And… Volatility is back!

We’ve been writing since the start of the month, and weekly that buying 3m and 6m vol and 1m gamma might pay off this month.

This week the move we were looking for happened - a 5 SD 2-day move in relation to the past 180 and 120 days.

However the trigger for this move was not something we expected at all.

In fact, last week the FOMC was much more hawkish than expected, and globally, central banks are withdrawing liquidity at a faster rate than anyone had expected.

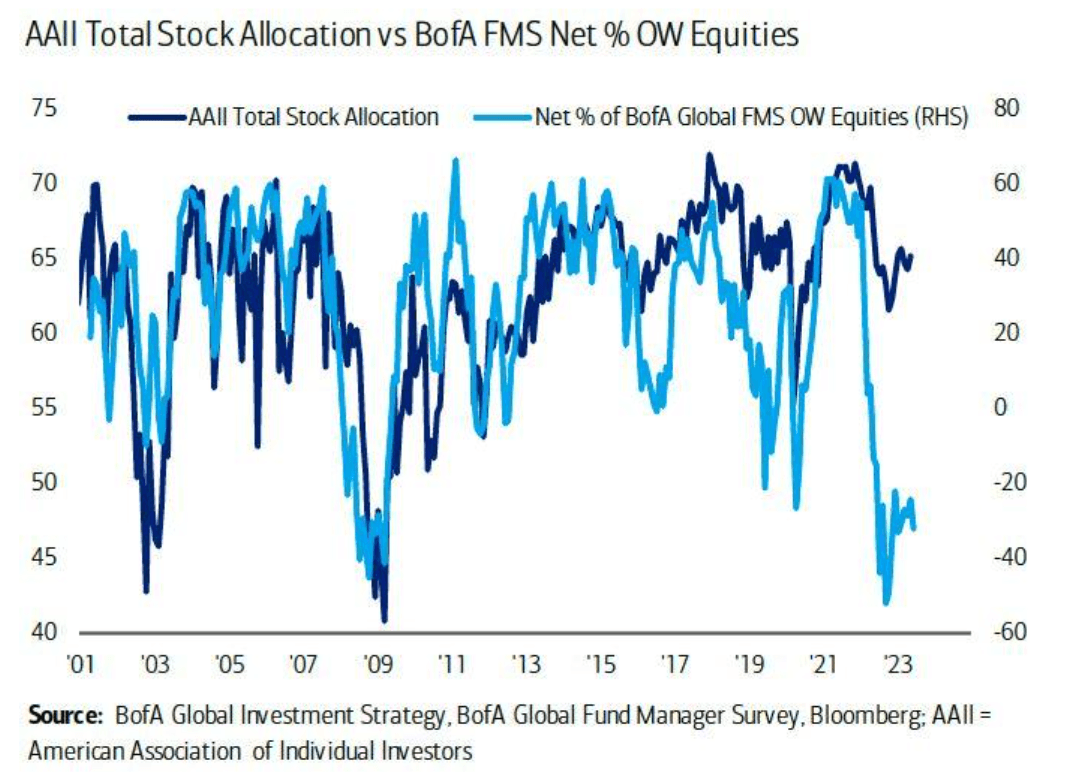

However none of that matters for the time being, as investment FOMO looms large in the market, and investment managers deploy their historically high levels of sideline cash (in money market funds and other deposit like instruments) to chase a risk asset rally they have missed for the most part (Chart 1).

While this market is difficult to explain logically, we have been trading along what we call our ‘Q2 trading blueprint’ - the March 2020/March 2023 analog that we first shared in our Q1 2023 quarterly Zombieland! The Sequel (Chart 2).

To recap, we wrote that this analog will work because ‘there are many parallels between today's price action and 2020 for bitcoin.’

‘In March 2020 we were on the verge of a massive price breakdown below 5k when the Fed unleashed the liquidity tap, resulting in an exponential price increase as we approached the halving cycle the following year.’

‘Similarly in March 2023, we were about to break below 20k on BTC as a result of the banking crisis risk-off, when the Fed again unleashed the liquidity tap to drive us back above 30k, as we head into the next halving cycle next year.’

However this month, we wrote that our reason for going long 1m gamma is that while ‘this consolidation has played out perfectly so far, we expect that we are soon coming close to the end sometime this month.’

The trigger for this week's move was certainly something unexpected - as the market latched onto Blackrock's spot ETF application as a sign the SEC was ready to approve a Bitcoin spot ETF.

We note Blackrock's success rate when it comes to ETF applications with the SEC - 575 approved vs. 1 rejected.

Since then there has been a flurry of Bitcoin spot ETF reapplications, which further increased the market's confidence that a BTC spot ETF is on the way.

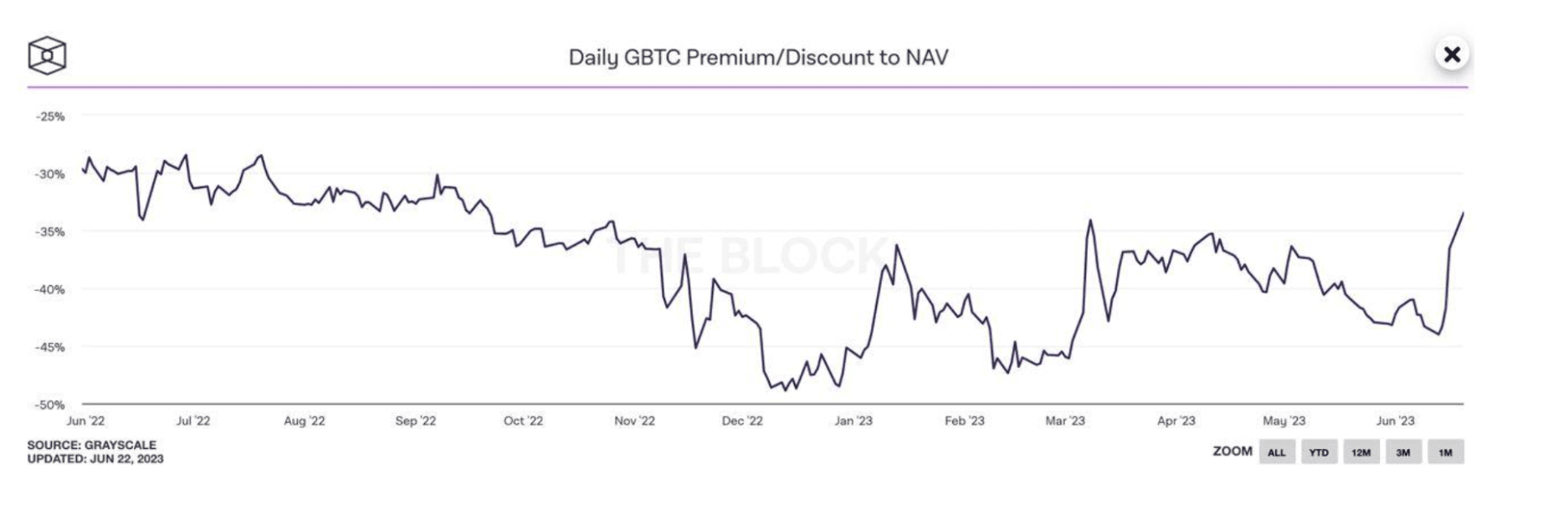

Even GBTC managed to stage its sharpest absolute price-to-NAV move since the peak of the crypto bull market in Dec 2020 on the back of excitement in the sector, and rumours of Fidelity's interest. (Chart 3)

However with Gensler as head of the SEC, we are not confident of the actual ETF approval happening in the near-term.

Nevertheless as we've continually maintained, there is a huge place for institutional BTC and ETH in the asset management world, and over the next months and years we will see further steps in that direction.

In the near-term though, this break has brought us back into the dreaded 30-35k resistance zone again (Chart 4), and we are hedging our gamma in this area here. Medium-term this is a very bullish move, and we think miners are quite short gamma, especially above this resistance zone which will exacerbate the topside move on a break.

Into next week's quarter-end expiry we expect some very tradable gamma action in this area. We believe it has become a great time to own vol again.

Disclaimer:

QCP Capital is an exempt payment services provider pending licensing by the Monetary Authority of Singapore as an MPI for Digital Payment Token Services under the Payment Services Act (2019).

This information contained in this document is intended as a general introduction to QCP Capital and its activities as a Digital Payment Token (DPT) service provider and is for informational purposes only. QCP Capital is not acting and does not purport to act in any way as an advisor or in a fiduciary capacity vis-a-vis any counterparty. Therefore, it is strongly suggested that any prospective counterparty obtain independent advice in relation to any trading investment, financial, legal, tax, accounting or regulatory issues discussed herein. This document is only directed at informed and qualified investors. By reading this material attests that you are fully aware that trading of DPTs is not suitable for the general public and that you are an informed and qualified investor, and are also fully cognisant of all technological and financial risk(s) associated with trading Digital Payment Tokens.

Before you engage us or any of our services, you should be aware of the following:

QCP Capital is an exempt payment services provider pending licensing by the Monetary Authority of Singapore as an MPI for Digital Payment Token Services under the Payment Services Act (2019). Please note that this does not mean you will be able to recover all the money or DPTs you paid to your DPT service provider if your DPT Service Provider’s business fails.

You should be aware that the value of DPTs may fluctuate greatly. You should buy DPTs only if you are prepared to accept the risk of losing all of the money you put into such tokens.

You should not transact in the DPT if you are not familiar with this DPT. This includes how the DPT is created, and how the DPT you intend to transact is transferred or held by your DPT service provider.

You should be aware that your DPT service provider, as part of its licence to provide DPT services, may offer services related to DPTs which are promoted as having a stable value, commonly known as “stablecoin”.