Disclaimer: Nansen has produced the following report in collaboration with Slice Analytics as part of its existing contract for services provided to Scroll Foundation (the "Customer") at the time of publication. While Scroll Foundation has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

Scroll is a Layer-2 scaling solution for Ethereum built on a bytecode-equivalent zkEVM, enabling developers to deploy unmodified Ethereum smart contracts with lower costs and faster execution. As a zero-knowledge rollup, Scroll batches transactions off-chain and submits succinct cryptographic proofs to Ethereum, preserving decentralization and security while boosting scalability. With its open-source ethos and deep compatibility with existing Ethereum tooling including Solidity, Vyper, and Huff, Scroll is easy to onboard, allowing developers to scale without re-auditing or rewriting applications.

In Q2 2025, Scroll marked a historic milestone with the Euclid upgrade, its most significant protocol transformation to date, delivering a 90% reduction in DA costs, 4x throughput gains, and critical advancements in decentralization and UX. Euclid introduced the OpenVM prover, MPT integration, EIP-7702 support, and censorship-resistant mechanisms, enabling Scroll to become the first zkRollup to reach Stage 1 status. This shift guarantees user exit rights, permissionless block inclusion, and seamless smart account functionality - solidifying Scroll's position as a frontrunner in scalable, secure zk infrastructure. Additional technical progress included a reduction to 1-second block times, a streamlined onramp integration with ZKP2P, and expanded regional access through key SEA CEX listings. Across DeFi, Enterprise, and ecosystem tooling, Scroll has seen dynamic adoption. deSync and HoneyPop launched yield-focused platforms, while Quill Finance returned with $USDQ minting and a gamified rewards system. While ether.fi Cash introduced a fully non-custodial Visa card. Builders gained easier access to audits via the Scroll Audit Marketplace, and tools like Crossmint and Fractionax expanded developer capabilities and democratized access to luxury asset ownership.

Key Developments: Q2 2025

- The Euclid upgrade, Scroll’s most transformative protocol overhaul since launch, was released on mainnet, delivering a 90% reduction in data availability (DA) costs, 4x throughput improvements, and enhanced security to support the growing demands of DeFi, AI agents, and decentralized applications. Key changes include a shift to the OpenVM prover for faster, lower-cost proofs and support for complex transactions; adoption of Ethereum’s Merkle-Patricia Trie (MPT) for improved performance and compatibility; rollup optimizations that drastically cut batch commitment costs; integration of EIP-7702 and RIP-7212 to enable smart accounts and better UX; and new censorship resistance and liveness tools that secure Scroll’s move to Stage-1 decentralization. Together, these pillars solidify Scroll’s position at the forefront of next-gen ZK rollup infrastructure.

- Scroll has become the first zkRollup to reach Stage 1 status, a major decentralization milestone that eliminates reliance on a centralized sequencer and ensures censorship resistance through permissionless transaction inclusion. Enabled by the Euclid upgrade, this transition introduces recursive proof continuations and a move from rigid zkEVM circuits to a more flexible OpenVM zkVM architecture, allowing Scroll to handle arbitrarily large transactions without compromising finality. Backed by a diverse and quorum-restricted Security Council, Scroll now guarantees user exit rights, transparent governance, and system liveness even if the operator fails.

- Scroll has expanded its presence in Southeast Asia (SEA) by listing its native token, SCR, on five key centralized exchanges - Bitkub, Bitrue, Coinstore, Coins.ph, and Hotcoin, making it easier for users across Thailand, the Philippines, Indonesia, and beyond to access the Scroll ecosystem. This initiative supports the region's rapidly growing Web3 community, where a new generation of developers and founders are leveraging blockchain to solve real-world problems.

- Scroll has slashed its block time to just 1 second, significantly improving transaction speed and user experience across its network. This upgrade reduces latency - the delay between initiating and confirming an action - making Scroll feel more like a traditional web app. For users, it means faster payments, less uncertainty, and protection from price slippage. For developers, it enables responsive interfaces, simpler code, and new time-sensitive use cases. The change already benefits products like ether.fi Cash, making crypto payments as seamless as using a traditional card. This improvement has directly led to massive adoption, with ether.fi Cash surpassing $50M TVL locked and over 200k transactions settled on Scroll.

- Scroll has made onramping significantly easier through a new integration with ZKP2P, allowing users to fund their wallets using familiar platforms like Revolut, Venmo, Cash App, Wise, and more. This enables global, permissionless access with local convenience, helping bring the Open Economy to a broader audience. With ZKP2P, users can now seamlessly onramp directly into the Scroll ecosystem through apps they already trust and use - making decentralized finance more accessible than ever.

Ecosystem

DeFi

- HoneyPop is officially live on Scroll, bringing a smooth and rewarding DeFi experience to users. You can now swap tokens and explore liquidity pools.

- Quill Finance is back and live on Scroll, offering an over-collateralized stablecoin protocol that lets users mint $USDQ by lending assets like ETH and liquid staking tokens (LSTs). Built for speed and scalability on Scroll and secured with real-time data from Chainlink oracles, Quill enables a fast, trustless, and transparent DeFi experience. Liquidity providers can earn rewards through the Quill Points Program, featuring Ink Blobs and Sparks.

- Gelato and Morpho have launched Embedded Crypto-Backed Loans, enabling exchanges, wallets, custodians, and fintech apps to offer seamless, non-custodial borrowing experiences directly within their platforms. Available now in beta on Scroll, along with Arbitrum, Optimism, Polygon, and Base, this solution allows users to borrow stablecoins like USDC against crypto collateral without signing transactions, paying gas, or managing seed phrases. Powered by Morpho’s onchain lending protocol and Gelato’s Smart Wallet SDK, the system delivers one-click wallet creation, gasless UX, and EIP-7702 smart account support.

Enterprise & RWAs

- Nexity, a leading platform for real-world asset (RWA) tokenization, is moving to the Scroll ecosystem to power its next phase of growth. By leveraging Scroll’s high-throughput, low-cost, and secure infrastructure, Nexity will issue and manage tokenized invoices, contracts, and debt products, enabling faster capital access for small and mid-sized businesses. Their platform covers the full RWA lifecycle, including origination, risk scoring, token issuance, compliance, insurance, settlement, and even onchain/offchain dispute resolution. Scroll’s predictable cost structure, enterprise-grade security, and developer-friendly EVM environment make it an ideal match for Nexity’s high-volume settlement needs.

- Ether.fi Cash is redefining crypto-native banking by launching the first truly non-custodial Visa card built on Scroll, allowing users to borrow against their crypto holdings, spend globally, and earn rewards - without giving up wallet control or dealing with custodial intermediaries. Building on Scroll’s secure, high-throughput zk-rollup infrastructure, ether.fi Cash offers gasless transactions, sponsored fees via the Euclid upgrade, and instant settlement finality - enabling real-world payment functionality that matches traditional banking standards. Unlike prepaid cards, it functions as a genuine credit card, letting users hold assets like eETH until repayment while earning up to 3% cashback.

- Scroll has launched the Scroll Audit Marketplace on Areta Market, giving builders a faster, more affordable, and transparent way to secure smart contract audits from top-tier security firms. Traditionally, audits involve lengthy wait times, inconsistent pricing, and tedious outreach - but this new platform streamlines the process by offering 6–8 competitive quotes per request from vetted providers like Hacken, Spearbit, Nethermind, Zellic, and more. Builders can easily submit their audit scope, compare offers, and select the best fit based on price, timeline, or preference - often saving up to 30% in costs.

- Crossmint is now live on Scroll, offering developers a powerful suite of tools to rapidly build full-featured applications in a weekend. With simple APIs and no-code dashboards, Crossmint enables AI agents to become economic actors by equipping them with wallets and payment capabilities linked to 200+ onchain actions. Developers can easily onboard users with embedded wallets using email, social login, or phone number, and choose between smart or EOA, custodial or non-custodial wallets. Crossmint also supports large-scale tokenization and credential issuance, and facilitates global payments across 190+ countries using fiat or crypto, even for users without wallets.

- Fractionax, now live on Scroll mainnet, is transforming access to high-value real-world assets by allowing anyone to buy, sell, and trade fractional shares of premium items - like Dubai penthouses, fine art, and luxury watches. The platform uses the ERC-3643 to ensure regulatory compliance while offering small-ticket investments, instant liquidity, and DeFi integration. Users can start investing with as little as $10, trade asset tokens at any time, and even use them as collateral for loans - making asset ownership more inclusive and liquid than ever before.

On-chain Data

Daily Transactions

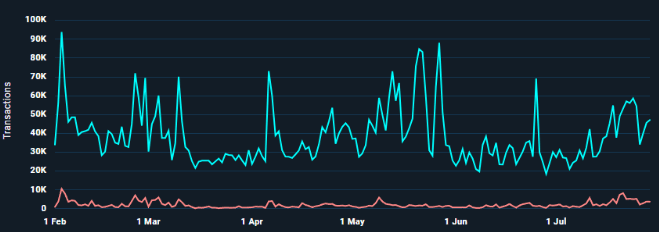

In Q2 2025, Scroll saw strong and accelerating transaction activity. The quarter began with a breakout in early April, reaching a peak of over 70K daily transactions, while the monthly average rose from 15K to more than 30K. May was marked by high volatility, with day-to-day fluctuations exceeding 40K transactions in some cases. Despite the variability, overall activity trended upward, culminating in a quarterly high of over 87K transactions processed in a single day. Following this peak, transaction volumes stabilized in June, consolidating within a consistent range of 30K to 40K per day.

Daily Active Addresses

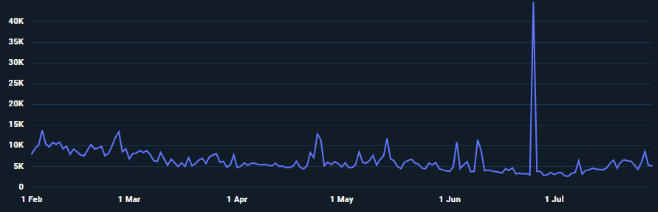

Scroll’s daily active addresses remained remarkably stable throughout Q2, consistently ranging between 5K and 15K users per day. Minor, isolated peaks occurred in response to ongoing network developments, but overall activity maintained a steady trajectory. However, this trend was dramatically increased in late June during Scroll’s presence at EthCC, when the network recorded a surge of over 45K unique active users in a single day - further research pointed towards large volume of transactions between Scroll users and Bitget a leading exchange on Scroll.

Top Entities by Users and Transactions

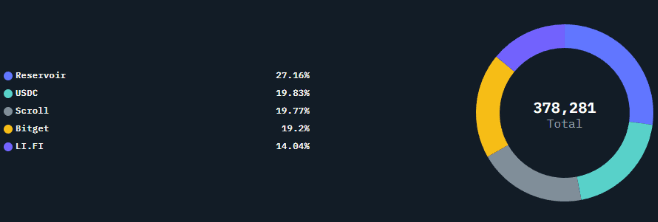

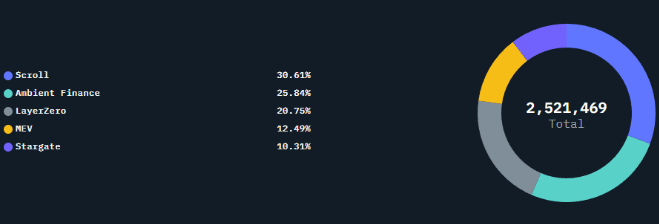

In Q2, Scroll’s Top Entities by Users and Transactions highlighted the growing diversity and depth of its ecosystem. Leading the Users category was Reservoir, a comprehensive token trading infrastructure platform, which accounted for over 27% of Scroll’s 378K unique users. It was followed by USDC, one of the world's most widely used stablecoins, capturing nearly 20% of user share. The remainder of the Top 5 included native Scroll transactions, Bitget - a major centralized exchange - and LI.FI, a multichain swap and bridge protocol, which held just over 10% of user market share. In the Transactions category, Scroll itself dominated with over 750K native interactions, indicating a strong and growing demand for core network functionality. Ambient Finance, a leading decentralized exchange on the chain, followed closely, contributing over 25% of total transactions during the quarter. Rounding out the list were LayerZero and Stargate, two major multi-chain bridging protocols, with 20% and 10% transaction share respectively. Notably, MEV-related activity between these entities underscored the vibrancy of Scroll’s DeFi ecosystem.

Closing Thoughts

Scroll’s performance in Q2 2025 reflects a major step forward in both technical innovation and ecosystem maturity. The release of the Euclid upgrade not only cemented Scroll’s place as the first zkRollup to achieve Stage 1 status, but also laid the groundwork for faster, cheaper, and more secure on-chain experiences. From reducing block times to 1 second and introducing OpenVM, to integrating EIP-7702 smart accounts and enabling permissionless censorship resistance, Scroll has redefined the baseline for zk-rollup capabilities. Paired with enhanced global accessibility through ZKP2P and new SEA exchange listings, these advancements collectively position Scroll as a foundational platform for scalable, decentralized applications.

Beyond infrastructure, Scroll’s ecosystem continues to diversify, with rapid innovation across DeFi, enterprise, and developer tooling. deSync, HoneyPop, and Quill Finance expanded DeFi use cases with high-yield and stablecoin solutions, while Seree and ether.fi Cash demonstrated real-world utility in payments and remittances. Builders benefited from improved tooling via the Scroll Audit Marketplace and Crossmint’s embedded APIs, while projects like Nexity and Fractionax unlocked new possibilities in real-world asset tokenization. On-chain metrics further validated growth, with surging transaction volumes, a record 45K daily active users during EthCC, and strong engagement across leading apps. As Scroll continues to scale, its blend of performance, accessibility, and composability is rapidly shaping the next generation of Ethereum-based infrastructure.