Since the turn of the month, we have seen another exponential leg higher in spot BTC, already up 15% MTD in the first week, taking us to a whopping 260% gain YTD.

Yet again, the move is entirely spot ETF related and this time it is triggered by the SEC on 1 Dec publishing that 5 Jan 2024 will be the final deadline for rebuttal comments, which officially sets up the following week after, as the week for a likely approval.

In our last market update (https://t.me/QCPbroadcast/1105), we wrote that it would be fitting for the SEC to approve the first spot ETF on 3 January 24 - that date being the 15th year anniversary of the Bitcoin Genesis block. Unfortunately such symbolism is certainly lost on the SEC.

With BTC at close to 45k leading up to the official announcement on the second week of January, one has to ask how much of the news has been priced in.

From this point on, whether we revisit the 69k all-time high or not depends onthe genuine flows the actual ETF will bring in the first few weeks of trading. Otherwise, this sets things up for the classic “sell-the-news” moment next year.

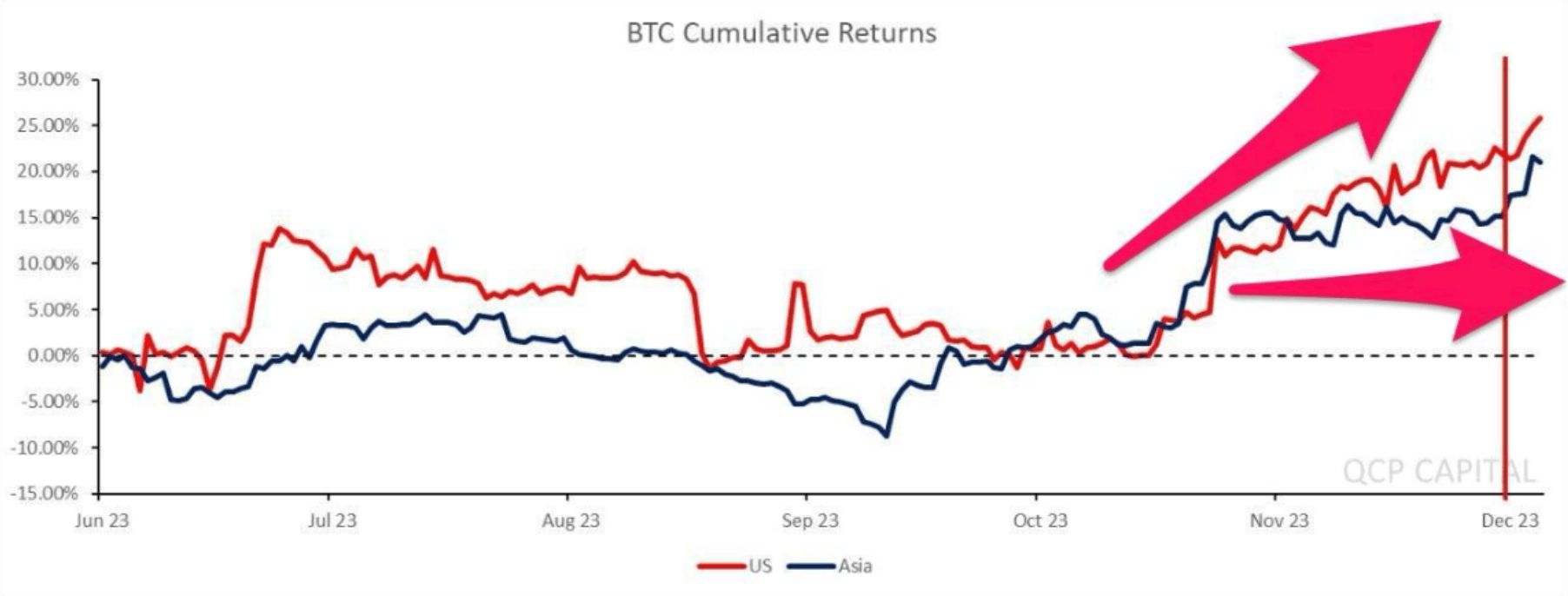

The 1 December SEC announcement has also reignited Asian buyers who had been sitting on the sidelines the past month, with all the spot gains coming in US hours since mid-October (Chart 1 below).

When the spot ETF launches, there certainly won’t be a lack of product choices - with 13 applications now in the running to be amongst the first batch out of the gate!

Apart from these vanilla spot applications, there are also many other leveraged and options related ETFs being filed as we speak, with BTC as the underlying product.

This means that should spot BTC top on launch day itself, it will not stop the Traditional Finance ecosystem boom around BTC, and soon ETH - the likes of which we have been writing about for years now.

We expect in an environment of low costs, tight spreads and thin margins, structured products could be one of the asset classes generating the most alpha - which is the case in other similar markets like gold.

For the Accumulator + HYPP structure (43k strike) from our previous update, these levels mark the 'maximum gamma' for the structure:

- Below 43k and you will be buying BTC at a significantly discounted 33k each week.

- Above 43k and the structure will pay a weekly USD dividend yielding 40% (annualized).