposit across the full range or you can do a more custom liquidity range. Of course, there lies risk of impermanent loss (IL) when LPing.

- Invariant

- Is a concentrated liquidity AMM that is offering a points program. It is currently incentivizing the USDC/ETH and tETH/ETH pools which are yielding 58% and 6% APR respectively at the time of writing for LPs.

- Orca

- Lending

- Save

- Save is the rebrand of Solend and is the leading lending protocol with $8.5m of deposits and nearly ~$1m borrowed.

- Users can deposit their SOL, ETH, tETH or USDC. The yields are quite low at the moment but it is a good way to further put your assets to work, particularly tETH given it is layered yield on top of what was mentioned above.

- There are other lending protocols such as Astrol Finance and EnsoFi but Save is currently the main one as measured by TVL.

- Save

- Prediction Markets

- Polymarket<>Skate

- You can trade prediction markets on Polymarket through Skate on Eclipse.

- Sharp Trade

- Is an options and prediction market platform. The options are relatively new and offer P2P 7-day American style options. The prediction markets allow speculation down to the minute candle of popular tokens like SOL. Of course, this is very new and quite ‘degen’ so do exercise caution.

- Polymarket<>Skate

Other Notable Platforms

- Domains

- Alldomains

- Domain platform on Eclipse with 173k+ domains registered already. You can register your domain and start earning points. Given you have to link a Twitter account, it adds a bit of ‘sybil resistance’ which can help differentiate from the masses.

- They also have a bridge, which can be used when moving across Solana<>Eclipse.

- Alldomains

- NFTs

- NFT Platforms and Collections

- Scope

- Top marketplace and launchpad for NFTs.

- The top collection is ASC, whose floor is over 0.57 ETH at the time of writing. Other top collections include Validators and Solar Companions at the time of writing.

- Scope

- NFT Platforms and Collections

- Consumer Apps

- Turbo Tap

- Requires an invite code but manually execute transactions to help stress test the network, and serves as an easy way to increase transaction count.

- Although this increases transaction count, it often is only one area that previous airdrops have taken into account historically. Given there are 200k+ Discord users, this might get crowded as more people play with it.

- Send Arcade

- Arcade games on Eclipse to play such as snakes and ladders.

- These are just a few of the games available but there are many to play around with.

- Turbo Tap

Given that recent (larger) airdrops have strived away from the default of "more wallets is better" and went more towards the volume / points / TVL route, it is important to take a diversified approach, rather than over indexing on any one metric (i.e Turbo Taps) across the maximum number of wallets. Given this, combined with the 200k+ of Discord users, Twitter following and such, it is key to stand out from the masses. Although the average bridging size per wallet is $848.5 and the canonical bridge (from mainnet) was $371, it is likely good measure to bridge over a few hundred $ to stand out, while also putting them to work. The average of ~$609 doesn't reflect the typical Eclipse user because it's skewed by a few whales. You can still be in the top XYZ% of users despite the average being misleading.

Further, given that gas fees are paid in ETH and the most liquid assets on Eclipse are the majors (SOL/ETH), an LRT(tETH) and stablecoins, there are some options that allow you to bridge over while maintaining the same spot positioning of your current portfolio.