Andre's Departure

Please see our prior report on Fantom for a more in-depth overview.

One of the most apparent risks to the Fantom ecosystem, as noted in our Fantom report, was its excessive dependency on its founder Andre.

Renowned DeFi builder Andre Cronje and his partner Anton Nell said their goodbyes to the world of DeFi on March 6, 2022. Andre's exit wasn’t entirely unexpected, as he had previously stated multiple times that he will be quitting the world of DeFi. Andre's departure from DeFi was most likely motivated by his discontent with the "toxic work climate," as he indicated in a Medium blog from 2021.

Soon after his departure, a lot of things began to break down in the Fantom Ecosystem.

Andre - linked token’s prices plunge

| Token | Pre-announcement Price | Price as of 10 March | % Change |

|---|---|---|---|

| FTM | $1.63 | $1.3 | -20.2% |

| Solid | $2.67 | $2.17 | -18.7% |

| SEX | $5.56 | $4.4 | -20.9% |

| YFI | $19,951 | $19,547 | -2% |

| KP3R | $562.7 | $342.5 | -39.1% |

Source: Treehouse Finance

Andre - linked projects TVL plunges

| Project | Pre-announcement TVL | TVL as of 10 March | % Change |

|---|---|---|---|

| Fantom | 9.05b | 7.16b | -20.9% |

| Solidly | 1.25b | 0.78b | -37.6% |

| Solidex | 1.23b | 0.75b | -39.1% |

| Yearn Finance | 3.16b | 3.03b | -4.1% |

| Keep3rV1 | 0.59b | 0.57b | -3.1% |

Source: Treehouse Finance

Overall, Fantom ecosystem projects lost a whopping $1.5 billion in market valuation soon after his announcement, as Fantom dropped about 22% to hit lows of $1.32 then.

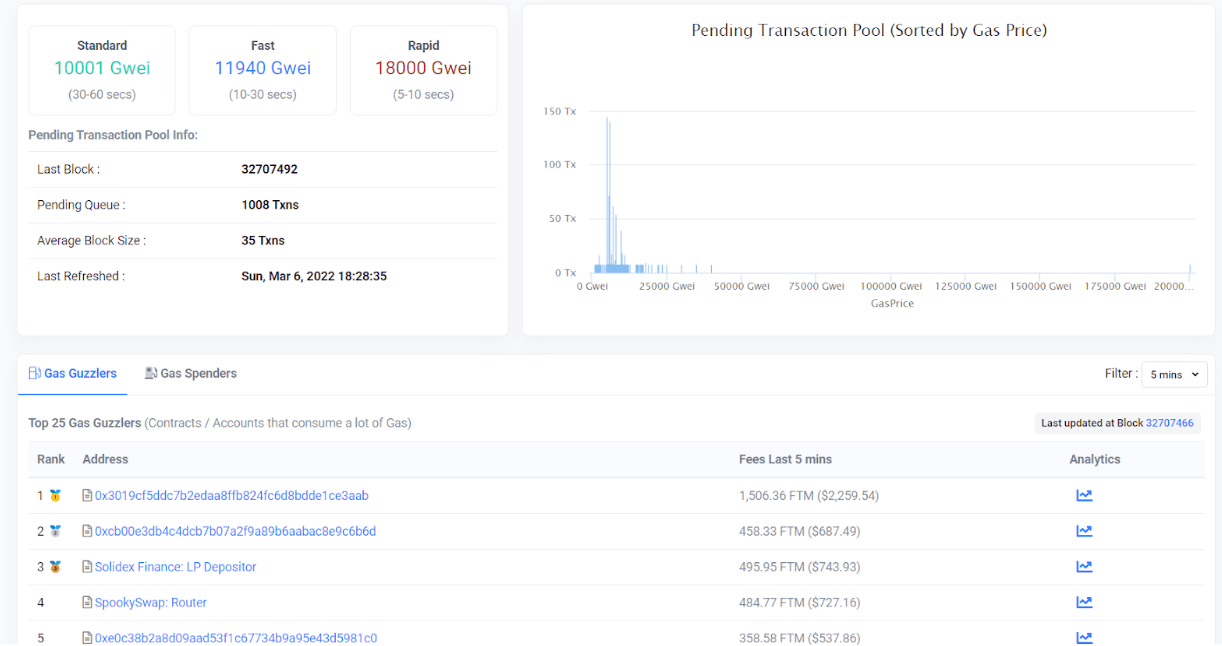

Gas fee spikes as users rush to withdraw their funds

How is Fantom doing after Andre left?

There hasn't been much coverage on the Fantom ecosystem's performance and activity since Andre's departure. Let's take a look at some numbers.

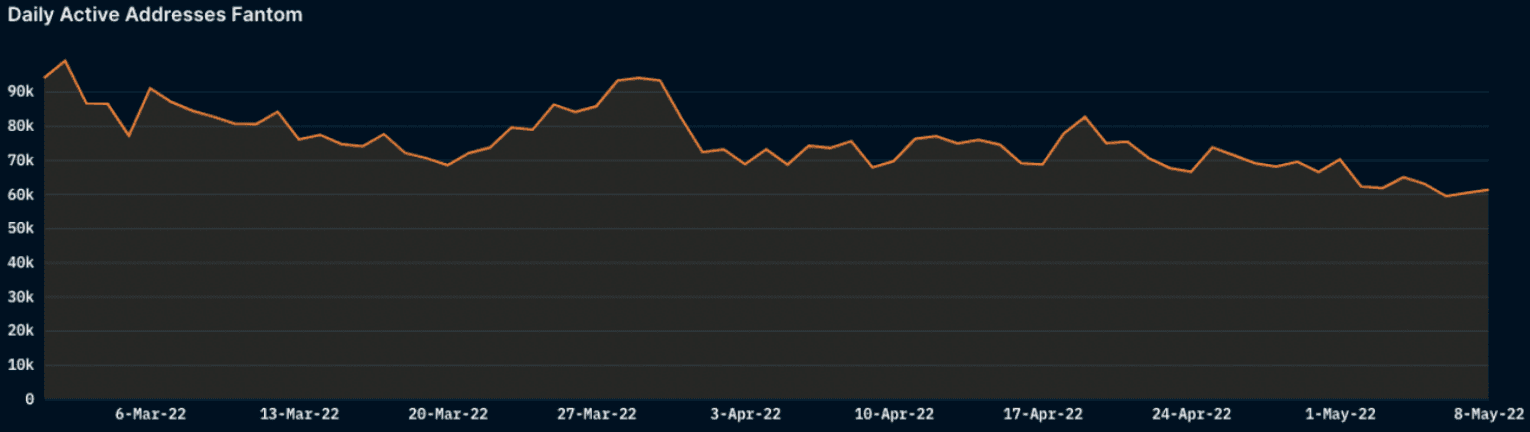

Decreasing active addresses on Fantom

Unique Active Addresses |Past 1D|Past 7D|Past 30D| |:---:|:---:|:---:| |50.2k|134k|315k|

Source: Nansen

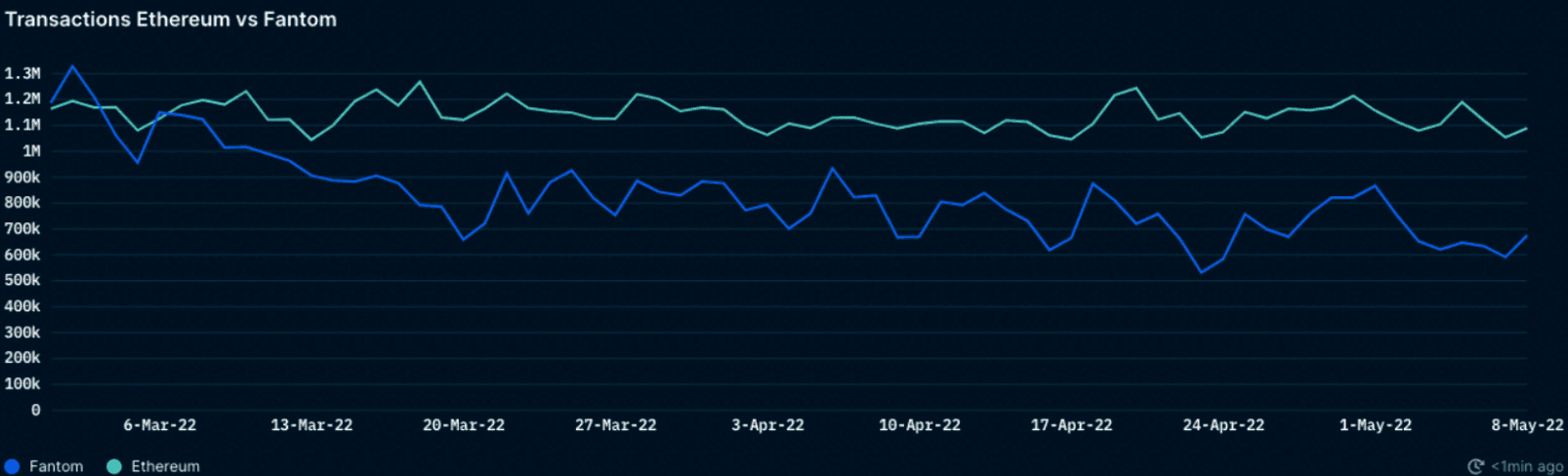

Transactions: Ethereum v Fantom

We also observe a similar declining pattern with regards to the number of transactions on Fantom relative to Ethereum. This indicates that more activity is moving away from Fantom back to Ethereum.

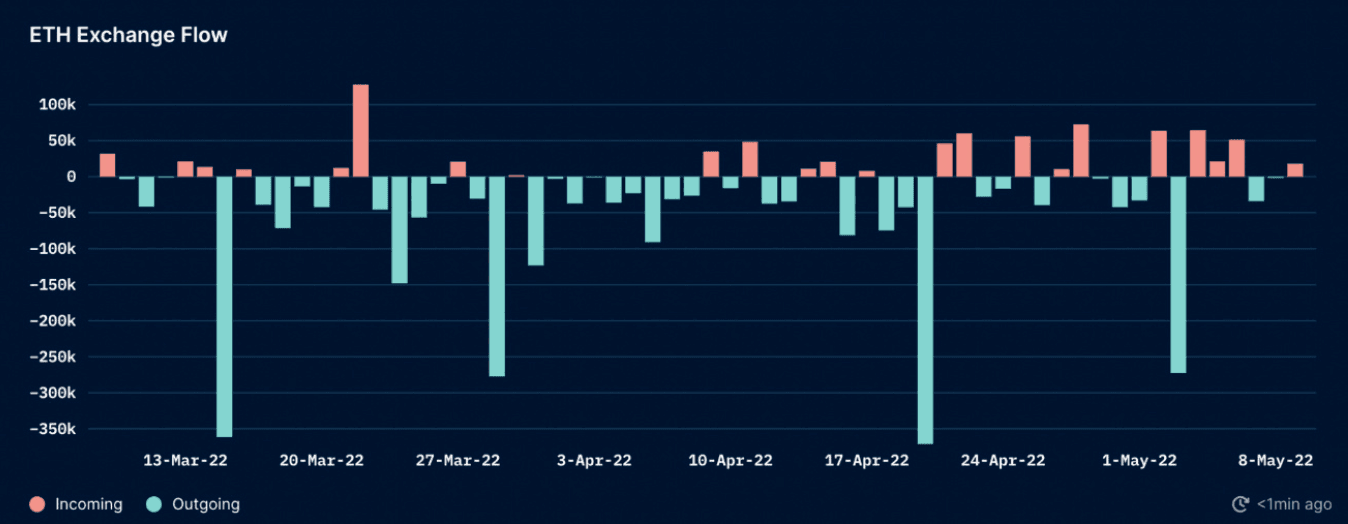

ETH Exchange Flow

We can see that there has been a significant net outflow of funds from Fantom into Ethereum since Andre's departure in March 2022.

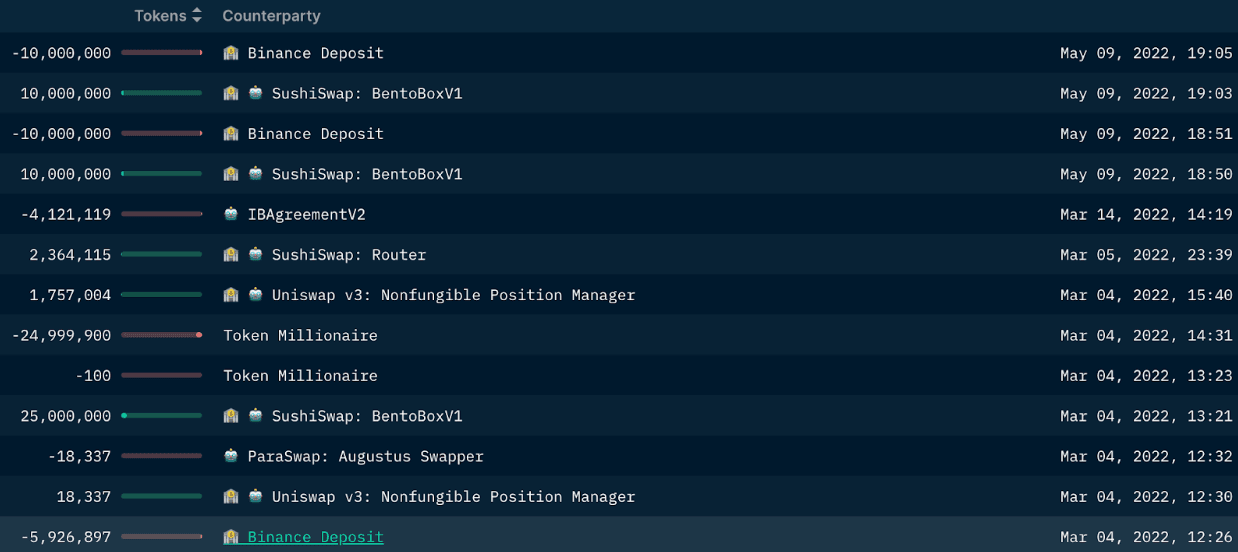

Offloading of $FTM

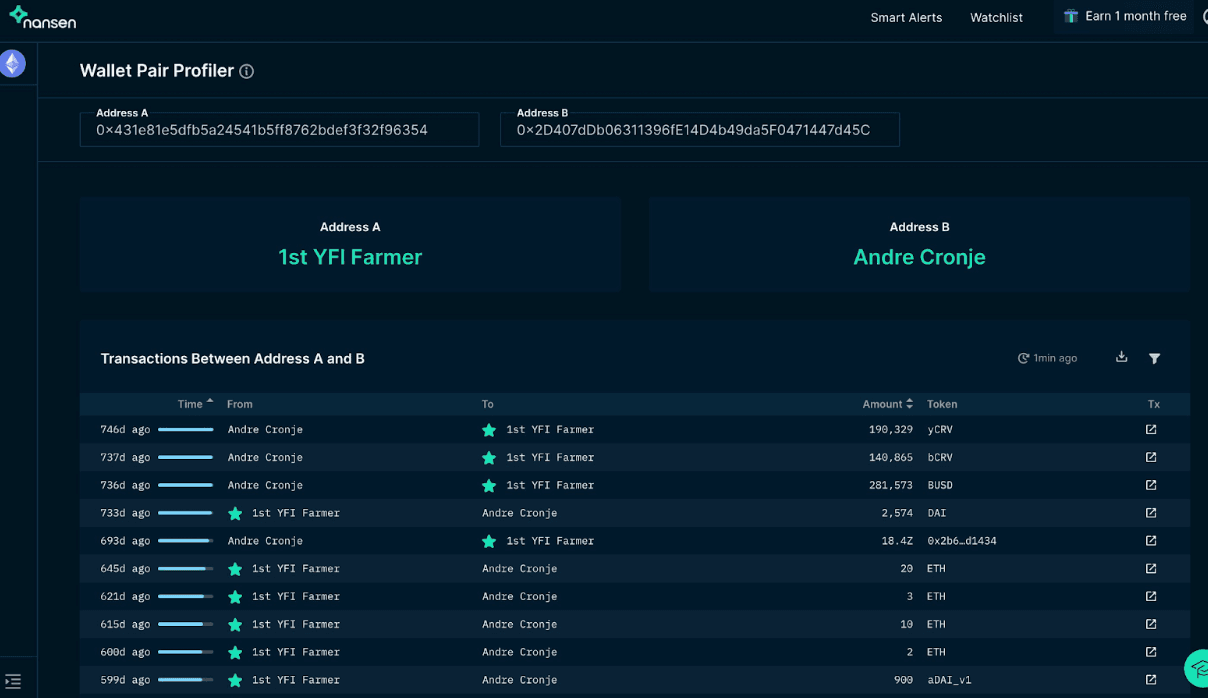

1st YFI Farmer offloading the day before Andre announces his departure.

While we are unsure whether the “1st YFI farmer” address belongs to Andre himself, the two parties have transacted 75+ times over 2 years as seen below.

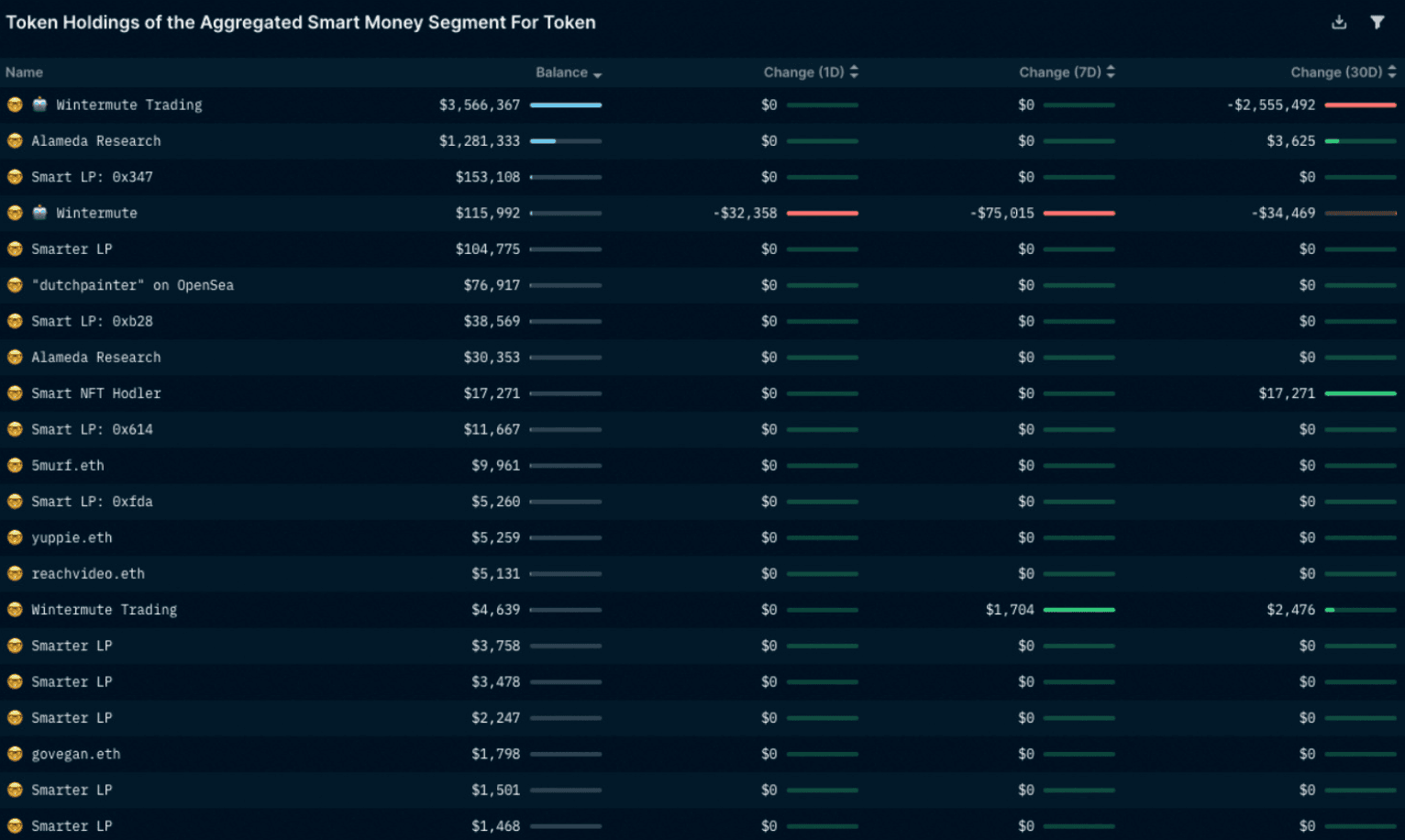

Alameda offloading before Andre’s announcement

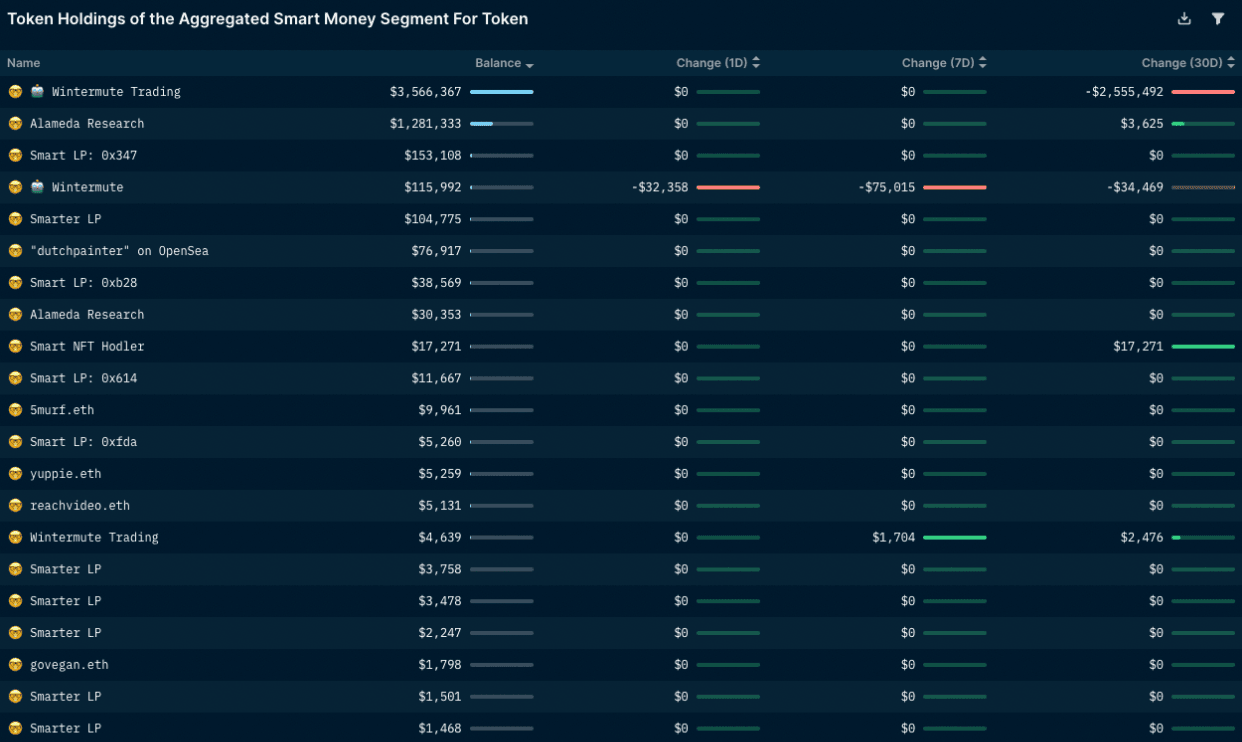

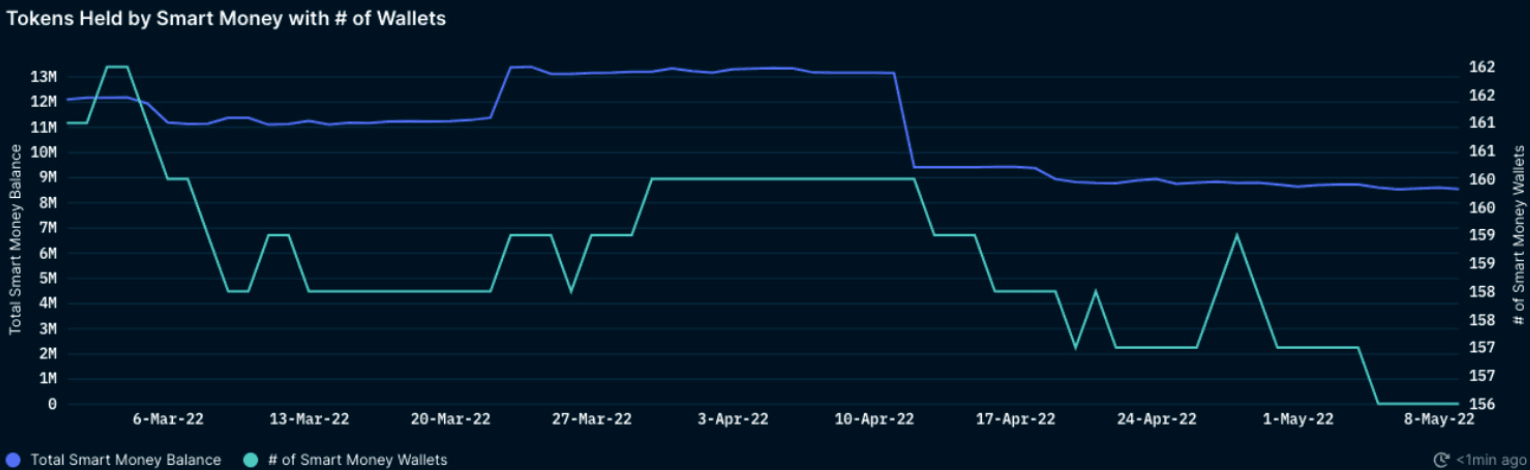

Smart money decline on Fantom

When looking at the smart money's FTM token holdings, it appears that they have reached all-time lows. There has been no significant accumulation or transactions by these smart money wallets since Andre left. Smart money balance of FTM reduced by 29.4% since Andre left.

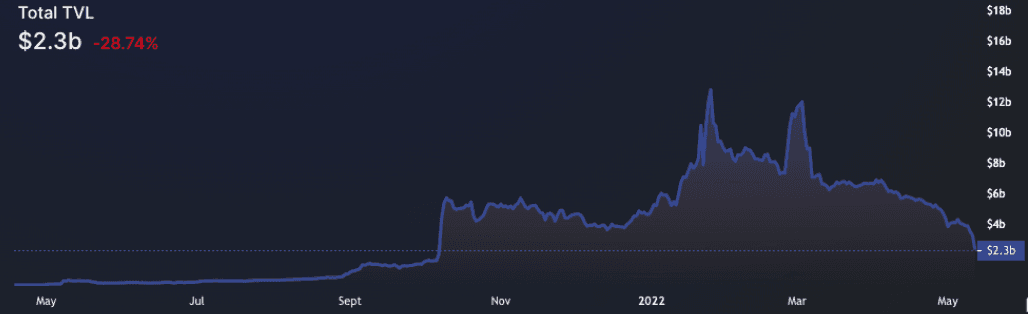

Fantom Ecosystem TVL has since decreased by 76.1%

TVL change by protocol

| Protocol | TVL as of March 6 | Current TVL | TVL Change |

|---|---|---|---|

| SpookySwap | 1.09B | 219.34m | -79.8% |

| Beethoven X | 348.6m | 190.93m | -45.2% |

| Scream | 666.87m | 177.23m | -73.4% |

| Geist | 743m | 120.39m | -83.8% |

| SpiritSwap | 243.74m | 84.3m | -65.4% |

| Solidex | 1.23b | 66.14m | -94.6% |

| Tarot | 214m | 60.35m | -71.8% |

| Solidly | 1.2b | 53.4m | -95.6% |

| Liquid Driver | 165.4m | 57.9m | -65% |

Source: DefiLlama

Andre's last project, Solidly, appears to have taken the biggest blow. Looking back, it's shocking how Solidly was able to vampire attack its incumbents and skyrocket its TVL, which then plummeted shortly after Solidly went live.

Key Takeaways

Despite several attempts by the Fantom foundation to instil confidence among its users after Andre left, the data shown above suggests that it was unsuccessful in its attempts. While the general macro climate may have contributed to Fantom's demise, the biggest impact would undoubtedly be the loss of confidence that occurred when Fantom lost its figurehead. With other L1s such as NEAR gaining more attention and financial firepower, it would seem that Fantom faces an uphill task in regaining investor confidence and reclaiming its former grandeur.