QCP Market Update

It has been a quiet week for big macro data releases in the past week, with the next major economic data release being ADP on 8th March next week.

More importantly, what we have been watching recently is Fed speak. Fed speakers continue to talk about higher for longer, and some are even alluding to the difficulty of achieving a soft landing.

We believe this month's FOMC (22 Mar) will set the stage for the rest of the year as market participants will be able to see where the Fed sees the terminal rate in 2023, and if the Fed sees cuts in 2024.

Dollar weakness earlier this week was due to Chinese manufacturing PMI numbers coming in at 52.6. With this, the China reopening narrative has reawakened, but we remain wary.

We expect DXY to head higher, and risk assets to come under pressure for over the longer term.

Firstly, yield curves have been shifting higher as markets continually price in a higher terminal for longer.

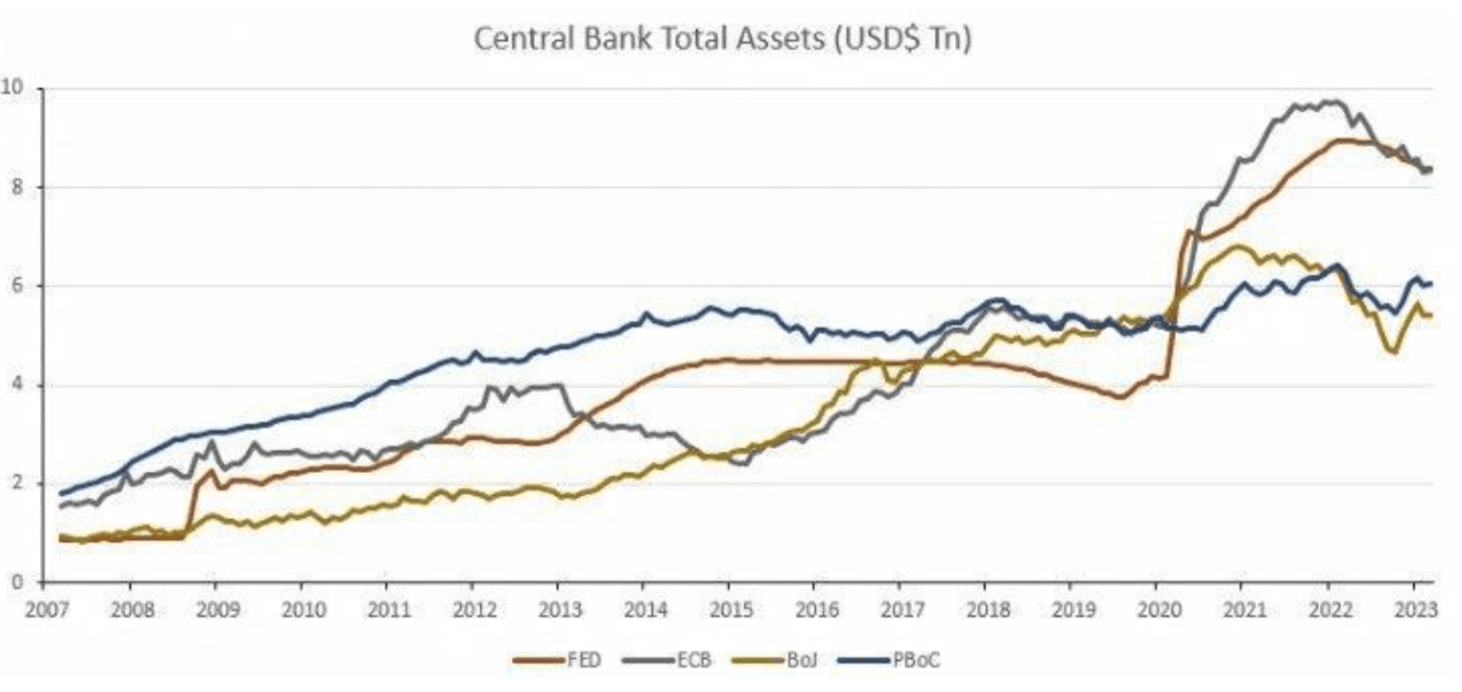

Secondly, global liquidity is tightening again as the PBoC and BoJ reduce liquidity injections, and will continue to decrease as central banks continue their fight against inflation.

Thirdly, the S&P 500 forward P/E ratio has been creeping up despite real yields moving higher. A violent correction is on the books if these two measures continue to diverge.

Despite the doom and gloom, crypto continues to hold up extremely well with BTC staying above 23k despite the S&P 500 breaking below the key 4000 level last week and now looking to test the 3900 level.

However, if equities continue to fall, and the DXY and yields continue to move higher, crypto prices might struggle to sustain these levels.

In the options space, we saw massive unwinding of long option trades (particularly calls) as bulls lose faith on a topside break. We've also been seeing strong interest in option-based yield products as yield seekers are no longer finding viable strategies in the lending/borrowing market. This has been putting pressure on vols.

The vol curve is also notably flatter than we've seen in previous sell-offs, suggesting that the market expects a sideways trading environment in the medium term.

At these vol levels, we are positioning long vega in anticipation of some volatility as we head towards FOMC at the end of the month.

Disclaimer

"QCP Capital is an exempt payment services provider pending licensing by the Monetary Authority of Singapore as an MPI for Digital Payment Token Services under the Payment Services Act (2019).

This information contained in this document is intended as a general introduction to QCP Capital and its activities as a Digital Payment Token (DPT) service provider and is for informational purposes only. QCP Capital is not acting and does not purport to act in any way as an advisor or in a fiduciary capacity vis-a-vis any counterparty. Therefore, it is strongly suggested that any prospective counterparty obtain independent advice in relation to any trading investment, financial, legal, tax, accounting or regulatory issues discussed herein. This document is only directed at informed and qualified investors. By reading this material attests that you are fully aware that trading of DPTs is not suitable for the general public and that you are an informed and qualified investor, and are also fully cognisant of all technological and financial risk(s) associated with trading Digital Payment Tokens.

Before you engage us or any of our services, you should be aware of the following:

QCP Capital is an exempt payment services provider pending licensing by the Monetary Authority of Singapore as an MPI for Digital Payment Token Services under the Payment Services Act (2019). Please note that this does not mean you will be able to recover all the money or DPTs you paid to your DPT service provider if your DPT Service Provider’s business fails.

You should be aware that the value of DPTs may fluctuate greatly. You should buy DPTs only if you are prepared to accept the risk of losing all of the money you put into such tokens.

You should not transact in the DPT if you are not familiar with this DPT. This includes how the DPT is created, and how the DPT you intend to transact is transferred or held by your DPT service provider.

You should be aware that your DPT service provider, as part of its licence to provide DPT services, may offer services related to DPTs which are promoted as having a stable value, commonly known as “stablecoin”.