Disclaimer: Nansen has produced the following report as part of its existing contract for services provided to Polygon Labs (the "Customer") at the time of publication. While Polygon has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

Polygon PoS is a Layer 2 scaling solution developed by Polygon that utilizes sidechains for off-chain computation and a decentralized network of Proof-of-Stake (PoS) validators. The combination of low fees, ease of development, and energy efficiency of Polygon PoS sparked an adoption boom in 2021. By the end of Q3, Polygon PoS had over ~2.2b transactions recorded, ~190m unique addresses, and tens of thousands of dApps.

Aside from PoS, Polygon also has a wide range of scaling solutions for web3 developers, from application-specific blockchain networks called Polygon Supernets (built using Polygon Edge, a framework for developers to build EVM-compatible blockchain) to various ZK-Rollups in development such as Polygon Zero, Polygon zkEVM, and Polygon Miden. Each scaling solution may have differing tradeoffs, but they all aim to provide a more secure and faster network with low transaction costs.

In this quarterly report, we will look at Polygon’s performance in Q3 2022 and list the key developments implemented by Polygon and its ecosystem to improve overall network performance and user experience.

Check out Nansen’s previous report on Polygon and other chains here.

Key Developments

Polygon zkEVM and other Zero-Knowledge updates

- In July 2022, the Polygon team unveiled Polygon zkEVM, the first step in supporting the next billion users on Ethereum. It leverages performant Zero Knowledge (ZK) proofs within an environment that is nearly equivalent to the Ethereum Virtual Machine.

- The Polygon team also made the key technology source code available, providing access to the ZK community to audit the technology to ensure its safety before its enablement.

- Plonky 2, a zero-knowledge proving system that offers fast proofs and efficient recursive proofs, was dual-licensed under the MIT license and Apache2 in Aug 2022, while the PIL toolkit was dual-licensed in Sep 2022.

Bor Consensus Support on Erigon

- The immense growth experienced by Polygon PoS had also increased the size of the historical data of the blockchain, pushing up the limits of cloud providers’ offerings which could result in difficulty accessing blockchain history in the future.

- Erigon is a re-architected implementation of the Ethereum client written in Go which could be the solution to reduce the size of archive nodes. Bor consensus is now natively available on the Erigon client, the first of many steps in making Polygon PoS more robust.

Ecosystem

Although adoption has slowed in 2022, Polygon still attracts some of the biggest projects from inside and outside of the web3 space. Below are exciting updates from the Polygon ecosystem:

- In July 2022, British consumer tech start-up, Nothing collaborated with Polygon for the launch of its NFT loyalty program. It will allow members access to exclusive community content, unlock special perks such as discounts on merchandise, gain entry into unique offline events, and more.

- The Internet’s largest social platform, Reddit, announced a collaboration with Polygon at the beginning of the quarter to launch an NFT collectible marketplace and integrate an NFT avatar into the website. The collaboration resulted in 3 million vault wallets being created by Reddit users at the time of writing, to buy and trade NFTs on the platform.

- Starbucks announced in Sep 2022 that its Web3 experience, Starbucks Odyssey, will be powered by Polygon. Starbucks Rewards loyalty program members and Starbucks partners (employees) in the United States will be able to earn and purchase digital collectible stamps in the form of NFTs.

- Popular user-friendly investment app, Robinhood, announced two big news items in Q3. It launched support for deposits and withdrawals of the MATIC token to and from the Polygon network. It also chose Polygon as the first blockchain network to support its newly launched Web3 wallet, opening access to decentralized finance (DeFi) for millions of U.S. users.

- Juno, which allows its users to earn, invest and spend their cash and crypto from one checking account, turned on support for instant on-ramps to USDC on Polygon. Juno App users can instantly convert their fiat funds to USDC without paying transaction fees. The new functionality added another bridge to connect Web3 and DeFi with the broader economy.

Nansen On-chain Data

Daily Transactions

Daily transactions count on Polygon was relatively volatile throughout Q3 2022, within a range of 2.2-3.5m transactions. The highest transaction count was on Aug 30, 2022, when the transactions were dominated by MEV bots.

The daily gas paid was even more volatile, with a peak slightly above $110k and the lowest point at $20k. The two days that saw the highest gas paid were on Aug 2, 2022, and Jul 19, 2022, showing that Polygon followed a similar pattern to other EVM-compatible chains, which also had higher activity on those dates.

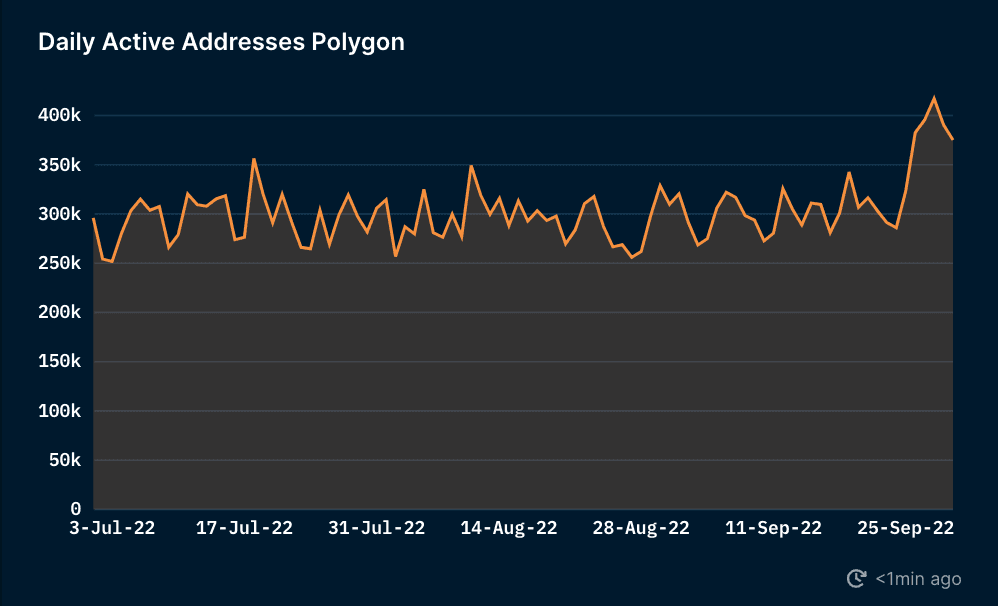

Daily Active Addresses

The number of daily active addresses on Polygon was volatile from the beginning of the quarter up to mid-Sep 2022, on a range between 250-350k addresses. It had an uptick at the end of the quarter after Polygon announced the beta wallet of Robinhood, which saw the active addresses soar into the beginning of Q4.

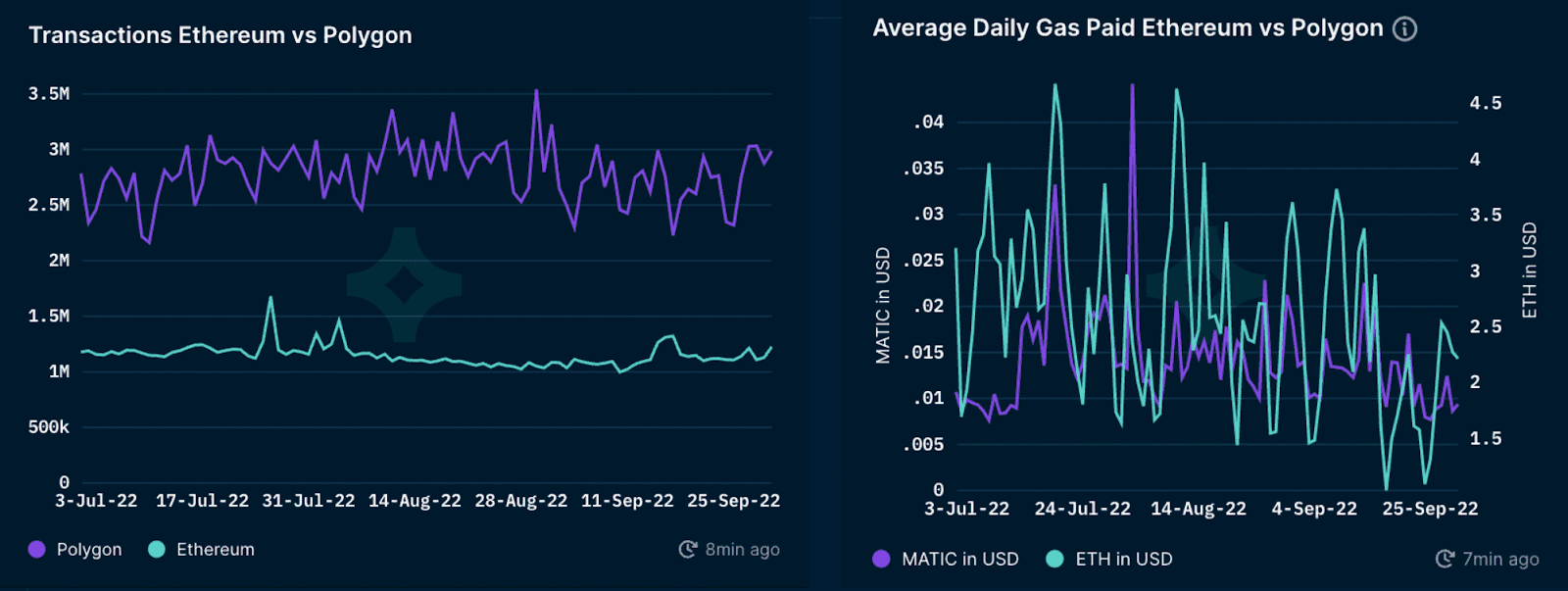

Daily Transactions and Gas Paid (vs Ethereum)

Polygon’s daily transactions were twice as high and more volatile than Ethereum’s throughout Q3 2022. Ethereum showed three peaks between the end of July and early Aug 2022, as well as an increase in transaction count leading up to The Merge in Sep 2022.

On average, the gas paid for transactions on Polygon was 100x cheaper than on Ethereum. The highest average gas paid on Polygon was in early Aug 2022 at $0.044, while on Ethereum, mid-July and mid-Aug 2022 saw the highest average gas paid at ~$4.6 per transaction. The average gas paid on Ethereum dropped towards the end of the quarter to as low as ~$1.

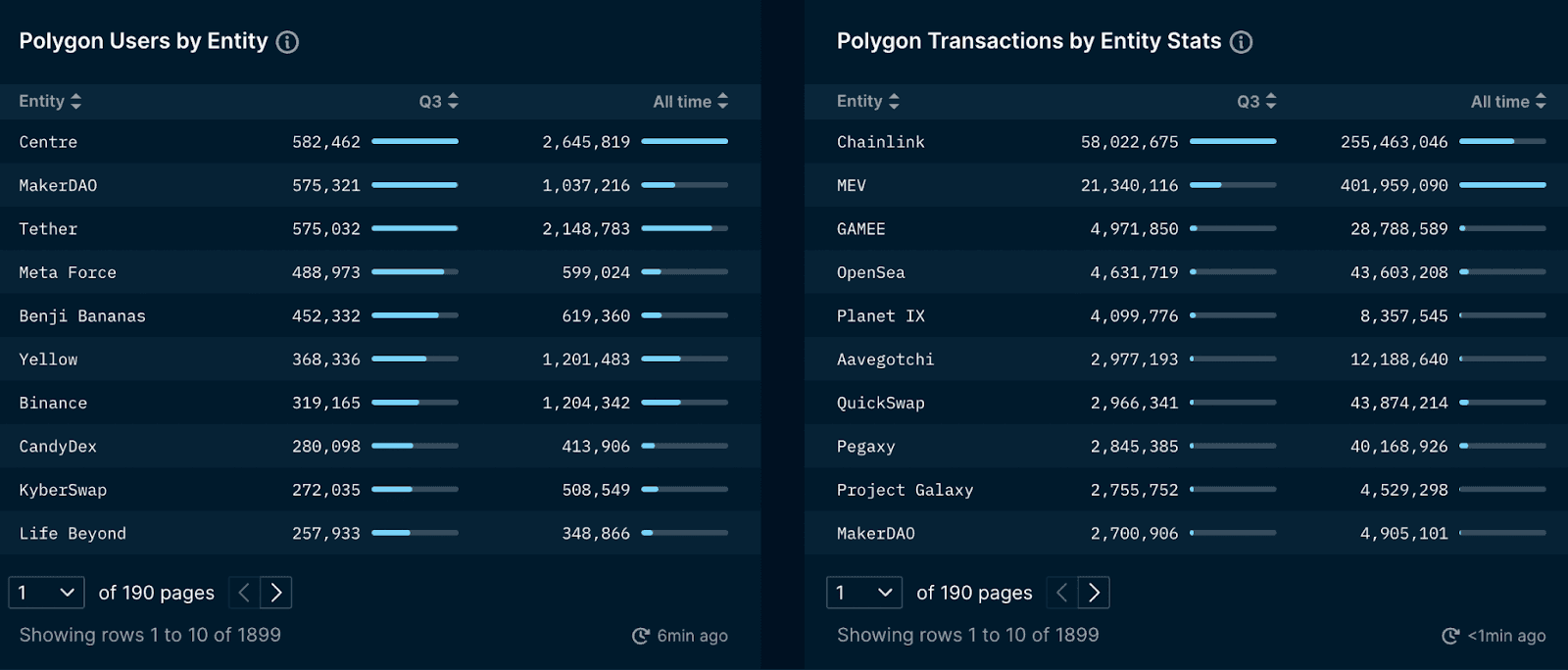

Top Entities by Users and Transactions

One could analyze the top entities in Q3 based on the number of users and transactions on Polygon using Nansen’s comprehensive list of labels. Chainlink had the highest number of transactions for being a cross-chain data oracle on Polygon, followed by MEV bots transactions at above 21m throughout Q3 2022. Arc8 (Gamee), OpenSea, and Planet IX had more than 4m transactions in Q3, which showed that GameFi and NFT were popular on Polygon.

When sorted by the number of users, stablecoins seemed to be the popular entities. Centre (USDC) and Tether (USDT) were in the top three. MakerDAO, the platform that issues DAI, had the second-highest number of users.

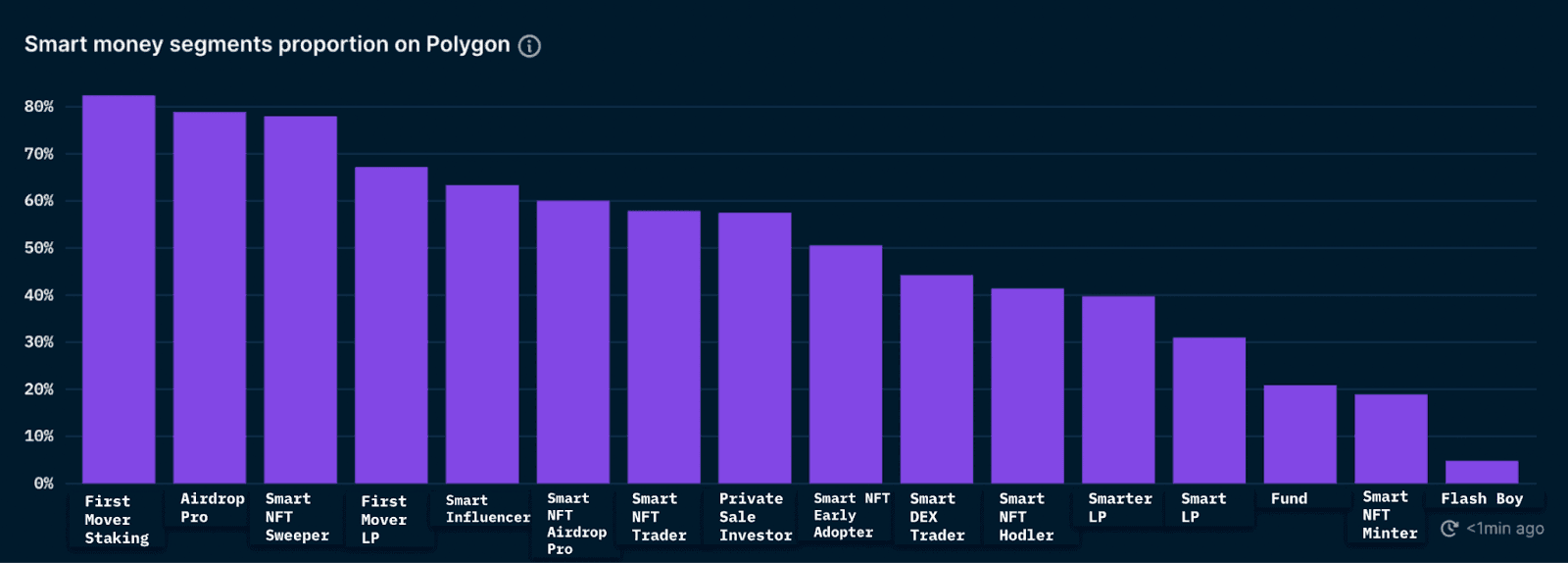

Smart Money Segments on Polygon

The chart above shows a breakdown of the Smart Money Ethereum addresses that are also active on Polygon. Smart Money is one of Nansen’s most useful features, which contains a list of labels for wallets that are very active and prolific on-chain. In Q3 2022, First Mover Staking, Airdrop Pro, and Smart NFT Sweeper were the three highest proportions of Smart Money on Polygon at above 70%. This may indicate that there was a balanced combination of enthusiasm between DeFi and NFT in the Polygon ecosystem.

Check out this page for how the Smart Money categories are defined and how you can use those labels on Nansen!

Notable Projects in Q3 2022

Benji Bananas

- Benji Bananas is a physics-based action platformer/runner in which players guide Benji swinging from vine to vine through the jungle while collecting fruits and similar items to unlock upgrades.

- Since its launch, the game has had a loyal user base, with over 50 million downloads across the Apple App Store and Google Play Store.

- It integrated a play-to-earn system into its game using Polygon technology in the form of PRIMATE tokens and Benji Bananas NFT. In order to earn PRIMATE, players must obtain a Benji Bananas Membership Pass NFT, which is necessary to use Benji Bananas’ play-to-earn system.

Paraswap

- Paraswap is a platform that aggregates decentralized exchanges and other DeFi services in one comprehensive interface. It is available on Ethereum and EVM-compatible chains: Polygon, Avalanche, and BSC.

- Paraswap gains its edge by maximizing user experience when doing a swap on its platform, which include the best token exchange rate, optimized order execution, most efficient routing, as well as the ability to interact with several services and smart contracts in one gas-efficient transaction.

Closing Thoughts

Despite the general bearish sentiment on the crypto market in Q3 2022, Polygon kept onboarding various popular companies into the Web3 space, thanks to its EVM compatibility, fast finality, and low fees. It was further proven by the significant increase in active users at the end of the quarter. To handle the upcoming mass adoption of Web3, Polygon announced some network upgrades and future launches, such as integrating Erigon with Bor Consensus to offload the memory issue, as well as developing Polygon zkEVM.