With the 4th July break over, we now begin the traditional second half of the trading year.

This year’s Independence Day holiday happened to fall on a "Super" full buck moon, the first Supermoon of the year.

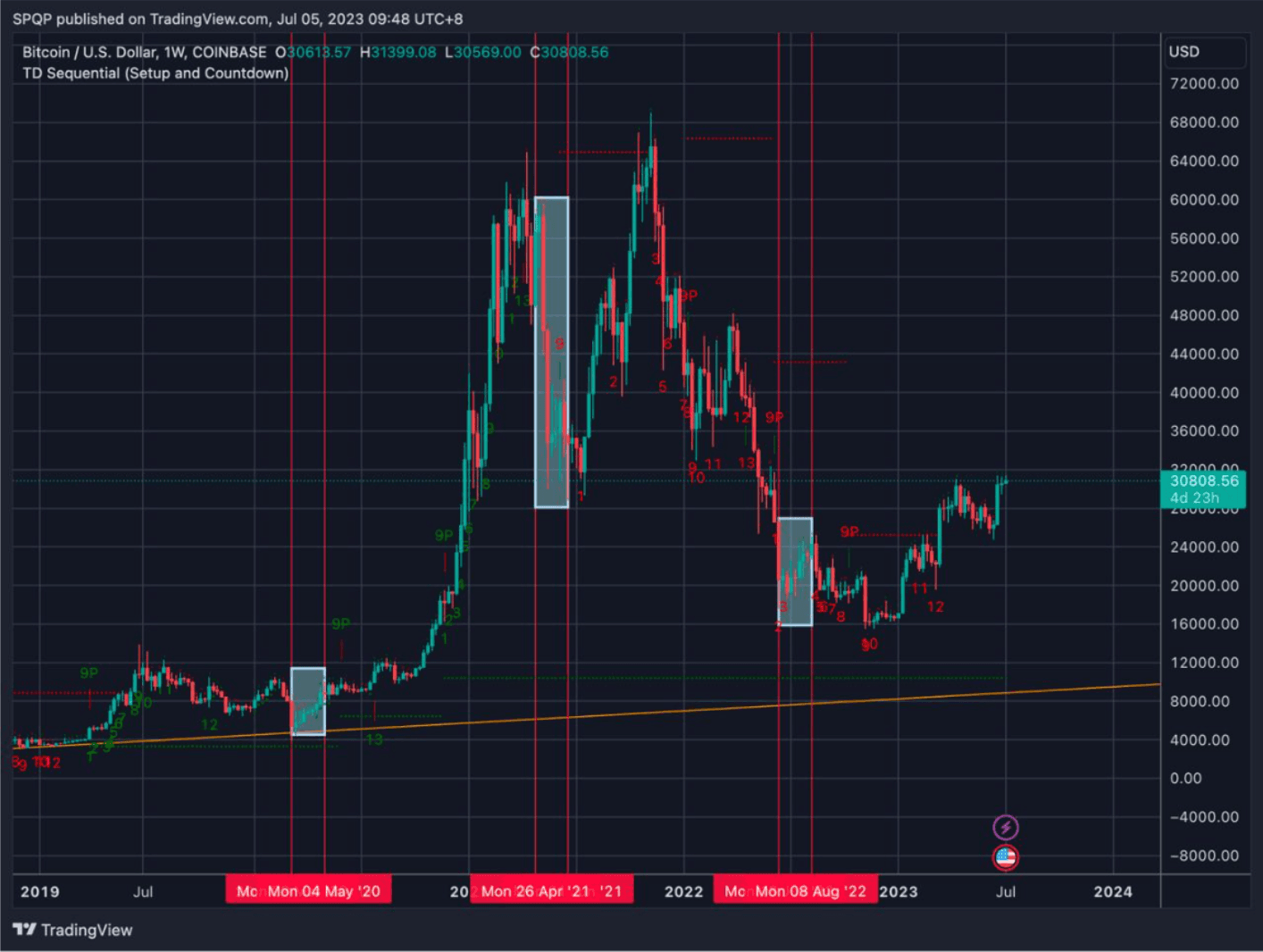

We’ve observed that previous Supermoon periods coincide with countertrend reversals - the red line/blue boxes indicate the periods of Supermoons in the past 3 years (Chart 1).

2020: Week of 9 Mar - 7 May (161% Rally during Bear market) 2021: Week of 27 Apr - 24 Jun (51% Sell-off during Bull Market) 2022: Week of 14 Jun - 12 Aug (43% Rally during Bear market)

Would the 2023 period (from now to September) see a pause or reversal in the recent rally?

Fundamentally we think most of the good news has been priced into BTC, with no response expected from the SEC this quarter, at least not in the affirmative.

On the macro side, the Fed looks locked into another hike this month (although this is largely priced by markets), and inflation appears likely to stagnate around 3-4% until year-end, with positive base effects from the oil price decline ending this quarter, and high frequency rent prices turning back up.

This means that while falling inflation has been getting the market excited, for the Fed with their 2% inflation target blinkers on - its close but probably still not enough for rate cuts.

Tactically (short-term), our favoured trade to play this is selling end-Sep 33k to 35k calls, and using the premiums to buy 30k puts.

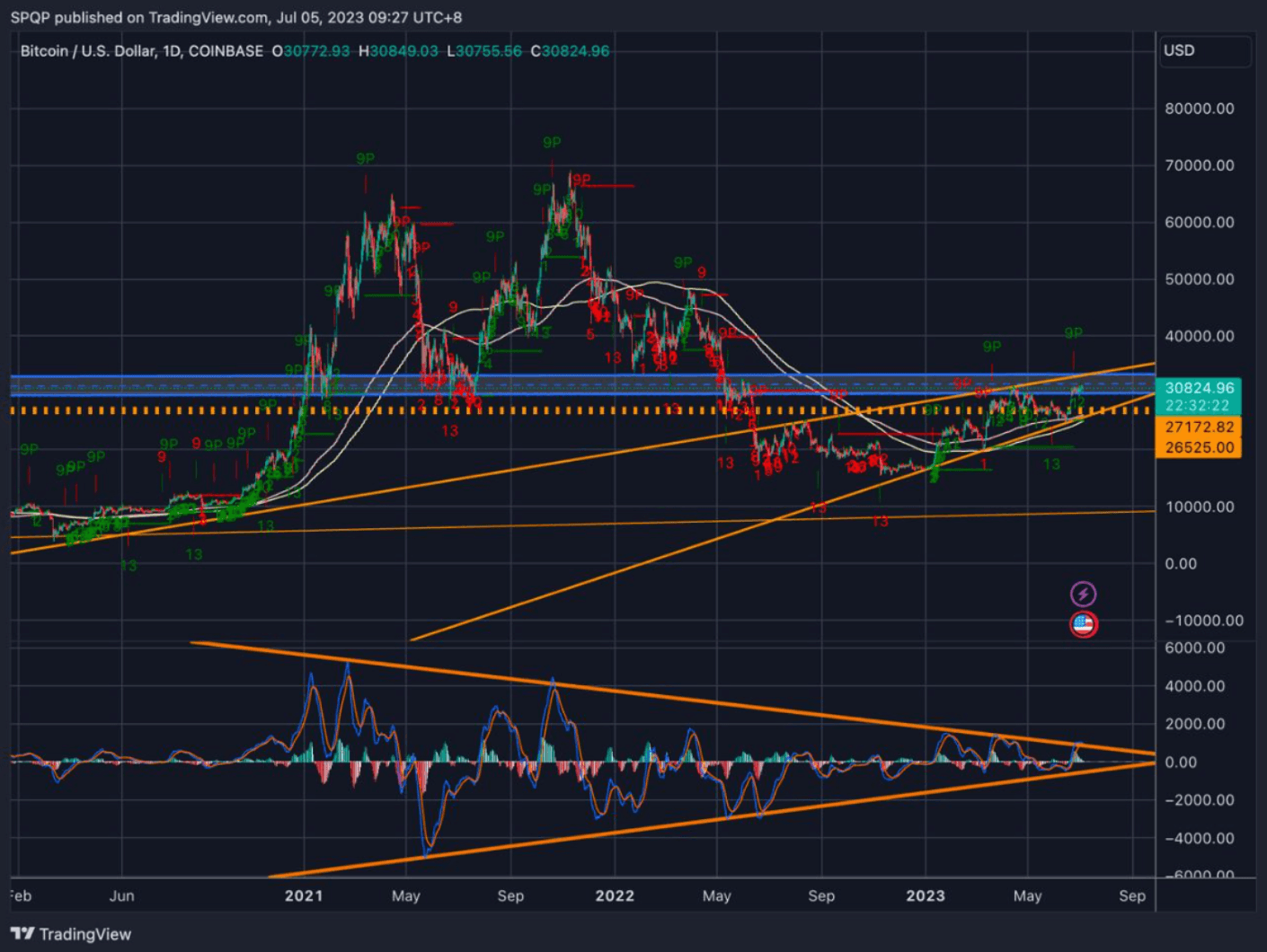

The top-side levels work well as any rally from here would be considered the ending 5th wave from the November FTX lows. The 33-35k level is also where we see wedge resistance as well as MACD hitting 3-year triangle resistance (Chart 2).

Structurally (long-term) however, we prefer to go long against the 24-26k level. Longer-term accumulators anticipating a Q4 run higher could look to systematically sell end-23 puts at these levels on any dip under 30k.

For more information, visit https://qcp.capital/