Macro-wise, we think the balance of risks are tilted towards a risk-off - lower equities and a higher USD which would drag BTC/ETH lower as well. Nonetheless we expect BTC and ETH to be more resilient relative to historic betas.

However, crypto specific risk events today are likely to be friendlier to BTC and ETH and could result in a relief rally in Alts this week. We are watching for the:

Potential unsealing of the SEC’s internal Hinman documents in the Ripple case

Hearing on Tuesday 2pm ET for the SEC’s temporary restraining order (TRO) against Binance US in Washington, D.C federal court

The SEC's response to Coinbase's petition in the 3rd Circuit

End of the period for public comment on the SEC’s proposed expanded definition of an exchange

Having said that, as we've always maintained, legal proceedings such as these are almost impossible to price, and any outsized reactions should be seen as part of a trading range to fade.

Moving on to the macro side, we think the consensus has it right. Based on high frequency indicators, US inflation is falling rapidly, which will enable the FOMC to make this week's meeting their first pause in more than a year.

However, the danger is that the consensus has become too complacent on this blueprint.

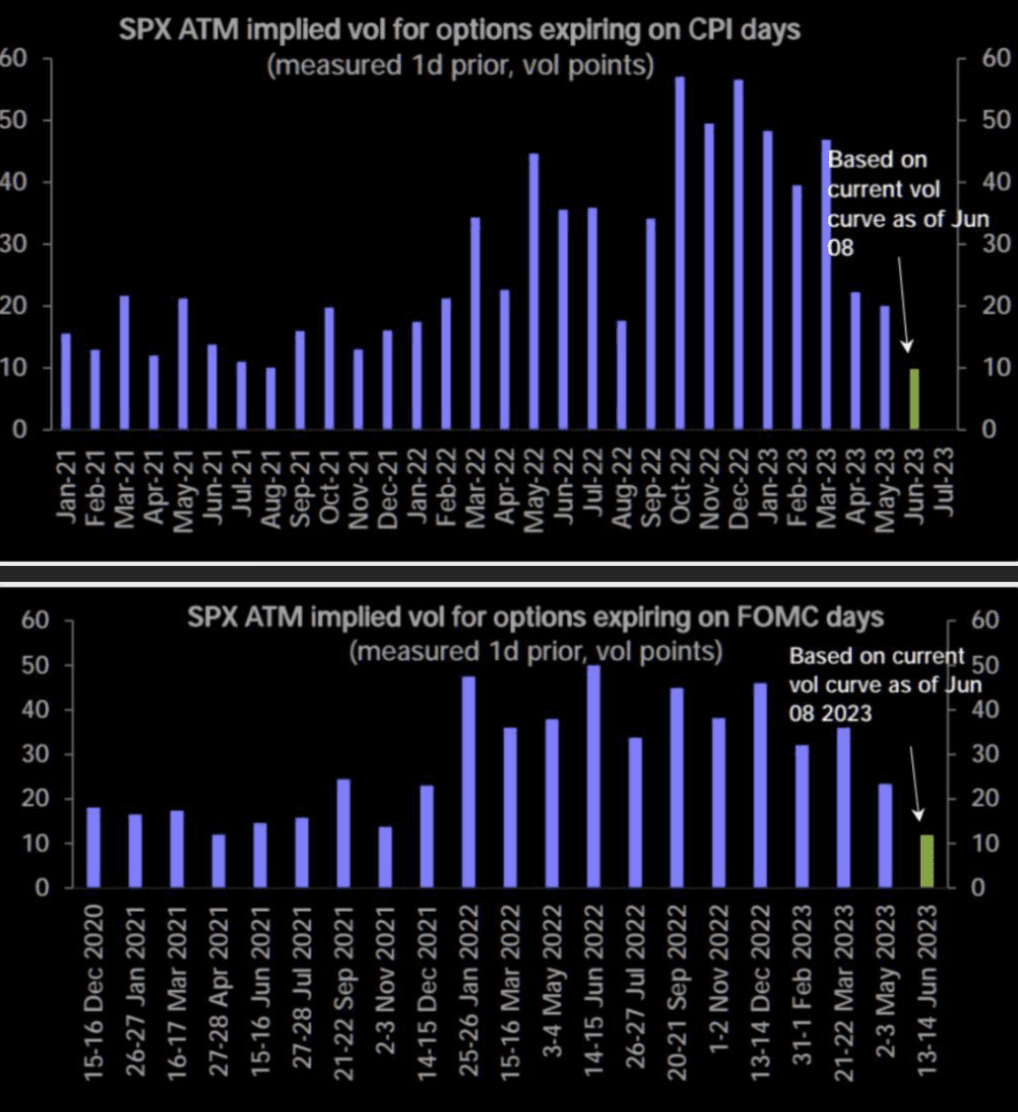

Volatility markets outside of crypto as well are pricing this week’s key events with the lowest implieds since before Covid!

While today’s CPI print is binary (and probability skewed towards an in-line or lower print), the market is absolutely unprepared for a higher inflation print, and the pain trade is certainly for a number that would be higher than expected.

For FOMC tomorrow, we think the risk is that they do a “hawkish skip” - implying they pause at this meeting, but raise their median dot projection to show a continued hiking bias to appease the committee hawks.

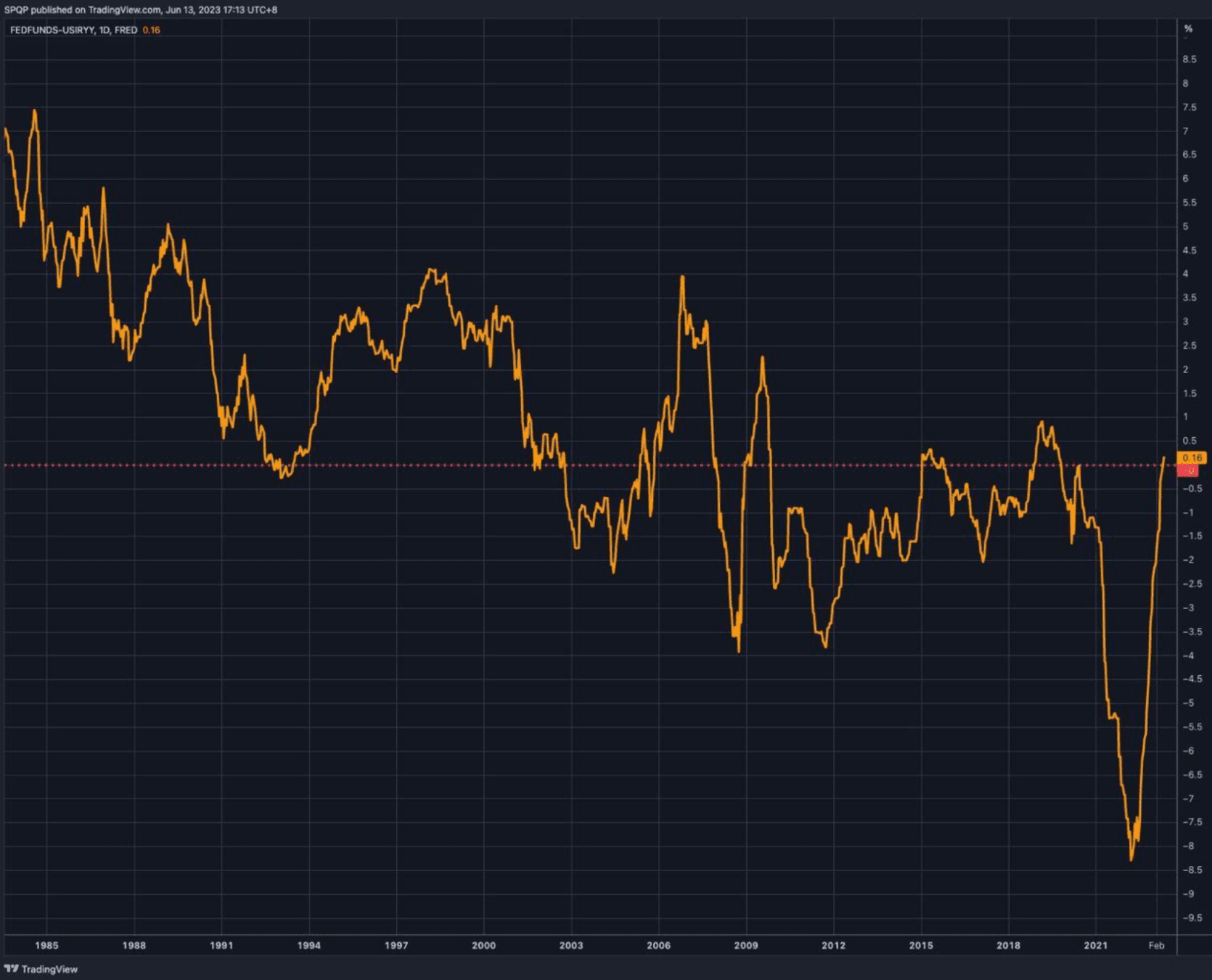

While US real rates have finally turned positive (Chart 2 - Fed funds rate minus CPI inflation), which is giving the FOMC reason to pause, hawks will nonetheless see progress towards the Fed's mandate of 2% core PCE inflation as slowing, which requires even higher rates from here.

Furthermore we think the easing of financial conditions as a result of this massive melt-up equity rally will play at the back of their minds.

We think therefore the risk reward balance this week favors being long 25d BTC and ETH puts, with 1m gamma continuing to look cheap as well. Key levels for a sharp downside move are a break of the key 25k and 1700 levels on BTC/ETH.

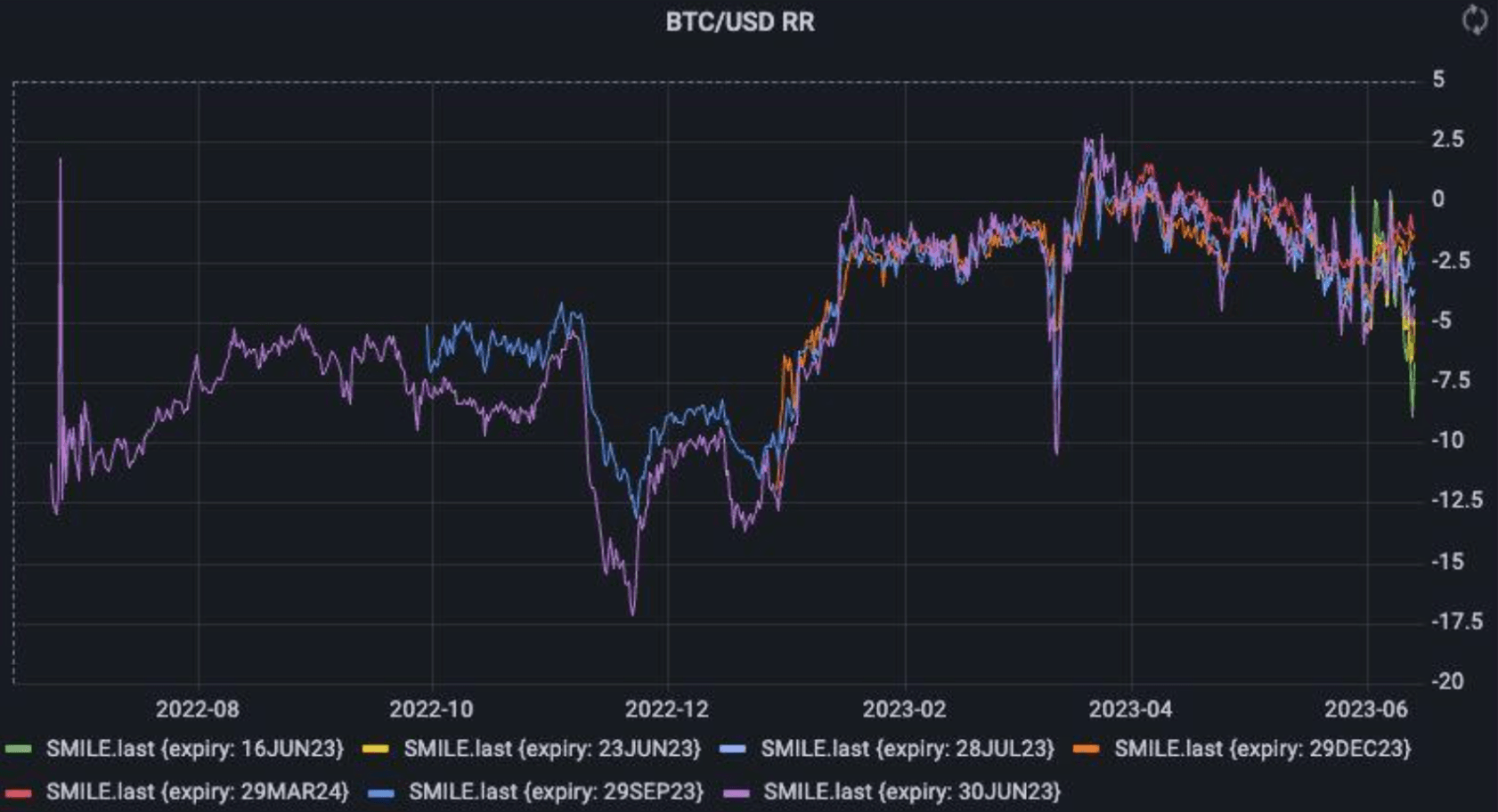

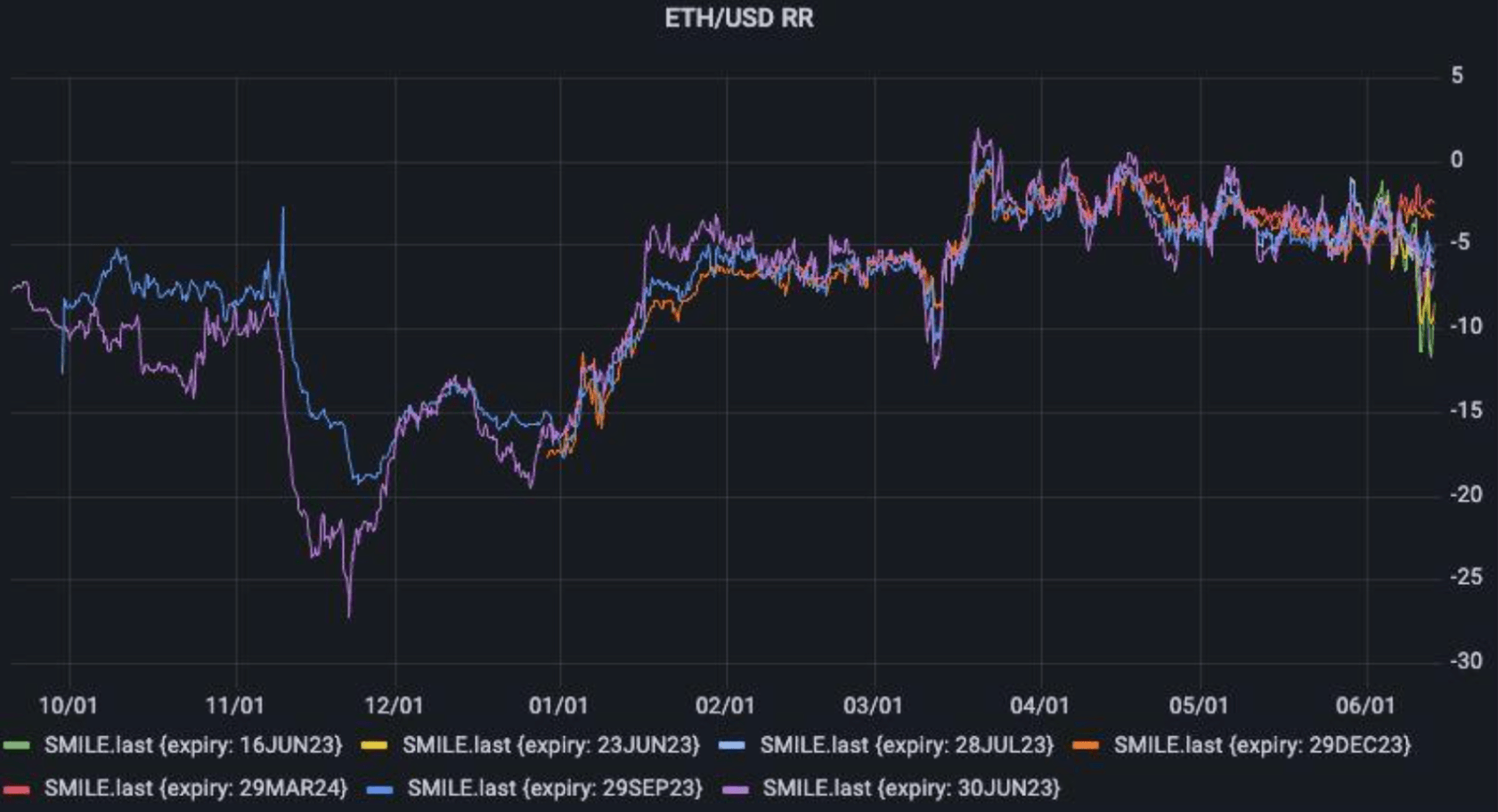

Positioning in the BTC and ETH options market is towards the downside as well, with risk reversals sharply lower this month, although we still remain well off the November FTX lows (Chart 3 and 4).