Disclaimer: Nansen has produced the following report as part of its existing contract for services provided to Solana (the "Customer") at the time of publication. While Solana has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

Solana is an open-source blockchain project maintained by the Solana Foundation, focusing on scalability and user-friendly experience, all while maintaining decentralization through ~3.9k nodes and keeping transaction costs low. Solana uses an innovative hybrid consensus model that combines a unique algorithm called Proof of History (PoH), along with a version of Proof of Stake (PoS), the lightning-fast synchronization engine.

In this quarterly report, we will look at Solana’s performance in Q3 2022 and list down the key developments implemented by Solana to improve overall network performance and user experience.

Check out Nansen’s previous report on Solana and other chains here.

Key Developments

Solana Mobile Stack (SMS)

- Solana Mobile, a subsidiary of Solana Labs, debuted early in Q3 the Solana Mobile Stack (SMS), an open-source software toolkit for Android enabling native Android web3 apps on Solana.

- There are four innovations that SMS has, which are meant to streamline web3 on mobile devices:

- Mobile Wallet Adapter: Users will find similar ease of use such as on the desktop, but for their mobile.

- Seed Vault: A key storage option between software custody and a hardware wallet.

- Solana Pay: Users will be able to pay with a QR code or NFC tap with their mobile device.

- Decentralized App Store: A turbo-charged web3 application marketplace that appears alongside standard app marketplaces.

- With SMS, the Solana Mobile team hoped to kickstart a new ecosystem and inspire creators to build web3 experiences on mobile that weren’t possible due to the existing gatekeeper model.

- Dialect, a web3 messaging service, also announced that it’s been working with Solana Mobile to build out core messaging infrastructure and developer tooling for SMS.

Solana Summer Camp Hackathon

- Solana Summer Camp was a highly competitive global online hackathon for the Solana ecosystem and community. Teams from around the world competed with each other between Jul 11 - Aug 16, 2022 to win $5m in prizes and seed funding.

- Solana also organized IRL summer camps throughout the event in various locations around the globe, where users could meet up with hackathon builders, find teammates, and learn about developing on Solana.

- Solana Summer Camp saw nearly 18,000 participants submit a record of 750 final projects to the judges, which included Anatoly Yakovenko (co-founder of Solana and CEO of Solana Labs) and Alex Svanevik (CEO of Nansen).

- IronForge, a platform that includes automated deployments, program previews, auto-generated APIs, monitoring, and more, received the Grand Champion prize of $65,000 in USDC, along with passes to attend Breakpoint, the annual Solana conference in Lisbon held on Nov 4-7, 2022, where they will present their project.

Ecosystem

Solana hosts one of the most diverse ecosystems of dApps despite being a non-EVM blockchain, thanks to its fast finality and low fees. The list of Solana projects can be browsed here.

In Q3 2022, there were many updates from Solana ecosystem projects and protocols, most notably:

DeFi

- marginfi, a decentralized portfolio margining on Solana, launched its alpha to Solana mainnet-beta. Users get improved capital efficiency and improved risk management by unifying their on-chain liquidity in a single account and operating within marginfi’s overlayed risk framework.

- Jito Labs launched an MEV dashboard for Solana, finally providing some valuable information for Solana users regarding MEV activity. Since Jan 2022, Jito Labs had classified more than 36 billion transactions, labeling atomic arbitrage and liquidation across the two largest lending protocols, Mango and Solend.

- From Aug 30, 2022, Fireblocks customers can securely access lending, borrowing, staking, and Web3 dApps that are powered by the Solana blockchain. Being the first enterprise-grade gateway to allow a secure connection to non-EVM chains, Fireblocks brought unprecedented access to the growing world of Web3 for its user base.

- Coinbase announced earlier in Q3 that Coinbase Wallet supports Solana and Solana-based USDC, following which users could start to connect to Solana dApps from the wallet as well.

NFT, GameFi and DAOs

- In early Q3 2022, Phantom allowed users to directly list their NFTs on Magic Eden after sealing their partnership with the popular Solana-based NFT marketplace. With this update, users can also edit the price or unlist their listed NFTs directly from the Phantom browser extension.

- Neo Fairies launched a new entertainment DAO on Solana, with the vision to become a generational entertainment property spanning gaming, film, fashion, etc. where the creative building blocks – the Neo Fairies shared world, characters, and stories – are composable and collectively owned by the creators and community.

- Bonfida launched the new version of the Solana Name Service website as well as xMS (Cross Messaging Service), a messaging standard to be interoperable and accessible both on or off-chain. Trust Wallet and Neko Wallet also integrated Solana Name Service in Q3.

- AtomicWallet announced that Solana NFTs are now supported on their desktop and mobile versions, adding one more to the list of multichain wallets supporting the Solana NFT ecosystem.

Nansen On-chain Data

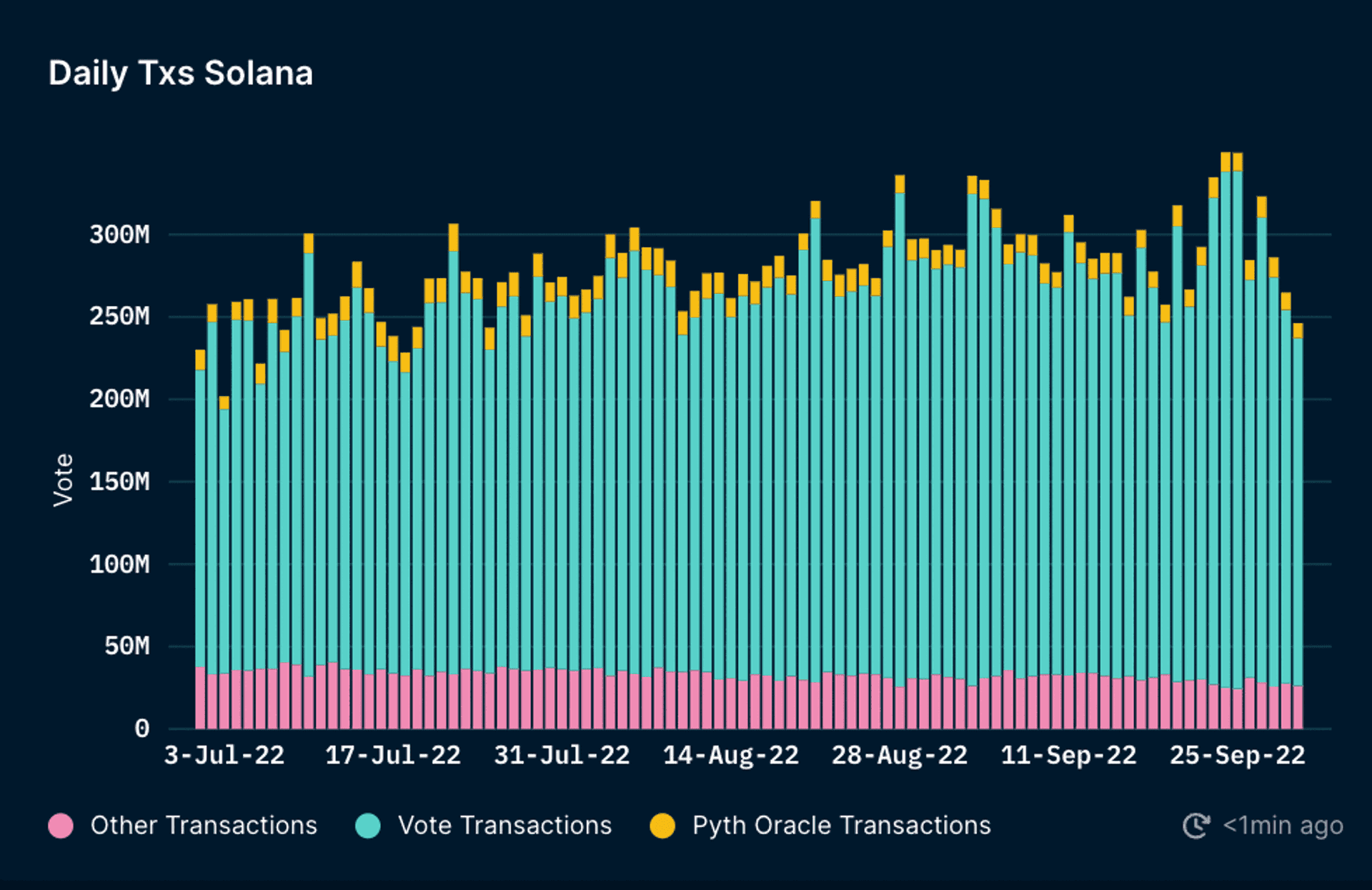

Daily Transactions

Overall daily transactions on Solana had stayed above 200m transactions throughout this quarter, which increased almost twofold from the previous quarter. Pyth Oracle transactions, which carry cross-chain market data on the Solana mainnet, were fluctuating between ~7.7-16.7m transactions. Vote transactions followed similar volatile trajectory, ranging between 160-314m transactions per day.

Other transactions, which include program executions, were relatively stable in a range of ~30-37m per day. In mid-Sep 2022, it declined to a range of ~24-26m daily transactions. Top programs in this quarter were Mango Markets and Serum DEX. Although NFT projects and marketplaces launched many exciting updates in Solana during Q3 2022, the DeFi products were still driving the most traffic in the network.

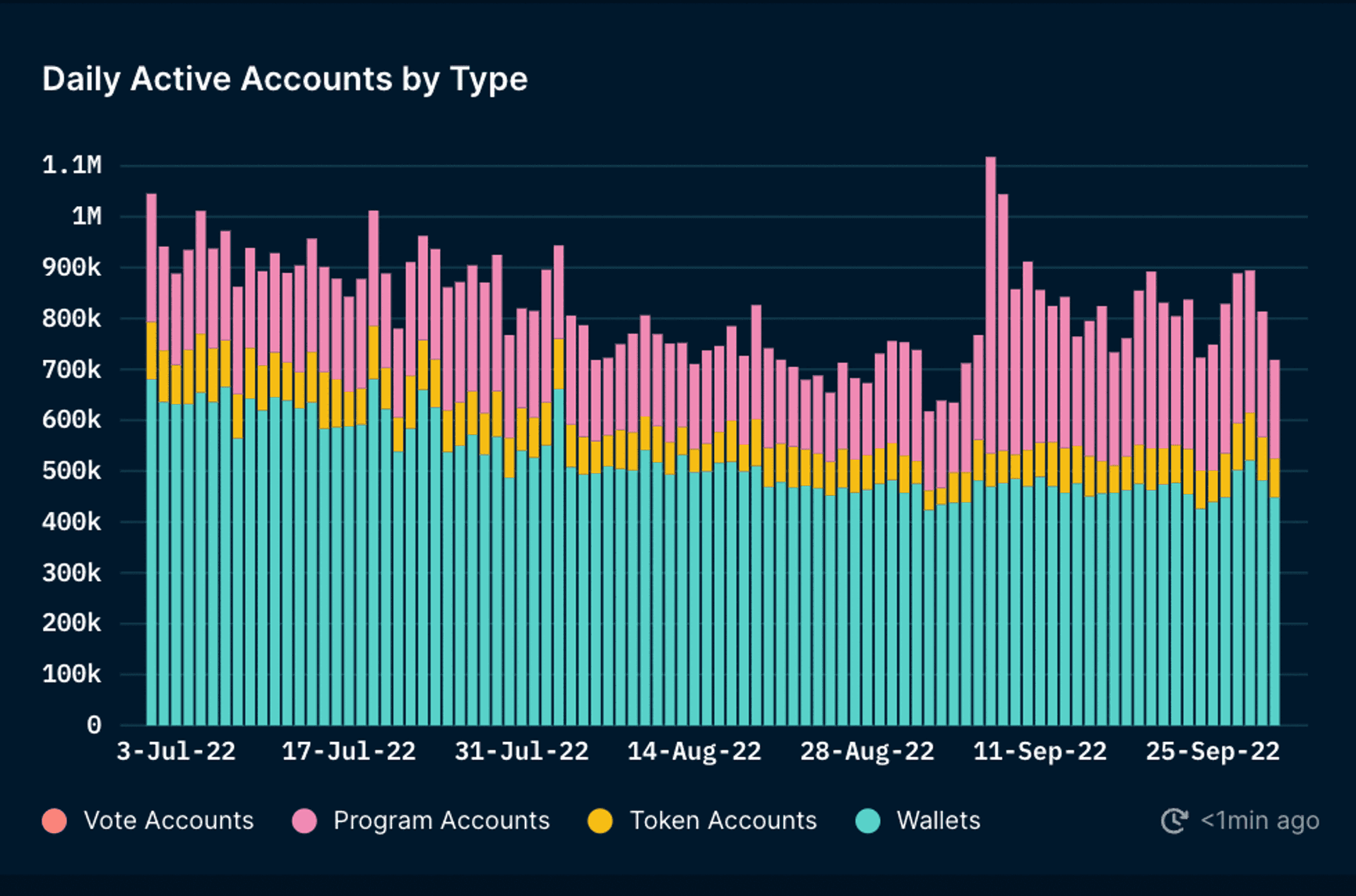

Daily Active Accounts

The overall daily accounts in Solana were relatively volatile in Q3 2022, ranging between 600k to 1.1m. There was a significant uptick in active program accounts on Sep 7-8, 2022, with more than 500k accounts each day. The wallets, token, and vote accounts were following similar trajectories, slightly declining from the numbers shown earlier in the quarter. There were two upticks of more than 650k daily active wallets on Jul 19 and Aug 3, 2022.

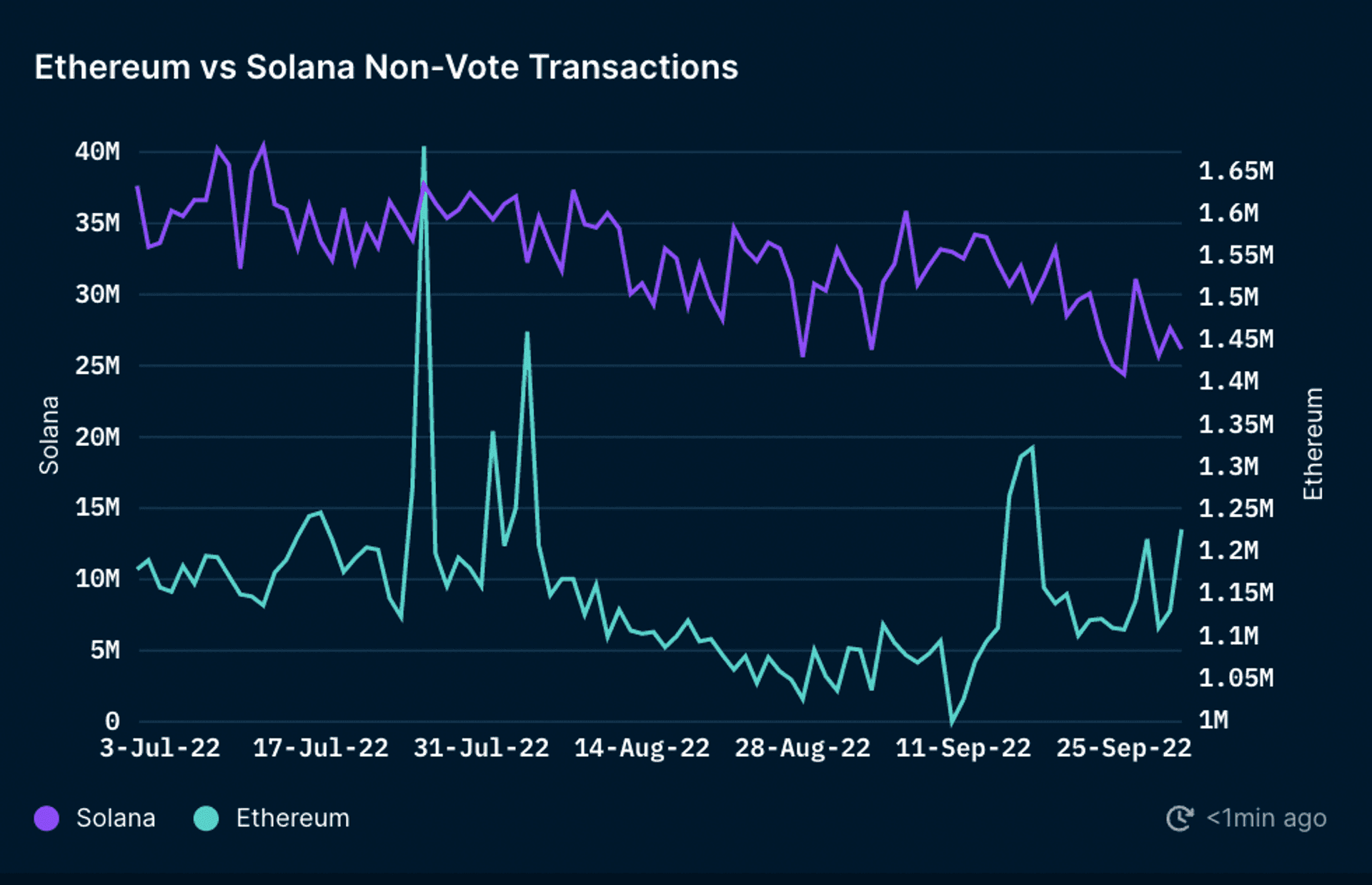

Daily Transactions (vs Ethereum)

Comparing the number of Solana non-vote transactions to Ethereum, the transactions count on Ethereum was significantly fewer and more volatile than on Solana’s. Solana’s non-vote transactions remained above 25m throughout the quarter, with the highest transactions count at the beginning of the quarter which reached 40m transactions per day.

The daily transactions on Ethereum stayed within a range of 1-1.65m transactions, the highest transaction was on Jul 26 and Aug 4, 2022. Interestingly, these were the dates when the active wallets saw an uptick on Solana, which indicates an event (or combination of events) that affected the entire crypto market.

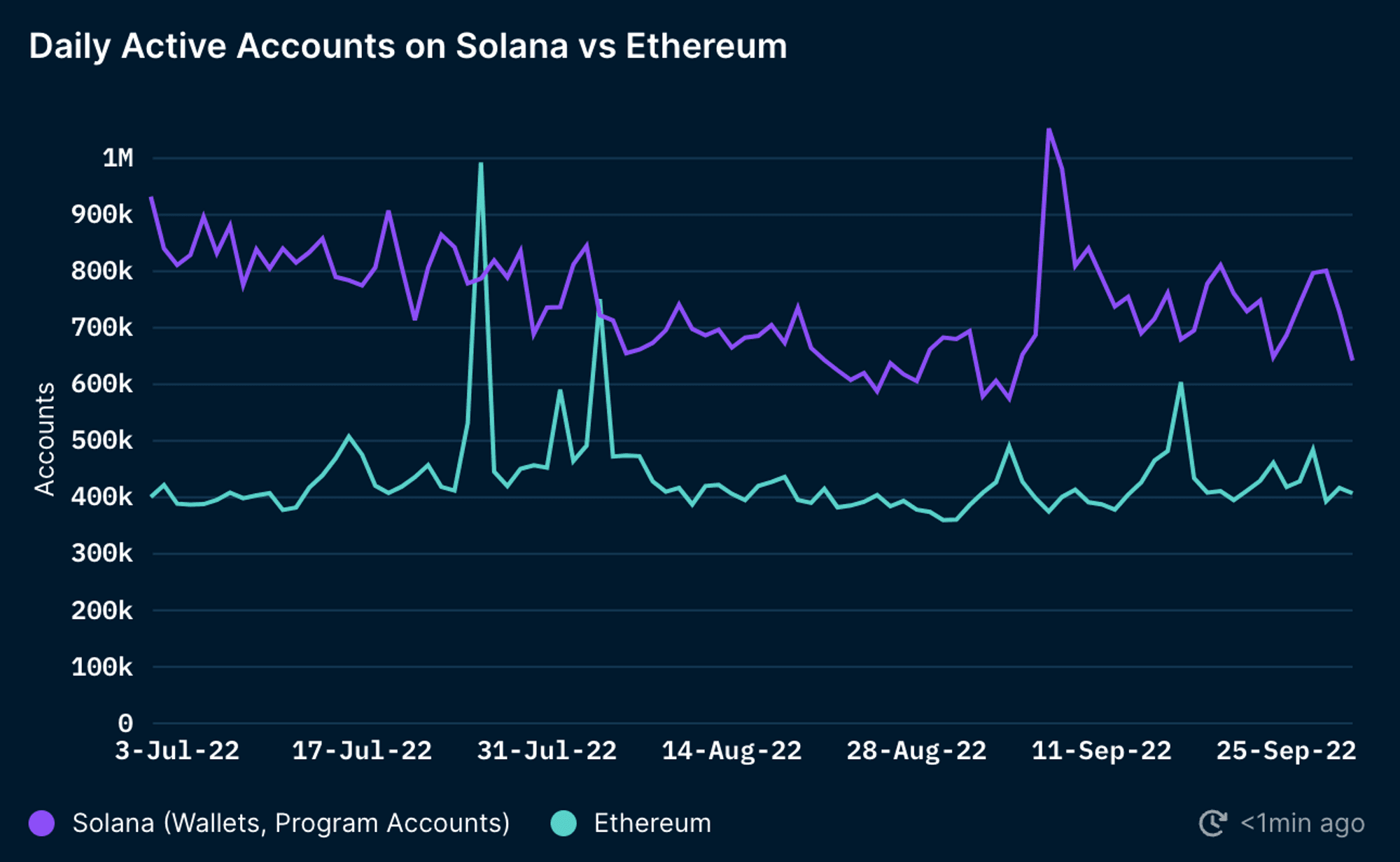

Daily Active Accounts (vs Ethereum)

When compared to Ethereum, the number of daily active accounts on Solana was higher and more volatile in Q3 2022. There was a declining trend up to early Sep 2022, when it fell below 600k accounts, before having a significant uptick above 1m on Sep 7, 2022.

Ethereum accounts was relatively stable with several peaks, notably on Jul 26, Aug 4 and Sep 17, 2022. These were the dates when the transaction count peaked as well.

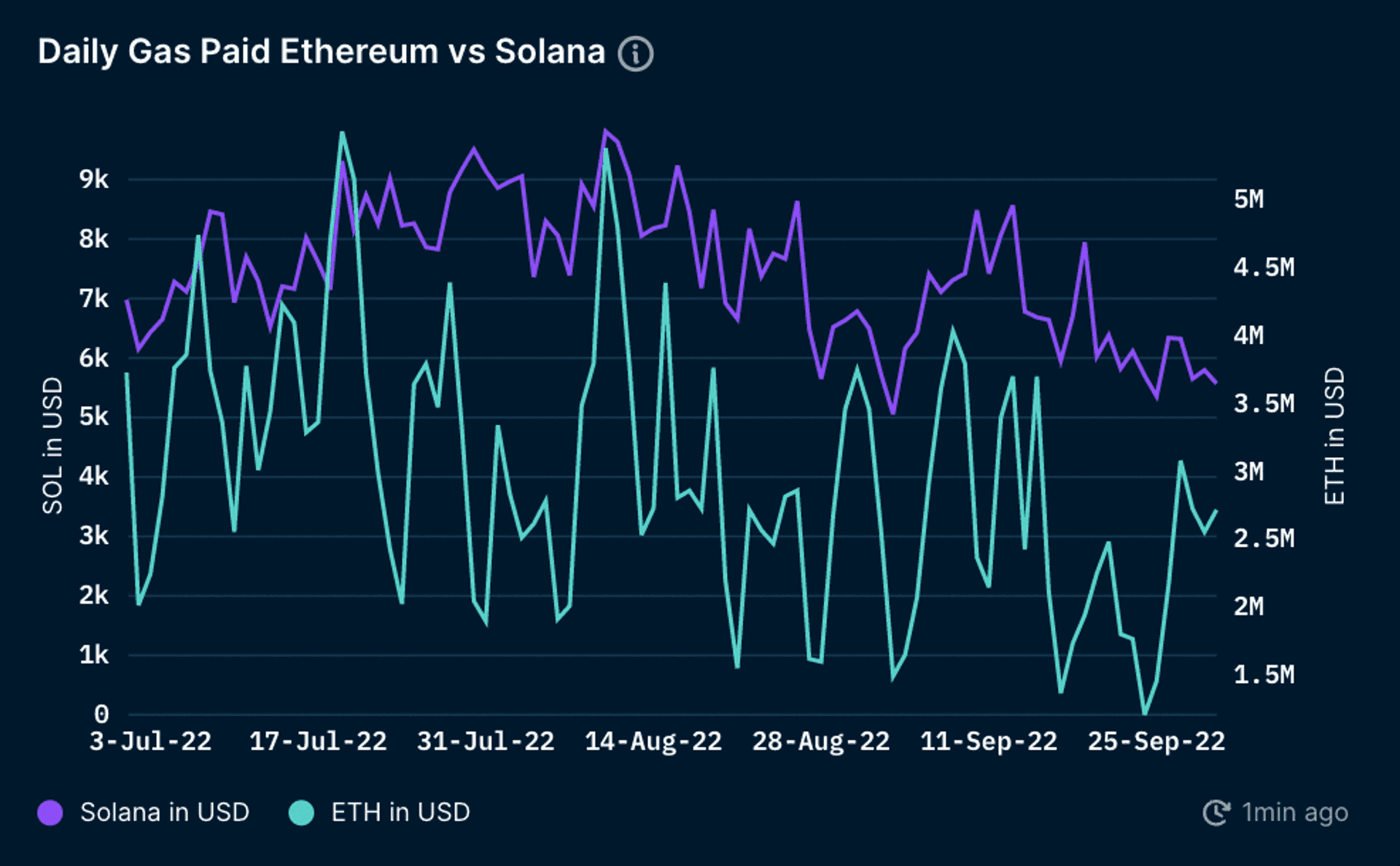

Daily Gas Paid (vs Ethereum)

The daily gas paid of Solana and Ethereum were both volatile throughout Q3 2022. From the chart above, the difference was apparent. The range of Solana gas throughout the quarter was between $5-10k. In contrast, Ethereum gas was between $1-5.5m, despite having much fewer transactions count than Solana. Compared to the results in Q2 2022, the daily gas paid on both chains was cheaper in Q3 2022.

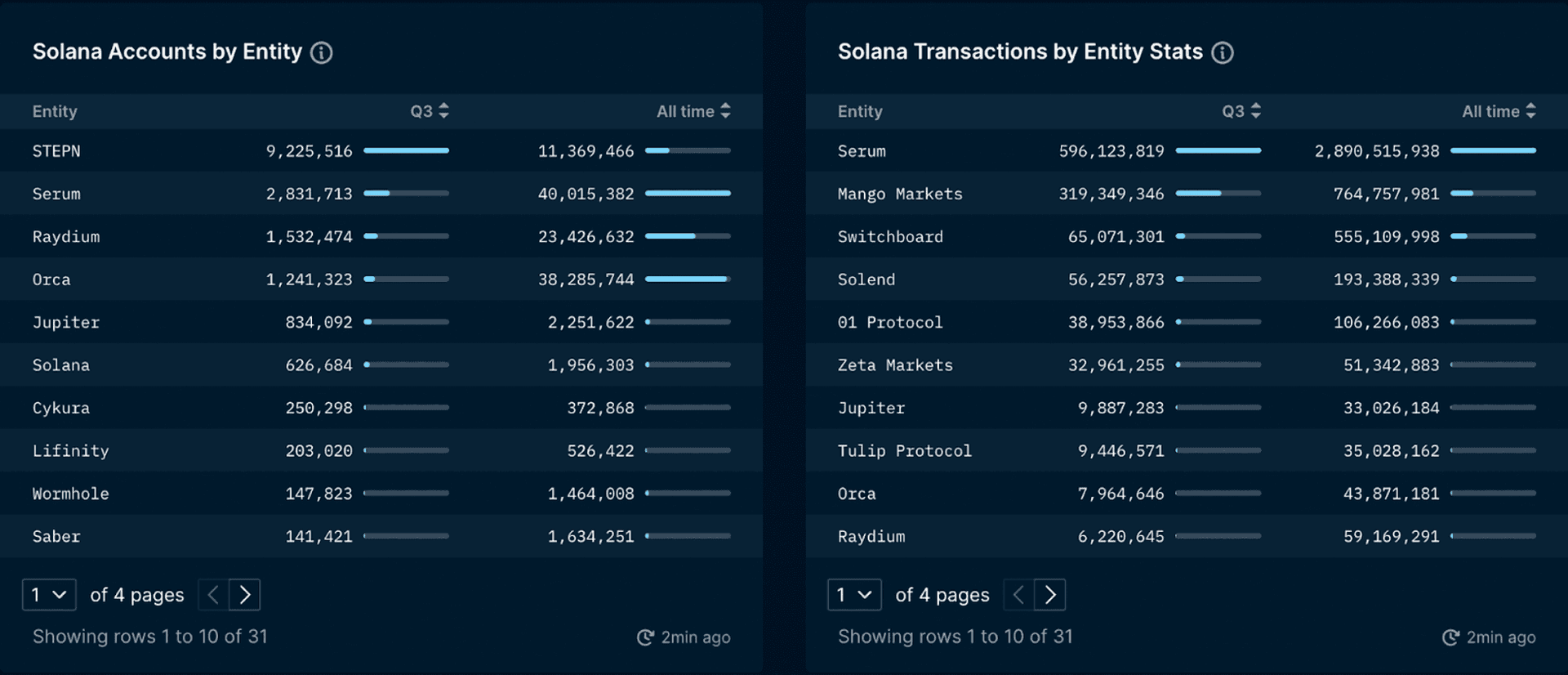

Top Entities by Users and Transactions

By using Nansen labels, one could analyze the top entities being interacted with based on the number of users and transactions on Solana. In this quarter, Serum was the top entity based on transaction count and came second place based on the number of accounts. StepN made a big break this Q3 2022, as indicated by the number of accounts that interacted with it (~9.2m), more than three times the number of users in Serum.

Other than those two projects, it seemed like DeFi products still dominated the Solana network based on the activity. The DeFi products that made it to the top 10 entities in both categories were DEXes (Serum, Raydium, Orca, Jupiter), Derivatives (01 Protocol, Zeta Markets), Margin Trading (Mango Markets), Yield Aggregator (Tulip Protocol), and Lending (Solend).

Notable Projects

01 Protocol

- 01 Protocol is a decentralized derivative exchange on Solana. Users can trade fully decentralized derivatives (perpetual futures to power perpetuals) on an on-chain limit order book.

- Its order book is powered by Serum, with cross-collateralization and cross-margining, to ensure users’ risk management and maximization of profit.

- Users can also earn a yield on their deposits and borrow through variable interest rates.

FormFunction

- FormFunction is a 1/1 NFT Marketplace on Solana, that prides itself on supporting independent creators in the space and trying to minimize the environmental impact of NFT trading.

- FormFunction is also community-governed, which means the artists and collectors collectively vote to decide who to onboard next on the platform.

- Having a full-featured marketplace, they explored some ways to help creators fund their creative dream projects by selling art. The first project to be community-funded on Formfunction was Off Leash, a hand-drawn animated short film.

Closing Thoughts

Although the marketwide sentiment remained bearish in Q3 2022, Solana Labs, along with the projects and protocols on the network, continued to build and launch a wide range of exciting products to maintain the enthusiasm of Solana users. From Solana Labs, the launch of Solana Mobile Stack and Solana Summer Camp Hackathon pushed the innovation from community and ecosystem builders to build on Solana. This was proven effective as the number of transaction counts remained high throughout the quarter, all while keeping the gas low and maintaining the network from outages.