Disclaimer:Nansen has produced the following report in collaboration with Slice Analytics as part of its existing contract for services provided to Linea (the "Customer") at the time of publication. While Linea has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

Linea, developed by Consensys, is a zero-knowledge (zk) rollup designed to address the scalability constraints on Ethereum. ZK-Rollups batch a large number of off-chain transactions and generate a mathematical proof regarding their validity. Linea is an EVM-compatible ZK-Rollup, enabling EVM developers to deploy their applications in a familiar environment.

The reduction of on-chain data and execution steps also results in reduced gas fees, as Linea minimizes the number of instructions executed within the L1 EVM. Furthermore, Linea's ZK-rollup design enhances security by relying on mathematical ZKPs (Zero-Knowledge Proofs) to validate state updates. This avoids the vulnerabilities associated with challenge periods in Optimistic Rollups. Many consider ZK technology as the endgame for blockchain scaling. In H1 2024, Linea had multiple technological improvements, including the following key developments and ecosystem advancements.

Key Developments: H1 2024

Linea introduced a new era for EVM rollups when it launched its Mainnet Alpha V2 on February 13th 2024, introducing two new features to Linea: Proof aggregation and data compression. This milestone aims to advance the Ethereum ecosystem by enhancing scalability and performance. Specifically, this update aims for significant reductions in transaction fees, potentially cutting costs by up to 90%. This development is a crucial step towards Linea's vision of a more efficient and scalable Ethereum network.

On March 13, 2024, Linea saw the implementation of EIP-4844 as part of the Ethereums Dencun upgrade. This upgrade introduced "blobs" for data storage, reducing transaction fees on Linea by up to 35x compared to Ethereum. The new format allowed Ethereum to process more rollup data and higher transaction volumes without increasing storage requirements for nodes. The result was enhanced data availability, reduced costs, and increased scalability for Linea, making it more accessible and attractive for developers and users.

Linea launched Linea Voyage: The Surge to enhance liquidity in its ecosystem, crucial for the success of decentralized finance (DeFi) protocols. Within eight months of its mainnet launch, Linea reached $440M in total value locked (TVL). The Surge program, which began in April, rewarded liquidity providers with LXP-L tokens, encouraging user participation and boosting market efficiency. The initiative aimed to drive significant growth in TVL and user engagement, promoting a healthy and robust ecosystem with diverse asset classes and applications.

The Linea Ecosystem Investment Alliance (LEIA), an investment syndicate with over 50 leading venture capital firms, announced its first seven investments. Launched in July last year, LEIA aimed to ease fundraising for startups building on Linea. The first investments include Agora, CARV, Entangle, MYX, Tomo, ZeroLend, and Inverter. These projects span DeFi, social, and gaming sectors, providing innovative solutions and contributing to the growth and diversification of the Linea ecosystem. LEIA also offers technical support and mentorship to selected projects.

Linea announced a partnership with Tenderly, integrating their all-in-one development platform with Linea’s zkEVM network. This collaboration provides EVM developers with enhanced tools for building, testing, monitoring, and operating smart contracts. Key features include transaction profiling, simulation, and a comprehensive dashboard. This partnership aims to improve efficiency, security, and cost-effectiveness for developers, enhancing the overall developer experience and promoting the growth of the Linea ecosystem.

Ecosystem

DeFi

Lido is integrating with Linea to enhance DeFi by combining Linea's scalability with Lido's liquid staking. This integration makes wstETH native on Linea, managed by the Lido Foundation. Users can stake ETH via Lido, bridge wstETH to Linea, and engage in DeFi activities seamlessly, improving liquidity and security. This partnership also strengthens ties with MetaMask, facilitating a more unified user experience.

DapDap integrated with Linea, DapDap is an all-in-one platform for exploring and engaging with Ethereum L2s, supporting 13 chains and over 100 dapps. Users can search, onboard quickly, and navigate seamlessly within DapDap, enhancing their DeFi experience. The new DapDap Odyssey gamifies onboarding with a "Spin-to-Win" feature, rewarding users with points (PTS) for completing quests and engaging in on-chain actions. The first phase, “Uncharted Realms,” encourages interaction with ecosystems like Linea, Base, and zkSync. DapDap aims to simplify and enrich the web3 user journey.

Linea has enabled native ETH restaking within its ecosystem by partnering with Renzo Protocol, leveraging EigenLayer technology. This advancement allows users to restake their ETH as $ezETH on Linea, providing economic security to Ethereum and EigenLayer while unlocking additional benefits. Collaborations with Connext, Nile Exchange, Mendi Finance, and ZeroLend enhance $ezETH's functionality, offering seamless swaps, lending opportunities, and robust liquidity. This integration marks a significant step in making DeFi on Linea more dynamic, accessible, and efficient, showcasing the potential of Layer 2-native restaking solutions.

Clip Finance launched its token, $CLIP, on Linea Key features included TVL-linked rewards, a well-structured incentive mechanism, and emissions that decline with each milestone until $1 billion TVL. Governance rolled out in three stages: alpha (Intract Governance), multisig governance, and a combination of on-chain and off-chain governance. Proposals required $CLIP token locks and had to reach a quorum to succeed.

NFTs & Gaming

Linea launched A Gamer’s Guide to Crypto Wallets. Understanding crypto wallets is essential for gamers venturing into the world of gaming and cryptocurrencies. These wallets function as interfaces to the blockchain, holding keys that grant access to digital currencies and enabling transactions.

Linea Park launched on February 20, 2024, and concluding after its 6th week on April 4th 2024. Linea Park offered an immersive experience in web3 gaming and social dapps. With $440M in total value locked, the park features 10 zones, including Administrative Zones for essential tasks and Theme Zones for various gaming genres. Highlights include RPGs, MMO games, and NFT interactions. The first-week spotlights RPG and MMO games, featuring titles like Meta Apes, The Unfettered, Space Falcon-Aviatrix, zAce, Micro3, and AlienSwap. Participants earn Linea LXP through quests, enhancing engagement and accessibility in the Linea ecosystem.

Enterprise

The Linea Builder Launchpad, created in partnership with Aspecta, is a portal for web3 developers to access resources and activities within the Linea ecosystem. Developers can attest to their identity, join the Linea Builders Club for exclusive events, participate in the monthly Dev Cook-Off hackathon, and attend weekly workshops. This platform fosters a supportive community, offering mentorship and growth opportunities.

The Graph on Linea provided decentralized indexing and querying for blockchain data through subgraphs. This collaboration allowed users to access data via open APIs, improving transparency and reducing censorship risks. Linea's ecosystem leveraged The Graph's robust network of Indexers for reliable data access, essential for dapp front-end needs. To create a subgraph on Linea, developers followed steps to initialize, write, deploy, and test their subgraphs using tools like the Graph CLI and Subgraph Studio. This integration enhanced Linea's data performance and utility for web3 applications.

Linea has partnered with HackQuest and Aspecta to offer learning opportunities for web3 developers by launching the Linea Learning Track. HackQuest provides structured learning tracks to enhance skills through guided projects, including token launches, NFT Dutch Auctions, and decentralized social dapps. Aspecta, an identity ecosystem, emerged from a HackQuest hackathon, offering AI-generated identities and tools for seamless digital interaction. Developers can participate in the Linea Dev Cook-Off, a monthly hackathon with prizes including 1 ETH, $500 from Dune, and custom NFTs.

Nansen On-chain Data

Daily Transactions

In H1 2024, the Linea network experienced notable fluctuations in daily transaction counts, ranging from 100k to 4.5m transactions. Transactions steadily increased between February and April, before peaking at 4.5m. This surge in transaction volume can be attributed to the many successful incentive programs Linea has built, including Linea Park. Following this peak in April, the transaction volume decreased, stabilizing with periodic spikes, ranging between 500k and 1.1m transactions.

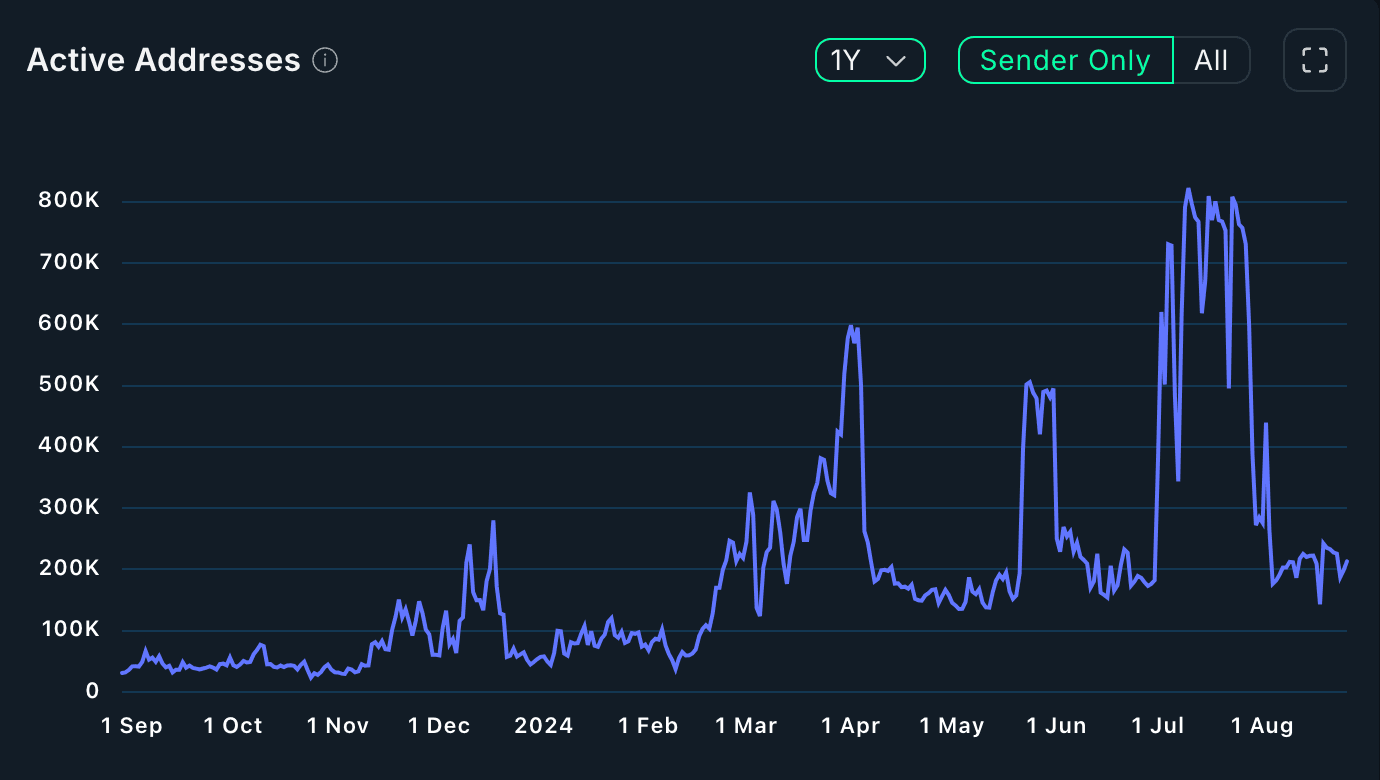

Active Addresses

The trajectory of active addresses closely mirrors that of transactions, showcasing robust growth between February & April, notably aligning with the commencement of Linea Park. This suggests initiatives like Linea Park successfully attract and onboard new users to the chain.

Top Entities by Users and Transactions

Nansen's list of labels provides a comprehensive way to analyze the top entity interactions on Linea Mainnet based on the number of users and transactions. Dmail claims the top position in number of users at 1.5m. Excluding tokens, Layer3 is the second highest protocol by number of users at 1.2m, followed closely by Zypher Games at 1.1m. This indicates that a primary use case for Linea is messaging, gaming, and financial dApps.

Closing Thoughts

The first half of 2024 was transformative for Linea, marked by significant technological advancements and strategic partnerships that bolstered its ecosystem. Linea's Mainnet Alpha V2 and EIP-4844 implementation significantly reduced transaction fees, enhancing scalability and performance. The Linea Voyage: The Surge initiative drove liquidity and user engagement, while partnerships with Tenderly, and Renzo Protocol improved developer tools and DeFi transparency. The launch of Linea Park and various enterprise collaborations, including The Graph and HackQuest, further solidified Linea's position as a leading zkEVM network, fostering innovation and growth across DeFi, NFTs, and enterprise sectors.