TLDR

- Goldfinch is expanding the scope of DeFi by enabling real-world businesses to access on-chain liquidity.

- The benefits of integrating DeFi and lending to real-world businesses include the efficiencies of DeFi and smart contracts, immutable on-chain credit records, and transparent financial activity.

- Goldfinch is building an infrastructure that matches credit risk assessors, borrowers and lenders. Its focus is on providing funding to fintech and credit firms in emerging markets. It is a prime example of the potential for DeFi to provide funding to underserved but worthy businesses that are unrelated to crypto.

- All Goldfinch loans are overcollateralized by off-chain assets.

- While Goldfinch has the potential to take DeFi to the next level, its loans carry greater risk than overcollateralized protocols such as Aave and Compound.

- Goldfinch loans introduce default risk. Although loans are overcollateralized off-chain, enforcement of these rights and liquidations may still take a long time to reimburse lenders.

- LPs must rely on the quality of due diligence conducted by Goldfinch (and Backers) regarding the safety of the lending pool.

- Any default on Goldfinch will impact all Senior Pool LPs.

- Withdrawing liquidity from Goldfinch pools is dependent on the amount of liquidity available in the pools, meaning lenders may not be able to access liquidity when they require it.

- This additional risk is compensated with higher APYs derived from businesses with little exposure to cryptomarkets. ## Goldfinch

Goldfinch is a DeFi credit protocol based on Ethereum. It has focused on emerging market borrowers who have demonstrated strong creditworthiness but are underserved financially. Borrowers are typically lenders with between 2-10 year track records of deploying capital. Goldfinch has issued ~$102m of capital so far at the time of writing.

At present, all loans on Goldfinch are fully collateralized with off-chain assets rather than crypto. This opens up far greater efficiencies and utility for DeFi by tapping into the enormous value of real-world assets. It is a common misconception that these loans are uncollateralized due to the lack of on-chain collateral. Loans are tied to real-world legal structures.

- Goldfinch operates by extending credit lines to lending businesses. These businesses receive USDC, exchange it for fiat and deploy it in their local markets.

Examples include:

- LendEast (South East Asia and India)

- Addem Capital (Mexico)

- Greenway through Almavest (India), and

- Cauris (Africa, Asia, and Latin America)

Below is a chart that shows the countries that Goldfinch-sourced capital has been deployed:

Goldfinch is looking to develop a “trust through consensus” model whereby borrowers can demonstrate creditworthiness to the collective assessment of other participants which can then trigger the automatic allocation of capital to such borrowers. “Trust through consensus” is yet to be fully implemented, as there are many complexities in building a robust platform for financing real-world assets in DeFi, requiring careful progression. Of course, it remains to be seen whether ‘trust though consensus’ can work effectively in practice.

At present, KYC is required to participate in Goldfinch’s pools, and US-based persons are not eligible to participate (except accredited investors). Goldfinch has received a total of $37m in funding, with its last round in January 2022 led by a16z.

| Key terms | Definition |

|---|---|

| GFI | GFI is Goldfinch’s governance and utility token. |

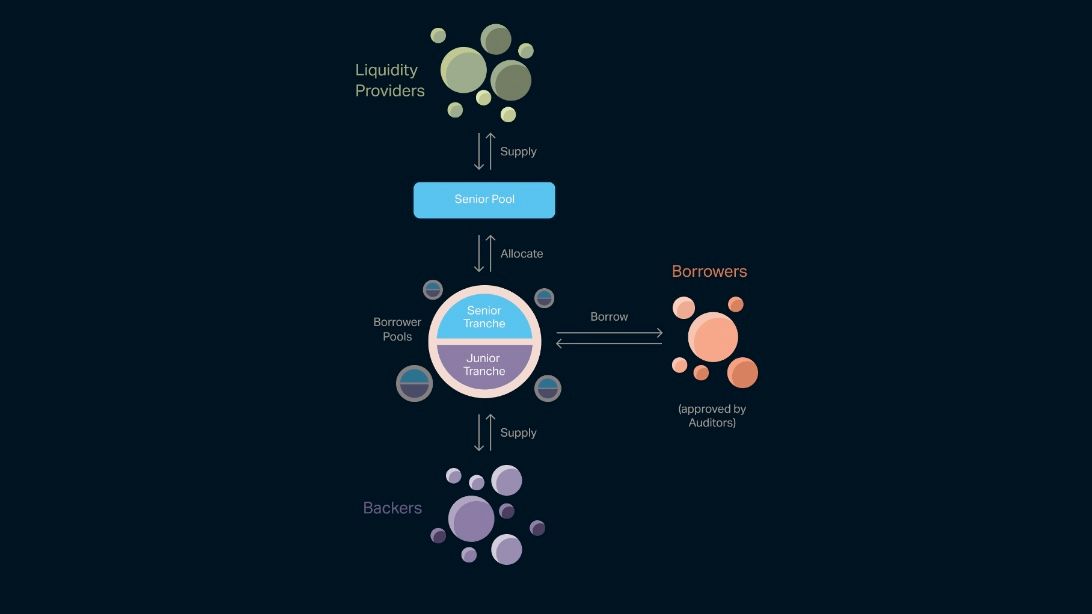

| Senior Pool | LPs contribute capital to the Senior Pool to earn passive yield from Goldfinch’s pools. The Senior Pool is a smart contract that allocates capital to the senior tranches of Borrower Pools, in accordance with Goldfinch’s Leverage Model. |

| Leverage Model | The way in which the Senior Pool automatically determines how much capital to allocate to the senior tranche of each Borrower Pool. |

| FIDU | FIDU is an ERC-20 issued to Senior Pool LPs that can be redeemed for USDC at an exchange rate based on the net asset value of the Senior Pool (with a 0.5% withdrawal fee). It is analogous to Compound’s cTokens whereby it increases in value as interest is paid (but decreases in value in the event of a writedown). |

| Borrowers | Real-world lenders seeking to access DeFi liquidity. Goldfinch’s borrowers are credit funds and fintechs, primarily in emerging markets |

| LPs | LPs provide liquidity in the form of USDC to the Senior Pool which automatically allocates investment across pools in order to earn yield. |

| Auditors | GFI stakers that are randomly selected to approve borrowers in order to guard against malicious activity. This is a human-level check to confirm that the borrowers are legitimate. The Auditor system is not in place yet. |

| Backers | Assess Borrower Pools. Provide first-loss capital directly to specific pools based on their assessment. |

How It Works

Borrowers

- Goldfinch’s current borrower profile is credit funds (of which there is an additional layer of underwriting end-deals) or well-known fintechs.

- Borrowers propose Borrower Pools which are currently assessed by Goldfinch. This states the terms the borrower seeks e.g. interest rate and repayment terms.

- If Goldfinch approves a borrower, they are then subject to the assessment of Backers who must make the independent decision of providing first-loss capital to the pool. The Senior Pool then allocates capital to these pools in accordance with the Leverage Model.

- In the future, Goldfinch seeks to transition to a model where ‘Lead Backers’ will propose Borrower Pools that will be subject to the collective assessment of backers in accordance with the ‘trust through consensus’ vision.

- Additionally, Borrowers will be required to stake GFI (of undefined value) which will be redeemed when the loan is repaid. If auditors do not approve the Borrower, the entire stake is slashed.

- This is to ensure that only serious borrowers will apply for a Borrower Pool.

- Goldfinch currently arranges corresponding off-chain legal documents for all on-chain deals. This is to ensure that recourse is achievable and agreements are enforceable. For example, when a Borrower Pool is filled, a script of the Backer's names/countries/email addresses is auto-generated and included in the loan agreement. Agreements also include clauses for borrowers to communicate with backers on an ongoing basis regarding the status of the loan.

- This is necessary to ensure a degree of certainty that the loans are legitimate and will be repaid.

- In the future, it is highly likely that Backers will require an agreement with Borrowers before supplying capital. This will be important for confidence in providing loans to the Goldfinch platform.

- Backers will rationally require such an agreement to be in effect, either with them directly or with another Backer, in order to be willing to supply capital. It is highly unlikely that a large number of backers will supply capital to a borrower without legal recourse in place. However, while supported, these agreements are not explicitly required at the base protocol level.

Backers

At a high level, Backers assess Borrower Pools and provide first-loss capital to approved pools.

Unlike Pool Delegates in Maple, Backers do not need credit underwriting experience to invest in pools, and only need to pass KYC checks. As Goldfinch grows, it is likely that "Lead Backers" (e.g. participants who bring borrowers to the protocol and vouch for them by investing in the Backer Pools) will need to be able to show that they have experience underwriting deals.

Financing the Junior Tranche Backers fund the junior tranche. This acts as a first-loss buffer in the event of a default and is designed to align the interests of Backers and LPs by incentivising backers to only approve loans with a high probability of repayment. Due to this additional risk, 20% of the yield that would otherwise be allocated to the senior tranche is reallocated to the junior tranche to compensate Backers.

Backers can withdraw liquidity whenever interest/principal payments come in and are not subject to a withdrawal fee.

Note that US-based persons are excluded from participating as a Backer (except accredited investors).

Leverage Model

The Leverage Model (not live yet) is how Goldfinch will allocate capital from the Senior Pool to each Borrower Pool. This is part of the ‘trust through consensus’ model that Goldfinch is building.

The Leverage Model will work as follows:

- The more Backers that allocate capital to a Borrower Pool, the more capital the Senior Pool will allocate to that Borrower Pool.

- This operates under the assumption that the collective assessment of Backers regarding which pool to allocate their at-risk capital to are the safest pools to lend to, and will thus receive the greatest funding from the Senior Pool.

Auditors

Auditor Approval Process

Auditors vote on whether or not to approve a borrower. Auditors are required to stake GFI to vote and are rewarded with GFI if they vote alongside the majority. The Auditor system is not live yet but will be a key component of Goldfinch.

- Anyone can be an auditor if they pass a KYC check and stake a (not yet specified) amount of GFI.

- The protocol will randomly select a number of auditors based on a weighted amount of the GFI they have staked.

- Auditors are not required to conduct a sophisticated credit analysis, but rather merely investigate whether or not the borrower is legitimate, does what it is claiming to do, and not evidently colluding with other Goldfinch participants.

- Auditors can carry out audits in whatever way they see fit.

Borrowers can request audit approval when they have surpassed ~20% of their funding limit (to be confirmed).

The auditor system could work well if it can be anonymised who the auditors are in each round. Beyond that, collusion and bribery are possible by malicious actors. The auditor system is not live yet, and it will be interesting to see how it gets deployed in practice.

LPs

- LPs supply capital to the Senior Pool for passive yield. The Senior Pool allocates capital to Borrower Pools, based on the Leverage Model.

- After providing liquidity to the Senior Pool, LPs will receive an equivalent value of FIDU. This is an ERC-20 token that can be redeemed for USDC at an exchange rate based on the net asset value of the Senior Pool (with a 0.5% withdrawal fee).

- To contextualize, FIDU can be compared to Compound’s cTokens. The value of FIDU increases as interest payments are received (or decreases in the event of writedowns).

- The value of FIDU is hardcoded in the Senior Pool to reflect USDC interest accrued over time. As long as there is sufficient USDC in the Senior Pool, FIDU holders will be able to redeem at its fair value. On secondary markets like Curve, it is likely that the price will deviate from its fundamental value at times.

- LPs can earn GFI rewards by staking their FIDU.

- GFI rewards will increase if the total balance of the Senior Pool is beneath the Target Balance. Conversely, GFI rewards will decrease when the Senior Pool is above the Target Balance.

- The current Target Balance is $100m.

- The 0.5% withdrawal fee will incentivize longer-term LPing to the Senior Pool as it will leave many without profit if they withdraw early.

- While this incentivizes longer-term LPing, it also could disincentivize other LPs from providing capital to Goldfinch due to the lack of flexibility it implies.

- After providing liquidity to the Senior Pool, LPs will receive an equivalent value of FIDU. This is an ERC-20 token that can be redeemed for USDC at an exchange rate based on the net asset value of the Senior Pool (with a 0.5% withdrawal fee).

- The Senior Pool uses the Leverage Model to automatically allocate capital to the Borrower Pools, based on how many Backers are participating in them.

- LPs can withdraw at any time, minus a 0.5% withdrawal penalty. However, if there is insufficient liquidity to withdraw, the LP will not be able to withdraw until new capital enters the pool.

- This is another consideration for LPs who may not be able to access their capital for an indefinite period of time.

- Alternatively, users can utilize the FIDU-USDC Curve Factory pool to swap out if liquidity is available there (there is currently $3m on each side, totalling ~6m). Note that users may not receive fair value on their FIDU as the Curve pool is subject to market forces and a potential liquidity premium.

- Note that KYC is required to participate as an LP, and US-based persons are excluded (except accredited investors).

GFI Token

GFI is the utility and governance token of Goldfinch. The token is designed to align incentives and coordinate the various different actors in the ecosystem. At a high level, its utility includes:

- Governance - vote locking governance proposal now live.

- Incentives - auditor staking*, liquidity mining, backer rewards.

- Borrowers will need to stake GFI of equivalent value to twice the cost of Auditor approval in order to create a Borrower Pool (not yet implemented).

- This gives additional functionality to the token as it is used to pay the auditors and prevents spam by a financial signal of intent from borrowers.

The GFI token is a coordination token designed to be deeply embedded in the system. It is designed to coordinate the various participants and disincentivise malicious behaviour through slashing mechanisms. The GFI token will be crucial in coordinating the ecosystem going forward, which should give it strong fundamental value if the platform succeeds. Many protocols have launched questionable and poorly integrated tokens, whereas GFI should be an integral component of how Goldfinch works.

Goldfinch can incorporate some buyback elements in the future as revenue moves through the platform back to GFI. This is reflected in GIP-13 - a tokenomics proposal published on June 7th 2022 that seeks to introduce vote locking and rewards based on the longevity of the locking period.

In this, holders can stake their GFI for a period of up to 4-years, and receive voting power for doing so. Furthermore, those that stake their GFI and lockup their capital supply (those who contribute to the Senior Pool and/or Borrower Pools) will receive a share of platform revenue in the form of FIDU. This means that governance-locked GFI will not be inflationary, as users will receive FIDU (which represents the USDC supplied to the Senior Pool).

At a high level:

- Users invest in the Senior Pool and/or Borrower Pools and lock the FIDU and/or Backer position in a vault, choosing their desired lockup period.

- In addition, the user locks GFI for their desired lockup period.

- Goldfinch protocol supplies USDC protocol fees to the Senior Pool for FIDU which is distributed among the member pool. Members receive FIDU based on the weighted amounts of GFI and capital supply locked.

- Accumulated FIDU rewards can be claimed at any time.

Allocation

The token allocation towards the team and early supporters is arguably high, however, full-time team member tokens are locked for a total period of 4-6 years which is positive as it properly aligns the interests of team members beyond the short-term success of the protocol.

In addition, investors are subject to a 3-year unlock with a 6-month cliff and 12-month transfer restriction which is longer than most vesting schedules and can be considered positive.

Note that only ~8% of tokens are currently in circulation, meaning that the circulating supply of GFI will increase more than 12x. As a result, the market value of Goldfinch will need to increase by 12x to retain the current price when at total supply. While Goldfinch is currently early into its roadmap, if it executes on its mission to enable real-world lenders access to DeFi liquidity and becomes one of the primary players in this space, a valuation well in excess of this is possible.

Risks

Goldfinch’s key risks are smart contract and default risk. On smart contract risk, Goldfinch has partnered with Nexus Mutual to provide insurance.

Default Risk At present, Goldfinch appears to be focused on lending to high-quality emerging market credit firms and fintechs. While this is an underserved market and represents a massive opportunity, lending to these markets is generally considered riskier than more developed markets. In addition, many fintech businesses are suffering in the current macroeconomic conditions. The counterpoint to this is that businesses in emerging markets have been exposed to these higher interest rates for many years, as opposed to fintechs in the US and Europe which are facing this environment anew. Therefore, LPs need to take this into account when considering providing liquidity to Goldfinch.

In addition, when providing capital to the Senior Pool, LPs cannot decide which pools their capital will flow to. In addition, LPs will receive FIDU - which is based on the net asset value of the Senior Pool. Therefore, the LPs have exposure to the risk of the entire Goldfinch portfolio, meaning they will likely be affected if any of the large Borrowers default. That said, Goldfinch has stated that all its borrowers are overcollateralized off-chain, and legal recourse exists in the event of default. The protocol has issued over $100M in loans and currently has a 0% default rate. Taking this to be true, legal recourse can still be time-consuming and LPs may not receive their capital back for an extended period.

Therefore, off-chain lending in emerging markets clearly carries more risk than lending to an overcollateralized protocol such as Aave. However, this additional risk is compensated with far greater real APY. If one deems the smart contract risk to be minimal, and the default risk acceptable, then Goldfinch can provide a unique opportunity. Goldfinch’s general lack of exposure to crypto companies may be seen as desirable from a diversification standpoint.

Audit Goldfinch has been audited by Trail of Bits.

The report found 2 high severity exposures that impact system confidentiality and integrity. There was an additional 1 medium severity exposure and 1 informational. These issues were addressed prior to deployment.

See the audit report here.

In addition, Defisafety ranked Goldfinch as having a 93% safety score, which puts it on par with protocols such as Compound and Curve by this metric.

Traction

Goldfinch is still in its early stages and has a relatively modest credit issuance of $100m. However, the protocol appears to be building for something much greater than this. In May 2022, Frax voted to allocate $100m towards Goldfinch pools. This is part of their decision to diversify into assets that are less correlated to crypto markets - loans to real-world businesses. However, the timeline for when this will go into effect is unclear.

Onboarding real-world assets is highly complicated and labour intensive, with complex credit assessments, loan agreements and investment structures required that can interact with smart contracts and span 5 continents. Much of this work is front-loaded which means that Goldfinch cannot feasibly grow rapidly, and tradfi fintech lenders generally take many years to reach this initial scale of traction. However, once the infrastructure is more established, and if it is robust - Goldfinch can be in a strong position to scale.

Goldfinch has steadily increased its protocol revenue, despite wider industry declines (now exceeding $800k). This revenue is verifiable on-chain. Check out their various on-chain dashboards here.

This helps demonstrate how the fundamental performance of Goldfinch is far less correlated with the broader crypto market. Protocol revenue will increase as more loans are issued, to real-world companies with minimal exposure to the cryptocurrency industry.

Maple Finance and Goldfinch Comparison

| Attribute | Maple | Goldfinch | ||

|---|---|---|---|---|

| Borrower Assessments | Pool Delegates: Pool Delegates are whitelisted professionals from the credit industry. Manage lending pools by performing due diligence and arranging the terms of the loan with Borrowers. | Backers: Individuals/companies that Assess Borrower Pools. Backers provide first-loss capital to approved pools. Currently conducted by Goldfinch. | ||

| Borrower Profile | Borrowers are subject to approval by Pool Delegates. Focus is on crypto trading firms at present. | Borrowers are fintechs and credit firms, generally in emerging markets and with track records between 2-10 years. Focus is on yields generated by real-world business activity, uncorrelated to crypto trading. | ||

| Higher Yield Options | Can stake xMPL for higher yield, or MPL:USDC BPTs. This is arguably unfavourable as BPTs are subject to impermanent loss, and if one is bullish MPL, getting liquidated MPL is highly undesirable. | Backers can add USDC liquidity to the junior tranche (first loss pool). Arguably a more user-friendly alternative.Capital Issued | ~$1.5bn loans issued | ~$100m loans issued |

| Lending | Lenders can select which pool they want to allocate capital towards. This may be a preferable option for some lenders who want to have some degree of control over how their money is distributed. Lending is permissionless. | Backers can select which pool they want to allocate capital toward (as first-loss cover). Liquidity Providers to the Senior Pool cannot select which pool their capital goes to. This is distributed according to where backers have allocated their capital. Liquidity providers are required to pass KYC. US-based persons are excluded (except accredited investors). | ||

| Current Valuations | ~$150m FDV ~$93m MC. | ~$140m FDV ~$10.67m MC. Note that this will be highly inflationary as only ~8% of the total supply is circulating. |

Key Takeaways

- Goldfinch is building infrastructure to enable real-world businesses across 5 continents to access DeFi liquidity. It has already financed $100m in loans and is demonstrating the real-world value that DeFi can create.

- Building this out is highly complex on a legal, structural and technological level, but if the team can build a robust system, there is enormous potential to scale the platform.

- There has been a greater focus on compliance compared to other DeFi credit protocols such as Maple and Clearpool - which may bode well for the protocol going forward as the industry gets more regulated.

- Goldfinch’s focus on lending to real-world businesses with minimal exposure to the cryptocurrency industry is a compelling value proposition, as it is not heavily reliant on the performance of the crypto industry for the growth of its business.

- It will be interesting to see how the ‘trust through consensus’ model develops, whereby the protocol decentralizes the approval of Borrowers and issuance of capital. It is a compelling concept, and progress has been made in that direction with the Leverage Model.

- Goldfinch remains in its early stages, and participating in Goldfinch’s pools as an LP and/or Backer carries considerable risk.