Crypto 2 – 0 SEC

The SEC is now 0 for 2 in landmark cases against the industry, with a judgement that (on a plain reading) does not paint the regulator’s actions in a favourable light.

We wrote about Judge Torres’s 13th July ruling here, and now an appellate judge has said the SEC was “arbitrary and capricious” to reject GBTC’s Bitcoin spot ETF filing.

While the SEC has predictably appealed last month’s securities decision, an appeal to the Supreme Court in this case is a far more complicated endeavour and is not a given.

In itself, this ruling is a great outcome for the industry, and the rally in GBTC and Coinbase are understandable. Nonetheless it is near-term inconsequential for spot price, and an opportunity to fade the short-term knee-jerk pump in spot and vol.

The ruling is, however, not tantamount to an approval of the application, and neither does the ruling mean that the SEC has to approve GBTC’s refilling. It remains open to the SEC to reject the refilling on fresh grounds.

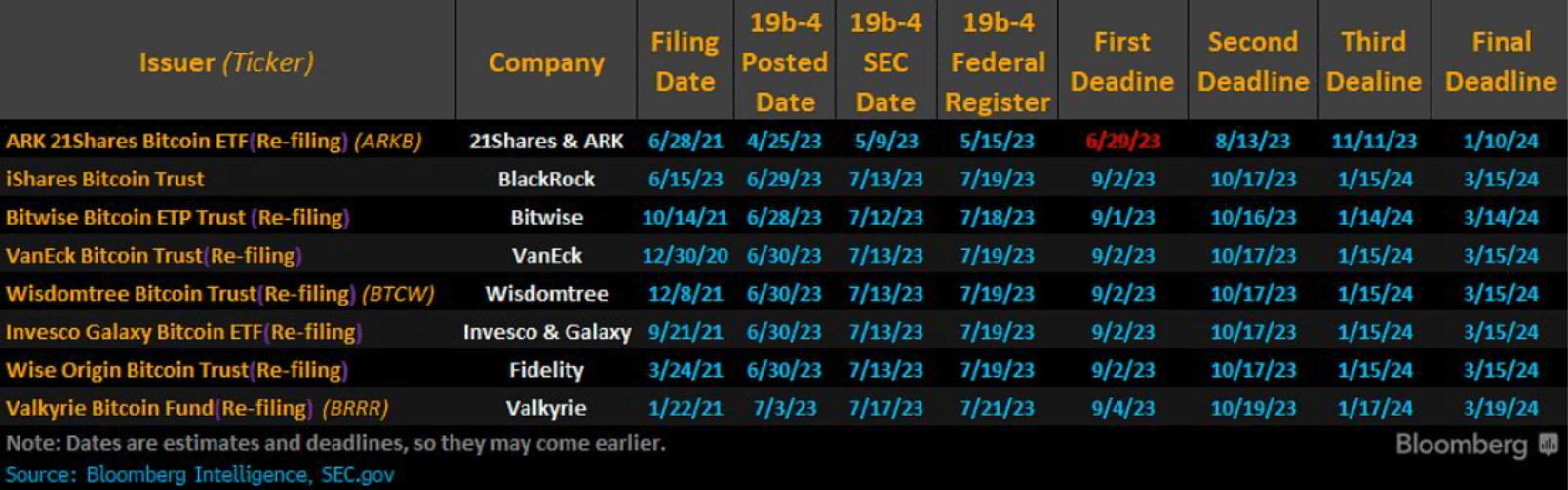

Nonetheless it does cement the odds-on chance of an ultimate Bitcoin spot ETF approval, while ironically making it more likely that the SEC will kick that decision to the March final deadline (Chart 1).

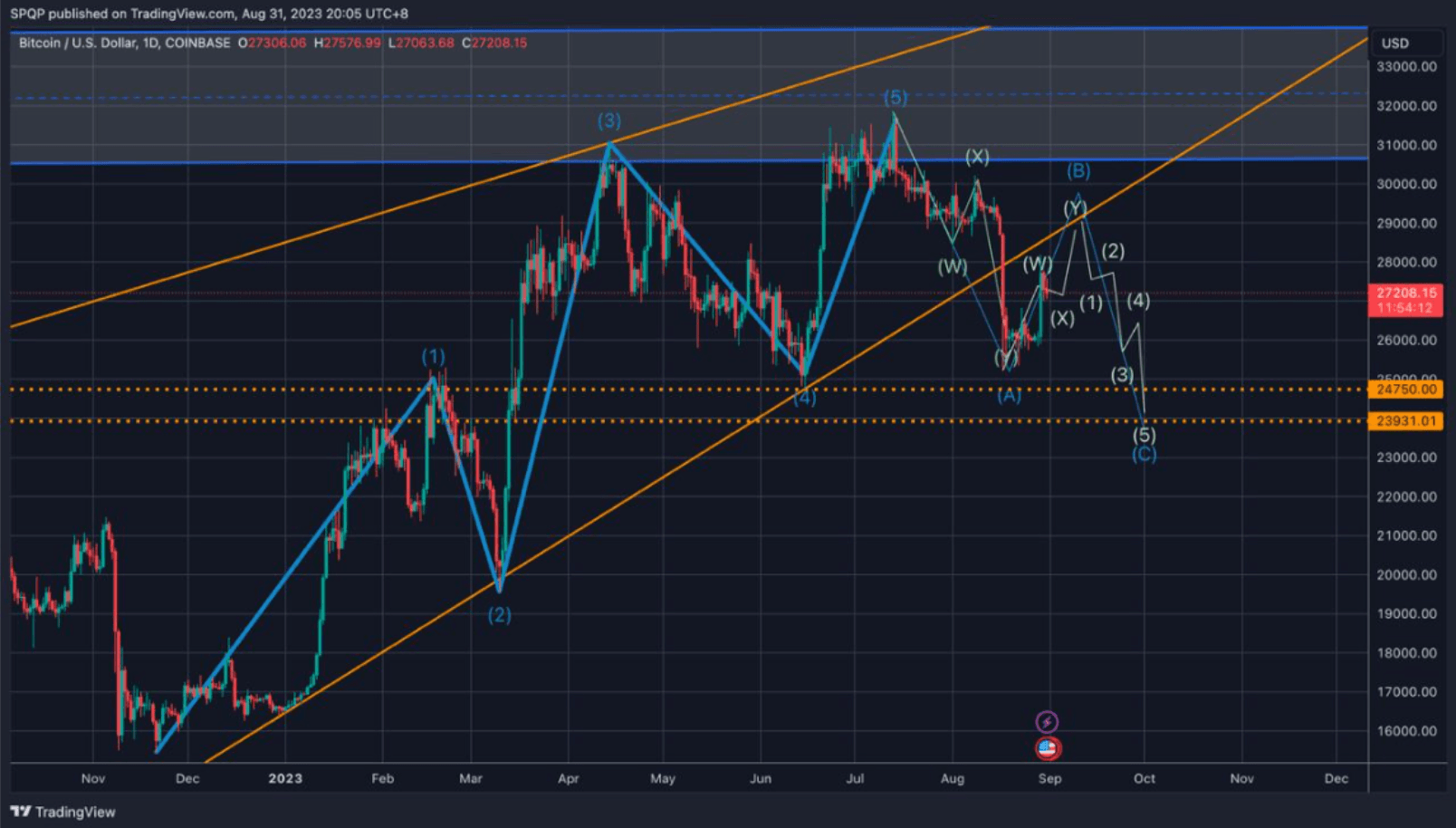

In any case, this ruling has provided the catalyst for our B wave count, which we posted in our last update 2 weeks ago (Chart 2).

Based on our wave count, a final push higher to end the B wave correction is likely in the following weeks, as these 2 court rulings realign crypto in a more positive light, just as the NVDIA-led AI rally continues unabated, and other traditional proxies like Gold and Rates show some recent strength.

However we think we would likely still start Q4 near the lows as optimism on the spot ETF again fade into the backdrop with more can-kicking from the SEC side, and lack of innovation in the sector as compared to other tech sectors.

Furthermore the upcoming known event calendar including the Mt. Gox payout next month will provide short-term bearish flow pressure to come.

Nonetheless with the likely ETF approval in March coinciding with the upcoming halving sometime in April, and a sharp US economic slow down finally looking likely in Q2 – we think a big new year Q1 rally is on the cards.

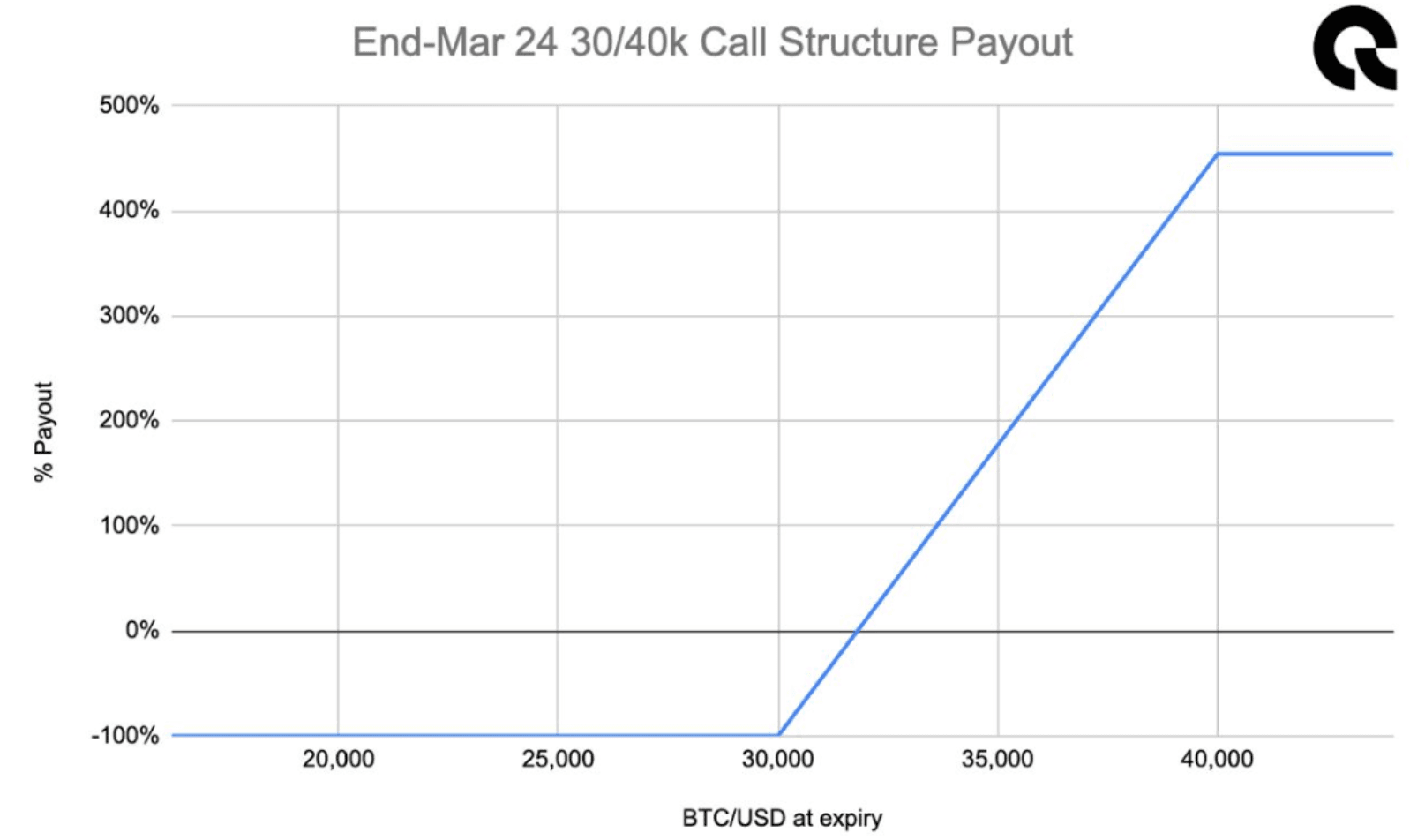

However rather than timing the rally between now and then, the trade we really like now is buying a topside end Mar-24 option structure to leg into the bullish Q1-24 view.

The payout on a 30/40k call structure is looking attractive, with a limited loss and a 450% payout at the top strike (Chart 3). Such a structure earns decay on the top strike if our wave count plays out, but also gives the buyer exposure to a rally starting today.