In comparison to the macro markets, BTC and ETH have underperformed

It’s been 1 week since the FTX debacle, and the dust has yet to settle on this monumental event.

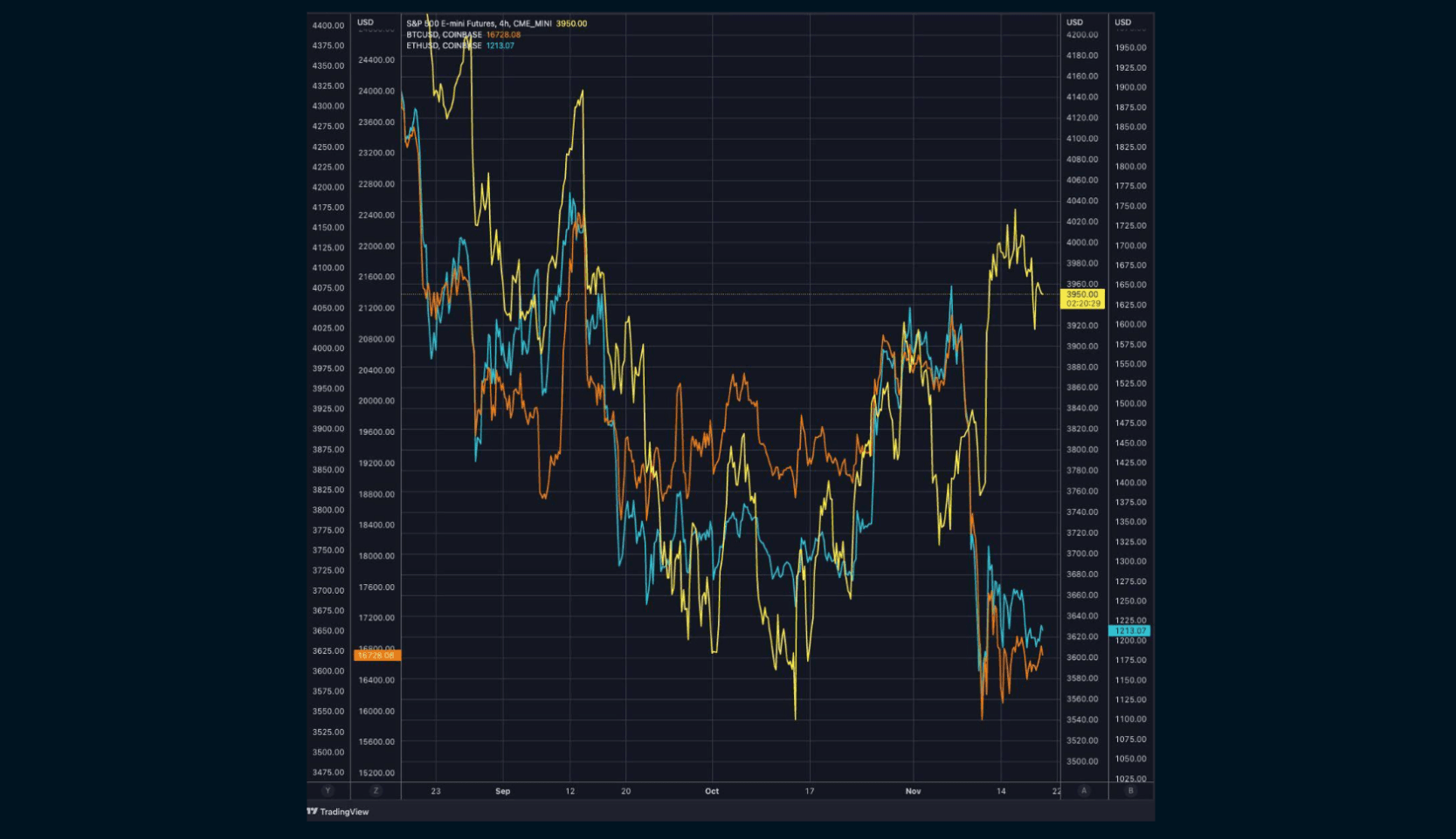

Understandably, crypto markets have diverged significantly from all other macro markets. Bellwether coins BTC and ETH have been unable to join in the huge post-CPI short squeeze staged by global risk assets (Chart 1 - Yellow line S&P 500, Orange line BTC, Blue line ETH).

Chart 1 - S&P 500 (Yellow) vs. BTC (Orange) vs. ETH (Blue)

This underperformance of all crypto assets is here to stay until the bulk of uncertainly has cleared up - likely only near the turn of the new year. Therefore, this changes completely our previous view of a Wave 4 year-end macro rally that will be led in crypto by ETH (Wave 4)

In contrast, our Wave 5 projection (Wave 5) could extend further now, down to 12k for BTC and even a retest of 800 for ETH. As a side-note, crypto markets have been trading akin to commodities ever since the 2017 top

- with extended Wave 5s as the longest wave. Hence such potential price action with new lows into the new year would be characteristic of previous bear market sell-offs.

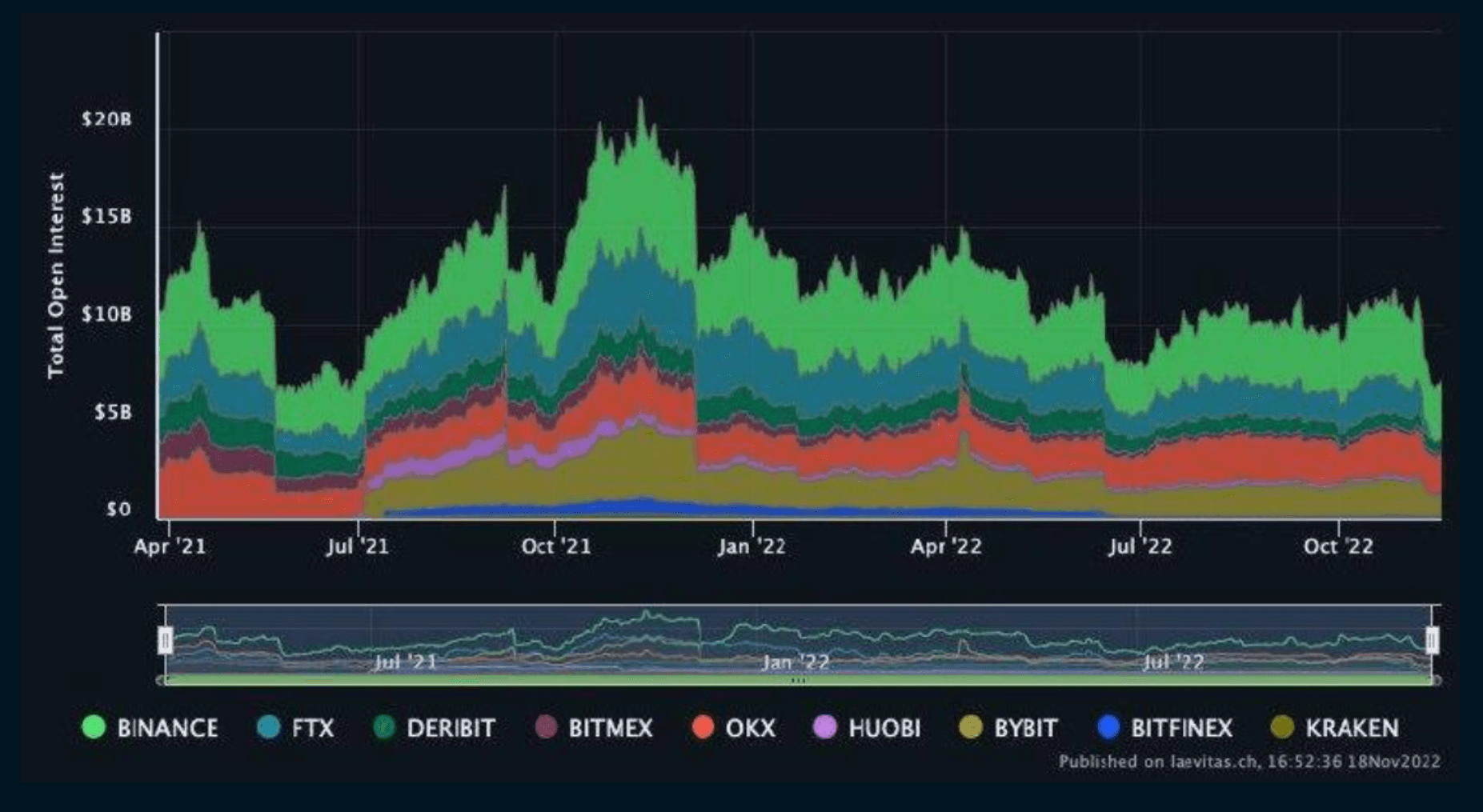

Derivative volumes on CEXes

So far, CEX derivative exchange volumes have been most affected. Combined futures OI is now back to pre-2021 levels, a massive backward step for the industry (Chart 2).

Chart 2 - CEX Derivatives Exchange Volumes

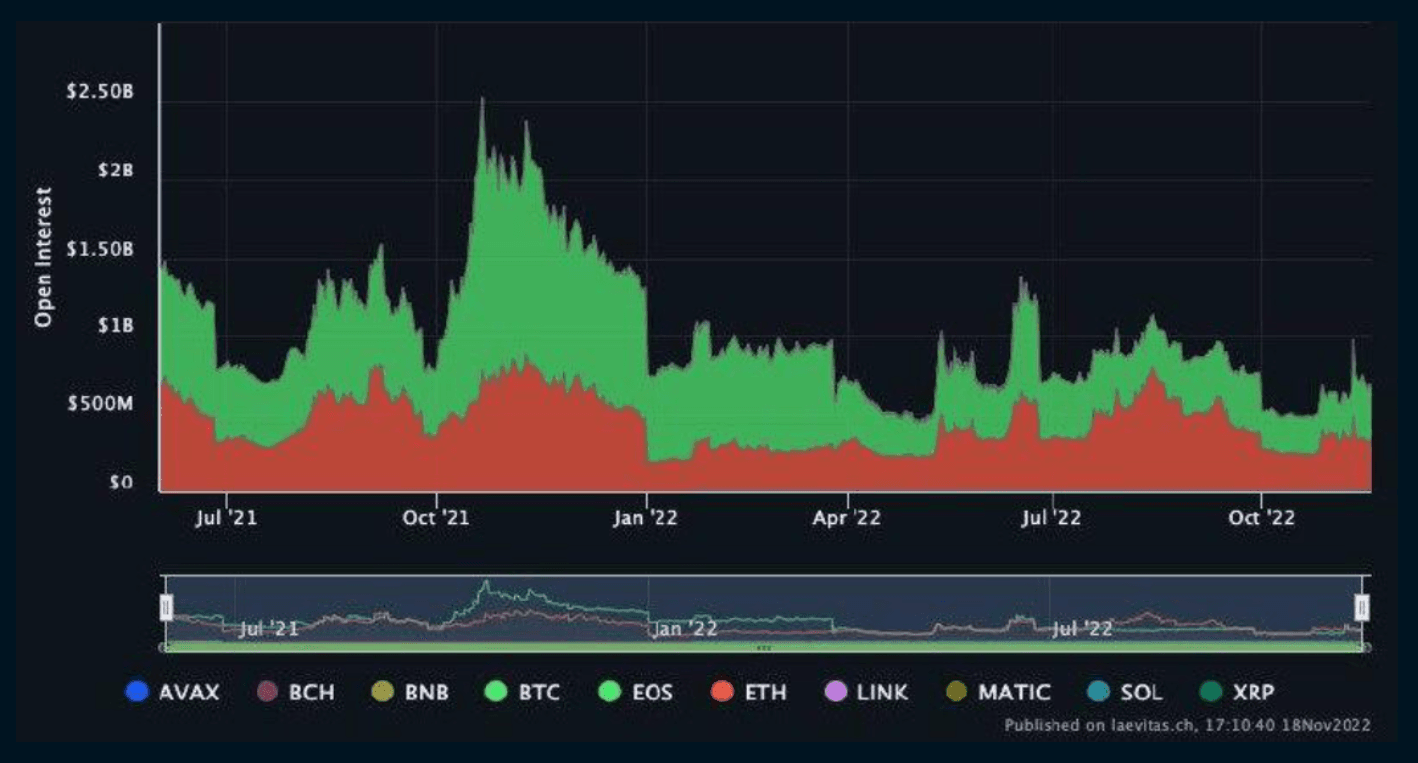

Options volume

Options have held up better - with OI remaining close to the year's average (Chart 3).

Chart 3 - Options OI

However this is only due to the large institutional element in options trading, and the bulk of it being OTC dealing with centralised clearing (on Deribit).

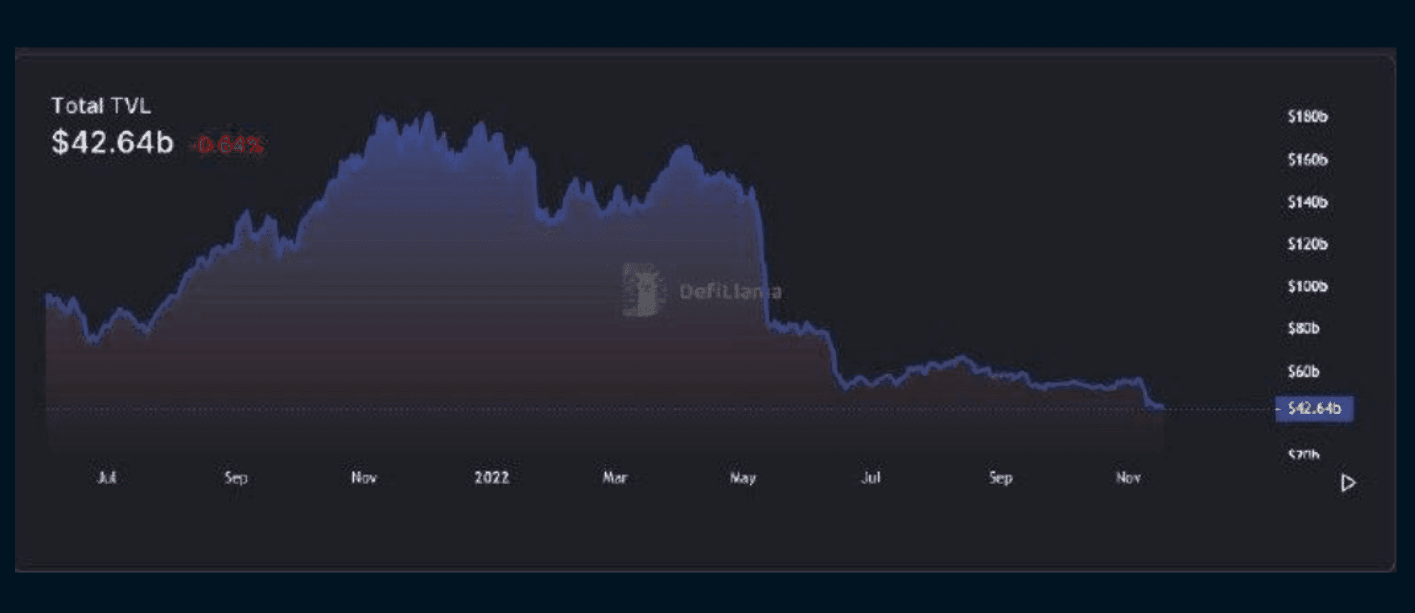

DeFi volumes are also decreasing

More worryingly, we have seen DeFi volumes shrink as well - which implies the entire crypto pie is being cut massively. Overall DeFi TVL is now less than 1/4 last year's peak (Chart 4)!

Chart 4 - Overall DeFi TVL

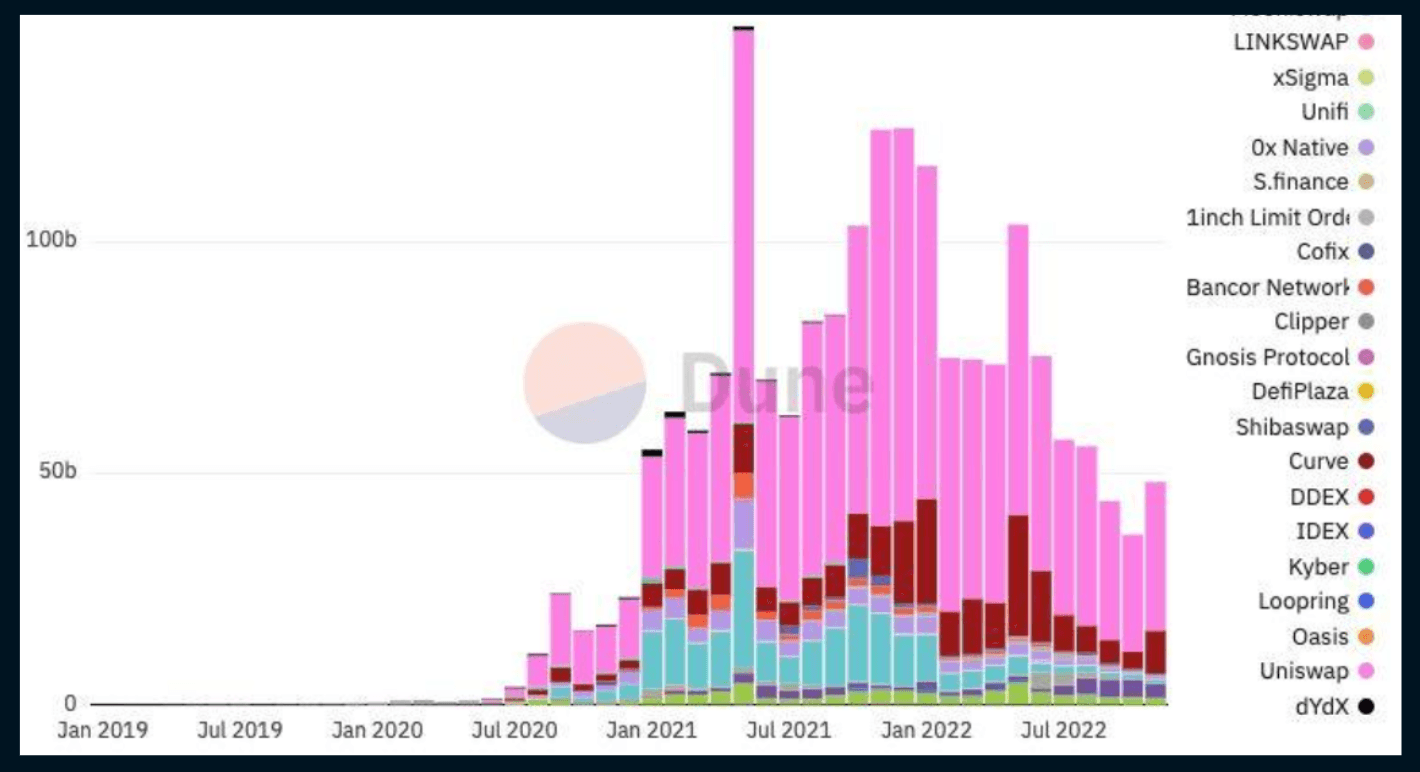

DEX Volumes

Even DEXes which would be expected to gain the most, have only seen volumes rise to Jul/Aug levels, even with all the emergency token/stables/chain swapping that needed to be done post-FTX (Chart 5).

Chart 5 - DEX Volumes

Will firms affected by Luna and FTX survive?

In last week's broadcast, we wrote that trust would be the biggest victim in this, and that firms who got hit by the double-whammy of Luna and FTX will find it hard to survive.

Genesis Global Capital

Yesterday, the latest victims to come out of FTX have been Genesis Global Capital, themselves the largest institutional crypto lender, and part of the DCG conglomerate - arguably the largest crypto-related group right now. Genesis said on a conference call they would be halting withdrawals due to liquidity issues.

Genesis Lending was by far the largest lender to 3AC, and had already required multiple bailouts from its parent company before they made the announcement yesterday. In biting the bullet on the Genesis Lending failure, DCG was likely learning the FTX/Alameda lesson, and preventing massive liquidity needs from one side of the business end up dragging the rest of the group down.

Genesis Lending's failure will have far-reaching implications within the space, especially in the institutional segment - a sector we had projected will drive crypto's growth amidst a long-drawn winter. Genesis has close business ties to Silvergate bank - the venue for the bulk of crypto's institutional banking needs; and was running the staking programs of Gemini and Circle - USDC, the former of which Gemini Earn itself has had withdrawals halted since.

DCG and Grayscale

Many are now expecting DCG to use the most liquid part of the business - Grayscale to shore up Genesis and other parts of the business. We had written of a potential sale of GBTC's BTC assets in our 2022 year outlook, although we never expected it to be under such circumstances.

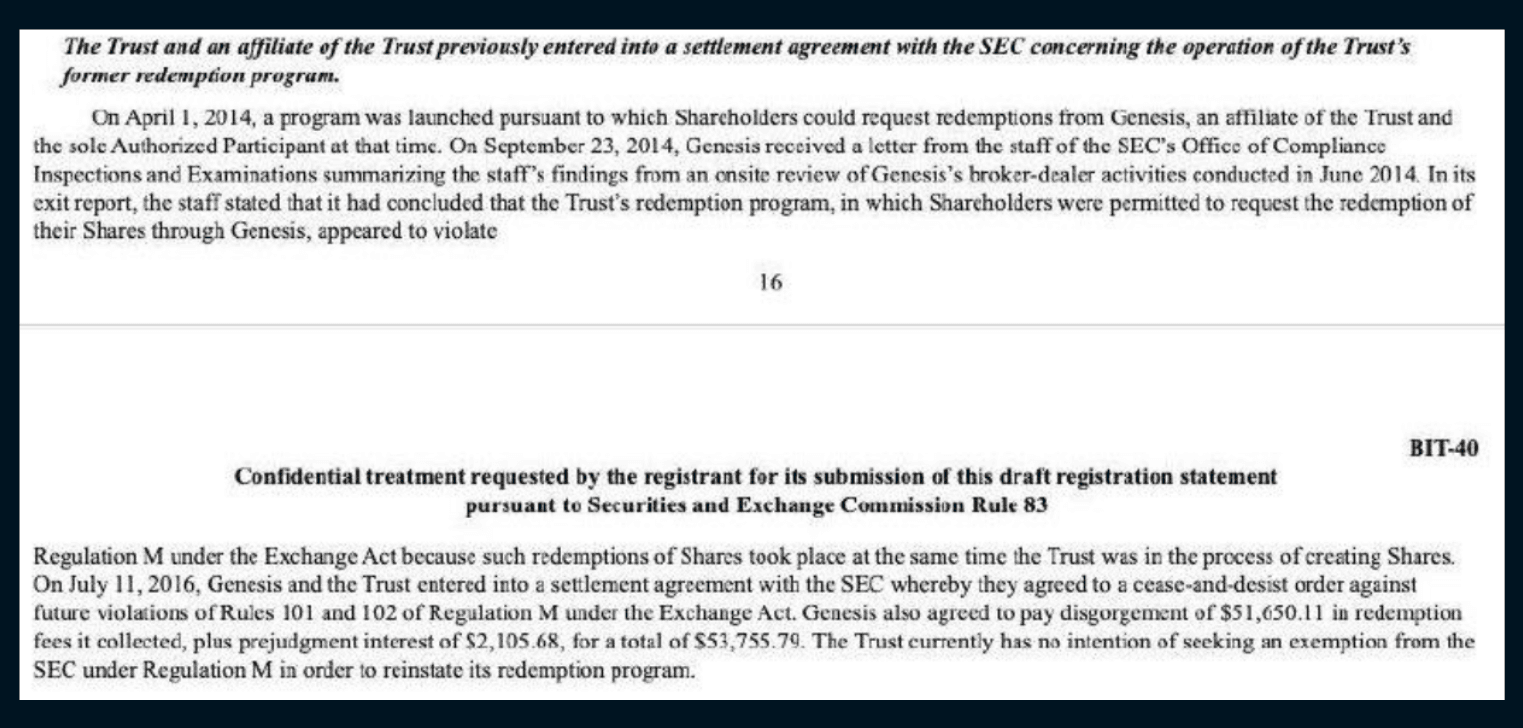

Nevertheless, in relation to GBTC, it bears pointing out what many in the market may be failing to see. The only reason for GBTC's huge push to convert to an ETF this year, thereby forgoing their 2% management fees worth well over half a yard USD a year(!) was due to their redemption program having been suspended by the SEC before, as per GBTC's tax filing (Chart 6).

Chart 6 - Suspended Redemption Program

In 2014 when they launched the Trust, GBTC had a concurrent redemption program as well. However the SEC found that this closed subscription plus redemption program was in effect benefiting shareholders at the expense of the public. The subsequent settlement in 2016 forced them to suspend this redemption program.

However this suspension of redemptions was still fine, as shares in the trust were trading at up to >100% premiums to NAV, which meant stakeholders could still subscribe and sell in the open market following a 1-year/6-month lockup.

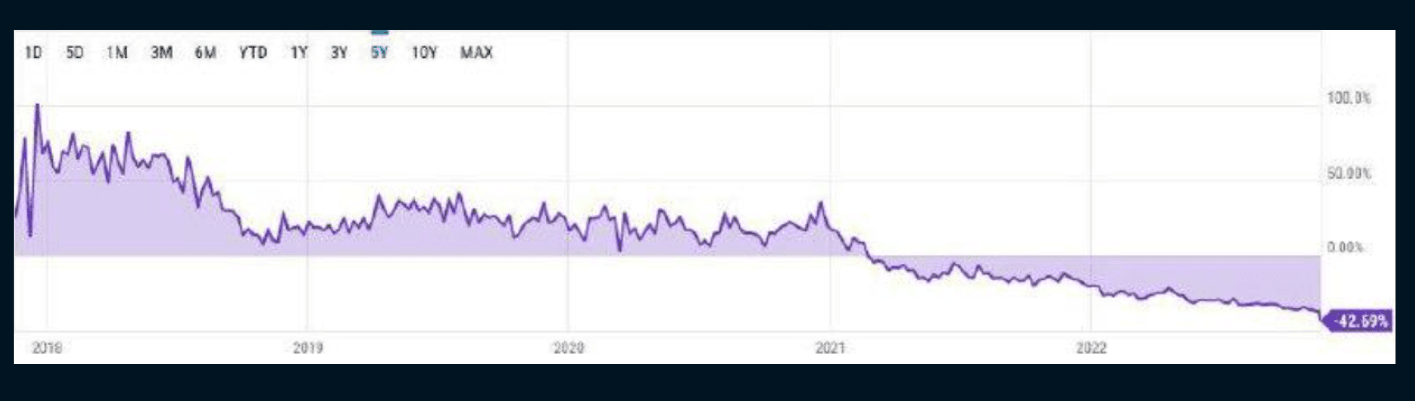

Equities on sale

However with shares now trading at more than 40% discount (Chart 7), this changes the equation and as such, over $4.5bn of value is being locked up in the trust like this.

Chart 7 - Equities Performance

Final thoughts

In any case, those expecting GBTC to allow a one-off redemption for Genesis to meet liquidity needs are misguided, as this has to be done with the SEC's approval. With all of the SEC's opposition to GBTC this year, we certainly don't expect this to happen anytime soon. On the bright side this also means a low chance of a large one-off BTC selling pressure from this.

However as we've been constantly writing before, with 650k BTC AUM, it is impossible for BTC to flip to a bull market again with GBTC in discount, and this discount is only getting larger. In the shorter-term though, Genesis' failure means it is even more unlikely we will see a meaningful rebound in BTC/ETH as investors wait on the sidelines for the dust to settle.

Disclaimer

QCP Capital is an exempt payment services provider pending licensing by the Monetary Authority of Singapore as an MPI for Digital Payment Token Services under the Payment Services Act (2019).

This information contained in this document is intended as a general introduction to QCP Capital and its activities as a Digital Payment Token (DPT) service provider and is for informational purposes only. QCP Capital is not acting and does not purport to act in any way as an advisor or in a fiduciary capacity vis-a-vis any counterparty. Therefore, it is strongly suggested that any prospective counterparty obtain independent advice in relation to any trading investment, financial, legal, tax, accounting or regulatory issues discussed herein. This document is only directed at informed and qualified investors. By reading this material attests that you are fully aware that trading of DPTs is not suitable for the general public and that you are an informed and qualified investor, and are also fully cognisant of all technological and financial risk(s) associated with trading Digital Payment Tokens.

Before you engage us or any of our services, you should be aware of the following:

Please note that this does not mean you will be able to recover all the money or DPTs you paid to your DPT service provider if your DPT Service Provider’s business fails.

You should be aware that the value of DPTs may fluctuate greatly. You should buy DPTs only if you are prepared to accept the risk of losing all of the money you put into such tokens. your DPT service provider if your DPT service provider’s business fails.

You should not transact in the DPT if you are not familiar with this DPT. This includes how the DPT is created, and how the DPT you intend to transact is transferred or held by your DPT service provider.

You should be aware that your DPT service provider, as part of its licence to provide DPT services, may offer services related to DPTs which are promoted as having a stable value, commonly known as “stablecoin”.