Disclaimer: Nansen has produced the following report in collaboration with Slice Analytics as part of its existing contract for services provided to Algorand (the "Customer") at the time of publication. While Algorand has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

Algorand is a blockchain designed to overcome the common trade-offs between scalability, security, and decentralization. Its Pure Proof of Stake (PPoS) consensus mechanism ensures fast, secure, and efficient transactions with instant finality, making it highly reliable for decentralized applications. Unlike many blockchains, Algorand is fully decentralized and permissionless, enabling anyone to participate in consensus while maintaining low transaction fees and high throughput.

In H1 2025, the Algorand Foundation made several major advancements across staking, governance, developer tooling, and policy. It launched Staking Rewards on mainnet as part of the Algorand 4.0 upgrade, offering inclusive participation with no lockups or slashing, and rewarding validators with 10 ALGO per block and 50% of transaction fees. In parallel, the Foundation concluded its Governance Rewards program after three and a half years, with 33.9B ALGO committed by an average of 25K governors per period, distributing 687.5M ALGO in rewards. On the developer side, AlgoKit 3.0 introduced TypeScript smart contract support, visual debugging tools, real-time event monitoring, and a redesigned portal to simplify and scale Web3 development. Additionally, Algorand joined the Blockchain Association to advocate for pro-innovation crypto policy in the U.S., emphasizing the blockchain's use in financial inclusion, decentralized identity, and public infrastructure.

Key Developments: H1 2025

The Algorand Foundation has officially launched Staking Rewards on the Algorand mainnet, following the rollout of the Algorand 4.0 upgrade. This new program enhances network security by incentivizing validators with 10 ALGO per proposed block - gradually decreasing by 1% every million blocks - and 50% of the transaction fees from those blocks. Unlike traditional staking models, Algorand's system is designed for inclusivity and ease of use, with no token lockups or slashing penalties, and supports various participation methods, including running a node (for holders of 30K+ ALGO), liquid staking via platforms like Folks Finance and Tinyman, staking pools on Pact and Réti, and delegated staking through Valar.

AlgoKit 3.0, launched in March 2025, marked the most significant upgrade to Algorand's developer tooling to date, introducing robust support for TypeScript smart contracts, visual debugging, enhanced testing frameworks, and a fully rebuilt developer portal. The release featured the Beta debut of Algorand TypeScript, enabling full-stack development within the TypeScript ecosystem, and included new tools like [Lora the Explorer] (https://github.com/algorandfoundation/algokit-lora) for visualizing accounts, transactions, and apps; a VSCode AVM Debugger for step-by-step smart contract tracing; and redesigned Utils libraries for more intuitive blockchain operations. A new Subscriber module enabled real-time monitoring of on-chain events, while the updated portal delivered improved documentation, tutorials, and examples tailored for both human developers and AI tools.

The Algorand Foundation announced that, after three and a half years, its Governance Rewards program had concluded. Over its lifetime, the program saw governors commit a total of 33.9B ALGO - peaking at 3.8B in a single period - with an average of 25,000 participants per quarter, and disbursed 687.5 million ALGO in rewards (including allocations for DeFi and NFT initiatives and an xGov grants pilot.

The Algorand Foundation has officially joined the Blockchain Association, aligning with leading U.S. industry stakeholders to promote pro-innovation crypto policy and open blockchain infrastructure. By joining the association, the Foundation aims to support the development of a clear and consistent regulatory framework that emphasizes real-world blockchain use cases such as financial inclusion, decentralized identity, and digital public goods. With its energy-efficient, high-performance Layer 1 blockchain, Algorand brings a strong focus on practical applications and global financial access. The Foundation’s new Chief Legal and Operations Officer, Jennie Levin, will help lead its engagement in the Blockchain Association’s policy and advocacy efforts.

Ecosystem

DeFi

Kiln has announced support for ALGO staking, aligning with the Algorand Foundation’s launch of its Staking Rewards program. Users can now stake their ALGO through Kiln’s secure and user-friendly platform, gaining access to real-time rewards while helping to secure the Algorand network.

The Algorand Foundation has announced the integration of Wormhole’s Native Token Transfers (NTT) standard on the Algorand blockchain, enabling seamless multichain token transfers without wrapped assets. Developed in partnership with Folks Finance, this upgrade positions Algorand as a first-class participant in Wormhole’s interoperability network, which connects over 40 blockchains. The integration allows developers to mint NTT-compatible tokens and facilitates direct cross-chain transfers for users, opening new liquidity channels and expanding DeFi use cases.

Alpha Arcade, a prediction market application, launched on Algorand Mainnet, utilizing Algorand-based USDC (USDCa) for settling transactions.

The Algorand Foundation has announced that ALGO is now live on Telegram through its native Wallet integration, enabling over 1B Telegram users to trade ALGO directly within the app.

NFTs & Gaming

- World Chess and the Algorand Foundation have released a whitepaper proposing a blockchain-based “global chess passport” that would provide players with a secure, decentralized identity to unify their credentials across all chess platforms and tournaments. Powered by Algorand, the system would allow individuals to manage their achievements, ratings, and eligibility with one verifiable ID - streamlining tournament registration, preventing identity fraud, and promoting fair play in both online and offline competitions.

Enterprise

Exodus Movement Inc., a developer of self-custodial crypto wallets for networks like Bitcoin and Algorand, has successfully uplisted to the NYSE American exchange after an initial SEC rejection in May 2024. Previously traded on OTC Markets under the ticker "EXOD," the company's stock hit an all-time high of $41 in December 2024 in anticipation of the move. As the first crypto firm to go public on the NYSE in 2025, Exodus sets a notable precedent for other blockchain companies exploring public listings this year.

The Mann Deshi Foundation and the Algorand Foundation have expanded a blockchain-based credit scoring system to provide thousands of first-time women borrowers in India with access to formal financial services. Using Algorand’s secure blockchain, the initiative issues verified digital identities and alternative credit scores, replacing cumbersome paper-based processes with smartphone-accessible, privacy-compliant records. Integrated with India’s digital ID infrastructure, the system enables women with no prior credit history to prove creditworthiness and access loans more efficiently.

Pera Wallet has launched the Pera Card, a non-custodial, Mastercard-enabled debit card built on the Algorand blockchain, in partnership with Immersve. Initially available in the UK, Germany, Italy, Spain, and New Zealand, the card enables users to make everyday purchases using Algorand-based USDC (USDCa), with real-time crypto-to-fiat conversion at the point of sale.

RWAs

Midas, a fully regulated German tokenization platform, has launched mTBILL, a tokenized certificate referencing short-term U.S. Treasury ETFs, on the Algorand blockchain - marking its first non-EVM deployment. Designed for retail investors across Europe, mTBILL eliminates high entry barriers, offering access to high-quality assets like BlackRock’s IB01 and BUIDL without a minimum investment requirement. The token is permissionless and DeFi composable, benefiting from Algorand’s low fees, instant finality, and 24/7 settlement.

Mitsui O.S.K. Lines (MOL), one of the world’s largest shipping companies, has launched a group-wide carbon inset program in partnership with 123Carbon, an Algorand-based platform that tokenizes carbon insets on the blockchain. This initiative enables MOL and its customers to reduce emissions directly within their own supply chains by investing in low-emission fuels, rather than relying on traditional carbon offsets.

Italian energy giant Enel Group has partnered with crypto wallet provider Conio to launch a groundbreaking initiative that enables Italians to purchase fractional ownership of solar panels through tokenization on the Algorand blockchain. Available since January, the program allows residents - particularly those in apartment buildings - to benefit financially and environmentally by offsetting their electricity bills with energy produced from Enel's commercial solar farms.

MiCA-compliant stablecoins EURQ and USDQ, powered by Quantoz, are launching on the Algorand blockchain. Since their debut in November 2024, the two stablecoins have recorded over $50M in trading volume. Trading pairs for EURQ and USDQ are available on Folks Finance.

The Algorand Foundation has partnered with Paycode, a leader in biometric and offline digital payments, to boost financial inclusion in underserved regions. Operating in countries like Ghana, Zambia, and the DRC, Paycode serves over 6 million people and has enabled $250M in aid disbursements. As part of the collaboration, Paycode will move parts of its infrastructure to the Algorand blockchain, using its fast, secure, and energy-efficient platform to power transparent, offline-first financial services.

On-chain Data

Daily Transactions

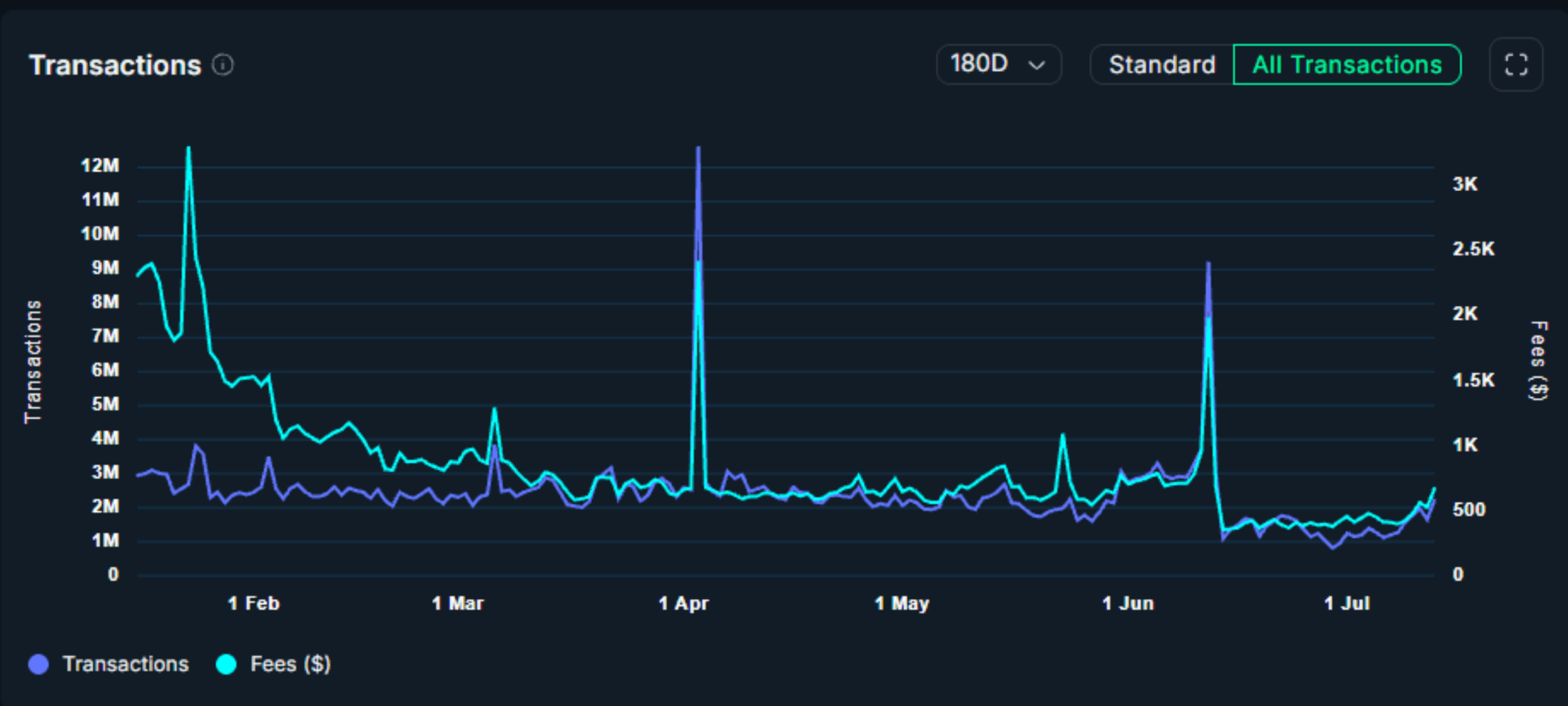

In H1 2025, the Algorand network remained stable within the 2–3M daily transaction range, despite turbulent market conditions across the cryptocurrency sector. From January to March, the number of transactors was fairly consistent, with occasional spikes reaching up to 4 million transactions - primarily driven by native dApp developers launching new products. In early April, following the announcement of Algorand’s transition away from its Governance Rewards program, transaction volume surged to over 12M in a single day - a record high for the chain in H1 2025. Activity then stabilized until June, when Binance staking announcements triggered another spike, exceeding 9 million daily transactions, followed by a period of consolidation. Overall, the transaction metrics reflect clear patterns of a large and diverse user base actively utilizing Algorand, signaling strong potential for future growth.

Daily Active Addresses

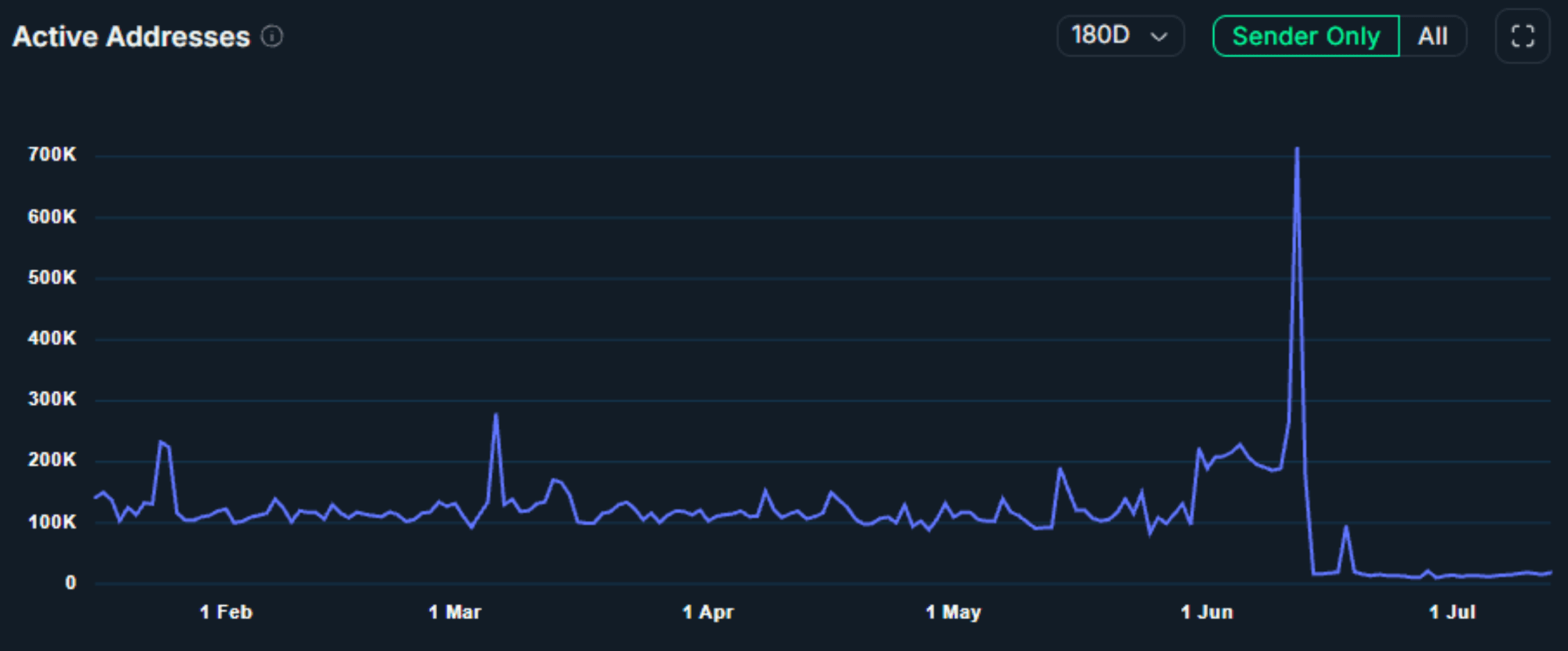

The active addresses metric tells a similar story to that of transaction volume. Algorand maintained a consistently stable user base of around 100K daily active wallets, reinforcing its position as one of the industry’s leading blockchains. Noticeable spikes occurred in January and March, reaching the 200-300K range, coinciding with the Foundation’s Staking and Governance program updates. The Binance campaign, however, shattered the H1 2025 record - surpassing 700K active users in a single day. Following that peak, activity stabilized through the end of the period.

Staking

Algorand’s staking ecosystem continues to demonstrate strong engagement, with over 1.9 billion ALGO currently staked across 1,821 active validators. At current network conditions, a reward-eligible solo node staking 30,000 ALGO is projected to earn approximately 1,687 ALGO annually, translating to a projected APY of 5.62%. Staking activity is highly concentrated, with the top 100 stakers holding hundreds of millions of ALGO through a mix of single-signature wallets, multi-signature setups, and application-based accounts. Among staking sources, single-signature wallets account for roughly 634.9 million ALGO (33.3%), followed by multi-signature wallets with 494.2 million (25.9%), Reti](https://reti.nodely.io/) represents 448.5 million (23.5%). while liquid staking platforms like Folks Finance contribute about 278.8 million (14.6%). Current block rewards average 9.45 ALGO, and validator participation remains diverse, highlighting a robust decentralized staking infrastructure that blends solo validators, institutional participants, and liquid staking protocols.

Top Entities

Algorand’s Entity ranking is showing great diversity in terms of sector representation, highlighting the network’s wide-ranging utility. World Chess, a FIDE-backed online chess platform, leads in transaction volume with nearly 24M transactions. In contrast, TravelX Wallet boasts the highest user count at over 8.1M, while maintaining 8.6M transactions - an astonishing feat. Algorand-based USDC, as a stablecoin, demonstrates strong utility with nearly 7M transactions across over 808K users, showing consistent adoption for payments and transfers. Oranges.meme also generated massive activity (over 23.5M transactions) from a relatively small user base (10,772), pointing to very high engagement of its holders. Protocols like Tinyman (DEX) and Folks Finance (DeFi) show robust participation from tens of thousands of users, while HesabPay stands out among financial apps with more than 370K users and 2.6M transactions. Overall, the data reflects both mass adoption use cases and niche, high-volume protocols driving on-chain activity across Algorand.

DeFi - Top Protocols

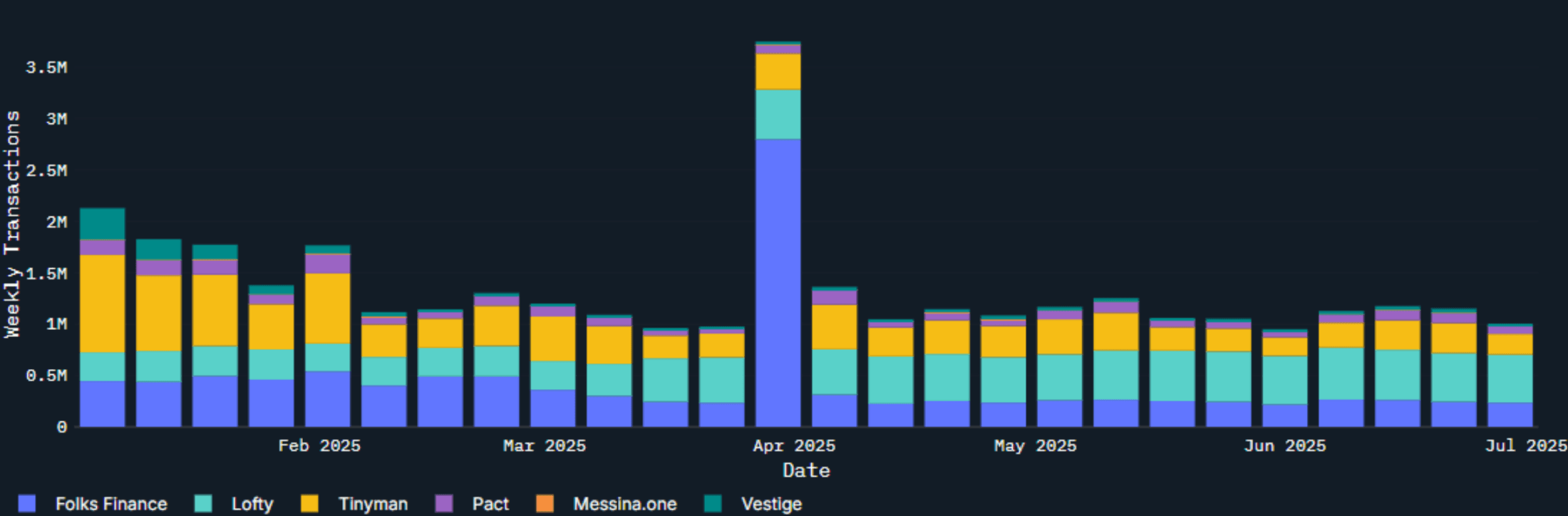

In terms of Algorand’s top DeFi protocols, H1 2025 began with Tinyman leading the way, averaging over 750K transactions per week throughout January - while Algorand’s “Magnificent Six” maintained a combined total in the 1.5 to 2M transaction range. In the following months, transaction volumes began to stabilize, with Tinyman losing some market share to Lofty, which gained traction thanks to ongoing development efforts. The first week of April was dominated by Folks Finance, whose liquid ALGO staking collaboration surged in popularity following the closure of the Governance Rewards program. Folks Finance alone surpassed 2.5 million transactions in a single week, contributing to a collective peak of nearly 4 million DeFi transactions during that period - the highest in H1 2025. After this spike, weekly transaction volumes returned to the pre-April range of 1.5 to 2 million, with Lofty emerging as Algorand’s top protocol by transaction volume, followed by Tinyman, Folks Finance, Pact, Vestige, and Messina.one.

Closing Thoughts

H1 2025 was a transformative period for the Algorand ecosystem, underscoring the protocol’s growing maturity, expanding utility, and commitment to real-world impact. With the launch of staking rewards projected at a current APY of 5.62%, the conclusion of its long-running governance rewards program, and the release of AlgoKit 3.0, Algorand has solidified its foundation for sustainable, decentralized growth. Institutional-grade integrations - from tokenized U.S. Treasuries and carbon insets to stablecoin settlements and financial inclusion tools - highlight the network’s ability to meet practical, global needs. Meanwhile, multichain interoperability through Wormhole NTT, major user acquisition campaigns, and increasing DeFi activity signal Algorand’s strong positioning in the evolving blockchain landscape. As user metrics surged to record highs and developer capabilities reached new levels, Algorand continues to prove it is not only a technically robust Layer 1, but one designed for meaningful adoption at scale. The outlook for the second half of the year is optimistic, with a community, infrastructure, and policy stance all aligned toward a decentralized, accessible future.