Disclaimer: Nansen has produced the following report in collaboration with Slice Analytics as part of its existing contract for services provided to Linea Foundation (the "Customer") at the time of publication. While Linea Foundation has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

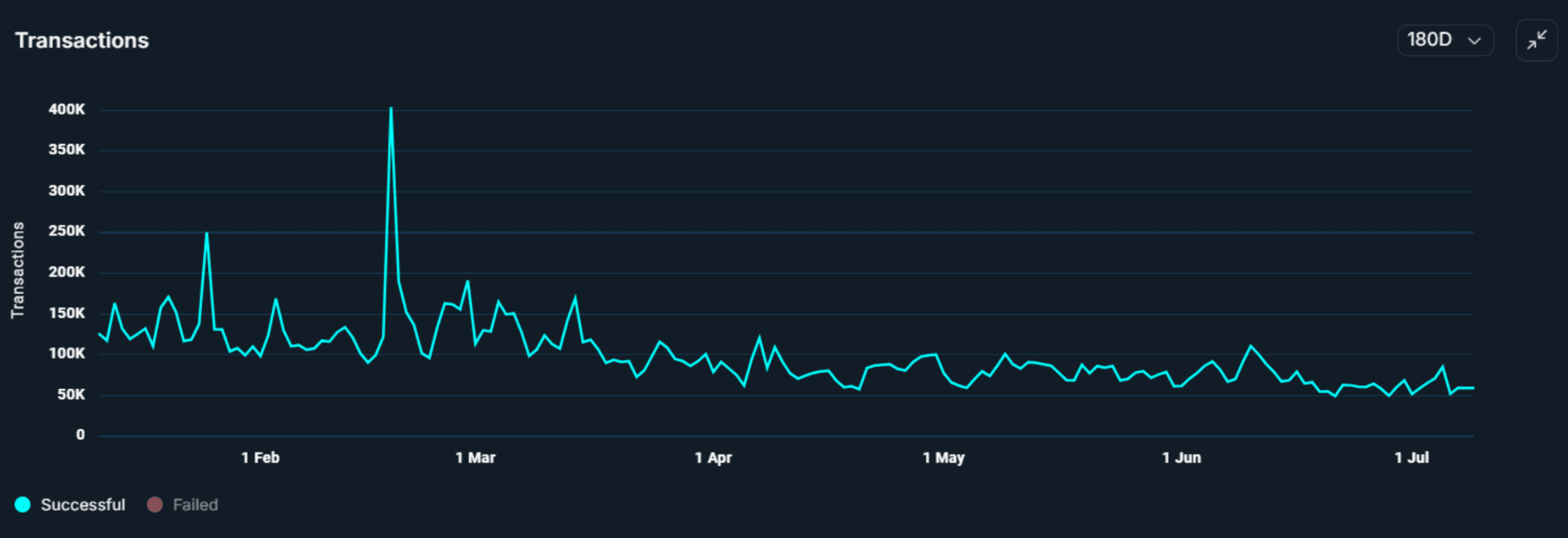

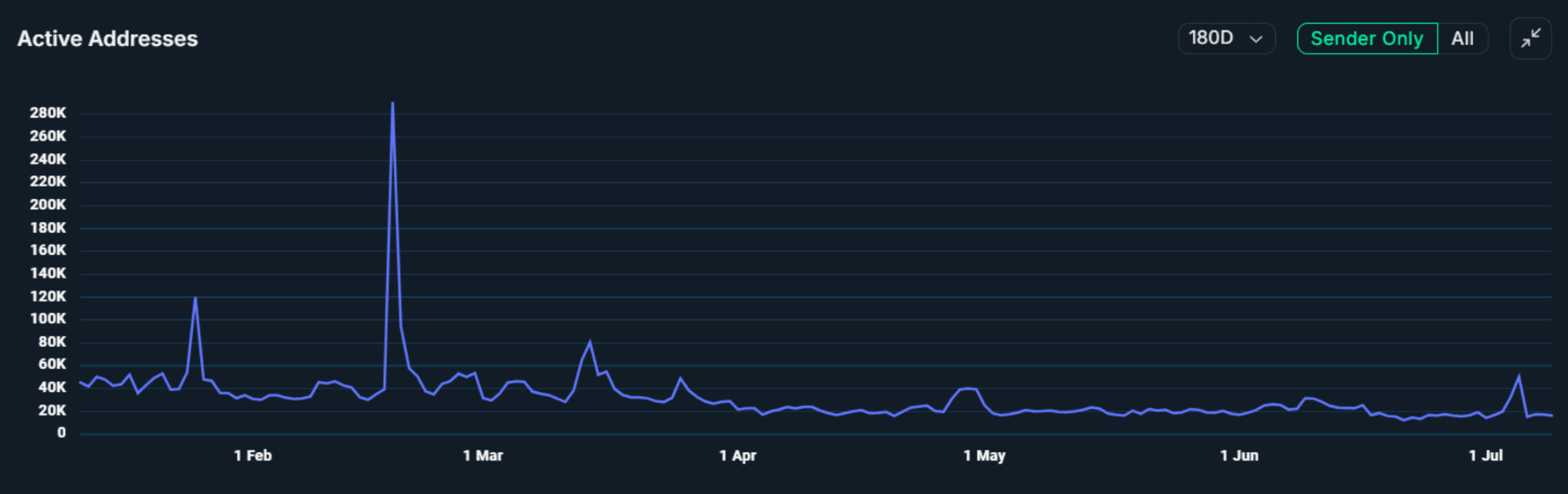

Linea entered 2025 with growing momentum across all layers of its ecosystem, progressing from an early stage rollup into a scalable, Ethereum aligned infrastructure layer. Activity surged in Q1, peaking at nearly 400,000 daily transactions and over 280,000 daily active wallets during key protocol launches and ecosystem campaigns. By Q2, both metrics stabilized at healthy baselines, reflecting a shift from incentive-driven bursts to sustained, utility-led engagement. This transition was reinforced by Linea's seamless upgrade from bridged USDC to native USDC through its deep partnership with Circle, enabling CCTP powered cross chain transfers and positioning the network as a compliant, enterprise grade settlement layer.

Linea also deepened its alignment with Ethereum’s long term roadmap, preparing for Pectra related optimizations to Blob and zkrollup performance. DeFi infrastructure matured through the launch of Lynex V2, 1inch Fusion, and Denaria's dynAMM based perpetuals, while consumer facing experiences advanced with innovations like Coinmunity Cashback for MetaMask Card users. Cultural traction accelerated through projects like Ethereum Frogs, Pond.fun, and community led campaigns highlighted in Linea’s Your Communities initiative. The network also positioned itself at the frontier of decentralized AI with integrations from Skald and Degents AI, and reinforced its identity infrastructure through collaboration with ENS.

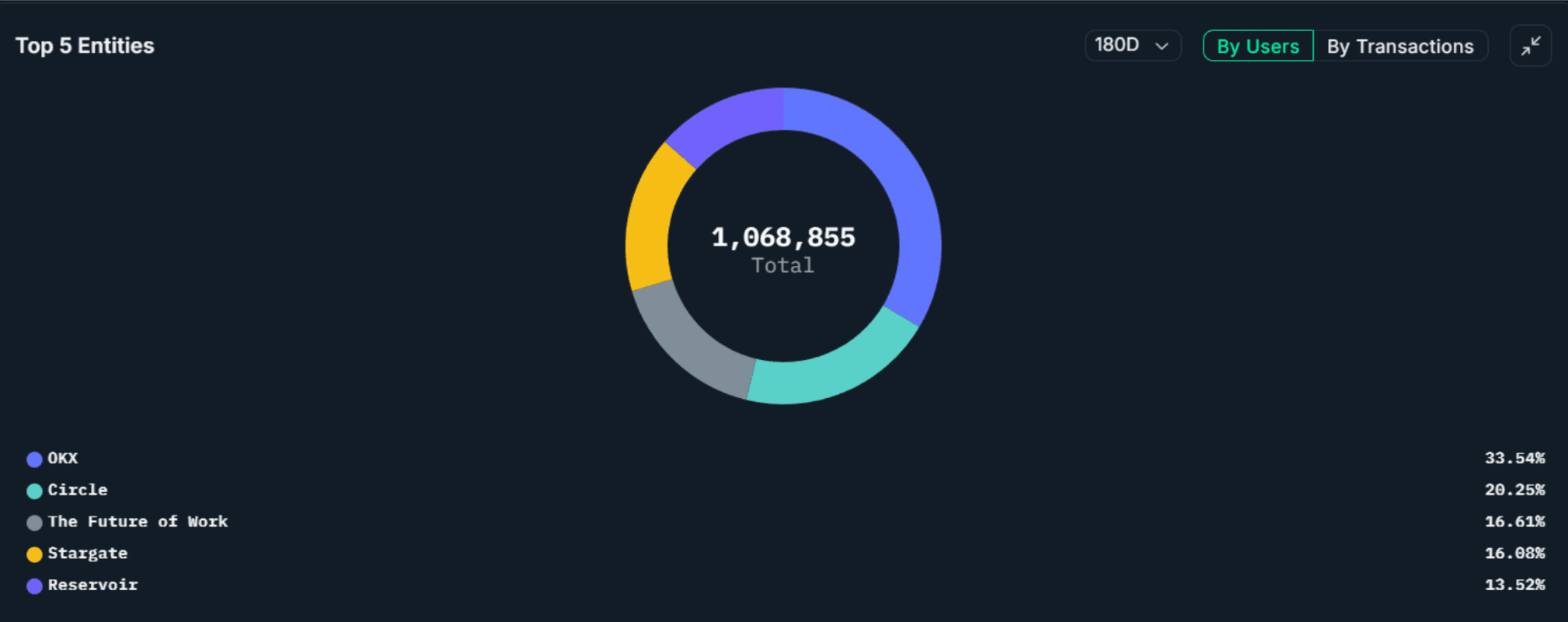

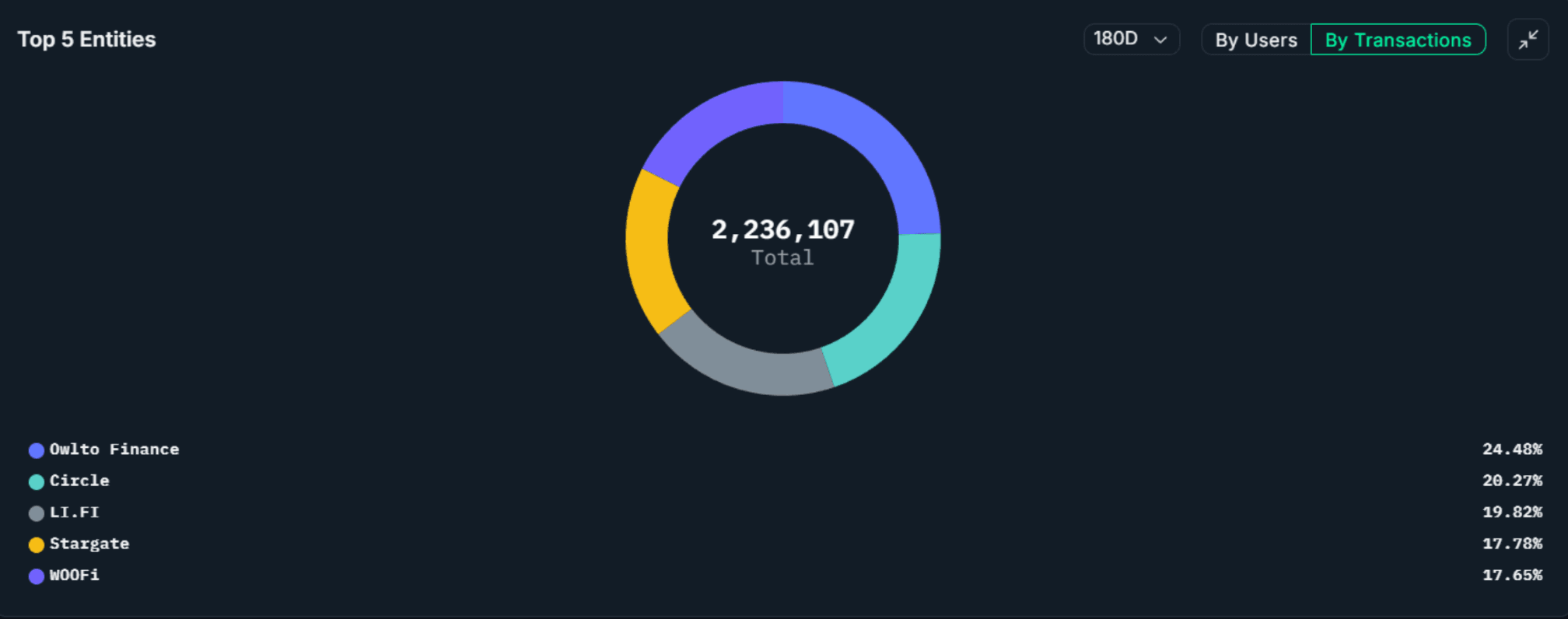

With over one-third of users onboarded via OKX and more than 20 percent of network activity driven by Circle, Linea’s ecosystem is supported by a diverse mix of centralized bridges, on-chain liquidity protocols, and regulated stablecoin infrastructure. These developments point to Linea’s evolution from speculative launchpad to durable Ethereum Layer 2, with a strong foundation in data, identity, liquidity, and cross-chain composability.

Key Developments: H1 2025

- Linea outlined its strategic alignment with Ethereum’s upcoming Pectra upgrade, which is expected to dramatically improve scalability, reduce blob costs, and enhance Layer-2 interoperability. Pectra introduces EIP-7702 and protocol-level support for L2 networks like Linea, enabling more efficient batching and lower-cost zk rollup proofs. Linea emphasized how these improvements will compound with its zkEVM architecture to offer faster, cheaper, and more composable on-chain experiences.

- Linea became the first blockchain to transition from the Bridged USDC Standard to native USDC, with the successful deployment of Circle CCTP V2 (Cross-Chain Transfer Protocol). This upgrade enables fast, trustless USDC transfers across Ethereum, Avalanche, Base, and Linea—eliminating wrapped token complexity and reducing cross-chain settlement to seconds.

- Linea introduced its official Token API, a core data infrastructure layer that enables real-time access to token prices, metadata, security scores, and market trends across the network. Already integrated into MetaMask Portfolio and the Linea Hub, the API empowers developers and analysts with composable endpoints for monitoring activity, powering dashboards, and building automated trading or wallet tools. By aggregating data from on-chain contracts, CoinGecko, Moralis, Dune, and other sources, the Token API establishes Linea as a transparent, data-rich environment. Its security filters and price tracking capabilities strengthen Linea’s position as a developer-first network with native support for composability, token quality assessment, and permissionless financial tooling.

Ecosystem

DeFi

- Linea and DapDap launched Coinmunity Cashback, a novel rewards program for MetaMask Card users that issues on-chain cashback to users who transact via Linea-based dApps. The program links real-world spending with Linea’s zkEVM Layer 2 network, distributing cashback directly to wallets through a smart contract tied to user activity.

- Lynex V2 launched on Linea, delivering significant upgrades to one of the network’s core decentralized exchanges. The new version features a streamlined interface, improved backend for faster interactions, and gas optimization upgrades that enhance cost-efficiency for traders.

- 1inch integrated its Fusion and Fusion+ swaps on Linea, bringing advanced DEX aggregation and deeper liquidity to the network. The rollout includes support for major protocols like SushiSwap, PancakeSwap, Nile Exchange, SyncSwap, and Lynex.

- Denaria released its whitepaper outlining the architecture for a fully on-chain perpetual DEX powered by dynAMM, a dynamic virtual automated market maker. By aligning execution prices with real-time oracles and adjusting liquidity curves dynamically, Denaria offers near-oracle pricing for traders and more sustainable returns for liquidity providers. The design improves on past models like GMX v1 by minimizing PnL risk and oracle-driven arbitrage. Key innovations include a multi stablecoin vault, matrix-based LP accounting, and a funding rate mechanism tied to global trade exposure. With a mobile-first interface and smart wallet integration, Denaria aims to deliver a user-friendly experience without compromising on decentralization or performance.

NFTs & Gaming

Ethereum Frogs, the first major NFT collection on Linea, surpassed 500 ETH in trading volume on Element Market, with a combined total of 610+ ETH when including its sibling project, Ethereum Froglets. Launched in March 2024, the ecosystem now includes Pond.fun and the $CROAK token.

Linea launched a community-focused initiative titled Your Communities on Linea, highlighting key cultural contributors across NFTs, gaming, and memecoins. The initiative showcases leading grassroots projects such as Ethereum Frogs, zkApes, and others that drive creative engagement and community-led innovation on the network.

Enterprise & RWAs

- Linea completed a seamless upgrade to native USDC, replacing bridged versions with Circle’s official deployment on its Layer 2 network. This transition reduces settlement risk, simplifies payment flows, and improves composability across Linea's DeFi and real-world asset integrations.

- Monerium has launched its regulated euro (EURe) and British pound (GBPe) stablecoins on Linea, marking a significant expansion of fiat-denominated digital assets on the network. Fully compliant with EU e-money regulations, these stablecoins are now integrated with the MetaMask Card, enabling direct real-world spending.

- Skald AI Agent announced its integration with Linea, expanding the zkEVM network’s reach into AI-powered agents and smart on-chain automation. Skald’s integration enables decentralized applications to leverage AI agents for tasks such as user onboarding, intelligent dApp interaction, and automated DeFi participation.

- Degents AI launched a decentralized platform for building, owning, and trading tokenized AI agents on Linea, marking a major step toward user-owned artificial intelligence. In contrast to centralized AI services like Google Cloud’s Automotive Agent, Degents enables on-chain deployment of autonomous, multi-agent systems with blockchain-native economic incentives.

- ENS hosted a Namechain workshop at ETHGlobal Brussels, where Linea participated alongside other Layer 2s to explore the future of cross-chain naming and identity standards. Built on the Linea stack, Namechain aims to integrate ENS-native resolution into rollups and bring naming directly into dApp UX at the protocol layer, making Linea a foundational part of ENS’s next-generation naming infrastructure.

- Circle officially launched native USDC and CCTP V2 on Linea, completing the network’s transition from bridged USDC to a fully reserved, redeemable stablecoin issued by Circle. With CCTP V2, users and apps on Linea gain seamless access to cross-chain USDC transfers across Ethereum, Avalanche, Base.

On-chain Data

Daily Transactions

During the first half of 2025, Linea demonstrated strong foundational activity across its ecosystem, with transaction volumes reflecting both early-stage momentum and a shift toward sustained, infrastructure-driven growth. The network saw notable transaction surges in January and March, reaching a peak of nearly 400,000 daily transactions, likely tied to major launches and user acquisition campaigns. As the period progressed, transaction counts normalized, stabilizing between 60,000 and 90,000 daily by late April through June. Rather than signaling a slowdown, this pattern reflects the maturation of the network, where initial bursts of speculative or incentivized activity gave way to more consistent, utility-driven engagement. This transition coincided with key milestones such as the rollout of native USDC, CCTP V2 integration, and the onboarding of regulated assets and real-world payment tools. Linea’s ability to maintain steady transactional throughput while deepening its infrastructure and enterprise focus underscores the network’s evolution into a scalable, user-ready Ethereum Layer 2 platform.

Daily Active Addresses

Throughout the first half of 2025, Linea maintained a steady base of active addresses while demonstrating its ability to attract bursts of user engagement during key ecosystem events. Activity peaked sharply in early March, with over 280,000 sender addresses recorded in a single day, coinciding with major protocol launches and liquidity programs. While the number of daily active addresses gradually declined in the months that followed, Linea sustained a consistent baseline of organic user participation, averaging between 20,000 and 40,000 active addresses per day. This stabilization reflects the network’s transition from short-term incentives toward deeper, more durable engagement tied to real-world use cases. As native USDC infrastructure came online and integrations with platforms like MetaMask Card, Monerium, and Degents AI expanded, Linea positioned itself as a foundational layer for sustainable, permissionless financial activity. The long-term viability of Linea’s user base is underscored by its ability to retain active wallets despite shifting market cycles, suggesting healthy ecosystem retention and a growing focus on product-market fit.

Top Entities by Users and Transactions

During H1 2025, the Linea ecosystem was driven by a diverse mix of high-impact entities, each contributing meaningfully to network usage through either user onboarding or transaction volume. On the user side, OKX led activity with 33.54 percent of total users, followed by Circle at 20.25 percent, illustrating strong traction from both centralized exchanges and stablecoin infrastructure providers. Additional contributions came from The Future of Work, Stargate, and Reservoir, highlighting Linea’s integration into cross-sector and NFT liquidity use cases. Meanwhile, transactional activity was dominated by Owlto Finance, which accounted for 24.48 percent of all transactions, demonstrating the growing importance of cross-chain infrastructure. Circle maintained its influence here as well, driving over 20 percent of total transactions, largely through its rollout of native USDC and CCTP V2. LI.FI, Stargate, and WOOFi rounded out the list, reflecting Linea’s role as a settlement layer for multichain liquidity protocols and real-time stablecoin transfers. Together, these data points reinforce the ecosystem’s dual strength: onboarding users through major exchange and stablecoin platforms while simultaneously processing large volumes of cross-chain and financial activity through its zkEVM architecture.

Closing Thoughts

The first half of 2025 represented a period of meaningful transition for Linea, as the network moved beyond early incentive driven growth to establish itself as a credible, utility-focused Layer 2 aligned with Ethereum’s long term roadmap. The migration to native USDC and the launch of Circle’s Cross Chain Transfer Protocol positioned Linea as a leading infrastructure layer for regulated stablecoin settlement and cross network capital flows. At the same time, Linea’s continued investment in zkEVM technology and core developer tools, including the release of its Token API and preparation for the Pectra upgrade, reinforced its focus on scalability, composability, and developer experience.

Although transactional activity moderated from earlier peaks, Linea sustained a stable foundation of active users and protocol adoption across key verticals, including decentralized exchanges, perpetual markets, consumer finance, digital identity, and on-chain AI. The network’s evolving ecosystem benefited from a diverse mix of contributors, from global platforms like OKX and Circle to community driven NFT and cultural projects. If the first half of the year was about proving technical credibility and securing core infrastructure, the second half will be defined by Linea’s ability to expand real world adoption, deepen liquidity, and scale its presence as a default Ethereum Layer 2 for users, builders, and enterprises.