We are now into the 8th week of a confused, rangy market that has been caught in 2 minds.

This lack of direction has led to an absolute crushing of implied volatility across asset classes.

VIX in particular has broken to new YTD lows, and is testing the 2022 lows that preceded the massive year-end spike in vol. The heavily correlated BTC DVOL has crashed to fresh cycle lows as well, although we are still some way from this being equal to YTD lows. (Chart below)

While gamma has been severely underperforming, with realized vol dragging implied vol lower, the upcoming 2 months of events makes vol a buy for us at these levels.

Gamma is also a buy. 1w BTC & ETH at 50 vols make little sense to us considering FOMC today, NFP on Fri and CPI next Wed.

Furthermore, last night we got another timely reminder that the banking crisis is far from over - as we wrote about in our latest Just Crypto quarterly published last month.

The ongoing banking crisis, and debt ceiling are 2 major narratives that we forsee will come to a head in the next 2 months.

As a result of these narratives we have flipped our position to be net long BTC and ETH, as shown in our trades update page at the end of the quarterly deck.

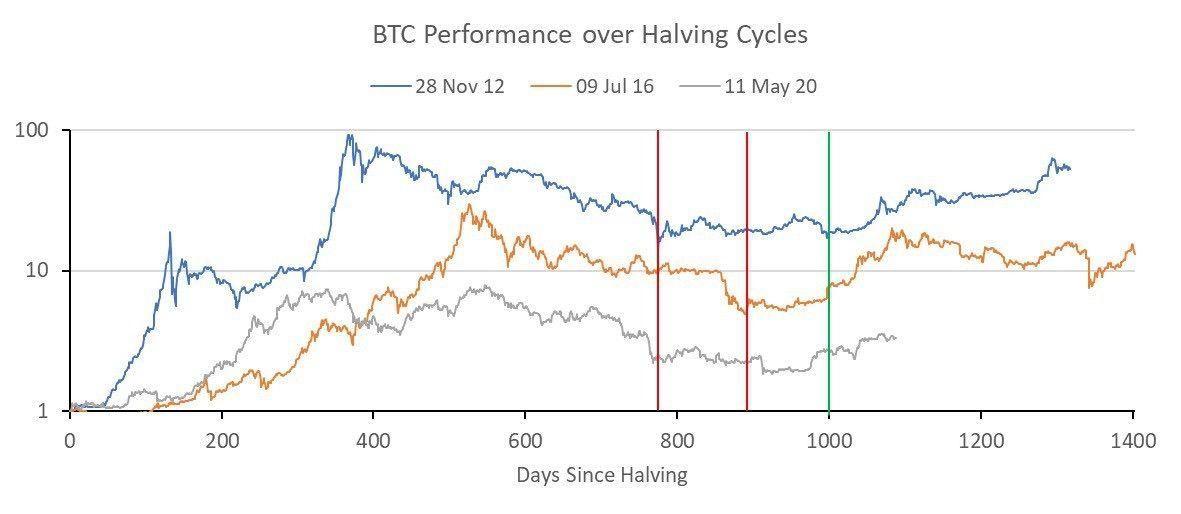

Also bullish for crypto are 2 charts which we published in our quarterly piece as well, and have updated here - the BTC halving cycle (Chart below), and the March 2020 analog (Chart below).

However, what is holding us back from breaking to new highs is the conflicting narrative of a hawkish Fed, continued strong employment and sticky inflation - which will be updated in the next week.

Also holding us back is positioning in the USD, which we believe is heavily skewed to the short side.

In the spot market, we are sitting at crucial pivots for BTC and ETH to resume their uptrends.

ETH had a false breakout from its triangle, failing at the old support turned resistance of 2150, which needs to clear for the uptrend to regain momentum. This week however we have a weekly TD 9 sell, with spot sitting right at the upper triangle trendline (Chart below).

BTC has to hold the very key 26,500 level, but we note the weekly RSI is already crossing below the trendline at 60, implying a fading of momentum. On the topside, the zone of heavy resistance between 30k and 32,500 remains the zone to clear for the uptrend to resume (Chart 5).

The biggest obstacle for crypto remains the USD - where we think the market is heavily positioned to the short side and vulnerable to a short squeeze, which could take BTC/ETH and Gold lower in response.

For the USD (DXY), the key level to the topside is 102.5, where we expect a break higher, to lead to a sharp correction lower in crypto. We note the positive divergence in RSI and MACD, and a potential double bottom at 101 (Chart below).

We expect that after these 3 key events over the next 7 days, the focus of the market will quickly switch solely to the debt ceiling fight, and we will give a more detailed update on this next week.