Yield Opportunities

Bitcoin has broken out of a prolonged consolidation range, lifting prices and market sentiment. This trend and new demand for leverage has resulted in onchain strategies that currently offer yields higher than the floating T-bill rate; investors should carefully assess risks and suitability before considering them. In addition to the strategies covering stables, we will also show some ETH strategies given it’s recent strength in price action and ETF flows. The report aims to surface a few farms to help users put their assets to work — specifically ETH and stables that can used productively for more optimal yields.

The farms are evaluated based on a few factors:

- TVL and volumes

- Protocol risk and complexity of strategies

- Popular EVM chains and Solana

Stablecoin Yields

Depending on the risk, there are stablecoins strategies for everyone. We will introduce the first few which are more straightforward and do not touch any leverage (via looping).

Ethena

Ethena’s yield is directly correlated with funding rates. As we continue to trend, the funding rates will increase for perps and USDe holders will be the beneficiaries of this arbitrage. SUSDE has boasted nearly ~10% APR over the last week and has over $5.6b in supply. Ethena’s yield is influenced by funding rates. It can be seen as a way to access higher yields in bullish conditions, though individual results and risks may vary.

Kamino Finance

Kamino was written about more extensively here but it also has promising yield opportunities as well. Across major stables including SyrupUSDC, USDC, USDG and USDS, vanilla supply APYs range from 6-10% APR. Additionally, they have their actively managed vaults which have different risk strategies. The most popular by TVL is the USDC Prime strategy by steakhouse with $25m in deposits and is yielding around 5.1% APR at the time of writing.

As for SOL, users can lend it out for ~4.7% APR on their main lending market with nearly $1b in deposits. On the other hand, their active vaults strategies are yielding up to 10% APR, with MEV Capital’s vault being the largest with $18m in deposits.

Pendle PTs

PTs are beginning to heat up again with double digit yields across different stables. Some notable PTs out there including Ethena USDE, Resolv’s wstUSR, Terminal’s tUSDe, OpenEden’s cUSDO, Maple Finance’s syrupUSDC and many others. These were simply prioritized by total liquidity and household names but there are even better APYs if one is comfortable with less liquidity and other conditions.

Pendle continues to be the yield hub and is the blue chip for YTs and PTs and can be a great source for passive yield (PT) over different maturity dates.

Resolv Labs

We wrote briefly on their TGE here but wanted to surface it again as its staking APR and leveraged delta-neutral RLP is yielding impressive numbers. As of July 17th:

- USR 7d APY: 12.4%

- RLP 7d APY: 24.7%

Can read more about USR here and the source of the yield on RLP here. 12-24% APR is very high depending on the risk one is looking to take. If one was looking for even more aggressive yields and risk, one can even loop RLP on Euler for even more multiples of yield.

Summer Finance

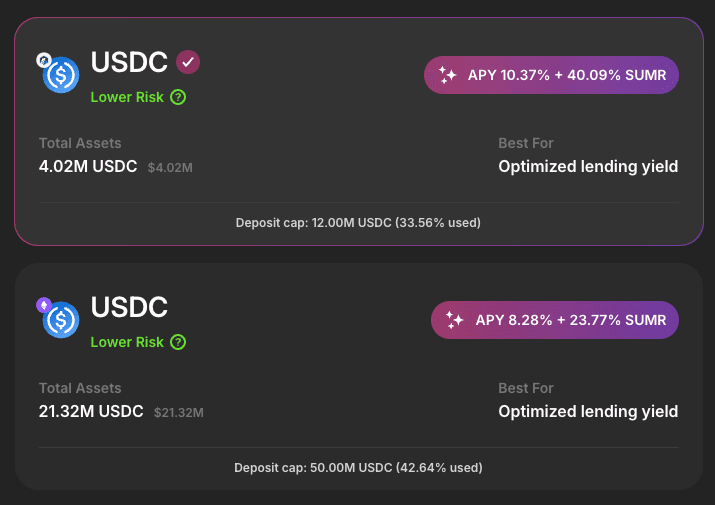

Summer Finance is a protocol focused on simplifying yield strategies into vaults managed by agents. We wrote it about them extensively here but they are currently running optimized lending vaults on stables and are offering additional speculative incentives on top of the base yield. As of July 17th, the USDC “low risk” vaults are interesting on Arbitrum and Ethereum mainnet:

Money Markets/Levered Looping

Infinifi

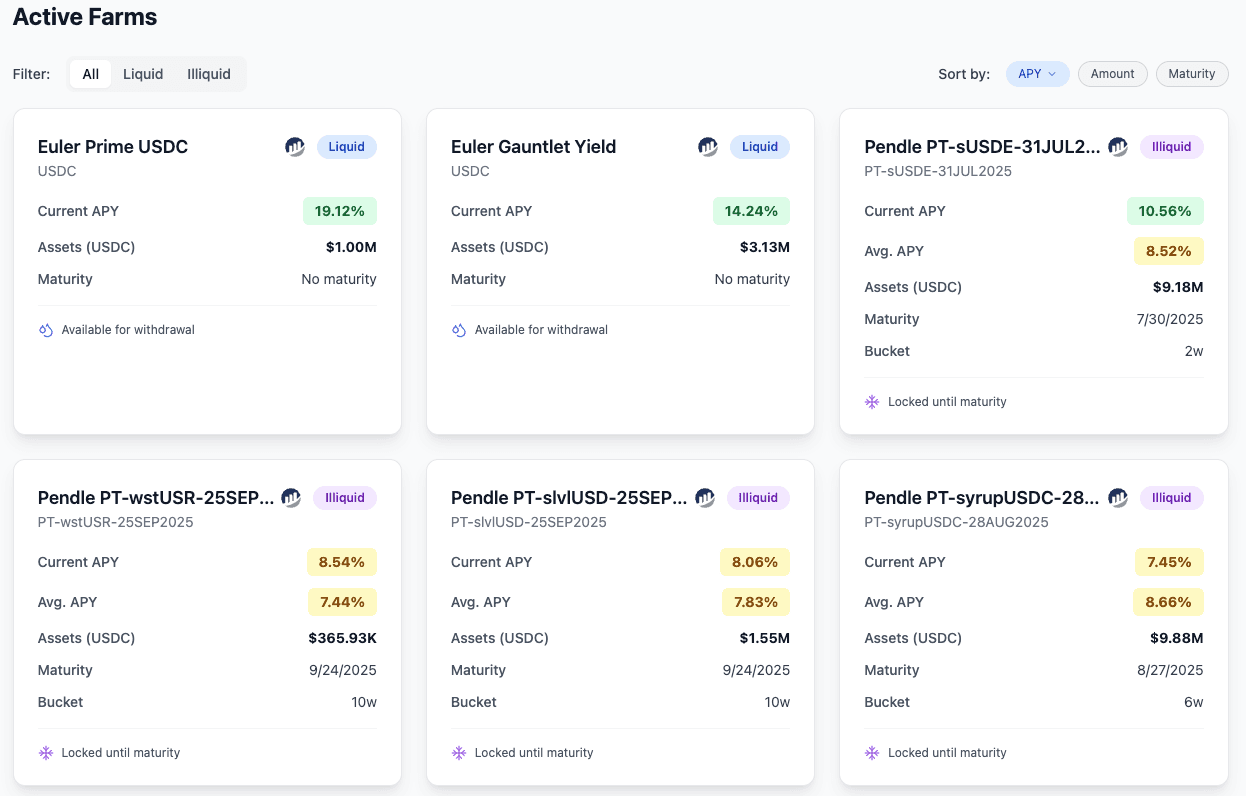

We have already covered infiniFi more in depth here, but the yield is also quite promising as well. Over the last week, it has posted 8.77% Net APY for its Senior Tranche. You can navigate active farms that are sorted by their liquidity, but this is a snapshot of some of the promising yields we are seeing:

Gauntlet

Gauntlet has quite a number of vault strategies that they curate. With over $1.2b in TVL across restaking, lending and trading strategies, they are becoming home to many competitive yield opportunities. Some of their trading strategies are yielding quite high double digit yields:

- hJLP 1x: 17.9% APR with over $23m TVL

- dYdX MegaVault: 15% APR with over $17m TVL

- hJLP 2x: 2x levered version yielding ~14% APR with over $10m TVL

There are many other strategies to browse through but these were among the higher reported APRs as of July 17th., though risk levels vary significantly.

Ether.fi

Ether.fi also has a USD vault that optimizes yields across Aave, Compound, Uni v3 and other protocols. It is currently yielding 8.2% APR with over $47m in TVL.

ETH Yields

ETH/BTC has been performing well alongside new ETF inflows and overall sentiment has improved in the recent months. Recent market conditions have led to increased interest in strategies that utilize ETH to earn yield. This half of the report outlines some of those strategies for informational purposes. The below strategies will be more passive ones and are not comprehensive.

Ether.fi

Through Liquid, Ether.fi offers automated vaults providing competitive yield for ETH. As of July 17th, their 2 vaults of interest are:

- Liquid Katana ETH: 18% APY with over $116m TVL. It earns KAT rewards during the 1st phase of the program.

- Liquid ETH Yield: 6.8% APY with over $763m in TVL. Strategies are mixed across lending, active LP management and Pendle markets.

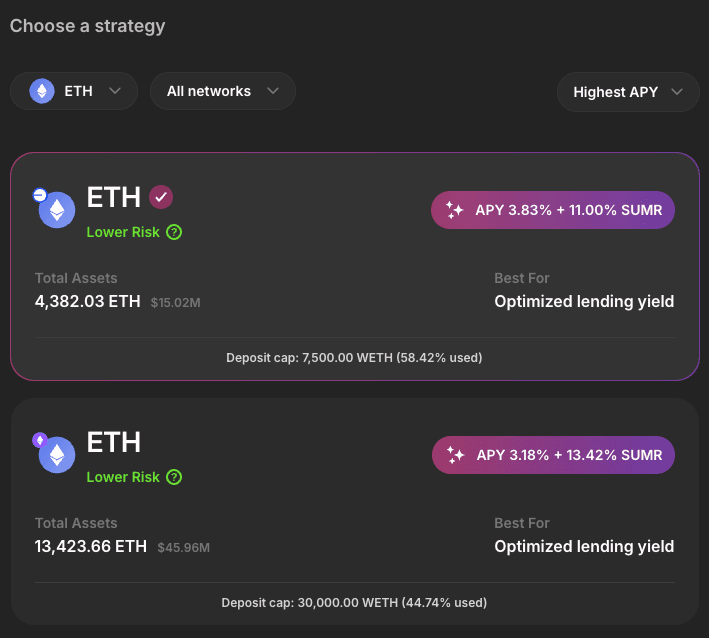

Summer Finance

Similar to the stable strategies mentioned earlier, Summer also offers optimized lending vaults for ETH as well. With a lower risk profile and between $15m and $46min deposits, these vaults provide a passive way of earning yields on ETH. Below are the ETH vaults in scope alongside their base APYs and SUMR incentives.

Euler Finance

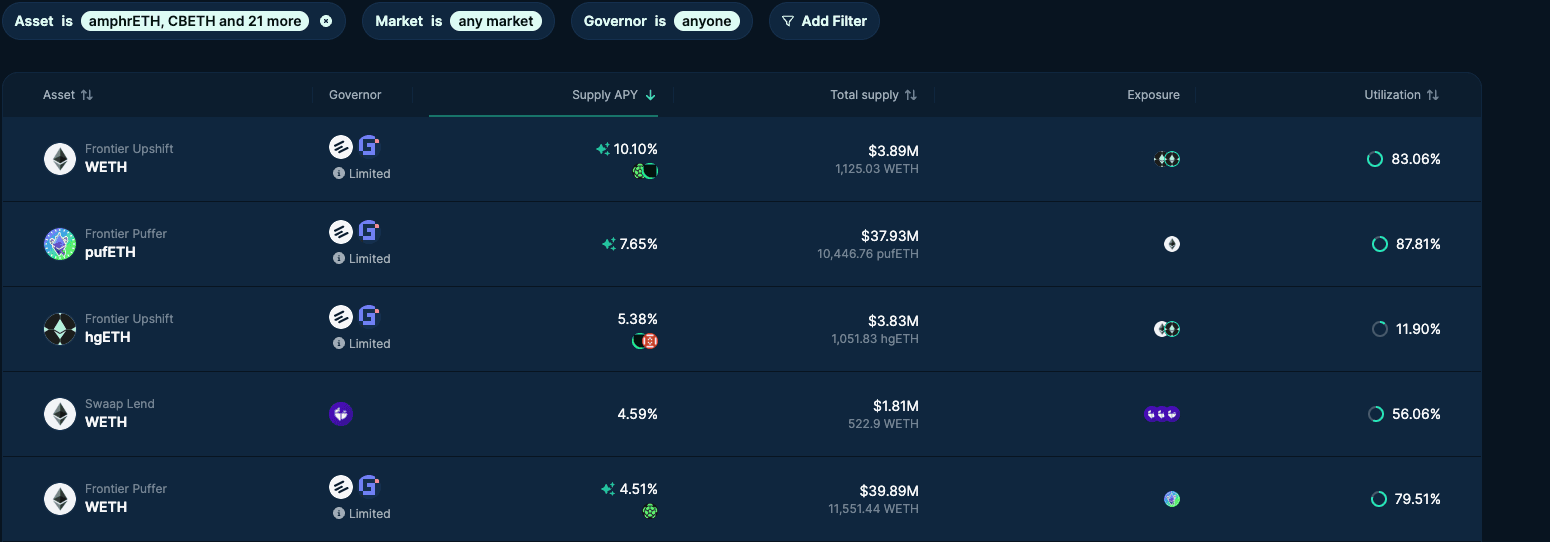

Euler has a few ways to earn on ETH. Through its vanilla lend strategies, you have some decent supply yields:

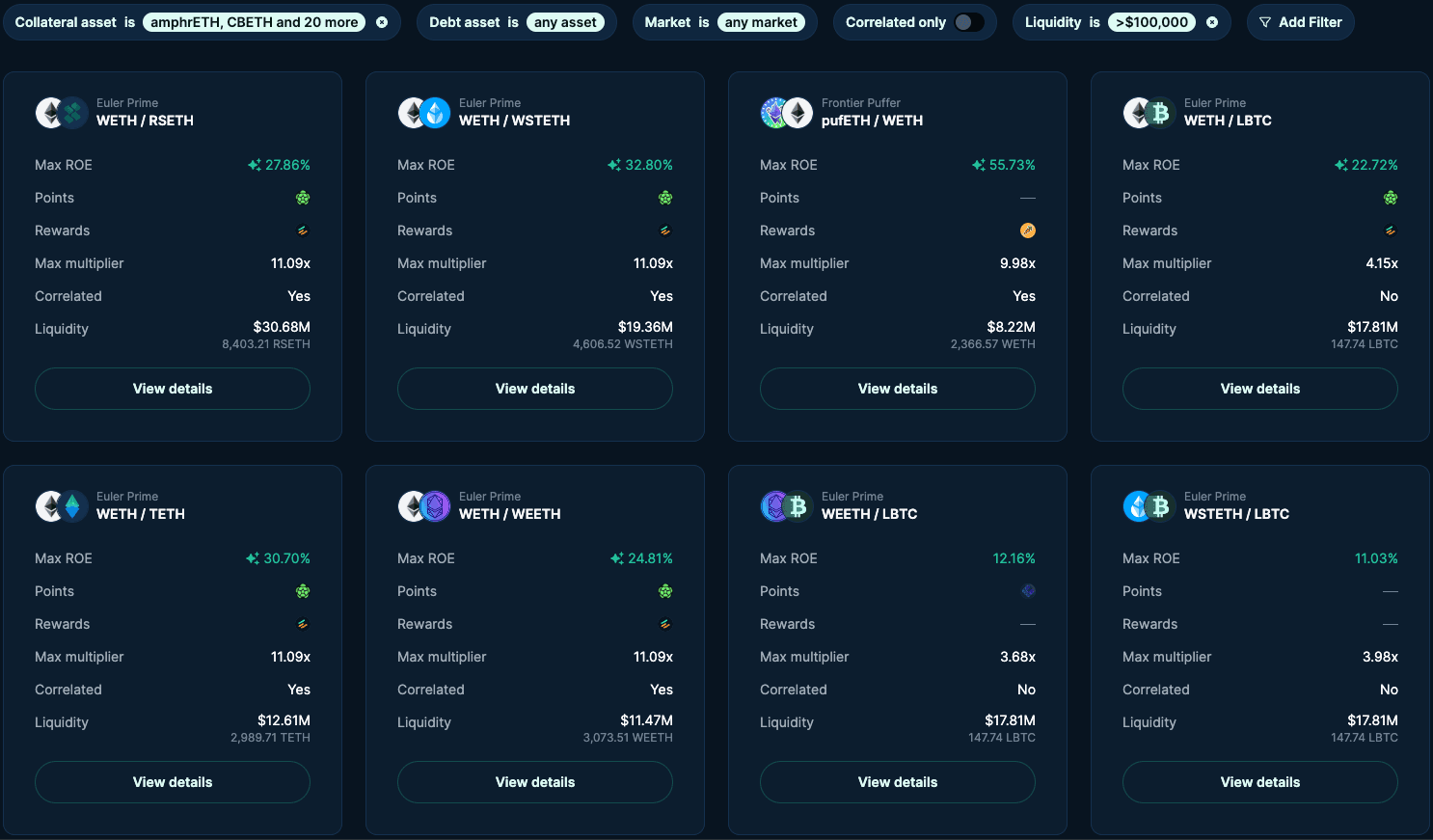

For those looking for more yield, Euler also offers a number of strategies to earn double digit plus yields on ETH across a number of restaking, points and other markets.

Conclusion

The further along we move into the bull market, we expect the yields onchain to continue to be competitive, with many double digit yields being available across a number of different risk profiles. The above is a non-exhaustive list of strategies available and there are varying underlying risks across all of the strategies mentioned but is a useful starting point for those looking to put their assets to work.