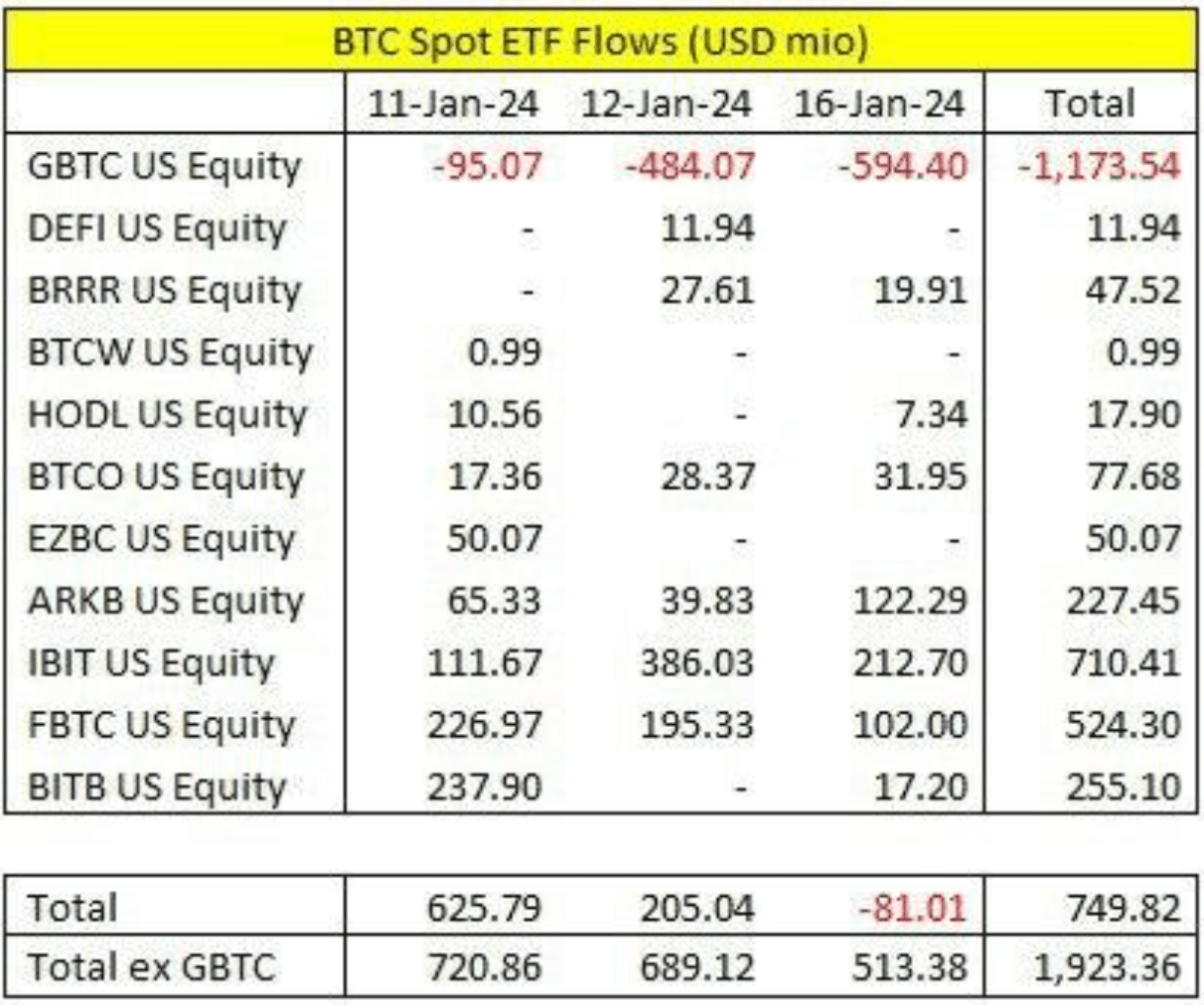

Since the launch of the BTC Spot ETF a week ago, total volumes transacted across all 11 ETFs have been $9.8b. GBTC alone accounted for $4.6b!

GBTC saw outflows of $1.17b since its conversion from a Trust to an ETF (Chart 1). This is not surprising since GBTC has traded at a discount since 2020 (as low as -48% at the start of 2023). This ETF conversion has been a long awaited chance for GBTC holders to exit at par value. The question is how much more of GBTC’s current $25.4b AUM will exit.

BTC traded to a high of 49,100 upon the ETF approval but has since traded lower, consolidating above 40,000 support. We’ve seen volumes slow down since the initial launch and all eyes are on the GBTC outflows.

When ETHBTC traded below 0.05, we mentioned that the cross looked attractive from both a technical perspective and with ETH as a catchup play. ETHBTC has since traded higher to the 0.06. We expect ETH to continue outperforming BTC over the medium term as the narrative rotates to potential ETH Spot ETF approvals.

Since the BTC spot ETF launch, BTC forwards have also fallen more than ETH forwards. BTC 1-month forward fell from a high of 32% ann. to a low of 9% (-23%) and ETH 1-month forward from a high of 28% to 12% (-16%).

ETH forwards still look attractive despite yields coming off, paying 11 – 13% ann. Selling ETH 1m 2200 Puts is also a decent play with yields above 21% ann. and a decent level to buy if there is a dip into the potential ETH spot ETF approvals.

The next major crypto events are BTC halving (mid-Apr), and potential ETH Spot ETF approvals from May. In the meantime, crypto might take some direction from macroeconomic events.

We’re keeping an eye on the Jan FOMC meeting as well as the Feb NFP and CPI prints. During the Jan FOMC, we expect more colour on the pace of the balance sheet runoff that was briefly discussed in Dec 2023. The market consensus is for the Fed to slow down the pace of QT, but when it starts and by how much, is very much unknown at this point.