Osmosis Overview

Osmosis is a DeFi-focused app-chain that is built out on the Cosmos stack. It aims to be the on-chain equivalent of Binance but is permissionless, more decentralized and interoperable with the cross-chain ecosystem by default. To execute on this vision, they are building out a core AMM that is a hybrid model of concentrated liquidity (Uniswap v3) and orderbooks with many complimentary apps composed together to be the one-stop shop for users’ DeFi needs. In short, Osmosis is a bet on IBC gaining adoption given its market dominance as the go-to DeFi Hub of Cosmos and its integrations with almost every other chain over IBC. Let's dive into today's statistics to get a better understanding of Osmosis and the proliferation of IBC across the interchain.

Is it a big market?

The addressable market of Osmosis is ultimately as large as the IBC ecosystem can extend out to. Given IBC is spreading to almost every ecosystem via other protocols such as Composable Finance, Polymer Labs or even zk-proofs on Ethereum, the potential market for Osmosis is immense. It is important to recognize that Osmosis will be a DeFi chain and not just a DEX, consisting of tightly-integrated lending markets, margin trading, perpetuals, and many other DeFi primitives co-located on the same chain. Thus, Osmosis should not just be viewed as just a DEX, but rather a full-fledged layer-1 ecosystem. On top of its coupled DeFi experience on the Osmosis chain itself, Osmosis will play a key role in providing shared security for other Cosmsos chains via ‘mesh security’ and will provide key cross-chain tooling for apps to compose with. The report will outline some of these core features and the future catalysts of the Osmosis chain in general. The current market cap of chains built out on the Cosmos technology stack is well over $68b, forming what many call the ‘Interchain’. With IBC acting as the glue to tie all of these sovereign chains together, Osmosis stands to become the Interchain DEX. With many new Cosmos chains in development alongside other near-term catalysts such as NEAR, Polkadot, and Kusama being added over IBC, the potential market size of the Osmosis ecosystem is significant.

Current Traction and Stats

Osmosis launched a little over a year ago and helped put IBC on the map by providing a liquidity hub for all Cosmos chains. IBC, which stands for Inter Blockchain Communication, can be thought of as the TCP/IP equivalent of blockchains - one shared messaging layer to unite many siloed ecosystems to become an interconnected ‘Interchain’. Prior to Osmosis launching, IBC was just a few months old with a basic module (ICS-20) that allows for token transfers between sovereign Zones. Many of the existing blockchains in the ecosystem were focused on non-DeFi oriented applications - decentralized compute (Akash), carbon credits (Regen Network), among other things, so IBC volume was rather low at the time. The main reason for this was that they were lacking the key DeFi primitives, mainly a DEX to unite all of the liquidity for all of these long-tail Cosmos SDK tokens.

Osmosis launched and you may read Nansen’s report here which covered some main highlights as a DEX, catalysts and some of the opportunities at the time. Over a year has passed since our last report and Osmosis has cemented itself as a blue-chip Cosmos chain.

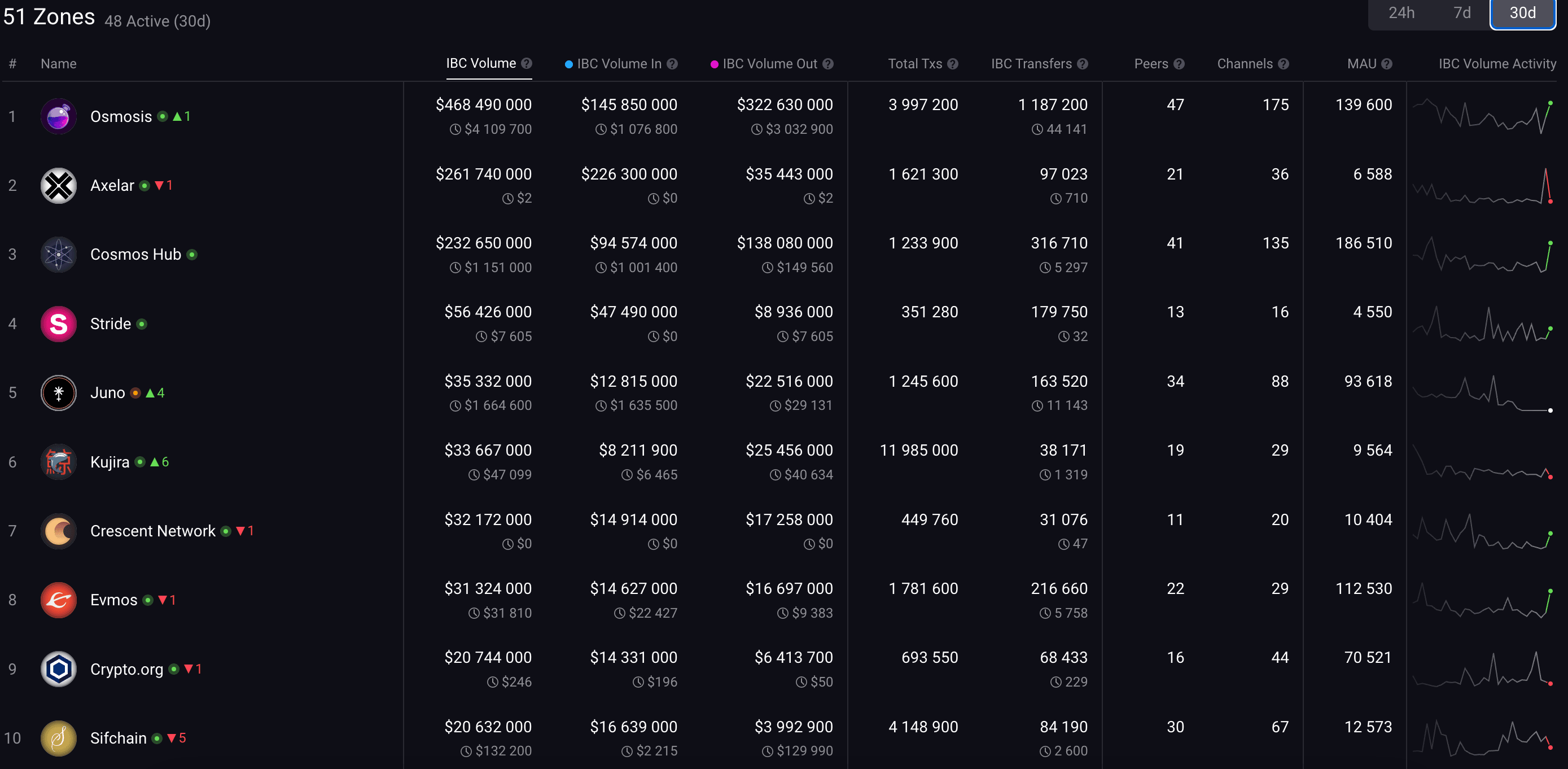

Looking at the IBC data above, Osmosis is leading across all of these metrics with over 140,000 Monthly Active Users, the highest volumes, the highest number of transactions, and more. Osmosis is also ranked 1st in…

- IBC connections with other chains (46/49 active Zones)

- IBC transfers (1.1m+ in past 30d)

- Token listings

- Governance participation

- Swap Fees

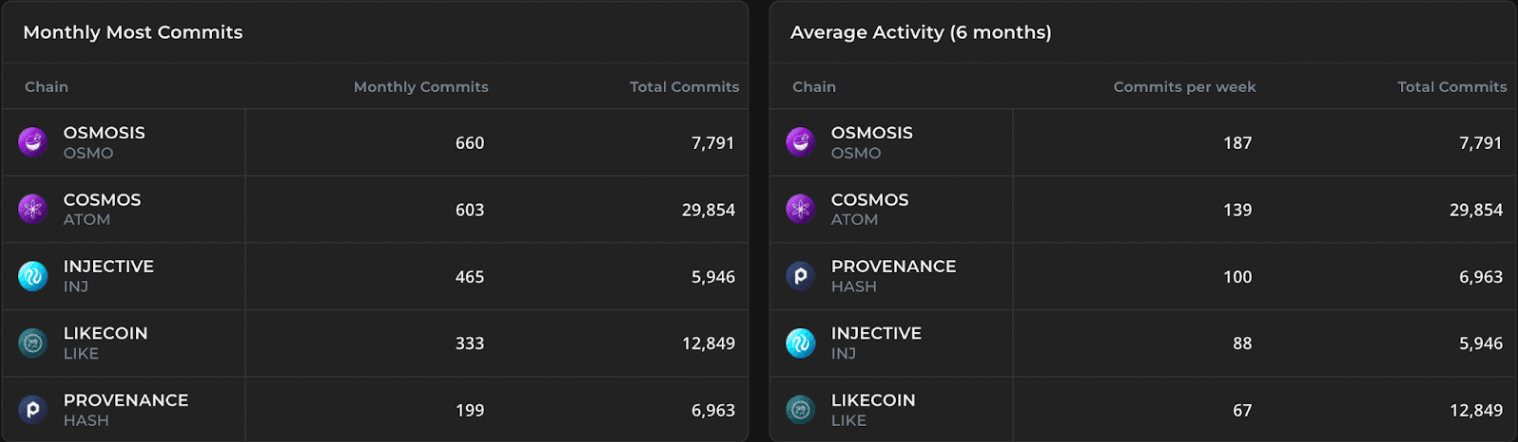

Looking towards developer activity, Osmosis has had the most monthly commits and the highest average number of weekly commits over the last 6 months. Although commits are not a perfect metric, the trend is clear - many developers are building on Osmosis. Many of these developers come from the displaced teams from Terra who were looking for a new DeFi home, as well as new CosmWasm developers coming into the ecosystem.

Although Osmosis is a layer-1 chain, there are very key differences between app-chains such as Osmosis and permissionless smart contract chains such as Ethereum or Solana. To understand the different design choices, let's briefly discuss the app-chain thesis and how it differs from its permissionless counterparts. To recount:

Permissioned = new apps are deployed via governance (governance gated) Permissionless = any app can launch on the chain (not governance gated)

The App-chain Thesis

Osmosis falls under the permissioned category and it is focused strictly on being a DeFi app-chain that has a core DEX with many products that complement the core DEX functionality. Put more simply, their aim is to be the on-chain version of Binance, except with a more decentralized and composable stack that can natively interoperate with a cross-chain world. Given Osmosis is its own layer-1 chain, it controls all parts of the technology stack - from the protocol logic to the end user wallet integrations, which can allow them to create a better product and a superior UX. A key takeaway of building out an app-chain is to simply create a better product. This sentiment is echoed by dYdX in their recent move to build on Cosmos who can have their validators run the orderbook in their mempools to recreate the same experience of CEX based orderbooks. Alright, but what are the actual advantages and disadvantages of being an app chain for Osmosis specifically?

Again, the main advantage to build an app-chain is to simply create a better product. If Osmosis were to launch as an app on multiple EVM chains, such as what Sushiswap did, they would fragment liquidity and UX across each deployment, force trusted 3rd party bridges upon users, excessive fees, increase complexity upon each new deployment, and force users to add new networks that force them to buy the native token to simply execute a transaction on the source and destination chain. Worrying about all of this complexity ultimately turns away users and hurts the end product. Developers must decide on where to deploy and maintain these deployments across multiple layer-1 chains that can even break their contracts at any time when they choose to undergo protocol upgrades. However, Osmosis’ approach is to build its platform out as a single chain and connect to the rest of the chains through IBC or canonical bridges to reduce liquidity fragmentation and make for a better UX.

In order to understand the UX Osmosis is trying to provide, it is important to understand how permissionless chains do protocol upgrades. Given there are 1,000s of apps co-located on a permissionless chain like Ethereum, it makes it harder to coordinate protocol changes. Although this is a good thing for Ethereum given it handles billions of dollars and is sufficiently decentralized, it is surely not optimized to make any one application better - all apps are treated equally. Whereas on Osmosis, its apps are treated as ‘first-class’ citizens given that upgrades are made for custom integrations with the apps composed on top of it. Hence, we can come to the conclusion that permissionless chains like Ethereum do not make protocol changes for any one application, but optimizes for the average use case. Is there a way out of this for applications to enhance their product while being sufficiently decentralized? Yes.

When Osmosis makes an upgrade, the protocol logic understands the applications built on top of it. Thus, Osmosis is able to have protocol upgrades that directly benefit its apps. This is in contrast to permissionless chains whose upgrades make general improvements to the chain (and thus the applications on top) but upgrades are not targeted at any specific application and are more general. A key takeaway is that there are less apps (stakeholders) on app-chains like Osmosis, so protocol changes are rapid and can be optimized for the specific app(s). These upgrades are not just more iterative, but they can create fundamentally new features that otherwise couldn't be created elsewhere as seen with Osmosis’ Superfluid Staking already. More on this below, but it gives Osmosis or any app-chain for that matter, a much bigger design space when tackling their core verticals.

To illustrate how poor the UX is now, let's briefly cover the workflow from a user starting on Ethereum and wanting to use Uniswap on Polygon to swap a token:

Goal: User has USDC she would like to swap on Polygon for X token

- Step 1: User must buy ETH to pay for transaction costs on Ethereum (fluctuates highly).

- Step 2: User must add the Polygon network RPC to their wallet.

- Step 3: User must use a multisig or small validator secured bridge to bring their funds over from Ethereum (different bridges fragment liquidity due to various canonical representations).

- Step 4: User must buy MATIC to transact on the Polygon network before swapping (either through a faucet in a Discord or buying off a CEX and manually transferring which requires KYC and more fees).

- Step 5: User goes to Uniswap to swap their USDC for X token but the liquidity is not as deep on Polygon as it is on Ethereum, so she gets worse execution.

- Step 6: She finally has X token in her wallet.

The above workflow for an end user is not a feasible UX to bring in the next wave of users to crypto. A user should not have to buy 2 separate assets (plus fees) to swap their USDC for a desired token and wait hours to bridge, be forced to use trusted 3rd parties, and much more - this UX flow makes it difficult to onboard new users who might prefer to opt for Binance over the current decentralized counterparts given the better UX there. But how can a dApp compete with Binance and even offer a superior product?

Enter the Osmosis App-chain

The key takeaway for building an app-specific chain on Cosmos is that it allows developers to build one specialized chain for their application and connect to everything else via IBC - no need to fragment liquidity and UX across multiple chains/rollups. Rather than being a jack-of-all-trades and master-of-none, Osmosis opts to be a master of DeFi and compose with every other key vertical app-chain in a near trustless way over IBC (Ex: Stargaze for NFT marketplace, Akash for decentralized cloud compute, etc.). Let's dive into the Osmosis DEX and then get into the specific examples of how Osmosis is tackling UX.

Osmosis DEX Design Space

Osmosis at its core is an exchange, similar to Uniswap or its centralized counterparts like FTX. It currently uses an AMM model that was originally based on Balancer’s design but in the near future, it will utilize a hybrid version of concentrated liquidity similar to Uniswap v3. Their approach will be based on Uniswap v3 which has been tried and tested to show how it can be highly scalable while also capital efficient. Whereas fully on-chain orderbooks have not been fully proven to scale yet. For example, users canceling orders would require thousands of transactions alone and this is a main reason why dYdX is opting to keep their orderbook off-chain in their v4. In Osmosis’ v13 upgrade expected in Q4 of 2022, Osmosis will launch their stableswap which will be the first of its kind for the Cosmos ecosystem (minus small forked EVM DEXs on Evmos). Right now, liquid staking derivatives and their respective Cosmos SDK tokens are mainly pooled on Osmosis’ constant product pools which are less capital efficient for users. With stableswap, liquid staking derivatives and stablecoins will finally find a home in the Cosmos ecosystem - across Cosmos native stables such as USK or IST to bridged ERC-20 stables and native USDC itself.

Later in the roadmap, they will launch their own version of concentrated liquidity. The exact details of the implementation are still not well known but more updates will come with the end goal of increasing capital efficiency and providing traders, and LPs with the best experience. With these different AMM designs, Osmosis will also have native limit order support and other custom integrations such as DCA and fiat onramps via Kado. Alongside these baked in features of the DEX, Osmosis will also have in-protocol arbitrage/liquidations for stakeholders of the Osmosis protocol to accrue value from the MEV being extracted on the chain.

Some other features Osmosis is trying to implement at the DEX level:

- Combat MEV with Threshold Encryption

- Encrypts all transactions in the mempool to a threshold key of all the validators.

- Once the validators commit and finalize the ordering of the block, then the txns will be decrypted and executed - preventing frontrunning and sandwich attacks.

- Sunny Aggarwal and others were working on this prior to founding Osmosis but prioritized the AMM given this is a feature, not a product.

- Volatility-Aware AMM

- Helps protect LPs from impermanent loss (IL).

- Similar to orderbooks and what market-makers do in times of high volatility (increased spreads given the increased risk of loss).

- Different from THORChain or Bancor that use inflationary mechanisms, this requires no token incentives or inflation.

- This is being built by a team of students from UC Berkeley alongside the Osmosis team.

Key themes are that Osmosis is able to explore a unique design space for DEXs in particular with a key focus of creating a more bundled DeFi experience for its users. Given these are just the designs and experimentation being done for the DEX, what about the other integrations that are aiming to make Osmosis the DeFi hub of the Interchain?

Examples of good UX

Deposit/withdraw assets over IBC and Axelar all natively from the same easy-to-understand UI.

This abstracts the complexity behind the user’s having to use custom bridges to move around chains and from having to manually use IBC.

They will also be integrating Composable Finance which will connect the Polkadot, Kusama and NEAR ecosystems to Osmosis directly over IBC which will also be abstracted away in the same UI

Same goes for Wormhole to connect Solana (although have not heard of any recent updates here)

Takeaway: A user can utilize the Osmosis DEX across any integrated chain, without having to worry about the technology stack each is built on. Osmosis stands to abstract away the complexity mentioned above that is experienced by the end user today. Similar to how users can send different tokens across different standards to Binance from separate chains seamlessly, Osmosis will do the same but in a permissionless manner.

Transaction fee UX abstraction

Can pay for gas in any token, allows for the user to not have to buy OSMO just to use the chain (token agnostic) while the fees accrue to OSMO stakers given Osmosis would sell the rewards back into OSMO (value accrual as a function of demand, not forcing OSMO on users).

- Currently, Osmosis allows for zero gas fees for all users as well. End users will just have to wait for a zero-fee validator to produce a block to be included. Keep in mind, there are mechanisms in place to ensure someone does not just spam the chain.

This feature will be brought to other chains using Osmosis in the backend. New chains don't need to spin up their own DEXs, and can compose with Osmosis’ liquidity for its fee abstraction directly over IBC. This makes the UX better for end users and it brings more value back to the native token of the platform.

Ex: Juno Network allows users to pay fees in any token. Let's say many users pay with USDC and those fees accrue and every 12 hours, the Juno network executes a timed sell on Osmosis for USDC to be swapped into JUNO and ‘IBC’d’ back over to Juno which will accrue to its stakers (or whatever governance decides on). Osmosis is the backend for fee abstraction given its liquidity for all major Cosmos native tokens and bridged assets.

Takeaway: Another instance of how Osmosis is utilizing the Cosmos stack to optimize for the end user to enable a better UX without enforcing its native token. Simultaneously, Osmosis is taking advantage of its liquidity dominance to provide a key backend component for any other chain to utilize and build upon.

Axelar integrations

Axelar is the canonical bridge of Osmosis and it is a standalone Cosmos chain, secured by Tendermint BFT Consensus and built out on the Cosmos SDK. Canonical bridge means that only Axelar's wrapped assets (bridged) will be shown on the main Osmosis frontend (not Gravity Bridge, Nomad or any other bridges). Other bridges can still use Osmosis on their permissionless frontend called the Frontier, but these pools will not be given OSMO incentives or be listed on the main frontend. This was done to reduce liquidity fragmentation as seen with other ecosystems with too many bridged assets. Given its technology stack, Axelar is a validator-secured bridge and shares similar liveness and safety guarantees to other Cosmos PoS chains which you can read about more in Nansen’s previous cross-chain report. Rather than being a specific bridge implementation, it functions as a generic transport layer of the cross-chain communication stack which allows apps to build on top of it. This app layer can create a lot of interesting cross-chain features, many of which can flow downstream to Osmosis.

For example, this app layer can allow for cross-chain lending using Osmosis in the backend as the DEX and use Axelar’s cross-chain network. If Compound chose to launch on Axelar, they could allow their users to borrow against assets on separate chains (Borrow MATIC on Polygon against ETH collateral on Ethereum). Axelar has already built out the cross-chain message passing and Osmosis would facilitate the liquidity as the default DEX. Rather than spending years trying to build out this cross-chain framework, projects could choose to simply use Osmosis.

The key takeaway is that many new apps can launch with new frontends that can build on top of the Osmosis <> Axelar technology stack as a core building block. This ultimately increases the utility of the DEX by routing transactions through Osmosis and creates a flywheel effect for Osmosis liquidity. It is increasingly becoming a plug-and-play model since Osmosis has easily accessible APIs and a wealth of tooling.

Cosmos chains, Polkadot, Kusama, NEAR, and all of the EVM chains’ liquidity are expected to be on Osmosis by EOY 2022 - it simplifies the cross-chain landscape into one cross-chain DEX with many DeFi products for users to select from (chain agnostic) which is why it is often called the “Interchain DEX”. Similar to how Serum provides a core orderbook and tooling for Solana apps to compose on, Osmosis and Axelar aim to provide that DeFi tooling across all interconnected ecosystems.

Osmosis will prioritize the near trustless light client design of IBC, followed by validator-secured bridges such as Axelar which can progressively decentralize with new forms of shared security from the Cosmos ecosystem (more on this later). As for other Cosmos chains, Osmosis can also have outposts on them that give a better developer UX to make it feel like a native DEX co-located on the same chain that utilizes the unified liquidity on the Osmosis chain over IBC. An outpost is a local deployment of Osmosis on other Cosmos chains as a set of CosmWasm smart contracts and allows Osmosis’ services to be accessed easier by other chains’ applications.

Takeaway: Osmosis can become the cross-chain liquidity hub for all chains to compose with. Since the Moonbeam integration over Axelar, Osmosis now has the 2nd deepest liquidity for DOT. With Composable Finance integrating the Polkadot, Kusama and NEAR ecosystems with Osmosis over IBC, the multichain world will be unified by a singular DEX. Osmosis is not just a DEX, but is a key infrastructure for the cross chain world.

Shared Security and Higher Yields

Osmosis will provide two versions of shared security in the future that will aim to create a liquidity flywheel effect for many Cosmos assets to gravitate to Osmosis - Interfluid Staking and Mesh Security. Given Osmosis is the center of liquidity in the IBC ecosystem, it'll be a better security provider candidate. With more traction, it'll become a more secure system of other chains depending on it and it would bring even more liquidity. Using the mechanisms below, a strong liquidity feedback loop can occur.

- Interfluid Staking: Taking Osmosis DeFi assets and using those for cross-staking.

- Mesh Security (ICS): Taking the native OSMO staking tokens and cross-staking them to secure other chains. This is similar to what the v3 of ICS will look like, but the main difference is that Mesh Security brings a bi-directionality on top of it such that it creates a mesh security instead of a hub and spoke model.

Via interfluid staking, Osmosis seeks to offer shared security via its own liquidity pools for Cosmos chains (native Cosmos SDK staking tokens).

- Ex: For an AKT-OSMO LP pair, a large % of the underlying AKT can be attested over IBC and staked natively on the Akash chain. The LP balance would be updated automatically and is attested over IBC which allows security to be derived dynamically over IBC from Osmosis’ liquidity pools (increases the bond ratio for each chain) which incentivizes more liquidity given there is no tradeoff between staking the native asset for securing the chain and LPing for more APR. This creates a flywheel effect for Osmosis liquidity given Cosmos chains can opt for this over liquid stalking solutions that pose their own set of issues.

Osmosis can also implement its own version of ICS via Mesh Security which allows Osmosis and other Cosmos chains to derive shared security from one another. Sunny Aggarwal, one of the Co-Founders of Osmosis, compared the future mesh security network of Cosmos chains to that of NATO - similar to how there are sovereign countries that do not get involved in each other's internal affairs, they form a military alliance. If one is attacked, they can come together for the joint security of all of the nations such that each nation has the joint military power of the entire NATO alliance. Similarly, Cosmos chains partaking in this mesh security will still have their own unique validator sets (control their internal affairs), yet there will be more economic weight backing them. For the end user who stakes their OSMO, they can choose to take on the slashing risk of other chains to back a validator on another chain in order to earn more staking yield. Going off of incentives, it seems likely users will take on additional slashing risk to earn more yield. Although a user may stake with a Notional validator on Osmosis, when she cross-stakes her OSMO, she can stake to different validators - they do not need the same hardware requirements to get the economic value. Chains will also handle cross-chain governance and decide how much governance they would like another chain to have on their own.

Ex: If 100% of the OSMO stake opted to secure Juno Network and 100% of the JUNO stake opted to secure Osmosis, then they would both get the security of the joint market caps of the 2 chains, while remaining sovereign chains. You can now imagine this across multiple chains that create a mesh of shared security. Combined with Interfluid Staking and other attempts at shared security, the Cosmos vision of shared security differs greatly from that of Polkadot or Ethereum. Of course, the delegated stakers to these validators would take on slashing risk for each new chain it chooses to validate and there are a lot of governance-related questions to work out. A lot of these details are still very early, so there are a lot of things to develop. Based on the prototype from HackWasm, one of the developers Sunny believes that they are a few months away from a working MVP. The concept of Mesh Security is very similar to what EigenLayer is doing with its ‘restake’ concept which allows ETH 2.0 validators to ‘restake’ to be able to provide additional services on Ethereum such as DA for rollups, oracles, and other things. Mesh Security takes the same idea and instead of using it for other services, applies it to provide security for other chains.

To flesh out the mesh security idea even more, there is even a potential reality where Cosmos chains and Ethereum derive shared security from one another. Of course, each chain can be thought of as its own country, but united, they stand stronger and safer together. Mesh security is not just a proof of concept, a prototype is being worked on here by some of the devs following HackWasm.

CosmWasm Apps <> Osmosis

Given Osmosis is a permissioned app-chain, they can allow for tighter integrations with the apps deployed on it. For instance, Mars can offer margin trading and subaccounts to mimic a CEX-like experience given the Osmosis protocol logic can be configured to work with the primitives Mars puts forward (contract to contract lending).

CosmWasm is a smart contract framework that was built for the Cosmos ecosystem and it allows IBC to be more dynamic through rapid prototyping. Currently written in Rust, CosmWasm is the most popular standard for smart contracts for the Cosmos ecosystem. Due to its prevalence and advantages over other frameworks, contracts can be composable across separate chains and utilize IBC for cross-chain communication. This combination of CosmWasm and IBC allows for chains such as Osmosis to deploy as a set of CosmWasm contracts on other chains and natively compose with Osmosis’ liquidity over IBC such that it provides good developer UX for other chains’ dApps and does not fragment liquidity.

Osmosis Support Lab

- Osmosis has 24/7 support for users where they can live chat with dedicated support members or go through their comprehensive list of resources for help. Again, this is very similar to a CEX experience and provides users with a wide range of resources to find the help they need. Of course, this is in addition to the Discord support and other communication channels set up which can be accessed here.

Now let's look into the specific advantages of being an app-chain.

Advantages of being an App-chain

Scalability

A network of app-specific chains is more scalable than chains where the validators secure everything (validators strained for capacity). Cosmos chains are able to take advantage of both horizontal scalability (more chains = more scalability) and vertical scalability via rollups that are interoperable over IBC.

Given app-chains are permissioned, they reduce the number of applications deployed on them. For Osmosis, they only allow applications that complement its core DEX so it is limited to a few apps, which helps reduce the bloat of a chain. Of course, MEV ensures any chain with sufficient DeFi activity becomes congested at some point which can be visualized here and Osmosis is taking steps to combat MEV. The key point is Osmosis will have fewer apps co-located on its chain and scale for more apps via Interchain Security (horizontal) and via ZK-Rollups (vertical) further down the roadmap.

Blockchain Design and Developer Friendly

Cosmos SDK: Makes it relatively easy to deploy a customizable and sovereign blockchain

Multiple Smart Contract Frameworks: CosmWasm, EVM, Solana Sealevel VM, and Agoric’s Hardened Javascript.

- Osmosis has enabled CosmWasm which is built for cross-chain smart contracts (the fastest-growing smart contracting language in the Cosmos ecosystem)

Tendermint: Paves an easy way to ensure consensus, Osmosis is currently at 135 validators with a proposal to make it 150 validators. Changes can be made to either increase or decrease the number of validators with varying tradeoffs to time-to-finality (TTF). More validators = longer TTF, whereas fewer validators = faster TTF in Tendermint-based chains (pBFT-based consensus) where 2/3rd of validators are needed to attest the proposed block.

These core infrastructure pieces allow developers to focus on the application as opposed to the underlying consensus. The Cosmos SDK is packed with a suite of modules that chains can contribute to or select from all of the other modules other chains contributed to the Cosmos SDK. More chains building on the Cosmos SDK = more modularity for chains to integrate a breadth of modules. For instance, Osmosis created the Token Factory Module that allows tokens created by Osmosis’ CosmWasm contracts to be treated as Cosmos SDK assets. This allows Osmosis to only deal with one token type instead of two and any chain that uses CosmWasm can use this open-sourced module.

Apps do not need to overpay for security or gas fees

- Osmosis has the option for customizable gas fees and can pay in any token or even pay with zero gas fees (need to wait for a zero-gas validator to propose a block).

Chains can ask their validators to do more for them

- Ex: Sommelier has its validators run additional hardware to support cross-chain features with Ethereum as well as adding in off-chain components. Another example is dYdX which will have its validators run an off-chain orderbook (not committed to consensus) that is distributed across its validators to enable a better trading experience while decentralizing this centralized component of its architecture across its validators.

Capturing MEV and Combatting MEV

As fees race towards zero with more abundant block space, MEV is a key component to capturing a lot of this value for app-chains in particular.

Can use MEV mitigations with the aim to combat “bad” MEV and internalize “good” MEV across Osmosis’ stakeholders - stakers, LPs, and traders. Given the governance of app-chains, it ultimately empowers the community to decide on how to capture MEV revenues and where the value accrues.

Threshold Encryption will be used to combat bad MEV - transactions are encrypted until they are included in a block (which will occur once ABCI++ is used sometime in 2023).

- Bad MEV = front running, sandwich attack, etc.

- Good MEV = liquidations and arbitrage

Can internalize good MEV and distribute across Osmosis stakeholders via in-protocol mechanisms. Protocol-owned MEV is a huge value capture for Osmosis and any app-chain for that matter. Given they have the mechanisms to prevent a good chunk of bad MEV with threshold encryption, capturing most of the other value derived from MEV offers a new way to align economic incentives across stakers, LPs, and traders.

Skip Protocol is working with the Osmosis team to make an in-protocol Osmosis module that will unlock arbitrage revenue for stakers, validators or the community pool

As Osmosis adds new features, Skip will have to extend the module to add in additional logic (stableswap, concentrated liquidity, liquidations, and more)

They will eventually be running in-protocol block space auctions for the first spot in the block. This can occur when Osmosis supports ABCI++, this is thought to be the better solution for general-purpose platforms today and helps capture the long tail of MEV

Can find a comprehensive dashboard covering MEV on Osmosis here and even track the daily MEV updates for Osmosis on Twitter

Zones select who they are interoperable with, reducing exposure to external incentives and risk

If a chain is deemed too risky, Osmosis does not need to establish an IBC connection with it. Given they have to think about who they are interoperable with and set up the needed infrastructure, Cosmos treats interoperability as a spectrum. Chains such as Osmosis must think about who they want to be interoperable with, which can probably be seen as a good thing that it is left up to each chain.

If a specific chain on Cosmos is corrupted and fails, other connected Cosmos chains will be negatively affected. However, at the end of the day, they can continue to function which was seen with the Terra failure causing Osmosis LPs to get hurt given they were locked in their bonded LP positions, but Osmosis has successfully come out of it.

On the other hand, for something like Polkadot or Ethereum, if everything is running on top of one system and it fails due to someone going Byzantine and double spending or MEV proves to be too much (MEV doomsday hat is on), everything that was running on that one system has now failed along with it. In this way, Cosmos’ multichain vision is NOT a one-size fits all way of tackling specific design instances (such as Terra) or MEV, but an emerging ecosystem using a diversity of techniques that can fail independently, but not as a collective. Please check out Charlie Noye’s video here on an introduction to MEV that covers the design approaches of multiple chains that are said more elegantly all the way back in 2020.

Disadvantages of App-chains

Security Guarantees

- Each Zone is responsible for its own level of security. On Ethereum, all apps inherit the security of layer-1.

- Runs the risk of not being able to secure their own chains and create fragmented security assumptions of each new chain in Cosmos. For each new Zone Osmosis establishes an IBC connection; they inherently trust the state of the other chain. To combat this, Osmosis created 2 frontends - 1 that is permissionless for the long tail of tokens called the ‘Frontier’ and 1 that is permissioned (governance-gated and can be incentivized with OSMO).

Any app can now launch on a permissionless chain like Juno or on a permissioned chain such as Osmosis via the CosmWasm smart contract framework (written in Rust) instead of launching as its own chain. Hence, the new workflow for a team that wants to come to build on Cosmos without initially bootstrapping a validator set can be the following:

- Launch as an app until they reach product-market-fit and subsequently launch as its own chain if they choose to. Most high-value applications will want control over the validator set for the reasons stated above where validators can do more for your chain. An example of this workflow in practice is Mars Protocol, which is launching its first ‘outpost’ on Osmosis prior to launching its own Cosmos chain. Eventually, Mars will have its own chain where it will redirect liquidity and control governance across all of its outposts but for now, it will launch as an app first. This way, liquidity is not fragmented and can be redirected to where it is needed the most over the Mars Chain.

Outside of launching as an application, there are many ways that a chain can derive security in the Cosmos ecosystem in the near future:

- Interchain Security: Any team can launch as a ‘consumer chain’ secured by the Cosmos Hub or any other chain that implements ICS such as Osmosis or Evmos. Eventually becomes a ‘mesh security’ network in v3 of ICS.

- Celestia: shared security for optimistic rollups and various execution environments.

- Saga: shared security for gaming and metaverse chains.

- Osmosis: Interfluid Staking allows other Cosmos chains to derive security from LP pairs on Osmosis.

Composability

- Each Cosmos Zone is its own blockchain so it is not interoperable with other Zones by default

Each Cosmos Zone must set up individual IBC connections with the new chain it wants to be interoperable with and have corresponding channels for each IBC module.

- Interoperability is treated as a spectrum. For instance, BNB Chain is not interoperable with other Cosmos chains, yet Osmosis is very interoperable with other chains.

Interchain Accounts is an IBC module that brings the composability of the EVM to each of these sovereign Cosmos Zones with established IBC connections - contracts can be composable with other contracts on different blockchains (more on this later).

ICS-20 was the only other module supported which is for basic token transfers but Interchain accounts open up more composability to fully sovereign chains.

Finally, chains can choose to deploy their own smart contract outposts on other chains. The key difference between deploying as an outpost vs using interchain accounts is the UX of integration for contracts on the outpost chains.

- Interchain Accounts are for stateful things such as cross-chain LPing.

- Outposts can be used for ephemeral actions such as a DAO on Juno Network making a swap on Osmosis as easy as a native DEX on Juno like JunoSwap.

- Mars is currently doing this by deploying on Osmosis as an outpost as a set of smart contracts but will have its own chain to act as the central post to redirect liquidity where needed. Additionally, Stargaze plans on doing this as well where it will build outposts of their NFT marketplace on other sovereign chains.

- Of course, this may take away volume from these chains’ native DEXs given Osmosis’ advantage in liquidity. The UX for the end user and for the contracts on the outpost chains will remain the same as native DEXs.

Additionally, synchronous interaction and composability are still possible within a single Cosmos chain. Hence, every application launched within Osmosis will be composable with one another by default.

- Teams like Anoma are even building out proof-of-concepts for their own versions of flash loans asynchronously over IBC called “Cinderella Tokens”.

Longer to build than an app on Ethereum

- Spinning up a Cosmos Zone takes longer than launching a smart contract on Ethereum. There is a lot of overhead that is needed to build an entire consensus network which includes bootstrapping a validator set and a native PoS token.

Osmosis and CosmWasm Ecosystem of Apps

Now that we have stated the app-chain thesis and what UX Osmosis makes possible, where is the ecosystem of applications? To begin, Osmosis has taken a methodical and slow approach to enable new dApps to build on Osmosis by building out the core infrastructure needed. They recently went through a v12 upgrade which came with a Time Weighted Average Price (TWAP) which will be utilized to calculate the prices of assets in the liquidity pools. With this TWAP feature enabled, apps such as lending and margin trading can be done safely without the large risk of pricing manipulation by large actors. Another feature in v12 included Stargate queries for CosmWasm contracts to query data on other chains over IBC and finally they are enabling Interchain Accounts (it was previously implemented in an upgrade but never enabled).

The number of applications planning to launch on Osmosis is quite extensive, so we will just highlight Mars, one of the most anticipated ones. To see a full list of Osmosis applications and integrations, check out their official ecosystems page and there can be a follow-up report on the other DeFi apps launching on Osmosis as well.

Mars

Mars is a money markets protocol that was originally built on Terra prior to the collapse. Looking for a new home, its vision includes a Mars Hub, an independent Cosmos chain, that facilitates liquidity, governance and many other things across its many ‘outposts’ on any Cosmos chain that has enough liquidity. The design of Mars allows users to create a credit account called a ‘Rover’ which enables users to cross margin all of their activities from the same account across spot trading, margin trading, lending/borrowing and leveraged yield farming. There is a single liquidation threshold for a credit account and many subaccounts can be created segmented by different risk types or strategies (these are issued as NFTs). Given the credit accounts are issued as NFTs, Mars’ credit accounts unlock new primitives on top of it:

- Fractionalized NFTs to create asset management.

- Social profiles with on-chain PnL, net worth and credit scores.

- And other utilities added to it in the future.

The Mars integration on Osmosis gives more capital efficiency because the native DEX and Mars’ credit facility are highly integrated and creates this bundled DeFi experience. This custom integration (cannot be done on permissionless chains) enables new features for users by ‘white-listing’ specific contracts such that you have contract-to-contract lending. When a user borrows funds, those funds would be only available for pre-defined purposes such as a margin account. On the other hand, when borrowing on Aave on Ethereum, a user can do anything with that borrowed money so generalized parameters around LTV have to be accounted for whereas Osmosis and Mars are more tightly integrated to create fine-tuned parameters for margin and other features. Of course, this all comes back to the thesis for app-chains.

Mars will bring forth other interesting integrations such as ‘subaccounts’ similar to a CEX experience and cross-collateralization between contracts where users can have spot longs as collateral for another account to use for leverage.

Other Osmosis Apps

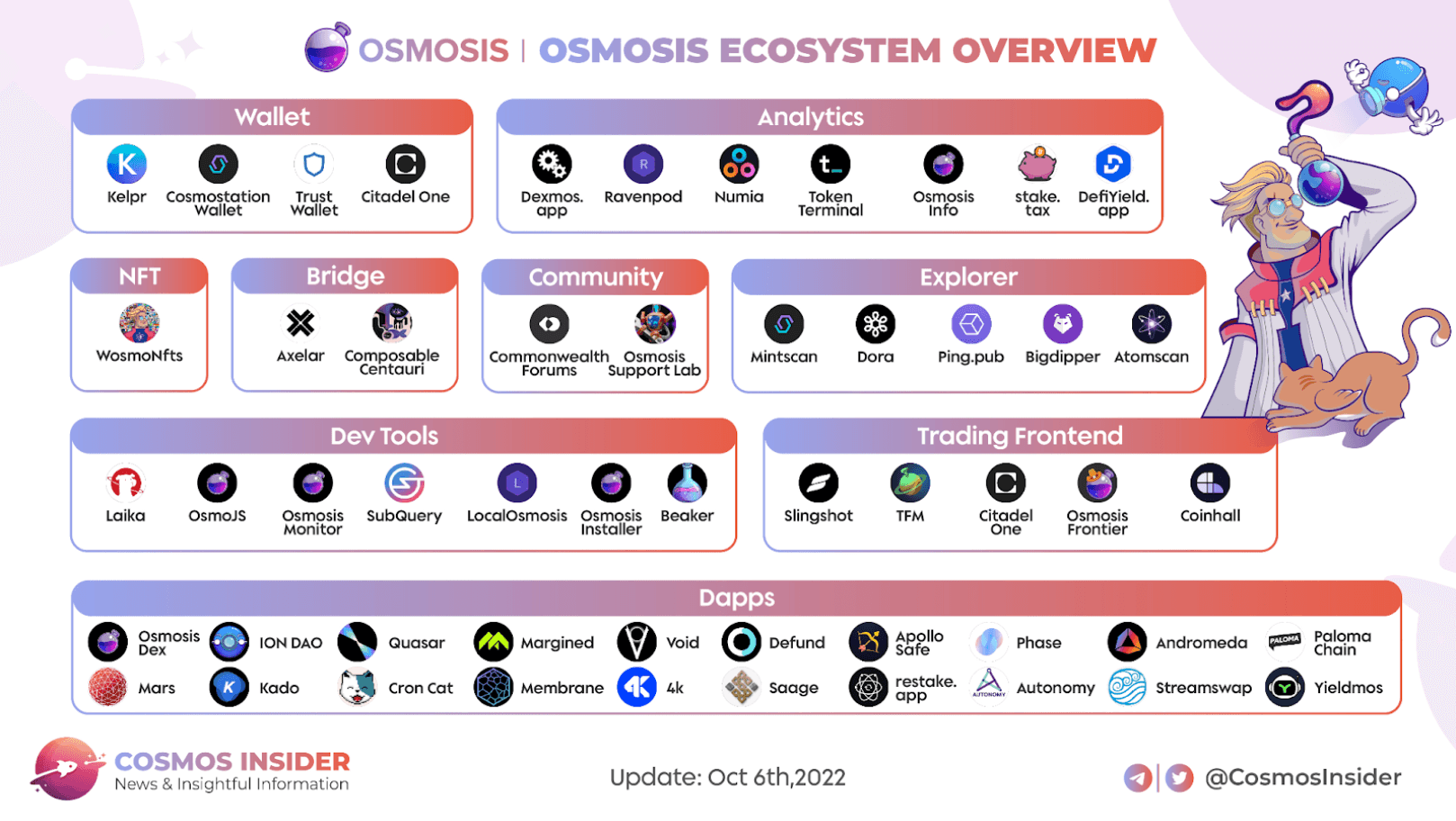

Again, the list of dApps is quite extensive for this report so we will list some of them under the DeFi categories they fall into. Below, is a nice visualization that gives an overview of the Osmosis ecosystem.

- Perpetuals/derivatives

- NFTs

- ETFs and Asset Managers

- Scheduling and Automation

- CDP and Stables

- And more listed in the above image!

Osmosis Tokenomics

Osmosis has the OSMO token that is used across many functions such as staking, governance and as a productive asset through LPs in traditional pools or even Superfluid Staking. Similar to Bitcoin, OSMO will undergo a thirdening each year until its inflation rate reaches zero as it approaches the capped supply of 1 billion OSMO tokens. Given its design, Osmosis front-loads a lot of the inflationary rewards to LPs and stakers to incentivize liquidity and a high bond ratio in the early years, while gradually phasing out the inflationary pressure on its tokenomics. To learn more about the distribution mechanics, read the official release here.

Osmosis Investors

Osmosis was airdropped to ATOM stakers and there was no presale for its initial launch. Briefly after launch, they had a round led by Paradigm which was a $21m token purchase around ~$1.60 per OSMO. The price of OSMO for these private sale investors was disclosed by one of the co-founders in a community call and the strategic reserve wallet for the private sale investors can be found here. Thus, one can track the investors in real-time but going off the $1.60 token price, investors are down at the time of writing with OSMO trading at ~$1.10. Thus, it is probable that the potential sell pressure is likely to come from the LPs who may be selling their rewards, rather than in-profit VCs.

Value Accrual

Of course, many may see OSMO as just another native governance and staking token but what about the value accrual to the (future) activity on the chain itself? Let's discuss below some of the potential mechanisms Osmosis can utilize to bring value back to OSMO stakers. Of course, this is a non-exhaustive list of value capture mechanisms for OSMO today and moving forward.

- Make OSMO More Productive (live)

- Superfluid Staking - earn more yield on OSMO paired tokens via the underlying OSMO in the LP token being staked.

- Cheaper Swaps - Swapping between OSMO paired pools allows traders to pay less fees.

- Transaction fee abstraction as a Service (coming soon)

- On Osmosis, users can pay gas fees in any token they’d like. These tokens will accrue to the community DAO and be sold back into OSMO and distributed according to governance.

- This type of transaction fee abstraction will be offered as a service for all other Cosmos chains to facilitate this superior UX, while still capturing value for the native governance token of each chain.

- Internalizing MEV (coming soon)

- Via Skip Protocol, Osmosis will capture many of the MEV activities occurring on the chain such as liquidation/arbitrage bots and it’ll also offer auctions later down the line.

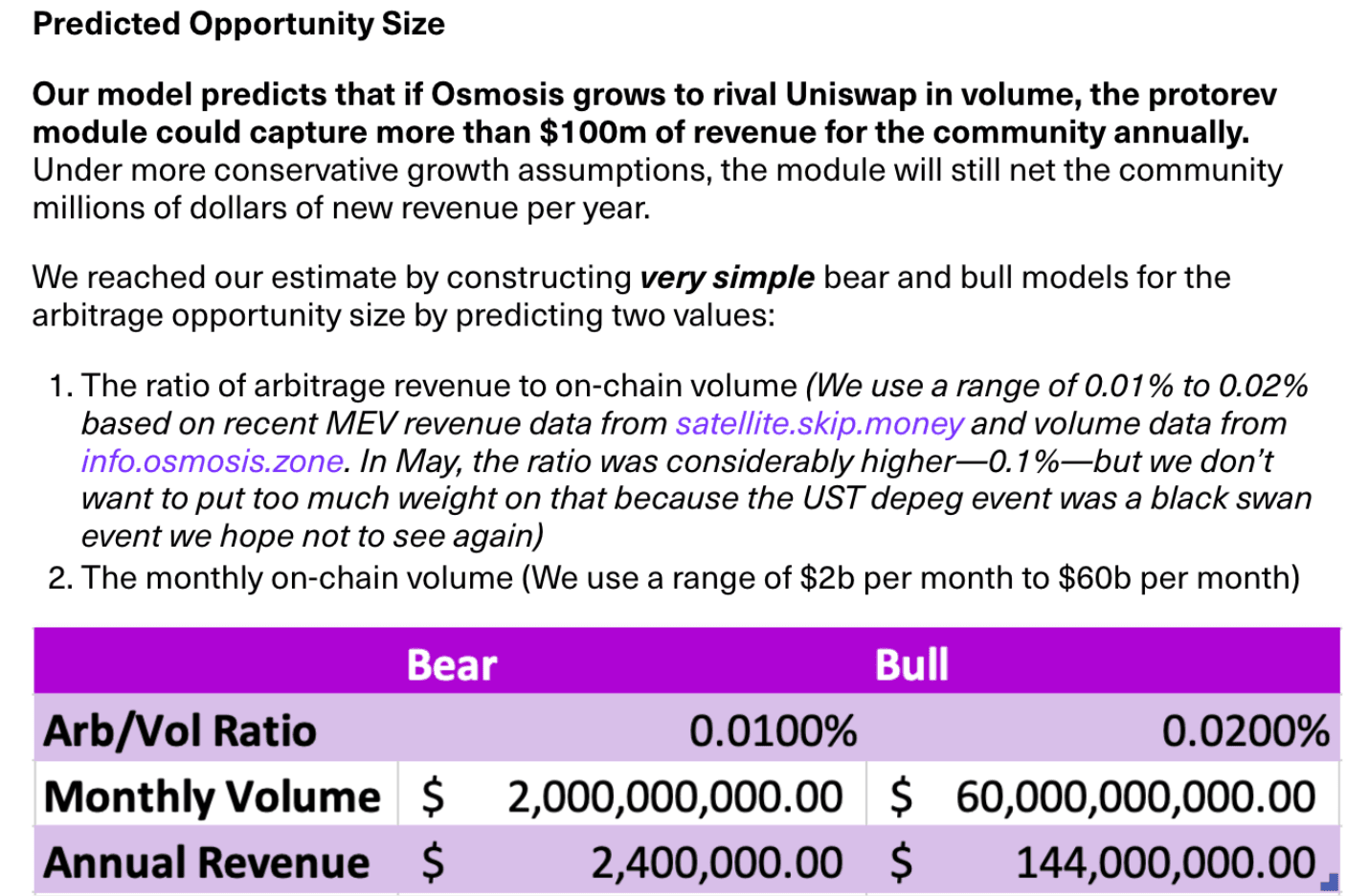

- A model by the Skip team in a recent proposal predicted their MEV capture module can generate up to $100m in fees for OSMO holders a year if it achieves similar volumes to that of Uniswap today (large assumption, but demonstrates the value that can be captured given significant traction).

Shared Security

- Interfluid Staking

- Similar to Superfluid staking, Interfluid staking allows other tokens in an OSMO pair to derive security from liquidity on Osmosis. This allows LPs to earn more yield (in both OSMO and the other paired token). This makes OSMO more attractive as a token to LP with on the DEX.

Mesh Security

- With Mesh Security (a bi-directional version of ICS v3), OSMO stakers can opt to cross-stake the economic value of their OSMO stake to secure other chains and receive more rewards - OSMO staking rewards and that of other consumer chains = more yield for OSMO stakers who are providing a mesh network of shared security for N number of Cosmos chains that are highly economically integrated. The design of mesh security is a bottom-up approach to shared security that will provide more emergent coordination between sovereign chains, rather than centralized coordination.

- Interfluid Staking

Airdrops

Historically, many chains have airdropped tokens to OSMO stakers given the engaged community and alignment of incentives across liquidity and open-sourced tooling.

With new CosmWasm apps launching on Osmosis, this trend will likely continue if these apps choose to launch governance tokens.

- Osmosis Outposts

Similar to how Aave can deploy its app across a number of layer 1s, Osmosis can deploy ‘Outposts’ of the Osmosis DEX to other Cosmos chains without fragmenting liquidity or UX across each new deployment.

Can bring more volume/trading fees to Osmosis at developers on other chains can integrate with the Osmosis DEX as opposed to spinning up their native DEX and fighting for liquidity. All of this can be done as a series of CosmWasm contracts that provide the developers with a better UX and communicate over IBC. Again, this creates a flywheel effect for the Osmosis DEX given its liquidity advantage.

- Cross-chain DEX

- Osmosis is the default DEX for Axelar and the many applications launching on it.

- Osmosis has a lot of lindy such that other IBC-based bridges like Composable Finance will use them as their default DEX.

- Given the bridge integrations to other non-Tendermint chains like DotSama and NEAR, Osmosis can be the cross-chain DEX for all assets, regardless of the ecosystem.

- Tokenomics Redesign

- Can implement an EIP-1559-like mechanism to counteract inflation. Although the tokenomics are similar to Bitcoin, Osmosis governance can ultimately vote to add, change or remove things.

- Inflation of the OSMO token gets decreased by a third every year. Currently, inflation sits around 43% which is quite high, but the issue of dilution will decrease each year until inflation approaches 0 in a few years time.

Relative Valuation Models

Osmosis is currently valued at a $500m market cap at the time of writing. However, is the market valuing it as just a DEX or as a full-fledged layer-1 Cosmos chain? Nobody knows nor will this report pretend to, so let's look at multiple ways of valuing it.

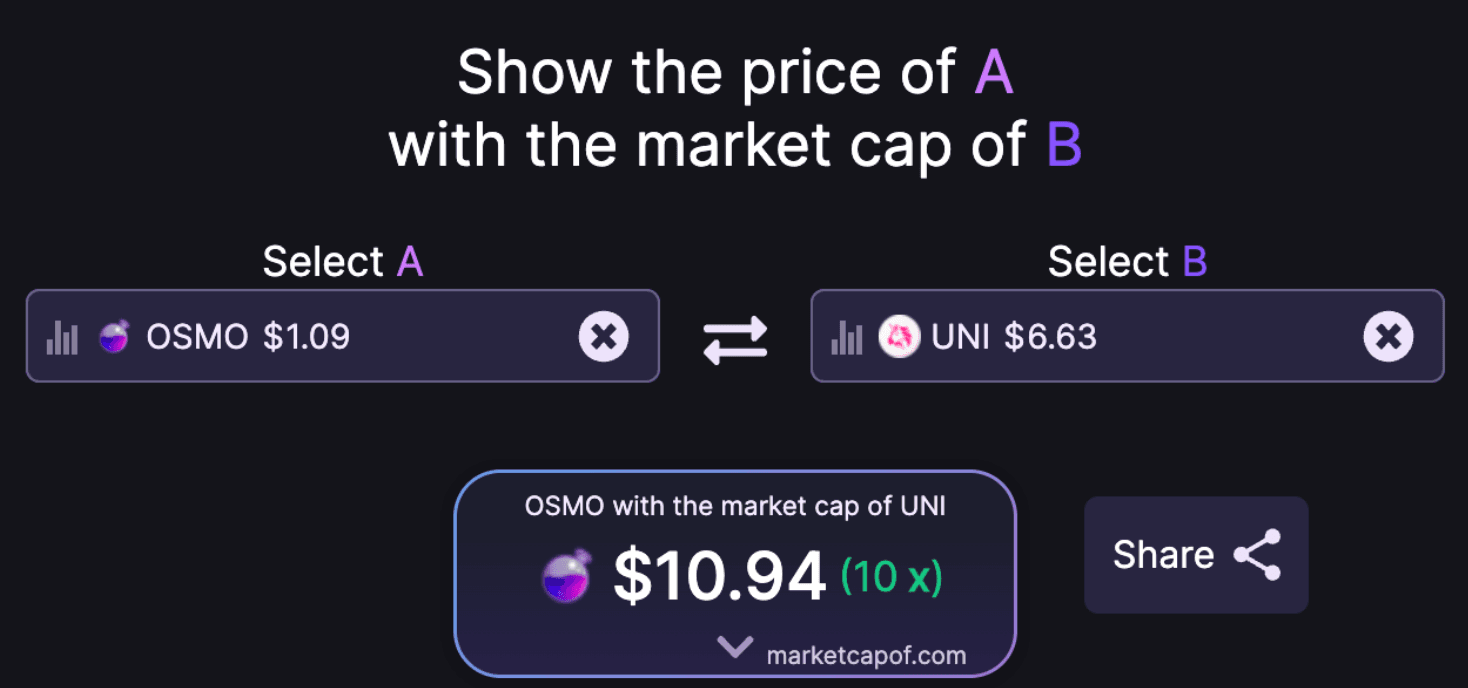

For Osmosis to reach the same market cap as Uniswap, it would be 10x from its current prices:

Of course, this is valuing Osmosis as a DEX, but as outlined by the report, it is a fully-fledged DeFi Hub. Given the internalized MEV and cross-chain integrations, Osmosis has the opportunity to settle billions in cross-chain volume and capture that value back to the stakers, traders and LPs. Uniswap is the gold standard for DEXs and they facilitate billions whereas Osmosis’ volume is negligible by today’s standards. However, this provides a relative framework for investors to assess the OSMO token in this landscape. Moving on from competitive DEXs, let's look at how OSMO stacks up against the Cosmos Hub (ATOM):

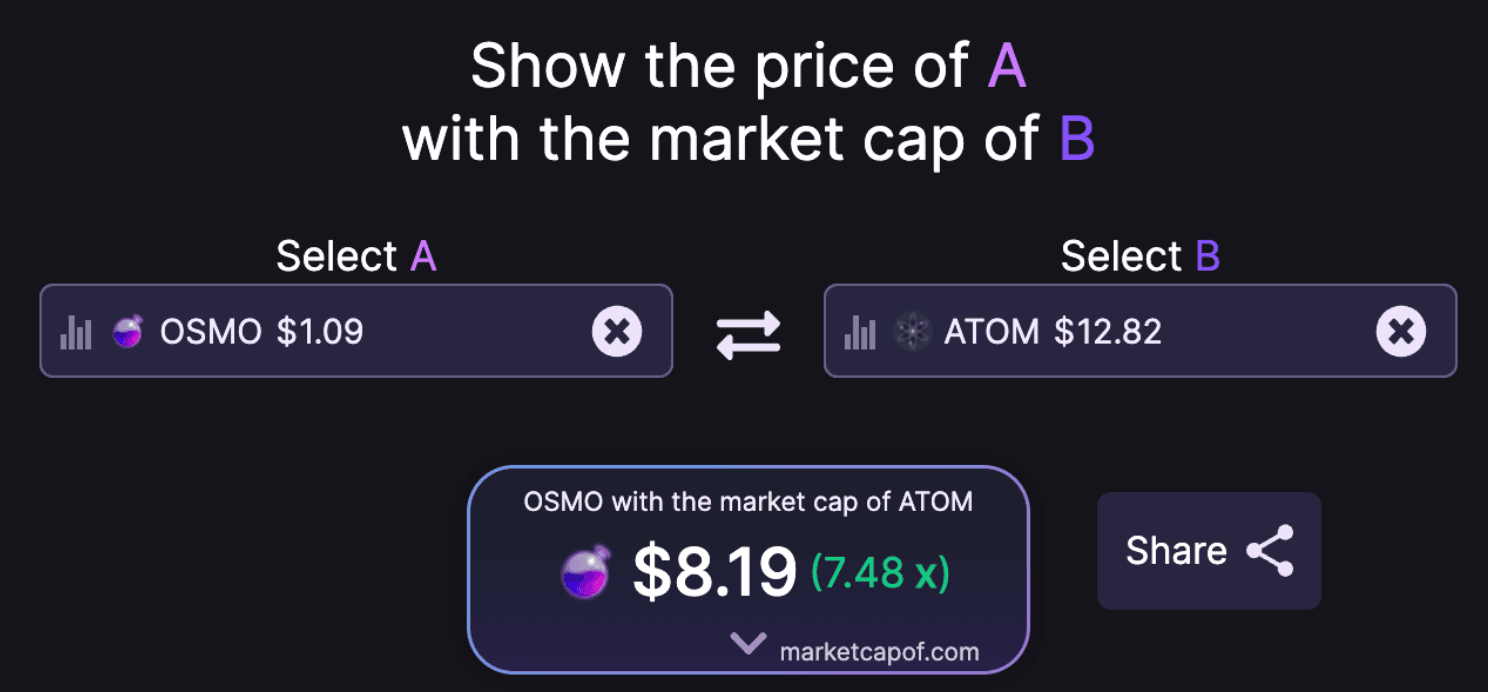

OSMO would have to 7.48x to reach the same market cap of the Cosmos Hub. As explained above, Osmosis sits at the center of the Cosmos ecosystem based on IBC data and DeFi activity. Thus, a relative valuation to the highest MC Cosmos chain such as the Cosmos Hub can be used to relatively value OSMO. This ignores BNB Chain and Polygon which are both built on a forked version of Tendermint and shows that investors may be valuing ATOM as a proxy bet on IBC. Moving forward, this may be subject to change as the current developments play out.

Note Terra Luna Classic is valued around 4x more than Osmosis and Cronos Chain (CRO) is 5.5x at the time of writing. Other chains such as Evmos have only $1.5m in TVL at the time of writing and the market cap is close to that of Osmosis. There seems to be a mispricing across Cosmos assets in the ecosystem relative to on-chain data and fundamentals. Of course, using a relative valuation is not a perfect metric on its own and should not be treated as financial advice - it is simply a mental framework to assess how to compare a DeFi app-chain, Osmosis, to other market participants.

Risks and Considerations

Time to shift focus to the risks and considerations of Osmosis. To begin, Osmosis is a relatively new chain and has suffered a previous exploit and has often had the chain halt due to consensus bugs (prefers safety over liveness). Previously, there was a $5m exploit on the DEX itself that allowed LPs to increase their LP shares by 50% by simply adding and removing liquidity. Around 40% of the funds were returned and the rest were permanently lost. Funds were returned to the affected LPs from the Osmosis developer fund and they have added more testing for their upgrades as a result of this costly bug. Moving forward, Osmosis is not immune to exploits nor chain halts and this is something to be mindful of as new CosmWasm apps launch on it in the coming months.

More competitors are emerging in the DeFi hub space, as well as DEXs and shared security. In the DEX space alone there is:

- Crescent Network

- JunoSwap

- THORChain

- Sifchain

- And more!

As for other DeFi Hubs:

- dYdX: Focused more on derivatives, can be seen as adjacent to Osmosis similar to how dYdX is currently complementary to Uniswap.

- Sei Network: Focused on providing a CEX trading experience, makes different tradeoffs than Osmosis, from the validator set to CLOBs vs AMMs.

- Crescent Network: hybrid orderbook and AMM model.

As for Osmosis’ interfluid staking vs other forms of shared security

- Interfluid staking only addresses Cosmos SDK tokens in LP pairs on Osmosis but it is complementary to the solutions mentioned already like Celestia, Saga, and others.

Can the team do the job?

App-chains have been gaining significant traction recently and the Cosmos thesis is complementary to that of Ethereum. In the future, they might be able to secure one another through the vision of Mesh Security - a shared economic alliance between various sovereign chains similar to that of NATO. There is already a working prototype that is being fleshed out by the Cosmonauts Band below:

There was recently a HackWasm hackathon and many developments in the space, particularly around CosmWasm apps. For Osmosis specifically, one can check out the Osmosis conference that showcased many of the teams building on Osmosis on days 1 and 2. Paying attention to IBC data as a metric for gaining adoption via MapofZones or Mintscan will also prove helpful in addition to the data and tooling Osmosis already has here for further developments.

The Osmosis team comprises of former Tendermint engineers, the team behind the Keplr Wallet, CosmWasm core developers, open sourced contributors and the many teams behind the apps launching on it. Additionally, students at UC Berkeley are contributing to some of the DEX features and the greater Cosmos ecosystem in general.

The team comes from a diverse background with many years of experience building in the Cosmos ecosystem. By choosing to create a vertical stack with the deepest integrations with the greater Cosmos ecosystem, many dedicated developers continue to build on and around the Osmosis chain. With some of the upcoming catalysts and equipped with their core team, Osmosis is in a good position to execute on their ultimate vision of becoming the DeFi Hub of the Interchain.

Glossary

| Term | Description |

|---|---|

| App-chain | An L1 blockchain focused on a specific vertical or industrial use-case. For instance, Osmosis is a DeFi-focused app-chain. |

| Zone | A Zone is an app-chain on Cosmos that has enabled IBC. |

| Hub | Refers to a Zone that gets sufficiently popular where it becomes integral in cross-chain interoperability - any Zone can become a Hub. Examples include the Cosmos Hub (ATOM). |

| Cosmos Hub | Refers to the L1 blockchain that is home to ATOM, and does not reflect the broader ecosystem. This is confusing naming and should not be misconstrued with the entire ecosystem. |

| Inter Blockchain Communication (IBC) | A generalized messaging protocol that allows for any Cosmos Zone to be interoperable with each other. IBC comprises many parts, such as the base layer, transport layer, authentication layer and interface layer. |

| Shared Security | Cosmos chains do NOT have shared security by default and must secure their own chains with a native staking token. There are many shared security solutions in development such as Interchain Security, Mesh Security, Celestia, Saga and Interfluid Staking. |

| Tendermint | A consensus engine and pBFT consensus algorithm. Any state machine (app-chain) can be built on top of it in any language. It combines the networking and consensus layers of a blockchain into a generic engine. |

| Cosmos SDK | A modular framework that makes it easy for developers to build customizable blockchains. Focuses on the application level by having an ecosystem of modules for developers to choose from. Developers can build their own modules or use existing modules to easily support applications |

| Application Blockchain Interface (ABCI) | An interface that allows the Tendermint BFT engine to connect to the applications on a given chain. It uses a socket protocol, which allows for a consensus engine (Tendermint) to communicate with the application. |

| Interchain Accounts | Is an IBC module that allows for contracts to be composable across different blockchains. |