QCP Market Update

Here is a quick review of last week and preview for this week.

There are no big macro data releases scheduled this week, only the 2nd tier U.Mich inflation expectations which came out on Friday.

However, we think Powell's annual sit-down with David Rubenstein at the Economic Club of Washington (8 Feb 1am SGT) could shake things up a bit and is something the market is not pricing fully.

At the FOMC press conference last week, it was impossible to tell if the Powell of 2023 had reverted to the dovish ex-2022 Powell of old.

While we believe he was trying his best to sound as neutral as possible, he certainly was not attempting to be hawkish.

Hopefully tomorrow’s interview will clear things up for everyone - especially his view on financial conditions, and whether he thinks this rally has gotten out of hand.

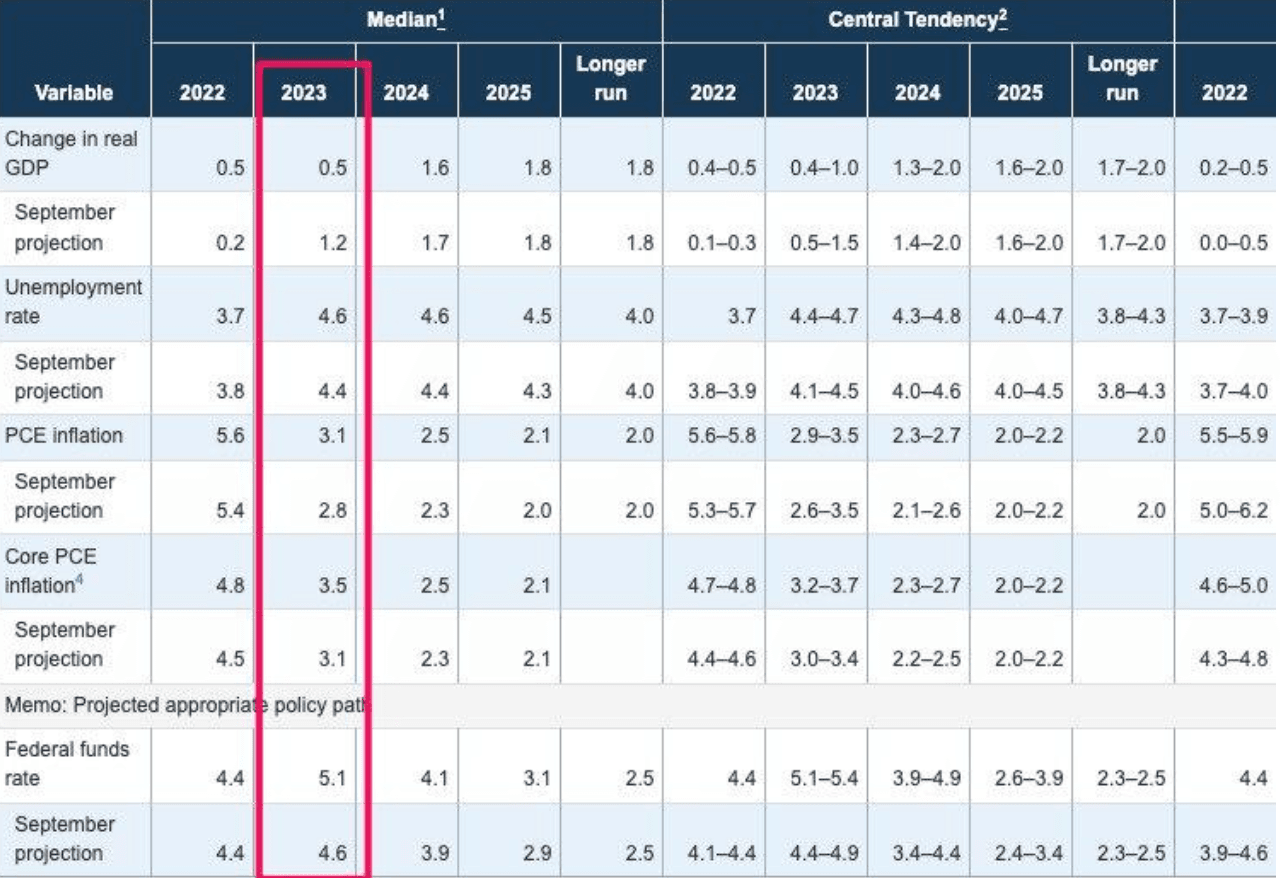

From Powell’s communication, it seems inflation had indeed fallen quicker than what the FOMC forecasted in Dec, as compared to our expectation that it was in-line with their projections.

So when Powell said the committee will upgrade their forecasts at the upcoming March meeting, many took it as a potential for a step-down in the rate path on the back of lower inflation projections.

However after Friday’s gangbuster NFP and unemployment rate of 3.4%, they will certainly have to revise down their unemployment, and possibly raise their growth forecasts too (Chart below).

Without a recession and >4% unemployment this year, it is extremely unlikely the Fed will cut rates, which means our view that the market’s pricing of cuts this year is too dovish still holds.

Hence, we still prefer very much last week’s trade of selling the Jun 28k call to fund a Jun 20k put, expecting the top to remain capped in the event of no cuts this year.

Having said that, how well the put performs is down to how high the terminal rate will go.

Unless the blockbuster labour market numbers actually feed into higher wages and higher inflation, the FOMC would be willing to ignore its strength and hold rates at 5-5.25%, which is not too far off the market’s terminal rate of 5% now.

BTC has thus far held up encouragingly despite all of our dominoes falling one by one on Friday - USD, Gold, and Yields.

We expect how equities perform today and after Powell’s speech tomorrow will guide our next leg in crypto.

However, if he again defers to next week’s CPI, then we could be in for a nervous wait.

Although BTC/ETH are our main instruments of trade, we prefer to express our view through a long USD or short Gold position, as we expect crypto to remain more resilient on the way down.

Post Powell, all eyes will quickly move to CPI on 14 Feb, barring any unforeseen outliers in this Friday’s inflation expectations number.

Will we see a Valentine’s Day massacre or a redemption off another weak print?

We are closely watching all sell-side economists for forecasts of Jan’s inflation, but as we wrote in last week’s broadcast, risks are tilted towards a higher number and continued reversal lower in risk.

Disclaimer

QCP Capital is an exempt payment services provider pending licensing by the Monetary Authority of Singapore as an MPI for Digital Payment Token Services under the Payment Services Act (2019).

This information contained in this document is intended as a general introduction to QCP Capital and its activities as a Digital Payment Token (DPT) service provider and is for informational purposes only. QCP Capital is not acting and does not purport to act in any way as an advisor or in a fiduciary capacity vis-a-vis any counterparty. Therefore, it is strongly suggested that any prospective counterparty obtain independent advice in relation to any trading investment, financial, legal, tax, accounting or regulatory issues discussed herein. This document is only directed at informed and qualified investors. By reading this material attests that you are fully aware that trading of DPTs is not suitable for the general public and that you are an informed and qualified investor, and are also fully cognisant of all technological and financial risk(s) associated with trading Digital Payment Tokens.

Before you engage us or any of our services, you should be aware of the following:

Please note that this does not mean you will be able to recover all the money or DPTs you paid to your DPT service provider if your DPT Service Provider’s business fails.

You should be aware that the value of DPTs may fluctuate greatly. You should buy DPTs only if you are prepared to accept the risk of losing all of the money you put into such tokens. your DPT service provider if your DPT service provider’s business fails.

You should not transact in the DPT if you are not familiar with this DPT. This includes how the DPT is created, and how the DPT you intend to transact is transferred or held by your DPT service provider.

You should be aware that your DPT service provider, as part of its licence to provide DPT services, may offer services related to DPTs which are promoted as having a stable value, commonly known as “stablecoin”.