Introduction

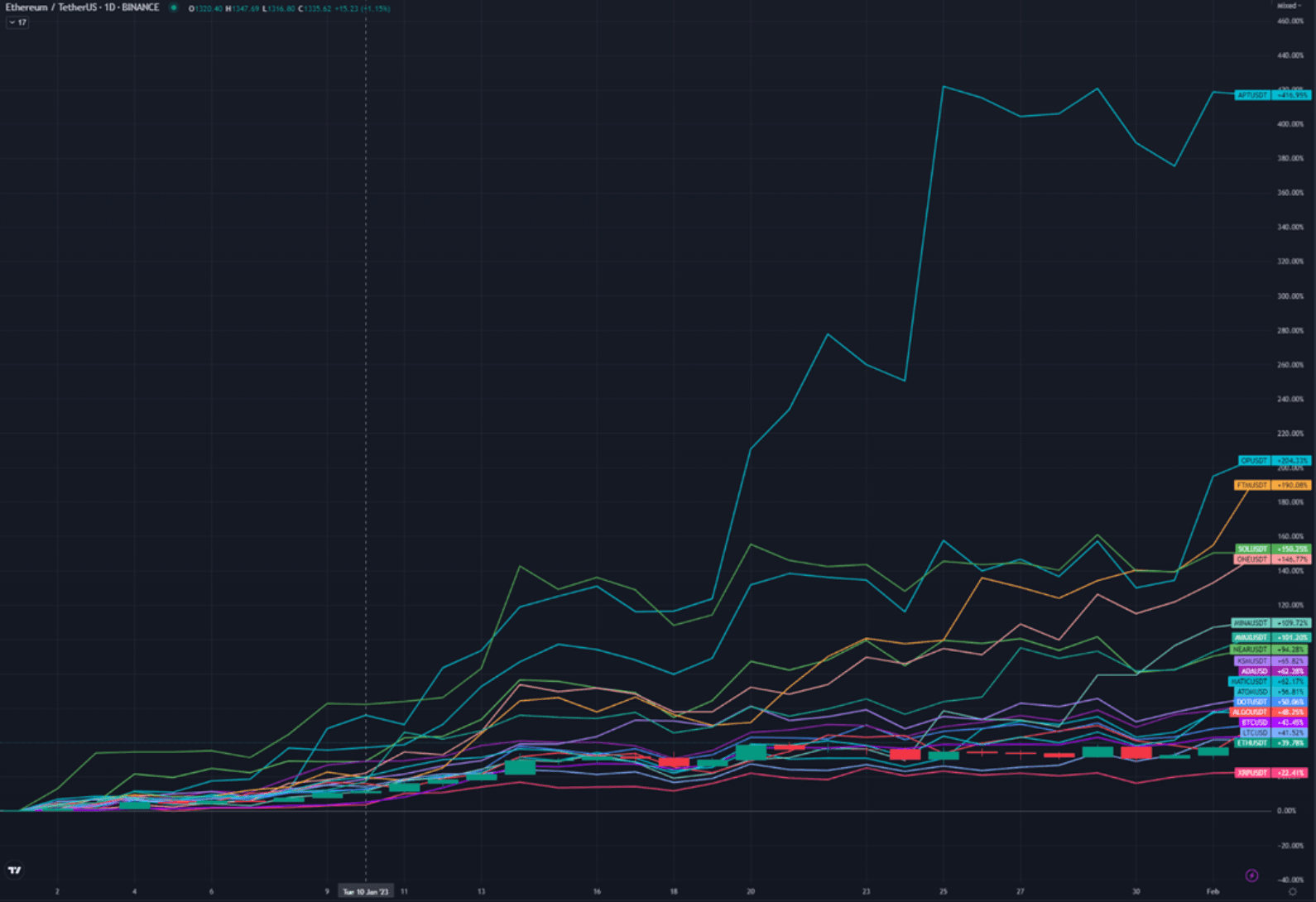

After the YTD run in alts, MATIC stands out to us as somewhat left behind. To put this in context, here are the major L1/L2s YTD. MATIC is in the mid-low end of the pack and admittedly this makes sense – large cap, liquid, one the top performers in 2022 and not particularly ‘degen’. Whilst MATIC is up 12% today post FOMC, it has significantly lagged its main L2 peer OP (up +197% YTD) despite the fact that OP’s on chain KPIs have recently taken a dive following what appears to be aggressive farming as part of Optimism’s quests ahead of upcoming airdrop rewards, and excitement around the Bedrock upgrade. As this rally matures, we think it is likely that we see some capital rotation out of alts that have rallied 2-4x into higher quality/market cap names. If we sell off, well MATIC is a low(er) beta, safer bet that we would expect to hold up far better than many heavily bid alts.

The Case For MATIC

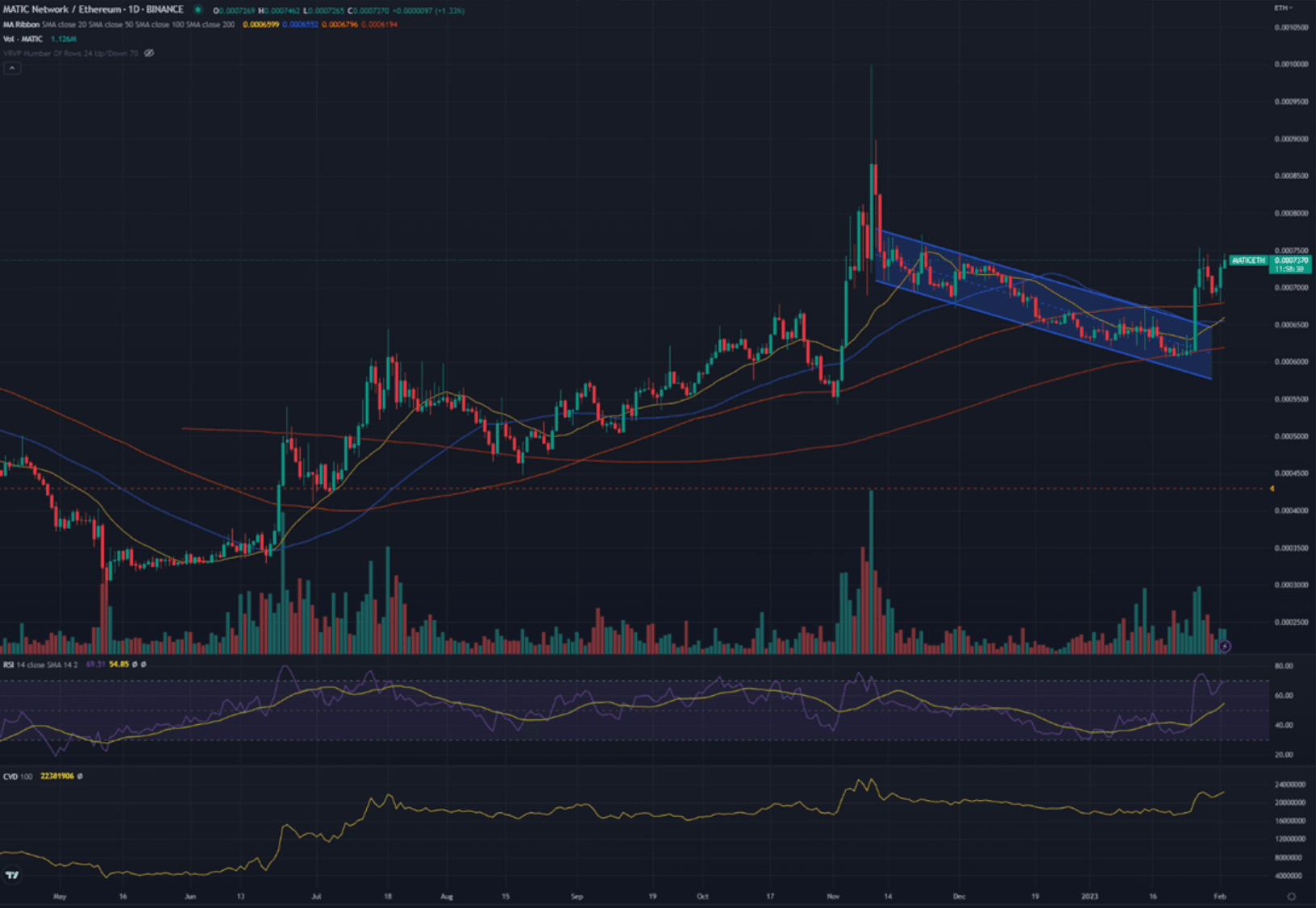

MATIC is interesting to us on a number of levels. From a price action/ positioning perspective it’s at best a mid-pack performer YTD among L1/L2s. In late Q4, ~$150m of MATIC vested to Hermez (one of the zk projects Polygon acquired over the last year) and to the investors from the January 2022 raise, which we think may have held it back, but this supply is largely digested by this point.

Furthermore, we see a number of meaningful catalysts coming in the next few weeks and months and given recent price action, we think there is little priced in. First, Supernets (Polygon’s upcoming dedicated project chains) are currently under development and the team recently said the tech should be ready by mid February, with a formal launch at the Game Developers Conference in San Francisco on March 20-24th, with 10 supernet projects supposedly waiting to launch. But what does this tangibly mean? Well we believe supernets will likely require staking of MATIC, in return for a yield in the native tokens (or in theory stablecoins) of these projects (similar to DOT parachains or ATOM consumer chains). This will likely mean incremental buy pressure for MATIC staking, additional yield for MATIC stakers and the formation of a more sustainable revenue generation model for Polygon.

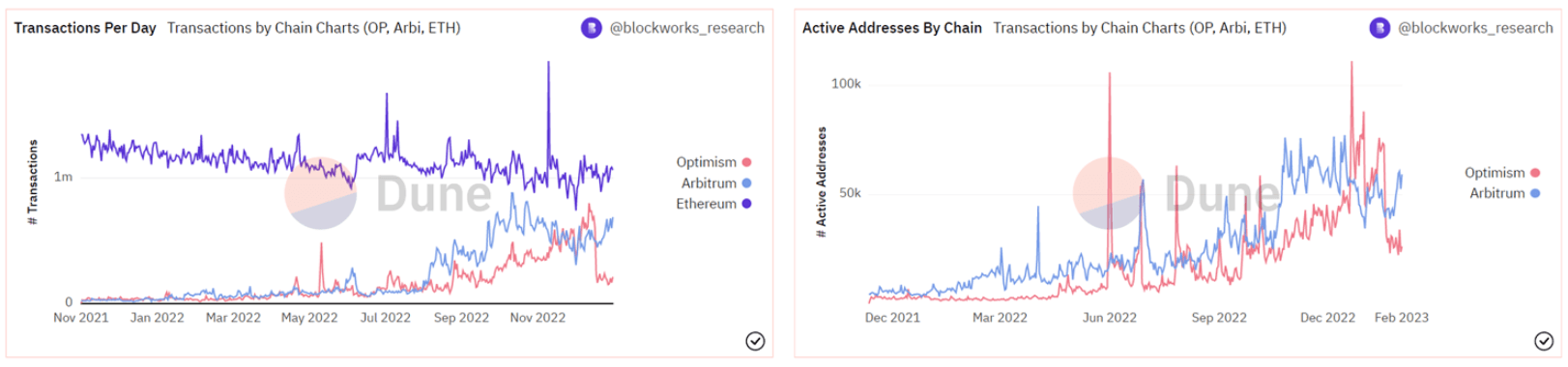

Second, Polygon’s zkEVM is currently in testnet. While no formal date has yet announced, a recent tweet from the team implies mainnet will be launched in the near term and in fact the founder of Mir tweeted earlier this week that zkEVM should reach mainnet ‘sooner than 3 months’. This should be a game changer for Polygon – we recently spoke to a DeFi project founder who had been considering Polygon but one of the key concerns had been the frictions around chain reorgs (partially addressed with the recent hard fork in his view) which make DeFi on Polygon challenging at this point, and in part explain the greater DeFi activity on Optimism and particularly Arbitrum. While details around the zkEVM are still somewhat TBD, the user experience should see a dramatic improvement, and costs should apparently fall by 5-10x (possibly 50-100x in time) which will hopefully drive increased on-chain activity & TVL. As one of the first zkEVM L2 implementations on Ethereum, this should hopefully help capture more crypto native users from Optimism/Arbitrum and zk solutions promise to be more efficient and scalable than optimistic rollups. Unlike Stakware or zkSync, being EVM equivalent (Polygon’s solution will likely be a level 2 or 3 offering, midway on the spectrum between zk equivalence and compatibility) allows for projects to easily port their code base which should support growth in project deployments. Polygon have acquired four leading project teams in the zk space over the last year and anecdotally we hear their tech is highly regarded. They have also been working with EY on Nightfall, which is a privacy focused enterprise grade implementation that is set to launch around May.

Third, on the L2 narrative, we think that post Shanghai (most likely in March), the Ethereum community wll begin to focus on EIP-4844, which will dramatically reduce the cost and increase the throughput for L2s. With a market leading L2 solution which Polygon have lacked to date, we think MATIC can be a direct play on this narrative which should be heavily in focus from Q2 onwards.

Lastly, it’s well known that Polygon have been making waves with recent non-crypto partnerships (Nike, Starbucks, Meta, Reddit…). We expect more of these and while its easy to be cynical about early proof of concept projects, these appear to be gaining material traction – after all 6 million Reddit users have signed up for an NFT…

Disrupting TradFi

But what’s more interesting to us is the emerging push into TradFi. I highly recommend the David Solomon op-ed in the WSJ from early December. In it, he talks about the promise of blockchain for banks and says that Goldman Sachs have been building blockchain based trading systems for clients and experimenting with smart contracts, while talking about the potential for fractional real estate ownership via tokenization.

Around this time Larry Fink, BlackRock CEO, also said that the ‘next generation for markets…and securities’ is tokenization. Asset managers have been dealing with extreme price competition and market share loss to ETFs. Settlement is expensive, slow, messy and prone to human error. It makes enormous sense to replace antiquated systems with fast, reliable and efficient blockchain based solutions and in doing so take out huge cost overheads and reduce operational risk. Just this week, Polygon announced a partnership with Hamilton Lane, where their flagship $2bn equity fund will be tokenized on Polygon.

Also in December, the Bank for International Settlements (the main global regulatory body for banks) changed their limits on crypto ownership for banks to 2% (previously 1%) after what appears to be some pressure from the banking industry. Why does this matter? Banks, payments firms and ecommerce giants are increasingly seeing the potential in stablecoins and are quite rightly concerned about being disrupted. Why would anyone want a current account earning 0% when you can keep eg fully backed JPM$ in your on chain mobile wallet, with instant settlement 24/7? Stablecoins will likely disrupt the current account and as such threaten a key source of zero cost funding for retail banks. The market can likely only digest so many stablecoins given liquidity, onboarding overhead and composability and so will likely be winner take most (and supported by banking licenses and eg FDIC guarantees). Consumers will naturally seek the highest quality, lowest risk options and so banks and retailers will likely be racing to be first to market with fully backed, regulated, USDC like offerings. At first, these stables will likely offer no yield to users like USDC – accruing net interest margin to the issuers - but in time competition will lead to users accruing the interest from say short duration T-bills (and in fact Ondo recently launched tokenized US Treasuries this month) which will further accelerate consumer demand.

In summary, TradFi is clearly now being forced to take crypto seriously both in terms of the huge revenue and cost opportunities and the strategic threats. For these risk averse financial institutions, which L1/L2 will they back? To us the lowest risk, most enterprise friendly and robust options at this point are Polygon and also Avalanche, who recently launched a tokenized fund for KKR.

What could this mean for crypto and potentially Polygon? Imagine a total reworking of the global banking, asset management and payments infrastructure, with much of this moving on chain onto a public, enterprise focused, composable solution, most likely with some degree of zk-based privacy, possibly functioning across a number of composable dedicated L2s and supernets/subnets/appchains. To put this in context, SWIFT is the main global payments standard which connects 11000 institutions in over 200 countries and processes roughly half of high value global payments volumes and is owned by consortium of banks. SWIFT was founded in 1973 and is historically well known for being inefficient and expensive with transactions often being routed via multiple banks. SWIFT is clearly a prime candidate for disruption from a modern, decentralized payments network. While this might sound like a stretch in the near term given how difficult it is to disrupt incumbent core banking infrastructure, we believe there will be a significant amount of press over the next 1-2 quarters around TradFi frms seriously investing in crypto and this ‘slow release’ narrative could gain meaningful traction.

Polygon's Gaming Outlook

Beyond this, we see MATIC winning across a number of other verticals, with gaming and NFTs a key focus (in fact Ryan Wyatt, the head of Polygon Studios most recently led gaming at Youtube) and the team are one of if not the highest quality in crypto with a wide number of highly experienced web3, big tech and TradFi executives. Supernets open the door to meaningful revenue generation and while this is very difficult to assess, the work we did as part of our deep dive in September roughly implied a potential revenue opportunity of ~$300m pa over the medium term from web2 supernet yields/’rents’ alone. We also estimated that mass adoption across eg payments or web3 gaming could drive a potential $1-5bn pa of gas spend, though admittedly this is extremely difficult to estimate especially given ongoing cost reductions for L2s. But to sense check this, at 0.2c/txn (the current proving costs for Polygon’s zkEVM for a Uniswap trade) this would imply ~500bn txns pa, which compares to ~350bn on Mastercard and Visa alone (each ~5000 tps), and in fact in November last year, gas spend on Ethereum hit $1.9bn in a month. In time, costs should come down, but we would expect throughput to dramatically improve and we would also envisage some revenue generation from MEV (which currently accounts for ~1pp of ETH’s staking yield).

Comparison against other L1/L2s

Lastly, valuation is fairly compelling. FDV/TVL is ~10x which compares to ~7x for Ethereum, 16x for AVAX, 50x for SOL and 16x for OP (which has a comparable FDV to MATIC at $12bn) and we would argue underprices the potential for dramatic TVL improvement following the zkEVM release.

Summary

So to summarize:

- In line/ underperformer amongst L1/L2s, dramatic underperformer vs main peer OP, valuation attractive vs L1/L2 space on FDV/TVL basis

- Not helped by Q4 vesting but this should now have largely been digested.

- Either we move into next phase of the rally, in which high performance alts like OP likely see profit taking and reallocation to similar. sector/theme, but higher quality names that have lagged OR market corrects, in which case quality/large cap names like MATIC should at least outperform.

- Two hard catalysts on the horizon, likely within 3 months – supernets and zkEVM mainnet

- Likely to see more partnership announcements and management have said publicly to expect material partnership announcements with Wall St.

- Long term fundamentals/narrative very strong – 1) Bet on the future evolution of ETH as spelled out by Vitalik, ie L2s with a preference for zk and EIP-4844 coming into focus post Shanghai 2) plenty of verticals in which they can win- NFTs, gaming, DeFi the key focus 3) First class team with relentless BD focus and the most enterprise friendly offering in crypto, 4) Supernets offering a route to revenue generation/ non-inflationary yield for MATIC stakers with meaningful bull case revenue generation from gas and possibly MEV over the medium term.

Disclaimer

The information (“Information”) provided by Cumberland DRW LLC and its affiliated or related companies (collectively, “Cumberland”), either in this document or otherwise, is for informational purposes only and is provided without charge. Cumberland is a principal trading firm; it is not and does not act as a fiduciary or adviser, or in any similar capacity, in providing the Information, and the Information may not be relied upon as investment, financial, legal, tax, regulatory, or any other type of advice. The Information has not been prepared or tailored to address, and may not be suitable or appropriate for the particular financial needs, circumstances, or requirements of any person, and it should not be the basis for making any investment or transaction decision. THE INFORMATION IS NOT A RECOMMENDATION TO ENGAGE IN ANY TRANSACTION.

If any person elects to enter into transactions with Cumberland, whether as a result of the Information or otherwise, Cumberland will enter into such transactions as principal only and will act solely in its own best interests, which may be adverse to the interests of such person. Before entering into any such transaction, you should conduct your own research and obtain your own advice as to whether the transaction is appropriate for your specific circumstances. In addition, any person wishing to enter into transactions with Cumberland must satisfy Cumberland’s eligibility requirements. Cumberland may be subject to certain conflicts of interest in connection with the provision of the Information. For example, Cumberland may, but does not necessarily, hold or control positions in the cryptoasset(s) discussed in the Information, and transactions entered into by Cumberland could affect the relevant markets in ways that are adverse to a counterparty of Cumberland. Cumberland may engage in transactions in a manner inconsistent with the views expressed in the Information.

Cumberland makes no representations or warranties (express or implied) regarding, nor shall it have any responsibility or liability for the accuracy, adequacy, timeliness, or completeness of, the Information, and no representation is made or is to be implied that the Information will remain unchanged. Cumberland undertakes no duty to amend, correct, update, or otherwise supplement the Information.

The virtual currency industry is subject to a range of risks, including but not limited to: price volatility, limited liquidity, limited and incomplete information regarding certain instruments, products, or cryptoassets, and a still emerging and evolving regulatory environment. The past performance of any instruments, products, or cryptoassets addressed in the Information is not a guide to future performance, nor is it a reliable indicator of future results or performance. Investing in virtual currencies involves significant risks and is not appropriate for many investors, including those without significant investment experience and capacity to assume significant risks.

Cumberland SG Pte. Ltd. is exempted by the Monetary Authority of Singapore (“MAS”) from holding a license to provide digital payment token (“DPT”) services. Please note that you may not be able to recover all the money or DPTs you paid to a DPT service provider if the DPT service provider’s business fails. You should not transact in a DPT if you are not familiar with the DPT. This includes how the DPT is created, and how the DPT you intend to transact is transferred or held by your DPT service provider. You should be aware that the value of DPTs may fluctuate greatly. You should buy DPTs only if you are prepared to accept the risk of losing all of the money you put into such tokens. You should be aware that your DPT service provider, as part of its license to provide DPT services, may offer services related to DPTs which are promoted as having a stable value, commonly known as “stablecoins.”

WWW.CUMBERLAND.IO