We have been looking forward to the ETH spot ETF approvals as the next bullish narrative. However, whether it will happen in 2024 is still in question.

We think that an approval is likely if the SEC continues to delay both BlackRock and Fidelity’s deadlines to cluster around the VanEck and Ark21 deadlines around end-May. This was what they did ahead of the BTC approvals.

However, if they delay BlackRock and Fidelity to the maximum of end-June (i.e. no clustering), it might be an indication that they have no intention to approve the ETH spot ETF this year.

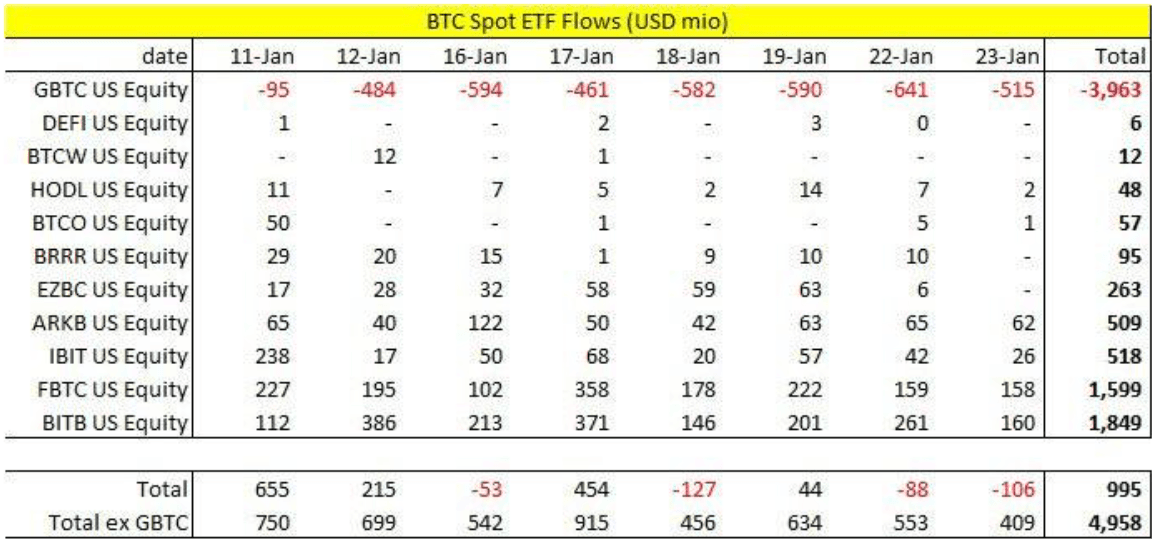

BTC has traded to a low of about 38,500 on the back of significant daily outflows from GBTC of $500m - $600m (Chart 1). GBTC still has around $21b of AUM, a large potential supply.

The break below 40k seems to have been triggered by headlines about Mt.Gox confirming BTC addresses for creditor repayments. This is another potentially large supply of 142-200k BTC.

In more positive news, the People's Bank of China (PBoC) today announced a surprised 50bps cut to the Reserve Requirement Ratio (RRR). The Chinese Government also proposed a $278b package yesterday to support Chinese stock markets.

Chinese equities are +7-8% higher from the lows and this might have given provided some support for risk assets today, including crypto.

We are also paying attention to the upcoming FOMC meeting on 31 Jan where we expect more colour on the pace of the balance sheet runoff, as well as the Quarterly Refunding Announcement (QRA) by the US Treasury.

We expect the US Treasury to keep to Nov 2023's playbook and issue more short-term debt. Two reasons:

US elections are happening this year. Keeping liquidity flushed and US equities higher is beneficial for the incumbent regime (i.e. the Secretary of the Treasury more likely to keep her seat).

With the expectation that the Fed will cut rates this year, the US Treasury would want to delay locking in long term issuances now and choose to issue long-term debt later when rates are lower.

If the US Treasury issues more short-term debt as we expect, this would be bullish for risk assets and crypto as well. However, if they surprise the market by increasing long-term issuances instead, bond yields would rise again and equities would sell off sharply. We think the bullish case is more likely.