Disclaimer: Nansen has produced the following report as part of its existing contract for services provided to Avalanche (the "Customer") at the time of publication. While Avalanche has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

Avalanche is a three-chain smart contract platform designed to optimize scalability, network security, and decentralization simultaneously. Its primary network consists of the P, X, and C chains, with the C-chain implementing the Ethereum Virtual Machine (EVM) for compatibility with Ethereum applications. A key feature of Avalanche’s architecture is its Layer 1s, which are sovereign networks that define unique membership and token economics. This customizable framework allows Layer 1s to achieve consensus independently, supporting efficient scaling without affecting the main network.

In Q1 2025, the Avalanche ecosystem expanded its innovation frontier through several key initiatives across AI, finance, and privacy. In partnership with Aethir, the Avalanche Foundation fast-tracked AI and gaming projects from its infraBUIDL(AI) Program into Aethir’s $100 million Ecosystem Fund, marking its first third-party grant collaboration to provide funding, computational resources, and strategic support. Simultaneously, Avalanche launched the Avalanche Card with Rain, enabling users in underbanked regions such as Latin America, Nigeria, and Southeast Asia - to spend crypto assets like USDC and AVAX anywhere Visa is accepted, advancing real-world crypto adoption. Additionally, AvaCloud unveiled eERC, an encrypted ERC20 token standard that introduced confidential transactions to EVM-compatible blockchains, offering privacy and auditability for applications in sectors such as finance, healthcare, and government.

Key Developments: Q1 2025

- The Avalanche Foundation has partnered with Aethir, a decentralized GPU cloud computing provider, to fast-track AI and gaming projects from its infraBUIDL(AI) Program into Aethir’s $100 million Ecosystem Fund. This collaboration represents Avalanche’s first third-party grant partnership and aims to accelerate the development of AI-driven Web3 innovations by offering funding, computational resources, and strategic guidance. Through this alliance, Aethir will join the infraBUIDL(AI) committee, prioritize qualifying projects for its fund, and provide compute grants tailored to each project’s needs.

- The Avalanche Foundation, in partnership with Rain, has launched the Avalanche Card, a crypto-powered debit card that allows users to spend digital assets like USDC, USDT, AVAX, and wAVAX anywhere Visa is accepted. Designed to address financial exclusion in underbanked regions such as Latin America, Nigeria, and Southeast Asia, the card offers a practical alternative to traditional banking by enabling real-world crypto transactions for essentials like groceries, bills, and transportation. The card debuted at ETHDenver and is now open for sign-ups, representing a major step toward real-world crypto adoption and financial empowerment.

- AvaCloud has unveiled eERC (Encrypted ERC), a next-generation token standard that introduces confidential transactions to both permissioned and permissionless blockchains, enabling secure and private token transfers without sacrificing auditability. Designed for EVM compatibility, eERC allows users to issue ERC20 tokens with encrypted balances and transfer amounts, making it ideal for privacy-critical sectors like finance, healthcare, and government. Key features include seamless integration, protocol-layer independence, high-performance client-side encryption, and a built-in Auditability Module for regulatory compliance. eERC supports granular privacy control, external auditing with rotatable keys, and lightweight implementation with no extra hardware requirements.

Ecosystem

DeFi

- Nonco, a leading institutional digital asset trading firm, has launched FX On-Chain, an institutional-grade foreign exchange protocol built on Avalanche’s C-Chain to bring real-world FX liquidity and pricing into the stablecoin economy. Designed for enterprises and financial institutions, the protocol automates cross-border conversions between USD-backed and local currency stablecoins (e.g., USDC, USDT, AUSD), enabling faster, cheaper, and more efficient global payments and remittances. Leveraging Avalanche’s speed, low fees, and EVM compatibility, FX On-Chain offers features such as atomic on-chain settlement, RFQ-based targeted pricing, and direct integrations with banks and stablecoin issuers. Inversion, led by crypto investor Santiago Roel Santos, is launching its own Avalanche Layer 1 blockchain to drive mainstream crypto adoption by transforming blockchain into an operating system for traditional businesses. Unlike typical go-to-market strategies, Inversion will acquire established businesses and transition them to on-chain operations, creating crypto-native private equity models akin to a "Berkshire on-chain." Built on Avalanche for its performance, flexibility, and interoperability, Inversion will use its Layer 1 to deliver essential services like mobile and banking, embedding stablecoins and DeFi into real-world applications without user friction.

- Avant pushed stablecoin utility in DeFi forward with the launch of avUSD, a digital dollar optimized for payments, lending, and portfolio stability, and savUSD, its yield-bearing counterpart. Users can deposit USDC to mint avUSD, then stake it to mint savUSD earning passive, risk-managed yield via delta-neutral strategies. With no reliance on token emissions or centralized exchanges, savUSD offers sustainable, onchain yield generation and can be used as collateral across DeFi protocols.

NFTs & Gaming

- Gaming industry veterans from legendary studios like Rovio, MiniClip, Jagex, and Kwalee have united with Web3 developers to launch WARP, a pioneering Web3 gaming ecosystem built on a custom Avalanche Layer 1 blockchain. Designed by seasoned game creators, not outsiders, WARP aims to transition traditional gaming into a decentralized future, empowering players with true digital ownership, asset interoperability, and blockchain-enabled value creation. The platform offers a complete suite of AI-driven tokenomics tools, development infrastructure, and publishing services to help studios overcome technical barriers and build sustainable, scalable in-game economies.

- March marked a major milestone as Avalanche welcomed its first Layer 1 integration on Binance via GUNZ, the gaming-focused blockchain from Gunzilla Games. Launching through Binance Launchpool, users were able to purchase GUN, the native token powering Gunzilla’s ecosystem, including shooter Off The Grid. GUN will support core in-game functions such as gameplay rewards, trading, gear upgrades, and minting NFTs from loot boxes called HEXes.

- Haunted Space, a visually stunning sci-fi horror dogfighting game built on Avalanche, is set to launch on Xbox and PlayStation, marking a major milestone in Web3 gaming’s entry into mainstream consoles. Developed by Galaxy Lab and supported by an Epic MegaGrant and Microsoft, Haunted Space enables true asset ownership via Avalanche’s blockchain, letting players own and trade ships, skins, and weapons in a fast, secure, low-latency environment. The game also integrates Polaris AI, featuring Polaris Coach for real-time strategic coaching and Polaris Accessibility, an adaptive AI tool that customizes gameplay for users with physical, visual, or auditory disabilities.

Enterprise

- LEVR has launched the first decentralized leveraged sports betting platform, LEVR Bet, on Avalanche’s C-Chain, combining perpetual trading mechanics with live sports wagering. Offering up to 5x leverage and real-time position adjustments, the platform leverages Avalanche’s low fees and near-instant finality - enhanced by the recent Avalanche9000 upgrade - to deliver a faster, smarter betting experience. Currently in its testnet phase during the NFL playoffs, LEVR Bet allows users to place demo bets for rewards while preparing for a mainnet launch with real USDC payouts. Powered by LVP Vaults, the platform introduces a novel liquidity model rewarding stablecoin depositors with real yield. Led by a team with deep experience in sports betting and DeFi, LEVR is also pursuing a Curacao gaming license to ensure a compliant launch.

- The Dantewada District Administration in Chhattisgarh, India, has launched a blockchain-secured land record application in partnership with Zupple Labs, digitizing over 700,000 records using Avalanche to ensure tamper-proof, instantly verifiable data. Previously dependent on paper documents, the new system enables revenue officers to authenticate land records in minutes, reducing transaction times from weeks to a single day and significantly enhancing transparency and efficiency. Developed with Zupple Labs' LegitDoc platform, the initiative marks a major step in digital governance, particularly benefiting tribal and marginalized communities.

- Gelato has expanded its developer platform to offer Avalanche Layer 1 (L1) Blockchain-as-a-Service (BaaS), empowering enterprises to launch sovereign, scalable blockchains tailored to their specific needs. Aligned with the Avalanche9000 upgrade - which introduces dynamic fees and removes AVAX staking requirements - Gelato’s BaaS enables faster, lower-cost deployments with built-in interoperability through Avalanche InterChain Messaging (ICM). Designed for use cases like KYC-gated fintech, gaming economies, and enterprise apps, Gelato’s platform includes a full Web3 services suite: high-availability RPCs, account abstraction, verifiable randomness, onchain automation, and 50+ integrations including LayerZero and The Graph.

- Quboid launched as a next-generation decentralized loyalty management platform on Avalanche’s gasless Layer 1 via AvaCloud, aiming to transform the way brands and consumers engage. By addressing the inefficiencies of traditional loyalty programs - such as fragmentation, low engagement, and limited scalability - Quboid introduces tokenized, interoperable loyalty assets that enable instant settlements, liquidity aggregation, and reduced operational complexity. Its ecosystem includes tools like Studio (a CRM for brands), Club (a consumer engagement app), QExchange (a loyalty token marketplace), and gamified portals for customer interaction.

- Kite AI has launched the first purpose-built artificial intelligence Layer 1 on Avalanche, introducing a decentralized platform tailored for collaborative AI development. Built with Avalanche’s scalable infrastructure, Kite AI addresses key limitations in existing blockchains - such as limited scalability, unfair AI contributor rewards, and centralized data silos - by implementing a unique Proof of Attributed Intelligence (PoAI) consensus mechanism. This system ensures transparent attribution and fair rewards across data providers, model developers, and AI agents. The Kite AI ecosystem includes a decentralized data engine, customizable subnets, composable AI coordination tools, and portable AI memory for privacy-preserving scalability. Backed by major investors and partners like AWS, Chainlink, and Sui, and led by a team with deep AI and blockchain experience, Kite AI aims to establish a programmable AI value chain on Avalanche.

Nansen Onchain Data

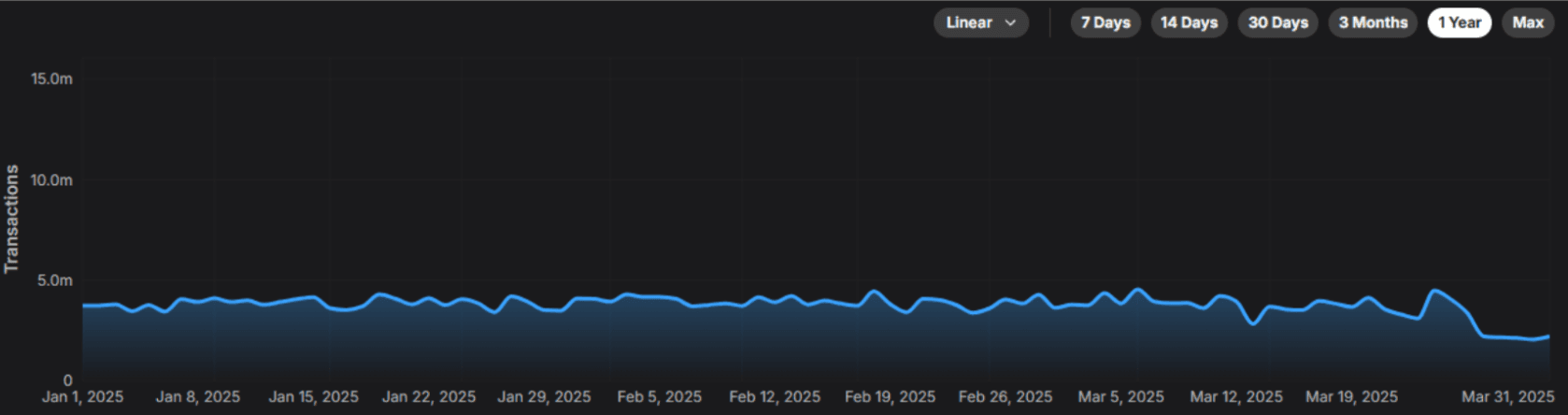

Daily Transactions Across Avalanche Chains

From January to March 2025, daily transaction volume on the Avalanche blockchain remained relatively stable, fluctuating between 3 to 5M transactions, indicating consistent network usage. At the end of Q1, we saw a slower period, with transactions dipping into 2 to 3M per day - likely induced by macroeconomic conditions, as other chains recorded similar loss of activity in the same period. This chart shows that Avalanche has a very consistent base of users, relying on the network to perform their day-to-day operations.

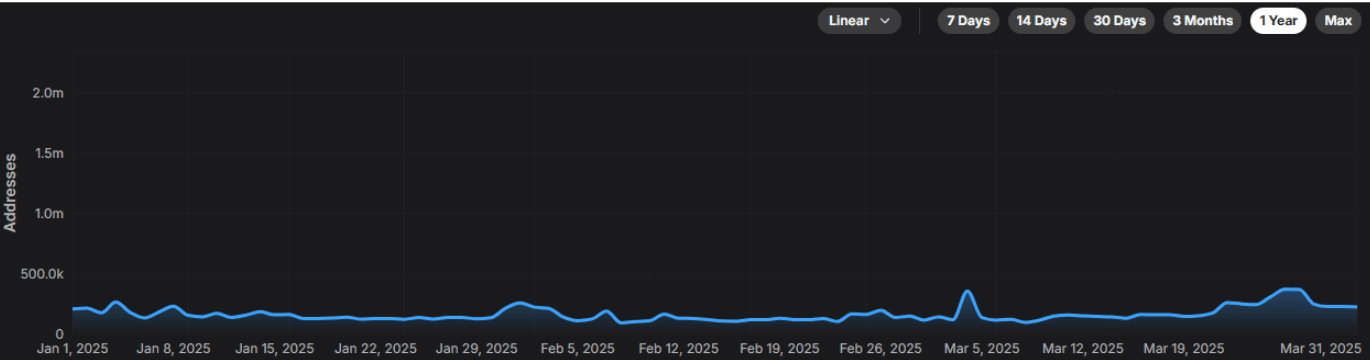

Daily Active Addresses Avalanche Chains

In Q1 2025, Active Addresses activity remained relatively stable for most of the period, typically ranging between 100 to 300K. However, there were a few noticeable spikes - particularly around early February, March 5, and late March - with the latter reaching close to 1 million addresses, indicating short bursts of heightened user interaction, which may be attributed to the launch of new Avalanche Layer 1s - thanks to the Avalanche9000 update deployed in late 2024.

Top Entities by Users and Transactions

Nansen's list of labels provides a comprehensive way to analyze the top entity interactions on Avalanche based on the number of users and transactions. By analyzing these interactions, we gain deeper insights into the behavior and trends of key entities on the Avalanche network.

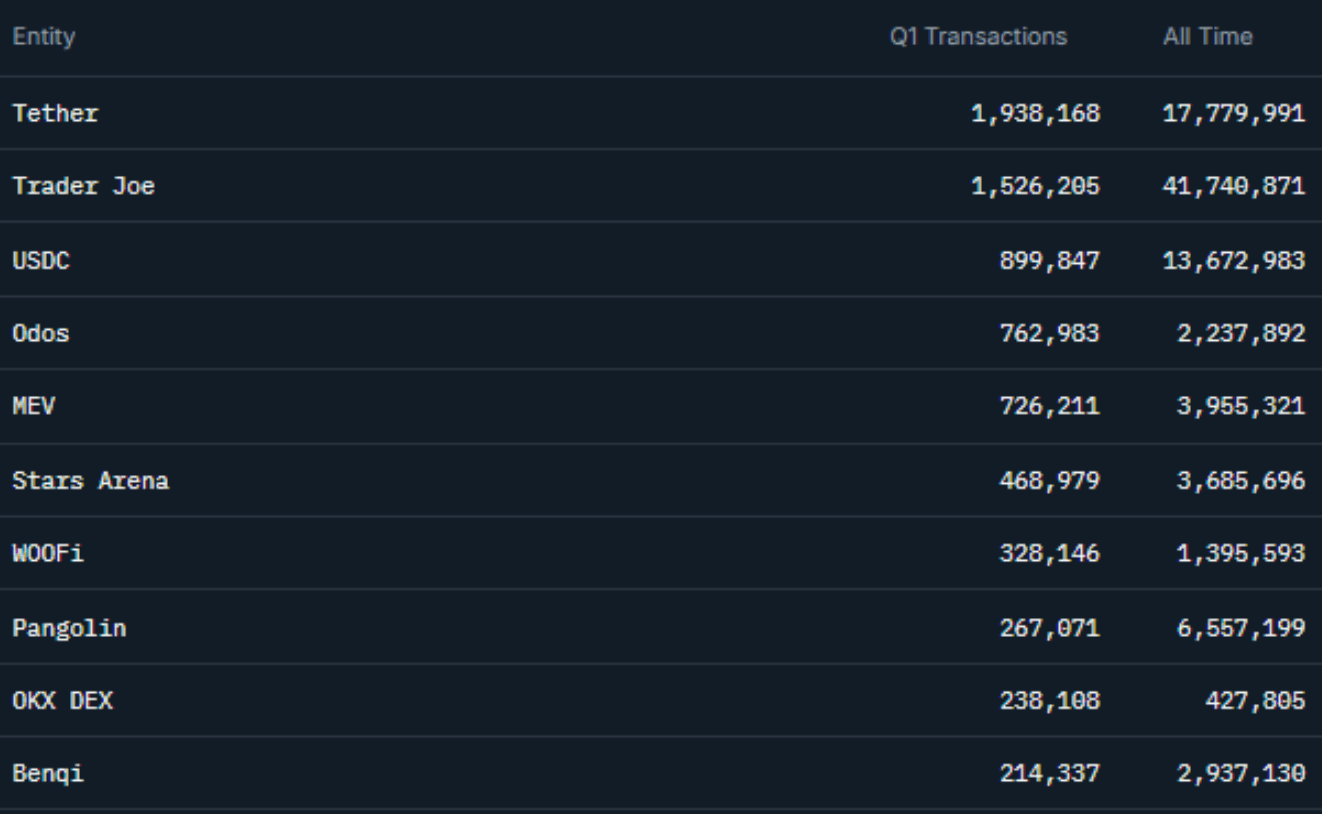

Avalanche Transactions by Entity

In Q1 2025, Avalanche was dominated by DeFi entities. The number one spot belonged to Tether, a well-established stablecoin with almost 2M transactions during the course of the quarter, while silver and bronze medals went to LFJ - Avalanche’s biggest DEX - and USDC, a stablecoin operated by Circle. Closely following USDC, fourth place went to Odos, a trading routing solution, which optimizes fees - which has been climbing the Top 10 over the past couple of quarters and managed to accrue over 750K transactions in the period. Below Odos, we see an aggregated activity of MEV bots summing up to over 700K transactions, indicating a market that’s ripe for arbitrage opportunities, and The Arena - a SocialFi outlier turned DEX that consistently ranks in the Top 10 and has amassed over 450K transactions. The rest of the ranking is, once again, DeFi all the way - with household names such as WOOFi, Pangolin and OKX DEX trading blows, and ending with Benqi - a lending protocol, which managed to hit almost 215K transactions.

Avalanche Users by Entity

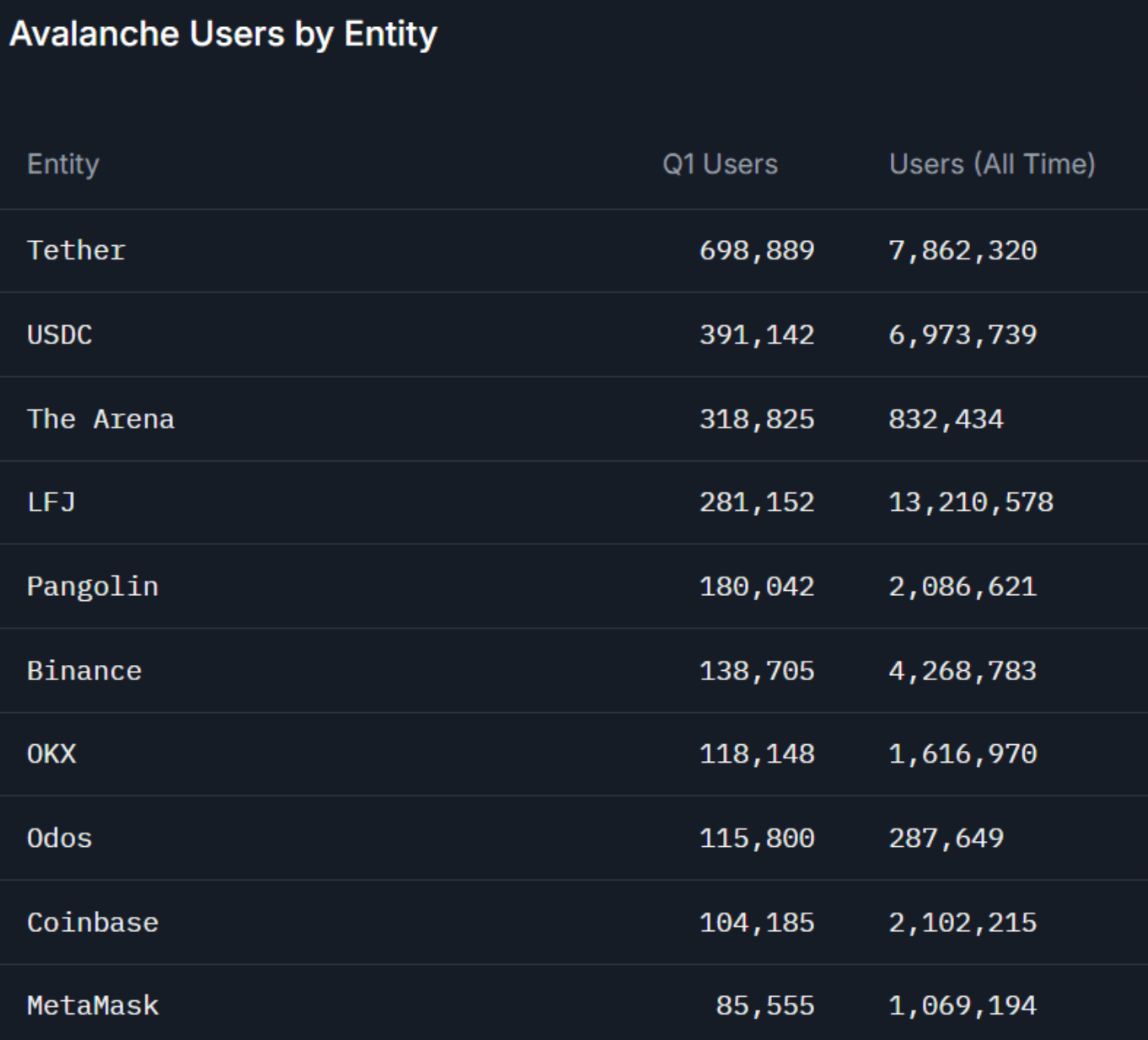

The Users Entity table paints a similar picture to the Transactions one - once again, Tether and USDC sit at the top, with 698K and 391K users, respectively, over Q1 2025. Tether was followed by The Arena and LFJ - both hovering around the 300K mark. Pangolin took the fifth spot with 180K users, and the rest of the Top 10 belongs to crypto staples, such as Binance, OKX, Coinbase and Metamask - all utilized heavily for moving funds on and off the chain - with Odos sneaking up in between them to take the eighth spot with their 115K users over the course of the quarter.

Closing Thoughts

Q1 2025 showcased Avalanche’s continued evolution as a high-performance, developer-friendly blockchain ecosystem driving innovation across multiple verticals. From AI and DeFi to gaming, enterprise infrastructure, and digital identity, the network demonstrated its versatility and real-world applicability, highlighted by the launch of initiatives like the Avalanche Card and eERC standard. These features strengthen the bridge between decentralized finance and practical, compliant use cases, while the rise of projects like Kite AI, Quboid, and Inversion signaled growing institutional confidence in Avalanche’s Layer 1 framework. On-chain metrics confirmed a stable and active user base, punctuated by spikes tied to new Layer 1 launches enabled by the Avalanche9000 upgrade. With DeFi continuing to dominate usage - led by stablecoins, DEXs, and innovative tools like Odos - the ecosystem remains deeply rooted in financial utility. As Avalanche solidifies its role as a foundational layer for next-generation applications, its focus on scalability, privacy, and real-world impact positions it for strong momentum heading into the rest of 2025.