Overview

Mantle is an Ethereum Layer 2 scaling solution that combines optimistic rollup technology with a modular architecture to deliver high throughput, low transaction costs, and enhanced capital efficiency. Built on the OP Stack, Mantle leverages a sequencer and innovative data availability solutions to provide a scalable foundation for decentralized applications. The network has positioned itself as infrastructure for real-world assets (RWA) and institutional finance, with a focus on tokenization services and distribution channels connecting traditional finance with onchain liquidity.

Q4 2025 marked a strategic pivot for Mantle as the network officially shifted from a general-purpose Layer 2 to specialized infrastructure for RWA and institutional finance. The quarter witnessed significant milestones including the "all-in RWA" strategy announcement at Token2049 SG, the first CEX-related chain support for USDT0, the launch of the UR super-app, and the successful transition to a ZK Validity Rollup using Succinct's SP1 technology. These developments, combined with strong ecosystem growth including DeFi TVL reaching a Q4 peak of $461M and stablecoin supply growing to $825M, demonstrate Mantle's evolution into a specialized infrastructure layer for institutional-grade tokenized assets.

Outside of upgrades, MNT reached a new ATH of $2.86 in early October 2025. The circulating market cap reached ~$8.7 billion in October, placing MNT among the top 30 cryptocurrencies by market cap. Among layer 2 tokens, MNT leads by market cap, closing 2025 over $3B, highlighting increasing differentiation within the L2 landscape. While the broader market faced uncertainty in December with BTC dipping, MNT remained a top performer among the top 50 assets, outperforming Bitcoin during several weekly intervals in late Q4.

Key Developments: Q4 2025

- Mantle officially shifted its positioning from a general-purpose Layer 2 to a specialized infrastructure for RWA and institutional finance. At Token2049 SG, Mantle publicly articulated an "all-in RWA" strategy alongside World Liberty Finance, signaling a deliberate pivot from general L2 competition toward RWA-native infrastructure by providing TaaS (Tokenization as a Service) which focuses on issuers, asset managers, and institutions. Mantle's intent is to act as a distribution and liquidity layer, rather than a standalone issuance chain.

- Mantle partnered with Bybit to launch Mantle vault to earn competitive onchain yield.

- Mantle became the first CEX-related chain to support USDT0, reinforcing its role as a stable, institution-friendly settlement layer for tokenized assets and strengthening Mantle's suitability for RWA settlement, yield distribution, and capital rotation.

- The deployment of QCDT on Mantle demonstrates Mantle's readiness for regulated, yield-bearing real-world assets and validates infrastructure assumptions around custody, settlement, and composability.

- In October 2025, UR, a blockchain-native "super-app" built on Mantle Network and designed to unify fiat and crypto, was launched. It serves as a gateway for payments, multi-currency asset management, and delivers onchain banking infrastructure that allows for the seamless movement of money across borders.

- Mantle successfully transitioned to a ZK Validity Rollup using Succinct's SP1 technology on the OP Stack. This upgrade aims to reduce withdrawal finality from 7 days to 1 hour, significantly improving capital efficiency.

- The network continues to leverage a modular stack and is focusing on the development of "RETH" and "REVM". The adoption of RETH and REVM is driven by multiple performance optimization considerations, including execution efficiency, storage, and related system-level improvements which boost execution performance dramatically.

Ecosystem

DeFi

- DeFi TVL on Mantle grew from $242M to a Q4 peak of $461M (+90.5%), before closing the quarter at $333M, representing a net QoQ increase of 37.6% and a peak retention rate of approximately 72%.

- Stablecoin TVL on Mantle increased from $389M in January to a December ATH of $825M (+112.1%), before closing Q4 at $669M, retaining approximately 81% of peak liquidity. Top TVL dApps include MI4, Merchant Moe, and TreeHouse.

- MNT utility expanded from token to network operating asset, with integration with Bybit reaching a "platform-level" stage. MNT is now used for trading fee discounts, VIP programs, and institutional products. In December 2025, Bybit reported processing $172.8B in Mantle-related trading volume.

- Mantle advanced its role as a distribution layer for RWAs, combining asset issuer partnerships with liquidity and access channels. This included integrations with Ondo Finance (USDY), Securitize, and Backed / xStocks, alongside regulated custody support from Anchorage Digital for MNT.

- A three-way partnership with Aave and Bybit leverages Bybit's exchange infrastructure as a liquidity bridge, enabling faster lending markets and deeper pools on Mantle.

- The $SCOR dual listing on Bybit Spot and one of Mantle’s native DEXs generated Mantle's first major onchain activity surge from a new token in nearly a year, driven by retail participation and arbitrage flows, highlighting the effectiveness of the CeDeFi expansion model in converting exchange liquidity into onchain volume, powering a more unified liquidity across both the centralized and decentralized ecosystems.

Enterprise and RWAs

- Mantle's "all-in RWA" strategy positions the network as specialized infrastructure for real-world assets and institutional finance, providing TaaS focused on issuers, asset managers, and institutions.

- The network deepened its role as a distribution layer, connecting traditional finance with onchain liquidity. This included integration with Mastercard and the expansion of the Mantle Index Four (MI4), a $400M tokenized fund.

Community & Builder Initiatives

- Mantle Global Hackathon 2025-2026 launched in late Q4, surpassing 2039+ registrations by December. With a strong focus on RWA as a core track, alongside AI and DeFi, the program was designed to seed RWA-native applications and institutional-grade use cases, while providing builders with direct exposure to the Mantle community and ecosystem stakeholders.

- As of January 15, 2026, the Mantle Hackathon has received 277 project submissions and is on track to surpass 350. It is poised to set a new record as the largest online Web3 hackathon by participant count in 2025.

- The RWA Scholars Program, is designed to empower content creators to amplify Mantle’s RWA-focused narrative and strategy while educating the community. Through this initiative, Mantle sponsored individual content creators called Mantle Scholars to join CCCC (Crypto Content Creator Campus) in November in Lisbon, giving creators the opportunity to connect directly with the Mantle team and core community voices so they can better understand, experience, and help spread Mantle’s vision for RWA to a broader audience.

Onchain Data

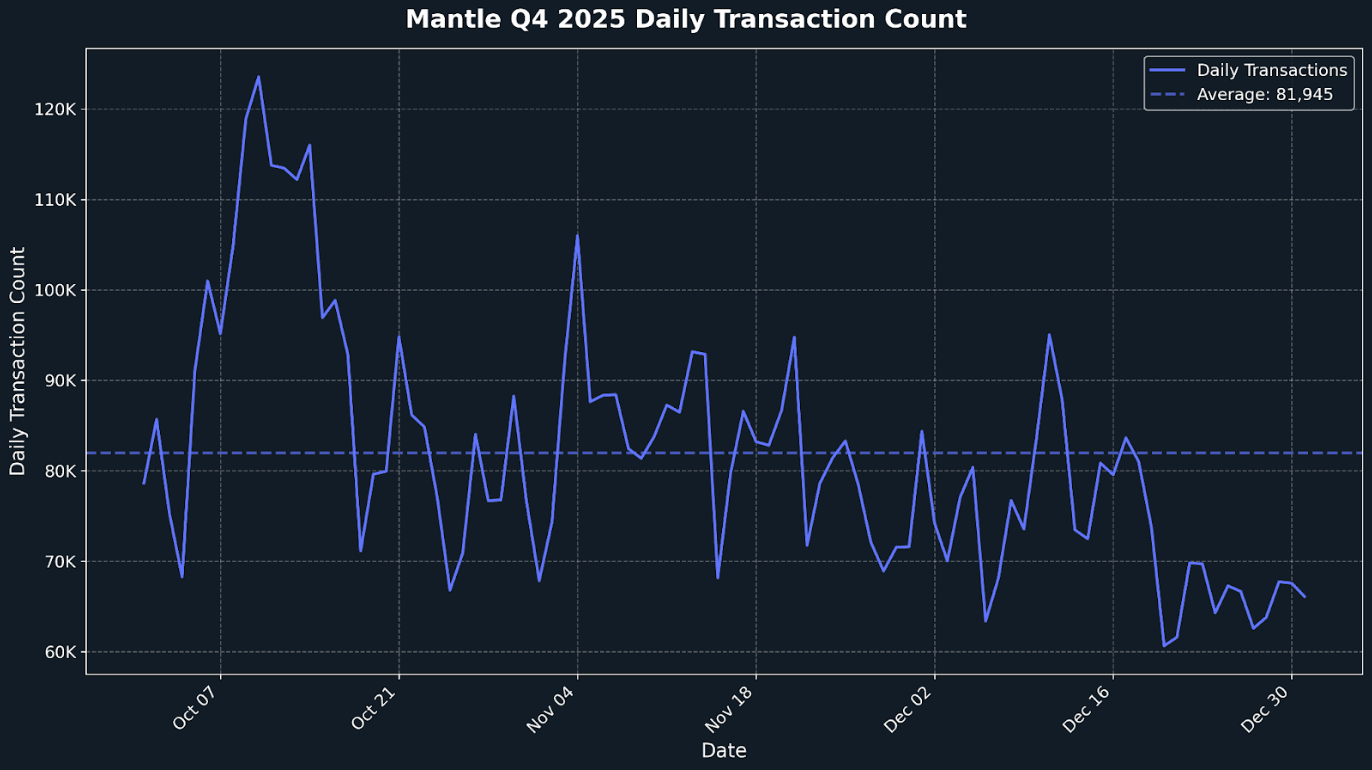

Daily Transactions

Mantle demonstrated steady transactional throughput across Q4 2025, with consistent activity reflecting broad protocol usage and ongoing dApp engagement. Transaction volumes showed resilience throughout the quarter, with daily transactions averaging approximately 80,000-85,000 and peaks reaching over 120,000 transactions per day. The quarter began with strong activity in early October, with daily transactions consistently above 100,000 through mid-October, before stabilizing around 70,000-90,000 transactions per day for the remainder of the quarter. Notable activity spikes occurred in early October, mid-November, and early December, coinciding with key ecosystem developments including the UR app launch, the $SCOR dual listing on Bybit Spot and Mantle DEXs, and continued RWA infrastructure expansion. The consistent transaction volumes throughout the quarter, combined with the network's transition to a ZK Validity Rollup, demonstrate Mantle's capacity to handle institutional-grade workloads while maintaining low costs and improved capital efficiency.

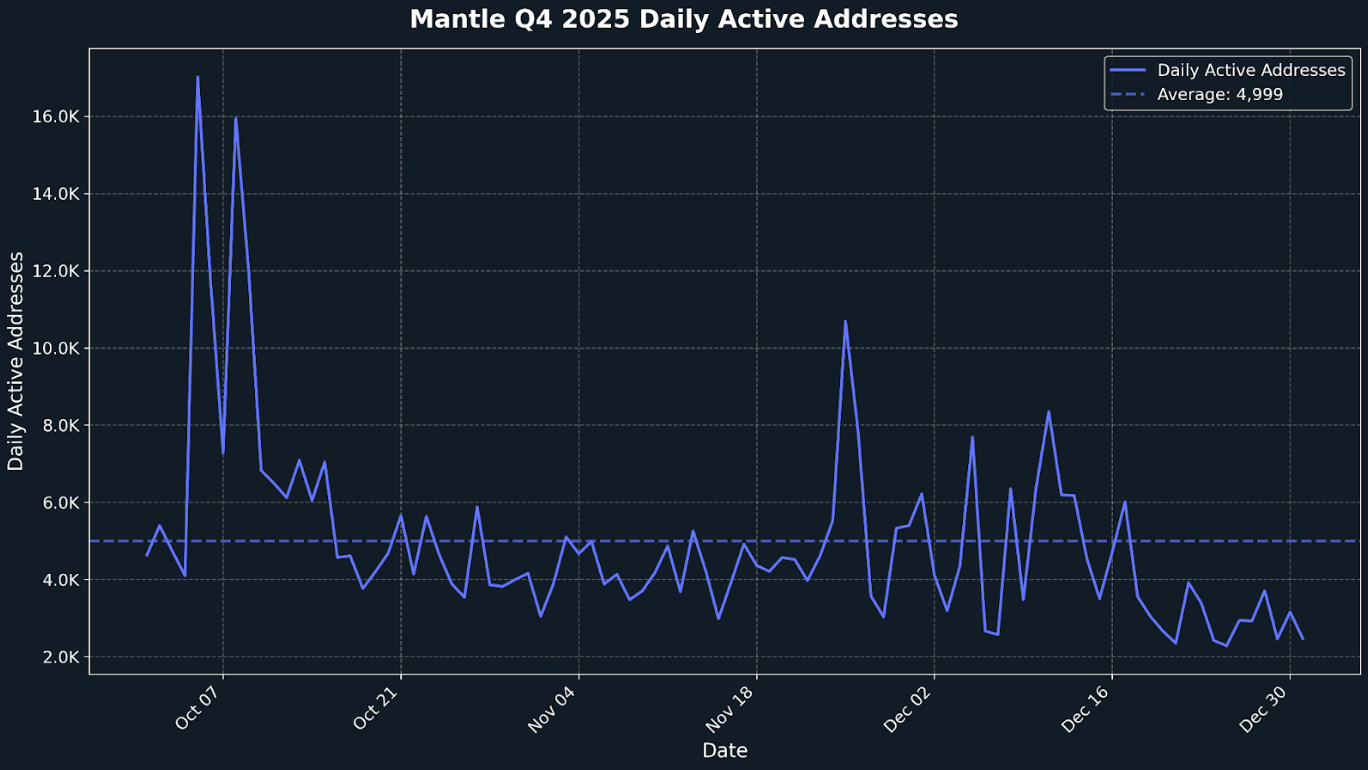

Daily Active Addresses

Mantle maintained a consistent base of active addresses throughout Q4 2025, with periodic spikes reflecting sustained engagement across ecosystem initiatives and protocol launches. Activity trends showed resilience throughout the quarter, with daily active addresses averaging approximately 5,000-6,000 and peaks reaching over 17,000 addresses. The quarter began with notable activity spikes in early October, including a peak of 17,021 active addresses on October 5, coinciding with the UR app launch and continued RWA infrastructure expansion. Activity levels remained strong across the quarter, with periodic surges in late October, mid-November (reaching 10,689 active addresses on November 25), and early December (reaching 8,352 active addresses on December 11). These activity spikes demonstrate growing user engagement across diverse use cases, from DeFi protocols and stablecoin usage to RWA tokenization and institutional settlement. The consistent user base reflects Mantle's expanding appeal as specialized infrastructure for institutional finance, with integrations from Bybit, Aave, Ondo Finance, and Mastercard bringing institutional-grade tokenization and distribution capabilities to the network.

Top Entities by Users and Transactions

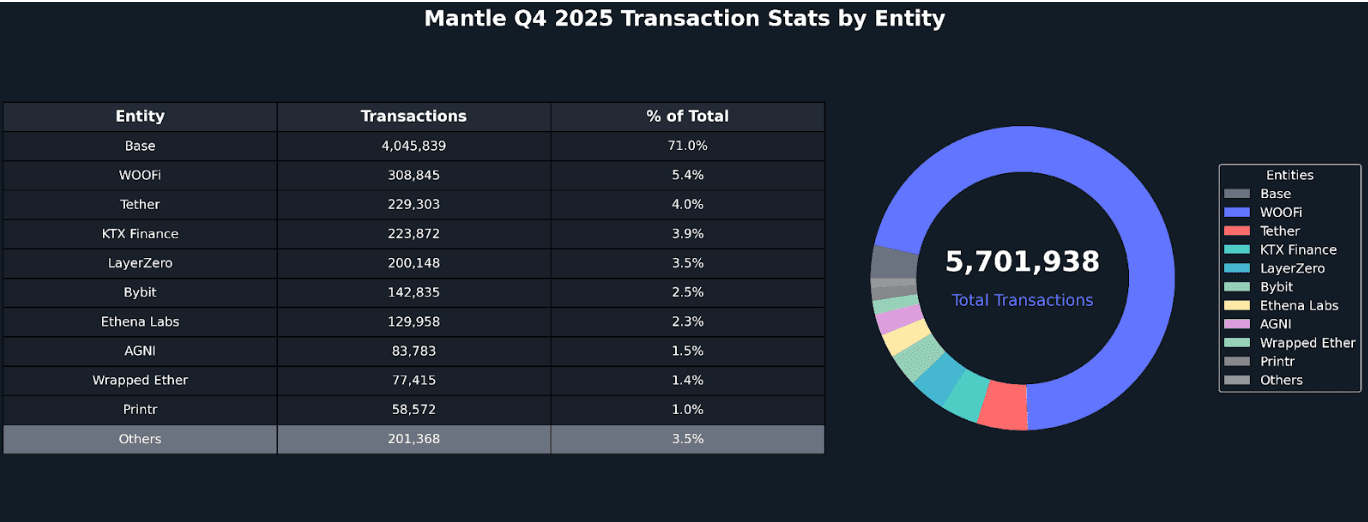

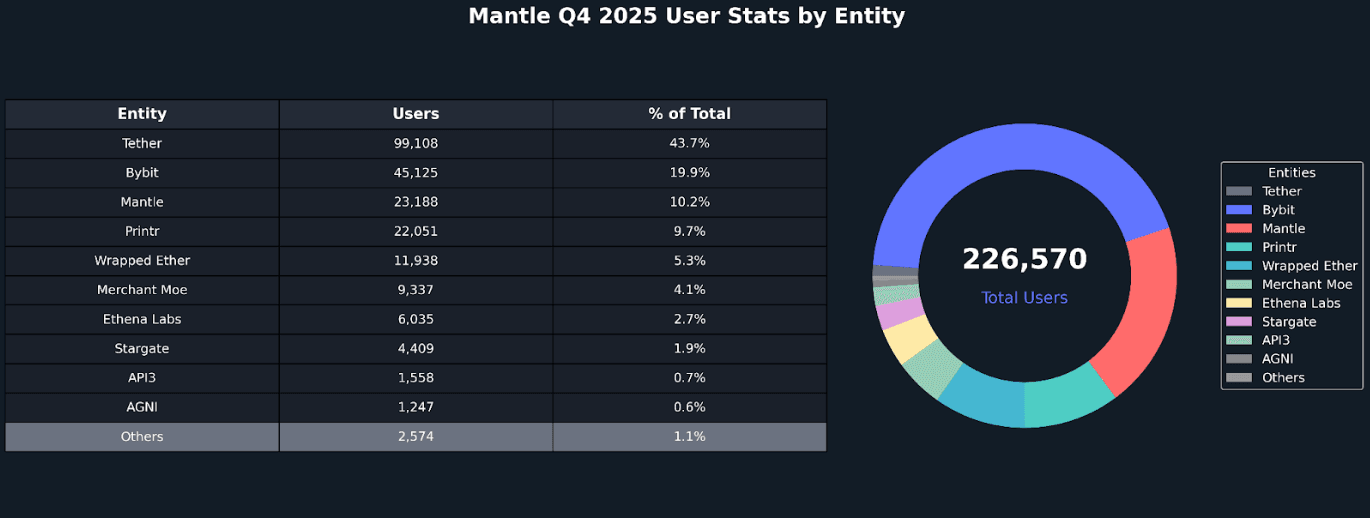

Mantle's top entities by users and transactions highlight a well-rounded ecosystem anchored by infrastructure, DEX protocols, and stablecoin usage. Base led transaction volume with 4.05 million transactions, representing minimal change (0.03% growth) compared to Q3 2025, while maintaining 948 users. WOOFi, a DEX entity, ranked second with 308,845 transactions (26.75% growth quarter-over-quarter) and 270 users, demonstrating strong DeFi engagement. Tether accounted for 229,303 transactions (46.56% decrease) and 99,108 users (37.57% decrease), reflecting stablecoin activity on the network. KTX Finance, another DEX entity, ranked fourth with 223,872 transactions (21.66% growth) and 474 users, while LayerZero rounded out the top infrastructure entities with 200,148 transactions (8.04% growth) and 317 users. On the user side, Tether dominated with 99,108 users, followed by Bybit with 45,125 users (20.35% decrease), demonstrating strong exchange and stablecoin adoption on Mantle. Printr, a new entity in Q4, accounted for 22,051 users, while native Mantle infrastructure accounted for 23,188 users (45.83% decrease). The distribution reflects Mantle's growing utility across infrastructure, DeFi protocols, stablecoin usage, and exchange integrations, with the network serving as critical infrastructure for RWA settlement, yield distribution, and capital rotation.

Closing Thoughts

Q4 2025 has reaffirmed Mantle's strategic pivot toward specialized infrastructure for RWA and institutional finance, with the network officially shifting from a general-purpose Layer 2 to a focused platform for tokenization services and distribution channels. From the "all-in RWA" strategy announcement to the first CEX-related chain support for USDT0, the UR super-app launch, and the transition to a ZK Validity Rollup, Mantle demonstrates its ability to serve institutional-grade tokenized assets. The network's onchain metrics reflect strong ecosystem engagement, with consistent transaction volumes averaging 80,000-85,000 daily transactions and active addresses averaging 5,000-6,000 daily throughout the quarter.

With the ZK Validity Rollup transition complete, USDT0 support live, and the "all-in RWA" strategy in full execution, Mantle enters 2026 well-positioned to serve as critical infrastructure for the institutional adoption of blockchain technology. The network's combination of Layer 2 scalability, improved capital efficiency through ZK proofs, and specialized RWA infrastructure provides a strong foundation for issuers, asset managers, and institutions seeking to tokenize real-world assets and access onchain liquidity through Mantle's distribution and settlement infrastructure.