TLDR

Juno Network is a permissionless smart contract layer 1 chain that is built out on the Cosmos SDK and secured via Tendermint BFT Consensus.

Already accounting for more than 10% of IBC activity across Cosmos chains, it aims to be the home of CosmWasm, a unique smart contracting framework that allows for much more rapid app development compared to spinning up an entire blockchain.

JunoSwap is the first native DEX on Juno Network. They currently do not have a token but will be doing a retroactive airdrop for LPs with their native token RAW as well as external incentives via JUNO. JunoSwap is well positioned to be the home for many CosmWasm-based (CW-20) tokens to find liquidity.

The DAO DAO is a DAO that provides the tooling to build out DAOs on Juno and any other chain that implements the CosmWasm module. There are lots of interesting multichain DAO features using IBC and it is an interesting project tackling DAO tooling.

Staking JUNO is around 110% APR at the time of writing and qualifies for many airdrops for the apps deploying on Juno.

CosmWasm is currently a Rust implementation that allows for secure and cross-chain applications using IBC. They are working on supporting other languages as well and it is gaining in popularity amongst Cosmos chains.

Juno Network Overview

Juno Network is a layer 1 blockchain focused on permissionless smart contracts within the Cosmos ecosystem. It is built out on the Cosmos SDK and secured via Tendermint BFT consensus. In order to preserve the credible neutrality of the Cosmos Hub, the community decided to launch Juno Network where it would offload all of the smart contract activity to Juno Network - a ‘sister Hub’ to the Cosmos Hub. The creation of Juno ensures it becomes the home of smart contracts while the Cosmos Hub retains its principle of Hub minimalism and smart contracts can live natively on Juno. In Cosmos, each chain is app-specific such that Osmosis is the DEX/DeFi chain, Umee is the lending chain and so on. In the same regard, Juno is aiming to be the smart contract chain of the Cosmos ecosystem, allowing anyone to deploy apps there. Juno significantly decreases the barrier to entry for developers to build on Cosmos because developers do not need to build out an entire layer 1 - they can simply deploy as an app on Juno and enjoy a cross-chain life through IBC.

IBC and Juno

Without looking at charts to measure the success of a project on Cosmos, one can look at the number of IBC transactions - which have been rapidly increasing over time. You can track IBC activity here, where you will see that Juno already accounts for more than 10% of all IBC activity throughout the Cosmos ecosystem and has the 3rd highest number of supported channels for its assets to flow across the interchain to other chains such as Osmosis. Channels are simply data pathways for IBC modules to communicate over. Each new cross chain connection requires its own channel - which demands a certain amount of infrastructure to support. Hence, there is a lindy effect in being able to support such a comprehensive number of active channels with its relayer network. This allows Juno to be connected to more chains and makes it more attractive to build there given you can access more chains via IBC.

We will likely reference the interchain many times in the report which is simply referring to the greater IBC ecosystem without confusing the ecosystem with the Cosmos Hub.Juno was originally conceived as a way to scale smart contracts on Cosmos and was initially airdropped to all ATOM stakers. From this airdrop, we have seen a vibrant community driven chain where they have a very diverse set of developers building out DeFi legos, key DAO tooling and much more. Instead of being an EVM layer 1, Juno is built out on the Cosmos SDK and has needed to bootstrap a developer community given they couldn't easily fork popular DeFi protocols. It utilizes the CosmWasm smart contracting framework to build out applications where users can deploy apps in languages such as Rust or Golang.

Juno was the first Cosmos chain to implement CosmWasm with IBC, which gives it a first mover advantage in cross-chain contract deployment.Similar to the EVM that uses Solidity, CosmWasm is a smart contracting framework that currently supports a Rust implementation. It was originally conceived in 2019 at a Cosmos hackathon and other languages outside of Rust are being worked on today including Golang and vlang. We will dive deeper into CosmWasm later in the report, but it plays a key role in scaling IBC and broader interoperability between sovereign Cosmos Zones. The main takeaway is that CosmWasm is a framework that allows developers to make secure and composable cross-chain applications, without having to launch an entire layer 1 blockchain; thus, significantly reducing the barrier to entry for apps and tokens to launch on Cosmos.

CosmWasm is key to the success of Juno and it will play an ever important role in cross-chain interoperability between sovereign Zones.Juno has prided itself on building out unique applications using this framework and being the home for CosmWasm development. We have already seen an explosion of apps being built out such as DAO DAO, which allows users to spin up a DAO in a couple of clicks without writing a single line of code. Although this is similar to other DAO tooling, it has unique interchain features already built into it like managing accounts on other chains like Osmosis from the Juno chain. The DAO DAO is just one example of the innovations occurring here and we will cover some of the Juno ecosystem more broadly later in the report. It is important to note that these apps on Juno are truly permissionless, so there will likely be a lot of variance between the quality of applications deploying there - meme coins to integral tooling alike.

Juno is aiming to be a sandbox environment for every vertical in crypto that makes use of smart contracts, not just DeFi applications. The Juno Network is a much broader scope than most other app-chain’s core focus, whether that be a DEX, NFT marketplace or a privacy-focused platform. It is aiming to execute this vision by offering permissionless deployment of contracts without a strict governance process. Because of the permissionless aspect, we are seeing an explosion of apps, from DAO tokens to interesting store-of-value airdrops like NETA. So what is the main difference between Juno Network and other Cosmos Zones?

The key difference is that Juno is built for permissionless deployment whereas other chains introduce governance to align the CosmWasm projects launching natively on their chain. In short, it seems likely many projects will find a home on Juno and can access the interchain through IBC. More on this later.The Home of CosmWasm

Again, Juno is aiming to be the home of CosmWasm- the main smart contracting framework they will be using to build applications. With the Moneta upgrade back in October, they were finally able to implement the CosmWasm 1.0 module into Juno which made it the first CosmWasm chain that has IBC connected to their CosmWasm contracts. Since then, we have seen a blossoming ecosystem with native DEXs such as JunoSwap, DAO tooling/infrastructure, app tooling and much more.

CosmWasm allows any developer to upload programs to it using any language that compiles to WASM. Given it enables cross-chain applications between independent blockchains, how exactly do these apps communicate? First, we will define what CosmWasm is and what modules are more broadly that exist on the Cosmos SDK. Then, we will go over the advantages and disadvantages of CosmWasm as it stands today.

CosmWasm

CosmWasm itself is an SDK module that any chain can implement if they are built on the Cosmos SDK. A module simply contains the business logic for the specific application. Each module is unique to their specific application which contains their own business logic. Given there are a variety of modules like CosmWasm (and ever growing!) with their own unique use cases, how can they compose together? They can be composed together through the SDK via the core which allows developers to build out their app-specific chains and opt into these modules as they see fit.

The interesting aspect of modules built out on the SDK is that they are available for the entire Cosmos ecosystem to use. For instance, the team at Confio helped launch the CosmWasm module and now any Cosmos SDK chain can implement it to enhance their chains. Hence, more Cosmos development means more modules to implement in your blockchain, which simplifies the stack and allows developers to select from a range of composability between modules. This is a key theme in Cosmos where independent chains build out key modules for themselves and deploy them to the SDK - Cosmos protocol development is inherently tied to the app-specific blockchain.

Significance of CosmWasm

We have now covered what modules are and given a high-level overview CosmWasm, but what is the significance of CosmWasm over other smart contract frameworks? To start, each CosmWasm contract can natively communicate with every other integrated CosmWasm contract on other Cosmos chains over IBC.

Thus, the total addressable market for CosmWasm apps covers any chain that is built on the Cosmos SDK. A basic example of this type of communication can be a DEX aggregator that lives on Juno Network and aggregates trades across other DEXs that live on other CosmWasm chains. This cross-chain composability can all be done via a CosmWasm contract that lives on Juno, yet pulls the best prices across any N number of Cosmos DEXs. This is just one example of CosmWasm enhancing the network effects of IBC and allowing for a more fast and iterative design approach for sovereign Zones to be interoperable.

CosmWasm Features

Below we will summarize the basic and advanced features of CosmWasm.

Basic Features

- Storage Plus

- Provides state management like Ethereum which makes it easier for apps using the Cosmos SDK to write more complex apps.

- Security by Design

- Designed architecture to combat common Solidity attacks such as re-entrancy attacks, uninitialized variables, and other bugs that can be made. Note, the business logic can still have bugs but you do not need to worry about other bugs sneaking in.

- Submessages

- Allows communication and composition between different contracts.

- Easy Upgrades

- Allows easy upgrades to your code. Makes it powerful on Terra and other chains that are using CosmWasm.

Advanced Features

- Snapshot Map

- A map is how you store state in Cosmwasm and lets you take a snapshot of any history

- Provides lazy snapshotting for checkpoints you choose ‘lazily’ query them later

- Can power the evolution of DAOs and governance for that takes snapshots of voting and allows next gen governance

- Ex: DAO DAO team

- Migrations

- Migrating on the Cosmos SDK is hard

- Can do upgrades and transformations

- With a migration, you can do anything a contract can do: instantiate new code, create new contracts

- Ex for DeFi: Take a Uniswap pool with a router that routes to many other pools + interchain pools while maintaining the same interface + location

- IBC Contracts

- Enables a dynamic IBC - allows for an iterative design of IBC protocols at a much faster speed

- It takes a long time to upgrade and develop IBC protocols

- Allows for composability across Zones and reduces the barrier to entry for new DeFi participants

- Ex: Yield farming protocol that aggregates over multiple different chains.

- Enables a dynamic IBC - allows for an iterative design of IBC protocols at a much faster speed

The main takeaway from this table is that CosmWasm enhances IBC - IBC protocols will be more dynamic and can be more iterative via CosmWasm. As of now, it can take months to upgrade and develop IBC modules but CosmWasm allows for a lightweight layer for faster development of IBC interoperability.

As of now, when there is consensus breaking changes like Tendermint being upgraded, there will need to be a new light client for blocks produced on the new Tendermint upgrade. Thus, every IBC connection that uses clients on the previous Tendermint will need to be updated which can be done via governance but it requires upgrades on both sides. This upgradeability is very manual and requires time and coordination between the two chains - this becomes a bottleneck with scaling IBC given it requires more coordination efforts the more connections a Zone has. This problem can be mitigated if WASM clients are everywhere. Because of this, it seems likely CosmWasm will continue to play a really important role in the Cosmos ecosystem. As Sunny Aggarwal stated on Twitter:

“_EVM - Legacy VM Solana - VM designed for vertical scalability CosmWasm - VM designed for cross-chain horizontal scalability_”

In short, CosmWasm fills a very important role for cross-chain VMs and allows for a promising design space and allows for IBC to be more dynamic between Zones.

Juno Network vs Other Cosmos Zones

Now that we have defined some of the key components of the Juno Network, what makes Juno unique from other Cosmos Zones like Osmosis? Given any chain built on the Cosmos SDK can implement CosmWasm, why exactly would they choose to deploy on Juno over something like Osmosis where there is more liquidity and security by market cap at the time of writing. In short, chains like Osmosis will handle new CosmWasm apps via governance and keep the number of apps to a minimum given that governance deems they are complementary to the core functionality of the chain. For example, CosmWasm apps on Osmosis would likely have to complement its core AMM which can be something like a lending protocol.

There are other reasons why Zones like Osmosis won't integrate every CosmWasm app but the main reason is they are trying to keep the chain as light as possible and do not want it to become congested with thousands of apps that do not necessarily need to be co-located on the same chain. Allowing for the permissionless deployment of apps on an app-specific chain would essentially defeat the purpose of being an app chain, which is where Juno Network comes in. If CosmWasm apps are not voted in on a chain like Osmosis, then they can permissionlessly launch on a chain like Juno and have the assets be cross-chain via IBC. Therefore, one can think of Juno being home to the long tail of apps that do not fit the specific needs of an app-specific Zone. Additionally, the reverse can happen as well, where apps launch on Juno and then expand to the rest of the Cosmos ecosystem. There is lots of evidence pointing to this type of experimentation happening on Juno first such as with the DAO DAO.

The beauty of Cosmos is that it can enable a positive sum game - IBC and CosmWasm can allow for integrated apps to natively communicate, compose and take advantage of liquidity that is on separate chains. What does this mean in practice? It can be something similar to the aggregator example we gave previously but it can even extend outwards to cross-chain governance and higher level implementations via Interchain Accounts.

Token Standards and Interoperability

Given Juno could be the main hub of experimentation for CosmWasm, there is an inherent first mover advantage to be the home of CosmWasm. Cosmos chains are able to communicate by sending packets of information over IBC channels and these channels can contain things like token transfers. Similar to how Ethereum uses the ERC-20 token standard, CosmWasm uses their own token standards: CW-20 tokens and CW-721 for NFTs.

It is important to note that these CW-20 tokens are not one and the same as native Cosmos SDK tokens. Rather, they are two different token standards. Given Juno was the first chain to integrate IBC with CosmWasm, these standards are still very new. A very important development of these tokens recently took place with Osmosis listing NETA, a CW-20 token, on the platform. This is a huge milestone because it shows that CW-20 tokens can safely interact with other chains like Osmosis over IBC, whereas token transfers/listings were previously only used by Cosmos SDK tokens. Such compatibility opens the doors to all Juno tokens and CW-20 tokens more broadly. Hence, you can have any token on Juno flow over IBC to any Cosmos Zone and be useful in the respective ecosystems.

Currently, most relayers that send token transfers only work for Cosmos native assets, not CW-20 tokens. Again, Juno has shown that CW-20 tokens can flow over IBC to other chains. The difference in packet relaying for these token transfers comes down to the channel the CW-20 tokens are sent over, which are different from the channels Cosmos SDK tokens are sent on. To send these assets over, relayers need to have upgraded software to send these assets, which can use the same node and the same relay software that they currently use for normal IBC assets. This means that relayers that want to relay CW-20 assets need to update their config to allow for this new channel. In short, there is a lindy effect of having the relayer infrastructure in place, especially for CW-20 tokens, and Juno already has 58 active channels for tokens to flow in and out of it.

In short, CW-20 tokens can become more in demand as they are proven to be compatible with every Cosmos chain with CosmWasm supported. Juno is the pioneer on this front and the success of NETA demonstrates the benefits of deploying apps on Juno to get access to the interchain. However, CW-20 tokens have not won out as a standard, and it recreates similar issues seen with Ethereum where there are 2 token types which increases the bug surface of EVM contracts. Given this, Native SDK assets remain dominant in terms of liquidity and volumes throughout the Cosmos ecosystem.

Why would a project deploy on Juno Network?

Simply put, an application built on Juno can be truly cross-chain. If an app chooses to deploy on multiple L1s, it will only fragment their liquidity, UX, and increase the attack surface of their protocol. Thus, deploying on many chains can cannibalize the core product given there is more maintenance/upkeep in having your code living on N number of chains.

Rather, by deploying a single application on Juno network, developers will be able to access liquidity across every IBC-enabled chain. At the time of writing, that is around $75b and that is without any highly liquid stablecoin (outside of UST). This is immensely powerful when it comes to cross-chain composability. As of recently, apps would need to deploy as a sovereign L1 chain to exist on Cosmos. Deploying as an L1 is very hard given you must bootstrap a validator set, combat MEV and many other considerations that apps do not need to build around. Juno simplifies the experience by allowing developers to build apps like they are used to building on other chains. If for any reason a project may want to be its own chain, they can launch on Juno Network to find initial product market fit. Thus, the lifecycle for an app can be launch on Juno to gain adoption, then build your own sovereign app-chain. In short, their model decreases the barrier to entry and allows for developers to build a single application to access the interchain natively over IBC.

So how will Juno Network attract developers and users to its chain?

The Juno community pool had a 30% genesis allocation to support any developer initiatives by funding independent projects. Juno is currently incentivizing smart contract challenges for developers to build useful apps on their ecosystem. For 2022, 1.15 million JUNO was allocated to the Moneta hacks, which is around $35m at the time of writing. The allocations will be based on priority - top priority being interchain contracts/use cases, DeFi apps, NFTs, DAOs, gaming and privacy.

Juno Network Ecosystem

In just over 2 months since the Moneta upgrade that integrated the CosmWasm 1.0 module, Juno has seen tremendous growth.

- 55 apps and tools

- Over 91,000 monthly active users

- 1,200+ DAOs

- 125 Validators

- 150+ ecosystem devs

- 58 IBC relayers

Juno Network is still a very young ecosystem but below we will highlight some of the key applications today.

JunoSwap

JunoSwap is the first AMM to launch on Juno and it is focused on providing liquidity to all CW-20 assets. The DEX is permissionless and allows anyone to create a pool with any combination of native SDK coins and CW-20 tokens. For instance, there can be a pool for an SDK token like SCRT and a CW-20 token NETA - any type of token can find liquidity on JunoSwap. JunoSwap was built from the ground up and it has become the native DEX of Juno where users can swap in and out of all asset types - the major SDK coins to the extreme long tail of CW-20 assets.

It has around $42m in TVL at the time of writing, without having any incentives - there is an inherent demand for CW-20 asset liquidity. The incentives contract is being worked on where they can begin offering incentives to LPs. So when assessing the DEX landscape, does JunoSwap compete with Osmosis or other DEXs? One can think of JunoSwap as being the home to every CW-20 asset, covering the long tail of CW-20 assets. Whereas Osmosis may have more liquidity for SDK coins such as AKT or SCRT but will have less pairs for the long tail of CW-20 assets like DAO tokens, etc. Given Osmosis is a layer 1, one can argue the value accrual mechanisms are better and that the design space is more open. However, both DEXs satisfy different assets in the risk curve and can complement one another, such that an aggregator can route through them all - the end user wins and all token types can find a place of liquidity.

DAO DAO

One of the most interesting projects on Juno is the DAO DAO, which is a DAO that builds tools for building DAOs. They have provided a UI for all DAO activities: voting, creating, deploying or joining DAOs in just a few clicks and without any coding necessary. These DAOs are built to be inherently cross chain - using IBC, these DAO tokens can be sent to any IBC-enabled chain. Their technical stack involves building out smart contracts in Rust and they remain in Beta, so their contracts have not been properly audited yet.

Again, over 1,200 DAOs have already been created using the DAO DAO stack. Although there is extreme variance of DAO quality, this speaks volumes for the ease of use of the DAO DAO framework and its scale at just a few months old. We are very excited to see the development of DAOs on Juno and think the DAO DAO is positioned to play a key role in the future design of DAOs across the interchain. It is even being discussed of using the DAO DAO CosmWasm implementation to support an IBC DAO natively on the Cosmos Hub - the DAO DAO is becoming a core building block for any interchain DAO.

There is other complimentary DAO tooling being developed on Juno. Another notable mention is DAO Up, which is a crowdfunding platform for DAOs that is fully integrated with the DAO DAO. DAO Up provides a transparent system for creators and backers - if a funding goal is not met, backers are guaranteed refunds. Users that decide to back a DAO through DAO Up, can become part of the project and its community which is guaranteed by having successful campaigns having their treasury sent to a DAO controlled by the backers. DAO Up is another building block in the DAO stack for Juno, allowing users to set funding goals, tokens to fundraise and to compose with existing DAOs from the DAO DAO.

To contextualize the 3 apps mentioned above, let's give an example that connects them together. One can create a DAO using the DAO DAO tooling, fundraise it via DAO Up, and can immediately find liquidity for these tokens via JunoSwap - the pieces are coming together.

Passage and Strange Clan

Passage is a platform supporting a suite of features for metaverse integrations - a built in NFT marketplace, P&E games, in platform 3D land powered by Unreal Engine and profit sharing with its token holders. Passage is launching their NFT marketplace on Juno at the end of February. To start, the marketplace will only be for Strange Clan’s NFTs using the CW-721 standard but will soon expand to support other NFTs. Passage is able to be streamed on any device, from a smartphone to a desktop and they partnered with Akash Network to help stream high resolution graphics.

Passage is creating an ecosystem built for the metaverse, with Strange Clan being the first 3D P&E game to launch there. They have built out their platform to support many customizable 3D worlds and facilitate the development and modification of the games on it. Strangeclan is an adventure game with varying quests, battles and in-game items to be traded on the marketplace. Passage will provide the key marketplace for characters and in-game items to be sold. Although Passage is mainly building out their marketplace for Strangeclan, it will eventually be open to any IBC-enabled NFT on any chain for a 3% transaction fee to cover the cloud compute. Given it is built on Juno, Passage will be able to compose with every NFT on other Cosmos chains via IBC. It is demonstrating this cross-chain NFT composability with its recent partnership with Stargaze, a layer 1 focused on NFTs.

PASG is the token that powers the Passage platform, offering incentives to stake your tokens to receive discounted fees, profit sharing rewards, discounts on marketplace transactions and much more.

Juno Tokenomics

JUNO is the native asset of the Juno Network. It has a number of use cases:

- Secure the Juno Network chain via PoS

- Used for gas for any txns on Juno

- Fees from apps deployed on Juno Network

- Governance

- Used as a collateral asset across apps

- Base currency for NFTs or DAOs

In order to bootstrap a validator set, Juno did a stakedrop for ATOM validators with a snapshot back in February 2021 of those who had their ATOM bonded. This was a very sizable airdrop that accounted for 47% of the genesis supply. The stakedrop approach enabled a broad distribution by reaching 46k unique ATOM stakers, avoided exchange validators like Binance and enabled a whale cap at 50k ATOM per airdrop - no seed, private or public sale for JUNO. Still, as a top 100 coin by market cap, JUNO is not listed on any CEX making JUNO and OSMO the only top MC coins to not be listed on a single CEX.

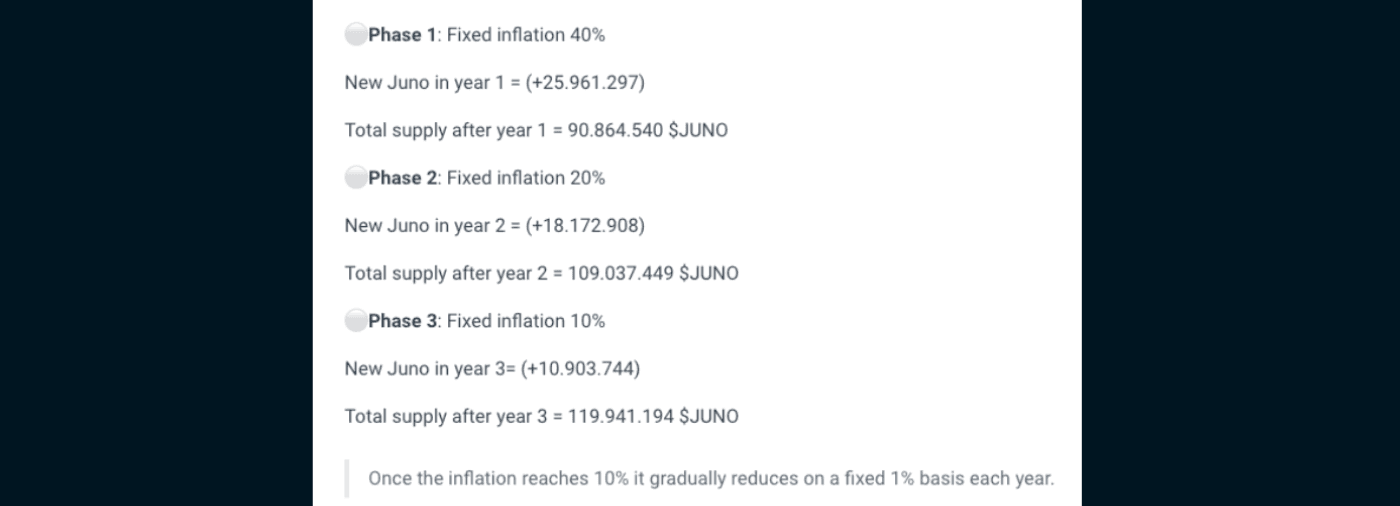

JUNO supply schedule is fixed and is designed to reward early adopters who stake their JUNO. The first year is 40% inflation and then it is cut in half each subsequent year until inflation reaches 10%. At that point, it will gradually reduce 1% each year until the 12th year where it will later become deflationary. Given JUNO issuance becomes deflationary, the network expects transaction fees by the apps deployed on it and IBC traffic to secure the chain, while airdrops/stakedrops can accommodate network incentives. We have already seen the sizable airdrops from staking JUNO with the likes of NETA who airdropped JUNO stakers nearly 5 figures for participating in a single governance proposal. Of course, this is on top of the 110% APR for staking JUNO. Staking your JUNO allows you to receive 2 forms of rewards: newly distributed JUNO from inflation and through transaction fees collected on the network.

In short, the inflationary rewards for Juno Network are quite high so it is important to consider staking your JUNO or LPing in a JUNO pair either on JunoSwap or any other DEX on Cosmos that lists JUNO in a liquid pair which competes with the staking rewards.

Risks and Other Considerations

General Purpose Blockchain vs App-chains

Juno Network is live on mainnet and has been operational with CosmWasm apps since October 2021. As with all smart contract platforms, there is always the risk of smart contract exploits. CosmWasm is still a younger VM compared to the EVM, so formal audits and battle testing of it will continue to mature.

The chain can possibly become congested and face long-term scaling issues - scalability trilemma. Given it is permissionless, it is likely that it will face scaling issues over a long enough time frame. Although JunoSwap addresses a different market than Osmosis at the time of writing, it will be hard to compete for the major liquidity given it is not its own chain. For instance, after liquidity mining incentives slow down, Osmosis has built out Superfluid staking to provide yield and shared security for the tokens in the given LP pairs. Whereas JunoSwap pays its fees out on Juno and is subject to network congestion if many apps decide to deploy there.

Competing VMs

The Juno Network is a bet on a permissionless smart contract chain, powered by CosmWasm and the design potential it unlocks. Although we think there are many benefits to CosmWasm over other VMs, it will still have to compete with other VMs for developer mindshare such as the EVM via Evmos and with Javascript via Agoric. We will likely see a positive sum game where liquidity can flow between the 3 VMs on Cosmos, whether it be through the ERC-20 module or some other mechanism. However, it is important to highlight that the EVM has become dominant on most chains it is deployed on outside of Solana and Cosmos. With Evmos launching soon and Agoric launching this year, this will be an important consideration to track the developer mindshare into 2022 and beyond.

CosmWasm is also not as battle tested as the EVM and harder to onboard given it does not use Solidity. Some of the disadvantages as it stands today are the following:

- Complex

- apps that are spread out across many contracts become hard to read

- Difficult

- bigger learning curve than Solidity and hard to write simple things

- Auditability

- harder to audit than Solidity

Although there are some disadvantages, CosmWasm will likely be the dominant VM on Cosmos for the reasons mentioned above - it was designed to be inherently cross chain.

Key Takeaways

Juno Network is becoming a sandbox for developers to deploy new and innovative applications. We will be closely monitoring the developer activity and the wide range of dapps that deploy on Juno Network.

The Cosmos narrative has not yet achieved its multichain vision. This is due to a number of reasons - lack of a main bidirectional bridge with Ethereum, no highly liquid stablecoin (outside of UST), and lack of VMs such as CosmWasm or the EVM. All of these bottlenecks are being addressed, whether it be through the Gravity bridge, Axelar, Wormhole or the many other bridges into Cosmos. As for stables, we are seeing ERC-20 stables flow in from Ethereum via the Gravity Bridge and other Cosmos native stablecoins launch through the likes of Shade and Agoric’s Run token. Finally, CosmWasm is beginning to get implemented by more and more chains such as Osmosis and the EVM will be made available through Evmos.

With the launch of Evmos in late February and the further maturity of the ETH to Cosmos bridges could kick start a capital rotation into the Cosmos ecosystem. Evmos will be EVM compatible from day 1 and it allows users to use Metamask and other key tooling they are familiar with. This could result in greater interest likely in the wider Cosmos ecosystem - in particular, Juno Network and other DeFi-focused chains like Osmosis.