Disclaimer: Nansen has produced the following report as part of its existing contract for services provided to Polygon Labs (the "Customer") at the time of publication. While Polygon has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

Polygon PoS is a Layer 2 Ethereum sidechain scaling solution created by Polygon Labs.. Its low fees and ease of development have made it popular since rising to prominence in 2021.

In addition to Polygon PoS, Polygon Labs has developed a range of scaling solutions, including application-specific blockchain networks called Polygon Supernets, built with Polygon Edge, an EVM-compatible blockchain framework. Polygon Labs is also working on several ZK-Rollups, including Polygon Zero, and Polygon Miden. While each scaling solution may have different tradeoffs, they all aim to provide a faster and more secure network with low transaction costs.

In this quarterly report, we look at Polygon Labs’ performance in Q1 2023 and list key developments implemented by Polygon Labs for the Polygon ecosystem to improve overall network performance and user experience.

Check out Nansen’s previous report on Polygon and other chains here.

Key Development: Q1 2023

- Polygon recently implemented a new token mapping process to streamline the mapping of tokens onto its Layer 2 scaling solution for Ethereum, reducing the associated time and complexity. The new process requires token issuers to submit a mapping request and provide relevant information about the token. Token mapping is a critical step in enabling decentralized finance (DeFi) applications on Polygon and improving cross-chain interoperability.

- Polygon has launched its Mainnet Beta for the open-source technology Polygon zkEVM, which has been publicly built and tested on a testnet. The code is now fully open-source under the AGPL v3 license, with audit reports available for public review and a bug bounty program in place to identify critical vulnerabilities. The move aims to enhance transparency as Polygon zkEVM becomes feature-complete and works toward decentralizing the sequencer in the future.

- Polygon ID is an open-source tool providing a decentralized identity solution for users and developers, enabling secure interaction with different applications and services on the Polygon network while allowing users to control their personal data. The release aims to promote DeFi and improve the user experience on the Polygon platform.

Ecosystem

Despite prevailing market conditions, Polygon witnessed a flurry of activity in Q1 2023, attracting major projects from both within and outside the web3 space. Below are notable developments from the Polygon ecosystem during this period:

- Cope Studio has launched Mint, a blockchain-based platform that allows fractional ownership of real-world assets like art and real estate, featured on the Polygon Spotlight. The platform leverages Polygon's scaling technology to provide fast and low-cost transactions, potentially revolutionizing the investment landscape.

- On Jan 6, 2023, Mastercard announced a partnership with Polygon Labs to launch a Web3 musical artist accelerator program that will leverage blockchain technology to support emerging musicians. The program aims to help artists build and monetize their fan base by providing access to resources and tools, including NFTs and decentralized finance (DeFi), that are powered by Polygon's scalable infrastructure.

- Rarible has launched a marketplace builder for creating custom NFT marketplaces on Polygon, enabling users to create and manage their own NFT collections and marketplaces. The integration with Polygon's infrastructure aims to reduce gas fees and increase transaction speeds, making NFTs more accessible.

- Hamilton Lane announced on Jan 31, 2023 that the $2.1b fund is now accessible to individual investors through Securitize on Polygon, enabling efficient and low-cost transactions using blockchain technology. The partnership leverages Polygon's scalable infrastructure for a seamless and secure investment experience.

- Shemaroo Entertainment and Polygon are launching a Bollywood NFT collection on NFT marketplace Virtasy.io to provide a sustainable and cost-effective way for fans to engage with iconic moments and generate a new revenue stream for the entertainment industry, furthering the use of NFTs in India.

- Ripio has integrated with Polygon to improve scalability and user experience, enabling faster and cheaper transactions for its customers and promoting blockchain adoption in Latin America. The integration underlines Polygon's commitment to providing an accessible and efficient blockchain ecosystem in the region.

- Unstoppable Domains and Polygon Labs have launched .polygon, a new domain ending, which allows developers to create and use human-readable blockchain domain names on the Polygon network. The collaboration aims to enhance the user experience, facilitate seamless blockchain transactions, and increase adoption of the Polygon network.

- AQUA and Polygon Labs have partnered to improve onramps to Web3 gaming on the Polygon network, providing an enhanced gaming experience with user-friendly interfaces and a fast, low-cost network. The partnership showcases the growing adoption of blockchain technology in gaming and Polygon's potential as a leading platform for Web3 gaming.

- Immutable and Polygon launched Immutable ZK-EVM, a Layer 2 scaling solution for Ethereum that uses zero-knowledge proofs to cater to the gaming industry's needs in Web3. The collaboration is expected to improve the Web3 gaming experience by providing a scalable and efficient platform for smart contract execution.

Upcoming Event

Polygon Labs has announced the DevX Global Tour a series of events aimed at educating and engaging developers on the Polygon network. The tour will feature virtual and in-person events, including hackathons, workshops, and webinars, and will cover topics such as smart contract development, NFTs, and DeFi applications on the Polygon network. The goal of the tour is to encourage developers to build on Polygon and expand the ecosystem.

Nansen On-chain Data

Daily Transactions

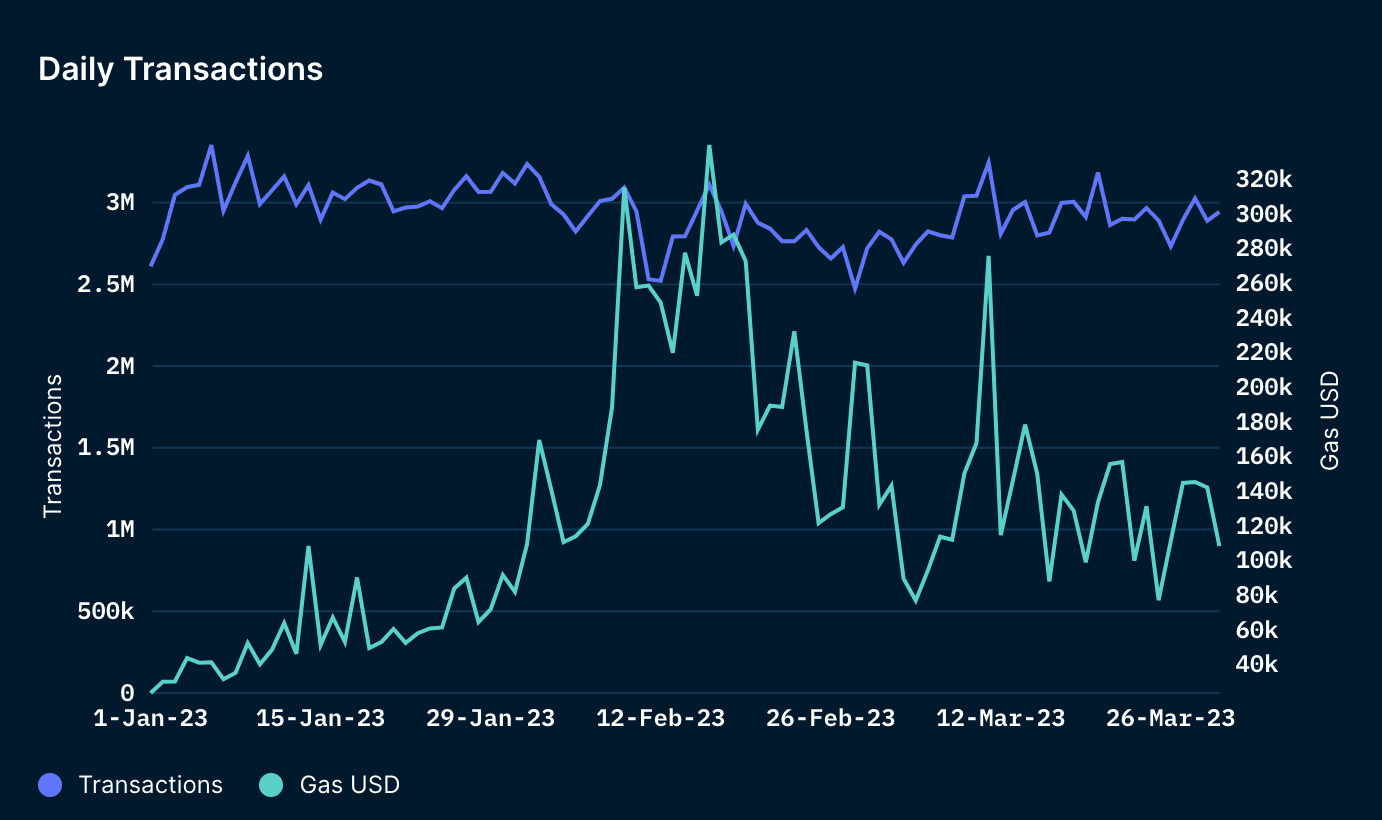

During the first quarter of 2023, daily gas paid on the Polygon network exhibited significant volatility, fluctuating within a range of ~$23k - $340k. Conversely, daily transaction counts peaked at approximately 3.3m and hit a low of around 2.4m. The increase in gas paid was likely attributable to the USDC de-pegging event, which prompted users to attempt to convert their USDC to other cryptocurrencies.

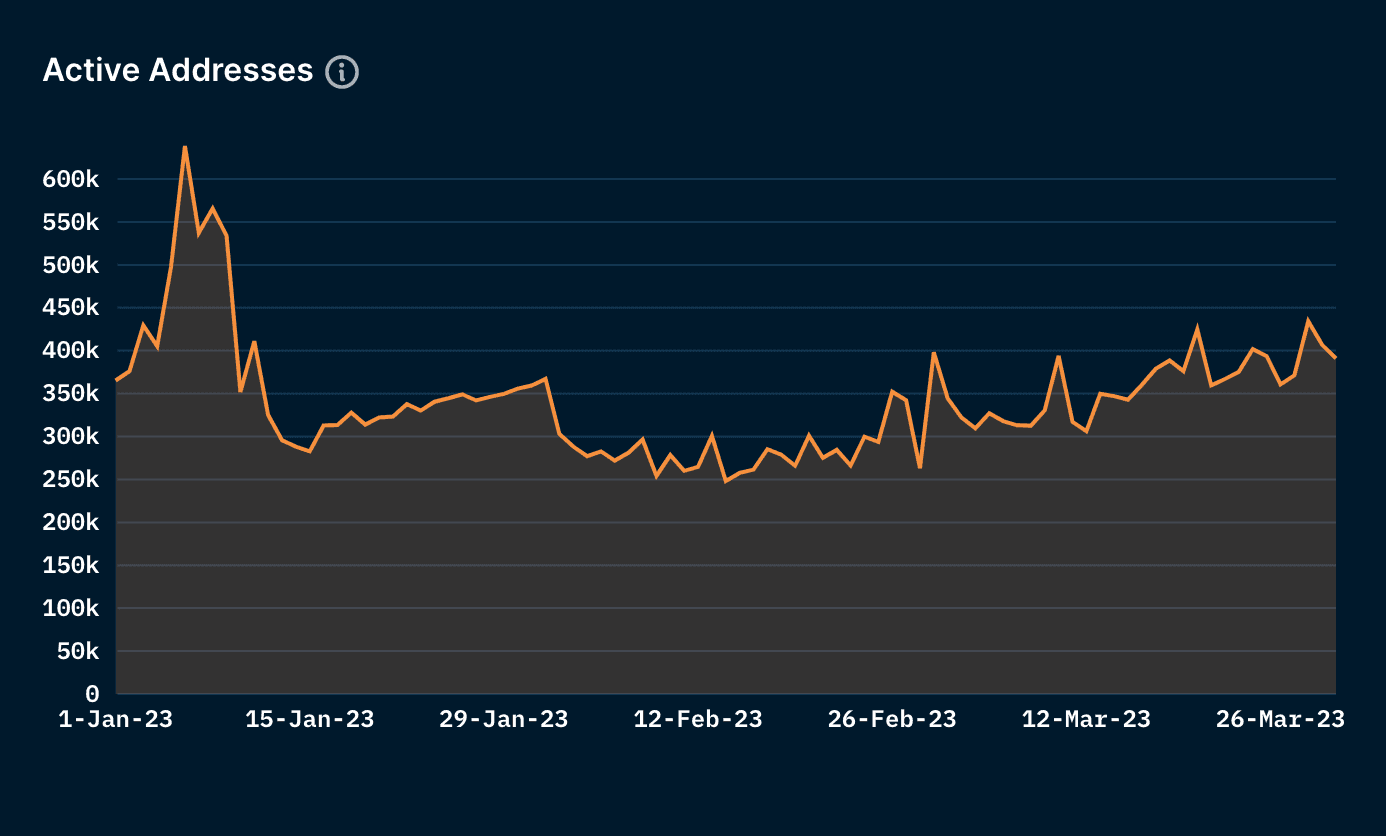

Daily Active Addresses

The number of daily active addresses on the Polygon network exhibited significant volatility over the quarter. On Jan 6, 2023, the number of daily active addresses reached a peak of 638k, while for the remainder of the quarter, it remained within a range of 250k - 400k addresses.

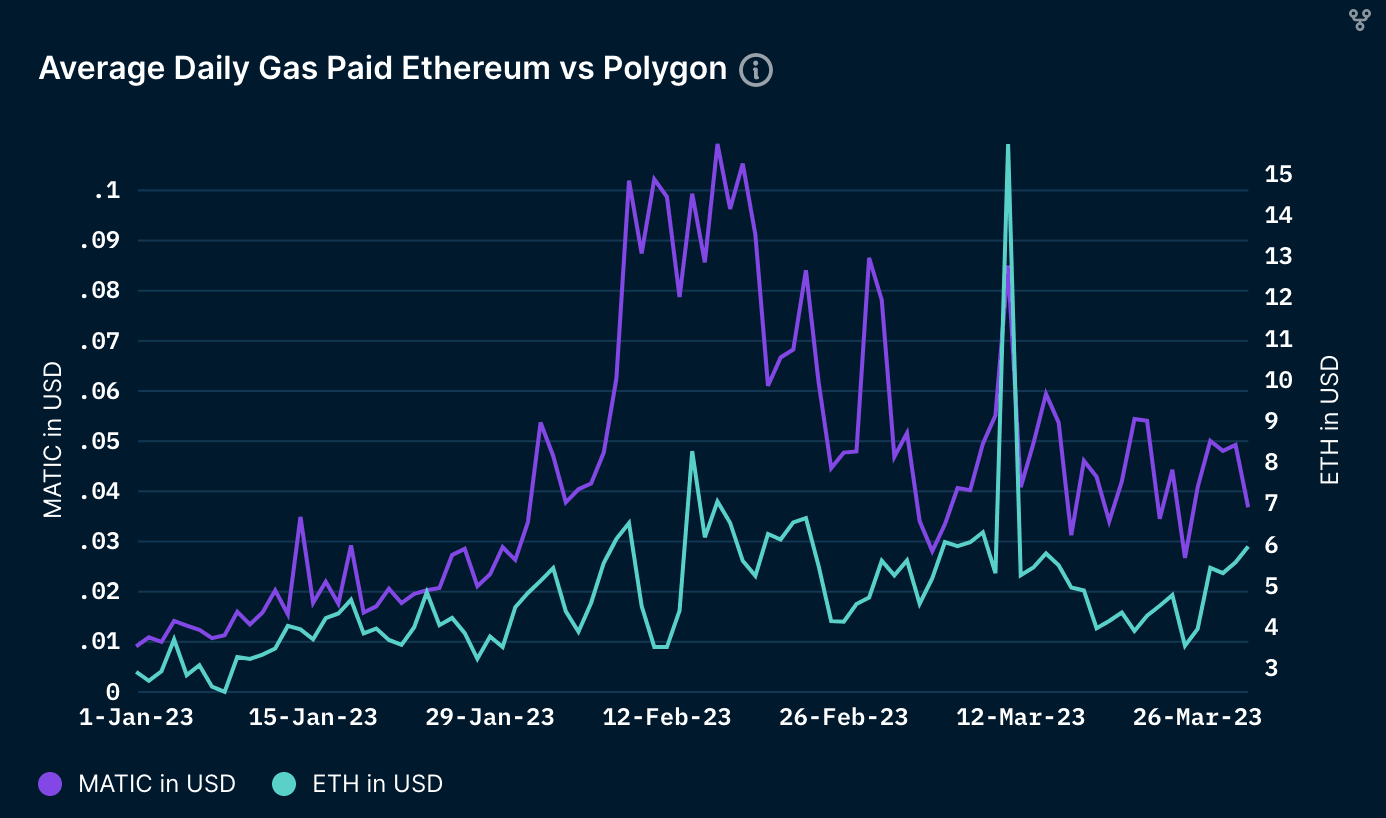

Average Daily Gas Paid (vs Ethereum)

The average daily gas paid for transactions on Polygon during its highest period was $0.11. By contrast, Ethereum's highest average gas paid of $16 occurred on Mar 11, 2023. Although Polygon's gas chart appears more volatile than Ethereum's, this is primarily due to a sudden surge in gas usage on March 11, when many users migrated from USDC de-pegging to ETH, causing an increase in the average daily gas paid.

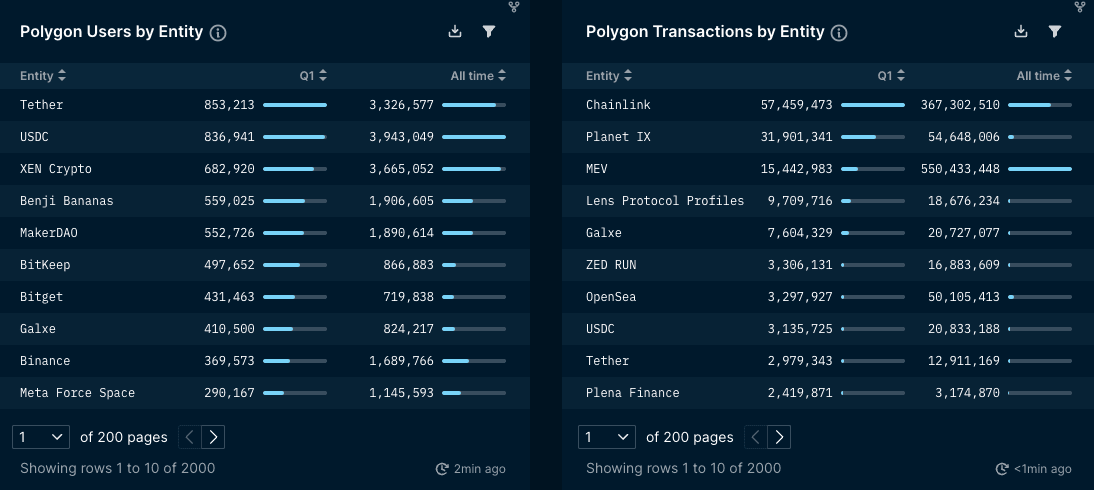

Top Entities by Users and Transactions

To conduct a thorough analysis of the top entities on Polygon in Q1 2023, we can utilize Nansen's comprehensive list of labels to examine the number of users and transactions. Among the highest transaction volumes, Chainlink stands out as a cross-chain data oracle, with over 57m transactions. It is followed by Planet IX (GameFi) with more than 31m transactions, while MEV bots account for over 15m transactions throughout Q1 2023.

When considering the number of users, stablecoins remained a popular choice on Polygon. Specifically, Centre's USDC and MakerDAO's DAI both ranked within the top five.

Smart Money Segments on Polygon

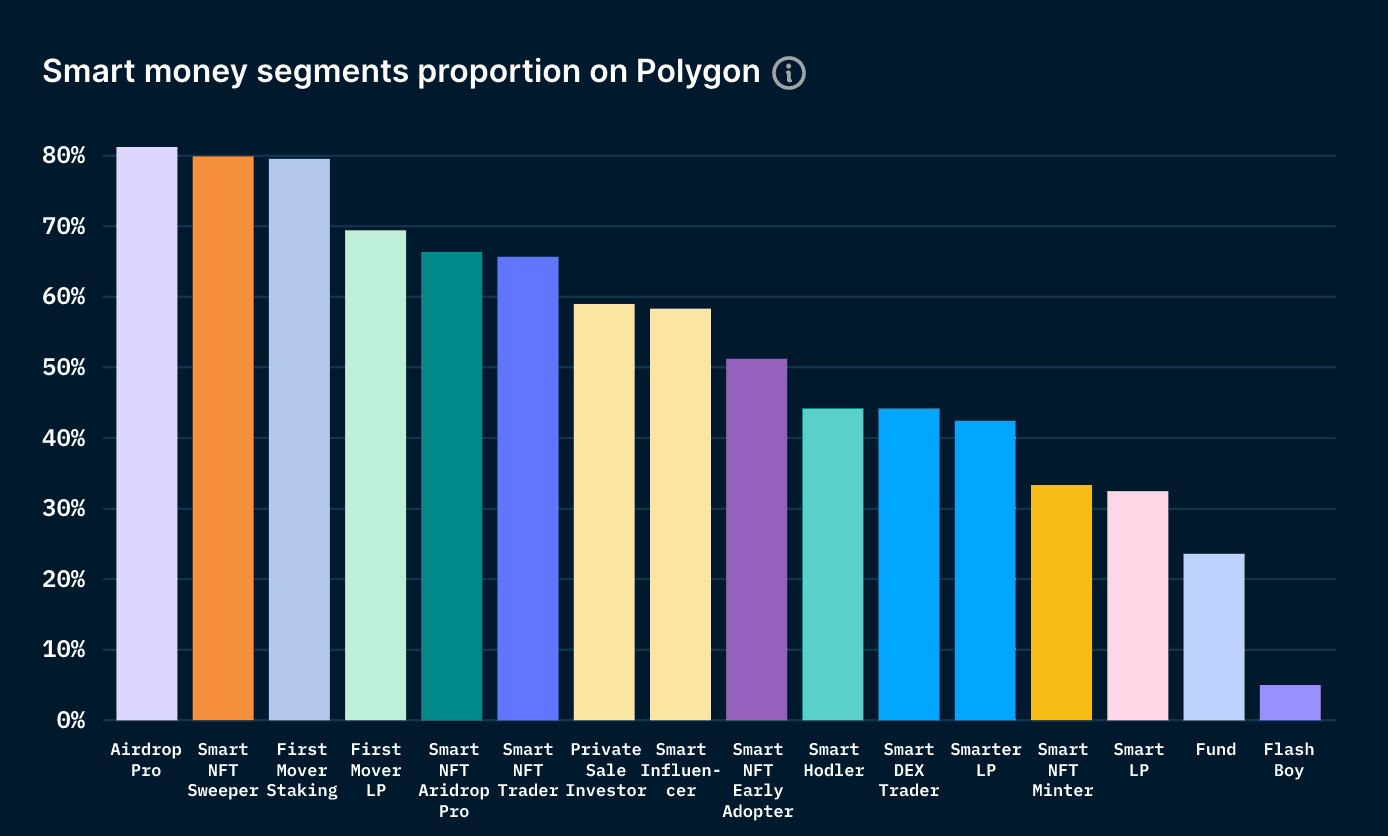

The chart presented above provides a comprehensive breakdown of Smart Money Ethereum addresses that have been active on Polygon. Smart Money is one of the most beneficial features offered by Nansen, as it comprises a list of labels for wallets that exhibit high levels of activity and profitability on-chain. During Q1 2023, Airdrop Pro, Smart NFT Sweeper, and First Mover Staking represented nearly 80% of the Smart Money on Polygon. This could be indicative of a harmonious combination of enthusiasm for both DeFi and NFT within the Polygon ecosystem.

Check out this page for how the Smart Money categories are defined and how you can use those labels on Nansen!

Closing Thoughts

In Q1 2023, Polygon has successfully continued to onboard numerous prominent companies into the Web3 space. This can be attributed to its combination of EVM compatibility, fast finality, and low fees. Additionally, the Polygon ecosystem has demonstrated a noteworthy expansion in metaverse projects and web3 gaming, with Immutable being one of the most recent collaborations.

This progress highlights the increasing demand for scalable and cost-effective blockchain solutions, which Polygon has been able to provide.

In conclusion, Polygon's persistent growth and the successful onboarding of well-known entities into the Web3 space are positive indicators for the continued adoption of blockchain technology.