Key Takeaways

- Despite UST’s depeg, NEAR protocol and TRON protocol are continuing attempts to adopt versions of their own algorithmic stablecoins: USN and USDD respectively.

- We take a look at the risk and opportunities these new algorithmic stablecoins provide and how to access them.

- USN has very little information available, very shallow liquidity depth and comparatively low APY - is the 7% APR worth the risk given the fate of other algo stablecoins and the trusted bridge setups and smart contract vulnerabilities?

- USDD is more transparent (although not as much as other stablecoins) and the APYs and liquidity depth are significantly higher, although certain prejudices regarding Justin Sun and TRON exist within the crypto community.

Introduction

We’ve witnessed the dramatic rises and falls of algorithmic stablecoin experiments over the past few years. Most recently, UST’s depeg has sent Terra’s ecosystem spiralling with consequences reverberating throughout the entire industry.

New entrants in the algorithmic stablecoin space, namely NEAR’s USN and TRON’s USDD, were originally inspired by Terra’s success and try to create their own version of UST - but do they now also face the same risks and what are the opportunities behind these coins?

The Stablecoin Spectrum: A trilemma

Similar to blockchain design, stablecoins face a design trilemma: An inevitable tradeoff between decentralization, (peg) stability and capital efficiency. So far, no one has been able to achieve all 3 to the full extent.

Three prominent examples with typical designs would be

- UST (decentralized + capital efficient): extremely capital efficient (minted through the burning of native token LUNA whose price is driven by UST adoption, with an added risk event of de-pegging from 1:1 USD)

- DAI (decentralized + stable): decentralized governance, mostly centralized collateral, good peg stability, but at the cost of heavy overcollaterization

- USDC (stable + relatively capital efficient): great peg stability, exactly 1:1 collateralization with USD, but this ultimately gives the US government power over all of the collateral. Note: The above is simplified and the described trilemma is more of a spectrum than “choose 2, discard 1”

In the next sections, we dive into the USN and USDD stablecoins to understand their designs, risks and yield opportunities.

Since USN and USDD both have design parallels to Terra, for both we dedicate a small section to examine how the stable coins differ from UST.

For a full analysis of major stablecoins (including UST), check out our Alpha Stablecoin Report.

Note: The report was written before the collapse of UST and Terra, but the risk of a collapse was outlined.

NEAR Protocol: USN

USN is NEAR Protocol's native stablecoin, pegged to the US dollar. USN is issued by depositing NEAR tokens into the reserve fund, and it can always be redeemed (burned) for an equal amount of NEAR at the prevailing NEAR/USD exchange rate (example: If USN = $0.8 and NEAR = $10 you will still be able to exchange 10 USN for 1 NEAR even though 10 USN cost only $8 on the open market). USN will be over-collateralized as a result of the reserve fund including USDT as additional backing. The majority of the reserve fund's NEAR denominated capital will be staked to provide native yield for USN holders.

The team and issuer behind USN as well as the initial governing body is Decentral Bank DAO. Decentral Bank DAO is not yet doxxed at the time of writing but has confirmed ties to the Near team.

How USN Works

Design Differences vs UST Unlike Terra, where UST is minted by burning LUNA and vice versa, USN is minted by "swapping" NEAR. This has some small but significant consequences:

- USN has no direct impact on the total NEAR supply (although it does on the staked supply) and a USN depeg would not lead to infinite NEAR minting. This decouples the risk of a complete NEAR ecosystem failure from USN. Should USN ever reach enough adoption that a big portion of NEAR’s value is derived from it (like UST for LUNA), this might change.

- Since NEAR is swapped and not burned, there is a reserve consisting of the swapped NEAR (and some additional USDT) that is owned by the USN issuer Decentral Bank DAO.

- The reserve is essentially protocol owned liquidity and can be put to work to create yield for the protocol, in this case the plan is to stake the NEAR to generate native USN yield.

Decentral Bank DAO itself can also burn/mint USN from the Ref finance USN <> USDT pool, where they are a major LP, to keep the pool balanced (similar to FRAX AMOs).

The USN <> NEAR Ratio A total of 100 million NEAR will be deposited and staked in the USN contract to earn rewards. However, the market cap of USN will most likely be smaller, possibly for a long time (at the current price of NEAR, 100 million NEAR is worth more than 1 billion USD), implying that 1 USN equals staking rewards earned by more than $1 worth of NEAR. At the time of writing however, there is not 100 million NEAR in the official wallet and details are not public yet.

The native USN APY is determined by:

- The ratio of the market value of NEAR in the reserve and the circulating supply of USN

- The NEAR staking rewards

Example: NEAR staking APY = 10%, 100m NEAR at $10 in the treasury, 500m USN in circulation would lead to $1b worth of NEAR at 10% APY (=$100m / year) generating yield for $500m USN; the native USN yield would be 20%.

USN Reserves: What is backing USN?

According to MetaWeb.VC, a global crypto firm with an investment focus in NEAR, the first 1 billion USN in circulation is planned to be backed 1:1 by USDT, as well as 1 billion dollars worth of NEAR staked in USN's Decentral Bank DAO reserve, which would ensure over-collateralization of the first 1b USN even in the event of extreme NEAR price fluctuations.

Takeaway: The collateralization ratio of USN is the ratio of USN in circulation and Decentral Bank DAO reserves (USDT + NEAR reserves).

Roadmap USN aims to establish itself as one of the large stable coins by becoming an integral part of the NEAR ecosystem. The steps to fulfilling this future include the following :

- Liquidity bootstrapping on Ref finance with a USN <> USDT pool and enabling of USN <> NEAR swap (live)

- USN integration in different protocols in the NEAR ecosystem (in progress)

- USN integration on CEXs (tbd)

- Multi-chain expansion (tbd)

- Protocol-level integration of USN as a native asset on NEAR to be used as gas and storage fees (tbd)

Risks of USN

- De-peg risk:

- According to current information, USN is only completely hedged against NEAR price fluctuations for the first $1b in supply which are supposed to be backed 1:1 by USDT, afterwards it potentially faces the same de-peg risk inherent in other algorithmic stablecoins.

- Furthermore, the full $1b USDT could not be confirmed on-chain, only a fraction of it in the Ref finance USN <> USDT pool (note: $USN price on Coingecko has not always been accurate, check the Ref finance pool for more accurate estimations).

- Collateral risk:

- USN is currently only backed by a basket of USDT and NEAR. Although the protocol claims to have run various simulations to determine USDT as the “best” collateral for them, many believe it is riskier than other stable coins like USDC (see Alpha Stablecoin Report for more information) and even shortly depegged in recent days.

- The NEAR token is subject to price volatility.

- Smart Contract Risk:

- As it stands today, USN is not integrated on a protocol level and faces the same smart contract risk as any protocol and there is no official public audit yet.

- Highly centralized:

- The owner of the smart contract, presumably Decentral Bank DAO, can call functions like “blacklist address” and “burn black funds”.

- Furthermore, Decentral Bank DAO is not yet a decentralized DAO, in fact, not much is known about who exactly is behind it at the time of writing (although the Near team confirmed ties to the project).

- General lack of transparency:

- See USN Takeaways below.

USN Takeaways USN tries to take the best from existing stablecoins (mainly UST and FRAX) while trying to mitigate their shortcoming and combines it into a solution for the NEAR ecosystem.

While the idea may have merit, the launch felt rushed and USN seems to be released prematurely with many features and information missing we would expect from a stablecoin that people can confidently invest large parts of their portfolio in. To name the most prominent examples:

- Team is not doxxed while it holds all the governance power and has significant influence on a smart contract level (see risks above)

- It is unclear why “blacklist address” and “burn black funds” functions were included in the smart contract

- No information / address / analytics about the USDT reserves, the only information is this wallet address which contains no USDT. It is unclear how much of the USDT in the Ref finance pool belongs to Decentral Bank DAO and where the rest of the $1b USDT is that they supposedly have

- NEAR reserves are not staked yet with no information on when this will start (NEAR staking is supposed to fuel USN rewards)

- Very quiet discord and marketing, no official announcement for 1 month

- Native integration on a protocol layer could have been done from the start, seems like a lot of effort to do this retroactively

In light of the currently underwhelming yields for USN which are not yet generated through staking NEAR, the lack of information and systemic risk of the model, it is prudent to wait for further information and higher yield opportunities before getting exposure.

USN Farming Opportunities & How-to Guide

Native USN Yields Floor APY: The current NEAR PoS staking reward rate is used as the floor APY for USN holders. This would give a current APY of ~10% in NEAR if the tokens were staked.

Realized APY: Realized APY would be higher than basic PoS staking rewards. It's based on the Reserve Fund's NEAR token staking payouts, which are claimed by circulating USN holders. Every epoch, or around every 15 hours, staking rewards would be generated, automatically swapped to USN, and distributed.

Use Cases and yield opportunities of USN

- Lending & Folding

- USN as collateral on lending protocols like Burrow (live), Bastion, Aurigami (announced) and Pret (protocol launching soon)

- Perps

- Perps launching soon on NEAR. Open positions with USN as margin, more info tbd

- DEX and yield farming

- Currently there is incentivized farming on Ref finance for USN. If yield bearing tokens are accepted by DEXes, it presents farming opportunities to earn both LP rewards and lending rewards

Below are some of the most prominent places to earn yield with USN:

| Platform | Type | Pair | Rewards Asset(s) | TVL | APY |

|---|---|---|---|---|---|

| Ref finance | Liquidity pool | USN-USDT | REF | $13.5M | 5.50% |

| Burrow | Lending | USN | USN, BRRR | $2.8M | 0.30% |

| TriSolaris | Liquidity pool | USDC-USDT-USN | TRI, AURORA | $7M | 7% |

Sources: ref.finance farm , burrow.cash, Trisolaris.io

How to set up a NEAR wallet

Learn how to set up a NEAR wallet here: NEAR Wallet Setup Tutorial

How to bridge liquidity to NEAR

There are several bridges between Ethereum, Aurora (EVM chain built on top of NEAR) and NEAR, including their native Rainbow Bridge. However, unfortunately you can only bridge wNEAR - NEAR and wNEAR are analogous to ETH and wETH, in that you need NEAR to pay for gas and storage fees but wNEAR to deposit in dapps or provide liquidity.

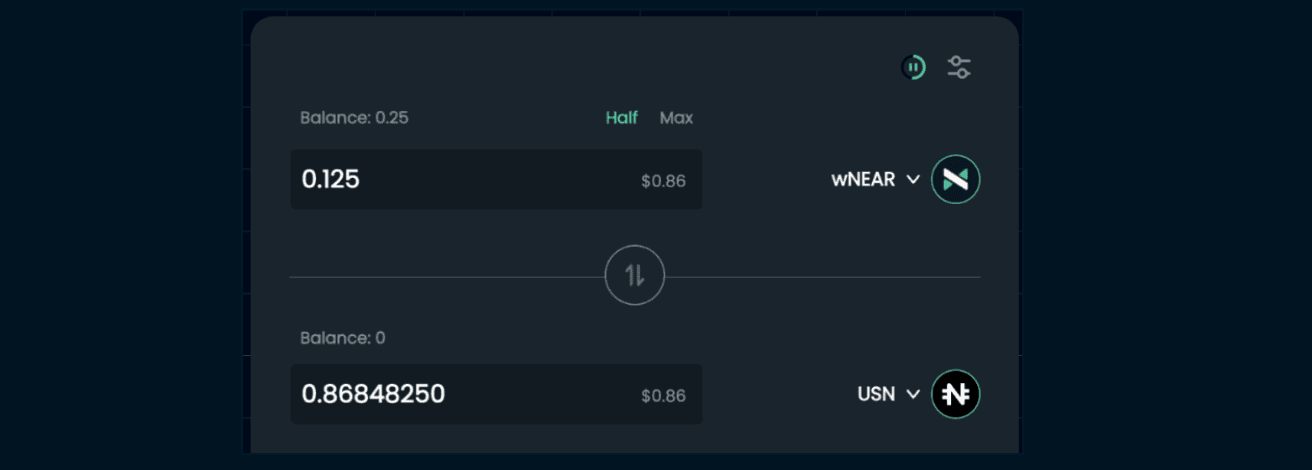

To actually get NEAR, you can ask in their discord or get it from a CEX (e.g. FTX). Once you have native NEAR in your wallet, you can use Rainbow Bridge to transfer various tokens (incl. most popular stable coins) on-chain from Ethereum. You can then swap the bridged tokens on Ref Finance for USN (they also have a stableswap option) and also provide liquidity to the USN-USDT pair:

Example: Step 1: Head to swap on https://app.ref.finance/ Step 2: Swap your token for 50/50 USN and USDT, if you plan on using the whole balance of your token for LP, you can select “half” to swap exactly 50%. If you swap into USN/USDT from another stablecoin you can use the stable swap option as well.

Step 3: Provide USN/USDT liquidity at https://app.ref.finance/

Step 4: Stake your LP shares at https://app.ref.finance/ to start earning rewards

TRON Protocol: USDD

How USDD Works

Design Differences vs UST USDD is in its core design very similar to UST, and will basically be for TRX and the TRON network what UST is for LUNA with a few minor twists.

USDD Reserves: What is backing USDD? USDD is primarily backed by TRON. However, according to their whitepaper, TRON DAO Reserve (initial issuer and governance body of USDD) will also raise $10b early-stage reserves from prominent blockchain industry players, effectuating deposits over six to twelve months which would give the USDD peg additional security. The TRON DAO Reserve Twitter account has been posting news of purchases (mostly BTC), however, they do not come close to $10b yet and there is no public analytics page or disclosed wallet addresses currently.

Roadmap USDD will launch in several phases, (more info in the whitepaper), with a rather centralized design at the beginning that decentralizes over time:

- Currently, USDD is heavily reliant on the TRON DAO Reserve and its stakeholders (whitelisted institutions). Only they are able to mint/burn USDD and are in charge of keeping the peg. Initially, there is a 1b USDD authorized supply (of which ~270m have been minted so far), however, the TRON DAO Reserve can authorize more with a 5/7 multisig.

- By the end of the year (30. Dec. 2022), USDD aims to decentralize by giving its governance power from the TRON DAO Reserve to the TRON USDD decentralized network and implement “public” minting/burning.

By launching in various steps in a very controlled way, USDD hopes to be able to prevent it from spiralling out of control like UST and LUNA. Currently, the mechanism is designed in a very similar way to Terra, so it will be interesting to see if there will be changes to the proposed design in light of the recent Terra crash.

Risks of USDD- Depeg risk:

- Due to the similarity to UST, USDD faces many of the same risks, including depeg risk and the risk of exposure to underlying collateral (TRON).

- However, in the short term, the risk should be lower than late-stage UST, given the supply, minting and redemption are all managed by TRON DAO Reserve and the market cap ratio between USDD and TRON is still very low.

- Collateral risk:

- USDD is currently only backed by TRON.

- Smart contract risk:

- The smart contract has been audited by Slowmist. Slowmist’s audit report can be found here.

- Highly centralized:

- In the beginning, USDD is highly centralized but the operators are known and there is reason to believe they are trustworthy (since they are closely tied to TRON and hurting USDD users would mean a huge blow to TRON).

- Key person risk:

- The whole TRON ecosystem is dominated by Justin Sun (most of the largest protocols on TRON even have his name in them in some way like JustLend, SUN.io, SunSwap). If anything were to happen with Justin Sun (e.g. a large scandal), it is likely to have a substantial impact on the whole ecosystem and potentially the value of USDD.

- Furthermore, the crypto community’s opinion of Justin Sun is very mixed, leading to additional reputational risk for USDD.

Nansen’s take on USDD

Given the latest developments in Terra and the ambiguous information about the $10b backing, it is understandable that many people would rather stay away from USDD at the moment. However, given the current market cap and authorized amount, the current minting/burning control and the backing of the people involved, USDD in its current stage is unlikely to face the same fate as UST in the near future.

Furthermore, given the recent events, there is a high chance that the design will be adjusted before USDD minting/redemption becomes open and decentralized. The yields are very attractive compared to the competition on e.g. Curve, however, they are associated with substantial risk as mentioned above.

USDD Farming Opportunities & How-to Guide

Native USDD yields As of now, there are no plans to use yield generated from underlying assets to create USDD native yield. All the yield comes from the respective use cases and/or protocols.

Use cases and yield opportunities for USDD Currently there are opportunities for USDD in flagship TRON projects as well as Ellipsis on BNB chain - however it is not disclosed how long these opportunities will be incentivized (most incentives are paid out directly in USDD):

- DEX and yield farming:

- SUN.io

- SunSwap

- Ellipsis (BNB)

- Stableswap:

- Curve (Ethereum)

- Lending & Borrowing:

- JustLend, looping / leveraging possible

| Platform | Type | Rewards Asset(s) | TVL | APY |

|---|---|---|---|---|

| Justlend | Lending | USDD + JST | $474M (leveraged) | 11.4% (w/o leverage) |

| SUN.io 3pool | Stable swap | USDD + SUN | $88.5M | 13% |

| SUN.io USDD-USDT pool | Swable swap | USDD + SUN | $46M | 16% |

| Ellipsis USDD-3EPS pool | Stable swap | USDD + EPS | $50.8M | 9.5% |

| Curve USDD-3pool | Swable swap | USDD + Curve | $33M | 24% |

| Sunswap USDD-USDT | Stable swap | USDD + SUN | $31M | 16.4% (not boosted) |

| Ellipsis USDD-BUSD | Stable swap | USDD + EPS | $34M | 18% |

| Huobi | 30-day Fixed Term | USDD | - | 30% |

Sources: Justlend, SUN.io, Ellipsis, Curve , Huobi as of 25.05.2022

How to set up a Tron wallet Choose any of the wallets offered here and follow the instructions (TronLink is the most common Tron wallet). Make sure to also bridge some TRON, as you will need it to pay for transactions (costs are usually in the single-digit dollar range).

How to bridge to TRON It has to be noted that to our knowledge there are limited on-chain options for bridging stables directly from Ethereum to TRON. Most people take the route via a CEX and the TRX token.

Example: How to stake USDD/TUSD/USDT 3pool

Step 1: Head to https://sun.io/, and on the tab bar select “Liquidity” and the pool you want to deposit in (in this case “3pool”)

Step 2: Stake USDD/TUSD/USDT, you can choose any amount of any asset but might receive a slight penalty if you imbalance the pool too much

Step 3: Head over to the “Farm” tab and stake your LP tokens

Nansen’s Take

Both USN and USDD are algorithmic stablecoins which carry a systemic risk which many of the large stablecoins like USDC or USDT do not have. The attractive yields are not risk-free and should be interpreted as reward for the higher risk of engaging with these protocols / stablecoins.

With these kinds of products, it is crucial to closely monitor the reserves, market cap and liquidity and reassess their security on a regular basis. Since both of them lack information, especially about the reserves, we consider them highly risky at this point. Additionally, both are quite new and smart contract risk should be considered as well.

In the following table we compare some of the key aspects of USN and USDD:

| Category | USN | USDD |

|---|---|---|

| Mechanism | Swapping NEAR for USN, swapped NEAR staked as protocol owned liquidity to generate yield + Additional reserves | Burning TRON for USDD, similar to LUNA / UST model + Additional reserves |

| Documentation and Info | Severe lack of documentation and information (in most aspects, e.g. reserves, team, rewards, …) | Partial lack of documentation and information (esp. Details of non-TRON reserves and rewards schedule) |

| Yield opportunities | Max. 7% (Trisolaris) | Max. 24% (Curve) |

| Market Cap & Liquidity Depth | Market Cap not disclosed, $20M TVL across swap pools | $540M Market Cap, Almost $300M TVL across pools |

| Reserves | $17M NEAR in wallet, $1b USDT announced but details not disclosed and not confirmable on-chain | $7.9b TRX market cap, $10b raise announced but details not disclosed and not confirmable on-chain |

| Perceived | Due to severe lack of information it is hard to build trust, at the same time the yield opportunities are very low | Not all information is available and the rewards seem long-term unsustainable, however the yields are among the highest for stable coins currently |

| Risk / Reward | -> Very high risk, low reward | -> High risk, good reward |

Sources: ref.finance farm, SUN.io as of 25.05.2022

Given the higher yields on USDD, the risk-reward profile is more competitive relative to USN. However, users must be cognizant of the inherent risks in the design of both USN and USDD and exercise caution in sizing the portions of their stable portfolio invested in USDD/ USN.