The lack of action in BTC/ETH spot and vol markets mask the many subplots brewing beneath the surface.

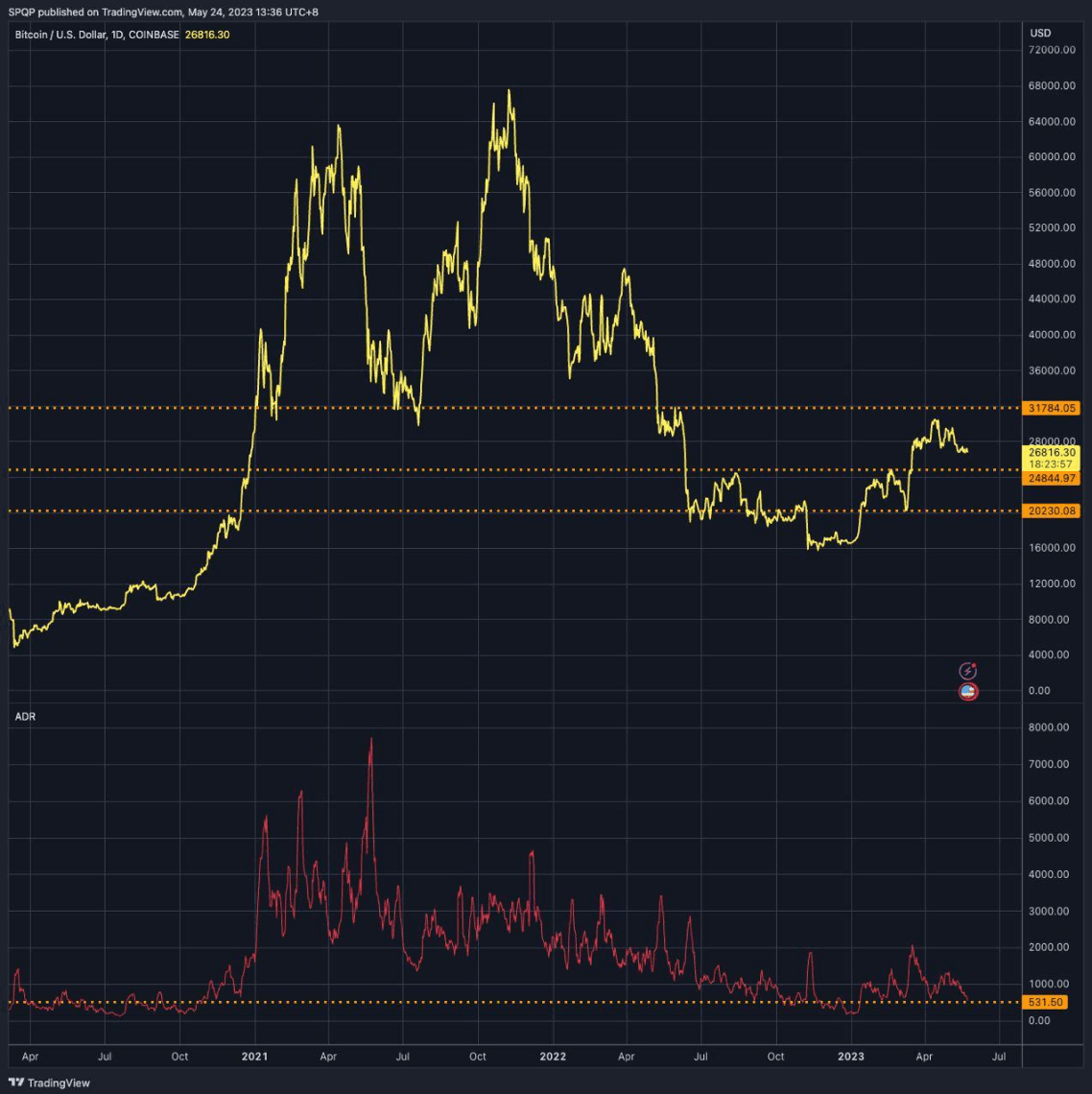

To give a sense of how tight the range has been, we have broken to new YTD lows on the Average Daily Range, almost taking us back to the December lows, prior to the massive Jan move (Chart below).

This in turn has dragged implieds to the most extreme levels we have seen in over a year, with the entire vol curve now trading <50 vols and the front-end at just 35 vols! (Chart below)

The carry roll-down from being short vol on such a move has been extremely attractive. However, this feels distinctly different from last December, when the market was sitting on its short vega position very comfortably.

This time, with so many undercurrent narratives waiting to take hold, we believe that any breakout in spot will lead the vol market to quickly test the highs.

As such we favour gradually taking profits on any outstanding short vol positions this week and putting on a long 2w and 1m BTC 26.5k straddle as a tactical trade this Friday post Deribit expiry, and after the usual weekly short vol rolls.

Front and centre of all narratives, and the catalyst for this trade, is of course the debt ceiling.

So far markets are trading this with an uneasy complacency thus far, which we believe is due to these 5 reasons:

Biden and House speaker McCarthy, the 2 key men to trash out a deal, have continually emphasised that default is absolutely off the table.

They are continuing to treat 1 Jun as the hard deadline.

As such they have agreed to meet daily to work something out by this week.

House Democrats have agreed to support McCarthy, to be able to override the lost votes from his own GOP right wing (with House Democrats even extending their support to any confidence vote on his speakership).

In the last 2 debt ceilings, a deal was only struck at the last possible minute, and markets are allowing a window of grace to this current negotiation as well.

On point 5, we expect the market's patience to run out by next week. We believe that as the Treasury's TGA cash balance runs down, the market has come around to accept that it is unlikely we will get past the 15 Jun corporate tax bump window anymore.

In the meantime, markets seem very confident a deal will be done, despite little evidence in this regard, that it has moved to begin pricing the mechanics of what would happen immediately post-deal.

Once Biden and McCarthy reach an agreement (hopefully by this weekend), they would put it to a House and Senate vote next week (which would require bipartisan support).

Should Congress vote for a deal (likely to extend the debt ceiling to 2025), the Treasury would then have to quickly rebuild its TGA cash reserves by issuing a ton of T-bills.

When we say 'a ton' we mean $500bn in short order, which would extend to $1.2tn in 2H23 alone!

In addition to the ongoing QT, this represents a massive drain on liquidity, with the most direct expression being higher USD yields.

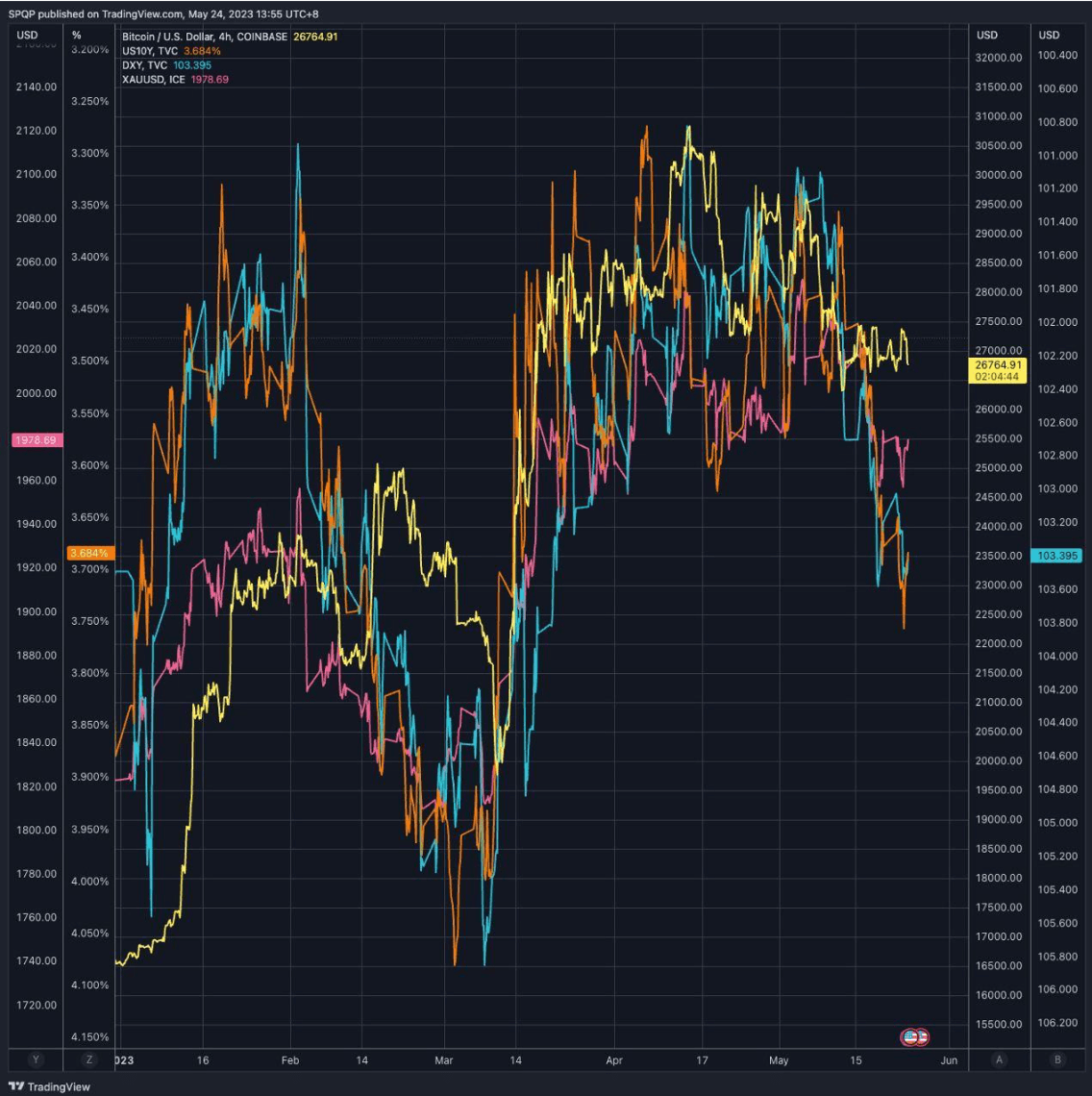

Accordingly, we have seen a sharp rise in yields across the curve, which has in turn dragged the USD higher and sent Gold tumbling (Chart 3: BTC - Yellow, 10y yield - Orange, USD - Blue, Gold - Red).

We believe that the disconnect between BTC holding up vs. other comparable markets, is due to investors having learnt from the recent banking crisis that BTC is the best high-beta hedge against a 'no-deal' scenario here.

Therefore it is unlikely anyone would sell the best macro tail risk hedge before an actual deal is done.

Although our medium-term bias is for higher BTC, on a deal scenario - we think BTC could quickly sync back with what other macro markets are implying.

On a 'no-deal' scenario however, we will easily take out the year's highs.

It is noticeable over the past few weeks of range markets, that implied vols tend to compress on any spot move lower and move higher when spot rallies - implying the market could be extremely caught out on a 'no-deal' move higher in this regard.