The Lunar New Year has ushered in the bulls. BTC broke the key 48k resistance and is currently trading above 52k. ETH broke the local highs of 2700 and is trading above 2800.

Two key reasons for this leg higher are:

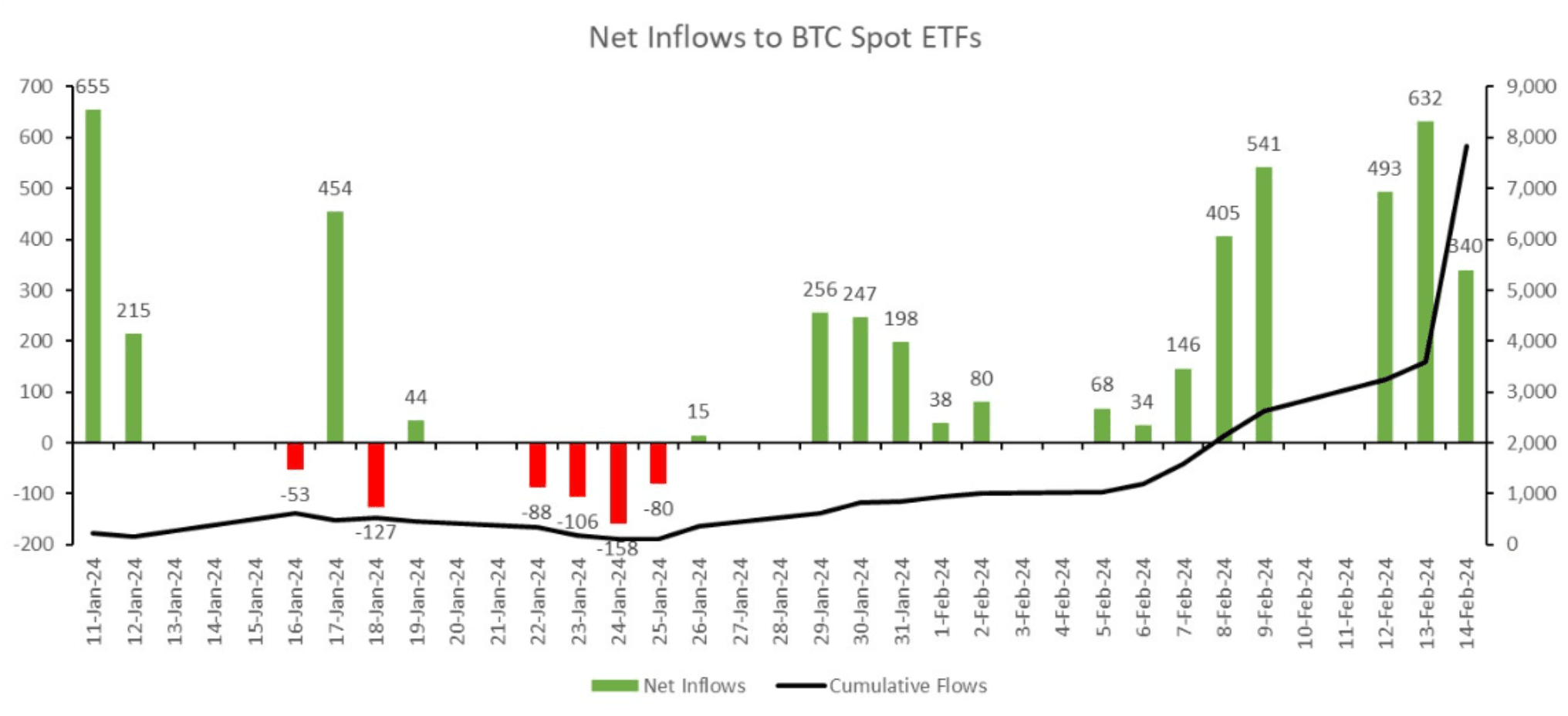

Strong BTC spot ETF inflows We flipped into firm net inflow territory towards the end of Jan (Chart 1) and saw massive sizes in the last week up to $632M in a day! The sheer size of spot demand inevitably drove prices higher.

Source: Chart 1

Source: Chart 1CME margin requirement increase This has recently become an important trigger for volatility. In this case, leveraged players were positioned short and the new requirement resulted in widespread short covering over a relatively illiquid Lunar New Year weekend. This drove both spot price and forwards higher. The forward spread trade in BTC is now back to around 11-12% ann.

An important macro data point to note this week is CPI coming out higher than expected. Headline CPI was 3.1% act. v 2.9% exp., and Core CPI was 3.9% act. v 3.7% exp.

As expected, risk assets sold off across the board. However, this was very short-lived with the market buying the dip with a vengeance the very next day, particularly for crypto which has since seen new highs.

While we remain bullish with liquidity rushing back into risk assets, inflation being sticky over 3% remains a downside risk, and would also mean increased volatility across markets.

For investors who are still bullish but are starting to be downside defensive at these levels, we provide an Upside Participation Structure (UPS) which gives 100% protection on the principal investment amount but uses the yield for a leveraged upside bet.

A $100k deployment for end-Jun 75/85k UPS will earn $13,120 (+13.12% over 4.5 months) if BTC price is above 85k at the end of Jun. If BTC is below 75k, the $100k principal is returned. Anything in between will profit pro-rata in the range.